Professional Documents

Culture Documents

ADVANCED ACCOUNTING CONSOLIDATION

Uploaded by

Julie Ann CanlasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ADVANCED ACCOUNTING CONSOLIDATION

Uploaded by

Julie Ann CanlasCopyright:

Available Formats

Advanced Accounting Part 2 Final Quiz Miami Corporation acquires 80,000 shares of Heat Companys outstanding stock January

y 1, 2013, y gi!ing the fo""o#ing considerations e"o#$ Cash, %2,000,000 &ssued 80,000 shares of common stock #ith a %'0 fair !a"ue during acquisition date( ) contingent payment of %200,000 cash on *ecem er 31, 201+, if the a!erage income of during the 2,year period of 2013 - 201+ e.ceeds %2'0,000 per year( Miami estimates that there is a 30/ percent change or pro a i"ity that the %200,000 payment #i"" e required( Miami a"so agreed to issue additiona" ',000 shares if Heat Company #i"" generate cash f"o#s from operation of %1,000,000( 0he additiona" ',000 shares e.pected to e issued are !a"ued at %31',000(

Heat Company de ited other recei!a "es for the payments made in comp"eting the acquisition( )cquisition costs paid #ere as fo""o#s$ 2rokers fee paid to firm that "ocated Heat )ccountants fee for pre,acquisition 3ega" fee for contract of usiness com ination Cost of 45C registration, inc"uding accounting and "ega" fees %rinting cost of stock certificates issued 6enera" and administrati!e e.penses 10,000 20,000 3',000 20,000 10,000 2',000

7n *ecem er 31, 2012, prior to the usiness com ination, the fo""o#ing data are a!ai"a "e$ Common stock, %20 par Common stock, %20 par %aid in capita" in e.cess of par 8etained earnings Miami %',000,000 2,'00,000 1,'00,000 Heat % 2,000,000 1,180,000 820,000

7n the same date, the current !a"ue of Heat Companys identifia "e assets and "ia i"ities #ere the same as their carrying !a"ues e.cept for the fo""o#ing assets$ )ssets &n!entories 3and 2ui"ding 5quipment Machineries$ Machinery 301 Machinery 101 2onds %aya "e &ncrease 200,000 200,000 200,000 30,000 35,000 *ecrease 2'/ #ere sti"" unso"d year ended 2013( 20 years remaining "ife 100,000 10 years remaining "ife ' years remaining "ife 7 years remaining life 20,000 ' years remaining "ife

)t the date of acquisition the fair !a"ue of non,contro""ing interest is estimated to e %1,'00,000( 7n )ugust 1, 2013, Miami recei!ed the fina" !a"ue of Heats 3and and 2ui"ding from the independent appraisa" if fina" !a"ues are compared #ith the pro!isiona" amount gi!en during acquisition date oth assets are sti"" under!a"ued y %300,000 and %100,000, respecti!e"y( 7n 9o!em er 1, 2013, the pro a i"ity !a"ues that Heat a!erage income #i"" e.ceed %2'0,000 is estimated to increase y +0/(

Inter-company sales of inventory (Under FIFO) $ear 2013 2013 201+ 201+ %old to Miami eat eat Miami %old from eat Miami Miami eat %ales 2:3,2'0 2:2,'00 280,000 210,000 &ost 1=',000 11',000 200,000 1+0,000 'nsold 101,2'0 118,12' 10,000 10',000

&n year 201+, Heat sti"" o#es Miami from intercompany purchases made amounted to %12',000, #hi"e Miami sti"" o#es Heat from purchased made 201+ amounted to %=0,000( Inter-company sale of plant assets 7n January 1, 2013, Miami so"d a ui"ding to Heat for %1,380,000( 0he cost of the ui"ding #as %2,000,000 #ith 2' years usefu" "ife and accumu"ated depreciation of %800,000 on the date of sa"e( 7n Ju"y 1, 2013, Heat so"d "and purchased for %'00,000 t#o years ago to Miami for %1'0,000( >urthermore, 7n )pri" 1, 2013 Miami purchased Heat Machinery,101 for %108,000( 0he machinery #as acquired y Ce"tic January 1, 2010 for %120,000 #ith estimated usefu" "ife of 10 years and no sa"!age !a"ue( Miami used the remaining "ife of the machinery for future depreciation( 7n January 1, 201+, Miami Company so"d equipment to Heat for %8+,000 #ith a ook !a"ue of %:0,000( 0he equipment is e.pected to ha!e a remaining "ife of si. ;:< years from the date of sa"e( 7n Ju"y 1, 201+, Miami so"d Machinery,101 to outsider for % %18,000( 2oth companies are using straight "ine method for depreciation( )dditiona" information &mpairment of good#i"" %200,000 year 2013 and %100,000 year 201+ Miami dec"ared di!idends of %200,000 in year 2013 and on the same year recei!ed di!idends from Heat of %80,000( %rior to conso"idation of Miami and Heat financia" statements, Miami #as gi!en information that Heat met a"" the condition for contingent "ia i"ities agreed during acquisition #ith the o"d stockho"ders( Miami #ith the minority stockho"ders of Heat Company agreed to sett"e a"" contingencies this year 201+( )cquisition costs are sti"" unsett"ed y year end 201+(

0he indi!idua" financia" statements for these t#o companies as of *ecem er 31, 201+ are as fo""o#s$

4a"es Cost of goods so"d 7perating e.penses *i!idends income 3oss on sa"e of machinery 6ain on sa"e of equipment 9et &ncome 8etained 5arnings, January 1, 201+ 9et income *i!idends paid 8etained 5arnings, *ecem er 31, 201+

Miami 1,'1+,200 ;8:',200< ;221,000< =:,000 ;10,000< 2+,000 '32,000 1,='0,000 '32,000 200,000 2,2!2,000

eat 1,'':,2'0 ;110,800< ;20:,+'0<

'1=,000 1,321,000 '1=,000 120,000 ",7!#,000

Miami Current )ssets Cash and cash equi!a"ents 0rade and other recei!a "es &n!entories 0ota" Current )ssets 9on,current )ssets 3and 2ui"ding )ccumu"ated *eprecation , 2ui"ding 5quipment )ccumu"ated *epreciation - 5quipment Machineries )ccumu"ated *epreciation , Machinery &n!estment in Ce"tics 0ota" 9on,current assets 0ota" )ssets *ia+ilities 0rade and other paya "es 2onds %aya "e 0ota" "ia i"ities %toc,-olders. /0uity Common 4tock %aid in capita" in e.cess of par 8etained 5arnings 0ota" stockho"ders? equity 0ota" "ia i"ities and equities 2,0+=,000 1,322,'00 1,+'0,000 (,!2",500

eat 811,000 1,010,000 1,21',000 3,"#2,000

1,=00,000 2,000,000 ;800,000< '20,000 ;312,000< 1,++8,000 ;'30,'00< :,000,000 "0,225,500 "5,0(7,000

'00,000 1,=80,000 ;':,000< 28+,000 ;=+,000< 120,000 ;+',000< 2,#!),000 5,!5",000

1:',000 '00,000 1,2:',000

:8',000 200,000 88',000

:,:00,000 +,=00,000 2,282,000 13,182,000 "5,0(7,000

2,000,000 1,180,000 1,18:,000 +,=::,000 5,!5",000

Ans1er t-e follo1ing2 'nder Full 3ood1ill Quiz " 4anuary ", 20"3 1( 4u sidiary 9et assets at fair !a"ue 2( 6ood#i"" attri uta "e to %arent 3( 6ood#i"" attri uta "e to 9C& +( Conso"idated Common stock '( Conso"idated %aid in capita" ;total) :( Conso"idated 8etained earnings 1( Conso"idated 4tockho"ders 5quity Quiz 2 5 At 6ecem+er 3", 20"3 in 7re7aration of consolidated financial statement, determine t-e follo1ing accounts 1( Conso"idated net income 2( 9C& in the net income of 4u sidiary 3( Conso"idated net income attri uta "e to parent +( 6ood#i"" after impairment "oss '( 0ota" net ad@ustment on %"ant )sset for conso"idated 2a"ance 4heet ;at gross<( :( 0ota" net ad@ustment on )ccumu"ated *epreciation for conso"idated 2a"ance 4heet( 1( Common 4tock 8( %aid in capita" ;total) =( 8etained 5arnings 10( 9C& in the net assets of 4u sidiary Quiz 3 At 6ecem+er 3", 20"( in 7re7aration of consolidated financial statement, determine t-e follo1ing accounts 1( 6ain on sa"es of "and - in the consolidated income statement 2( 6ainA;"oss< on sa"e of machinery - in the consolidated income statement 3( 4a"es +( Cost of goods so"d '( 7perating e.penses :( 9et income 1( 9et income attri uta "e to parent 8( 9et income attri uta "e to 9C& =( 8etained 5arnings 10( Common stock 11( %aid in Capita" ;total) 12( 9C& in the net asset of 4u sidiary 13( Conso"idated 0ota" )ssets 1+( Conso"idated 0ota" 3ia i"ities 1'( Conso"idated 4tockho"ders 5quity

3od 8less $ou All

You might also like

- Aa2e Hal Testbank Ch04Document26 pagesAa2e Hal Testbank Ch04jayNo ratings yet

- P2 Bus Com.O2016Document9 pagesP2 Bus Com.O2016Paulo Miguel100% (2)

- Business Combination Theory QuestionsDocument4 pagesBusiness Combination Theory QuestionsAldon100% (3)

- Business Combi - SubsequentDocument5 pagesBusiness Combi - Subsequentnaser100% (2)

- Business CombinationDocument7 pagesBusiness CombinationJae DenNo ratings yet

- Business Combination Test Bank Part 2Document21 pagesBusiness Combination Test Bank Part 2School Worksandfiles100% (1)

- ACRV 1023 Final Exams With Answers PDFDocument8 pagesACRV 1023 Final Exams With Answers PDFMary Grace Narag100% (1)

- Business Combinations - Part 1 Recognition and MeasurementDocument54 pagesBusiness Combinations - Part 1 Recognition and MeasurementJOANNE PEÑARANDANo ratings yet

- Acquiring IMMATURE: Estimating GoodwillDocument1 pageAcquiring IMMATURE: Estimating GoodwillRiselle Ann Sanchez50% (2)

- Bus. Combi Probs and SolnDocument3 pagesBus. Combi Probs and SolnRyan Prado AndayaNo ratings yet

- Junior Philippine Accounting Midterms ReviewDocument5 pagesJunior Philippine Accounting Midterms ReviewezraelydanNo ratings yet

- Chapter 14 Business Combinations Part 1Document23 pagesChapter 14 Business Combinations Part 1Marvel Keg-ay Polled75% (8)

- PFRS 3 - Business Combination PDFDocument2 pagesPFRS 3 - Business Combination PDFMaria LopezNo ratings yet

- AFAR Review Net Asset AcquisitionDocument12 pagesAFAR Review Net Asset AcquisitionThom Santos Crebillo100% (1)

- CPAR - P2 - 7406 - Business Combination at Date of Acquisition With Answer PDFDocument6 pagesCPAR - P2 - 7406 - Business Combination at Date of Acquisition With Answer PDFAngelo Villadores100% (4)

- Use The Fact Pattern Below For The Next Three Independent CasesDocument5 pagesUse The Fact Pattern Below For The Next Three Independent CasesMichael Bongalonta0% (1)

- Joint Arrangement HandoutDocument5 pagesJoint Arrangement HandoutClyde Saul100% (1)

- Acctg630 - ICMA 1st Sem SY2013-14 - With AnswerDocument35 pagesAcctg630 - ICMA 1st Sem SY2013-14 - With AnswerJasper Andrew AdjaraniNo ratings yet

- Business Combination. Quiz IDocument2 pagesBusiness Combination. Quiz ICattleyaNo ratings yet

- MS Preweek QuizzerDocument23 pagesMS Preweek QuizzerJun Guerzon PaneloNo ratings yet

- Multiple choice questions on business combinationsDocument12 pagesMultiple choice questions on business combinationsHerwin Mae BoclarasNo ratings yet

- Business Combination (Statutory Merger) ReviewerDocument1 pageBusiness Combination (Statutory Merger) ReviewerErika100% (2)

- Advanced Accounting Baker Test Bank - Chap004Document56 pagesAdvanced Accounting Baker Test Bank - Chap004donkazotey90% (10)

- Auditing Theory QuizDocument9 pagesAuditing Theory QuizMilcah Deloso SantosNo ratings yet

- Business Combinations QuizzerDocument9 pagesBusiness Combinations QuizzerjaysonNo ratings yet

- MCQs - RICCHIUTE TEST BANK CHAPTER 1-2Document30 pagesMCQs - RICCHIUTE TEST BANK CHAPTER 1-2jpbluejnNo ratings yet

- AFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFDocument133 pagesAFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFLote Marcellano71% (14)

- BOSCOMDocument18 pagesBOSCOMArah Opalec100% (1)

- CPAR P2 7406 Business Combination at Date of Acquisition With Answer PDFDocument6 pagesCPAR P2 7406 Business Combination at Date of Acquisition With Answer PDFRose Vee0% (2)

- Pfrs 3 and 10 EXAM - FINALDocument12 pagesPfrs 3 and 10 EXAM - FINALElizabeth DumawalNo ratings yet

- 1Document35 pages1Rommel CruzNo ratings yet

- Joint Arrangement HandoutDocument5 pagesJoint Arrangement HandoutClyde SaulNo ratings yet

- CPA REVIEW SCHOOL PHILIPPINES BUSINESS COMBINATIONSDocument5 pagesCPA REVIEW SCHOOL PHILIPPINES BUSINESS COMBINATIONSAngelo Villadores100% (3)

- Business Combination. Quiz IIDocument2 pagesBusiness Combination. Quiz IICattleyaNo ratings yet

- College of Accountancy and Finance: 1st Semester, S.Y. 2018-2019 Page 1 of 4 Prof. GMDocument4 pagesCollege of Accountancy and Finance: 1st Semester, S.Y. 2018-2019 Page 1 of 4 Prof. GMPpp BbbNo ratings yet

- Prof. Jon D. Inocentes, Cpa Lecture January 31, 2018Document8 pagesProf. Jon D. Inocentes, Cpa Lecture January 31, 2018Riza Mae Biad LumaadNo ratings yet

- Home Office Agency and Branch FinancialsDocument11 pagesHome Office Agency and Branch FinancialsRaraj100% (1)

- Practical Accounting - Business Combinations Solved ProblemsDocument12 pagesPractical Accounting - Business Combinations Solved ProblemsRay Allen PabiteroNo ratings yet

- PAMANTASAN NG LUNGSOD NG VALENZUELA REVIEW PRACTICAL ACCOUNTING II INTEGRATED QUIZ ON BUSINESS COMBINATION AND CONSOLIDATED FINANCIAL STATEMENT DATE OF ACQUISITIONDocument6 pagesPAMANTASAN NG LUNGSOD NG VALENZUELA REVIEW PRACTICAL ACCOUNTING II INTEGRATED QUIZ ON BUSINESS COMBINATION AND CONSOLIDATED FINANCIAL STATEMENT DATE OF ACQUISITIONRichel Lidron100% (1)

- ACTREV 4 Business CombinationDocument4 pagesACTREV 4 Business CombinationchosNo ratings yet

- The Following Information Will Be Used For Question Nos. 8 and 9Document5 pagesThe Following Information Will Be Used For Question Nos. 8 and 9jenieNo ratings yet

- Joint Arrangements: Problem 6-1: True or FalseDocument18 pagesJoint Arrangements: Problem 6-1: True or FalseVenz LacreNo ratings yet

- Advanced AccountingDocument14 pagesAdvanced AccountingBehbehlynn67% (3)

- 11 - Substantive Tests of Property, Plant and EquipmentDocument27 pages11 - Substantive Tests of Property, Plant and EquipmentArleneCastroNo ratings yet

- Chapter 16 Business Combinations - Part 3Document11 pagesChapter 16 Business Combinations - Part 3Erwin Labayog MedinaNo ratings yet

- Activity 1Document4 pagesActivity 1Fernando III PerezNo ratings yet

- Contract Account Preparation For Loss/Profit CalculationDocument6 pagesContract Account Preparation For Loss/Profit CalculationMozam MushtaqNo ratings yet

- Chapter 07, 08, 09 Non Current AssetsDocument8 pagesChapter 07, 08, 09 Non Current Assetsali_sattar15No ratings yet

- Audit of PPEDocument1 pageAudit of PPEshambiruar100% (1)

- Historical Cost Accounting Limitations University Exams 2010/2011Document5 pagesHistorical Cost Accounting Limitations University Exams 2010/2011dmugalloyNo ratings yet

- Total Assets 524,600 ? ? 220,111Document2 pagesTotal Assets 524,600 ? ? 220,111Saranya VillaNo ratings yet

- Funds Flow Analysis: Problems and Solutions: Balance SheetDocument12 pagesFunds Flow Analysis: Problems and Solutions: Balance SheetAbhilash ShahNo ratings yet

- Practicalweek48 0809answersDocument8 pagesPracticalweek48 0809answersLaura BasalicNo ratings yet

- Cash Flow StatementsDocument8 pagesCash Flow StatementsAloyNireshNo ratings yet

- BIFR FUNCTIONSDocument12 pagesBIFR FUNCTIONSdakshbajajNo ratings yet

- CHAPTER 10 - Pre-Board ExaminationsDocument34 pagesCHAPTER 10 - Pre-Board Examinationsmjc24No ratings yet

- Tax Depreciation, Amortisation, Pre-Commencement Expenditure ICAP F StudentsDocument10 pagesTax Depreciation, Amortisation, Pre-Commencement Expenditure ICAP F Studentssohail merchantNo ratings yet

- 201455200239Amendments-F.a. 2013 - For UplaodingDocument7 pages201455200239Amendments-F.a. 2013 - For UplaodingvishalniNo ratings yet

- Assignment 1Document2 pagesAssignment 1Lina AnastasiaNo ratings yet

- TUF Scheme For Textile IndustryDocument10 pagesTUF Scheme For Textile IndustryhirentrvdNo ratings yet

- Chapter 15 Multiple Choice - Answer KeysDocument7 pagesChapter 15 Multiple Choice - Answer KeysJulie Ann CanlasNo ratings yet

- I Could Not Ask For More and I Love You GoodbyeDocument3 pagesI Could Not Ask For More and I Love You GoodbyeJulie Ann CanlasNo ratings yet

- Exam 3Document8 pagesExam 3Julie Ann Canlas0% (1)

- Airplanes LyricsDocument2 pagesAirplanes LyricsJulie Ann CanlasNo ratings yet

- Carag Vs NLRC Case DigestDocument2 pagesCarag Vs NLRC Case DigestJulie Ann CanlasNo ratings yet

- Gross Profit Variation AnalysisDocument1 pageGross Profit Variation AnalysisJulie Ann Canlas100% (2)

- Time Value of MoneyDocument20 pagesTime Value of Moneymdsabbir100% (1)

- San Beda Insurance Mem AidDocument24 pagesSan Beda Insurance Mem AidSean GalvezNo ratings yet

- APA Sample PaperDocument10 pagesAPA Sample Paperjeremyreynolds841538No ratings yet

- Chapter 15 Multiple Choice - Answer KeysDocument7 pagesChapter 15 Multiple Choice - Answer KeysJulie Ann CanlasNo ratings yet

- CVP AnalysisDocument2 pagesCVP AnalysisJulie Ann CanlasNo ratings yet

- Solution-Review Problems of Chapter 17Document11 pagesSolution-Review Problems of Chapter 17Julie Ann CanlasNo ratings yet

- Holy Angel University Department of Accountancy Exam NoticeDocument2 pagesHoly Angel University Department of Accountancy Exam NoticeJulie Ann Canlas100% (1)

- The Sacrament of WaitingDocument3 pagesThe Sacrament of WaitingJulie Ann CanlasNo ratings yet

- + Ad Majorem Dei Gloriam Security and Credit TransactionsDocument28 pages+ Ad Majorem Dei Gloriam Security and Credit TransactionsJulie Ann CanlasNo ratings yet

- + Ad Majorem Dei Gloriam Security and Credit TransactionsDocument28 pages+ Ad Majorem Dei Gloriam Security and Credit TransactionsJulie Ann CanlasNo ratings yet

- Sample Land ContractDocument11 pagesSample Land ContractJulie Ann Canlas100% (1)

- Internal Control-Integrated FrameworkDocument6 pagesInternal Control-Integrated FrameworkJulie Ann CanlasNo ratings yet

- Reporting of Fraud, Has Referred To Fraud As Encompassing "An Array of Irregularities and Illegal ActsDocument6 pagesReporting of Fraud, Has Referred To Fraud As Encompassing "An Array of Irregularities and Illegal ActsNur Syifa NadiaNo ratings yet

- Name: Mamta Madan Jaya Topic: Management Accounting (Comparative Balance Sheet) ROLL NO: 5296 Class: Sybms Marketing Div: CDocument5 pagesName: Mamta Madan Jaya Topic: Management Accounting (Comparative Balance Sheet) ROLL NO: 5296 Class: Sybms Marketing Div: CKirti RawatNo ratings yet

- 2 CVP and Break-Even AnalysisDocument7 pages2 CVP and Break-Even AnalysisXyril MañagoNo ratings yet

- Wonder (Pvt) Ltd Company ACCN 101 Group AssignmentDocument37 pagesWonder (Pvt) Ltd Company ACCN 101 Group AssignmentSimphiwe KarrenNo ratings yet

- BUS 5110 Managerial Accounting-Portfolio Activity Unit 8Document6 pagesBUS 5110 Managerial Accounting-Portfolio Activity Unit 8LaVida LocaNo ratings yet

- Road Maintenance Management ManualDocument36 pagesRoad Maintenance Management ManualMichael KaziNo ratings yet

- At Handout 3 RA 9298Document10 pagesAt Handout 3 RA 9298xernathanNo ratings yet

- Chapter - 2 Cost TermsDocument23 pagesChapter - 2 Cost TermsZubair Chowdhury0% (1)

- Internal Control SystemDocument9 pagesInternal Control SystemMuhammad TabbasumNo ratings yet

- Financial Accounting 7th Edition Harrison Test BankDocument27 pagesFinancial Accounting 7th Edition Harrison Test Bankjessicapatelojgsfyqmbt100% (16)

- First Quiz in Management AccountingDocument7 pagesFirst Quiz in Management AccountingEumell Alexis PaleNo ratings yet

- Accounting For Business CombinationsDocument13 pagesAccounting For Business CombinationsLu CasNo ratings yet

- MBA Pre-Term - Ch3 - BSDocument83 pagesMBA Pre-Term - Ch3 - BSJoe YunNo ratings yet

- Chapter 3Document5 pagesChapter 3Julie Neay AfableNo ratings yet

- Accounting Equation and TransactionsDocument12 pagesAccounting Equation and TransactionsAl Francis GuillermoNo ratings yet

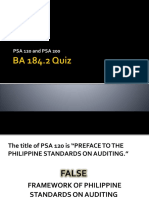

- PSA 120 and PSA 200Document26 pagesPSA 120 and PSA 200Anna CastroNo ratings yet

- Udoh, Emmanuel Billy: Personal StatementsDocument3 pagesUdoh, Emmanuel Billy: Personal StatementsImmanuel Billie AllenNo ratings yet

- Akuntansi Keuangan Lanjutan - Akuntansi Penggabungan UsahaDocument67 pagesAkuntansi Keuangan Lanjutan - Akuntansi Penggabungan UsahachendyNo ratings yet

- AAA Company Financial PositionDocument4 pagesAAA Company Financial PositionEthan Michael CorralesNo ratings yet

- University of The Cordilleras College of Accountancy Quiz On Partnership Formation 1Document6 pagesUniversity of The Cordilleras College of Accountancy Quiz On Partnership Formation 1Ian Ranilopa100% (1)

- Soal + JawabDocument4 pagesSoal + JawabNaim Kharima Saraswati100% (1)

- Cash and Accrual BasisDocument2 pagesCash and Accrual Basisviji9999No ratings yet

- Accounting 201: True-False StatementsDocument4 pagesAccounting 201: True-False StatementsThao LeNo ratings yet

- Revenue Accounting and RecognitionDocument7 pagesRevenue Accounting and RecognitionjsphdvdNo ratings yet

- Differences Between Auditing and InvestigationDocument9 pagesDifferences Between Auditing and InvestigationAbid Tareen0% (1)

- Audit ResearchDocument10 pagesAudit ResearchChamunorwa MunemoNo ratings yet

- Jadwal Interview Analisa Jabatan BP V 2Document3 pagesJadwal Interview Analisa Jabatan BP V 2Reza ZachrandNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument2 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Standard Costing Journal EntriesDocument11 pagesStandard Costing Journal EntriesRachel LeachonNo ratings yet

- Agenda Item 5-B: International Framework For Assurance EngagementsDocument21 pagesAgenda Item 5-B: International Framework For Assurance Engagementskelvin mkweshaNo ratings yet