Professional Documents

Culture Documents

Stock Smart Weekly (Feb 07, 2014)

Uploaded by

jhnayarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stock Smart Weekly (Feb 07, 2014)

Uploaded by

jhnayarCopyright:

Available Formats

Pakistan Weekly Update

StockSmart

AKD Equity Research / Pakistan

Weekly Review

Index & Volume Chart

300,000

26,751

13.0%

27,000

11.0%

26,950

26,682

290,000

26,900

9.0%

26,850

7.0%

Top-5 Volum e Leaders

280,000

26,800

5.0%

Sym bol

270,000

26,750

3.0%

Volum e (m n)

26,700

JSCL

164.07

260,000

ANL

71.29

250,000

26,600

1.0%

FCCL

43.61

240,000

26,550

3.0%

230,000

26,500

5.0%

BYCO

36.61

EFERT

32.23

26,863

26,650

3Feb

4Feb

ReadyVolume(LHS)

6Feb

7Feb

KSE100Index(RHS)

1.0%

POL

26,946

SSGC

310,000

Universe Gainers & Losers

(Index)

HMB

(Shrs'000)

ICI

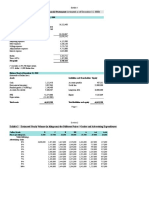

Avg. Daily Turnover ('mn shares)

This week

283.53

Last week

299.49

Change

-5.33%

HCAR

US$bn

61.51

62.65

-1.83%

MTL

PkRbn

6,482.33

6,607.30

-1.89%

AGTL

Indices

KMI-30

Allshare

This week 44,090.97 19,881.18

Last week 44,186.56 20,244.31

Change

-0.22%

-1.79%

FATIMA

Indices

KSE-100

KSE-30

This week 26,681.78 19,255.94

Last week 26,784.34 19,296.75

Change

-0.38%

-0.21%

The market remained sluggish as the KSE-100 Index shed 0.38%WoW to end at 26,682

points on Friday, failing to sustain its high after closing at 26,863 points on Thursday.

Average daily turnover came off by 5.33%WoW to 284mn shares but this remains a

healthy run rate. Key news flows during the week included 1) low CPI reading for Jan14

where CPI clocked in at 7.9%YoY, 2) recommendation by the Senate Standing Committee to abolish GST on tractors, 3) announcement by the PTA Chairman that the PTA is

targeting the third week of Mar14 for the 3G/4G auction and 4) MoP proposal to deregulate prices of petroleum products. At the same time, political noise picked up this week as

negotiations between the TTP nominated committee and GoP representatives commenced. Within our coverage, key gainers during the week were DAWH (+12.4%WoW),

EPCL (+6.9%WoW), FATIMA (+2.7%WoW), MTL (+2.3%WoW) and AGTL (+1.1%WoW).

On the flipside, the main losers during the week included POL (-4.1%WoW), SSGC (4.0%WoW), HMB (-3.9%WoW), HCAR (-3.2%WoW) and ICI (-2.9%WoW). Volumes during the week were led by JSCL (164.07mn shares), ANL (71.29mn shares), FCCL

(43.61mn shares), BYCO (36.61mn shares) and EFERT (32.23mn shares).

EPCL

research@akdsecurities.net

009221 111 253 111

DAWH

AKD Research

Mkt Cap.

This week

Last week

Change

7 February 2014

Source: KSE & AKD Research

(Index)

(mn)

700

28,000

26,700

600

25,400

500

24,100

22,800

400

21,500

300

20,200

18,900

200

17,600

100

16,300

0

Feb-14

Oct-13

Dec-13

Jul-13

Volume (LHS)

Aug-13

May-13

Mar-13

Feb-13

15,000

Outlook

The Pakistan Market remains largely secluded from global developments (e.g. tapering

QE3 by the US Fed). As such, market movement will likely be driven by the result season

picking pace where major results coming next week include the Nishat Group companies

including MCB, NPL, DGKC and NML as well as ENGRO and ABL. Progress on the GoP

-TTP talks is also likely to garner investor attention.

KSE- 100 Index

Important disclosures including investment banking relationships and analyst certification at end of this report. AKD Securities does and seeks to do business with companies

Important disclosures covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of the report. Investors

should consider this report as only a single factor in making their investment decision.

AKD SECURITIES

Member: Karachi Stock Exchange

Find AKD research on Bloomberg

(AKDS<GO>), firstcall.com

and Reuters Knowledge

Copyright2014 AKD Securities Limited. All rights reserved. The information provided on this document is not intended

for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be

contrary to law or regulation or which would subject AKD Securities or its affiliates to any registration requirement within

such jurisdiction or country. Neither the information, nor any opinion contained in this document constitutes a solicitation

or offer by AKD Securities or its affiliates to buy or sell any securities or provide any investment advice or service. AKD

Securities does not warrant the accuracy of the information provided herein.

www.akdsecurities.net

AKD Securities Limited

StockSmart

7 February 2014

Pakistan Weekly Update

This Weeks Daily Reports

Feb 07, 2014

26,943

Banks CY13 Universe Result Preview, AKD Daily (Feb 07, 2014)

26,894

Banking sector results will start coming in from next week with MCB and ABL scheduled to announce their full-year CY13 results on Tuesday, Feb 11'14. Going by precedence, the rest of the major banks should announce their results in the ongoing month

as well. In this regard, the Big-6 banks in our coverage are projected to post combined

NPAT of PkR91.0bn in CY13E vs. combined NPAT of PkR95.9bn in CY12, translating

into a decline of 5%YoY (ex-NBP: +0.3%YoY). Key trends visible in full-year results are

expected to be 1) decline in NII largely due to margin contraction, 2) a sharp decline in

loan provisions (with the exception of NBP), 3) modest 5%YoY growth in non-interest

income and 4) in-control admin expense growth of ~10%YoY. We flag the possibility of

net provisioning reversals in 4QCY13, which may potentially lead to positive earnings

surprises. However, payout announcements should largely be on track. At current levels, we retain our preference for UBL (TP: PkR145/share), ABL (TP: PkR95/share) and

NBP (TP: PkR62.5/share).

26,845

26,796

26,747

26,698

26,649

15:48

15:03

14:19

13:36

12:53

12:10

11:27

9:59

10:43

9:15

26,600

Feb 06, 2014

Cement Dispatches Jan'14/7MFY14, AKD Daily (Feb 06, 2014)

26,905

26,880

26,855

26,830

26,805

26,780

26,755

15:29

14:37

13:45

12:54

12:04

11:13

9:30

10:22

26,730

Cement dispatches for Jan'14 increased by 2.6%YoY to clock in at 2.73mn tons.

Growth was largely led by a sharp 26.1%YoY increase in exports via sea resulting in an

overall increase in exports of 7.6%YoY to clock in at 563k tons. Growth in local dispatches on the other hand remained subdued, posting an increase of 1.3%YoY to

2.16mn tons. As a result, total 7MFY14 dispatches clocked in at 18.86mn tons posting

a tepid increase of 1.3%YoY. Local dispatches grew by 2.1%YoY to 14.15mn tons

while exports posted a decline of 0.8%YoY to 4.71mn tons. Decline in exports to Afghanistan will likely continue to be a drag on dispatch growth where competition from

Iranian cements and slow pace of progress on development projects in Afghanistan

have been holding back growth. The declining proportion of sales to Afghanistan

(7MFY14 share of 48% vs. 7MY13 share of 56%) and a dip in exports post a potential

US troop withdrawal may force manufacturers to look to the South for future expansions / consolidations.

Banks: Susceptible to lull in rate hike cycle, AKD Daily (Feb 04, 2014)

Feb 04, 2014

26,895

26,860

26,825

26,790

26,755

26,720

26,685

15:25

14:34

13:44

12:54

12:04

11:13

9:29

10:22

26,650

Pakistan Market: Jan14 Review & Outlook, AKD Daily (Feb 03, 2014)

Feb 03, 2014

26,991

26,958

26,925

26,892

26,859

26,826

26,793

15:26

14:35

13:45

12:54

12:04

11:13

9:29

26,760

10:22

CPI inflation for Jan'14 has clocked in at 7.91%YoY, higher than our projected 7.5%

YoY, but sharply lower than 9.18%YoY in Dec'13. This deceleration is largely attributable to a downtick in food inflation (+6.7%YoY/-0.1%MoM) and a contained 1.5%MoM

increase in the housing & utilities category. As a result, the 7MFY14 CPI average

comes to 8.6%YoY. At the same time, Core CPI (trimmed mean) also depicted a downward trend to clock in at 8.2%YoY in Jan'14 versus 8.7%YoY in Dec'13 and 9.9%YoY

in Jan'13. Going forward even if CPI increases by 0.8%MoM, the full-year average

should still fall within single digits (~9%YoY). Considering the Discount Rate already

stands at 10% and the PkR has depicted stability of late, we believe the SBP is likely

hold interest rates in the Mar'14 MPS. For our Banks Universe, we have incorporated

an average DR of 10.5% for CY14F where a reduction in this to 10% will, all else the

same, reduce our CY14F Universe proft estimates by 8% on average. For now however, we leave base-case estimates unchanged where risks to resumption of monetary

tightening emanate from 1) inordinate delay in targeted foreign flows, 2) snags in the

privatization process and 3) continued high GoP borrowing from the central bank.

Source:KSE&AKDResearch

The market welcomed the new year with its bullish theme intact as the benchmark KSE

-100 Index gained 6.03%MoM in Jan'14 to close at 26,784 points. In the process, the

Index has returned 27.5%FY14TD, on track to reach our base case Jun'14 Index target

of 27,800 points (bull case Index target: 29,700). Despite the strong performance, Pakistan continues to be attractive on valuations with an FY14F P/E of 8.6x compared to

regional average of 11.2x. At the same time, Pakistan's dividend yield at 5.9% far exceeds the regional average of 3.4%. In terms of corporate developments, key headlines

in the month included i) hike in GIDC for industrial sectors, ii) approval of concessionary

gas rate for Engro Fertilizer and iii) announcement by the Chinese group Shandong

Ruyi of investing US$2bn in the textile and energy sectors of Pakistan. At the same

time, lower than expected inflation reading with Dec'13 CPI clocking in at 9.18%YoY

buoyed market sentiment. Despite the positives, the market may potentially be heading

AKD Securities Limited

StockSmart

7 February 2014

Pakistan Weekly Update

This Weeks Daily Reports

down correction territory with the MSCI EM Index down 3.7% over the past two weeks.

Taking cue, frontier markets have also underperformed with the MSCI FM Index down

1.2% over the past two weeks, where we may see a trickle down impact on the KSE100 Index as well. At current levels, we advocate a cautious stance in Feb'14 where

our preferred stocks include a blend of growth (NML, DGKC, FATIMA) and high D/Y

(HUBC, KAPCO, NBP).

AKD Securities Limited

StockSmart

7 February 2014

Pakistan Weekly Update

Regional Valuations (2014)

EPSGrowth

PE(x)

Pakistan

22% 8.56

Indonesia

13% 10.55

Malaysia

17% 11.65

Philippines

9% 14.49

Vitenam

16% 14.36

India

19% 12.53

China

15% 6.93

%

Pakistan

Indonesia

Malaysia

Philippines

Vitenam

India

China

ROE

21.38

18.76

13.64

14.73

18.47

17.50

14.02

DivdYld

5.82

2.54

3.51

2.58

n.a

1.94

4.04

Source: Bloomberg & AKD Universe

Major World Indices Performance

Country

BloombergCode

Pakistan

Srilanka

Thailand

Jakarta

Malaysia

Philippines

Vietnam

HongKong

Singapore

Brazil

Russia

India

China

S&P

DJIA

NASDAQComposite

UK

German

Qatar

AbuDhabi

Dubai

Kuwait

Oman

SaudiArabia

MSCIEM

MSCIFM

KSE100Index

CSEALLIndex

SETIndex

JCIIndex

FBMKLCIIndex

PCOMPIndex

VNINDEXIndex

HSIIndex

FSSTIIndex

IBXIndex

RTSSTDIndex

SENSEXIndex

SHCOMPIndex

SPXIndex

INDUIndex

CCMPIndex

UKXIndex

DAXIndex

DSMIndex

ADSMIIndex

DFMGIIndex

KWSEIDXIndex

MSM30Index

SASEIDXIndex

MXEFIndex

MXFMIndex

7Feb14

31Jan14

26,682

6,142

1,296

4,467

1,809

6,011

550

21,637

3,013

19,644

9,966

20,377

2,044

1,773

15,629

4,057

6,570

9,285

11,192

4,722

3,931

7,832

7,107

8,819

930

602

26,784

6,248

1,274

4,419

1,804

6,041

557

22,035

3,027

19,560

9,829

20,514

2,033

1,783

15,699

4,104

6,510

9,306

11,156

4,673

3,770

7,756

7,087

8,761

937

600

WoW

CYTD

0.38%

5.62%

1.70%

3.87%

1.74%

0.17%

1.08%

4.50%

0.25%

3.13%

0.50%

2.06%

1.21%

8.94%

1.81%

7.16%

0.47%

4.87%

0.43%

7.75%

1.39%

2.07%

0.67%

3.75%

0.56%

3.38%

0.51%

4.05%

0.45%

5.72%

1.14%

2.86%

0.91%

2.66%

0.23%

2.80%

0.33%

7.83%

1.04%

10.06%

4.27%

16.67%

0.98%

3.74%

0.27%

3.98%

0.67%

3.32%

0.72%

7.27%

0.35%

1.20%

Source: Bloomberg

International Major Currencies

SPOT

PkR/US$ Trend

109.0

7Feb14

31Jan14

80.973

81.311

WoW

CYTD

0.338

0.42%

1.17%

USD/PkR

105.370

105.470

0.100

USD/JPY

102.260

0.09%

0.04%

102.040

0.220

0.22%

2.90%

EUR/USD

1.357

1.349

0.008

0.62%

1.26%

GBP/USD

1.634

1.644

0.010

0.60%

1.30%

AUD/USD

0.894

0.876

0.018

2.08%

0.24%

NZD/USD

0.825

0.809

0.016

1.99%

0.40%

CHF/USD

0.902

0.907

0.005

0.54%

0.97%

CAD/USD

1.107

1.113

0.006

0.55%

4.18%

USD/KRW

1,074

1,081

6.520

0.60%

2.35%

CNY/USD

6.064

6.061

0.003

0.16%

0.04%

Source: Bloomberg

DollarIndex

108.0

107.0

106.0

105.0

104.0

103.0

102.0

101.0

100.0

99.0

98.0

Feb-14

Dec-13

Oct-13

Jul-13

Sep-13

May-13

Mar-13

Feb-13

97.0

Source: Bloomberg

Chg+/

Commodities

TRJ-CRB Index

SPOT

Units

7Feb14

31Jan14

WoW

CYTD

TRJCRB

Points

287.22

283.31

1.38%

2.52%

295

Nymex(WTI)

US$/bbl.

97.6

97.49

0.11%

0.83%

290

ICEBrent

US$/bbl.

107.02

107.2

0.17%

3.43%

285

N.GasHenryHub

US$/Mmbtu

7.1767

5.0098

43.25%

65.21%

280

Cotton

USd/Pound

92.3

92.75

0.49%

2.90%

Gold

US$/Tr.Oz

1261.67

1244.55

1.38%

4.65%

Sliver

US$/Tr.Oz

19.883

19.1775

3.68%

2.13%

2.68%

300

275

Feb-14

Jan-14

Dec-13

Oct-13

Nov-13

Sep-13

Aug-13

Jul-13

Jun-13

May-13

Apr-13

Mar-13

Feb-13

270

Source: Bloomberg

Copper

US$/MT

7178

7096

1.16%

Platinum

US$/Oz

1387.5

1379.38

0.59%

1.32%

Coal

US$/MT

79.9

79.9

0.00%

5.56%

Source: Bloomberg

AKD Securities Limited

StockSmart

7 February 2014

Pakistan Weekly Update

Chart Bank

Earnings Yield vs. T-Bill (12M) Differential

Advance to Decline Ratio

(%)

1.60

12.0

1.50

10.0

1.40

8.0

1.30

6.0

4.0

1.20

2.0

1.10

FIPI Flows for the week

Feb14

Dec13

Oct13

Aug13

Jun13

Feb13

Jan14

Jun13

Dec12

May12

Oct11

Apr11

Sep10

Mar10

Aug09

Jan09

0.80

Jul08

(6.0)

Dec07

0.90

LIPI Flows for the week

(US$mn)

(US$'000)

Bank/DFI,

4.24

6.00

3,500

2,997

M.Funds,

(11.11)

4.00

3,000

2,625

2.00

2,500

2,000

(2.00)

Ind.,0.10

1,500

Co.,(2.22)

1,000

NBFC,4.70

(4.00)

980

(6.00)

275

(8.00)

Others,

(9.32)

(10.00)

06Feb14

07Feb14

KSE100

75%

65%

55%

45%

35%

25%

15%

5%

5%

15%

May13

Aug13

KSEAllShareIndex

Nov13

Feb14

AKDUniverse

MSCIEM

MSCIFM

Jan13

52%

47%

42%

37%

32%

27%

22%

17%

12%

7%

2%

3%

Feb13

KSE-100 vs. MSCI-EM & MSCI-FM

Nov13

AKD Universe vs. KSE-100 Index

Aug13

04Feb14

Jun13

03Feb14

Feb14

500

Mar13

Jun07

(4.0)

Apr13

1.00

(2.0)

AKD Securities Limited

StockSmart

7 February 2014

Pakistan Weekly Update

AKD Universe Valuations

7Feb14

EPS(PkR)

EPSchg(%)

EPSchg(%)ExFinancials

BookValueperShare(PkR)

Payout(%)

Valuations

PricetoEarnings(x)

PricetoBook(x)

PER(x)ExFinancials

P/BVS(x)ExFinancials

PricetoCF(x)

EarningsYield(%)

DividendYield(%)

EV/EBITDA(x)

Profitability

ReturnonEquity(%)

ReturnonAssets(%)

ChginSales(%)

GrossMargin(%)

OperatingMargin(%)

NetMargin(%)

2011A

8.12

24.30

25.15

38.13

52.26

2012A

8.75

7.72

6.72

43.80

50.74

2013A/E

9.68

10.59

18.50

49.35

51.57

2014F

11.82

22.14

26.51

55.30

49.87

2015F

13.88

17.39

19.23

61.96

47.16

12.46

2.65

13.42

3.24

20.43

8.03

4.20

7.93

11.56

2.31

12.57

2.85

21.64

8.65

4.39

7.01

10.46

2.05

10.61

2.42

10.84

9.56

4.93

6.17

8.56

1.83

8.39

2.11

19.12

11.68

5.82

5.37

7.3

1.63

7.03

1.86

11.78

13.71

6.47

4.74

21.31

3.85

17.34

23.41

14.47

11.38

19.98

3.56

17.28

21.79

12.95

10.46

19.61

3.81

6.12

22.80

13.99

10.90

21.38

4.12

13.68

22.36

13.85

11.71

22.40

4.39

10.52

22.85

14.61

12.44

Source: AKD Research

Market PER Chart 2014F

(x)

15

11

8

Jan14

Nov12

Aug11

May10

Mar09

Dec07

Sep06

Jul05

Source: AKD Research

Market P/BVS Chart 2014F

(x)

3.5

2.6

1.7

Jan14

Nov12

Aug11

May10

Mar09

Dec07

Sep06

Jul05

0.8

Source: AKD Research

AKD Securities Limited

StockSmart

7 February 2014

Pakistan Weekly Update

EPS

Symbol Coverage

Price

TPClusters

Stance Valuations

AKD Universe Active

(PkR)

Stocks

PE(x)

PB(x)

DY(%)

(PkR)

(PkR)

12A 13A/E 14F

12A 13A/E 14F 12A13A/E 14F 12A13A/E 14F

AutomobileandParts

IndusMotors

INDU

377.2 384.29 Neutral 54.7 42.7 49.16.98.87.7 1.71.7 1.58.5 6.66.4

PakSuzukiMotors

PSMC

163.8 173.46 Accumulate 11.9 24.3 21.713.86.87.5 0.90.8 0.71.5 3.12.4

ConstructionandMaterials

DGKC

96.1 105.47 Accumulate 9.4 12.6 12.110.27.67.9 1.30.9 0.81.6 3.13.1

DGKhanCement

Chemicals

EngroPolymerChemicals

EPCL

16.1 16.49 Neutral 0.11.11.1 138.4 15.1 14.0 1.71.5 1.4

ICIPakistanLimited

ICI

311.7 228.39

Sell

10.57.4 17.829.6 41.9 17.5 2.82.8 2.51.8 1.62.9

LotteChemicalPakistanLtd.

LOTCHEM 7.2 8.53 Accumulate 0.0(0.3) 0.6 n.m n.m 12.1 0.90.9 0.83.5

EngroCorporation

ENGRO

176.3 196.20 Accumulate 2.6 18.7 22.967.69.47.7 2.11.2 1.1

EngroFertilizersLimited

EFERT

49.1 55.45 Accumulate (2.3) 4.25.6(21.7) 11.68.7 4.02.9 2.2

DawoodHerculesLimited

DAWH

76.0 71.83 Reduce 2.09.2 13.137.28.25.8 1.9 n.a n.a1.3

FaujiFert.BinQasimLtd.

FFBL

42.8 49.33 Accumulate 4.66.06.69.27.16.5 3.22.5 2.6 10.5 12.8 14.6

FaujiFertilizerCompany

FFC

114.0 138.62

Buy

16.4 15.8 16.47.07.26.9 6.66.0 5.8 13.6 14.0 14.3

FatimaFertilizer

FATIMA

29.1 35.09

Buy

2.94.15.010.07.25.8 2.11.8 1.56.9 6.96.9

FoodProducers

EngroFoodsLimited

EFOODS 102.1 80.92

Sell

3.40.32.630.2 371.1 39.3 7.86.8 5.8

Oil&Gas

Oil&GasDevelopmentCo.

OGDC

273.4 265.50 Neutral 21.6 21.1 27.612.6 13.09.9 4.43.6 2.92.7 3.04.2

PakOilfields

POL

508.0 612.57

Buy

50.1 45.8 59.110.1 11.18.6 3.43.5 3.2 10.3 8.99.1

PakistanStateOil

PSO

343.8 335.18 Neutral 36.7 50.8 76.89.46.84.5 1.71.4 1.11.6 1.52.9

Electricity

HubPowerCo.

HUBC

63.0 77.41

Buy

7.18.19.68.97.86.5 2.42.2 2.19.5 12.7 14.3

KotAdduPowerCompany

KAPCO

64.7 63.00 Neutral 6.98.49.19.47.77.1 2.42.3 2.3 10.7 11.6 13.5

FixedLineTelecommunication

PakistanTelecommunication PTC

28.8 32.5 Accumulate 2.22.93.413.09.98.6 1.41.3 1.3 6.8 8.5

PersonalGoods

NishatMills

NML

135.9 141.38 Neutral 10.0 16.6 19.013.58.27.1 1.30.8 0.72.6 2.93.7

NCL

64.2 61.61 Neutral 3.5 11.4 14.818.45.64.3 2.11.6 1.22.6 2.87.0

NishatChunianLtd.

Banks

AlliedBankLimited

ABL

87.0 95.03 Accumulate 11.4 10.7 11.07.68.17.9 1.81.5 1.46.8 6.36.9

BankAlFalah

BAFL

27.7 26.95* Accumulate 3.43.33.88.28.37.3 1.21.2 1.17.2 5.46.3

HabibBankLimited

HBL

165.0 154.97 Reduce 16.7 16.3 18.29.9 10.19.1 1.71.6 1.54.1 5.25.8

MCBBankLimited

MCB

283.0 255.00 Reduce 20.9 22.2 22.413.5 12.7 12.7 2.72.5 2.34.2 4.95.3

NationalBankofPakistan

NBP

58.1 62.50 Accumulate 7.95.78.07.4 10.37.2 0.80.8 0.7 10.5 7.79.5

UnitedBankLtd

UBL

134.1 145.00 Accumulate 15.7 15.0 15.98.58.98.4 1.61.6 1.46.3 6.36.7

*TPforBAFLrisestoPkR30/shareuponsuccessfulWaridstakesale

Source: AKD Research

AKD Securities Limited

StockSmart

7 February 2014

Pakistan Weekly Update

AKD Universe Coverage Clusters Performance

Stocks

Sym bol

Price

7-Feb-14

1M

CYTD

1 Year

High

1 Year

Low

26681.78

1.6

14.9

14.8

53.5

5.6

27104.70

17492.00

AGTL

MTL

206.27

473.61

-4.0

-3.5

3.2

-0.4

-5.6

-6.8

-11.7

-9.1

-2.9

-1.8

235.93

519.58

197.00

433.73

INDU

PSMC

377.20

163.83

7.0

-1.1

13.9

33.8

5.1

8.9

32.4

72.1

13.3

6.5

398.10

167.70

282.00

97.29

DGKC

LUCK

96.07

308.69

4.4

-1.9

32.4

19.4

11.0

34.7

71.4

95.9

12.1

2.9

95.63

321.67

57.89

160.97

EPCL

ICI

LOTCHEM

DAWH

ENGRO

FATIMA

FFBL

FFC

16.06

311.73

7.15

75.99

176.34

29.10

42.83

114.01

2.2

19.8

-7.1

27.1

3.7

-2.0

-3.6

-1.8

28.8

85.1

8.7

43.3

32.4

7.9

8.6

2.6

25.2

88.9

-6.0

36.0

20.7

17.2

3.4

4.6

53.8

106.5

-6.2

123.4

86.7

13.1

12.4

-4.1

19.8

23.2

-2.6

35.4

11.3

1.9

-2.2

1.8

16.66

298.25

8.89

69.01

186.91

30.16

45.42

119.75

9.29

135.37

6.46

35.76

94.44

21.29

36.90

101.90

EFOODS

102.13

-12.9

16.6

-18.5

-13.0

-2.2

162.22

80.37

39.61

4.2

51.3

28.2

59.6

6.0

40.37

23.57

OGDC

POL

PSO

273.36

508.00

343.78

-4.3

-1.1

1.7

2.4

8.9

17.6

9.2

-3.1

-2.3

40.9

8.3

80.6

-1.1

2.1

3.5

287.84

531.92

367.10

197.32

435.37

184.67

HUBC

KAPCO

62.96

64.70

-1.4

2.4

0.8

7.1

-7.5

10.2

28.0

19.6

3.7

4.8

73.42

68.34

50.13

49.53

PTC

28.81

-2.2

5.8

7.3

48.0

1.3

31.70

17.46

NCL

NML

64.20

135.89

1.7

1.2

21.2

36.1

3.1

32.0

70.5

108.5

6.6

6.8

68.82

140.79

43.31

67.46

ABL

AKBL

BAFL

HBL

HMB

MCB

MEBL

NBP

UBL

87.04

14.00

27.69

165.01

24.50

283.04

38.17

58.09

134.08

-3.8

0.1

0.7

1.1

-4.1

-2.5

-2.1

-0.9

-1.4

3.3

29.0

12.8

10.6

9.0

-3.1

-0.9

13.8

5.0

10.9

8.9

27.4

-0.1

29.4

1.0

4.0

1.3

7.7

30.3

-10.3

48.2

54.8

32.4

47.3

46.1

29.7

46.4

-3.3

0.0

2.4

-1.0

-2.3

0.7

-3.1

0.1

1.2

94.51

16.15

28.66

181.57

26.16

316.87

40.87

59.45

154.21

55.01

10.76

14.77

88.00

14.61

183.00

24.11

37.66

82.16

KSE-100 Index

Absolute Perform ance (%)

3M

6M

12M

Industrial Engineering

Al-Ghazi Tractor

Millat Tractors

Autom obile and Parts

Indus Motors

Pak Suzuki Motors

Construction and Materials

DG Khan Cement

Lucky Cement

Chem icals

Engro Polymer Chemicals

ICI Pakistan Limited

Lotte Pakistan PTA Limited

Daw ood Hercules

Engro Chemical

Fatima Fertilizer

Fauji Fert. Bin Qasim Ltd.

Fauji Fertilizer Company

Food Producers

Engro Foods Limited

Non Life Insurance

Adamjee Insurance

AICL

Oil & Gas

Oil & Gas Development Co.

Pak Oilfields

Pakistan State Oil

Electricity

Hub Pow er Co.

Kot Addu Pow er Company

Fixed Line Telecom m unication

Pakistan Telecommunication

Personal Goods

Nisaht (Chunian) Ltd.

Nishat Mills

Banks

Allied Bank Limited

Askari Bank Limited

Bank AlFalah

Habib Bank Limited

Habib Metropolitan Bank

MCB Bank Limited

Meezan Bank Limited

National Bank of Pakistan

United Bank Ltd

Source: KSE & AKD Research

AKD Securities Limited

StockSmart

7 February 2014

Pakistan Weekly Update

Economic Snapshot

End Month Data

Units

Feb-13

Mar-13

Apr-13

May-13

Jun-13

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

T-bill

3M

9.20

9.37

9.42

9.41

9.26

8.93

9.00

9.15

9.47

9.63

9.93

6M

9.32

9.46

9.44

9.42

9.16

9.01

9.20

9.35

9.68

9.88

10.02

12M

9.37

9.47

9.46

9.43

9.19

9.03

9.34

9.48

9.81

9.96

10.12

PIB 10Y

11.99

12.00

11.92

11.25

10.86

11.57

11.97

12.28

12.83

12.93

12.90

KIBOR 6M

9.43

9.54

9.58

9.60

9.39

9.08

9.15

9.29

9.55

9.52

10.13

Discount rate

9.50

9.50

9.50

9.50

9.00

9.00

9.00

9.50

9.50

10.00

10.00

Headline inflation

7.40

6.60

5.80

5.10

5.90

8.26

8.55

7.40

9.10

10.90

9.18

Core inflation

9.6

9.00

8.70

8.10

7.80

8.20

8.50

8.70

8.40

8.50

8.20

Food inflation

7.4

6.30

5.50

6.50

7.90

9.20

10.30

7.90

9.80

13.00

9.30

1,835

2,134

2,130

2,175

2,197

2,095

1,996

2,622

1,864

1,804

2,275

3,383

3,687

3,909

4,346

3,940

3,814

3,572

3,791

3,281

3,651

3,561

(1,548)

(1,553)

(1,779)

(2,171)

(1,743)

(1,719)

(1,576)

(1,169)

(1,417)

(1,847)

(1,286)

1,028

1,119

1,216

1,186

1,165

1,404

1,233

1,283

1,348

1,131

1,385

(596)

(513)

(354)

(346)

(163)

46

(575)

(574)

(166)

(572)

285

6,645

6,777

6,709

6,950

7,316

7,069

7,174

7,125

7,133 7,309.45 7,529.37

3,868

3,873

3,857

3,906

3,869

3,788

3,817

3,831

3,921 4,008.03 4,071.47

3,909

4,024

3,893

3,942

4,129

3,837

3,708

3,873

3,776 4,035.48 4,069.80

11.52

11.50

11.42

11.49

11.36

11.28

11.11

11.10

11.10

11.13

11.07

5.34

5.26

5.23

5.15

5.01

4.97

4.83

4.79

4.90

4.89

5.05

6.18

6.24

6.19

6.34

6.35

6.31

6.28

6.31

6.20

6.24

6.02

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

Inflation

External Indicators

Export (PBS)

US$ (mn)

Import (PBS)

US$ (mn)

Trade Deficit (PBS)

US$ (mn)

Home Remittances

US$ (mn)

Current Account

US$ (mn)

Banking Sector

Deposits

PkR (bn)

Advances

PkR (bn)

Investments

PkR (bn)

Weighted avg lending rate

Weighted avg deposit rate

Spread rate

Public Finance

Tax collection

PkR (mn)

Direct taxes

PkR (mn)

Indirect Taxes

PkR (mn)

140,264 190,357 153,199 173,268 267,608

48,743

78,649

48,462

60,982 128,889

91,521 111,708 104,737 112,286 138,719

Currency

Reserves (RHS)

US$ (mn)

USDPkR - Interbank

PkR/USD

12,936

12,250

11,812

11,474

11,020

10,287

9,998

9,995

9,525

8,238

8,168

98.16

98.42

98.48

98.52

98.94

101.90

104.51

105.24

106.89

107.56

107.13

Source: SBP, PBS & AKD Research

AKD Securities Limited

StockSmart

7 February 2014

Pakistan Weekly Update

Analyst Certification

We, the AKD Research Team, hereby individually & jointly certify that the views expressed in this research report accurately reflect our personal views about the subject securities and issuers. We also certify that no part of our compensation was, is,or will be, directly or indirectly,

related to the specific recommendations or views expressed in this research report. We further certify that we do not have any beneficial holding

of the specific securities that we have recommendations on in this report.

AKD Research Team

Analyst

Tel no.

Coverage

Naveed Vakil

Raza Jafri, CFA

Usman Zahid

Anum Dhedhi

Raza Hamdani

Bilal Alvi

Qasim Anwar

Hassan Quadri

Azher Ali Quli

Nasir Khan

Tariq Mehmood

+92 111 253 111 (692)

+92 111 253 111 (693)

+92 111 253 111 (693)

+92 111 253 111 (637)

+92 111 253 111 (693)

+92 111 253 111 (647)

+92 111 253 111 (680)

+92 111 253 111 (639)

+92 111 253 111 (646)

+92 111 253 111 (646)

+92 111 253 111 (643)

naveed.vakil@akdsecurities.net

raza.jafri@akdsecurities.net

usman.zahid@akdsecurities.net

anum.dhedhi@akdsecurities.net

raza.hamdani@akdsecurities.net

bilal.alvi@akdsecurities.net

qasim.anwar@akdsecurities.net

hassan.quadri@akdsecurities.net

azher.quli@akdsecurities.net

nasir.khan@akdsecurities.net

tariq.mehmood@akdsecurities.net

Director - Research & Business Development

Pakistan Economy & Commercial Banks

E&P, FMCGs & Fertilizer

Pakistan Economy

Fertilizer, Oil Marketing & Power

Textiles, Cements & Chemical

Technical Analysis

Research Production / Autos

Research Production

Research Production

Library Operations

DISCLOSURES & DISCLAIMERS

This publication/communication or any portion hereof may not be reprinted, sold or redistributed without the written consent of AKD Securities

Limited. AKD Securities Limited has produced this report for private circulation to professional and institutional clients only. The information,

opinions and estimates herein are not directed at, or intended for distribution to or use by, any person or entity in any jurisdiction where doing so

would be contrary to law or regulation or which would subject AKD Securities Limited to any additional registration or licensing requirement

within such jurisdiction. The information and statistical data herein have been obtained from sources we believe to be reliable and complied by

our research department in good faith. Such information has not been independently verified and we make no representation or warranty as to

its accuracy, completeness or correctness. Any opinions or estimates herein reflect the judgment of AKD Securities Limited at the date of this

publication/ communication and are subject to change at any time without notice.

This report is not a solicitation or any offer to buy or sell any of the securities mentioned herein. It is for information purposes only and is not

intended to provide professional, investment or any other type of advice or recommendation and does not take into account the particular investment objectives, financial situation or needs of individual recipients. Before acting on any information in this publication/communication, you

should consider whether it is suitable for your particular circumstances and, if appropriate, seek professional advice. Neither AKD Securities

Limited nor any of its affiliates or any other person connected with the company accepts any liability whatsoever for any direct or consequential

loss arising from any use of this report or the information contained therein.

Subject to any applicable laws and regulations, AKD Securities Limited, its affiliates or group companies or individuals connected with AKD

Securities Limited may have used the information contained herein before publication and may have positions in, may from time to time purchase or sell or have a material interest in any of the securities mentioned or related securities or may currently or in future have or have had a

relationship with, or may provide or have provided investment banking, capital markets and/or other services to, the entities referred to herein,

their advisors and/or any other connected parties.

AKD Securities Limited (the company) or persons connected with it may from time to time have an investment banking or other relationship,

including but not limited to, the participation or investment in commercial banking transaction (including loans) with some or all of the issuers

mentioned therein, either for their own account or the account of their customers. Persons connected with the company may provide corporate

finance and other services to the issuer of the securities mentioned herein, including the issuance of options on securities mentioned herein or

any related investment and may make a purchase and/or sale of the securities or any related investment from time to time in the open market or

otherwise, in each case either as principal or agent.

This document is being distributed in the United State solely to "major institutional investors" as defined in Rule 15a-6 under the U.S. Securities

Exchange Act of 1934, and may not be furnished to any other person in the United States. Each U.S. person that receives this document by its

acceptance hereof represents and agrees that it: is a "major institutional investor", as so defined; and understands the whole document. Any

such person wishing to follow-up any of the information should do so by contacting a registered representative of AKD Securities Limited.

The securities discussed in this report may not be eligible for sale in some states in the U.S. or in some countries.

Any recipient, other than a U.S. recipient that wishes further information should contact the company.

This report may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose.

10

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Stock Smart Weekly (May 23, 2014)Document10 pagesStock Smart Weekly (May 23, 2014)jhnayarNo ratings yet

- Stock Smart Weekly (Jan 31 2014)Document10 pagesStock Smart Weekly (Jan 31 2014)jhnayarNo ratings yet

- Divine punishment for disbelief and oppressionDocument3 pagesDivine punishment for disbelief and oppressionjhnayarNo ratings yet

- Stock Smart Weekly (May 16, 2014)Document10 pagesStock Smart Weekly (May 16, 2014)jhnayarNo ratings yet

- 1888 The Gate of The Hundred Sorrows Rudyard KiplingDocument6 pages1888 The Gate of The Hundred Sorrows Rudyard KiplingjhnayarNo ratings yet

- Cement Dispatches Feb'14 - 8MFY14, (AKD Daily, Mar 06, 2014)Document5 pagesCement Dispatches Feb'14 - 8MFY14, (AKD Daily, Mar 06, 2014)jhnayarNo ratings yet

- Stock Smart Weekly (Apr 18, 2014)Document10 pagesStock Smart Weekly (Apr 18, 2014)jhnayarNo ratings yet

- Stock Smart Weekly (Apr 25, 2014)Document9 pagesStock Smart Weekly (Apr 25, 2014)jhnayarNo ratings yet

- Salik's Journey to Love and FreedomDocument3 pagesSalik's Journey to Love and FreedomjhnayarNo ratings yet

- The Best Spiritual - Awakening - Dharma Films of All TimeDocument15 pagesThe Best Spiritual - Awakening - Dharma Films of All TimejhnayarNo ratings yet

- Stock Smart Weekly (Apr 04, 2014)Document10 pagesStock Smart Weekly (Apr 04, 2014)jhnayarNo ratings yet

- Stock Smart Weekly (Mar 21, 2014)Document10 pagesStock Smart Weekly (Mar 21, 2014)jhnayarNo ratings yet

- Lesson 8 - The Ten Ox Herding Pictures - ExplanationDocument5 pagesLesson 8 - The Ten Ox Herding Pictures - Explanationjhnayar100% (1)

- Bashair Al Khairat - Glad Tidings of Good Things by Al Ghawth Al Azam Abd Al Qadir Al JilaniDocument29 pagesBashair Al Khairat - Glad Tidings of Good Things by Al Ghawth Al Azam Abd Al Qadir Al JilaniDanish Kirkire Qadri Razvi100% (3)

- Const.p.5 2011Document23 pagesConst.p.5 2011jhnayarNo ratings yet

- Gulistaan Sa'Adi Shiraazi (Translation) 2Document1 pageGulistaan Sa'Adi Shiraazi (Translation) 2jhnayarNo ratings yet

- Historic FrodshamDocument1 pageHistoric FrodshamjhnayarNo ratings yet

- Discoveries in Translating Enigmatic Sufi PoetryDocument10 pagesDiscoveries in Translating Enigmatic Sufi Poetryrpelton3258No ratings yet

- Kashkol E Kalimi UrduDocument159 pagesKashkol E Kalimi UrduZeeshan Ul Haq100% (2)

- Gulistaan Sa'Adi Shiraazi (Translation) 1Document1 pageGulistaan Sa'Adi Shiraazi (Translation) 1jhnayarNo ratings yet

- Secretrosegarden Secret Rose GardenDocument104 pagesSecretrosegarden Secret Rose GardenjhnayarNo ratings yet

- Whither Ye SadhuDocument76 pagesWhither Ye SadhujhnayarNo ratings yet

- Don't Stand By My Grave And Cry Poem About Life After DeathDocument1 pageDon't Stand By My Grave And Cry Poem About Life After DeathjhnayarNo ratings yet

- Hayat e QadirDocument137 pagesHayat e Qadirmtkhusro92No ratings yet

- Makhzan Al AsrarDocument115 pagesMakhzan Al AsrarjhnayarNo ratings yet

- At The Moment We Saw Your SunDocument1 pageAt The Moment We Saw Your SunjhnayarNo ratings yet

- A Psalm of LifeDocument2 pagesA Psalm of LifejhnayarNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Dawood Habib GroupDocument3 pagesDawood Habib GroupShuja HussainNo ratings yet

- Analysis and Interpretation of Financial Statements: Christine Talimongan ABM - BezosDocument37 pagesAnalysis and Interpretation of Financial Statements: Christine Talimongan ABM - BezostineNo ratings yet

- Exhibits and Student TemplateDocument7 pagesExhibits and Student Templatesatish.evNo ratings yet

- National Stock Exchange of IndiaDocument22 pagesNational Stock Exchange of IndiaParesh Narayan BagweNo ratings yet

- Admission of A PartnerDocument21 pagesAdmission of A PartnerHarmohandeep singhNo ratings yet

- Quiz Test 2 KMB FM 05Document1 pageQuiz Test 2 KMB FM 05Vivek Singh RanaNo ratings yet

- Case Digest - OPT and DSTDocument30 pagesCase Digest - OPT and DSTGlargo GlargoNo ratings yet

- Philippine Health Care Providers Dispute Over Documentary Stamp Tax AssessmentDocument2 pagesPhilippine Health Care Providers Dispute Over Documentary Stamp Tax AssessmentGeralyn GabrielNo ratings yet

- Coa C2015-002Document71 pagesCoa C2015-002Pearl AudeNo ratings yet

- Case Delta Beverage Group 7Document8 pagesCase Delta Beverage Group 7Wouter Hendriksen100% (1)

- Brexit Implications On CM FXDocument6 pagesBrexit Implications On CM FXAyobami EkundayoNo ratings yet

- Form 2106Document2 pagesForm 2106Weiming LinNo ratings yet

- LATAM Airlines Group 20F AsFiledDocument394 pagesLATAM Airlines Group 20F AsFiledDTNo ratings yet

- Highlights:: DCB Bank Announces Third Quarter FY 2022 ResultsDocument7 pagesHighlights:: DCB Bank Announces Third Quarter FY 2022 ResultsanandNo ratings yet

- The Correct Answer Is: P105,000Document5 pagesThe Correct Answer Is: P105,000cindy100% (2)

- KPMG Nppa New Payments Platform Minimising Payments FraudDocument16 pagesKPMG Nppa New Payments Platform Minimising Payments FrauddavemacbrainNo ratings yet

- Week 03 - Bank ReconciliationDocument6 pagesWeek 03 - Bank ReconciliationPj ManezNo ratings yet

- Public Expert - Trend IndicatorsDocument21 pagesPublic Expert - Trend Indicatorsrayan comp100% (1)

- Ruchi Soya Is One of The Largest Manufacturers of Edible Oil in India. Ruchi Soya IndustriesDocument3 pagesRuchi Soya Is One of The Largest Manufacturers of Edible Oil in India. Ruchi Soya IndustriesHarshit GuptaNo ratings yet

- PDF September Ict Notespdf - CompressDocument14 pagesPDF September Ict Notespdf - CompressSagar BhandariNo ratings yet

- A Case For Economic Democracy by Gary Dorrien - Tikkun Magazine PDFDocument7 pagesA Case For Economic Democracy by Gary Dorrien - Tikkun Magazine PDFMegan Jane JohnsonNo ratings yet

- HOME DEPOT - Debt StructureDocument3 pagesHOME DEPOT - Debt Structureluxi0No ratings yet

- Denim Jeans Stitching UnitDocument25 pagesDenim Jeans Stitching UnitSaad NaseemNo ratings yet

- Kotler SummaryDocument27 pagesKotler Summaryshriya2413No ratings yet

- Ins - 21-1Document13 pagesIns - 21-1Siddharth Kulkarni100% (1)

- Closing Your Savings Account FormDocument1 pageClosing Your Savings Account FormtafseerahmedNo ratings yet

- Finance A Ethics Enron Hyacynthia KesumaDocument1 pageFinance A Ethics Enron Hyacynthia KesumaCynthia KesumaNo ratings yet

- Exercise 7.3Document5 pagesExercise 7.3Craig GrayNo ratings yet

- Bank Reconciliation NotesDocument3 pagesBank Reconciliation Notesjudel ArielNo ratings yet

- SECP PresDocument29 pagesSECP PresZoha MirNo ratings yet