Professional Documents

Culture Documents

BBA Guidelines Understanding The Balance Sheet 2010

Uploaded by

prabhat kumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BBA Guidelines Understanding The Balance Sheet 2010

Uploaded by

prabhat kumarCopyright:

Available Formats

Understanding the Balance Sheet

The following guideline is general in nature and may not include all situations that a business will need to consider. It is strongly advised that business owners work with a qualified accountant in determining the structure of business financial statements and appropriate methods for accounting that meet the needs of the business and remain compliant with Canada Revenue Agency (CRA) requirements.

A Balance Sheet, also known as a statement of financial position, reveals a companys assets, liabilities and shareholders equity (net worth). A Balance Sheet reveals to a business owner, or a potential lender, the overall financial health of the business from an equity standpoint. General Definitions: 1. Assets are what a company owns and uses to operate its business. 2. Liabilities are what a company owes on purchase of assets or in financing its operations. 3. Shareholders' equity is the amount of money initially invested into the company plus any retained earnings (net income). The Balance Sheet is divided into two main sections (Assets and Liabilities) that, based on the following equation, must equal (or balance) each other. The main formula behind the Balance Sheet is: Assets = Liabilities + Shareholders Equity It is important to note that a Balance Sheet is a snapshot of the companys financial position at a single point in time. An example of a Balance Sheet is attached on Page 4. It may be useful to view this while reading. Details: 1. Assets Assets are what a company owns and uses to operate its business. There are two classes of assets, Current assets and Fixed or Capital assets, as defined below. a) Current Assets Current Assets are assets that a company has at its disposal (liquid) and that can be easily converted into cash within one operating cycle. An operating cycle is the time that it takes to sell a product or service and collect cash from the sale, i.e.: 30-60 days. Such assets classes are: i. Cash & Equivalents are monies in business accounts. This is usually cash however cash equivalents could also be stock investments, etc. Cash and equivalents are completely liquid assets. ii. Short-Term Investments normally come into play when a company has enough cash on hand that it can afford, and chooses, to invest this money in order to earn interest. Short term investments are those that come due, or can be converted to cash without penalty within one year. This investment cannot be immediately turned to cash without planning but it will earn a higher return than cash in a business bank account. iii. Accounts Receivable consists of the short-term obligations owed to the company by its clients. Companies may sell products or a service to clients on credit, which is tracked in this line until the client pays their invoice in full. iv. Inventories may represent raw materials in stock, work-in-progress goods and finished goods for resale. Not all companies have inventories, particularly if they are consulting or service based companies. v. Prepaid Expenses are expenditures that the company has already paid to its suppliers or service providers for future costs such as insurance, rent, etc. Although this is not liquid in the sense that, if cash was needed, a refund may not be possible, it is an asset in the sense that it preserves cash for future use.

Basin Business Advisors Program Business Guidelines: Understanding the Balance Sheet Page 1

b) Fixed or Capital Assets Fixed/Capital Assets are those that are not turned into cash or liquidated easily, expected to be turned to into cash within a year and/or have a life span of over a year. Examples would be: i. Tangible assets such as machinery, equipment, buildings and land. A business should seek the advice of an accountant to determine what assets should be assigned as Fixed/Capital assets if there is any doubt. ii. Intangible assets such as goodwill, patents and copyrights. Note: Depreciation or Amortization calculations will appear in this section of the Balance Sheet. Depreciation is calculated and deducted from tangible assets, while Amortization is the corresponding calculation for intangible assets. Both calculations represent the economic cost of fixed assets over their useful life. As an example, a company vehicle is considered an asset of the business. It is not expensed at the time of purchase but rather depreciated at an assigned percentage, until the asset is fully depreciated. The value of Depreciation/Amortization is booked in as an expense in the companies Income Statement. 2. Liabilities: Liabilities are what a company owes on purchase of assets or in financing its operations. There are two classes of liabilities: Current liabilities and Long Term liabilities as defined below. a) Current Liabilities Current liabilities are the financial obligations a company owes to outside parties that are due within one year or could be called in for repayment by the lender at any time and include: i. Short-term loans: Lines of Credit and Credit card balances ii. Deposits on unfulfilled contracts, relevant for building contractors. iii. Accounts Payable are financial obligations the company owes for services or goods purchased. iv. Accrued Liabilities: tax remittances (ie: GST) and payroll benefits, e.g. money owed to employees as salary, vacation pay and bonuses that the company currently owes. v. Current portion of long-term debt is the total amount of long-term debt that must be repaid within a year. b) Long Term Liabilities Long-term liabilities are debts, which are due after a period of at least one year from the date of the balance sheet. Long terms debts may include: i. Secured Bank loans with terms of repayment over one year ii. Mortgage financing iii. Shareholder loans, whether they have an active agreement for repayment or not. 3. Shareholders Equity Shareholders equity is the initial amount of money invested into a business plus any subsequent investments less cash withdrawn and plus or minus Net profit. When a company generates a profit, management will either pay shareholders a cash dividend, or retain the earnings to reinvest into the business. Corporations can manage their tax implications through payment of these dividends and retained losses. An accountant is required to guide the business in managing this aspect of the business effectively. When a sole proprietorship generates a positive Net profit this profit is reported as personal income in the year it is incurred. In order for the Balance Sheet to balance, Total assets must equal Total liabilities plus Shareholders equity.

Basin Business Advisors Program Business Guidelines: Understanding the Balance Sheet Page 2

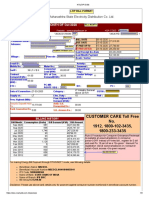

Below is an example of a Balance Sheet. Company Balance Sheet as at Dec. 31 Assets Current Assets Cash & Cash Equivalents Accounts Receivable Inventory Pre Paid Expenses Total Current Assets Fixed Assets Land Buildings and Improvements Fixtures & Equipment Vehicle - truck Less: Accumulated Depreciation Total Fixed Assets Total Assets Liabilities & Shareholders Equity Current Liabilities Accounts Payable Accrued Liabilities Current Portion of Long Term Debt Total Current Liabilities Long Term Liabilities Long term debt Shareholders Equity Shareholders Loan Less: Net drawings during the period Retained Earnings Total Shareholders Equity Total Liability & Shareholders Equity 200X

5,000 2,500 30,000 350 37,850 25,000 65,000 3,000 20,000 10,000 103,000 140,850

5,100 3,400 18,000 26,500 40,000 20,000 44,350 10,000 74,350 140,850

Note: The Equity portion of a balance sheet may appear differently on some financial statements. Owners Equity may appear rather than Shareholders Equity.

Conclusion The Balance Sheet, along with the Income and Cash flow statements, is an important tool for business owners to gain insight into their company and its operations. The Balance Sheet is a snapshot at a single point in time of the companys account balances and financial health. The Balance Sheet is useful in business analysis, in tracking financial performance trends and illustrating its ability to take on more credit or risk. It is important that all business owners know how to use, analyze and read their Balance sheet.

Basin Business Advisors Program Business Guidelines: Understanding the Balance Sheet Page 3

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Money Math WorkbookDocument109 pagesMoney Math WorkbookIamangel1080% (10)

- Ceres Gardening Company Graded QuestionsDocument4 pagesCeres Gardening Company Graded QuestionsSai KumarNo ratings yet

- Bank Written 90 Math BankDocument29 pagesBank Written 90 Math BankWakil0% (1)

- Taxation: Md. Kamrul Hasan ShovonDocument15 pagesTaxation: Md. Kamrul Hasan ShovonMaruf KhanNo ratings yet

- The Organizational Plan: Hisrich Peters ShepherdDocument23 pagesThe Organizational Plan: Hisrich Peters ShepherdHamza HafeezNo ratings yet

- Financial Regulation in South AfricaDocument202 pagesFinancial Regulation in South AfricaCoastal Roy100% (4)

- (Epelbaum) Vol Risk PremiumDocument25 pages(Epelbaum) Vol Risk PremiumrlindseyNo ratings yet

- Sumia To Kagua Claim O3Document2 pagesSumia To Kagua Claim O3Justin KubulNo ratings yet

- Unilever Strategies AssessmentDocument16 pagesUnilever Strategies AssessmentÎrîsh LyzaNo ratings yet

- Draft Operating Agreement (LLC)Document10 pagesDraft Operating Agreement (LLC)haspiNo ratings yet

- A History of NHS PrivatisationDocument16 pagesA History of NHS PrivatisationProtect our NHSNo ratings yet

- Income Statement, Oener's Equity, PositionDocument4 pagesIncome Statement, Oener's Equity, PositionMaDine 19No ratings yet

- Role of Microfinance in Empowerment of Female Population of Bahawalpur DistrictDocument7 pagesRole of Microfinance in Empowerment of Female Population of Bahawalpur DistrictFarhan SarwarNo ratings yet

- Manual Steps SAPNote 1699985Document3 pagesManual Steps SAPNote 1699985chandrasekha3975No ratings yet

- Project ReportsDocument296 pagesProject Reportsvyavahareyogesh100% (1)

- AlgorithmDocument2 pagesAlgorithmPato MartinezNo ratings yet

- KW Legal NoticeDocument3 pagesKW Legal NoticeNANCY KESARWANINo ratings yet

- The Pricing of Crude Oil: Stephanie Dunn and James HollowayDocument10 pagesThe Pricing of Crude Oil: Stephanie Dunn and James HollowayAnand aashishNo ratings yet

- Illovo Sugar (Malawi) PLC - Final Results - 31 Aug 2022Document1 pageIllovo Sugar (Malawi) PLC - Final Results - 31 Aug 2022Mallak AlhabsiNo ratings yet

- 2 ING Bank N.V. v. CIRDocument2 pages2 ING Bank N.V. v. CIRRamon EldonoNo ratings yet

- Itria Ventures LLC Response To March 30 Daily Caller Article 2Document3 pagesItria Ventures LLC Response To March 30 Daily Caller Article 2Daily Caller News FoundationNo ratings yet

- Financial Analysis With Microsoft Excel 6th Edition Mayes Solutions ManualDocument24 pagesFinancial Analysis With Microsoft Excel 6th Edition Mayes Solutions Manualaramaismablative2ck3100% (15)

- Lecture 8 Metrics For Entrepreneurs and Startup Funding PDFDocument28 pagesLecture 8 Metrics For Entrepreneurs and Startup Funding PDFBhagavan BangaloreNo ratings yet

- Final Answer KeyDocument13 pagesFinal Answer Keysiva prasadNo ratings yet

- Jun 2006 - Qns Mod ADocument11 pagesJun 2006 - Qns Mod AHubbak Khan100% (2)

- LTIP E Bill Oct 20 For WebDocument3 pagesLTIP E Bill Oct 20 For WebRabbul RahmanNo ratings yet

- Singapore Property Weekly Issue 137Document14 pagesSingapore Property Weekly Issue 137Propwise.sgNo ratings yet

- CFA Level 2 Fixed Income 2017Document52 pagesCFA Level 2 Fixed Income 2017EdmundSiauNo ratings yet

- ASSIGNMENT 3 - Evaluating A Single ProjectDocument9 pagesASSIGNMENT 3 - Evaluating A Single ProjectKhánh Đoan Lê ĐìnhNo ratings yet

- ACCELERATING Entrepreneurship in Africa: Understanding Africa's Challenges To Creating Opportunity Driven Entrepreneurship - Omidyar Network in Partnership With Monitor GroupDocument48 pagesACCELERATING Entrepreneurship in Africa: Understanding Africa's Challenges To Creating Opportunity Driven Entrepreneurship - Omidyar Network in Partnership With Monitor GroupCraft AfrikaNo ratings yet