Professional Documents

Culture Documents

Certified Mail

Uploaded by

KNOWLEDGE SOURCECopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Certified Mail

Uploaded by

KNOWLEDGE SOURCECopyright:

Available Formats

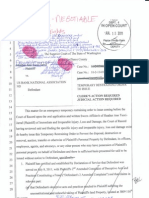

CERTIFIED MAIL RETURN RECEIPT REQUESTED 7004 1350 0005 2690 XXXX Re: THIRD FACTA Demand Letter

Acct# 0174246870XXXXXXX American Express Credit Bureau Unit P.O. Box 297871 Fort Lauderdale, FL 33329-7871 (800) 847-XXXX NOTICE OF INTENT TO FILE SUIT Good day Credit Bureau Unit, This is the third and final letter that I will send on this matter. 1. On or about May 17, 2006 I sent you a dispute letter pursuant to FCRA ? 623. ( a )( 8 ) ABILITY OF CONSUMER TO DISPUTE INFORMATION DIRECTLY WITH FURNISHER, you failed to respond within the 30 day time limit in which the statues allow. That is a one violation for each of the three credit bureaus and are enforceable per Sections 616 and 617 of the FCRA which talks about how much the fines are for violations of the FCRA (the willful and negligent non compliance), typically $1000. That is $3000.00 total. 2. On or about June 28, 2006, I sent a second dispute letter informing you of your FCRA violation. This time you have confirmed receipt within the 30 day time period but you have failed again to provide the proof of what you are reporting to the credit bureaus, these are same violations of the FCRA ? 623. ( a )( 8 ) As above. Also you have failed to notify all three credit bureaus twice of my dispute pursuant to the FCRA ? 623. ( a ) ( 3 ). That is one violation for each of the credit bureaus and again are enforceable per Section 616 and 617 of the FCRA which talks about how much the fines are for violations of the FCRA (the willful and negligent non compliance), typically $1000. That is $3000.00 total. With your request for my Social Security number it is now apparent that you do not have the information that you used to verify the disputes I submitted repeatedly to the Credit Bureaus, six in total, two each over the past 120 days. It is not my job to report accurate information to the credit bureaus; it is your job to do so. And over the past 120 days you have verified my disputes with Equifax, TransUnion and Experian six times and therefore from that fact alone, you MUST know about my account because you have verified it. Otherwise you have verified without performing the required investigation pursuant to the FCRA. Either way, you are being willfully and negligently non compliant, not to mention deceitful, if not to me than to the credit bureaus where you have verified the disputed

and falsely reported information. Which one is it? If you can not provide the information that you are using to verify my disputes to the credit bureaus, you are REQUIRED by the FCRA to delete the Trade Lines. You owe me $6000.00 for violations of the FCRA and if I must retain a legal representative you can pay for his/her fees as well. Or you have the option to settle this now by deleting the trade line on all three credit bureaus and never reporting it again through your own credit bureau unit or its ASSIGNS. Either way is fine and acceptable to me. You have 10 business days to delete the trade line entries on my credit reports and send me a confirmation letter stating as such, else I will file suit. Sincerely, Teddt Theodore Esquire III

You might also like

- How to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersFrom EverandHow to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersRating: 3 out of 5 stars3/5 (1)

- 609 Letter Templates: The Ultimate Guide to Repair Your Credit Score. Learn How to Use Credit Report Disputes, Improve Your Personal Finance and Raise Your Score to 100+.From Everand609 Letter Templates: The Ultimate Guide to Repair Your Credit Score. Learn How to Use Credit Report Disputes, Improve Your Personal Finance and Raise Your Score to 100+.No ratings yet

- Templates of Credit Rebuilding LettersDocument28 pagesTemplates of Credit Rebuilding LettersDonnell Jefferson100% (3)

- 46 Consumer Reporting Agencies Investigating YouFrom Everand46 Consumer Reporting Agencies Investigating YouRating: 4.5 out of 5 stars4.5/5 (6)

- Stop Bill Collectors: The No Bull Guide to Outwitting Bill CollectorsFrom EverandStop Bill Collectors: The No Bull Guide to Outwitting Bill CollectorsRating: 5 out of 5 stars5/5 (1)

- Legal Potential Power LettersDocument28 pagesLegal Potential Power LettersKNOWLEDGE SOURCENo ratings yet

- 12 2 10KeatingOnAngelaStarkDocument3 pages12 2 10KeatingOnAngelaStarkKNOWLEDGE SOURCE100% (11)

- Advice For Closing MortgagesDocument4 pagesAdvice For Closing MortgagesMegan McAuley83% (6)

- Form 96Document3 pagesForm 96KNOWLEDGE SOURCE0% (1)

- Debt Validation Sample Letter DisputeDocument15 pagesDebt Validation Sample Letter DisputeKNOWLEDGE SOURCE96% (51)

- Dispute Credit Report ErrorsDocument6 pagesDispute Credit Report ErrorsKNOWLEDGE SOURCE100% (30)

- Dispute Credit Report ErrorsDocument6 pagesDispute Credit Report ErrorsKNOWLEDGE SOURCE100% (30)

- Sample Debt Verification LetterDocument22 pagesSample Debt Verification LetterCurt E Daniels100% (3)

- How to Make Your Credit Card Rights Work for You: Save MoneyFrom EverandHow to Make Your Credit Card Rights Work for You: Save MoneyNo ratings yet

- DemandDocument7 pagesDemandKNOWLEDGE SOURCENo ratings yet

- Collection Agency Removal LetterDocument4 pagesCollection Agency Removal LetterKNOWLEDGE SOURCENo ratings yet

- TILA Regulators HandbookDocument137 pagesTILA Regulators HandbookCarrieonic100% (1)

- Bankster in Dishonour - Updated: Notice of Acceptance For ValueDocument56 pagesBankster in Dishonour - Updated: Notice of Acceptance For ValueKNOWLEDGE SOURCE100% (4)

- Bankster in Dishonour - Updated: Notice of Acceptance For ValueDocument56 pagesBankster in Dishonour - Updated: Notice of Acceptance For ValueKNOWLEDGE SOURCE100% (4)

- No Response LetterDocument2 pagesNo Response LetterFreedomofMind50% (4)

- Credit Repair Retainer AgreementDocument3 pagesCredit Repair Retainer AgreementKNOWLEDGE SOURCE100% (2)

- Untitled 1 3Document13 pagesUntitled 1 3KNOWLEDGE SOURCE100% (2)

- Why Credit Restoration Works: Remove Items Using FCRA Section 609Document3 pagesWhy Credit Restoration Works: Remove Items Using FCRA Section 609KNOWLEDGE SOURCE100% (3)

- 1a - Unsecured Debt - Affidavit - Collection AgencyDocument14 pages1a - Unsecured Debt - Affidavit - Collection AgencyCK in DCNo ratings yet

- Arbitration Assn Application SATCOMM911Document8 pagesArbitration Assn Application SATCOMM911CK in DC0% (1)

- Transunion Follow UpDocument1 pageTransunion Follow UpKNOWLEDGE SOURCENo ratings yet

- Billing ErrorDocument1 pageBilling ErrorKNOWLEDGE SOURCE100% (1)

- Credit Dispute LettersDocument25 pagesCredit Dispute LettersBarb Volkmann100% (2)

- 6 Non Response Creditor Refused To RespondDocument2 pages6 Non Response Creditor Refused To RespondKNOWLEDGE SOURCE100% (2)

- 80 LettersDocument100 pages80 LettersKNOWLEDGE SOURCENo ratings yet

- Request For Credit File From InnovisDocument2 pagesRequest For Credit File From InnovisYaw Mensah Amun Ra100% (4)

- Debt Validation 02 UccDocument3 pagesDebt Validation 02 UccKNOWLEDGE SOURCE67% (3)

- 9 01 2005 FTB Hop 2Document9 pages9 01 2005 FTB Hop 2KNOWLEDGE SOURCENo ratings yet

- Debt Validation LetterDocument4 pagesDebt Validation LetterJerion Paragon Evans100% (1)

- V11N1 WhoseCarIsItDocument8 pagesV11N1 WhoseCarIsIttonythesom100% (3)

- Untitled 1 MotivationDocument4 pagesUntitled 1 MotivationKNOWLEDGE SOURCE100% (1)

- Affidavit/Declaration and Statement of Facts: RE: Tax Filing IssuesDocument2 pagesAffidavit/Declaration and Statement of Facts: RE: Tax Filing IssuesKNOWLEDGE SOURCENo ratings yet

- Birth Affidavit: Last Suffix First MiddleDocument2 pagesBirth Affidavit: Last Suffix First Middlebigwheel8No ratings yet

- Have Had Multiple Accounts With The Same Company.) : FTC Identity Theft AffidavitDocument1 pageHave Had Multiple Accounts With The Same Company.) : FTC Identity Theft AffidavitLaShundra R. LewisNo ratings yet

- Chexsystems Prove It 2Document2 pagesChexsystems Prove It 2Elcana MathieuNo ratings yet

- Consumer Protection Laws Limit Debt Collection PracticesDocument33 pagesConsumer Protection Laws Limit Debt Collection PracticesWARWICKJ100% (1)

- Re Notice of Validation of Alleged Debt AmendedDocument4 pagesRe Notice of Validation of Alleged Debt AmendedKathleen WashponNo ratings yet

- Debt Validation LetterDocument1 pageDebt Validation LetterFreedomofMind100% (2)

- Optional Credit RemovalDocument3 pagesOptional Credit RemovalKNOWLEDGE SOURCENo ratings yet

- Top Kicking ValidationDocument7 pagesTop Kicking ValidationKNOWLEDGE SOURCE60% (5)

- 08 ReinertDocument29 pages08 ReinertKNOWLEDGE SOURCENo ratings yet

- Sample Credit Repair Letters For Items in Credit Reports - Inaccurately ReportedDocument12 pagesSample Credit Repair Letters For Items in Credit Reports - Inaccurately ReportedKNOWLEDGE SOURCE100% (1)

- Excellent Document - Notice of Fraud To Collection Agency IIDocument2 pagesExcellent Document - Notice of Fraud To Collection Agency IICK in DCNo ratings yet

- 12 CFR 1024.35 - Error Resolution ProceduresDocument3 pages12 CFR 1024.35 - Error Resolution Proceduresmptacly9152No ratings yet

- ManageEngine ADAudit Plus DocumentationDocument84 pagesManageEngine ADAudit Plus DocumentationrpathuriNo ratings yet

- Information+Assets+Protection+Item 1744E-IAP GDL - UnlockedDocument47 pagesInformation+Assets+Protection+Item 1744E-IAP GDL - UnlockedAsdssadf Scrvhstw100% (2)

- Debt Validation TemplatesDocument2 pagesDebt Validation TemplatesDan Ponjican83% (24)

- Remove Inquires Now LetterDocument2 pagesRemove Inquires Now LetterElcana Mathieu50% (2)

- Final Notice of Default - 1Document2 pagesFinal Notice of Default - 1S Pablo August100% (1)

- Cleaning Up Credit ReportsDocument3 pagesCleaning Up Credit ReportsLor-ron Wade100% (2)

- Interrogatories RequestDocument6 pagesInterrogatories RequestKNOWLEDGE SOURCE100% (1)

- Promisary NoteDocument4 pagesPromisary Notellg8749100% (1)

- Good Earthing Practices For Generator System (Presentation) PDFDocument20 pagesGood Earthing Practices For Generator System (Presentation) PDFMokr AchourNo ratings yet

- Affidavit 3Document5 pagesAffidavit 3KNOWLEDGE SOURCE100% (2)

- Affidavit 3Document5 pagesAffidavit 3KNOWLEDGE SOURCE100% (2)

- Sample Foi A LetterDocument1 pageSample Foi A LetterSalaam Bey®No ratings yet

- 609 System OverviewDocument12 pages609 System OverviewFreedomofMind100% (1)

- 2nd Letter To BureauDocument8 pages2nd Letter To BureauKNOWLEDGE SOURCENo ratings yet

- 2nd Letter To BureauDocument8 pages2nd Letter To BureauKNOWLEDGE SOURCENo ratings yet

- Administrator Guide - (V100R002C01 06)Document779 pagesAdministrator Guide - (V100R002C01 06)pkavasan100% (1)

- 609 2Document2 pages609 2KNOWLEDGE SOURCE67% (3)

- Answer Debt Collection SuitDocument11 pagesAnswer Debt Collection SuitKNOWLEDGE SOURCENo ratings yet

- Application for Judgment Dismissal in Debt CollectionDocument12 pagesApplication for Judgment Dismissal in Debt CollectionKNOWLEDGE SOURCENo ratings yet

- Moonphases Seminar by Lew WhiteDocument67 pagesMoonphases Seminar by Lew WhiteLew White100% (2)

- Agreement For Security ServicesDocument13 pagesAgreement For Security Serviceskishor pratap singhNo ratings yet

- Formal Notice: /3rd Parties /solicitors Etc ? - SEND THEM THIS!Document3 pagesFormal Notice: /3rd Parties /solicitors Etc ? - SEND THEM THIS!KNOWLEDGE SOURCENo ratings yet

- Notice of Fraud To Collection Agency IIDocument2 pagesNotice of Fraud To Collection Agency IIKNOWLEDGE SOURCE100% (1)

- Please Remove Credit InquiriesDocument1 pagePlease Remove Credit InquiriesElcana MathieuNo ratings yet

- 1 - Debt Collector LetterDocument1 page1 - Debt Collector LetterDebbieCook59No ratings yet

- Boaz Barak's Intensive Intro To Crypto PDFDocument363 pagesBoaz Barak's Intensive Intro To Crypto PDFArasuArunNo ratings yet

- Remove My Name From Mailing List 4Document1 pageRemove My Name From Mailing List 4KNOWLEDGE SOURCE100% (3)

- Nimrod TeachingDocument10 pagesNimrod TeachingKNOWLEDGE SOURCENo ratings yet

- Department of Education DisputeDocument5 pagesDepartment of Education DisputeKNOWLEDGE SOURCENo ratings yet

- Biometrics Using Electronic Voting System With Embedded SecurityDocument8 pagesBiometrics Using Electronic Voting System With Embedded SecurityrashmibuntyNo ratings yet

- State Attorney Complaint LetterDocument1 pageState Attorney Complaint LetterFreedomofMindNo ratings yet

- Macsec (Sran18.1 Draft A)Document18 pagesMacsec (Sran18.1 Draft A)VVLNo ratings yet

- Date: Date 1, 2019 FromDocument2 pagesDate: Date 1, 2019 FromRichard LucianoNo ratings yet

- Affidavit TruthDocument5 pagesAffidavit TruthKNOWLEDGE SOURCENo ratings yet

- Letter To Collection Agency On Medical Account Reporting As Paid Dispute Letter For BothDocument4 pagesLetter To Collection Agency On Medical Account Reporting As Paid Dispute Letter For BothKNOWLEDGE SOURCENo ratings yet

- Sample Letter - Dispute To A CreditorDocument2 pagesSample Letter - Dispute To A CreditorTRISTARUSANo ratings yet

- Donna Soutter v. Equifax Information Services, 4th Cir. (2012)Document19 pagesDonna Soutter v. Equifax Information Services, 4th Cir. (2012)Scribd Government DocsNo ratings yet

- TRO Issued to Prevent Disposal of Evidence in Bank Fraud CaseDocument4 pagesTRO Issued to Prevent Disposal of Evidence in Bank Fraud CaseKNOWLEDGE SOURCENo ratings yet

- ConqeringDocument5 pagesConqeringKNOWLEDGE SOURCENo ratings yet

- Virginia Power Stop FC LawsDocument3 pagesVirginia Power Stop FC LawsKNOWLEDGE SOURCENo ratings yet

- Virginia Power Stop FC LawsDocument3 pagesVirginia Power Stop FC LawsKNOWLEDGE SOURCENo ratings yet

- Virginia Power Stop FC LawsDocument3 pagesVirginia Power Stop FC LawsKNOWLEDGE SOURCENo ratings yet

- Use For Mortgage CompanyDocument4 pagesUse For Mortgage CompanyKNOWLEDGE SOURCE100% (6)

- Virginia Power Stop FC LawsDocument3 pagesVirginia Power Stop FC LawsKNOWLEDGE SOURCENo ratings yet

- Fix Google ChromeDocument5 pagesFix Google ChromeKNOWLEDGE SOURCENo ratings yet

- ¡¡¡Aporte ZTE Blade L110 Unlock - Liberacion by NCK Box!!! - NCK DONGLE - GSMDEC - Foro de Telefonia Celular PDFDocument11 pages¡¡¡Aporte ZTE Blade L110 Unlock - Liberacion by NCK Box!!! - NCK DONGLE - GSMDEC - Foro de Telefonia Celular PDFAlfredo CamposNo ratings yet

- Request For New PAN Card Or/ and Changes or Correction inDocument2 pagesRequest For New PAN Card Or/ and Changes or Correction inpawaryogeshNo ratings yet

- Csit 101Document3 pagesCsit 101api-266386632No ratings yet

- Key Exchange Protocols: J. MitchellDocument31 pagesKey Exchange Protocols: J. MitchellUmesh ThoriyaNo ratings yet

- Configure Busy BDNS Manager for seamless Client-Server connectivity without a static IPDocument6 pagesConfigure Busy BDNS Manager for seamless Client-Server connectivity without a static IPTrilokThakurNo ratings yet

- Cyber Security For Automation Systems - v1.0 - Training ManualDocument53 pagesCyber Security For Automation Systems - v1.0 - Training ManualjacobnamoonNo ratings yet

- Accepted Manuscript: Computers & SecurityDocument38 pagesAccepted Manuscript: Computers & SecuritySenait MebrahtuNo ratings yet

- Cissp CursDocument7 pagesCissp Cursf7vbzqcfztNo ratings yet

- Adult Consent FormDocument2 pagesAdult Consent FormAshley OstrootNo ratings yet

- VSTFKnown IssuesDocument11 pagesVSTFKnown IssuesdenirwNo ratings yet

- LDAP Manager E25092Document88 pagesLDAP Manager E25092rlufthansaNo ratings yet

- Active Directory Interview Questions and AnswersDocument5 pagesActive Directory Interview Questions and AnswersMohitNo ratings yet

- Chapter 16. Common Automation Tasks: Lab 16.1 Script Project #3Document6 pagesChapter 16. Common Automation Tasks: Lab 16.1 Script Project #3Ayura Safa ChintamiNo ratings yet

- Git Workshop - Trunk Based DevelopmentDocument37 pagesGit Workshop - Trunk Based DevelopmentEl'azm MosleimNo ratings yet

- RC500 DatasheetDocument12 pagesRC500 DatasheetRaissan ChedidNo ratings yet

- Secured Lossless Share WatermarkingDocument4 pagesSecured Lossless Share WatermarkingEditor IJRITCCNo ratings yet

- 45345343Document3 pages45345343張奕晨No ratings yet

- Lane Departure Warning SystemDocument7 pagesLane Departure Warning SystemRavisingh RajputNo ratings yet

- Communiques - DP - DP 302 Submission of Annual System Audit ReportDocument13 pagesCommuniques - DP - DP 302 Submission of Annual System Audit ReportscnehraNo ratings yet

- IP Security: - Chapter 6 of William Stallings. Network Security Essentials (2nd Edition) - Prentice Hall. 2003Document31 pagesIP Security: - Chapter 6 of William Stallings. Network Security Essentials (2nd Edition) - Prentice Hall. 2003Priti SharmaNo ratings yet

- StrikerDocument228 pagesStrikerVictoria Vazquez PerezNo ratings yet

- Child Parent Online AgreementDocument1 pageChild Parent Online Agreement10News WTSPNo ratings yet