Professional Documents

Culture Documents

Pos Malaysia Tumbles On Poor Results - Business News - The Star Online

Uploaded by

LauHuiPingOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pos Malaysia Tumbles On Poor Results - Business News - The Star Online

Uploaded by

LauHuiPingCopyright:

Available Formats

Pos Malaysia tumbles on poor results - Business News | The Star Online

http://www.thestar.com.my/Business/Business-News/2014/02/21/Pos-...

Pos Malaysia tumbles on poor results

PETALING JAYA: Shares of Pos Malaysia Bhd plunged 12.7% yesterday to RM4.62 after dismal third quarter results and a weak earnings outlook prompted analysts to downgrade the stock. AmResearch analyst Wong Joe Vuei wrote in his report that Pos earnings in the quarter and the year-to-date were below expectations, accounting for only 59% of his full year estimate and 62% of consensus estimates. We revise our FY2014-FY2016 forecast earnings downwards by 8%-10%, as we adjust our earnings before interest taxes depreciation and amortisation to account for the higher operating expense. We also raise our effective tax rate assumption from 25% to 28%, Wong said. Wong kept his hold call on the stock with a target fair value of RM5.80. For the third quarter ended Dec 31, 2013, Pos Malaysias net profit declined to RM22.83mil from RM51.6mil in the same period previously. Revenue, however, rose to RM329.74mil from RM313.26mil previously. Kenanga Research in its report also downgraded its FY2014 and FY2015 forecast net profits by 5%, taking into account these higher operating costs. The research house also reduced its target price from RM5.39 to RM5.13 based on an unchanged 15 times 2014 revised earnings per share of 34.2 sen. Hong Leong Research retained its hold rating on the stock with a lowered target price to RM5 from RM5.53 based on an unchanged 16 times FY2015 price to earnings ratio. According to Bloomberg statistics, most analysts had a hold call on the stock with a consensus average 12-month price target of RM5.36. On its outlook moving forward, Kenanga Research sees Pos growing its profitable courier and logistics businesses which will have strong synergies from its 32% owner DRB-Hicom and the companys unit Kuala Lumpur Airport Services that will create an efficient logitics management service. Hong Leong said forward positives for Pos included strong growth opportunities on synergies with its major shareholder DRB-Hicom and the newly-acquired Konsortium Logistics. On the flipside, however, Hong Leong noted that negatives that could weigh Pos were huge staff numbers, its operation in a highly regulated industry, and with fortunes tied to the price of crude oil. By the end of the trading day, both its shares and call warrants topped the losers list with its warrants Pos-CL declining 30 sen to 34 sen and Pos-CM losing 20.5 sen to 14 sen.

1 of 1

2/21/2014 8:31 AM

You might also like

- Malaysia's Growth Intact, GDP Boosted by Rising Exports and InvestmentsDocument2 pagesMalaysia's Growth Intact, GDP Boosted by Rising Exports and InvestmentsLauHuiPingNo ratings yet

- He Had Such Quiet Eyes: By: Bibsy SoenharjoDocument6 pagesHe Had Such Quiet Eyes: By: Bibsy SoenharjoLauHuiPingNo ratings yet

- He Had Such Quiet EyesDocument4 pagesHe Had Such Quiet EyesAminatul FarhahNo ratings yet

- He Had Such Quiet EyesDocument13 pagesHe Had Such Quiet EyesLauHuiPingNo ratings yet

- SPM Module 1119 2010 Final LeapDocument66 pagesSPM Module 1119 2010 Final LeapNani Hannanika80% (5)

- He Had Such Quiet Eyes: Zarina Mohamed YusufDocument17 pagesHe Had Such Quiet Eyes: Zarina Mohamed YusufLauHuiPingNo ratings yet

- He Had Such Quiet EyesDocument7 pagesHe Had Such Quiet EyesMc G VANo ratings yet

- He Had Such Quiet EyesDocument1 pageHe Had Such Quiet EyesLauHuiPingNo ratings yet

- He Had Such Quiet EyesDocument4 pagesHe Had Such Quiet EyesSurender GunalanNo ratings yet

- He Had Such Quiet EyesDocument4 pagesHe Had Such Quiet EyesAminatul FarhahNo ratings yet

- EssayDocument32 pagesEssayMuhamad Arif100% (1)

- He Had Such Quiet EyesDocument12 pagesHe Had Such Quiet EyesLauHuiPingNo ratings yet

- Narrative StoryDocument18 pagesNarrative StorySNtsha Zlhlmi100% (2)

- Step by Wicked StepDocument37 pagesStep by Wicked StepShaz LindaNo ratings yet

- English SPM ModuleDocument197 pagesEnglish SPM Moduleabdfattah100% (16)

- SPM SAMPLE OF ESSAYS - CONTINUOUS WRITINGDocument10 pagesSPM SAMPLE OF ESSAYS - CONTINUOUS WRITINGSoon Kian Voon0% (1)

- Tips On Writing SPM Narrative EssaysDocument9 pagesTips On Writing SPM Narrative EssaysKhuzaimah Zakaria87% (31)

- Sample EssaysDocument8 pagesSample EssaysMAWiskillerNo ratings yet

- Sample EssaysDocument8 pagesSample EssaysMAWiskillerNo ratings yet

- Step-By-Wicked Step: Themes 1. The Importance of Preserving The Family UnitDocument7 pagesStep-By-Wicked Step: Themes 1. The Importance of Preserving The Family UnitSNtsha ZlhlmiNo ratings yet

- Eng Nar. EssayDocument6 pagesEng Nar. EssayShahirrah ShazimanNo ratings yet

- 50 Quality Essays-CompleteDocument6 pages50 Quality Essays-Completefattahjamal0% (2)

- Character Step by Wicked StepDocument7 pagesCharacter Step by Wicked StepAin AqilahNo ratings yet

- 50 Quality Essays-CompleteDocument6 pages50 Quality Essays-Completefattahjamal0% (2)

- Tips On Writing SPM Narrative EssaysDocument9 pagesTips On Writing SPM Narrative EssaysKhuzaimah Zakaria87% (31)

- I learnt my lesson the hard way after my father's tragic deathDocument3 pagesI learnt my lesson the hard way after my father's tragic deathRalph Diamond67% (3)

- Step by Wicked StepDocument37 pagesStep by Wicked StepShaz LindaNo ratings yet

- My Essay 1Document13 pagesMy Essay 1LauHuiPingNo ratings yet

- Continuous Writing Sample EssayDocument4 pagesContinuous Writing Sample EssayElaene Lauterbrunnen100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Operative ObstetricsDocument6 pagesOperative ObstetricsGrasya ZackieNo ratings yet

- Genocide/Politicides, 1954-1998 - State Failure Problem SetDocument9 pagesGenocide/Politicides, 1954-1998 - State Failure Problem SetSean KimNo ratings yet

- Case Digest in Special ProceedingsDocument42 pagesCase Digest in Special ProceedingsGuiller MagsumbolNo ratings yet

- Solar Powered Rickshaw PDFDocument65 pagesSolar Powered Rickshaw PDFPrãvëèñ Hêgådë100% (1)

- Rev Transcription Style Guide v3.3Document18 pagesRev Transcription Style Guide v3.3jhjNo ratings yet

- Political Science Assignment PDFDocument6 pagesPolitical Science Assignment PDFkalari chandanaNo ratings yet

- 001 Joseph Vs - BautistacxDocument2 pages001 Joseph Vs - BautistacxTelle MarieNo ratings yet

- MEAB Enewsletter 14 IssueDocument5 pagesMEAB Enewsletter 14 Issuekristine8018No ratings yet

- Midland County Board of Commissioners Dec. 19, 2023Document26 pagesMidland County Board of Commissioners Dec. 19, 2023Isabelle PasciollaNo ratings yet

- KaphDocument7 pagesKaphFrater MagusNo ratings yet

- McKesson Point of Use Supply - FINALDocument9 pagesMcKesson Point of Use Supply - FINALAbduRahman MuhammedNo ratings yet

- Effective Instruction OverviewDocument5 pagesEffective Instruction Overviewgene mapaNo ratings yet

- Term Paper On BF SkinnerDocument7 pagesTerm Paper On BF Skinnerc5rga5h2100% (1)

- NAME: - CLASS: - Describing Things Size Shape Colour Taste TextureDocument1 pageNAME: - CLASS: - Describing Things Size Shape Colour Taste TextureAnny GSNo ratings yet

- Surgical Orthodontics Library DissertationDocument5 pagesSurgical Orthodontics Library DissertationNAVEEN ROY100% (2)

- Voiceless Alveolar Affricate TsDocument78 pagesVoiceless Alveolar Affricate TsZomiLinguisticsNo ratings yet

- 25 Lanzar V Director of LandsDocument5 pages25 Lanzar V Director of LandsFlorieanne May ReyesNo ratings yet

- #1 HR Software in Sudan-Khartoum-Omdurman-Nyala-Port-Sudan - HR System - HR Company - HR SolutionDocument9 pages#1 HR Software in Sudan-Khartoum-Omdurman-Nyala-Port-Sudan - HR System - HR Company - HR SolutionHishamNo ratings yet

- Inferences Worksheet 6Document2 pagesInferences Worksheet 6Alyssa L0% (1)

- Diagnosis of Dieback Disease of The Nutmeg Tree in Aceh Selatan, IndonesiaDocument10 pagesDiagnosis of Dieback Disease of The Nutmeg Tree in Aceh Selatan, IndonesiaciptaNo ratings yet

- Industrial and Organizational PsychologyDocument21 pagesIndustrial and Organizational PsychologyCris Ben Bardoquillo100% (1)

- Infinitive Clauses PDFDocument3 pagesInfinitive Clauses PDFKatia LeliakhNo ratings yet

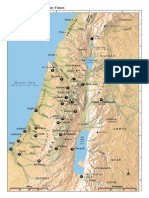

- Israel Bible MapDocument1 pageIsrael Bible MapMoses_JakkalaNo ratings yet

- Symbian Os-Seminar ReportDocument20 pagesSymbian Os-Seminar Reportitsmemonu100% (1)

- Identification Guide To The Deep-Sea Cartilaginous Fishes of The Indian OceanDocument80 pagesIdentification Guide To The Deep-Sea Cartilaginous Fishes of The Indian OceancavrisNo ratings yet

- Mariam Kairuz property dispute caseDocument7 pagesMariam Kairuz property dispute caseReginald Matt Aquino SantiagoNo ratings yet

- Revision Summary - Rainbow's End by Jane Harrison PDFDocument47 pagesRevision Summary - Rainbow's End by Jane Harrison PDFchris100% (3)

- Rainin Catalog 2014 ENDocument92 pagesRainin Catalog 2014 ENliebersax8282No ratings yet

- Comment On Motion To Release Vehicle BeridoDocument3 pagesComment On Motion To Release Vehicle BeridoRaffy PangilinanNo ratings yet

- Waiver: FEU/A-NSTP-QSF.03 Rev. No.: 00 Effectivity Date: Aug. 10, 2017Document1 pageWaiver: FEU/A-NSTP-QSF.03 Rev. No.: 00 Effectivity Date: Aug. 10, 2017terenceNo ratings yet