Professional Documents

Culture Documents

Subarans 2

Uploaded by

Fhremond ApoleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Subarans 2

Uploaded by

Fhremond ApoleCopyright:

Available Formats

Apole, Fhremond C. FM3A 1. How do you regulate non-bank financial service firms competing with banks?

A non-bank financial institution (NBFI) is a financial institution that does not have a full banking license or is not supervised by a national or international banking regulatory agency. NBFIs facilitate bank-related financial services, such as investment, risk pooling, contractual savings, and market brokering. Examples of these include insurance firms, pawn shops, cashier's check issuers, check cashing locations, payday lending, currency exchanges, and microloan organizations. 2. What is the structure of Federal Reserve System compared to BSP? The Federal Reserve System is composed of five parts: 1. The presidentially appointed Board of Governors (or Federal Reserve Board), an independent federal government agency located in Washington, D.C. 2. The Federal Open Market Committee (FOMC), composed of the seven members of the Federal Reserve Board and five of the twelve Federal Reserve Bank presidents, which oversees open market operations, the principal tool of U.S. monetary policy. 3. Twelve regional Federal Reserve Banks located in major cities throughout the nation, which divide the nation into twelve Federal Reserve districts. The Federal Reserve Banks act as fiscal agents for the U.S. Treasury, and each has its own nine-member board of directors. 4. Numerous other private U.S. member banks, which own required amounts of non-transferable stock in their regional Federal Reserve Banks. 5. Various advisory councils.

3. Illustrate organizational chart of a smaller community banks as compared to bigger community banks. Small community banks Chief Financial Officer In a community bank, the audit department is overseen by the chief financial officer. It is her responsibility to marshal the banks financial statements at the end of the fiscal year. Misrepresenting any portion of these statements can lead to fines and other regulatory sanctions against the bank. Additionally, should a community bank decide to go public, its financial statements are reported to the United States Securities and Exchange Commission. Any oversights the audit department fails to catch can become a material weakness reported to investors. Audit Committee The CFO will put together an audit committee to oversee the internal examination process. The committee will vote on the audit schedule, strategy and the comprehensiveness of the exams. This committee will be made up of bank officers representing each area being audited, including deposits, operations, lending, compliance, business development and information technology. Internal Auditors The audit department will be composed of one or more internal auditors. The internal auditor is the person who physically performs the exam. He will contact a department to be audited as dictated by the committee. He selects a sample of that departments work and requests the most current copy of departmental procedures. He will examine the work to ensure that it not only follows the appropriate procedures, but that it is in line with the regulations that govern the bank. Support Staff Depending on the size of the bank, the audit department will use support staff to enhance its functions. Support staff will perform a variety of tasks from collecting files to making copies to typing reports. An audit department at a large community bank with several branches will require more staff because the amount of paperwork and detail needed to perform the review is larger than a community bank with a single location.

Big community banks

4. What is an electronic banking system services? Personal Internet Banking The same technology that allows you to browse, chat, and send email also lets you do your banking from your PC. PNBs Internet Banking service offers you convenience and security. What you can do: Monitor account balances Transfer funds to family and friends Pay your bills Schedule payments and fund transfers in advance and program recurring transactions Order checkbooks View statement of account online Get notification via email to help you monitor your transactions Phone Banking Phone Banking allows you to do your banking transactions from the comfort of your home or office. What you can do: Check your account balances Inquire your last transactions/remittance

Transfer funds to family and friends Pay your bills Order checkbooks without going to the bank Request for a copy of your statement of account which can be sent through email Report lost/stolen ATM card/passbook

Mobile Banking Banking just got better. Now you can do your banking transactions anytime you need to, from wherever you happen to be. Using your mobile phone, you can enjoy the convenience and security of PNBs Mobile Banking service. What you can do: Inquire on your account balances and last transactions/remittances Transfer funds to family and friends Pay your bills Automated Teller Machine Get access to your cash and to banking transactions any time of the day through PNBs nationwide network of ATMs. What you can do: Withdraw cash from your ATM accounts affiliated with Bancnet, Megalink, and Expressnet networks Inquire your account balances Get a cash advance using your VISA card with PLUS logo (at the back of the card) 5. What is the difference between E-banking and E-commerce? E-Banking and E-Commerce refer to electronic mode of doing business. This is the age of computers and internet and it is making its presence felt in all walks of life. Banking and trading have not remained aloof and have embraced advancements gleefully to make both banking and buying and selling easier, fast and more convenient for people. The difference between e banking and e commerce is self-evident and is clear from the phrases. However, there are overlapping as e banking is often involved in many cases of e commerce. E-Banking E banking or online banking is nothing but allowing a customer to use internet to access his account anytime he wishes sitting in the comfort of his home or office or anywhere else. E banking, which started slowly has today become a need and also allows banks to cut down on expenditure involved with extra staff. Customers are happy as they are not required to go to the bank physically for various reasons and can conduct financial transactions even in the middle of night when the banks are closed. This has led to a revolution of sorts and has in fact given a boost to trade and commerce. E-Commerce E commerce is the name given to trading activities that are conducted using the power of internet. E commerce is simply online transactions. Buying and selling of goods and services using money through internet. E commerce can be between businesses to businesses when it is called B2B or business to consumer when it is called B2C.

6. What are the factors to consider in putting a new branch? Desirable Sites for New Branches Among the most desirable sites for full-service branch offices today are those with at least some of the following characteristics: 1. Heavy traffic count (for example, 30,000 to 40,000 cars per day), indicating a large flow of vehicular traffic (and potential customers) passing near the proposed site, but even at peak times (e.g., on Friday afternoons) customers must be able to easily see and access the office and its drive-up windows. 2. Large numbers of retail shops and stores present in the surrounding neighborhood, which usually generate a substantial volume of loan and deposit business. 3. Populations that are of above-average age(particularly those individuals 45 years of age and older) who often have substantial amounts of savings and need advice on how to invest those savings. 4. A surrounding area that encompasses substantial numbers of business owners, managers, and professional men and women at work or in residence. 5. A steady or declining number of service facilities operated by financial-service competitors, leaving a substantial volume of business that a new branch might be able to attract. 6. Above-average population growth, usually favorable to establishing a branch office in an area. 7. Above-average population density (i.e., a greater number of persons per square mile around the proposed site). 8. A relatively high target ratio of population per branch; measured by:

In the United States, for example, there is an average of about 4,000 people per branch office. However, some nations have even higher average population-per-branch ratios. For example, Austria and Germany count more than 10,000 people per bank branch, while Japan estimates more than 8,000 people per branch office. The larger the population served by each office, the more financial services is likely to be purchased, expanding revenues and enhancing operating efficiency

9. Above-average levels of household income, with higher-income groups usually offering branch offices the opportunity to sell more services. For offices designed primarily to attract deposits, key branch sites to look for usually include neighborhoods with relatively high median incomes, heavy concentrations of retail stores, older-than-average resident populations, and high proportions of homeowners rather than renters. On the other hand, financial firms seeking more checking accounts through their branches generally should enter neighborhoods with high levels of family income as well as areas where retail stores are concentrated. Higher levels of savings deposits are usually to be found in markets where there is an above -average proportion of older heads of households (including retired individuals) and a large proportion of residence who own their own homes. For branches primarily created to generate loan demand from household customers, residential areas with a heavy proportion of young families and substantial new home construction, along with concentrations of retail stores and high traffic flow, are particularly desirable locations. In contrast, commercial loan demand is usually focused upon central city office locations where a lending institutions credit analysts and loan approval committees are normally housed.

You might also like

- Money Theories, Money and Monetary PolicyDocument33 pagesMoney Theories, Money and Monetary PolicyFhremond ApoleNo ratings yet

- Pepsi-Cola Products Philippines Inc. (Pcppi) : Fhremond C. ApoleDocument7 pagesPepsi-Cola Products Philippines Inc. (Pcppi) : Fhremond C. ApoleFhremond ApoleNo ratings yet

- FINMANDocument30 pagesFINMANFhremond ApoleNo ratings yet

- 2009 EmployerSurveyDocument10 pages2009 EmployerSurveyFhremond ApoleNo ratings yet

- Areas of ConsiderationDocument1 pageAreas of ConsiderationFhremond ApoleNo ratings yet

- IntroDocument1 pageIntroFhremond ApoleNo ratings yet

- VII. Marketing Strategy: A.) SegmentationDocument2 pagesVII. Marketing Strategy: A.) SegmentationFhremond ApoleNo ratings yet

- Bodies of WaterDocument4 pagesBodies of WaterFhremond ApoleNo ratings yet

- Big BankDocument1 pageBig BankFhremond ApoleNo ratings yet

- Multiple Choice QuestionsDocument11 pagesMultiple Choice QuestionsFhremond Apole75% (8)

- TheoriesDocument6 pagesTheoriesFhremond ApoleNo ratings yet

- Money Andthe EconomyDocument8 pagesMoney Andthe EconomyFhremond ApoleNo ratings yet

- Bodies of WaterDocument4 pagesBodies of WaterFhremond ApoleNo ratings yet

- The Nervous SystemDocument38 pagesThe Nervous SystemFhremond ApoleNo ratings yet

- AcTG TestDocument8 pagesAcTG TestFhremond ApoleNo ratings yet

- GR 172087Document16 pagesGR 172087Fhremond ApoleNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Understanding Zara's Supply ChainDocument7 pagesUnderstanding Zara's Supply ChainDYPUSM WECNo ratings yet

- TENDER RFX NO. 2122100065 Supply of Skilled Manpower Services For Works in Generation DivisionDocument3 pagesTENDER RFX NO. 2122100065 Supply of Skilled Manpower Services For Works in Generation Divisionxafajat881No ratings yet

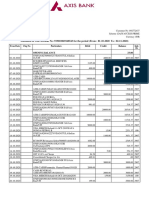

- Statement of Axis Account No:919010069168543 For The Period (From: 01-10-2020 To: 02-11-2020)Document2 pagesStatement of Axis Account No:919010069168543 For The Period (From: 01-10-2020 To: 02-11-2020)minniNo ratings yet

- Acct Statement - XX6717 - 18072023Document11 pagesAcct Statement - XX6717 - 18072023Mevaram GurjarNo ratings yet

- HG6145F GPON Optical Network Terminal Product Manual ADocument38 pagesHG6145F GPON Optical Network Terminal Product Manual AAtila RaphaelNo ratings yet

- Franklin PDFDocument48 pagesFranklin PDFkermech21607No ratings yet

- Account Statement: Date Value Date Description Cheque Deposit Withdrawal BalanceDocument2 pagesAccount Statement: Date Value Date Description Cheque Deposit Withdrawal Balanceomm123No ratings yet

- Non-Marketable Financial Assets: Bank DepositsDocument8 pagesNon-Marketable Financial Assets: Bank DepositsDhruv MishraNo ratings yet

- Contentitemfile Clakzz57bxlrw0a21yjksjcx8 PDFDocument4 pagesContentitemfile Clakzz57bxlrw0a21yjksjcx8 PDFJoseph OndariNo ratings yet

- Account Statements-AprDocument2 pagesAccount Statements-AprCAT ClusterNo ratings yet

- CCNA 200 Part 1Document406 pagesCCNA 200 Part 1Wallace LiraNo ratings yet

- Throughput of Inbound Applications (MBPS) : Applications (Exinda-Heves) Feb 16 2022 12:00am - Feb 17 2022 12:00amDocument6 pagesThroughput of Inbound Applications (MBPS) : Applications (Exinda-Heves) Feb 16 2022 12:00am - Feb 17 2022 12:00amLuis FernandoNo ratings yet

- Loan Agreement Document of $100,000.00 USDDocument3 pagesLoan Agreement Document of $100,000.00 USDUniverse Loan Company LimtedNo ratings yet

- Geeta Sy Fee ReceiptDocument1 pageGeeta Sy Fee Receiptrocky handsomeNo ratings yet

- T Rec K.26 200804 I!!pdf eDocument8 pagesT Rec K.26 200804 I!!pdf ejmrs7322No ratings yet

- Class 9 and 11-ptm CircularDocument2 pagesClass 9 and 11-ptm CircularRishabh GargNo ratings yet

- This Document Has 881 PagesDocument17 pagesThis Document Has 881 Pagespadmakar tripathiNo ratings yet

- PowerPoint Presentation On Inventory ControlDocument41 pagesPowerPoint Presentation On Inventory ControlSafwan Shaikh100% (2)

- Chapter 13: Basics of Commercial BankingDocument2 pagesChapter 13: Basics of Commercial BankingShane Tabunggao100% (1)

- Handyman Contractor Invoice TemplateDocument2 pagesHandyman Contractor Invoice TemplateStephanies GonzalezNo ratings yet

- Form12BB R539 Proof Submission Form PDFDocument4 pagesForm12BB R539 Proof Submission Form PDFSiva ThotaNo ratings yet

- Fortigate 2600f SeriesDocument6 pagesFortigate 2600f SeriesAzhar HussainNo ratings yet

- Bizmanualz Accounting Policies and Procedures SampleDocument8 pagesBizmanualz Accounting Policies and Procedures SamplePaulo LindgrenNo ratings yet

- Chapter 1-QuizDocument27 pagesChapter 1-QuizJpzelle100% (1)

- Product and Distribution StrategiesDocument37 pagesProduct and Distribution Strategiesmonel_24671No ratings yet

- 9 Feb 2021 FoodDocument2 pages9 Feb 2021 FoodRakesh ThalorNo ratings yet

- Net Pacific Inc. Organizational Structure: Evelyn Morales Lito Tac-AnDocument1 pageNet Pacific Inc. Organizational Structure: Evelyn Morales Lito Tac-AnPatrick PenachosNo ratings yet

- Basic Reconciliation StatementsDocument41 pagesBasic Reconciliation StatementsBeverly EroyNo ratings yet

- Benefit Verification LetterDocument4 pagesBenefit Verification LetterDonna BridgesNo ratings yet

- UGBS 205 Fundamentals of Accounting Methods: Week 8 - Bank Reconciliation StatementDocument16 pagesUGBS 205 Fundamentals of Accounting Methods: Week 8 - Bank Reconciliation StatementYaw Baah-BarimahNo ratings yet