Professional Documents

Culture Documents

Tax Ass - Taxation Synthesis: An Educational Experience

Uploaded by

Renz Ian DeeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Ass - Taxation Synthesis: An Educational Experience

Uploaded by

Renz Ian DeeCopyright:

Available Formats

Benefits of Learning Estate Tax: The Student Way Estate taxes are not so commonly known to most people

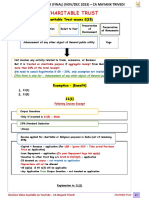

because, ob iously, they!re li ing and mostly, they don!t ha e any idea about it" #n other words, most people don!t care" $ust recently, the catastrophe brought by the typhoon depression %gaton in Butuan &ity could somehow be interconnected with estate taxation" 'or example, if Brgy" Buhangin alone, as of (onday, $anuary )*, )*+,, reported casualties of -. dead, ,., in/ured, and 0 missing (Butuan City FSUU Rover Report), by how much will be reported as total estates of the said dead and missing1 Through the report, it is wise to learn the nature of estate taxes, their purposes, and their help to e eryone linked at it" This context will focus about the personal learnings of Estate Tax" Estate Tax or tax on donation mortis causa is not /ust as easy as gi e2and2take of a thing" By definition, Estate tax is a tax on the right of the deceased person to transmit his estate to his lawful heirs and beneficiaries" #t is not a tax on property" Estate tax is held to be an excise tax imposed on the pri ilege of transmitting property upon the death of the owner" The estate tax is generated by death and accrues at the time of death" #t is go erned by the law in force at the time of death notwithstanding the postponement of the actual possession or en/oyment of the estate by the beneficiary" (www.thetrustguru.com/newspg4.htm) %t first, to reali3e that as long as an indi idual is either resident or citi3en, he is sub/ect to estate tax both in and out of domicile except on non2resident alien whose taxes are from within the country currently staying for business purposes unless otherwise when reciprocity is declared, deductions may be an effect" %s to deductions, always bear in mind that to familiari3e the format of deductions is important to a oid misguided deductions" Based on Transfer and Business Taxes . th Edition by 4alencia and 5oxas, p+). is the 6eduction %llowed from 7ross Estate"

#t is only pu33ling during the computation of whether the anishing deductions is to be deducted or not8 estate tax credit8 and especially when and how to recogni3e easily whether an item, expense, or deduction is exclusi e or con/ugal" %ll the said confusions bear long computations" %nother, exclusi e and con/ugal differences also exist in both computations under &on/ugal 9artnership or %bsolute &ommunity of 9roperties, gi ing a :uestion of, ;Which is which1< Trying many helps from others commonly resulted to an answer of, ;$ust read it o er and o er and try to understand"< That does not mean inclusi e of computation" E en the solution is confusing personally" %nother weakness possessed, about the theories and guidelines of reporting especially when one has to substitute the other or when one will pay for the sake of the other depending on situations" =owe er, standard deductions can be easily remembered because of their simple principles as standard and limited by maximum amounts such as family home of 9+ ( allowable deduction, medical costs of 9>** ?, funeral cost2with the rules of whiche er is lower, and etc" @o other :uick solution to do but rather to study, read it o er and o er, and practice" %s a student, you cannot reach your goal easily by learning irtually" %ctual spoon feeding is not literally how step by step you will learn but is about how you understand what you! e learned" ;The har est thing in the wor! taxes" We can!t escape it" to un erstan is the income ta".# by %lbert

Einstein" #n addition, let!s say business and transfer taxes do the same thing as income

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Intelenet payslip titleDocument1 pageIntelenet payslip titleSandeep SranNo ratings yet

- Feasibility Study On HardwareDocument4 pagesFeasibility Study On HardwareRenz Ian Dee100% (1)

- Setting up Mighty Hardware's organizational structureDocument5 pagesSetting up Mighty Hardware's organizational structureRenz Ian DeeNo ratings yet

- Chap.15 Guerrero Joint Product and By-Product AcctgDocument27 pagesChap.15 Guerrero Joint Product and By-Product AcctgGeoff Macarate100% (1)

- Chapter 13a Regular Allowable Itemized DeductionsDocument6 pagesChapter 13a Regular Allowable Itemized DeductionsJason Mables100% (1)

- Empleo Chapter 6 Investments in Financial Instruments PDFDocument19 pagesEmpleo Chapter 6 Investments in Financial Instruments PDFRhenielou CristobalNo ratings yet

- Santos vs. Servier PhilippinesDocument3 pagesSantos vs. Servier PhilippinesJanineNo ratings yet

- Fs Market StudyDocument11 pagesFs Market StudyRenz Ian Dee100% (2)

- Jitendra Raghuwanshi - ATCS Offer Letter - 7th February 2020Document4 pagesJitendra Raghuwanshi - ATCS Offer Letter - 7th February 2020Sonam BhardwajNo ratings yet

- Cost Allocation, Customer-Profitability Analysis, and Sales-Variance AnalysisDocument43 pagesCost Allocation, Customer-Profitability Analysis, and Sales-Variance AnalysisRenz Ian DeeNo ratings yet

- Groupings AC 513Document6 pagesGroupings AC 513Renz Ian DeeNo ratings yet

- DrawingDocument1 pageDrawingRenz Ian DeeNo ratings yet

- PromotionDocument137 pagesPromotionRenz Ian DeeNo ratings yet

- The Violinist PostureDocument1 pageThe Violinist PostureRenz Ian DeeNo ratings yet

- Fs Technical StudyDocument8 pagesFs Technical StudyRenz Ian DeeNo ratings yet

- Learning Insights-CES LetterDocument1 pageLearning Insights-CES LetterRenz Ian DeeNo ratings yet

- The CPA JournalDocument8 pagesThe CPA JournalRenz Ian DeeNo ratings yet

- The CPA Journal SummaryDocument2 pagesThe CPA Journal SummaryRenz Ian DeeNo ratings yet

- Learning Insights-CES LetterDocument1 pageLearning Insights-CES LetterRenz Ian DeeNo ratings yet

- Bonds and Their ValuationDocument41 pagesBonds and Their ValuationRenz Ian DeeNo ratings yet

- The CPA JournalDocument8 pagesThe CPA JournalRenz Ian DeeNo ratings yet

- Chapter 1 - Intro To IrtDocument2 pagesChapter 1 - Intro To IrtJuan Agustin Mendoza0% (1)

- Tax3211 Estate Tax 220318 130404Document17 pagesTax3211 Estate Tax 220318 130404MOTC INTERNAL AUDIT SECTIONNo ratings yet

- Chapter 4Document28 pagesChapter 4Nhi Phan TúNo ratings yet

- CHARITABLE TRUST DT CONCEPT BOOK (FINAL) Nov 2023Document11 pagesCHARITABLE TRUST DT CONCEPT BOOK (FINAL) Nov 2023Apurva MehtaNo ratings yet

- Taxation Law 2006-2014Document53 pagesTaxation Law 2006-2014justforscribd2No ratings yet

- Wage ActDocument1 pageWage ActShumayla KhanNo ratings yet

- Payslip For The Month of May 2021: 16 Iris House Business Centre Nangal Raya New Delhi 110046Document1 pagePayslip For The Month of May 2021: 16 Iris House Business Centre Nangal Raya New Delhi 110046Manisha ThakurNo ratings yet

- Bromley London Borough Council Case StudyDocument19 pagesBromley London Borough Council Case StudyM.AnudeepNo ratings yet

- Tax1. Cases. 1. A. Definition, Concept and Purpose of Taxation - B. Nature and Characteristics of TaxationDocument37 pagesTax1. Cases. 1. A. Definition, Concept and Purpose of Taxation - B. Nature and Characteristics of TaxationLecdiee Nhojiezz Tacissea SalnackyiNo ratings yet

- ITR 1 - AY 2023-24 - V1.3.xlsmDocument18 pagesITR 1 - AY 2023-24 - V1.3.xlsmsrinukkNo ratings yet

- "Isolated Activity": Sybbi / Sybaf PGBP Direct Taxation-II Chapter 5:-Profits & Gains of Business or ProfessionDocument5 pages"Isolated Activity": Sybbi / Sybaf PGBP Direct Taxation-II Chapter 5:-Profits & Gains of Business or Professionas2207530No ratings yet

- Corporate Income Tax - 2023Document56 pagesCorporate Income Tax - 2023afafrs02No ratings yet

- CXC It Sba 2015Document6 pagesCXC It Sba 2015Wayne WrightNo ratings yet

- Unit 7 - The General Deduction FormulaDocument22 pagesUnit 7 - The General Deduction FormulahavengroupnaNo ratings yet

- Finance Act 2019 key changes in income taxDocument28 pagesFinance Act 2019 key changes in income taxFaisal Islam ButtNo ratings yet

- Paper 11 PDFDocument6 pagesPaper 11 PDFKaysline Oscar CollinesNo ratings yet

- TRAINING ON AUDIT OF CFC ACCOUNTSDocument33 pagesTRAINING ON AUDIT OF CFC ACCOUNTSjaya prakashNo ratings yet

- Salary Slip PDFDocument3 pagesSalary Slip PDFmohd aslamNo ratings yet

- Tax System and Procedure in USA, UK, India by Simon (BUBT)Document165 pagesTax System and Procedure in USA, UK, India by Simon (BUBT)Simon HaqueNo ratings yet

- Module IV. Minimum Corporate Income Tax IAET GITDocument11 pagesModule IV. Minimum Corporate Income Tax IAET GITPinky DanqueNo ratings yet

- 1 Which of The Following Taxpayers May Not Deduct TheirDocument2 pages1 Which of The Following Taxpayers May Not Deduct Theirhassan taimourNo ratings yet

- Sadoy-Provisions Contengiences Exercise 3-Garfield CompanyDocument6 pagesSadoy-Provisions Contengiences Exercise 3-Garfield CompanyReymark SadoyNo ratings yet

- Renewable Energy Act of 2008 SummaryDocument8 pagesRenewable Energy Act of 2008 SummaryArcie SercadoNo ratings yet

- Compilation of ExercisesDocument15 pagesCompilation of ExercisesHazel MoradaNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountAnonymous HvihZxGNNo ratings yet

- Taxation Law ReviewDocument16 pagesTaxation Law ReviewSharmane PastranaNo ratings yet