Professional Documents

Culture Documents

Questions and Answer

Uploaded by

Santosh SarojOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Questions and Answer

Uploaded by

Santosh SarojCopyright:

Available Formats

1. Which factors affect the probable consequences likely if a risk does occur? Risk timing. Risk scope. 2.

An effective risk management plan will need to address which of the following issues? Risk avoidance / Risk monitoring / Contingency planning.

3. ne ob!ective of risk management is to reduce the volatility of a company"s cash flows. True. #. When considering the risk of foreign investment higher risk could from e$change rate risk and political risk while lower risk might from international diversification. True. %. &he firm"s business risk is largely determined by the financial characteristic of its industry. False. A bank suffers loss due to adverse market movement of a security. &he security was however held beyond the defeasance period. What is the type of the risk that the bank has suffered? Operational risk. perational risk does not arise from() Defaults by own customers. A bank e$pects fall in price of a security if it sells it in the market. What is the risk that the bank is facing? sset li!uidation risk. ,ystemic risk is the risk due to() Failure of entire banking system. .aily volatility of a stock is 1/. What is its 10 days volatility appro$imately? "#. arise result

6.

'. *.

+. 1-.

11.

A bank funds its assets from a pool of composite liabilities. Apart 1rom credit and operational risks2 it faces() $asis risk. A branch sanctions 3s.1 crore loan to a borrower2 which of the &he risk the branch is taking? %i!uidity risk/interest rate risk/credit risk/operational risk. 1inancial risk is defined as() &ncertainties' resulting in adverse variation of profitability or outrig(t losses. 4ield curve risk is known as() Risk owing to altering of yields across maturities and its impact on )**. 5ap method is basically used for() +easuring banks interest rate risk e,posure. 6n a given time band a negative or liability sensitive gap occurs When() Rate sensitive liabilities e,ceed rate sensitive assets. With a negative gap2 an increase in market interest rates could 7ause a() Decline in net interest income. true or false? Risk associated wit( portfolio is always less t(an t(e weig(ted average of risks of individual items in portfolio. ,ystemic risk can be diversified. &he statement is() False. 8a3 is() -otential worst case loss at a specific confidence level over a certain period of time. 7redit risk assessment of the borrower unit is for() ssessing t(e repayment capacity.

12.

13.

1#.

1%. 10.

1'.

1*.

1+. 2-.

21

22. 23.

6nterest rate risk is a type of() Credit risk. 8a3 means() .alue at risk

You might also like

- Chapter No.2: Risk Management and Basics of DerivativesDocument21 pagesChapter No.2: Risk Management and Basics of DerivativesSantosh SarojNo ratings yet

- 43Document9 pages43Santosh SarojNo ratings yet

- BFM - Ch-15 - Module CDocument21 pagesBFM - Ch-15 - Module CSantosh SarojNo ratings yet

- Chapter No.2: Risk Management and Basics of DerivativesDocument21 pagesChapter No.2: Risk Management and Basics of DerivativesSantosh SarojNo ratings yet

- Legal Aspects of BusinessDocument41 pagesLegal Aspects of BusinessRakesh BajajNo ratings yet

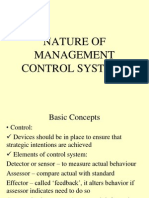

- Nature of Management Control SystemsDocument14 pagesNature of Management Control SystemsSantosh SarojNo ratings yet

- BFM-CH - 10 - Module BDocument20 pagesBFM-CH - 10 - Module BSantosh Saroj100% (1)

- Sales and Distribution Management, 2eDocument12 pagesSales and Distribution Management, 2eSantosh SarojNo ratings yet

- ProbabilityDocument9 pagesProbabilitySantosh SarojNo ratings yet

- Declaration: Shopping Behavior" With Reference To Ahmedabad Is Original To The Best of MyDocument7 pagesDeclaration: Shopping Behavior" With Reference To Ahmedabad Is Original To The Best of MySantosh SarojNo ratings yet

- Securities Transaction Tax: A.b.acharya Addl - Asst.directorDocument7 pagesSecurities Transaction Tax: A.b.acharya Addl - Asst.directorSantosh SarojNo ratings yet

- Service Marekting & CRM M 35 CourseDocument5 pagesService Marekting & CRM M 35 CourseSantosh SarojNo ratings yet

- BFM-CH - 10 - Module BDocument20 pagesBFM-CH - 10 - Module BSantosh Saroj100% (1)

- Income Under The Head "Salaries"Document22 pagesIncome Under The Head "Salaries"Santosh SarojNo ratings yet

- Certificate: Contemporary Trend in Online Shopping Behavior" With Reference To Ahmedabad in TheDocument1 pageCertificate: Contemporary Trend in Online Shopping Behavior" With Reference To Ahmedabad in TheSantosh SarojNo ratings yet

- Declaration: Shopping Behavior" With Reference To Ahmedabad Is Original To The Best of MyDocument7 pagesDeclaration: Shopping Behavior" With Reference To Ahmedabad Is Original To The Best of MySantosh SarojNo ratings yet

- Ch-6 PricingDocument17 pagesCh-6 PricingSantosh SarojNo ratings yet

- Ch-5 Communication MixDocument14 pagesCh-5 Communication MixSantosh SarojNo ratings yet

- Ch-8 Designing and Managing Service ProcessesDocument11 pagesCh-8 Designing and Managing Service ProcessesSantosh SarojNo ratings yet

- Ch-6 PricingDocument17 pagesCh-6 PricingSantosh SarojNo ratings yet

- Types of ContractDocument25 pagesTypes of ContractSachin MishraNo ratings yet

- Service Marekting & CRM M 35 CourseDocument5 pagesService Marekting & CRM M 35 CourseSantosh SarojNo ratings yet

- Nature of Management Control SystemsDocument14 pagesNature of Management Control SystemsSantosh SarojNo ratings yet

- Chap 2Document19 pagesChap 2Santosh SarojNo ratings yet

- Nature of Management Control SystemsDocument14 pagesNature of Management Control SystemsSantosh SarojNo ratings yet

- Sales WarrantiesDocument26 pagesSales WarrantiesSantosh SarojNo ratings yet

- Negotiable Instrument TypesDocument21 pagesNegotiable Instrument TypesSantosh SarojNo ratings yet

- CapmDocument7 pagesCapmSantosh SarojNo ratings yet

- Malhotra Mr05 PPT 01Document33 pagesMalhotra Mr05 PPT 01Santosh Saroj100% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Edited M3 Eng 9Document41 pagesEdited M3 Eng 9Hannah AdellitNo ratings yet

- Managing Diversity in ProjectsDocument35 pagesManaging Diversity in ProjectsAzam KhanNo ratings yet

- Arendt Thinking and Moral ConsiderationsDocument30 pagesArendt Thinking and Moral ConsiderationsOtávio LoboNo ratings yet

- FW Discussion QuestionsDocument4 pagesFW Discussion QuestionsA_WSM_SIC100% (2)

- Administration & Finance Officer 2013 App Form PDFDocument8 pagesAdministration & Finance Officer 2013 App Form PDFdiscovery_swanNo ratings yet

- HISTORY OF TESTING IN PADocument14 pagesHISTORY OF TESTING IN PAKv ArunNo ratings yet

- Bajura Technical ViewDocument2 pagesBajura Technical ViewAnonymous ZhVoIINo ratings yet

- Not All Lawyers Are Antisocial: Social Media Regulation and The First AmendmentDocument26 pagesNot All Lawyers Are Antisocial: Social Media Regulation and The First Amendmentkellen623No ratings yet

- Iqra Ramadan Brochure 2016Document12 pagesIqra Ramadan Brochure 2016Muhammad AlamgirNo ratings yet

- Mental Health CurriculumDocument5 pagesMental Health Curriculumapi-318989633No ratings yet

- Twatt Band Territory - William Twatt (Bremner)Document18 pagesTwatt Band Territory - William Twatt (Bremner)Red RiverNo ratings yet

- Excerpt Copied From A Previous Edition (Circa 1999?) of The Book Gender inDocument2 pagesExcerpt Copied From A Previous Edition (Circa 1999?) of The Book Gender inTiberius PostlethwaiteNo ratings yet

- Unit 31 LO1 Video Essay Script: Linus HereDocument6 pagesUnit 31 LO1 Video Essay Script: Linus Hereapi-295184503No ratings yet

- Programme Developed and Delivered by Deborah WilliamsDocument67 pagesProgramme Developed and Delivered by Deborah WilliamsMaruf AhmedNo ratings yet

- Triffles Significance PDFDocument22 pagesTriffles Significance PDFJames NguNo ratings yet

- AAU Gender Policy (Edited) Nov. 17, 2015 PDFDocument46 pagesAAU Gender Policy (Edited) Nov. 17, 2015 PDFmesfin DemiseNo ratings yet

- LGBTQ PosterDocument1 pageLGBTQ Posterapi-268186157No ratings yet

- Booker T. Washington and W. E. B. DuBois EssayDocument5 pagesBooker T. Washington and W. E. B. DuBois Essaydaliahbcap201650% (2)

- UrbisDraftv3 02Document165 pagesUrbisDraftv3 02Will HarperNo ratings yet

- Drafting Mission StatementDocument11 pagesDrafting Mission Statementapi-3750957100% (1)

- Assignment Topics CBDocument3 pagesAssignment Topics CBAnshul GargNo ratings yet

- 5 Faces of Oppression - YoungDocument4 pages5 Faces of Oppression - Youngcamilaoz100% (2)

- To Kill A MockingbirdDocument16 pagesTo Kill A MockingbirdSedeena50% (2)

- What is Morality? The Minimum ConceptionDocument38 pagesWhat is Morality? The Minimum ConceptionAshish KumarNo ratings yet

- English Speech 9Document2 pagesEnglish Speech 9Kiara JadeNo ratings yet

- The 100: A Post-Genre Utopia?Document16 pagesThe 100: A Post-Genre Utopia?Anaïs OrnelasNo ratings yet

- UN Resolution On Sexual Orientation and Gender IdentityDocument2 pagesUN Resolution On Sexual Orientation and Gender IdentityNat'l Center for Transgender Equality100% (1)

- MSC Registration FormDocument1 pageMSC Registration FormTiffany Ralston CummingsNo ratings yet

- Gay RightsDocument2 pagesGay Rightsapi-317209670No ratings yet