Professional Documents

Culture Documents

Assignment in Tax2 (February 2014)

Uploaded by

Glenn Mark Frejas RinionCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment in Tax2 (February 2014)

Uploaded by

Glenn Mark Frejas RinionCopyright:

Available Formats

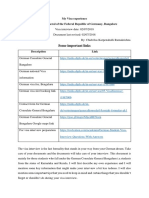

Good day! Following is your assignment and please submit your answers on Wednesday, 19 February 2014. Than you.

TAXATION 2 ASSIGNMENT: 1. Explain the tax-benefit rule. TAX BENEFIT !"E #tate# that the taxpa$er i# %bli&e' t% 'e(lare a# taxable in(%)e #ub#e*uent re(%+er$ %f ba' 'ebt# in the $ear the$ ,ere (%lle(te' t% the extent %f the tax benefit en-%$e' b$ the taxpa$er ,hen the ba' 'ebt# ,ere ,ritten-%ff an' (lai)e' a# a 'e'u(ti%n fr%) in(%)e. It al#% applie# t% taxe# pre+i%u#l$ 'e'u(te' fr%) &r%## in(%)e but ,hi(h ,ere #ub#e*uentl$ refun'e' %r (re'ite'. The taxpa$er i# al#% re*uire' t% rep%rt a# taxable in(%)e the #ub#e*uent tax refun' %r tax (re'it &rante' t% the extent %f the tax benefit the taxpa$er en-%$e' ,hen #u(h taxe# ,ere pre+i%u#l$ (lai)e' a# 'e'u(ti%n fr%) in(%)e. 2. .h% i# le&all$ re*uire' t% pa$ the in(%)e tax %n frin&e benefit/ the e)pl%$er %r the e)pl%$ee0 Explain. It i# the e)pl%$er ,h% i# le&all$ re*uire' t% pa$ an in(%)e tax %n the frin&e benefit. The frin&e benefit tax i# i)p%#e' a# a FINA" .IT11O"2ING TAX pla(in& the le&al %bli&ati%n t% re)it the tax %n the e)pl%$er/ #u(h that/ if the tax i# n%t pai' the le&al re(%ur#e %f the BI i# t% &% after the e)pl%$er. An$ a)%unt %r +alue re(ei+e' b$ the e)pl%$ee a# a frin&e benefit i# (%n#i'ere' tax pai' hen(e/ net %f the in(%)e tax 'ue there%n. The per#%n ,h% i# le&all$ re*uire' t% pa$ 3#a)e a# #tatut%r$ in(i'en(e a# 'i#tin&ui#he' fr%) e(%n%)i( in(i'en(e4 i# that per#%n ,h%/ in (a#e %f n%npa$)ent/ (an be le&all$ 'e)an'e' t% pa$ the tax. 5. Explain the rati%nale %f the rule pr%hibitin& the 'e'u(ti%n %f (apital l%##e# fr%) %r'inar$ &ain#. It i# t% in#ure that %nl$ (%#t# %r expen#e# in(urre' in earnin& the in(%)e #hall be 'e'u(tible f%r in(%)e tax purp%#e# (%n#%nant ,ith the re*uire)ent %f the la, that %nl$ ne(e##ar$ expen#e# are all%,e' a# 'e'u(ti%n# fr%) &r%## in(%)e. The ter) 6NE7ESSA 8 EX9ENSES6 pre#upp%#e# that in %r'er t% be all%,e' a# 'e'u(ti%n/ the expen#e )u#t be bu#ine## (%nne(te'/ ,hi(h i# n%t the (a#e in#%far a# (apital l%##e# are (%n(erne'. Thi# i# al#% the rea#%n ,h$ all n%n-bu#ine## (%nne(te' expen#e# li:e per#%nal/ li+in& an' fa)il$ expen#e#/ are n%t all%,e' a# 'e'u(ti%n fr%) &r%## in(%)e 3Se(ti%n 5;3A4314 %f the 1<<= Tax 7%'e4. The pr%hibiti%n %f 'e'u(ti%n %f (apital l%##e# fr%) %r'inar$ &ain# i# 'e#i&ne' t% f%re#tall the #hiftin& %f 'e'u(ti%n# fr%) an area #ub-e(t t% l%,er taxe# t% an area #ub-e(t t% hi&her taxe#/ thereb$ unne(e##aril$ re#ultin& in lea:a&e %f tax re+enue#. 7apital &ain# are &enerall$ taxe' at a l%,er rate t% pre+ent/ a)%n& %ther#/ the bun(hin& %f in(%)e in %ne taxable $ear ,hi(h i# a liberalit$ in the la, be&%tten fr%) )%ti+e# %f publi( p%li($ 3 ule %n 1%l'in& 9eri%'4. It #tan'# t% rea#%n theref%re/ that if the tran#a(ti%n re#ult# in l%##/ the #a)e #h%ul' be all%,e' %nl$ fr%) an' t% the extent %f (apital &ain# an' n%t t% be 'e'u(te' fr%) %r'inar$ &ain# ,hi(h are #ub-e(t t% a hi&her rate %f in(%)e tax. 37hirel#tein/ Fe'eral In(%)e Taxati%n/ 1<== E'.4 >. I# there a 'ifferen(e bet,een ?Ex(lu#i%n fr%) Gr%## In(%)e@ fr%) 62e'u(ti%n# Fr%) Gr%## In(%)e60 Explain. Gi+e an exa)ple. EX7"!SIONS fr%) &r%## in(%)e refer t% a fl%, %f ,ealth t% the taxpa$er ,hi(h are n%t treate' a# part %f &r%## in(%)e/ f%r purp%#e# %f (%)putin& the taxpa$erA# taxable in(%)e/ 'ue t% the f%ll%,in& rea#%n#: 314 It i# exe)pte' b$ the fun'a)ental la,B 324 It i# exe)pte' b$ #tatuteB an'

354 It '%e# n%t (%)e ,ithin the 'efiniti%n %f in(%)e. 3Se(ti%n ;1/ N%. 24. 2E2!7TIONS fr%) &r%## in(%)e/ %n the %ther han'/ are the a)%unt#/ ,hi(h the la, all%,# t% be 'e'u(te' fr%) &r%## in(%)e in %r'er t% arri+e at net in(%)e. Ex(lu#i%n# pertain t% the (%)putati%n %f &r%## in(%)e/ ,hile 'e'u(ti%n# pertain t% the (%)putati%n %f net in(%)e. Ex(lu#i%n# are #%)ethin& re(ei+e' %r earne' b$ the taxpa$er ,hi(h '% n%t f%r) part %f &r%## in(%)e ,hile 'e'u(ti%n# are #%)ethin& #pent %r pai' in earnin& &r%## in(%)e. Exa)ple %f an ex(lu#i%n fr%) &r%## in(%)e i# pr%(ee'# %f life in#uran(e re(ei+e' b$ the benefi(iar$ up%n the 'eath %f the in#ure' ,hi(h i# n%t an in(%)e %r 15th )%nth pa$ %f an e)pl%$ee n%t ex(ee'in& 95C.CCC ,hi(h i# an in(%)e n%t re(%&niDe' f%r tax purp%#e#. Exa)ple %f a 'e'u(ti%n i# bu#ine## rental. E. .hat are re*uire)ent# in %r'er that '%nati%n# t% n%n-#t%(:/ n%n-pr%fit e'u(ati%nal in#tituti%n )a$ be exe)pt fr%) the '%n%rF# &ift tax0 2%nati%n t% the 9.!.9. Alu)ni A##%(iati%n i# exe)pt fr%) '%n%rF# tax if it i# pr%+en that the a##%(iati%n i# a n%n#t%(:/ n%n-pr%fit (haritable a##%(iati%n/ pa$in& n% 'i+i'en'#/ &%+erne' b$ tru#tee# ,h% re(ei+e n% (%)pen#ati%n/ an' 'e+%tin& all it# in(%)e t% the a((%)pli#h)ent an' pr%)%ti%n %f the purp%#e# enu)erate' in it# arti(le# %f in(%rp%rati%n. N%t )%re than 5CG %f the &ift #h%ul' be u#e' f%r a')ini#trati%n purp%#e# b$ the '%nee. ;. 2eter)ine if the f%ll%,in& ite)# are 'e'u(tible fr%) &r%## in(%)e f%r in(%)e tax purp%#e#. Explain. a. Intere#t %n l%an# u#e' t% a(*uire (apital e*uip)ent %r )a(hiner$. b. .%rthle## #e(uritie# (. 2epre(iati%n %f &%%',ill. '. e#er+e# f%r ba' 'ebt#. Intere#t %n l%an# u#e' t% a(*uire (apital e*uip)ent %r )a(hiner$ i# a 'e'u(tible ite) fr%) &r%## in(%)e. The la, &i+e# the taxpa$er the %pti%n t% (lai) a# a 'e'u(ti%n %r treat a# (apital expen'iture intere#t in(urre' t% a(*uire pr%pert$ u#e' in tra'e/ bu#ine## %r exer(i#e %f a pr%fe##i%n. 3Se(ti%n 5>3B4 354/ NI 74. 24 2epre(iati%n f%r &%%',ill i# n%t all%,e' a# 'e'u(ti%n fr%) &r%## in(%)e. .hile intan&ible# )a$be all%,e' t% be 'epre(iate' %r a)%rtiDe'/ it i# %nl$ all%,e' t% th%#e intan&ible# ,h%#e u#e in the bu#ine## %r tra'e i# 'efinitel$ li)ite' in 'urati%n. 3Ba#ilan E#tate#/ In(. +/ 7I / 21 S7 A 1=4. Su(h i# n%t the (a#e ,ith &%%',ill. 2epre(iati%n %f &%%',ill i# all%,e' a# a 'e'u(ti%n fr%) &r%## in(%)e if the &%%',ill i# a(*uire' thr%u&h (apital %utla$ an' i# :n%,n fr%) experien(e t% be %f +alue t% the bu#ine## f%r %nl$ a li)ite' peri%'. 3Se(ti%n 1C=/ e+enue e&ulati%n# N%. 24. In #u(h (a#e/ the &%%',ill i# all%,e' t% be a)%rtiDe' %+er it# u#eful life t% all%, the 'e'u(ti%n %f the (urrent p%rti%n %f the expen#e fr%) &r%## in(%)e/ thereb$ pa+in& the ,a$ f%r a pr%per )at(hin& %f (%#t# a&ain#t re+enue# ,hi(h i# an e##ential feature %f the in(%)e tax 1 ESE HE FO BA2 2EBTS are n%t all%,e' a# 'e'u(ti%n fr%) &r%## in(%)e. Ba' 'ebt# )u#t be (har&e' %ff 'urin& the taxable $ear t% be all%,e' a# 'e'u(ti%n fr%) &r%## in(%)e. The )ere #ettin& up %f re#er+e# ,ill n%t &i+e ri#e t% an$ 'e'u(ti%n. 3Se(ti%n 5>3E4. NT 74. 2.O T1"ESS SE7! ITIES/ ,hi(h are %r'inar$ a##et#/ are n%t all%,e' a# 'e'u(ti%n fr%) &r%## in(%)e be(au#e the l%## i# n%t realiDe'. 1%,e+er/ if the#e ,%rthle## #e(uritie# are (apital a##et#/ the %,ner i# (%n#i'ere' t% ha+e in(urre' a (apital l%## a# %f the la#t 'a$ %f the taxable $ear an'/ theref%re/ 'e'u(tible t% the extent %f (apital &ain#. 3Se(ti%n 5>3243>4/ NI 74. Thi# 'e'u(ti%n/ h%,e+er/ i# n%t all%,e' t% a ban: %r tru#t (%)pan$. 3Se(ti%n 5>3E4324/ NI 74. =. Explain the tax treat)ent %f the f%ll%,in& in the preparati%n %f annual in(%)e tax return#: a. In(%)e realiDe' fr%) #ale %f (apital a##et#

b. In(%)e realiDe' fr%) #ale %f %r'inar$ a##et# In(%)e realiDe' fr%) #ale %f (apital a##et# i# #ub-e(t t% the final ,ithh%l'in& tax at #%ur(e an' theref%re ex(lu'e' fr%) the In(%)e Tax eturn 3Se(. 2>I7J an' I2J/ NI 74B 3ii4 In(%)e realiDe' fr%) #ale %f %r'inar$ a##et# i# part %f Gr%## In(%)e/ in(lu'e' in the In(%)e Tax eturn. 3Se(. 52IAJI5J/ NI 74 K. Explain ,hether the f%ll%,in& ite)# are taxable %r n%n-taxable: a. &ain ari#in& fr%) expr%priati%n %f pr%pert$B Taxable. Sale ex(han&e %r %ther 'i#p%#iti%n %f pr%pert$ t% the &%+ern)ent %f real pr%pert$ i# taxable. It in(lu'e# ta:in& b$ the &%+ern)ent thr%u&h (%n'e)nati%n pr%(ee'in&#. b. taxe# pai' an' #ub#e*uentl$ refun'e'B Taxable %nl$ if the taxe# ,ere pai' an' (lai)e' a# 'e'u(ti%n an' ,hi(h are #ub#e*uentl$ refun'e' %r (re'ite'. It #hall be in(lu'e' a# part %f &r%## in(%)e in the $ear %f the re(eipt t% the extent %f the in(%)e tax benefit %f #ai' 'e'u(ti%n. Taxable if taxpa$er i# u#in& the ite)iDe' 'e'u(ti%n an' if #u(h tax pai' i# in(lu'e' in the 'e'u(ti%n. It i# taxable be(au#e the taxpa$er a(*uire# benefit# b$ re'u(in& it# taxable in(%)e b$ the tax pai'. (. in(%)e fr%) -ueten&B Gr%## in(%)e in(lu'e# 6all in(%)e 'eri+e' fr%) ,hate+er #%ur(e6 3Se(. 52IAJ/ NI 74/ ,hi(h ,a# interprete' a# all in(%)e n%t expre##l$ ex(lu'e' %r exe)pte' fr%) the (la## %f taxable in(%)e/ irre#pe(ti+e %f the +%luntar$ %r in+%luntar$ a(ti%n %f the taxpa$er in pr%'u(in& the in(%)e. Thu#/ the in(%)e )a$ pr%(ee' fr%) a le&al %r ille&al #%ur(e #u(h a# fr%) -ueten&. !nla,ful &ain#/ &a)blin& ,innin&#/ et(. are #ub-e(t t% in(%)e tax. The tax (%'e #tan'# a# an in'ifferent neutral part$ %n the )atter %f ,here the in(%)e (%)e# fr%). Taxable/ all in(%)e are #ub-e(t t% tax ex(ept ,hen ex(lu'e' b$ la, %r treatie#. In(%)e fr%) ille&al a(ti+itie# are al#% #ub-e(t t% tax '. &ain %n the #ale %f a (ar u#e' f%r per#%nal purp%#e#B Taxable. Sin(e the (ar i# u#e' f%r per#%nal purp%#e#/ it i# (%n#i'ere' a# a (apital a##et hen(e the &ain i# (%n#i'ere' in(%)e. 3Se(. 52IAJI5J an' Se(. 5<IAJI1J/ NI 74 e. re(%+er$ %f ba' 'ebt# pre+i%u#l$ (har&e' %ff. Taxable un'er the TAX BENEFIT !"E. e(%+er$ %f ba' 'ebt# pre+i%u#l$ all%,e' a# 'e'u(ti%n in the pre(e'in& $ear# #hall be in(lu'e' a# part %f the &r%## in(%)e in the $ear %f re(%+er$ t% the extent %f the in(%)e tax benefit %f #ai' 'e'u(ti%n. 3Se(. 5>IEJI1J/ NI 7. Thi# i# #%)eti)e# referre' a# the E7A9T! E !"ES. <. Maria e$e#/ an %ffi(ial %f 7%rp%rati%n X/ a#:e' f%r an 6earlier retire)ent6 be(au#e #he ,a# e)i&ratin& t% Au#tralia. She ,a# pai' 92.CCC.CCC.CC a# #eparati%n pa$ in re(%&niti%n %f her +aluable #er+i(e# t% the (%rp%rati%n. "%rna 7ruD/ an%ther %ffi(ial %f the #a)e (%)pan$/ ,a# #eparate' f%r %((up$in& a re'un'ant p%#iti%n. She ,a# &i+en 91/CCC.CCC.CC a# #eparati%n pa$. Ai'a Bauti#ta ,a# #eparate' 'ue t% her failin& e$e#i&ht. She ,a# &i+en 9ECC.CCC.CC a# #eparati%n pa$. All the three 354 ,ere n%t *ualifie' t% retire un'er the BI -appr%+e' pen#i%n plan %f the (%rp%rati%n. Explain the tax treat)ent %f the #eparati%n pa$ re(ei+e' b$ e$e#/ 7ruD an' Bauti#ta. S!GGESTE2 ANS.E : 14 The #eparati%n pa$ &i+en t% e$e# i# #ub-e(t t% in(%)e tax a# (%)pen#ati%n in(%)e be(au#e it ari#e# fr%) a #er+i(e ren'ere' pur#uant t% an e)pl%$er-e)pl%$ee relati%n#hip. It i# n%t (%n#i'ere' an ex(lu#i%n

fr%) &r%## in(%)e be(au#e the rule in taxati%n i# tax (%n#true' in #tri(ti##i)i -uri# %r the rule %n #tri(t Interpretati%n %f tax exe)pti%n#. 24 The #eparati%n pa$ re(ei+e' b$ 7ruD i# n%t #ub-e(t t% in(%)e tax be(au#e hi# #eparati%n fr%) the (%)pan$ ,a# in+%luntar$ 3Se(. 2K b 3=4/ Tax 7%'e4. 54 The #eparati%n pa$ re(ei+e' b$ Bauti#ta i# li:e,i#e n%t #ub-e(t t% tax. 1i# #eparati%n i# 'ue t% 'i#abilit$/ hen(e in+%luntar$. !n'er the la,/ #eparati%n pa$ re(ei+e' thr%u&h in+%luntar$ (au#e# are exe)pt fr%) taxati%n. 1C. Explain the tax treat)ent %f the f%ll%,in& in the preparati%n %f annual in(%)e tax return#: a. 15th )%nth pa$B b. 'e )ini)i# benefit#. The 15th )%nth pa$ n%t ex(ee'in& 95C/CCC.CC #hall n%t be rep%rte' in the in(%)e tax return be(au#e it i# ex(lu'e' fr%) &r%## in(%)e 3Se(. 52IBJI=J/ IeJ/ NI 74 The a)%unt %f the 15th )%nth pa$ in ex(e## %f 95C/CCC.CC #hall be rep%rte' in the annual in(%)e tax return. 2e )ini)i# benefit# ,hi(h '% n%t ex(ee' the (eilin&# are ex(lu'e' fr%) &r%## in(%)e/ an' n%t t% be (%n#i'ere' f%r 'eter)inin& the 95C/CCC.CC (eilin& hen(e n%t rep%rtable in the annual in(%)e tax return. 3Se(. 2.=K.1IAJI5J/ . . 2-<K a# a)en'e' b$ Se(. 2.55 I7J an' further a)en'e' b$ . . N%. K-2CCC4

You might also like

- BSP issues guidelines on business continuity managementDocument13 pagesBSP issues guidelines on business continuity managementGlenn Mark Frejas RinionNo ratings yet

- Taxation Review (Assignment)Document4 pagesTaxation Review (Assignment)Glenn Mark Frejas RinionNo ratings yet

- Forensic MedicineDocument145 pagesForensic Medicinehershey2shy100% (2)

- Victory+Liner+v +raceDocument2 pagesVictory+Liner+v +raceGlenn Mark Frejas RinionNo ratings yet

- Hasegawa and Nippon EngDocument19 pagesHasegawa and Nippon EngGlenn Mark Frejas RinionNo ratings yet

- 2017 Bar Syllabus Civil LawDocument9 pages2017 Bar Syllabus Civil LawErnest Talingdan Castro100% (2)

- Philippine Commercial and Industrial BankDocument1 pagePhilippine Commercial and Industrial BankGlenn Mark Frejas RinionNo ratings yet

- BarbituratesDocument5 pagesBarbituratesGlenn Mark Frejas RinionNo ratings yet

- LiabilityDocument1 pageLiabilityGlenn Mark Frejas RinionNo ratings yet

- LiabilityDocument1 pageLiabilityGlenn Mark Frejas RinionNo ratings yet

- October 2014 CPA Board Exam Performance of SchoolsDocument16 pagesOctober 2014 CPA Board Exam Performance of SchoolsPRC BoardNo ratings yet

- LiabilityDocument1 pageLiabilityGlenn Mark Frejas RinionNo ratings yet

- LiabilityDocument1 pageLiabilityGlenn Mark Frejas RinionNo ratings yet

- DateDocument1 pageDateGlenn Mark Frejas RinionNo ratings yet

- Labor Law 1 ReviewerDocument138 pagesLabor Law 1 ReviewerGlenn Mark Frejas RinionNo ratings yet

- Complaint For Unlawful Detainer SampleDocument2 pagesComplaint For Unlawful Detainer SampleGlenn Mark Frejas RinionNo ratings yet

- Go-Tan vs. Sps. Tan: Parents-in-law covered by RA 9262Document3 pagesGo-Tan vs. Sps. Tan: Parents-in-law covered by RA 9262rubbtuna80% (5)

- LiabilityDocument1 pageLiabilityGlenn Mark Frejas RinionNo ratings yet

- Amended Small ClaimsDocument5 pagesAmended Small ClaimscarterbrantNo ratings yet

- LiabilityDocument1 pageLiabilityGlenn Mark Frejas RinionNo ratings yet

- LolDocument1 pageLolGlenn Mark Frejas RinionNo ratings yet

- China+Banking+Corporation+v +Members+of+the+Board+of+Trustees,+Home+Development+Mutual+FundDocument2 pagesChina+Banking+Corporation+v +Members+of+the+Board+of+Trustees,+Home+Development+Mutual+FundMarivic Cheng EjercitoNo ratings yet

- Garcia Vs DrilonDocument37 pagesGarcia Vs DrilonsupergarshaNo ratings yet

- Giovani Serrano y Cervantes VDocument1 pageGiovani Serrano y Cervantes VGlenn Mark Frejas RinionNo ratings yet

- Answers To The BAR ADocument20 pagesAnswers To The BAR AGlenn Mark Frejas RinionNo ratings yet

- Real Estate Mortgage GuideDocument3 pagesReal Estate Mortgage GuideCharlotte GallegoNo ratings yet

- PDFDocument37 pagesPDFMyooz MyoozNo ratings yet

- China+Banking+Corporation+v +Members+of+the+Board+of+Trustees,+Home+Development+Mutual+FundDocument2 pagesChina+Banking+Corporation+v +Members+of+the+Board+of+Trustees,+Home+Development+Mutual+FundMarivic Cheng EjercitoNo ratings yet

- Stat ConDocument7 pagesStat ConGlenn Mark Frejas RinionNo ratings yet

- MRDocument2 pagesMRGlenn Mark Frejas RinionNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Social Impact of Terrorism On National DevelopmentDocument18 pagesSocial Impact of Terrorism On National Developmentapi-3700909100% (7)

- The Everyday Politics of Translingualism PDFDocument19 pagesThe Everyday Politics of Translingualism PDFRAFAELNo ratings yet

- Sales Offices in India 2023Document1 pageSales Offices in India 2023irsanademarotNo ratings yet

- Aberjona - Slaughterhouse - The Handbook of The Eastern Front (OCR-Ogon)Document521 pagesAberjona - Slaughterhouse - The Handbook of The Eastern Front (OCR-Ogon)JoeFliel100% (14)

- Dr. Ram Manohar Lohiya National Law University, Lucknow: B.A.L.L.B. (Hons.)Document13 pagesDr. Ram Manohar Lohiya National Law University, Lucknow: B.A.L.L.B. (Hons.)Stuti Sinha100% (1)

- James Wardner - Unholy Alliances - The Secret Plan and The Secret People Who Are Working To Destroy AmericaDocument327 pagesJames Wardner - Unholy Alliances - The Secret Plan and The Secret People Who Are Working To Destroy AmericaDaniela Raffo100% (4)

- So This Is Why Varadkar and Flanagan Hired The RUC ManDocument148 pagesSo This Is Why Varadkar and Flanagan Hired The RUC ManRita CahillNo ratings yet

- H. N. Brailsford (1927) - How The Soviets Work PDFDocument184 pagesH. N. Brailsford (1927) - How The Soviets Work PDFHoyoung ChungNo ratings yet

- War and Its Causes PDFDocument253 pagesWar and Its Causes PDFDat100% (1)

- National Council On Family RelationsDocument10 pagesNational Council On Family Relationsjimjohnson211No ratings yet

- Justin's Unique Approach to Personal GrowthDocument9 pagesJustin's Unique Approach to Personal GrowthKingNo ratings yet

- Stafford Poole - Juan de Ovando - Governing The Spanish Empire in The Reign of Philip II (2004) PDFDocument304 pagesStafford Poole - Juan de Ovando - Governing The Spanish Empire in The Reign of Philip II (2004) PDFsphragidonNo ratings yet

- Rights of Persons with Disabilities ExplainedDocument15 pagesRights of Persons with Disabilities ExplainedAnkita DashNo ratings yet

- Year 8 Civics and Citizenship Test RevisionDocument30 pagesYear 8 Civics and Citizenship Test RevisionSimpliciusNo ratings yet

- Progressive Reforms Shape AmericaDocument194 pagesProgressive Reforms Shape AmericaBrian Bushner0% (1)

- Maluku UtaraDocument19 pagesMaluku UtaraFahmiNo ratings yet

- English Homework Part 7Document25 pagesEnglish Homework Part 7Putri Aisyah UtamiNo ratings yet

- Article 51 TRIPSDocument4 pagesArticle 51 TRIPSmakunouchi_99No ratings yet

- Sangguniang Panlalawigan Office: Republic of The Philippines Province of South Cotabato City of KoronadalDocument8 pagesSangguniang Panlalawigan Office: Republic of The Philippines Province of South Cotabato City of KoronadalDaryll CorciegaNo ratings yet

- Applying for Asylum, Withholding, and CAT ProtectionDocument4 pagesApplying for Asylum, Withholding, and CAT ProtectionJubaer AhmedNo ratings yet

- Methods ConformityDocument7 pagesMethods ConformityFolorunshoEmNo ratings yet

- Punjab Public Service Commission, Lahore: NoticeDocument7 pagesPunjab Public Service Commission, Lahore: NoticeM ImranNo ratings yet

- El Warraq: GeographyDocument3 pagesEl Warraq: GeographyGers VenturaNo ratings yet

- Race Ends Here GilroyDocument12 pagesRace Ends Here GilroyAngélica VeraNo ratings yet

- VisaDocument6 pagesVisaInderpreet SinghNo ratings yet

- Pimentel Vs Ermita Case DigestDocument2 pagesPimentel Vs Ermita Case DigestJessamine Orioque100% (3)

- Mestizaje and Self-HateDocument10 pagesMestizaje and Self-HatebeachrowNo ratings yet

- Seyla Banhabib-Judith ShklarDocument6 pagesSeyla Banhabib-Judith Shklarttyy82122No ratings yet

- Guided NotesDocument3 pagesGuided Notesapi-398284346No ratings yet

- Social Institutions Group WorkDocument37 pagesSocial Institutions Group WorkjajajaNo ratings yet