Professional Documents

Culture Documents

Moneysprite Market Bulletin 24032014

Uploaded by

MoneyspriteCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Moneysprite Market Bulletin 24032014

Uploaded by

MoneyspriteCopyright:

Available Formats

Moneysprite

Heron Tower 110 Bishopsgate London EC2N 4AD

T 0845 450 4660 M 07776 201606 jody.sturman@moneysprite.com www.moneysprite.com

MARKET BULLETIN 21 March 2014

This Market Bulletin has been produced in association with Threadneedle Investments. Its intended to provide you with a look back at the events that have affected the performance of global equity markets in the last fortnight. This is a general market update and should not be considered a comprehensive or sufficient basis

CURRENT VALUE

10 DaY % CHanGe

FTSE 100 Dow Jones Nikkei 225

6,557 16,368 14,224

-2.34% -0.49% -6.09%

Weekly Statistics (source: FT) Key per formance indicators (as at Friday 21 March 16:34 GMT)

Day-by-day analysis of FTSE 100 Index

Global equity markets staged a strong recovery in February. In the UK, the FTSE All-Share posted a sterling total return of 5.2%. Key contributing factors included comments from the new Chair of the Federal Reserve Janet Yellen that the recent disappointing economic data from the US might reflect the impact of recent exceptionally cold weather. In the UK, equity markets took encouragement from further signs of economic recovery alongside benign inflation data, with CPI moving below the 2% target for the first time since 2009. Emerging markets underperformed developed markets again, although a number including China ended February in positive territory, as some market participants began to highlight the relatively attractive valuations. In fixed income markets, the yield on 10-year US treasuries ended February barely changed at 2.7%. In the UK, gilt yields were unchanged across the curve. The key event of the month for gilt markets was the Bank of Englands inflation report where Governor Mark Carney announced the effective end to forward guidance, replacing it with a much broader set of policy indicators aimed at prolonging the recovery and ensuring that spare capacity in the economy is largely utilised ahead of any change in monetary policy. Carney went out of his way to say that when interest rates do start rising, the pace of the increase will be very gradual and the ultimate peak will be well below historical levels. In credit markets, the broad sterling credit indices made further headway, with the iBoxx sterling non-gilts index producing a total return of 0.36%. While February was a positive month for equities, March to date has been more challenging as investors focus has switched to the political crisis in Ukraine, an event which could determine risk appetite for the remainder of this year. To date, the fallout from the Ukrainian crisis has been largely confined to the emerging market debt, emerging market equity and commodity markets. At current levels, emerging market local currency debt appears to offer value, and we remain overweight EM local debt in our asset allocation model, although we expect both the hard and local currency markets to remain volatile in the short term. Emerging equities reflect concerns not only on Russia and Ukraine but also the weaker growth outlook in Brazil and China. In commodities, Russia is a significant player in energy, supplying some 30% of Europes gas, with 50% of that piped through Ukraine. Any move to curb Russian oil exports by the EU could easily drive Brent crude oil into the $140-160 a barrel range and as a result we are monitoring events very closely.

Elsewhere, investment grade and high yield markets have been largely unmoved by the crisis in Ukraine. Foreign exchange markets, outside of the obvious areas such as the rouble, have also ignored it. Developed market equity and bond markets have recently been driven by other factors such as the headwinds from a stronger pound for UK equities and the subsequent FX-related earnings downgrades, the severe weather in the US, and some weaker-than-expected European corporate results, despite ongoing signs of macroeconomic recovery. Core government bond investors have been focused on the softer US macroeconomic data, which has provided support for the asset class despite ongoing QE tapering. In terms of our positioning, we continue to favour equities (specifically the UK and Japan) within our asset allocation model, but recognise that it is important that companies deliver some earnings growth this year given the valuation rerating of equities that has been seen in recent years, and the gradually diminishing liquidity support for equities as US QE begins to fade. Companies that have failed to deliver on earnings in recent weeks have been punished as valuations leave little or no room for disappointment. In bond markets, we continue to prefer corporate credit over core government debt although total returns for both high yield and investment grade are likely to be modest this year. We continue to like UK commercial property for its attractive real yield and because of the growing investor interest in the asset class on the back of the ongoing domestic macroeconomic recovery.

Moneysprite is an appointed representative of Openwork Limited, which is authorised and regulated by the Financial Conduct Authority. The content of this bulletin, including the figures, is amalgamated from various sources and represent a snapshot of the market. Stock market and currency movements mean the value of your investment can go down as well as up and you may not get back the orginal amount invested. Past performance is not a guide to future performance.

In association with

You might also like

- Moneysprite Spring Budget 2017 - ReportDocument26 pagesMoneysprite Spring Budget 2017 - ReportMoneyspriteNo ratings yet

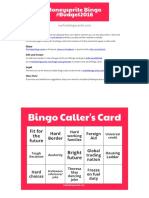

- Moneysprite Bingo #Budget2018Document32 pagesMoneysprite Bingo #Budget2018MoneyspriteNo ratings yet

- Moneysprite Report - Spring Statement 2018Document17 pagesMoneysprite Report - Spring Statement 2018MoneyspriteNo ratings yet

- Autumn Budget 2018Document20 pagesAutumn Budget 2018MoneyspriteNo ratings yet

- Nov 2017 Budget Quick FlashDocument4 pagesNov 2017 Budget Quick FlashMoneyspriteNo ratings yet

- Managing Your MoneyDocument22 pagesManaging Your MoneyMoneyspriteNo ratings yet

- Moneysprite Tax Tables 2017 2018Document16 pagesMoneysprite Tax Tables 2017 2018MoneyspriteNo ratings yet

- Moneysprite Tax Tables 2017 2018Document16 pagesMoneysprite Tax Tables 2017 2018MoneyspriteNo ratings yet

- Leaving A LegacyDocument27 pagesLeaving A LegacyMoneyspriteNo ratings yet

- Money View Autumn '15Document4 pagesMoney View Autumn '15MoneyspriteNo ratings yet

- Investing For Your ChildrenDocument33 pagesInvesting For Your ChildrenMoneyspriteNo ratings yet

- Moneysprite Mortgage Bulletin - Xmas '16Document4 pagesMoneysprite Mortgage Bulletin - Xmas '16MoneyspriteNo ratings yet

- Moneysprite Money View Summer '16Document4 pagesMoneysprite Money View Summer '16MoneyspriteNo ratings yet

- Moneysprite Budget Bulletin 2016Document26 pagesMoneysprite Budget Bulletin 2016MoneyspriteNo ratings yet

- Moneysprite Protection Bulletin Winter '15Document4 pagesMoneysprite Protection Bulletin Winter '15MoneyspriteNo ratings yet

- Moneysprite Mortgage Bulletin Winter '16Document4 pagesMoneysprite Mortgage Bulletin Winter '16MoneyspriteNo ratings yet

- Moneysprite VitalityDocument4 pagesMoneysprite VitalityMoneyspriteNo ratings yet

- Moneysprite Mortgage & Protection Bulletin Sum '14Document4 pagesMoneysprite Mortgage & Protection Bulletin Sum '14MoneyspriteNo ratings yet

- Moneysprite Mortgage & Protection News - Summer 2015Document4 pagesMoneysprite Mortgage & Protection News - Summer 2015MoneyspriteNo ratings yet

- Moneysprite Money View SPR '15Document4 pagesMoneysprite Money View SPR '15MoneyspriteNo ratings yet

- Moneysprite Budget Bulletin 2015Document24 pagesMoneysprite Budget Bulletin 2015MoneyspriteNo ratings yet

- Moneysprite Market BulletinDocument1 pageMoneysprite Market BulletinJody SturmanNo ratings yet

- Moneysprite Market BulletinDocument1 pageMoneysprite Market BulletinMoneyspriteNo ratings yet

- Moneysprite Budget Bulletin 2014Document23 pagesMoneysprite Budget Bulletin 2014MoneyspriteNo ratings yet

- Moneysprite Market BulletinDocument1 pageMoneysprite Market BulletinMoneyspriteNo ratings yet

- Moneysprite MoneyView SPR '14Document4 pagesMoneysprite MoneyView SPR '14MoneyspriteNo ratings yet

- Moneysprite Mortgage Bulletin SPR '14Document4 pagesMoneysprite Mortgage Bulletin SPR '14MoneyspriteNo ratings yet

- The Mortgage - Autumn 2011Document4 pagesThe Mortgage - Autumn 2011MoneyspriteNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Scientech 2502ADocument2 pagesScientech 2502Aashutosh kumarNo ratings yet

- Answer Here:: FAMILY NAME - FIRST NAME - CLASSCODEDocument4 pagesAnswer Here:: FAMILY NAME - FIRST NAME - CLASSCODEUchayyaNo ratings yet

- Operations Management 2Document15 pagesOperations Management 2karunakar vNo ratings yet

- Nitrate Reduction in Sulfate Reducing BacteriaDocument10 pagesNitrate Reduction in Sulfate Reducing BacteriaCatalinaManjarresNo ratings yet

- Infanrix Hexa RSMKL July 2023Document37 pagesInfanrix Hexa RSMKL July 2023Bayu KurniawanNo ratings yet

- Due process violation in granting relief beyond what was prayed forDocument2 pagesDue process violation in granting relief beyond what was prayed forSam LeynesNo ratings yet

- Speakout Vocabulary Extra Advanced Unit 03Document3 pagesSpeakout Vocabulary Extra Advanced Unit 03shasha1982100% (2)

- Curriculum VitaeDocument8 pagesCurriculum VitaeChristine LuarcaNo ratings yet

- Philosophical Perspectives Through the AgesDocument13 pagesPhilosophical Perspectives Through the Agesshashankmay18No ratings yet

- The Other Side of Love AutosavedDocument17 pagesThe Other Side of Love AutosavedPatrick EdrosoloNo ratings yet

- Skellig - Chapters 16-20 QuestionsDocument1 pageSkellig - Chapters 16-20 Questionselishasantos0% (1)

- Islamic Finance in the UKDocument27 pagesIslamic Finance in the UKAli Can ERTÜRK (alicanerturk)No ratings yet

- Adjustment DisordersDocument2 pagesAdjustment DisordersIsabel CastilloNo ratings yet

- Corporation Law Quiz AnswersDocument3 pagesCorporation Law Quiz AnswerswivadaNo ratings yet

- Supplier Development at Honda, Nissan and ToyotaDocument28 pagesSupplier Development at Honda, Nissan and Toyotapresidonsi100% (1)

- 50 Cool Stories 3000 Hot Words (Master Vocabulary in 50 Days) For GRE Mba Sat Banking SSC DefDocument263 pages50 Cool Stories 3000 Hot Words (Master Vocabulary in 50 Days) For GRE Mba Sat Banking SSC DefaravindNo ratings yet

- WORKSHOP ON ACCOUNTING OF IJARAHDocument12 pagesWORKSHOP ON ACCOUNTING OF IJARAHAkif ShaikhNo ratings yet

- Logic Puzzles Freebie: Includes Instructions!Document12 pagesLogic Puzzles Freebie: Includes Instructions!api-507836868No ratings yet

- Louis Theroux PowerpointDocument6 pagesLouis Theroux Powerpointapi-330762792No ratings yet

- Raman Spectroscopy: 1 Theoretical BasisDocument9 pagesRaman Spectroscopy: 1 Theoretical BasisJèManziNo ratings yet

- Marwar Steel Tubes Pipes StudyDocument39 pagesMarwar Steel Tubes Pipes Studydeepak kumarNo ratings yet

- Discrete Mathematics - Logical EquivalenceDocument9 pagesDiscrete Mathematics - Logical EquivalenceEisha IslamNo ratings yet

- (Cambridge Series in Statistical and Probabilistic Mathematics) Gerhard Tutz, Ludwig-Maximilians-Universität Munchen - Regression For Categorical Data-Cambridge University Press (2012)Document574 pages(Cambridge Series in Statistical and Probabilistic Mathematics) Gerhard Tutz, Ludwig-Maximilians-Universität Munchen - Regression For Categorical Data-Cambridge University Press (2012)shu100% (2)

- Lecture 15 (91 Slides)Document91 pagesLecture 15 (91 Slides)Hasnain GoharNo ratings yet

- ISE I Conversation Task - Rules and RegulationsDocument3 pagesISE I Conversation Task - Rules and RegulationsElena B. HerreroNo ratings yet

- Benefits and Risks of Dexamethasone in Noncardiac Surgery: Clinical Focus ReviewDocument9 pagesBenefits and Risks of Dexamethasone in Noncardiac Surgery: Clinical Focus ReviewAlejandra VillaNo ratings yet

- People vs. LorenzoDocument8 pagesPeople vs. LorenzoMRose SerranoNo ratings yet

- Test Unit 3Document2 pagesTest Unit 3RAMONA SECUNo ratings yet

- Combined RubricsDocument3 pagesCombined Rubricsapi-446053878No ratings yet

- The City - Populus' As A Self-Governing CorporationDocument24 pagesThe City - Populus' As A Self-Governing Corporation马寅秋No ratings yet