Professional Documents

Culture Documents

It-Is Time-Reap Benefits of RA

Uploaded by

Annie MooreOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

It-Is Time-Reap Benefits of RA

Uploaded by

Annie MooreCopyright:

Available Formats

It is time...

Reap the tax benets of a retirement annuity!

It is commonly known that only a small percentage of people end up with sufficient retirement savings to maintain their pre-retirement standard of living.

1. Putting money away for some distant goal requires a lot of discipline and commitment. 2. Deciding on the most appropriate investment vehicle for their retirement savings is also not easy.

What are the possible reasons for this?

What is a possible solution to address both these problems?

A retirement annuity! It has proven to be a benecial savings instrument for many people, because it encourages disciplined savings with accompanying tax incentives. The purpose of this article is to highlight the latter as well as some other important features or benets.

Tax incentives

Retirement annuity contributions reduce the clients taxable income up to certain limits: Part of the contributions come from tax savings, which means that the South African Revenue Service (SARS) is actually paying a part of the clients retirement savings. For example: This means that for each (say) R10 000 invested in a retirement annuity, R3 000 (for someone taxed at a marginal rate of 30%) is effectively paid back by SARS. Another big tax advantage is that the growth on the investment is tax free! Also of value is the favourable tax treatment of the lump-sum proceeds at retirement. On retirement the rst R315 000 of all retirement funds (cumulatively) is tax-free and the rest of the lump sum taxed at favourable scales.

Tax is not payable on rental income and interest and no tax is payable on either capital gains or dividends received in the investment fund.

Other important features of a retirement annuity are:

A retirement annuity is protected against creditors and therefore provides protection in the event of insolvency.

TRANSFER

A withdrawal from a pension fund can be transferred to a retirement annuity tax-free.

Various options exist at retirement: A conventional life annuity with or without capital protection; a linked annuity - more risky but offers investment fund choices and more exibility; or a composite life annuity part conventional life annuity and part linked annuity.

ESTATE

TAX

A compulsory life annuity as well as the lump sum is exempt from estate tax at the death of the client i.e. the member of the retirement annuity fund.

If the compulsory life annuity is used to fund medical aid contributions after age 65, it is currently fully deductible against income for income tax purposes. From 1 March 2014 however, such contribution and deduction of expenses will be replaced with a medical tax rebate.

From 1 March 2014, any member contributions to a retirement fund that has not already been allowed as a deduction will accordingly reduce the taxability of the compulsory life annuity.

MARCH 2015

From 1 March 2015 a transfer from a provident or preservation provident fund before or after this date will retain the right to a full commutation on contributions prior to this date plus growth.

FOR INTERMEDIARIES

LICENSED FINANCIAL SERVICES PROVIDER

V2830 12/2013

You might also like

- UK Pension Transfer GuideDocument17 pagesUK Pension Transfer GuidePETERWILLE CHUANo ratings yet

- How To Get The Most Out of Your Pension and Secure The Retirement That You Deserve2Document5 pagesHow To Get The Most Out of Your Pension and Secure The Retirement That You Deserve2Jack JamalNo ratings yet

- Consider factors when retiring and choose the right savings vehicleDocument2 pagesConsider factors when retiring and choose the right savings vehicleShingirai MatsanuraNo ratings yet

- FP Group WorkDocument12 pagesFP Group WorkStellina JoeshibaNo ratings yet

- 10 Most Attractive Income Tax DeductionsDocument4 pages10 Most Attractive Income Tax DeductionsspibluNo ratings yet

- Old Mutual Wealth Investment Vehicles GuideDocument5 pagesOld Mutual Wealth Investment Vehicles GuideJohn SmithNo ratings yet

- What Is A Pension?: Introduction To Pension PlanDocument18 pagesWhat Is A Pension?: Introduction To Pension PlanMahesh SatapathyNo ratings yet

- Tax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingFrom EverandTax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingNo ratings yet

- Super Pds A5Document24 pagesSuper Pds A5ppprrrabhNo ratings yet

- Options for members leaving retirement fundsDocument6 pagesOptions for members leaving retirement fundsKarolia ZinatNo ratings yet

- Freetrade SIPP Key Features DocumentDocument1 pageFreetrade SIPP Key Features DocumentssNo ratings yet

- E.Types of Retirement Plans-1Document13 pagesE.Types of Retirement Plans-1Madhu dollyNo ratings yet

- Three phases of retirement and SMSF withdrawal optionsDocument8 pagesThree phases of retirement and SMSF withdrawal optionsWong Wu SeanNo ratings yet

- Retirement Planning: by Prof Sameer LakhaniDocument18 pagesRetirement Planning: by Prof Sameer LakhaniPooja DeliwalaNo ratings yet

- Product Disclosure Statement Ay Super ("Fund") 1Document7 pagesProduct Disclosure Statement Ay Super ("Fund") 1YevNo ratings yet

- Taxation ProjectDocument12 pagesTaxation ProjectMohal gargNo ratings yet

- Planning For RetirementDocument9 pagesPlanning For RetirementMaimai DuranoNo ratings yet

- LIC's mission, vision and objectivesDocument11 pagesLIC's mission, vision and objectivesPradeep Kumar V PradiNo ratings yet

- RFLIPF Electronic Member Guide 22 March 2016Document16 pagesRFLIPF Electronic Member Guide 22 March 2016Lungile MalikaneNo ratings yet

- Tax-Free RetirementDocument8 pagesTax-Free RetirementNelson Yong100% (2)

- Guide For Deferred MembersDocument6 pagesGuide For Deferred MembersPeter BeattieNo ratings yet

- Vignana Jyothi Institute of Management Operations and Management OF Banks and Insurance Companies AssignmentDocument5 pagesVignana Jyothi Institute of Management Operations and Management OF Banks and Insurance Companies Assignmentsri kavyaNo ratings yet

- Commercial Premium Financing: Exit StrategiesDocument3 pagesCommercial Premium Financing: Exit StrategiesKevin WheelerNo ratings yet

- Our Free Guide Today Using This LinkDocument6 pagesOur Free Guide Today Using This LinkF MyersNo ratings yet

- Group Saving Linked Insurance SchemeDocument14 pagesGroup Saving Linked Insurance SchemeSam DavidNo ratings yet

- Tax Deductions and Investment Options for Single MotherDocument7 pagesTax Deductions and Investment Options for Single MotherUdbhav ShuklaNo ratings yet

- Handy Financial Tips Ebook EnglishDocument24 pagesHandy Financial Tips Ebook EnglishJPNo ratings yet

- Chapter 08 FINDocument32 pagesChapter 08 FINUnoNo ratings yet

- Soln 2Document10 pagesSoln 2Abhishek KumarNo ratings yet

- Igreat DamaiDocument18 pagesIgreat Damaiapi-240706460No ratings yet

- Tax Planning Tips for Salaried IndividualsDocument20 pagesTax Planning Tips for Salaried IndividualsRAJNo ratings yet

- Tax EfficientDocument22 pagesTax EfficientBrijesh NagarNo ratings yet

- Elements of Good Life Insurance PolicyDocument4 pagesElements of Good Life Insurance PolicySaumya JaiswalNo ratings yet

- Aviva Life Shield Plus1Document8 pagesAviva Life Shield Plus1Anoop NimkandeNo ratings yet

- HostPlus TPD Fact SheetDocument2 pagesHostPlus TPD Fact SheetCam Kemshal-BellNo ratings yet

- Proceeds From Life Insurance and Other Forms of InsuranceDocument4 pagesProceeds From Life Insurance and Other Forms of InsuranceEnrique Legaspi IVNo ratings yet

- Overview of Premium Financed Life InsuranceDocument17 pagesOverview of Premium Financed Life InsuranceProvada Insurance Services100% (1)

- Wealth Management - PPTX 06-11-2019Document14 pagesWealth Management - PPTX 06-11-2019Sree LakshmyNo ratings yet

- Partnership Deed FormatDocument56 pagesPartnership Deed Formatumair iqbalNo ratings yet

- Variable Annuities: Beware of Hard Sell TacticsDocument5 pagesVariable Annuities: Beware of Hard Sell TacticsTimothy Mark MaderazoNo ratings yet

- Company Profile BirlaDocument31 pagesCompany Profile BirlaShivayu VaidNo ratings yet

- AnnuitiesUnderstandingAnnuities PDFDocument6 pagesAnnuitiesUnderstandingAnnuities PDFJerome Dela PeñaNo ratings yet

- OTS 1 of 2015 Taxation Laws Amendment Act, 2014 Promulgated OnDocument3 pagesOTS 1 of 2015 Taxation Laws Amendment Act, 2014 Promulgated Onredico2301No ratings yet

- Income & Tax Saving Streams GuideDocument21 pagesIncome & Tax Saving Streams GuideJicksonNo ratings yet

- Unit Linked Insurance PlanDocument5 pagesUnit Linked Insurance Planagarwal13No ratings yet

- Financial Beacon: Knights of ColumbusDocument4 pagesFinancial Beacon: Knights of Columbusapi-286040101No ratings yet

- Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions ManualDocument56 pagesByrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions Manualhymarbecurllzkit100% (20)

- 8 ways to lower your tax billDocument6 pages8 ways to lower your tax billansplanetNo ratings yet

- Annuity PresentationDocument16 pagesAnnuity PresentationPraveen100% (1)

- Group Insurance ProductsDocument8 pagesGroup Insurance Productshamza omarNo ratings yet

- SEC Guide To Variable AnnuitiesDocument28 pagesSEC Guide To Variable AnnuitiesAlex SongNo ratings yet

- FAQ Group Life InsuranceDocument5 pagesFAQ Group Life InsuranceMuhammad Yousuf FazalNo ratings yet

- Irda - Hand Book On Life InsuranceDocument12 pagesIrda - Hand Book On Life InsuranceRajesh SinghNo ratings yet

- The "Best Practices" When Using Fore! Trust Software After Enactment of The Secure ActDocument6 pagesThe "Best Practices" When Using Fore! Trust Software After Enactment of The Secure ActENo ratings yet

- IPP protects against inflation with increasing coverageDocument25 pagesIPP protects against inflation with increasing coveragebelrayNo ratings yet

- NPS at a Glance: Costs, Funds, Pros & Cons of India's National Pension SchemeDocument5 pagesNPS at a Glance: Costs, Funds, Pros & Cons of India's National Pension SchemeKarthikeyanNo ratings yet

- Wealth Management Assignment Retirement SchemesDocument4 pagesWealth Management Assignment Retirement SchemesAvani JainNo ratings yet

- Cliff Notes: Preparing People To PassDocument5 pagesCliff Notes: Preparing People To PassCole LovickNo ratings yet

- Ifrs 16 LeasesDocument19 pagesIfrs 16 LeasesR SharmaNo ratings yet

- Engineering EconomicsDocument6 pagesEngineering EconomicsSisay AD100% (1)

- Quiz For Finals With Answers and SolutionsDocument6 pagesQuiz For Finals With Answers and SolutionsCJ GranadaNo ratings yet

- AUDIT OF INVESTMENTS GAINS AND LOSSESDocument6 pagesAUDIT OF INVESTMENTS GAINS AND LOSSESZyrelle DelgadoNo ratings yet

- 9e 06 Chap Student WorkbookDocument24 pages9e 06 Chap Student WorkbookRamakrishna MyakaNo ratings yet

- The Future of CruisingDocument7 pagesThe Future of CruisingAndreea DeeaNo ratings yet

- Sample Questions Exam 1 Wi 11Document6 pagesSample Questions Exam 1 Wi 11Albert SongNo ratings yet

- Differential Analysis: The Key To Decision MakingDocument26 pagesDifferential Analysis: The Key To Decision MakingEng Hinji RudgeNo ratings yet

- Awareness and Perception of Taxpayers Towards Goods and Services Tax (GST) Implementation1Document19 pagesAwareness and Perception of Taxpayers Towards Goods and Services Tax (GST) Implementation1Bhagaban DasNo ratings yet

- Notification GSR 739Document4 pagesNotification GSR 739Varinder AnandNo ratings yet

- Accounting For AttorneysDocument160 pagesAccounting For AttorneyschueneNo ratings yet

- Diego Company Manufactures One Product That Is Sol...Document5 pagesDiego Company Manufactures One Product That Is Sol...MingNo ratings yet

- Millares vs NLRC ruling on separation pay allowancesDocument6 pagesMillares vs NLRC ruling on separation pay allowancesDanica Irish RevillaNo ratings yet

- Joint Venture Agreement To Construct A SubdivisionDocument3 pagesJoint Venture Agreement To Construct A SubdivisionBeert De la Cruz100% (1)

- Unit 3 Admission of A Partner QuestionsDocument4 pagesUnit 3 Admission of A Partner QuestionsMitesh SethiNo ratings yet

- ZTBL ReportDocument76 pagesZTBL Reportapi-224920675No ratings yet

- Câu H i ạ ể: Hoàn thành t i m 1,00 trên 1,00Document4 pagesCâu H i ạ ể: Hoàn thành t i m 1,00 trên 1,00Tram NguyenNo ratings yet

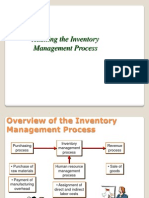

- Auditing The Inventory Management ProcessDocument15 pagesAuditing The Inventory Management ProcessGohar Mahmood100% (1)

- City of Columbus 2021 Proposed BudgetDocument426 pagesCity of Columbus 2021 Proposed BudgetABC6/FOX28No ratings yet

- 501 CDocument20 pages501 CEn Mahaksapatalika0% (1)

- Scope of The BclteDocument74 pagesScope of The BclteGreg Marilyn100% (3)

- Business Studies Finance and Accounting Unit 5 Chapter 26Document38 pagesBusiness Studies Finance and Accounting Unit 5 Chapter 26Krishna Das ShresthaNo ratings yet

- Estimation and ProblemsDocument18 pagesEstimation and ProblemsAyush SonthaliaNo ratings yet

- Yogesh Thar-Tax Management Through Wills Family ArrangementDocument69 pagesYogesh Thar-Tax Management Through Wills Family ArrangementMohan MohiniNo ratings yet

- 4.capital RationingDocument3 pages4.capital RationingmelonybluebellNo ratings yet

- HaiDocument8 pagesHaiPrajesh SrivastavaNo ratings yet

- Find Study Resources: Answered Step-By-StepDocument4 pagesFind Study Resources: Answered Step-By-StepJohn Carlos DoringoNo ratings yet

- Business PlanDocument18 pagesBusiness PlanAngelo Francis100% (2)

- Cir 205 - Guidelines Implementing The Optional Withdrawal of Pag-IBIG SavingsDocument3 pagesCir 205 - Guidelines Implementing The Optional Withdrawal of Pag-IBIG Savingsmaxx villaNo ratings yet

- Acc 9 TestbankDocument143 pagesAcc 9 TestbankPaula de Torres100% (2)