Professional Documents

Culture Documents

Kotak Balance Fund NAV, Managers and Holdings

Uploaded by

Khushboo VishwakarmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kotak Balance Fund NAV, Managers and Holdings

Uploaded by

Khushboo VishwakarmaCopyright:

Available Formats

Kotak Balance

Kotak Mahindra Mutual Fund

Nav Performance

NAV as on 22-Feb-06 Rs. 24.41

CIO :Sandesh Kirkire

Address: 5A,5th Floor, Bakhtawar, 229, Nariman Point, Bombay - 400 021

Phone:91 22 5638 4444

Fax:91 22 5638 4455

E-mail: sandesh.kirkire@kotak.com

website: http://www.kotakmutual.com

Scheme Snapshot

Anand Shah and

Ritesh Jain

Fund Manager

Asset Allocation

Particulars

as on 31-Jan-06

Percentage

Equity Shares

66.72

Corporate Debt /

16.29

Scheme Sub-Objective Balanced

Financial Institutions

Scheme Type

Open

Public Sector

6.46

Min. Investment(Rs)

5000

Undertakings

Total Assets(Rs./Mn)

797.74

Collateral Borrowing

4.39

Registrars

Computer Age

And Lending Obligation

Management

Net Current Assets /

3.47

Services Pvt.Ltd.

Liabilities

Launch Date

30-NOV-99

Futures

2.05

Term Deposits

0.63

Load Type

Value

Time Range(Days)

Investment Range(Rs)

Rs.

Entry

2.25%

--0

50000000

Entry

No Load

--Rs. 50000000

-Exit

No Load

----Scheme Objective

Balanced

Returns (%)

1wk

6 months

1 year

3 years*

View the entire portfolio of companies

Detailed financials

Inception*

Absolute

-0.20

20.44

25.14

50.20

41.44

19.52

Relative to Sensex **

-1.30

3.51

-7.99

-4.96

-4.14

6.02

Relative to Nifty **

-1.15

4.66

-4.29

1.99

-0.44

6.02

* Annualised Returns

** Percentage of returns greater or less (-ve) than the

indices

Sector Allocation

Search by Scheme

Type the scheme name to find your

schemes!

Search by sub Catego

Please choose a Sub Category

News Updates

Shree Renuka sugars plans refinery unit in Haldia -21-Feb-2006

Sundaram Mutual Fund launches Fixed Term Plan -20-Feb-2006

MFs invested in equities worth Rs 139.62 crore on Feb 07 -10-Feb-2006

MFs offloaded in equities worth Rs 330.01 crore on February 06 -08-Feb-2006

Prudential ICICI mutual fund launches Fusion Fund -07-Feb-2006

Corporate Debt / Financial Institutions

Industrial Capital Goods

Banks

Non-ferrous Metals

Public Sector Undertakings

Pharmaceuticals

Construction

Consumer Non Durables

Rabo India Finance Private Limit

NATION ALUM

IDBI LTD

SUNDARM FIN

BHEL

Entire Portfolio

Search by fund

3 months

Sector

Company

For the latest Balance sheet & Income s

Return Summary

Returns* (%)

Compare across Benchmarks

Top 5 Portfolio holdin

as on 31-Jan-06

as on 31-Jan-06

% Of Asset

16.29

12.09

8.40

6.58

6.46

5.96

5.27

4.89

Media And Entertainment

I T - Software

Collateral Borrowing And Lending

Ferrous Metals

Auto

Net Receivables / Payables

Fertilisers

Textiles - Cotton

Futures

Term Deposits

4.88

4.40

4.39

4.02

4.00

3.47

3.29

2.94

2.05

0.63

Kotak Balance

Kotak

Portfolio Composition

Total assets as on 31-Jan-06 is Rs. 797.74 million

Portfolio Details as on 31-Jan-06

Company

Sector

No. of Shares

Mkt. Value*

% of Assets

Equity Shares

NATION ALUM

BHEL

JAIPRAK ASSO

INFOSYS TECH

ALEMBIC

SAIL

MAH & MAH

AREVA

PUNJAB NATIONAL B

DECCAN CHR

COROMAN FERT

ABAN LLOYD

DENA BANK

HIND.SANITAR

NAHAR INDUST

UGAR SUGAR

ALLAHABAD BK

CIPLA

TV 18

NITINSPINNER

DABUR INDIA

ANDHRA BANK

66.72

Non-Ferrous Metals

Industrial Capital Goods

Construction

I T - Software

Pharmaceuticals

Ferrous Metals

Auto

Industrial Capital Goods

Banks

Media And Entertainment

Fertilisers

Industrial Capital Goods

Banks

Consumer Non Durables

Textiles - Cotton

Consumer Non Durables

Banks

Pharmaceuticals

Media And Entertainment

Textiles - Cotton

Consumer Non Durables

Banks

Company

190000

25000

103000

12200

96503

570000

57200

75386

58400

73598

380000

38000

600000

159225

110000

401625

165000

29000

28000

300000

49600

34318

Rating

52.48

44.89

42.05

35.14

34.73

32.06

31.94

28.48

27.18

26.53

26.24

23.08

22.83

17.85

17.17

15.26

13.84

12.83

12.36

6.30

5.87

3.19

Mkt. Value*

Portfolio other than Equity Portfolio

CORPORATE DEBT / FINANCIAL INSTITUTIONS

Rabo India Finance Private Limited

Sundaram Finance Limited

PUBLIC SECTOR UNDERTAKINGS

06.58

05.63

05.27

04.40

04.35

04.02

04.00

03.57

03.41

03.33

03.29

02.89

02.86

02.24

02.15

01.91

01.74

01.61

01.55

00.79

00.74

00.40

% of Assets

33.29

P1+

MAAA

79.92

50.00

16.29

10.02

06.27

06.46

Industrial Development Bank of India Limited

COLLATERAL BORROWING AND LENDING OBLIGATION

CBLO

NET CURRENT ASSETS / LIABILITIES

Net Current Assets/(Liabilites)

FUTURES

Dabur India Limited 2006

TERM DEPOSITS

Term Deposits

AA+

51.53

NA

35.00

NA

27.65

NA

16.35

NA

5.00

Grand Total

06.46

04.39

04.39

03.47

03.47

02.05

02.05

00.63

00.63

100.00 %

*Market Value in Rs Million

Sector Allocation

Sector

Corporate Debt / Financial

Institutions

Industrial Capital Goods

Banks

Non-ferrous Metals

Public Sector Undertakings

Pharmaceuticals

Construction

Consumer Non Durables

Media And Entertainment

I T - Software

Collateral Borrowing And Lending

Ferrous Metals

Auto

Net Receivables / Payables

Fertilisers

Textiles - Cotton

Futures

Term Deposits

as on 31-Jan-06

% Of Asset

Asset Allocation

Particulars

Equity Shares

16.29 Corporate Debt / Financial

Institutions

12.09

Public Sector Undertakings

8.40 Collateral Borrowing And

6.58 Lending Obligation

6.46 Net Current Assets /

5.96 Liabilities

5.27 Futures

4.89 Term Deposits

4.88

4.40

4.39

4.02

4.00

3.47

3.29

2.94

2.05

0.63

as on 31-Jan-06

Percentage

66.72

16.29

6.46

4.39

3.47

2.05

0.63

You might also like

- Sundaram Selact MidcapDocument6 pagesSundaram Selact MidcapEsha ShahNo ratings yet

- Account Project OrginalDocument41 pagesAccount Project OrginalshankarinadarNo ratings yet

- Live Project: Financial Planning For Hawkers GROUP 4 (PG SEC-B 2011-2012)Document15 pagesLive Project: Financial Planning For Hawkers GROUP 4 (PG SEC-B 2011-2012)Shakthi ShankaranNo ratings yet

- MF Report May 2010Document6 pagesMF Report May 2010sid_maliya1No ratings yet

- Indus Motor Company LTD Ratio AnalysisDocument166 pagesIndus Motor Company LTD Ratio AnalysisAqeel IfthkharNo ratings yet

- Share Sansar Samachar of 13th October' 2011Document4 pagesShare Sansar Samachar of 13th October' 2011sharesansarNo ratings yet

- Submitted By:-Shelza Gupta Roll No: - 500901509Document29 pagesSubmitted By:-Shelza Gupta Roll No: - 500901509digvijaygargNo ratings yet

- Sector Allocation: Reliance Vision Fund Vs BSE 100Document2 pagesSector Allocation: Reliance Vision Fund Vs BSE 100Rijo PhilipsNo ratings yet

- Online Summer Report on Major Auto Component CompaniesDocument63 pagesOnline Summer Report on Major Auto Component Companies070Zalak HirparaNo ratings yet

- Share Sansar Samachar of 29th December' 2011Document3 pagesShare Sansar Samachar of 29th December' 2011sharesansarNo ratings yet

- Value Research: JM Emerging LeadersDocument2 pagesValue Research: JM Emerging LeadersSandeep BorseNo ratings yet

- UTI Fund Guide: Investment Options from India's Largest Mutual FundDocument17 pagesUTI Fund Guide: Investment Options from India's Largest Mutual FundRaj KumarNo ratings yet

- Birla Sun Life Frontline Equity Fund: Investment ObjectiveDocument1 pageBirla Sun Life Frontline Equity Fund: Investment ObjectivehnarwalNo ratings yet

- SBI Securities Morning Update - 15-09-2022Document5 pagesSBI Securities Morning Update - 15-09-2022deepaksinghbishtNo ratings yet

- Share Sansar Samachar of 1st November' 2011Document4 pagesShare Sansar Samachar of 1st November' 2011sharesansarNo ratings yet

- Share Sansar Samachar of 14 October' 2011Document4 pagesShare Sansar Samachar of 14 October' 2011sharesansarNo ratings yet

- Share Sansar Samachar of 27th November' 2011Document3 pagesShare Sansar Samachar of 27th November' 2011sharesansarNo ratings yet

- Share Sansar Samachar of 07th November' 2011Document4 pagesShare Sansar Samachar of 07th November' 2011sharesansarNo ratings yet

- J Street Volume 294Document10 pagesJ Street Volume 294JhaveritradeNo ratings yet

- Equity-Balanced Funds of 5 Different Mutual Funds-Growth PlanDocument34 pagesEquity-Balanced Funds of 5 Different Mutual Funds-Growth Planapoorva_rastogi851261No ratings yet

- Kotak Mahindra BankDocument26 pagesKotak Mahindra Bankrammi1318No ratings yet

- Pramod Accounts & Finance CVDocument3 pagesPramod Accounts & Finance CVpramods128No ratings yet

- Auto Components SectorDocument62 pagesAuto Components SectorZalak HirparaNo ratings yet

- ICICIdirect Equity Pulse Weekly RoundupDocument2 pagesICICIdirect Equity Pulse Weekly Roundupdrsivaprasad7No ratings yet

- Share Sansar Samachar of 14th November' 2011Document4 pagesShare Sansar Samachar of 14th November' 2011sharesansarNo ratings yet

- R. Wadiwala: Morning NotesDocument7 pagesR. Wadiwala: Morning NotesRWadiwala SecNo ratings yet

- Equity Funds Hybrid Funds Fund-of-Funds: 30 December 2011Document28 pagesEquity Funds Hybrid Funds Fund-of-Funds: 30 December 2011Ahmed HusainNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Share Sansar Samachar of 26th August' 2011Document4 pagesShare Sansar Samachar of 26th August' 2011sharesansarNo ratings yet

- Half Yearly Portfolio Disclosure For The Period Ended September 30, 2016 (Company Update)Document89 pagesHalf Yearly Portfolio Disclosure For The Period Ended September 30, 2016 (Company Update)Shyam SunderNo ratings yet

- Kotak BankDocument28 pagesKotak BankGyanendra SharmaNo ratings yet

- Eclerx: Website: India HeadquartersDocument9 pagesEclerx: Website: India HeadquartersSahib ChandockNo ratings yet

- Daily market update and analysisDocument3 pagesDaily market update and analysisAyush JainNo ratings yet

- Financial-Results - May 08, 2023Document52 pagesFinancial-Results - May 08, 2023Pradeep KshatriyaNo ratings yet

- Share Sansar Samachar of 25th August' 2011Document4 pagesShare Sansar Samachar of 25th August' 2011sharesansarNo ratings yet

- Kotak MahindraDocument70 pagesKotak MahindrashivaniNo ratings yet

- Pension Super 12Document2 pagesPension Super 12RabekanadarNo ratings yet

- Moil Limited: (A Govt. of India Enterprise) Moil Bhawan, 1-A Katol Road, NAGPUR - 440 013Document9 pagesMoil Limited: (A Govt. of India Enterprise) Moil Bhawan, 1-A Katol Road, NAGPUR - 440 013amits3989No ratings yet

- List of Various CommitteesDocument8 pagesList of Various CommitteesRamprasad ThankaswamyNo ratings yet

- Careeer Point Word - Doc FINALDocument13 pagesCareeer Point Word - Doc FINALKaran JainNo ratings yet

- List of Committees Related To Banking & Finance in India - General Knowledge TodayDocument16 pagesList of Committees Related To Banking & Finance in India - General Knowledge TodayRavi RajputNo ratings yet

- Share Sansar Samachar of 24th November' 2011Document3 pagesShare Sansar Samachar of 24th November' 2011sharesansarNo ratings yet

- Share Sansar Samachar of 08 November' 2011Document4 pagesShare Sansar Samachar of 08 November' 2011sharesansarNo ratings yet

- Sector Wise List of Listed NSE Companies: Electrical EquipmentDocument29 pagesSector Wise List of Listed NSE Companies: Electrical EquipmentharshitabaranwalNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Fidelity Fund Management Private LimitedDocument28 pagesFidelity Fund Management Private LimitedsubudaniNo ratings yet

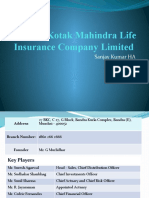

- Kotak Mahindra Life Insurance Company Limited: Sanjay Kumar HA 1DA19MBA39Document4 pagesKotak Mahindra Life Insurance Company Limited: Sanjay Kumar HA 1DA19MBA391DA19MBA39SanjayNo ratings yet

- Presented By: Himanshu Gurani Roll No. 33Document27 pagesPresented By: Himanshu Gurani Roll No. 33AshishBhardwajNo ratings yet

- SBI Becomes First Japan Group To List in HKDocument8 pagesSBI Becomes First Japan Group To List in HKishan_mishra85No ratings yet

- Reliance A Debt Free CompanyDocument13 pagesReliance A Debt Free Companypulimi manojNo ratings yet

- SBI Securities Morning Update - 29-09-2022Document4 pagesSBI Securities Morning Update - 29-09-2022deepaksinghbishtNo ratings yet

- Analysis of Various Funds Offered by Canara Robeco Asset Management CompanyDocument15 pagesAnalysis of Various Funds Offered by Canara Robeco Asset Management CompanyVineet MahajanNo ratings yet

- TY-BBA-2015 - Syllabus PDFDocument60 pagesTY-BBA-2015 - Syllabus PDFATULNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Endurance Technologies LTD: IPO ReportDocument3 pagesEndurance Technologies LTD: IPO ReportIngrid CarrNo ratings yet

- Vivekanand Education Society Polytechnic: Prepare A Report On Upstox and Present Its Cost SheetDocument19 pagesVivekanand Education Society Polytechnic: Prepare A Report On Upstox and Present Its Cost SheetPranav MhatreNo ratings yet

- Annual Report 07 08Document142 pagesAnnual Report 07 08jagat_sabatNo ratings yet

- Bank King News - Mca (Oct)Document20 pagesBank King News - Mca (Oct)kalyanNo ratings yet

- NBFCsand ARCs 10012023Document198 pagesNBFCsand ARCs 10012023tularamso34No ratings yet

- 8 App Internetbanking IndividualjointDocument4 pages8 App Internetbanking IndividualjointKhushboo VishwakarmaNo ratings yet

- 154Document14 pages154KogulanSathananthanNo ratings yet

- 7 App Internetbanking CompaniestrustcosocitiesDocument3 pages7 App Internetbanking CompaniestrustcosocitiesKhushboo VishwakarmaNo ratings yet

- 5 Requestletter Changemailingaddress ShareholdersDocument1 page5 Requestletter Changemailingaddress ShareholdersKhushboo VishwakarmaNo ratings yet

- Balance Sheet of Hero Motocorp - in Rs. Cr.Document16 pagesBalance Sheet of Hero Motocorp - in Rs. Cr.Khushboo VishwakarmaNo ratings yet

- Magnum Balanced FundDocument4 pagesMagnum Balanced FundKhushboo VishwakarmaNo ratings yet

- Capital Structure of Siddhartha Bank LimitedDocument14 pagesCapital Structure of Siddhartha Bank LimitedShreesha BhattaNo ratings yet

- Deed of Extrajudicial SettlementDocument2 pagesDeed of Extrajudicial SettlementremNo ratings yet

- DownloadDocument2 pagesDownloadJAYESH BHUGRANo ratings yet

- MS-44J (Working Capital Management)Document13 pagesMS-44J (Working Capital Management)juleslovefenNo ratings yet

- A Study On Sources of Funds and Its Mobilization of Century Commercial Bank LimitedDocument11 pagesA Study On Sources of Funds and Its Mobilization of Century Commercial Bank LimitedsaN bAnNo ratings yet

- Final Report On NBFCDocument82 pagesFinal Report On NBFCSanjeev86% (28)

- Fiqh or Fiction: Why Islamic Finance Needs Standardized TrainingDocument8 pagesFiqh or Fiction: Why Islamic Finance Needs Standardized TrainingEthica Institute of Islamic Finance™No ratings yet

- Credit Management in Indian Overseas BankDocument60 pagesCredit Management in Indian Overseas BankAkash DixitNo ratings yet

- Digital E-Stamp: Government of Uttar PradeshDocument28 pagesDigital E-Stamp: Government of Uttar PradeshPunit Tripathi (GorakhpurPadrauna Center)No ratings yet

- KCC Application Form 1Document14 pagesKCC Application Form 1ashish trivediNo ratings yet

- Elizabeth SeyoumDocument57 pagesElizabeth SeyoumDawit A AmareNo ratings yet

- Chapter 1: IntroductionDocument16 pagesChapter 1: IntroductionMizanur Rahman EmonNo ratings yet

- (Final) Financial Management Alevel Ent TwoDocument117 pages(Final) Financial Management Alevel Ent Twoojokdanniel77No ratings yet

- Tally NotesDocument44 pagesTally NotesJaydeep Paul100% (4)

- Bank Reconciliation Statement LessonDocument2 pagesBank Reconciliation Statement LessonDimple Grace AstorgaNo ratings yet

- KASB Bank's Capital Shortage and State Bank InterventionDocument4 pagesKASB Bank's Capital Shortage and State Bank InterventionAsad MemonNo ratings yet

- Intro To Corporate FinanceDocument75 pagesIntro To Corporate FinanceRashid HussainNo ratings yet

- Principles and Practice of BankingDocument27 pagesPrinciples and Practice of Bankingrangudasar100% (2)

- Appraisal of The ProposalDocument10 pagesAppraisal of The ProposalroutraykhushbooNo ratings yet

- Project Report On Islamic BankingDocument26 pagesProject Report On Islamic BankingMichael EdwardsNo ratings yet

- Merger and Acquisition in India: A Dissertation Report OnDocument43 pagesMerger and Acquisition in India: A Dissertation Report OnShehbaz ShaikhNo ratings yet

- UPSC CSAT Mock Test Question PaperDocument22 pagesUPSC CSAT Mock Test Question PaperUngistNo ratings yet

- Curriculum Vita PDFDocument5 pagesCurriculum Vita PDFNur AbdallahNo ratings yet

- MIT15 S12F18 Ses2Document38 pagesMIT15 S12F18 Ses2Nikhil PatelNo ratings yet

- Turkish Banks Profitability Comparison of Interest-Free vs Interest-BasedDocument29 pagesTurkish Banks Profitability Comparison of Interest-Free vs Interest-BasedCarnoto EmiradLogisticsNo ratings yet

- Types of Credit Facilities: Rule in Clayton's CaseDocument3 pagesTypes of Credit Facilities: Rule in Clayton's CaseMadhavKishore100% (1)

- Balance Cash HoldingDocument4 pagesBalance Cash HoldingTilahun S. KuraNo ratings yet

- Project Report On "Role of Banks in International Trade": Page - 1Document50 pagesProject Report On "Role of Banks in International Trade": Page - 1Adarsh Rasal100% (1)

- Benvolent FundDocument88 pagesBenvolent FundSakhawat Hussain0% (1)

- Schachtschneider, Jonas, CIPS - China's Cross-Border Interbank Payment System and Its Role Within The RMB Internationalization ProcessDocument21 pagesSchachtschneider, Jonas, CIPS - China's Cross-Border Interbank Payment System and Its Role Within The RMB Internationalization ProcessMáinaNo ratings yet