Professional Documents

Culture Documents

Summary Plan of Adjustment

Uploaded by

Channel SevenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Summary Plan of Adjustment

Uploaded by

Channel SevenCopyright:

Available Formats

OVERVIEW OF DETROITS PLAN OF ADJUSTMENT The Plan of Adjustment (Plan) that the City of Detroit (Detroit or City) filed

with the U.S. Bankruptcy Court for the Eastern District of Michigan on February 21, 2014 represents a critical step toward the Citys rehabilitation and recovery from a decades-long downward spiral. The Plan provides for the adjustment of up to as much as $18 billion in secured and unsecured debt and offers the greatest possible recoveries for the Citys creditors while simultaneously allowing for meaningful and necessary investment in the City. In connection with the Plan, the City intends to: Invest approximately $1.5 billion over 10 years to, among other things: o Improve and provide essential municipal services to the Citys 700,000 residents, including police, fire and emergency medical services, garbage removal and functioning streetlights; o Attract and retain residents and businesses to foster growth and redevelopment; and o Improve the Citys information technology systems, thereby increasing efficiency and decreasing costs. Provide pension treatment that is intended to deliver pensions that the City can afford and by which retirees can continue to meet their needs and maintain their current quality of life: o If police and fire retirees agree to the Plan, they would likely receive in excess of 90% of their earned pensions after elimination of cost of living allowances. General retirees who agree to the Plan would likely receive in excess of 70% of their pensions after elimination of cost of living allowances. o Detroits current active employees would continue to earn pensions in the future under traditional defined benefit formulas, rather than defined contribution arrangements. o The two pension funds the Police & Fire Retirement System and the General Retirement System would operate under more conservative investment return assumptions. This will allow pension contribution predictability and stability, which is critical for the City to be assured that it has sufficient funds for operations and its $1.5 billion investment program in the future. o Contributions to the two pension funds would come from three sources over the next 10 years accelerated pension funding contributions from the Detroit Water & Sewer Authority, contributions made in connection with a comprehensive settlement to preserve City-owned art for the benefit of the region, and

contributions to the pension funds from the State of Michigan (Michigan) under certain settlement conditions. o The State support will be further designed to ensure that those retirees whose household income is at or relatively near the U.S. federal poverty level will not fall below those levels. Lay the foundation for a solvent Detroit that can live within its means and meet realistic obligations. o Essentially all creditors are entitled to a recovery under the Plan. o Unsecured, non-retiree creditors (including certain unlimited tax and limited tax general obligation debt that is currently the subject of pending litigation) will generally receive (i) an approximately 20% recovery on their claims in the form of new securities to be issued by the City and (ii) the potential to share in any increased revenues realized by a revitalized City. Continue to negotiate with surrounding counties regarding the potential creation of a regional water and sewer authority. Emphasize negotiated solutions including through continuing federal mediation that maximize creditor recoveries while allowing the City to meet its obligations and have a viable future. The Plan contemplates: o A consensual resolution of matters related to the DIA expected to yield approximately $465 million from certain philanthropic foundations and DIA Corp., which funds would be devoted to increasing the assets of the City's two pension funds. o A potential agreement involving the State that would provide as much as $350 million for pension claims in exchange for releases from pension claimants that elect to participate in the settlement. o The continued pursuit of a potential resolution of a costly interest-rate swaps arrangement.

CLI-2187394v4

You might also like

- The Economic Impact of Beer in MichiganDocument2 pagesThe Economic Impact of Beer in MichiganBeth DalbeyNo ratings yet

- Consent Agreement Wayne CountyDocument12 pagesConsent Agreement Wayne CountyClickon DetroitNo ratings yet

- The NFL's Tom Brady Appeal DecisionDocument20 pagesThe NFL's Tom Brady Appeal DecisionTony ManfredNo ratings yet

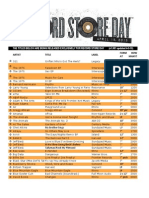

- Record Store Day 2015 ReleasesDocument11 pagesRecord Store Day 2015 ReleasesFernando Rivas HernándezNo ratings yet

- Statements From Charlie Bothuell IV & Monique Dillard-BothuellDocument11 pagesStatements From Charlie Bothuell IV & Monique Dillard-BothuellClickon DetroitNo ratings yet

- GM Ignition Compensation Program - Final ProtocolDocument14 pagesGM Ignition Compensation Program - Final ProtocolAlexNunezNo ratings yet

- Petition For Termination of Parental Rights of Mitchelle BlairDocument9 pagesPetition For Termination of Parental Rights of Mitchelle BlairChannel SevenNo ratings yet

- GM CEO Mary BarryDocument3 pagesGM CEO Mary BarryFrederick MeierNo ratings yet

- Komen Detroit Race2014 Site Map - (As of 5-13-14)Document1 pageKomen Detroit Race2014 Site Map - (As of 5-13-14)Channel SevenNo ratings yet

- GM Victim Plan FAQDocument15 pagesGM Victim Plan FAQfmeier22No ratings yet

- Michigan's Infrastructure Needs and Funding 2013: Michigan Department of TransportationDocument19 pagesMichigan's Infrastructure Needs and Funding 2013: Michigan Department of TransportationChannel Seven0% (1)

- Doboer Findings of Fact and Conclusions of LawDocument31 pagesDoboer Findings of Fact and Conclusions of LawThe Washington Post100% (1)

- Matt Sorisho Benefit FlyerDocument1 pageMatt Sorisho Benefit FlyerChannel SevenNo ratings yet

- Movie Theft Best Practices MPAA PDFDocument13 pagesMovie Theft Best Practices MPAA PDFtorrentfreakNo ratings yet

- Income Tax PreparationDocument1 pageIncome Tax PreparationChannel SevenNo ratings yet

- Warfield ReportDocument6 pagesWarfield ReportChannel SevenNo ratings yet

- Usa Const BriefDocument12 pagesUsa Const BriefChannel SevenNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Human Resource Management by John Ivancevich PDFDocument656 pagesHuman Resource Management by John Ivancevich PDFHaroldM.MagallanesNo ratings yet

- Understanding Consumer and Business Buyer BehaviorDocument47 pagesUnderstanding Consumer and Business Buyer BehaviorJia LeNo ratings yet

- Power For All - Myth or RealityDocument11 pagesPower For All - Myth or RealityAshutosh BhaktaNo ratings yet

- Kicks: This Brochure Reflects The Product Information For The 2020 Kicks. 2021 Kicks Brochure Coming SoonDocument8 pagesKicks: This Brochure Reflects The Product Information For The 2020 Kicks. 2021 Kicks Brochure Coming SoonYudyChenNo ratings yet

- Bismillah SpeechDocument2 pagesBismillah SpeechanggiNo ratings yet

- TOEFLDocument6 pagesTOEFLSekar InnayahNo ratings yet

- Home Guaranty Corp. v. Manlapaz - PunzalanDocument3 pagesHome Guaranty Corp. v. Manlapaz - PunzalanPrincess Aliyah Punzalan100% (1)

- Department of Labor: 2nd Injury FundDocument140 pagesDepartment of Labor: 2nd Injury FundUSA_DepartmentOfLabor100% (1)

- 6 AsianregionalismDocument32 pages6 AsianregionalismChandria Ford100% (1)

- Preventive Maintenance - HematologyDocument5 pagesPreventive Maintenance - HematologyBem GarciaNo ratings yet

- Jetweigh BrochureDocument7 pagesJetweigh BrochureYudi ErwantaNo ratings yet

- SH210 5 SERVCE CD PDF Pages 1 33Document33 pagesSH210 5 SERVCE CD PDF Pages 1 33Em sulistio87% (23)

- SettingsDocument3 pagesSettingsrusil.vershNo ratings yet

- Crawler Base DX500/DX600/DX680/ DX700/DX780/DX800: Original InstructionsDocument46 pagesCrawler Base DX500/DX600/DX680/ DX700/DX780/DX800: Original InstructionsdefiunikasungtiNo ratings yet

- Business Testimony 3Document14 pagesBusiness Testimony 3Sapan BanerjeeNo ratings yet

- Audit Certificate: (On Chartered Accountant Firm's Letter Head)Document3 pagesAudit Certificate: (On Chartered Accountant Firm's Letter Head)manjeet mishraNo ratings yet

- White Button Mushroom Cultivation ManualDocument8 pagesWhite Button Mushroom Cultivation ManualKhurram Ismail100% (4)

- WhatsApp Chat With JioCareDocument97 pagesWhatsApp Chat With JioCareYásh GúptàNo ratings yet

- DR-2100P Manual EspDocument86 pagesDR-2100P Manual EspGustavo HolikNo ratings yet

- Automatic Stair Climbing Wheelchair: Professional Trends in Industrial and Systems Engineering (PTISE)Document7 pagesAutomatic Stair Climbing Wheelchair: Professional Trends in Industrial and Systems Engineering (PTISE)Abdelrahman MahmoudNo ratings yet

- Oxygen BarrierDocument20 pagesOxygen BarrierKarina ArdizziNo ratings yet

- CBC Building Wiring Installation NC IIDocument72 pagesCBC Building Wiring Installation NC IIFaysbuk KotoNo ratings yet

- Safety Data Sheet: Fumaric AcidDocument9 pagesSafety Data Sheet: Fumaric AcidStephen StantonNo ratings yet

- Sciencedirect: Jad Imseitif, He Tang, Mike Smith Jad Imseitif, He Tang, Mike SmithDocument10 pagesSciencedirect: Jad Imseitif, He Tang, Mike Smith Jad Imseitif, He Tang, Mike SmithTushar singhNo ratings yet

- Interest Rates and Bond Valuation: All Rights ReservedDocument22 pagesInterest Rates and Bond Valuation: All Rights ReservedAnonymous f7wV1lQKRNo ratings yet

- Is.14785.2000 - Coast Down Test PDFDocument12 pagesIs.14785.2000 - Coast Down Test PDFVenkata NarayanaNo ratings yet

- PHP IntroductionDocument113 pagesPHP Introductionds0909@gmailNo ratings yet

- Curamik Design Rules DBC 20150901Document8 pagesCuramik Design Rules DBC 20150901Ale VuNo ratings yet

- Mpi Model QuestionsDocument4 pagesMpi Model QuestionshemanthnagNo ratings yet

- Gravity Based Foundations For Offshore Wind FarmsDocument121 pagesGravity Based Foundations For Offshore Wind FarmsBent1988No ratings yet