Professional Documents

Culture Documents

Chap 016

Uploaded by

limed1Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 016

Uploaded by

limed1Copyright:

Available Formats

Chapter 16 - Financial Leverage and Capital Structure Policy

Chapter 16 Financial Leverage and Capital Structure Policy

Multiple Choice Questions

1. Homemade leverage is: A. the incurrence o de!t !y a corporation in order to pay dividends to shareholders. ". the e#clusive use o de!t to und a corporate e#pansion pro$ect. C. the !orro%ing or lending o money !y individual shareholders as a means o ad$usting their level o inancial leverage. &. !est de ined as an increase in a irm's de!t-e(uity ratio. ). the term used to descri!e the capital structure o a levered irm.

*. +hich one o the ollo%ing states that the value o a irm is unrelated to the irm's capital structure, A. Capital Asset Pricing -odel ". -.- Proposition / C. -.- Proposition // &. La% o 0ne Price ). ) icient -ar1ets Hypothesis

2. +hich one o the ollo%ing states that a irm's cost o e(uity capital is directly and proportionally related to the irm's capital structure, A. Capital Asset Pricing -odel ". -.- Proposition / C. -.- Proposition // &. La% o 0ne Price ). ) icient -ar1ets Hypothesis

3. +hich one o the ollo%ing is the e(uity ris1 that is most related to the daily operations o a irm, A. mar1et ris1 ". systematic ris1 C. e#trinsic ris1 &. !usiness ris1 ). inancial ris1

16-1

Chapter 16 - Financial Leverage and Capital Structure Policy

4. +hich one o the ollo%ing is the e(uity ris1 related to a irm's capital structure policy, A. mar1et ". systematic C. e#trinsic &. !usiness ). inancial

6. "utter . 5elly reduced its ta#es last year !y 6247 !y increasing its interest e#pense !y 618777. +hich o the ollo%ing terms is used to descri!e this ta# savings, A. interest ta# shield ". interest credit C. inancing shield &. current ta# yield ). ta#-loss interest

9. :he unlevered cost o capital re ers to the cost o capital or a;n<: A. private entity. ". all-e(uity irm. C. governmental entity. &. private individual. ). corporate shareholder.

=. :he e#plicit costs8 such as legal and administrative e#penses8 associated %ith corporate de ault are classi ied as >>>>> costs. A. lotation ". issue C. direct !an1ruptcy &. indirect !an1ruptcy ). unlevered

16-*

Chapter 16 - Financial Leverage and Capital Structure Policy

?. :he costs incurred !y a !usiness in an e ort to avoid !an1ruptcy are classi ied as >>>>> costs. A. lotation ". direct !an1ruptcy C. indirect !an1ruptcy &. inancial solvency ). capital structure

17. "y de inition8 %hich o the ollo%ing costs are included in the term @ inancial distress costs@, /. direct !an1ruptcy costs //. indirect !an1ruptcy costs ///. direct costs related to !eing inancially distressed8 !ut not !an1rupt /A. indirect costs related to !eing inancially distressed8 !ut not !an1rupt A. / only ". /// only C. / and // only &. /// and /A only ). /8 //8 ///8 and /A

11. :he proposition that a irm !orro%s up to the point %here the marginal !ene it o the interest ta# shield derived rom increased de!t is $ust e(ual to the marginal e#pense o the resulting increase in inancial distress costs is called: A. the static theory o capital structure. ". -.- Proposition /. C. -.- Proposition //. &. the capital asset pricing model. ). the open mar1ets theorem.

1*. +hich one o the ollo%ing is the legal proceeding under %hich an insolvent irm can !e reorganiBed, A. restructure process ". !an1ruptcy C. orced merger &. legal ta1eover ). rights o er

16-2

Chapter 16 - Financial Leverage and Capital Structure Policy

12. A !usiness irm ceases to e#ist as a going concern as a result o %hich one o the ollo%ing, A. divestiture ". share repurchase C. li(uidation &. reorganiBation ). capital restructuring

13. )d%ards Farm Products %as una!le to meet its inancial o!ligations and %as orced into using legal proceedings to restructure itsel so that it could continue as a via!le !usiness. :he process this irm under%ent is 1no%n as a: A. merger. ". repurchase program. C. li(uidation. &. reorganiBation. ). divestiture.

14. :he a!solute priority rule determines: A. %hen a irm must !e declared o icially !an1rupt. ". ho% a distressed irm is reorganiBed. C. %hich $udge is assigned to a particular !an1ruptcy case. &. ho% long a reorganiBed irm is allo%ed to remain under !an1ruptcy protection. ). %hich parties receive payment irst in a !an1ruptcy proceeding.

16. A irm should select the capital structure that: A. produces the highest cost o capital. ". ma#imiBes the value o the irm. C. minimiBes ta#es. &. is ully unlevered. ). e(uates the value o de!t %ith the value o e(uity.

16-3

Chapter 16 - Financial Leverage and Capital Structure Policy

19. :he value o a irm is ma#imiBed %hen the: A. cost o e(uity is ma#imiBed. ". ta# rate is Bero. C. levered cost o capital is ma#imiBed. &. %eighted average cost o capital is minimiBed. ). de!t-e(uity ratio is minimiBed.

1=. :he optimal capital structure has !een achieved %hen the: A. de!t-e(uity ratio is e(ual to 1. ". %eight o e(uity is e(ual to the %eight o de!t. C. cost o e(uity is ma#imiBed given a pre-ta# cost o de!t. &. de!t-e(uity ratio is such that the cost o de!t e#ceeds the cost o e(uity. ). de!t-e(uity ratio results in the lo%est possi!le %eighted average cost o capital.

1?. AA :ours is comparing t%o capital structures to determine ho% to !est inance its operations. :he irst option consists o all e(uity inancing. :he second option is !ased on a de!t-e(uity ratio o 7.34. +hat should AA :ours do i its e#pected earnings !e ore interest and ta#es ;)"/:< are less than the !rea1-even level, Assume there are no ta#es. A. select the leverage option !ecause the de!t-e(uity ratio is less than 7.47 ". select the leverage option since the e#pected )"/: is less than the !rea1-even level C. select the unlevered option since the de!t-e(uity ratio is less than 7.47 &. select the unlevered option since the e#pected )"/: is less than the !rea1-even level ). cannot !e determined rom the in ormation provided

*7. Cou have computed the !rea1-even point !et%een a levered and an unlevered capital structure. Assume there are no ta#es. At the !rea1-even level8 the: A. irm is $ust earning enough to pay or the cost o the de!t. ". irm's earnings !e ore interest and ta#es are e(ual to Bero. C. earnings per share or the levered option are e#actly dou!le those o the unlevered option. &. advantages o leverage e#ceed the disadvantages o leverage. ). irm has a de!t-e(uity ratio o .47.

16-4

Chapter 16 - Financial Leverage and Capital Structure Policy

*1. +hich one o the ollo%ing statements is correct concerning the relationship !et%een a levered and an unlevered capital structure, Assume there are no ta#es. A. At the !rea1-even point8 there is no advantage to de!t. ". :he earnings per share %ill e(ual Bero %hen )"/: is Bero or a levered irm. C. :he advantages o leverage are inversely related to the level o )"/:. &. :he use o leverage at any level o )"/: increases the )PS. ). )PS are more sensitive to changes in )"/: %hen a irm is unlevered.

**. 5essica invested in Duantro stoc1 %hen the irm %as unlevered. Since then8 Duantro has changed its capital structure and no% has a de!t-e(uity ratio o 7.27. :o unlever her position8 5essica needs to: A. !orro% some money and purchase additional shares o Duantro stoc1. ". maintain her current e(uity position as the de!t o the irm did not a ect her personally. C. sell some shares o Duantro stoc1 and hold the proceeds in cash. &. sell some shares o Duantro stoc1 and loan out the sale proceeds. ). create a personal de!t-e(uity ratio o 7.27.

*2. +hich one o the ollo%ing ma1es the capital structure o a irm irrelevant, A. ta#es ". interest ta# shield C. 177 percent dividend payout ratio &. de!t-e(uity ratio that is greater than 7 !ut less than 1 ). homemade leverage

*3. -.- Proposition / %ith no ta# supports the argument that: A. !usiness ris1 determines the return on assets. ". the cost o e(uity rises as leverage rises. C. the de!t-e(uity ratio o a irm is completely irrelevant. &. a irm should !orro% money to the point %here the ta# !ene it rom de!t is e(ual to the cost o the increased pro!a!ility o inancial distress. ). homemade leverage is irrelevant.

16-6

Chapter 16 - Financial Leverage and Capital Structure Policy

*4. :he concept o homemade leverage is most associated %ith: A. -.- Proposition / %ith no ta#. ". -.- Proposition // %ith no ta#. C. -.- Proposition / %ith ta#. &. -.- Proposition // %ith ta#. ). static theory proposition.

*6. +hich o the ollo%ing statements are correct in relation to -.- Proposition // %ith no ta#es, /. :he re(uired return on assets is e(ual to the %eighted average cost o capital. //. Financial ris1 is determined !y the de!t-e(uity ratio. ///. Financial ris1 determines the return on assets. /A. :he cost o e(uity declines %hen the amount o leverage used !y a irm rises. A. / and /// only ". // and /A only C. / and // only &. /// and /A only ). / and /A only

*9. -.- Proposition // is the proposition that: A. the capital structure o a irm has no e ect on the irm's value. ". the cost o e(uity depends on the return on de!t8 the de!t-e(uity ratio8 and the ta# rate. C. a irm's cost o e(uity is a linear unction %ith a slope e(ual to ;EA - E&<. &. the cost o e(uity is e(uivalent to the re(uired rate o return on a irm's assets. ). the siBe o the pie does not depend on ho% the pie is sliced.

*=. :he !usiness ris1 o a irm: A. depends on the irm's level o unsystematic ris1. ". is inversely related to the re(uired return on the irm's assets. C. is dependent upon the relative %eights o the de!t and e(uity used to inance the irm. &. has a positive relationship %ith the irm's cost o e(uity. ). has no relationship %ith the re(uired return on a irm's assets according to -.Proposition //.

16-9

Chapter 16 - Financial Leverage and Capital Structure Policy

*?. +hich o the ollo%ing statements related to inancial ris1 are correct, /. Financial ris1 is the ris1 associated %ith the use o de!t inancing. //. As inancial ris1 increases so too does the cost o e(uity. ///. Financial ris1 is %holly dependent upon the inancial policy o a irm. /A. Financial ris1 is the ris1 that is inherent in a irm's operations. A. / and /// only ". // and /A only C. // and /// only &. /8 //8 and /// only ). /8 //8 ///8 and /A

27. -.- Proposition / %ith ta# supports the theory that: A. a irm's %eighted average cost o capital decreases as the irm's de!t-e(uity ratio increases. ". the value o a irm is inversely related to the amount o leverage used !y the irm. C. the value o an unlevered irm is e(ual to the value o a levered irm plus the value o the interest ta# shield. &. a irm's cost o capital is the same regardless o the mi# o de!t and e(uity used !y the irm. ). a irm's cost o e(uity increases as the de!t-e(uity ratio o the irm decreases.

21. -.- Proposition / %ith ta#es is !ased on the concept that: A. the optimal capital structure is the one that is totally inanced %ith e(uity. ". the capital structure o a irm does not matter !ecause investors can use homemade leverage. C. a irm's +ACC is una ected !y a change in the irm's capital structure. &. the value o a irm increases as the irm's de!t increases !ecause o the interest ta# shield. ). the cost o e(uity increases as the de!t-e(uity ratio o a irm increases.

2*. -.- Proposition // %ith ta#es: A. has the same general implications as -.- Proposition // %ithout ta#es. ". states that a irm's capital structure is irrelevant. C. supports the argument that !usiness ris1 is determined !y the capital structure decision. &. supports the argument that the cost o e(uity decreases as the de!t-e(uity ratio increases. ). concludes that the capital structure decision is irrelevant to the value o a irm.

16-=

Chapter 16 - Financial Leverage and Capital Structure Policy

22. :he present value o the interest ta# shield is e#pressed as: A. ;:C &<FEA. ". AG H ;:C &<. C. I)"/: ;:C &<JFEG. &. I)"/: ;:C &<JFEA. ). :c &.

23. :he interest ta# shield has no value %hen a irm has a: /. ta# rate o Bero. //. de!t-e(uity ratio o 1. ///. Bero de!t. /A. Bero leverage. A. / and /// only ". // and /A only C. /8 ///8 and /A only &. //8 ///8 and /A only ). /8 //8 and /A only

24. :he interest ta# shield is a 1ey reason %hy: A. the re(uired rate o return on assets rises %hen de!t is added to the capital structure. ". the value o an unlevered irm is e(ual to the value o a levered irm. C. the net cost o de!t to a irm is generally less than the cost o e(uity. &. the cost o de!t is e(ual to the cost o e(uity or a levered irm. ). irms pre er e(uity inancing over de!t inancing.

26. "ased on -.- Proposition // %ith ta#es8 the %eighted average cost o capital: A. is e(ual to the a terta# cost o de!t. ". has a linear relationship %ith the cost o e(uity capital. C. is una ected !y the ta# rate. &. decreases as the de!t-e(uity ratio increases. ). is e(ual to EG ;1 - :C<.

16-?

Chapter 16 - Financial Leverage and Capital Structure Policy

29. "an1ruptcy: A. creates value or a irm. ". trans ers value rom shareholders to !ondholders. C. technically occurs %hen total e(uity e(uals total de!t. &. costs are limited to legal and administrative ees. ). is an ine#pensive means o reorganiBing a irm.

2=. +hich one o the ollo%ing is a direct !an1ruptcy cost, A. company C)0's time spent in !an1ruptcy court ". maintaining cash reserves C. maintaining a de!t-e(uity ratio that is lo%er than the optimal ratio &. losing a 1ey company employee ). paying an outside accountant ees to prepare !an1ruptcy reports

2?. / a irm has the optimal amount o de!t8 then the: A. direct inancial distress costs must e(ual the present value o the interest ta# shield. ". value o the levered irm %ill e#ceed the value o the irm i it %ere unlevered. C. value o the irm is minimiBed. &. value o the irm is e(ual to AL H :C &. ). de!t-e(uity ratio is e(ual to 1.7.

37. +hich one o the ollo%ing has the greatest tendency to increase the percentage o de!t included in the optimal capital structure o a irm, A. e#ceptionally high depreciation e#penses ". very lo% marginal ta# rate C. su!stantial ta# shields rom other sources &. lo% pro!a!ilities o inancial distress ). minimal ta#a!le income

31. :he capital structure that ma#imiBes the value o a irm also: A. minimiBes inancial distress costs. ". minimiBes the cost o capital. C. ma#imiBes the present value o the ta# shield on de!t. &. ma#imiBes the value o the de!t. ). ma#imiBes the value o the unlevered irm.

16-17

Chapter 16 - Financial Leverage and Capital Structure Policy

3*. :he optimal capital structure: A. %ill !e the same or all irms in the same industry. ". %ill remain constant over time unless the irm changes its primary operations. C. %ill vary over time as ta#es and mar1et conditions change. &. places more emphasis on operations than on inancing. ). is una ected !y changes in the inancial mar1ets.

32. :he static theory o capital structure advocates that the optimal capital structure or a irm: A. is dependent on a constant de!t-e(uity ratio over time. ". remains i#ed over time. C. is independent o the irm's ta# rate. &. is independent o the irm's %eighted average cost o capital. ). e(uates the ta# savings rom an additional dollar o de!t to the increased !an1ruptcy costs related to that additional dollar o de!t.

33. :he !asic lesson o -.- :heory is that the value o a irm is dependent upon: A. the irm's capital structure. ". the total cash lo% o the irm. C. minimiBing the mar1eted claims. &. the amount o mar1eted claims to that irm. ). siBe o the stoc1holders' claims.

34. +hich orm o inancing do irms pre er to use irst according to the pec1ing-order theory, A. regular de!t ". converti!le de!t C. common stoc1 &. pre erred stoc1 ). internal unds

16-11

Chapter 16 - Financial Leverage and Capital Structure Policy

36. +hich o the ollo%ing are correct according to pec1ing-order theory, /. Firms stoc1pile internally-generated cash. //. :here is an inverse relationship !et%een a irm's pro it level and its de!t level. ///. Firms avoid e#ternal de!t at all costs. /A. A irm's capital structure is dictated !y its need or e#ternal inancing. A. / and /// only ". // and /A only C. /8 ///8 and /A only &. /8 //8 and /A only ). /8 //8 ///8 and /A

39. Corporations in the G.S. tend to: A. minimiBe ta#es. ". underutiliBe de!t. C. rely less on e(uity inancing than they should. &. have relatively similar de!t-e(uity ratios across industry lines. ). rely more heavily on de!t than on e(uity as the ma$or source o inancing.

3=. /n general8 the capital structures used !y G.S. irms: A. tend to over%eigh de!t in relation to e(uity. ". generally result in de!t-e(uity ratios !et%een 7.34 and 7.67. C. are airly standard or all S/C codes. &. tend to !e those %hich ma#imiBe the use o the irm's availa!le ta# shelters. ). vary signi icantly across industries.

3?. A irm is technically insolvent %hen: A. it has a negative !oo1 value. ". total de!t e#ceeds total e(uity. C. it is una!le to meet its inancial o!ligations. &. it iles or !an1ruptcy protection. ). the mar1et value o its stoc1 is less than its !oo1 value.

16-1*

Chapter 16 - Financial Leverage and Capital Structure Policy

47. +hich one o the ollo%ing statements related to Chapter 9 !an1ruptcy is correct, A. A irm in Chapter 9 !an1ruptcy is reorganiBing its operations such that it can return to !eing a via!le concern. ". Gnder a Chapter 9 !an1ruptcy8 a trustee %ill assume control o the irm's assets until those assets can !e li(uidated. C. Chapter 9 !an1ruptcies are al%ays involuntary on the part o the irm. &. Gnder a Chapter 9 !an1ruptcy8 the claims o creditors are paid prior to the administrative costs o the !an1ruptcy. ). Chapter 9 !an1ruptcy allo%s a irm to restructure its e(uity such that ne% shares o stoc1 are generally issued prior to the irm coming out o !an1ruptcy.

41. +hich one o the ollo%ing %ill generally have the highest priority %hen assets are distri!uted in a !an1ruptcy proceeding, A. consumer claim ". dividend payment to pre erred shareholder C. company contri!ution to the employees' retirement account &. payment to an unsecured creditor ). payment o employee %ages

4*. A irm may ile or Chapter 11 !an1ruptcy: /. in an attempt to gain a competitive advantage. //. using a prepac1. ///. %hile allo%ing the current management to continue running the irm. /A. only a ter the irm !ecomes insolvent. A. / and /// only ". / and // only C. /8 //8 and /A only &. /8 //8 and /// only ). /8 //8 ///8 and /A

42. :he "an1ruptcy A!use Prevention and Consumer Protection Act o *774: A. permits creditors to ile a prepac1 immediately a ter a irm iles or !an1ruptcy protection. ". prevents creditors rom su!mitting any reorganiBation plans. C. prevents irms rom iling or !an1ruptcy protection more than once. &. permits 1ey employee retention plans only i an employee has another $o! o er. ). allo%s irms to pay !onuses to all 1ey employees to entice those employees to remain in the irm's employ.

16-12

Chapter 16 - Financial Leverage and Capital Structure Policy

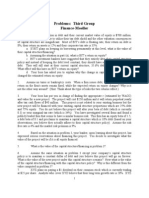

43. Kelso )lectric is de!ating !et%een a leveraged and an unleveraged capital structure. :he all e(uity capital structure %ould consist o 378777 shares o stoc1. :he de!t and e(uity option %ould consist o *48777 shares o stoc1 plus 6*=78777 o de!t %ith an interest rate o 9 percent. +hat is the !rea1-even level o earnings !e ore interest and ta#es !et%een these t%o options, /gnore ta#es. A. 63*8*7= ". 6338131 C. 6368222 &. 63?8669 ). 64*8*69

44. Holly's is currently an all e(uity irm that has ?8777 shares o stoc1 outstanding at a mar1et price o 63* a share. :he irm has decided to leverage its operations !y issuing 61*78777 o de!t at an interest rate o ?.4 percent. :his ne% de!t %ill !e used to repurchase shares o the outstanding stoc1. :he restructuring is e#pected to increase the earnings per share. +hat is the minimum level o earnings !e ore interest and ta#es that the irm is e#pecting, /gnore ta#es. A. 6248?17 ". 62=8416 C. 63*8777 &. 6338131 ). 63487*7

46. Se%er's Paradise is an all e(uity irm that has 48777 shares o stoc1 outstanding at a mar1et price o 614 a share. :he irm's management has decided to issue 6278777 %orth o de!t and use the unds to repurchase shares o the outstanding stoc1. :he interest rate on the de!t %ill !e 17 percent. +hat are the earnings per share at the !rea1-even level o earnings !e ore interest and ta#es, /gnore ta#es. A. 61.36 ". 61.47 C. 61.69 &. 61.== ). 61.?3

16-13

Chapter 16 - Financial Leverage and Capital Structure Policy

49. -iller's &ry Loods is an all e(uity irm %ith 348777 shares o stoc1 outstanding at a mar1et price o 647 a share. :he company's earnings !e ore interest and ta#es are 61*=8777. -iller's has decided to add leverage to its inancial operations !y issuing 6*478777 o de!t at = percent interest. :he de!t %ill !e used to repurchase shares o stoc1. Cou o%n 377 shares o -iller's stoc1. Cou also loan out unds at = percent interest. Ho% many shares o -iller's stoc1 must you sell to o set the leverage that -iller's is assuming, Assume you loan out all o the unds you receive rom the sale o stoc1. /gnore ta#es. A. 24.6 shares ". 37.7 shares C. 33.3 shares &. 39.4 shares ). 47.1 shares

4=. Cou currently o%n 677 shares o 5KL8 /nc. 5KL is an all e(uity irm that has 948777 shares o stoc1 outstanding at a mar1et price o 637 a share. :he company's earnings !e ore interest and ta#es are 61378777. 5KL has decided to issue 61 million o de!t at = percent interest. :his de!t %ill !e used to repurchase shares o stoc1. Ho% many shares o 5KL stoc1 must you sell to unlever your position i you can loan out unds at = percent interest, A. 1*7 shares ". 147 shares C. 1=7 shares &. *77 shares ). *47 shares

4?. Maylor's is an all e(uity irm %ith 678777 shares o stoc1 outstanding at a mar1et price o 647 a share. :he company has earnings !e ore interest and ta#es o 6=98777. Maylor's has decided to issue 69478777 o de!t at 9.4 percent. :he de!t %ill !e used to repurchase shares o the outstanding stoc1. Currently8 you o%n 477 shares o Maylor's stoc1. Ho% many shares o Maylor's stoc1 %ill you continue to o%n i you unlever this position, Assume you can loan out unds at 9.4 percent interest. /gnore ta#es. A. 277 shares ". 247 shares C. 294 shares &. 3*4 shares ). 477 shares

16-14

Chapter 16 - Financial Leverage and Capital Structure Policy

67. Pe%ter . Llass is an all e(uity irm that has =78777 shares o stoc1 outstanding. :he company is in the process o !orro%ing 66778777 at ? percent interest to repurchase 1*8777 shares o the outstanding stoc1. +hat is the value o this irm i you ignore ta#es, A. 6*.4 million ". 63.7 million C. 64.7 million &. 64.4 million ). 66.7 million

61. :he 5ean 0utlet is an all e(uity irm that has 1368777 shares o stoc1 outstanding. :he company has decided to !orro% the 61.1 million to repurchase 98477 shares o its stoc1 rom the estate o a deceased shareholder. +hat is the total value o the irm i you ignore ta#es, A. 61=82=9897* ". 61=84778777 C. 61?86668669 &. 6*187778777 ). 6*183128222

6*. Stacy o%ns 2= percent o :he :o%n Centre. She has decided to retire and %ants to sell all o her shares in this closely held8 all e(uity irm. :he other shareholders have agreed to have the irm !orro% 66478777 to purchase her shares o stoc1. +hat is the total mar1et value o :he :o%n Centre, /gnore ta#es. A. 61891784*6 ". 61893=8*1? C. 61899187=? &. 618=718376 ). 618=7=863?

62. +inter's :oyland has a de!t-e(uity ratio o 7.9*. :he pre-ta# cost o de!t is =.9 percent and the re(uired return on assets is 16.1 percent. +hat is the cost o e(uity i you ignore ta#es, A. 1?.21 percent ". 1?.93 percent C. *7.*? percent &. *7.36 percent ). *1.32 percent

16-16

Chapter 16 - Financial Leverage and Capital Structure Policy

63. 5e erson . &aughter has a cost o e(uity o 13.6 percent and a pre-ta# cost o de!t o 9.= percent. :he re(uired return on the assets is 12.* percent. +hat is the irm's de!t-e(uity ratio !ased on -.- // %ith no ta#es, A. 7.*6 ". 7.22 C. 7.29 &. 7.32 ). 7.34

64. :he Corner "a1ery has a de!t-e(uity ratio o 7.43. :he irm's re(uired return on assets is 13.* percent and its cost o e(uity is 16.1 percent. +hat is the pre-ta# cost o de!t !ased on -.- Proposition // %ith no ta#es, A. 9.17 percent ". =.9? percent C. 17.6= percent &. 19.46 percent ). 1=.37 percent

66. L.A. Clothing has e#pected earnings !e ore interest and ta#es o 63=8?778 an unlevered cost o capital o 13.4 percent8 and a ta# rate o 23 percent. :he company also has 6=8777 o de!t that carries a 9 percent coupon. :he de!t is selling at par value. +hat is the value o this irm, A. 6***849?.21 ". 6**28222.22 C. 6**3817=.16 &. 6**48*??.21 ). 6**48396.?1

16-19

Chapter 16 - Financial Leverage and Capital Structure Policy

69. Hanover :ech is currently an all e(uity irm that has 2*78777 shares o stoc1 outstanding %ith a mar1et price o 61? a share. :he current cost o e(uity is 14.3 percent and the ta# rate is 26 percent. :he irm is considering adding 61.* million o de!t %ith a coupon rate o = percent to its capital structure. :he de!t %ill !e sold at par value. +hat is the levered value o the e(uity, A. 64.*7? million ". 64.21* million C. 64.326 million &. 66.41* million ). 66.97= million

6=. "right -orning Foods has e#pected earnings !e ore interest and ta#es o 63=86778 an unlevered cost o capital o 12.* percent8 and de!t %ith !oth a !oo1 and ace value o 6*48777. :he de!t has an =.4 percent coupon. :he ta# rate is 23 percent. +hat is the value o the irm, A. 6*348477 ". 6*398677 C. 6*418477 &. 6*638=77 ). 6*918277

6?. )#ports Gnlimited is an unlevered irm %ith an a terta# net income o 6398=77. :he unlevered cost o capital is 13.1 percent and the ta# rate is 2* percent. +hat is the value o this irm, A. 6*978=69 ". 6*?382=7 C. 622?8779 &. 629=8333 ). 633983=?

16-1=

Chapter 16 - Financial Leverage and Capital Structure Policy

97. An unlevered irm has a cost o capital o 19.4 percent and earnings !e ore interest and ta#es o 62*98477. A levered irm %ith the same operations and assets has !oth a !oo1 value and a ace value o de!t o 66478777 %ith a 9.4 percent annual coupon. :he applica!le ta# rate is 2= percent. +hat is the value o the levered irm, A. 6182?98*1* ". 6182?=8*46 C. 61837*847? &. 6183798*=6 ). 6183138313

91. &o%n "edding has an unlevered cost o capital o 12 percent8 a cost o de!t o 9.= percent8 and a ta# rate o 2* percent. +hat is the target de!t-e(uity ratio i the targeted cost o e(uity is 14.41 percent, A. .62 ". .6= C. .91 &. .96 ). .=3

9*. 5ohnson :ire &istri!utors has de!t %ith !oth a ace and a mar1et value o 61*8777. :his de!t has a coupon rate o 6 percent and pays interest annually. :he e#pected earnings !e ore interest and ta#es are 6*81778 the ta# rate is 27 percent8 and the unlevered cost o capital is 11.9 percent. +hat is the irm's cost o e(uity, A. **.36 percent ". **.=9 percent C. *2.*7 percent &. *2.4? percent ). *4.13 percent

16-1?

Chapter 16 - Financial Leverage and Capital Structure Policy

92. Country -ar1ets has an unlevered cost o capital o 1* percent8 a ta# rate o 2= percent8 and e#pected earnings !e ore interest and ta#es o 6148977. :he company has 6118777 in !onds outstanding that have a 6 percent coupon and pay interest annually. :he !onds are selling at par value. +hat is the cost o e(uity, A. 1*.44 percent ". 12.26 percent C. 12.63 percent &. 13.79 percent ). 13.*? percent

93. :he PiBBa Palace has a cost o e(uity o 14.2 percent and an unlevered cost o capital o 11.= percent. :he company has 6**8777 in de!t that is selling at par value. :he levered value o the irm is 6318777 and the ta# rate is 23 percent. +hat is the pre-ta# cost o de!t, A. 3.92 percent ". 6.1= percent C. 6.4? percent &. 9.** percent ). ?.?* percent

94. :he Lreen Paddle has a cost o e(uity o 12.92 percent and a pre-ta# cost o de!t o 9.6 percent. :he de!t-e(uity ratio is 7.64 and the ta# rate is 2* percent. +hat is Lreen Paddle's unlevered cost o capital, A. 11.=4 percent ". 1*.9= percent C. 13.*? percent &. 13.36 percent ). 14.7= percent

96. "o!'s +arehouse has a pre-ta# cost o de!t o =.3 percent and an unlevered cost o capital o 13.6 percent. :he irm's ta# rate is 29 percent and the cost o e(uity is 1= percent. +hat is the irm's de!t-e(uity ratio, A. 7.9* ". 7.96 C. 7.9? &. 7.=* ). 7.=9

16-*7

Chapter 16 - Financial Leverage and Capital Structure Policy

99. &ouglass . Fran1 has a de!t-e(uity ratio o 7.34. :he pre-ta# cost o de!t is 9.6 percent %hile the unlevered cost o capital is 12.2 percent. +hat is the cost o e(uity i the ta# rate is 2? percent, A. 12.9? percent ". 13.=6 percent C. 14.?* percent &. 1=.37 percent ). 1=.=9 percent

9=. :he 5une "ug has a 6*978777 !ond issue outstanding. :hese !onds have a 9.4 percent coupon8 pay interest semiannually8 and have a current mar1et price e(ual to ?=.6 percent o ace value. :he ta# rate is 2? percent. +hat is the amount o the annual interest ta# shield, A. 628?3=.94 ". 63811*.67 C. 648211.** &. 698=?9.47 ). 6=8**4.*7

9?. Leorga's Eestaurants has 38477 !onds outstanding %ith a ace value o 618777 each and a coupon rate o =.*4 percent. :he interest is paid semi-annually. +hat is the amount o the annual interest ta# shield i the ta# rate is 29 percent, A. 6129826*.47 ". 616*8311.?7 C. 61=98947.77 &. 6*1783*7.77 ). 6*228==9.47

=7. &. L. :uc1ers has 6*18777 o de!t outstanding that is selling at par and has a coupon rate o 9.4 percent. :he ta# rate is 2* percent. +hat is the present value o the ta# shield, A. 6473 ". 6614 C. 6633 &. 668*77 ). 6689*7

16-*1

Chapter 16 - Financial Leverage and Capital Structure Policy

=1. 5emisen's has e#pected earnings !e ore interest and ta#es o 668*77. /ts unlevered cost o capital is 12 percent and its ta# rate is 23 percent. :he irm has de!t %ith !oth a !oo1 and a ace value o 6*8477. :his de!t has a ? percent coupon and pays interest annually. +hat is the irm's %eighted average cost o capital, A. 1*.3= percent ". 1*.66 percent C. 12.=9 percent &. 13.13 percent ). 13.29 percent

=*. A irm has de!t o 61*87778 a leveraged value o 6*683778 a pre-ta# cost o de!t o ?.*7 percent8 a cost o e(uity o 19.6 percent8 and a ta# rate o 29 percent. +hat is the irm's %eighted average cost o capital, A. 11.39 percent ". 11.4* percent C. 11.6? percent &. 1*.*2 percent ). 1*.3= percent

=2. Coung's Home Supply has a de!t-e(uity ratio o 7.=7. :he cost o e(uity is 13.4 percent and the a terta# cost o de!t is 3.? percent. +hat %ill the irm's cost o e(uity !e i the de!te(uity ratio is revised to 7.94, A. 17.=? percent ". 11.39 percent C. 11.97 percent &. 12.=? percent ). 13.*2 percent

=3. Percy's +holesale Supply has earnings !e ore interest and ta#es o 61768777. "oth the !oo1 and the mar1et value o de!t is 61978777. :he unlevered cost o e(uity is 14.4 percent %hile the pre-ta# cost o de!t is =.6 percent. :he ta# rate is 2= percent. +hat is the irm's %eighted average cost o capital, A. 11.?3 percent ". 1*.64 percent C. 12.34 percent &. 13.71 percent ). 13.29 percent

16-**

Chapter 16 - Financial Leverage and Capital Structure Policy

Essay Questions

=4. &ra% the ollo%ing t%o graphs8 one a!ove the other: /n the top graph8 plot irm value on the vertical a#is and total de!t on the horiBontal a#is. Gse this graph to illustrate the value o a irm under -.- %ithout ta#es8 -.- %ith ta#es8 and the static theory o capital structure. 0n the lo%er graph8 plot the +ACC on the vertical a#is and the de!t-e(uity ratio on the horiBontal a#is. Gse this second graph to illustrate the value o the irm's +ACC under -.%ithout ta#es8 -.- %ith ta#es8 and the static theory. "rie ly e#plain %hat the t%o graphs reveal a!out irm value and its cost o capital under the three di erent theories.

=6. "ased on the -.- propositions %ith and %ithout ta#es8 ho% much time should a inancial manager spend analyBing the capital structure o a irm, +hat i the analysis is !ased on the static theory,

=9. Pete is the CF0 o &e#ter /nternational. He %ould li1e to increase the de!t-e(uity ratio o the irm !ut is concerned that the irm's shareholders may not !e %illing to accept additional inancial leverage. Pete has come to you or advice. +hat is your recommendation,

16-*2

Chapter 16 - Financial Leverage and Capital Structure Policy

==. /n each o the theories o capital structure8 the cost o e(uity increases as the amount o de!t increases. So %hy don't inancial managers use as little de!t as possi!le to 1eep the cost o e(uity do%n, A ter all8 aren't inancial managers supposed to ma#imiBe the value o a irm,

=?. )#plain ho% a irm loses value during the !an1ruptcy process rom !oth a creditors and a shareholders perspective.

Multiple Choice Questions

?7. )ast Side8 /nc. has no de!t outstanding and a total mar1et value o 61268777. )arnings !e ore interest and ta#es8 )"/:8 are pro$ected to !e 61*8777 i economic conditions are normal. / there is strong e#pansion in the economy8 then )"/: %ill !e *9 percent higher. / there is a recession8 then )"/: %ill !e 44 percent lo%er. )ast Side is considering a 6438777 de!t issue %ith a 4 percent interest rate. :he proceeds %ill !e used to repurchase shares o stoc1. :here are currently *8777 shares outstanding. /gnore ta#es. / the economy enters a recession8 )PS %ill change !y >>>> percent as compared to a normal economy8 assuming that the irm recapitaliBes. A. -97.?9 percent ". -62.14 percent C. -4=.7= percent &. -3*.*? percent ). -2=.=9 percent

16-*3

Chapter 16 - Financial Leverage and Capital Structure Policy

?1. Morth Side8 /nc. has no de!t outstanding and a total mar1et value o 61948777. )arnings !e ore interest and ta#es8 )"/:8 are pro$ected to !e 6168777 i economic conditions are normal. / there is strong e#pansion in the economy8 then )"/: %ill !e 24 percent higher. / there is a recession8 then )"/: %ill !e 97 percent lo%er. Morth Side is considering a 6978777 de!t issue %ith a 9 percent interest rate. :he proceeds %ill !e used to repurchase shares o stoc1. :here are currently *8477 shares outstanding. Morth Side has a ta# rate o 23 percent. / the economy e#pands strongly8 )PS %ill change !y >>>> percent as compared to a normal economy8 assuming that the irm recapitaliBes. A. 2=.=7 percent ". 34.*6 percent C. 47.34 percent &. 42.?* percent ). 61.79 percent

?*. Lala#y Products is comparing t%o di erent capital structures8 an all-e(uity plan ;Plan /< and a levered plan ;Plan //<. Gnder Plan /8 Lala#y %ould have 19=8477 shares o stoc1 outstanding. Gnder Plan //8 there %ould !e 918377 shares o stoc1 outstanding and 61.9? million in de!t outstanding. :he interest rate on the de!t is 17 percent and there are no ta#es. +hat is the !rea1even )"/:, A. 6*=98=9=.9= ". 6*?=8222.22 C. 62418111.11 &. 62228222.22 ). 62318313.13

?2. A"C Co. and NCO Co. are identical irms in all respects e#cept or their capital structure. A"C is all e(uity inanced %ith 63=78777 in stoc1. NCO uses !oth stoc1 and perpetual de!tP its stoc1 is %orth 6*378777 and the interest rate on its de!t is 11 percent. "oth irms e#pect )"/: to !e 64=8377. /gnore ta#es. :he cost o e(uity or A"C is >>>>> percent8 and or NCO it is >>>>>> percent. A. 1*.19P 1*.6= ". 1*.19P 1*.?3 C. 1*.19P 12.22 &. 1*.*?P 1*.6= ). 1*.*?P 12.22

16-*4

Chapter 16 - Financial Leverage and Capital Structure Policy

?3. Lamont Corp. uses no de!t. :he %eighted average cost o capital is 11 percent. :he current mar1et value o the e(uity is 62= million and there are no ta#es. +hat is )"/:, A. 6283*28777 ". 62847=8677 C. 6289=18177 &. 628=?=8977 ). 6381=78777

?4. :he SLL Corp. uses no de!t. :he %eighted average cost o capital is 1* percent. :he current mar1et value o the e(uity is 621 million and the corporate ta# rate is 23 percent. +hat is )"/:, A. 6381=78777 ". 638=*181?3 C. 6486268263 &. 668*27871= ). 66846=8477

?6. +.A. :rees8 /nc. has a de!t-e(uity ratio o 1.3. /ts +ACC is 17 percent8 and its cost o de!t is ? percent. :he corporate ta# rate is 22 percent. +hat is the irm's unlevered cost o e(uity capital, A. 1*.2= percent ". 1*.9? percent C. 12.6= percent &. 13.17 percent ). 13.34 percent

?9. "ruce . Co. e#pects its )"/: to !e 61778777 every year orever. :he irm can !orro% at 17 percent. "ruce currently has no de!t8 and its cost o e(uity is *7 percent. :he ta# rate is 21 percent. +hat %ill the value o "ruce . Co. !e i the irm !orro%s 6438777 and uses the loan proceeds to repurchase shares, A. 6*=78127 ". 62368677 C. 62618937 &. 629=8?77 ). 62=184*7

16-*6

Chapter 16 - Financial Leverage and Capital Structure Policy

?=. "ruce . Co. e#pects its )"/: to !e 61778777 every year orever. :he irm can !orro% at 11 percent. "ruce currently has no de!t8 and its cost o e(uity is 1= percent. :he ta# rate is 21 percent. "ruce %ill !orro% 6618777 and use the proceeds to repurchase shares. +hat %ill the +ACC !e a ter recapitaliBation, A. 16.27 percent ". 16.=9 percent C. 19.14 percent &. 1=.*? percent ). 1=.=6 percent

??. Me% Schools8 /nc. e#pects an )"/: o 698777 every year orever. :he irm currently has no de!t8 and its cost o e(uity is 19 percent. :he irm can !orro% at = percent and the corporate ta# rate is 23 percent. +hat %ill the value o the irm !e i it converts to 47 percent de!t, A. 6*?8=91.19 ". 62189?6.39 C. 62*8379.16 &. 623844*.7= ). 629811?.27

16-*9

Chapter 16 - Financial Leverage and Capital Structure Policy

Chapter 16 Financial Leverage and Capital Structure Policy Ans%er Key

Multiple Choice Questions

1. Homemade leverage is: A. the incurrence o de!t !y a corporation in order to pay dividends to shareholders. ". the e#clusive use o de!t to und a corporate e#pansion pro$ect. C. the !orro%ing or lending o money !y individual shareholders as a means o ad$usting their level o inancial leverage. &. !est de ined as an increase in a irm's de!t-e(uity ratio. ). the term used to descri!e the capital structure o a levered irm. Ee er to section 16.*

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: )omemade le!erage

*. +hich one o the ollo%ing states that the value o a irm is unrelated to the irm's capital structure, A. Capital Asset Pricing -odel B. -.- Proposition / C. -.- Proposition // &. La% o 0ne Price ). ) icient -ar1ets Hypothesis Ee er to section 16.2

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%* 'o(ic: +,+ -ro(osition .

16-*=

Chapter 16 - Financial Leverage and Capital Structure Policy

2. +hich one o the ollo%ing states that a irm's cost o e(uity capital is directly and proportionally related to the irm's capital structure, A. Capital Asset Pricing -odel ". -.- Proposition / C. -.- Proposition // &. La% o 0ne Price ). ) icient -ar1ets Hypothesis Ee er to section 16.2

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%* 'o(ic: +,+ -ro(osition ..

3. +hich one o the ollo%ing is the e(uity ris1 that is most related to the daily operations o a irm, A. mar1et ris1 ". systematic ris1 C. e#trinsic ris1 D. !usiness ris1 ). inancial ris1 Ee er to section 16.2

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%* 'o(ic: Business ris/

16-*?

Chapter 16 - Financial Leverage and Capital Structure Policy

4. +hich one o the ollo%ing is the e(uity ris1 related to a irm's capital structure policy, A. mar1et ". systematic C. e#trinsic &. !usiness E. inancial Ee er to section 16.2

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%* 'o(ic: 0inancial ris/

6. "utter . 5elly reduced its ta#es last year !y 6247 !y increasing its interest e#pense !y 618777. +hich o the ollo%ing terms is used to descri!e this ta# savings, . interest ta# shield ". interest credit C. inancing shield &. current ta# yield ). ta#-loss interest Ee er to section 16.3

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%1 'o(ic: .nterest ta2 s3ield

16-27

Chapter 16 - Financial Leverage and Capital Structure Policy

9. :he unlevered cost o capital re ers to the cost o capital or a;n<: A. private entity. B. all-e(uity irm. C. governmental entity. &. private individual. ). corporate shareholder. Ee er to section 16.3

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%1 'o(ic: 4nle!ered cost of ca(ital

=. :he e#plicit costs8 such as legal and administrative e#penses8 associated %ith corporate de ault are classi ied as >>>>> costs. A. lotation ". issue C. direct !an1ruptcy &. indirect !an1ruptcy ). unlevered Ee er to section 16.4

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%5 'o(ic: Ban/ru(tcy costs

16-21

Chapter 16 - Financial Leverage and Capital Structure Policy

?. :he costs incurred !y a !usiness in an e ort to avoid !an1ruptcy are classi ied as >>>>> costs. A. lotation ". direct !an1ruptcy C. indirect !an1ruptcy &. inancial solvency ). capital structure Ee er to section 16.4

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%5 'o(ic: Ban/ru(tcy costs

17. "y de inition8 %hich o the ollo%ing costs are included in the term @ inancial distress costs@, /. direct !an1ruptcy costs //. indirect !an1ruptcy costs ///. direct costs related to !eing inancially distressed8 !ut not !an1rupt /A. indirect costs related to !eing inancially distressed8 !ut not !an1rupt A. / only ". /// only C. / and // only &. /// and /A only E. /8 //8 ///8 and /A Ee er to section 16.4

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%5 'o(ic: 0inancial distress costs

16-2*

Chapter 16 - Financial Leverage and Capital Structure Policy

11. :he proposition that a irm !orro%s up to the point %here the marginal !ene it o the interest ta# shield derived rom increased de!t is $ust e(ual to the marginal e#pense o the resulting increase in inancial distress costs is called: . the static theory o capital structure. ". -.- Proposition /. C. -.- Proposition //. &. the capital asset pricing model. ). the open mar1ets theorem. Ee er to section 16.6

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%# 'o(ic: Static t3eory of ca(ital structure

1*. +hich one o the ollo%ing is the legal proceeding under %hich an insolvent irm can !e reorganiBed, A. restructure process B. !an1ruptcy C. orced merger &. legal ta1eover ). rights o er Ee er to section 16.17

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%"6 'o(ic: Ban/ru(tcy

16-22

Chapter 16 - Financial Leverage and Capital Structure Policy

12. A !usiness irm ceases to e#ist as a going concern as a result o %hich one o the ollo%ing, A. divestiture ". share repurchase C. li(uidation &. reorganiBation ). capital restructuring Ee er to section 16.17

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%"6 'o(ic: Li7uidation

13. )d%ards Farm Products %as una!le to meet its inancial o!ligations and %as orced into using legal proceedings to restructure itsel so that it could continue as a via!le !usiness. :he process this irm under%ent is 1no%n as a: A. merger. ". repurchase program. C. li(uidation. D. reorganiBation. ). divestiture. Ee er to section 16.17

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%"6 'o(ic: 8eorgani9ation

16-23

Chapter 16 - Financial Leverage and Capital Structure Policy

14. :he a!solute priority rule determines: A. %hen a irm must !e declared o icially !an1rupt. ". ho% a distressed irm is reorganiBed. C. %hich $udge is assigned to a particular !an1ruptcy case. &. ho% long a reorganiBed irm is allo%ed to remain under !an1ruptcy protection. E. %hich parties receive payment irst in a !an1ruptcy proceeding. Ee er to section 16.17

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%"6 'o(ic: Absolute (riority rule

16. A irm should select the capital structure that: A. produces the highest cost o capital. B. ma#imiBes the value o the irm. C. minimiBes ta#es. &. is ully unlevered. ). e(uates the value o de!t %ith the value o e(uity. Ee er to section 16.1

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%" 'o(ic: Ca(ital structure

16-24

Chapter 16 - Financial Leverage and Capital Structure Policy

19. :he value o a irm is ma#imiBed %hen the: A. cost o e(uity is ma#imiBed. ". ta# rate is Bero. C. levered cost o capital is ma#imiBed. D. %eighted average cost o capital is minimiBed. ). de!t-e(uity ratio is minimiBed. Ee er to section 16.1

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%" 'o(ic: 0irm !alue

1=. :he optimal capital structure has !een achieved %hen the: A. de!t-e(uity ratio is e(ual to 1. ". %eight o e(uity is e(ual to the %eight o de!t. C. cost o e(uity is ma#imiBed given a pre-ta# cost o de!t. &. de!t-e(uity ratio is such that the cost o de!t e#ceeds the cost o e(uity. E. de!t-e(uity ratio results in the lo%est possi!le %eighted average cost o capital. Ee er to section 16.1

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%" 'o(ic: Ca(ital structure

16-26

Chapter 16 - Financial Leverage and Capital Structure Policy

1?. AA :ours is comparing t%o capital structures to determine ho% to !est inance its operations. :he irst option consists o all e(uity inancing. :he second option is !ased on a de!t-e(uity ratio o 7.34. +hat should AA :ours do i its e#pected earnings !e ore interest and ta#es ;)"/:< are less than the !rea1-even level, Assume there are no ta#es. A. select the leverage option !ecause the de!t-e(uity ratio is less than 7.47 ". select the leverage option since the e#pected )"/: is less than the !rea1-even level C. select the unlevered option since the de!t-e(uity ratio is less than 7.47 D. select the unlevered option since the e#pected )"/: is less than the !rea1-even level ). cannot !e determined rom the in ormation provided Ee er to section 16.*

AACSB: N/A Bloom's: Com(re3ension Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: 0inancial le!erage

*7. Cou have computed the !rea1-even point !et%een a levered and an unlevered capital structure. Assume there are no ta#es. At the !rea1-even level8 the: . irm is $ust earning enough to pay or the cost o the de!t. ". irm's earnings !e ore interest and ta#es are e(ual to Bero. C. earnings per share or the levered option are e#actly dou!le those o the unlevered option. &. advantages o leverage e#ceed the disadvantages o leverage. ). irm has a de!t-e(uity ratio o .47. Ee er to section 16.*

AACSB: N/A Bloom's: Com(re3ension Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: 0inancial le!erage

16-29

Chapter 16 - Financial Leverage and Capital Structure Policy

*1. +hich one o the ollo%ing statements is correct concerning the relationship !et%een a levered and an unlevered capital structure, Assume there are no ta#es. . At the !rea1-even point8 there is no advantage to de!t. ". :he earnings per share %ill e(ual Bero %hen )"/: is Bero or a levered irm. C. :he advantages o leverage are inversely related to the level o )"/:. &. :he use o leverage at any level o )"/: increases the )PS. ). )PS are more sensitive to changes in )"/: %hen a irm is unlevered. Ee er to section 16.*

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Brea/$e!en (oint

**. 5essica invested in Duantro stoc1 %hen the irm %as unlevered. Since then8 Duantro has changed its capital structure and no% has a de!t-e(uity ratio o 7.27. :o unlever her position8 5essica needs to: A. !orro% some money and purchase additional shares o Duantro stoc1. ". maintain her current e(uity position as the de!t o the irm did not a ect her personally. C. sell some shares o Duantro stoc1 and hold the proceeds in cash. D. sell some shares o Duantro stoc1 and loan out the sale proceeds. ). create a personal de!t-e(uity ratio o 7.27. Ee er to section 16.*

AACSB: N/A Bloom's: Com(re3ension Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: )omemade le!erage

16-2=

Chapter 16 - Financial Leverage and Capital Structure Policy

*2. +hich one o the ollo%ing ma1es the capital structure o a irm irrelevant, A. ta#es ". interest ta# shield C. 177 percent dividend payout ratio &. de!t-e(uity ratio that is greater than 7 !ut less than 1 E. homemade leverage Ee er to section 16.*

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: )omemade le!erage

*3. -.- Proposition / %ith no ta# supports the argument that: A. !usiness ris1 determines the return on assets. ". the cost o e(uity rises as leverage rises. C. the de!t-e(uity ratio o a irm is completely irrelevant. &. a irm should !orro% money to the point %here the ta# !ene it rom de!t is e(ual to the cost o the increased pro!a!ility o inancial distress. ). homemade leverage is irrelevant. Ee er to section 16.2

AACSB: N/A Bloom's: Com(re3ension Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%* 'o(ic: +,+ -ro(osition . wit3 no ta2

16-2?

Chapter 16 - Financial Leverage and Capital Structure Policy

*4. :he concept o homemade leverage is most associated %ith: . -.- Proposition / %ith no ta#. ". -.- Proposition // %ith no ta#. C. -.- Proposition / %ith ta#. &. -.- Proposition // %ith ta#. ). static theory proposition. Ee er to section 16.2

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%* 'o(ic: +,+ -ro(osition . wit3 no ta2

*6. +hich o the ollo%ing statements are correct in relation to -.- Proposition // %ith no ta#es, /. :he re(uired return on assets is e(ual to the %eighted average cost o capital. //. Financial ris1 is determined !y the de!t-e(uity ratio. ///. Financial ris1 determines the return on assets. /A. :he cost o e(uity declines %hen the amount o leverage used !y a irm rises. A. / and /// only ". // and /A only C. / and // only &. /// and /A only ). / and /A only Ee er to section 16.2

AACSB: N/A Bloom's: Com(re3ension Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%* 'o(ic: +,+ -ro(osition .. wit3 no ta2es

16-37

Chapter 16 - Financial Leverage and Capital Structure Policy

*9. -.- Proposition // is the proposition that: A. the capital structure o a irm has no e ect on the irm's value. ". the cost o e(uity depends on the return on de!t8 the de!t-e(uity ratio8 and the ta# rate. C. a irm's cost o e(uity is a linear unction %ith a slope e(ual to ;EA - E&<. &. the cost o e(uity is e(uivalent to the re(uired rate o return on a irm's assets. ). the siBe o the pie does not depend on ho% the pie is sliced. Ee er to section 16.2

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%* 'o(ic: +,+ -ro(osition ..

*=. :he !usiness ris1 o a irm: A. depends on the irm's level o unsystematic ris1. ". is inversely related to the re(uired return on the irm's assets. C. is dependent upon the relative %eights o the de!t and e(uity used to inance the irm. D. has a positive relationship %ith the irm's cost o e(uity. ). has no relationship %ith the re(uired return on a irm's assets according to -.Proposition //. Ee er to section 16.2

AACSB: N/A Bloom's: Com(re3ension Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%* 'o(ic: Business ris/

16-31

Chapter 16 - Financial Leverage and Capital Structure Policy

*?. +hich o the ollo%ing statements related to inancial ris1 are correct, /. Financial ris1 is the ris1 associated %ith the use o de!t inancing. //. As inancial ris1 increases so too does the cost o e(uity. ///. Financial ris1 is %holly dependent upon the inancial policy o a irm. /A. Financial ris1 is the ris1 that is inherent in a irm's operations. A. / and /// only ". // and /A only C. // and /// only D. /8 //8 and /// only ). /8 //8 ///8 and /A Ee er to section 16.2

AACSB: N/A Bloom's: Com(re3ension Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%* 'o(ic: 0inancial ris/

27. -.- Proposition / %ith ta# supports the theory that: . a irm's %eighted average cost o capital decreases as the irm's de!t-e(uity ratio increases. ". the value o a irm is inversely related to the amount o leverage used !y the irm. C. the value o an unlevered irm is e(ual to the value o a levered irm plus the value o the interest ta# shield. &. a irm's cost o capital is the same regardless o the mi# o de!t and e(uity used !y the irm. ). a irm's cost o e(uity increases as the de!t-e(uity ratio o the irm decreases. Ee er to section 16.3

AACSB: N/A Bloom's: Com(re3ension Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%1 'o(ic: +,+ -ro(osition . wit3 ta2es

16-3*

Chapter 16 - Financial Leverage and Capital Structure Policy

21. -.- Proposition / %ith ta#es is !ased on the concept that: A. the optimal capital structure is the one that is totally inanced %ith e(uity. ". the capital structure o a irm does not matter !ecause investors can use homemade leverage. C. a irm's +ACC is una ected !y a change in the irm's capital structure. D. the value o a irm increases as the irm's de!t increases !ecause o the interest ta# shield. ). the cost o e(uity increases as the de!t-e(uity ratio o a irm increases. Ee er to section 16.3

AACSB: N/A Bloom's: Com(re3ension Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%1 'o(ic: +,+ -ro(osition . wit3 ta2es

2*. -.- Proposition // %ith ta#es: . has the same general implications as -.- Proposition // %ithout ta#es. ". states that a irm's capital structure is irrelevant. C. supports the argument that !usiness ris1 is determined !y the capital structure decision. &. supports the argument that the cost o e(uity decreases as the de!t-e(uity ratio increases. ). concludes that the capital structure decision is irrelevant to the value o a irm. Ee er to section 16.3

AACSB: N/A Bloom's: Com(re3ension Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%1 'o(ic: +,+ -ro(osition .. wit3 ta2es

16-32

Chapter 16 - Financial Leverage and Capital Structure Policy

22. :he present value o the interest ta# shield is e#pressed as: A. ;:C &<FEA. ". AG H ;:C &<. C. I)"/: ;:C &<JFEG. &. I)"/: ;:C &<JFEA. E. :c &. Ee er to section 16.3

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%1 'o(ic: -: of interest ta2 s3ield

23. :he interest ta# shield has no value %hen a irm has a: /. ta# rate o Bero. //. de!t-e(uity ratio o 1. ///. Bero de!t. /A. Bero leverage. A. / and /// only ". // and /A only C. /8 ///8 and /A only &. //8 ///8 and /A only ). /8 //8 and /A only Ee er to section 16.3

AACSB: N/A Bloom's: Com(re3ension Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%1 'o(ic: .nterest ta2 s3ield

16-33

Chapter 16 - Financial Leverage and Capital Structure Policy

24. :he interest ta# shield is a 1ey reason %hy: A. the re(uired rate o return on assets rises %hen de!t is added to the capital structure. ". the value o an unlevered irm is e(ual to the value o a levered irm. C. the net cost o de!t to a irm is generally less than the cost o e(uity. &. the cost o de!t is e(ual to the cost o e(uity or a levered irm. ). irms pre er e(uity inancing over de!t inancing. Ee er to section 16.3

AACSB: N/A Bloom's: Com(re3ension Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%1 'o(ic: .nterest ta2 s3ield

26. "ased on -.- Proposition // %ith ta#es8 the %eighted average cost o capital: A. is e(ual to the a terta# cost o de!t. ". has a linear relationship %ith the cost o e(uity capital. C. is una ected !y the ta# rate. D. decreases as the de!t-e(uity ratio increases. ). is e(ual to EG ;1 - :C<. Ee er to section 16.3

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%1 'o(ic: +,+ -ro(osition .. wit3 ta2es

16-34

Chapter 16 - Financial Leverage and Capital Structure Policy

29. "an1ruptcy: A. creates value or a irm. B. trans ers value rom shareholders to !ondholders. C. technically occurs %hen total e(uity e(uals total de!t. &. costs are limited to legal and administrative ees. ). is an ine#pensive means o reorganiBing a irm. Ee er to section 16.4

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%5 'o(ic: Ban/ru(tcy

2=. +hich one o the ollo%ing is a direct !an1ruptcy cost, A. company C)0's time spent in !an1ruptcy court ". maintaining cash reserves C. maintaining a de!t-e(uity ratio that is lo%er than the optimal ratio &. losing a 1ey company employee E. paying an outside accountant ees to prepare !an1ruptcy reports Ee er to section 16.4

AACSB: N/A Bloom's: Com(re3ension Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%5 'o(ic: Ban/ru(tcy costs

16-36

Chapter 16 - Financial Leverage and Capital Structure Policy

2?. / a irm has the optimal amount o de!t8 then the: A. direct inancial distress costs must e(ual the present value o the interest ta# shield. B. value o the levered irm %ill e#ceed the value o the irm i it %ere unlevered. C. value o the irm is minimiBed. &. value o the irm is e(ual to AL H :C &. ). de!t-e(uity ratio is e(ual to 1.7. Ee er to section 16.6

AACSB: N/A Bloom's: Com(re3ension Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%# 'o(ic: O(timal ca(ital structure

37. +hich one o the ollo%ing has the greatest tendency to increase the percentage o de!t included in the optimal capital structure o a irm, A. e#ceptionally high depreciation e#penses ". very lo% marginal ta# rate C. su!stantial ta# shields rom other sources D. lo% pro!a!ilities o inancial distress ). minimal ta#a!le income Ee er to section 16.6

AACSB: N/A Bloom's: Com(re3ension Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%# 'o(ic: O(timal ca(ital structure

16-39

Chapter 16 - Financial Leverage and Capital Structure Policy

31. :he capital structure that ma#imiBes the value o a irm also: A. minimiBes inancial distress costs. B. minimiBes the cost o capital. C. ma#imiBes the present value o the ta# shield on de!t. &. ma#imiBes the value o the de!t. ). ma#imiBes the value o the unlevered irm. Ee er to section 16.6

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%# 'o(ic: O(timal ca(ital structure

3*. :he optimal capital structure: A. %ill !e the same or all irms in the same industry. ". %ill remain constant over time unless the irm changes its primary operations. C. %ill vary over time as ta#es and mar1et conditions change. &. places more emphasis on operations than on inancing. ). is una ected !y changes in the inancial mar1ets. Ee er to section 16.6

AACSB: N/A Bloom's: Com(re3ension Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%# 'o(ic: O(timal ca(ital structure

16-3=

Chapter 16 - Financial Leverage and Capital Structure Policy

32. :he static theory o capital structure advocates that the optimal capital structure or a irm: A. is dependent on a constant de!t-e(uity ratio over time. ". remains i#ed over time. C. is independent o the irm's ta# rate. &. is independent o the irm's %eighted average cost o capital. E. e(uates the ta# savings rom an additional dollar o de!t to the increased !an1ruptcy costs related to that additional dollar o de!t. Ee er to section 16.6

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%# 'o(ic: Static t3eory of ca(ital structure

33. :he !asic lesson o -.- :heory is that the value o a irm is dependent upon: A. the irm's capital structure. B. the total cash lo% o the irm. C. minimiBing the mar1eted claims. &. the amount o mar1eted claims to that irm. ). siBe o the stoc1holders' claims. Ee er to section 16.9

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%; 'o(ic: +,+ '3eory

16-3?

Chapter 16 - Financial Leverage and Capital Structure Policy

34. +hich orm o inancing do irms pre er to use irst according to the pec1ing-order theory, A. regular de!t ". converti!le de!t C. common stoc1 &. pre erred stoc1 E. internal unds Ee er to section 16.=

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%< 'o(ic: -ec/ing$order t3eory

36. +hich o the ollo%ing are correct according to pec1ing-order theory, /. Firms stoc1pile internally-generated cash. //. :here is an inverse relationship !et%een a irm's pro it level and its de!t level. ///. Firms avoid e#ternal de!t at all costs. /A. A irm's capital structure is dictated !y its need or e#ternal inancing. A. / and /// only ". // and /A only C. /8 ///8 and /A only D. /8 //8 and /A only ). /8 //8 ///8 and /A Ee er to section 16.=

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%< 'o(ic: -ec/ing$order t3eory

16-47

Chapter 16 - Financial Leverage and Capital Structure Policy

39. Corporations in the G.S. tend to: A. minimiBe ta#es. B. underutiliBe de!t. C. rely less on e(uity inancing than they should. &. have relatively similar de!t-e(uity ratios across industry lines. ). rely more heavily on de!t than on e(uity as the ma$or source o inancing. Ee er to section 16.?

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%= 'o(ic: Ca(ital structure

3=. /n general8 the capital structures used !y G.S. irms: A. tend to over%eigh de!t in relation to e(uity. ". generally result in de!t-e(uity ratios !et%een 7.34 and 7.67. C. are airly standard or all S/C codes. &. tend to !e those %hich ma#imiBe the use o the irm's availa!le ta# shelters. E. vary signi icantly across industries. Ee er to section 16.?

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%= 'o(ic: Ca(ital structure

16-41

Chapter 16 - Financial Leverage and Capital Structure Policy

3?. A irm is technically insolvent %hen: A. it has a negative !oo1 value. ". total de!t e#ceeds total e(uity. C. it is una!le to meet its inancial o!ligations. &. it iles or !an1ruptcy protection. ). the mar1et value o its stoc1 is less than its !oo1 value. Ee er to section 16.17

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%"6 'o(ic: 'ec3nical insol!ency

47. +hich one o the ollo%ing statements related to Chapter 9 !an1ruptcy is correct, A. A irm in Chapter 9 !an1ruptcy is reorganiBing its operations such that it can return to !eing a via!le concern. B. Gnder a Chapter 9 !an1ruptcy8 a trustee %ill assume control o the irm's assets until those assets can !e li(uidated. C. Chapter 9 !an1ruptcies are al%ays involuntary on the part o the irm. &. Gnder a Chapter 9 !an1ruptcy8 the claims o creditors are paid prior to the administrative costs o the !an1ruptcy. ). Chapter 9 !an1ruptcy allo%s a irm to restructure its e(uity such that ne% shares o stoc1 are generally issued prior to the irm coming out o !an1ruptcy. Ee er to section 16.17

AACSB: N/A Bloom's: Com(re3ension Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%"6 'o(ic: Ban/ru(tcy

16-4*

Chapter 16 - Financial Leverage and Capital Structure Policy

41. +hich one o the ollo%ing %ill generally have the highest priority %hen assets are distri!uted in a !an1ruptcy proceeding, A. consumer claim ". dividend payment to pre erred shareholder C. company contri!ution to the employees' retirement account &. payment to an unsecured creditor E. payment o employee %ages Ee er to section 16.17

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%"6 'o(ic: Ban/ru(tcy

4*. A irm may ile or Chapter 11 !an1ruptcy: /. in an attempt to gain a competitive advantage. //. using a prepac1. ///. %hile allo%ing the current management to continue running the irm. /A. only a ter the irm !ecomes insolvent. A. / and /// only ". / and // only C. /8 //8 and /A only D. /8 //8 and /// only ). /8 //8 ///8 and /A Ee er to section 16.17

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%"6 'o(ic: Ban/ru(tcy

16-42

Chapter 16 - Financial Leverage and Capital Structure Policy

42. :he "an1ruptcy A!use Prevention and Consumer Protection Act o *774: A. permits creditors to ile a prepac1 immediately a ter a irm iles or !an1ruptcy protection. ". prevents creditors rom su!mitting any reorganiBation plans. C. prevents irms rom iling or !an1ruptcy protection more than once. D. permits 1ey employee retention plans only i an employee has another $o! o er. ). allo%s irms to pay !onuses to all 1ey employees to entice those employees to remain in the irm's employ. Ee er to section 16.17

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%"6 'o(ic: Ban/ru(tcy

43. Kelso )lectric is de!ating !et%een a leveraged and an unleveraged capital structure. :he all e(uity capital structure %ould consist o 378777 shares o stoc1. :he de!t and e(uity option %ould consist o *48777 shares o stoc1 plus 6*=78777 o de!t %ith an interest rate o 9 percent. +hat is the !rea1-even level o earnings !e ore interest and ta#es !et%een these t%o options, /gnore ta#es. A. 63*8*7= ". 6338131 C. 6368222 &. 63?8669 E. 64*8*69 )"/:F378777 Q I)"/: - ;6*=78777 7.79<JF*48777P )"/: Q 64*8*69

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Brea/$e!en >B.'

16-43

Chapter 16 - Financial Leverage and Capital Structure Policy

44. Holly's is currently an all e(uity irm that has ?8777 shares o stoc1 outstanding at a mar1et price o 63* a share. :he irm has decided to leverage its operations !y issuing 61*78777 o de!t at an interest rate o ?.4 percent. :his ne% de!t %ill !e used to repurchase shares o the outstanding stoc1. :he restructuring is e#pected to increase the earnings per share. +hat is the minimum level o earnings !e ore interest and ta#es that the irm is e#pecting, /gnore ta#es. . 6248?17 ". 62=8416 C. 63*8777 &. 6338131 ). 63487*7 )"/:F?8777 Q I)"/: - ;61*78777 7.7?4<JFI?8777 - ;61*78777F63*<JP )"/: Q 6248?17

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Brea/$e!en >B.'

46. Se%er's Paradise is an all e(uity irm that has 48777 shares o stoc1 outstanding at a mar1et price o 614 a share. :he irm's management has decided to issue 6278777 %orth o de!t and use the unds to repurchase shares o the outstanding stoc1. :he interest rate on the de!t %ill !e 17 percent. +hat are the earnings per share at the !rea1-even level o earnings !e ore interest and ta#es, /gnore ta#es. A. 61.36 B. 61.47 C. 61.69 &. 61.== ). 61.?3 Mum!er o shares repurchased Q 6278777F614 Q *8777 )"/:F48777 Q I)"/: - ;6278777 .7.17<JF;48777 - *8777<P )"/: Q 698477 )PS Q I698477 - ;6278777 7.17<JF;48777 - *8777<P )PS Q 61.47

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Brea/$e!en >-S

16-44

Chapter 16 - Financial Leverage and Capital Structure Policy

49. -iller's &ry Loods is an all e(uity irm %ith 348777 shares o stoc1 outstanding at a mar1et price o 647 a share. :he company's earnings !e ore interest and ta#es are 61*=8777. -iller's has decided to add leverage to its inancial operations !y issuing 6*478777 o de!t at = percent interest. :he de!t %ill !e used to repurchase shares o stoc1. Cou o%n 377 shares o -iller's stoc1. Cou also loan out unds at = percent interest. Ho% many shares o -iller's stoc1 must you sell to o set the leverage that -iller's is assuming, Assume you loan out all o the unds you receive rom the sale o stoc1. /gnore ta#es. A. 24.6 shares ". 37.7 shares C. 33.3 shares &. 39.4 shares ). 47.1 shares -iller's interest Q 6*478777 7.7= Q 6*78777 -iller's shares repurchased Q 6*478777F647 Q 48777 -iller's shares outstanding %ith de!t Q 348777 - 48777 Q 378777 -iller's )PS8 no de!t Q 61*=8777F348777 Q 6*.=33333 -iller's )PS8 %ith de!t Q ;61*=8777 - 6*78777<F378777 Q 6*.97 -iller's value o stoc1 Q 378777 647 Q 6*87778777 -iller's value o de!t Q 6*478777 -iller's total value Q 6*87778777 H 6*478777 Q 6*8*478777 -iller's %eight stoc1 Q 6*87778777F6*8*478777 Q 7.=====? -iller's %eight de!t Q 6*478777F6*8*478777 Q 7.111111 Cour initial investment Q 377 647 Q 6*78777 Cour ne% stoc1 position Q 7.=====? 6*78777 Q 6198999.9= Cour ne% num!er o shares Q 6198999.9=F647 Q 244.4446 Mum!er o shares sold Q 377 - 244.4446 Q 33.3 shares C3ec/: ?our new loans @ 6%"""""" A&6B666 @ A&B&&&%&& ?our total unle!ered income @ 166 A&%<11111 @ A"B"*;%;< ?our total le!ered income @ C*55%555# A&%;6D E CA&B&&&%&& 6%6<D @ A"B"*;%;<

AACSB: Analytic Bloom's: Analysis Difficulty: .ntermediate Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: )omemade le!erage

16-46

Chapter 16 - Financial Leverage and Capital Structure Policy

4=. Cou currently o%n 677 shares o 5KL8 /nc. 5KL is an all e(uity irm that has 948777 shares o stoc1 outstanding at a mar1et price o 637 a share. :he company's earnings !e ore interest and ta#es are 61378777. 5KL has decided to issue 61 million o de!t at = percent interest. :his de!t %ill !e used to repurchase shares o stoc1. Ho% many shares o 5KL stoc1 must you sell to unlever your position i you can loan out unds at = percent interest, A. 1*7 shares ". 147 shares C. 1=7 shares D. *77 shares ). *47 shares 5KL interest Q 61m 7.7= Q 6=78777 5KL shares repurchased Q 61mF637 Q *48777 5KL shares outstanding %ith de!t Q 948777 - *48777 Q 478777 5KL )PS8 no de!t Q 61378777F948777 Q 61.=66669 5KL )PS8 %ith de!t Q ;61378777 - 6=78777<F478777 Q 61.*7 5KL value o stoc1 Q 478777 637 Q 6*m 5KL value o de!t Q 61m 5KL total value Q 6*m H 61m Q 62m 5KL %eight stoc1 Q 6*mF62m Q *F2 5KL %eight de!t Q 61mF62m Q 1F2 Cour initial investment Q 677 637 Q 6*38777 Cour ne% stoc1 position Q *F2;6*38777< Q 6168777 Cour ne% num!er o shares Q 6168777F637 Q 377 Mum!er o shares sold Q 677 - 377 Q *77 shares C3ec/: ?our new loans @ "/*CA&1B666D @ A<B666 ?our unle!ered income @ #66 A"%<####; @ A"B"&6 ?our le!ered income @ C166 A"%&6D E CA<B666 6%6<D @ A"B"&6

AACSB: Analytic Bloom's: Analysis Difficulty: .ntermediate Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: )omemade le!erage

16-49

Chapter 16 - Financial Leverage and Capital Structure Policy

4?. Maylor's is an all e(uity irm %ith 678777 shares o stoc1 outstanding at a mar1et price o 647 a share. :he company has earnings !e ore interest and ta#es o 6=98777. Maylor's has decided to issue 69478777 o de!t at 9.4 percent. :he de!t %ill !e used to repurchase shares o the outstanding stoc1. Currently8 you o%n 477 shares o Maylor's stoc1. Ho% many shares o Maylor's stoc1 %ill you continue to o%n i you unlever this position, Assume you can loan out unds at 9.4 percent interest. /gnore ta#es. A. 277 shares ". 247 shares C. 294 shares &. 3*4 shares ). 477 shares Maylor's interest Q 69478777 7.794 Q 6468*47 Maylor's shares repurchased Q 69478777F647 Q 148777 Maylor's shares outstanding %ith de!t Q 678777 - 148777 Q 348777 Maylor's )PS8 no de!t Q 6=98777F678777 Q 61.34 Maylor's )PS8 %ith de!t Q ;6=98777 - 6468*47<F348777 Q 67.6=2222 Maylor's value o stoc1 Q 348777 647 Q 6*8*478777 Maylor's value o de!t Q 69471 Maylor's total value Q 6*8*478777 H 69478777 Q 6287778777 Maylor's %eight stoc1 Q 6*8*478777F6287778777 Q 7.94 Maylor's %eight de!t Q 69478777F6287778777 Q 7.*4 Cour initial investment Q 477 647 Q 6*48777 Cour ne% stoc1 position Q 7.94 6*48777 Q 61=8947 Cour ne% num!er o shares Q 61=8947F647 Q 294 shares C3ec/: ?our new loans @ 6%&5 A&5B666 @ A#B&56 ?our unle!ered income @ 566 A"%15 @ A;&5 ?our le!ered income @ C*;5 A6%#<****D E CA#B&56 6%6;5D @ A;&5

AACSB: Analytic Bloom's: Analysis Difficulty: .ntermediate Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: )omemade le!erage

16-4=

Chapter 16 - Financial Leverage and Capital Structure Policy

67. Pe%ter . Llass is an all e(uity irm that has =78777 shares o stoc1 outstanding. :he company is in the process o !orro%ing 66778777 at ? percent interest to repurchase 1*8777 shares o the outstanding stoc1. +hat is the value o this irm i you ignore ta#es, A. 6*.4 million B. 63.7 million C. 64.7 million &. 64.4 million ). 66.7 million Firm value Q =78777 ;66778777F1*8777< Q 63 million

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%* 'o(ic: 0irm !alue

61. :he 5ean 0utlet is an all e(uity irm that has 1368777 shares o stoc1 outstanding. :he company has decided to !orro% the 61.1 million to repurchase 98477 shares o its stoc1 rom the estate o a deceased shareholder. +hat is the total value o the irm i you ignore ta#es, A. 61=82=9897* ". 61=84778777 C. 61?86668669 &. 6*187778777 E. 6*183128222 Firm value Q 1368777 ;61.1mF98477< Q 6*183128222

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%* 'o(ic: 0irm !alue

16-4?

Chapter 16 - Financial Leverage and Capital Structure Policy

6*. Stacy o%ns 2= percent o :he :o%n Centre. She has decided to retire and %ants to sell all o her shares in this closely held8 all e(uity irm. :he other shareholders have agreed to have the irm !orro% 66478777 to purchase her shares o stoc1. +hat is the total mar1et value o :he :o%n Centre, /gnore ta#es. . 61891784*6 ". 61893=8*1? C. 61899187=? &. 618=718376 ). 618=7=863? Firm value Q 66478777F7.2= Q 61891784*6

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%* 'o(ic: 0irm !alue

62. +inter's :oyland has a de!t-e(uity ratio o 7.9*. :he pre-ta# cost o de!t is =.9 percent and the re(uired return on assets is 16.1 percent. +hat is the cost o e(uity i you ignore ta#es, A. 1?.21 percent ". 1?.93 percent C. *7.*? percent &. *7.36 percent E. *1.32 percent E) Q 7.161 H ;7.161 - 7.7=9< 7.9* Q *1.32 percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%* 'o(ic: +,+ -ro(osition ..

16-67

Chapter 16 - Financial Leverage and Capital Structure Policy

63. 5e erson . &aughter has a cost o e(uity o 13.6 percent and a pre-ta# cost o de!t o 9.= percent. :he re(uired return on the assets is 12.* percent. +hat is the irm's de!t-e(uity ratio !ased on -.- // %ith no ta#es, . 7.*6 ". 7.22 C. 7.29 &. 7.32 ). 7.34 E) Q 7.136 Q 7.12* H ;7.12* - 7.79=< &F)P &F) Q 7.*6

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%* 'o(ic: +,+ -ro(osition ..

64. :he Corner "a1ery has a de!t-e(uity ratio o 7.43. :he irm's re(uired return on assets is 13.* percent and its cost o e(uity is 16.1 percent. +hat is the pre-ta# cost o de!t !ased on -.- Proposition // %ith no ta#es, A. 9.17 percent ". =.9? percent C. 17.6= percent &. 19.46 percent ). 1=.37 percent E) Q 7.161 Q 7.13* H ;7.13* - Ed< 7.43P Ed Q 17.6= percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%* 'o(ic: +,+ -ro(osition ..

16-61

Chapter 16 - Financial Leverage and Capital Structure Policy

66. L.A. Clothing has e#pected earnings !e ore interest and ta#es o 63=8?778 an unlevered cost o capital o 13.4 percent8 and a ta# rate o 23 percent. :he company also has 6=8777 o de!t that carries a 9 percent coupon. :he de!t is selling at par value. +hat is the value o this irm, A. 6***849?.21 ". 6**28222.22 C. 6**3817=.16 D. 6**48*??.21 ). 6**48396.?1 AG Q I63=8?77 ;1 - 7.23<JF7.134 Q 6***849?.21 AL Q 6***849?.21 H 7.23 ;6=8777< Q 6**48*??.21

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%1 'o(ic: +,+ -ro(osition . wit3 ta2es

69. Hanover :ech is currently an all e(uity irm that has 2*78777 shares o stoc1 outstanding %ith a mar1et price o 61? a share. :he current cost o e(uity is 14.3 percent and the ta# rate is 26 percent. :he irm is considering adding 61.* million o de!t %ith a coupon rate o = percent to its capital structure. :he de!t %ill !e sold at par value. +hat is the levered value o the e(uity, A. 64.*7? million B. 64.21* million C. 64.326 million &. 66.41* million ). 66.97= million AL Q ;2*78777 61?< H ;7.26 61.*m< Q 66.41*m A) Q 66.41*m - 61.*m Q 64.21*m

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%1 'o(ic: +,+ -ro(osition . wit3 ta2es

16-6*

Chapter 16 - Financial Leverage and Capital Structure Policy

6=. "right -orning Foods has e#pected earnings !e ore interest and ta#es o 63=86778 an unlevered cost o capital o 12.* percent8 and de!t %ith !oth a !oo1 and ace value o 6*48777. :he de!t has an =.4 percent coupon. :he ta# rate is 23 percent. +hat is the value o the irm, A. 6*348477 ". 6*398677 C. 6*418477 &. 6*638=77 ). 6*918277 AG Q I63=8677 ;1 - 7.23<J F7.12* Q 6*328777 AL Q 6*328777 H ;7.23 6*48777< Q 6*418477

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%1 'o(ic: +,+ -ro(osition . wit3 ta2es

6?. )#ports Gnlimited is an unlevered irm %ith an a terta# net income o 6398=77. :he unlevered cost o capital is 13.1 percent and the ta# rate is 2* percent. +hat is the value o this irm, A. 6*978=69 ". 6*?382=7 C. 622?8779 &. 629=8333 ). 633983=? AG Q 6398=77F7.131 Q 622?8779

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%1 'o(ic: +,+ -ro(osition . wit3 ta2es

16-62

Chapter 16 - Financial Leverage and Capital Structure Policy

97. An unlevered irm has a cost o capital o 19.4 percent and earnings !e ore interest and ta#es o 62*98477. A levered irm %ith the same operations and assets has !oth a !oo1 value and a ace value o de!t o 66478777 %ith a 9.4 percent annual coupon. :he applica!le ta# rate is 2= percent. +hat is the value o the levered irm, A. 6182?98*1* ". 6182?=8*46 C. 61837*847? D. 6183798*=6 ). 6183138313 AG Q I62*98477 ;1 - 7.2=<JF7.194 Q 6181678*=4.91 AL Q 6181678*=4.91 H 7.2=;66471< Q 6183798*=6

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%1 'o(ic: +,+ -ro(osition . wit3 ta2es

91. &o%n "edding has an unlevered cost o capital o 12 percent8 a cost o de!t o 9.= percent8 and a ta# rate o 2* percent. +hat is the target de!t-e(uity ratio i the targeted cost o e(uity is 14.41 percent, A. .62 ". .6= C. .91 &. .96 ). .=3 E) Q 7.1441 Q 7.12 H ;7.12 - 7.79=< &F) ;1 - 7.2*<P &F) Q 7.91