Professional Documents

Culture Documents

IT Depreciation - User Manual

Uploaded by

unfriendly.gy2268Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IT Depreciation - User Manual

Uploaded by

unfriendly.gy2268Copyright:

Available Formats

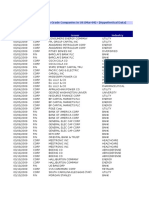

Following scenarios are considered in this document:1. Creation of Asset 2. Acquisition of Asset External Internal 3.

3. Retirement of Asset With customer Without customer 4. Income tax depreciation thereon

1. Creation of Asset:- (AS01)

India Specific data tab controls the IT depreciation. Hence from now on we do not require group asset as the Block key and the additional block key (Additional block key only in case of Plant & Machinery for additional depreciation) calculates the IT depreciation.

One can ignore Tax bal. sht. Depreciation key.

2. External acquisition of Asset:- (F-90)

External acquisition completed Calculation of Income tax depreciation Update transaction details at block level (J1INBLKTRNS)

Once you have verified the transaction go to main screen, remove tick from test run and execute again

One can also view the transactions at asset level (J1IDISPBLK)

Before one goes for viewing Income tax depreciation on the current transactions on prerequisite is to update the Opening WDV (J1INBLKOWDV)

After that, run the Income tax depreciation calculation report (J1IDEPCALPOST)

Note: Calculation of additional depreciation as per Income tax

2. Internal acquisition of Asset:Creation of Internal Order (KO01)

Booking cost against the internal order (FB60)

Settlement of Rs. 10,000 against AUC (Automatic settlement) (KO88)

Booking another cost against the internal order (FB60)

Settlement of Rs. 10,000 against AUC (Automatic settlement) (KO88)

Uncheck Test run

AUC balance should show Rs. 30,000 as balance. AW01N (Asset explorer)

Note: Value date would remain the settlement date. Creation of Asset to which AUC is to be settled (AS01)

We will have to change the settlement rule and add this asset in the rule.(KO02)

Now we will settle AUC against Main asset (KO88)

Uncheck Test run and then execute Asset Explorer (AW01N)

Calculation of Income tax depreciation Update transaction details at block level (J1INBLKTRNS) Note: If transactions have already been updated for a particular period (Irrespective of the block) select Re-Run and uncheck test run to update.

Before one goes for viewing Income tax depreciation on the current transactions on prerequisite is to update the Opening WDV (J1INBLKOWDV)

After that, run the Income tax depreciation calculation report (J1IDEPCALPOST)

3. Retirement with Customer (F-92) Enter the FA sales clearing account on the credit side by the amount of sale proceeds

After that click on the asset retirement option

After that it will guide you to another screen Enter the asset number to be retired and if the asset was acquired in current year only select transaction type 260 else 210. Also enter amount to be written off from the book value

Calculation of Income tax depreciation Update transaction details at block level (J1INBLKTRNS) After that, run the Income tax depreciation calculation report (J1IDEPCALPOST) 4. Retirement without Customer (ABAON)

Calculation of Income tax depreciation Update transaction details at block level (J1INBLKTRNS) After that, run the Income tax depreciation calculation report (J1IDEPCALPOST)

You might also like

- Manual Bank Reconciliation Using Excel UploadDocument25 pagesManual Bank Reconciliation Using Excel UploadGavin MonteiroNo ratings yet

- AIAB & AIBU & AIST - AUC Settlement & ReversalDocument10 pagesAIAB & AIBU & AIST - AUC Settlement & Reversalvaishaliak2008No ratings yet

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)From EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Rating: 3 out of 5 stars3/5 (1)

- Chapter 16 Extended Withholding Taxes-1 PDFDocument30 pagesChapter 16 Extended Withholding Taxes-1 PDFsowmyanaval0% (1)

- IT Depreciation India ConfigDocument10 pagesIT Depreciation India Configunfriendly.gy2268No ratings yet

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Interpretation Algorithms SAP DocumentationDocument4 pagesInterpretation Algorithms SAP Documentationsrinivas100% (1)

- Assets Capitalization Routing Through CWIP or AuC With IODocument3 pagesAssets Capitalization Routing Through CWIP or AuC With IORavindra Jain100% (2)

- Sap Bank MBRS and EBRS ConfigarationDocument34 pagesSap Bank MBRS and EBRS ConfigarationdevarajNo ratings yet

- Cross-Company - Inter-Company Transactions - SAP BlogsDocument26 pagesCross-Company - Inter-Company Transactions - SAP Blogspuditime100% (1)

- SAP Asset Tax DepreciationDocument2 pagesSAP Asset Tax DepreciationThatra K ChariNo ratings yet

- GST JV S4 Configuration&ProcessDocument6 pagesGST JV S4 Configuration&Processpraveer100% (1)

- Srinivas SAP Withholding TaxDocument3 pagesSrinivas SAP Withholding TaxsrinivasNo ratings yet

- F.19 - GR - IR RegroupingDocument9 pagesF.19 - GR - IR RegroupingDiogo Oliveira SilvaNo ratings yet

- FSCM-Collection Management - Ver 1Document38 pagesFSCM-Collection Management - Ver 1rajan karkiNo ratings yet

- Withholding TaxDocument31 pagesWithholding TaxharishNo ratings yet

- F-04 GL Account ClearingDocument8 pagesF-04 GL Account ClearingMillionn Gizaw0% (1)

- SABRIX ExerciseGuideDocument10 pagesSABRIX ExerciseGuidefrankfurtsolarNo ratings yet

- Isd Process V1Document3 pagesIsd Process V1Anand PrakashNo ratings yet

- Importing and Processing Credit Card Test File in SAP FI-TVDocument17 pagesImporting and Processing Credit Card Test File in SAP FI-TVAnupam DasNo ratings yet

- SAP FSCM Dispute Management Case Study Dow CorningDocument29 pagesSAP FSCM Dispute Management Case Study Dow Corningvenky3105No ratings yet

- Configuration Document For Prepaid Expense AutomationDocument28 pagesConfiguration Document For Prepaid Expense AutomationAjinkya MohadkarNo ratings yet

- SAP LockboxDocument7 pagesSAP Lockboxatlanta00100% (1)

- Plants Abroad - How ToDocument6 pagesPlants Abroad - How ToLuc De Winter100% (3)

- J1IG ISDN Process v1Document7 pagesJ1IG ISDN Process v1KAMALJEET SINGH100% (1)

- GST in STO ConfigurationDocument6 pagesGST in STO ConfigurationcsremsahilNo ratings yet

- Sap Functionality For Accounting of Prepaid ExpensesDocument3 pagesSap Functionality For Accounting of Prepaid ExpensesVanshika Narang100% (1)

- Specify Account Assignment Types For Account Assignment ObjeDocument3 pagesSpecify Account Assignment Types For Account Assignment ObjeharishNo ratings yet

- Multiple Shift DepreciationDocument10 pagesMultiple Shift DepreciationRanjit Raje100% (2)

- F 13 Automatic ClearingDocument9 pagesF 13 Automatic Clearingkrishna_1238No ratings yet

- Post Revaluations and New ValuationsDocument4 pagesPost Revaluations and New ValuationsfungayingorimaNo ratings yet

- Input and Output Tax Configuration SAPDocument7 pagesInput and Output Tax Configuration SAPAhmed KhanNo ratings yet

- SAP S4HANA FICO & TRM Month End & Period End Closing ActivityDocument3 pagesSAP S4HANA FICO & TRM Month End & Period End Closing ActivityNadiaNo ratings yet

- SAP FSCM Interview QuestionsDocument3 pagesSAP FSCM Interview QuestionsusasidharNo ratings yet

- F.13 Vendor Automatic Account ClearingDocument4 pagesF.13 Vendor Automatic Account ClearingVenkateswara PratapNo ratings yet

- Chapter 24 - Asset Management ConfigurationDocument23 pagesChapter 24 - Asset Management ConfigurationShine KaippillyNo ratings yet

- 3 Planning Layout Planner ProfileDocument17 pages3 Planning Layout Planner ProfileNarayan Adapa100% (2)

- Common Errors at The Time of Executing J1inchlnDocument4 pagesCommon Errors at The Time of Executing J1inchlnPavan KocherlakotaNo ratings yet

- ABUMN & ABT1N - Transfer of AssetsDocument18 pagesABUMN & ABT1N - Transfer of Assetsvaishaliak2008100% (2)

- SAP FI - Automatic Payment Program (Configuration and Run)Document26 pagesSAP FI - Automatic Payment Program (Configuration and Run)ravi sahNo ratings yet

- User Manual For FSCMDocument74 pagesUser Manual For FSCMDurga Tripathy Dpt100% (1)

- SAP FI Dunning Procedure For Customer Outstanding InvoicesDocument11 pagesSAP FI Dunning Procedure For Customer Outstanding Invoicesficokiran88No ratings yet

- Asset Under ConstructionDocument18 pagesAsset Under ConstructionSandhya AbhishekNo ratings yet

- Depreciation KeyDocument10 pagesDepreciation KeyM SAI SHRAVAN KUMAR100% (1)

- Lockbox ConfigurationDocument22 pagesLockbox ConfigurationSagar ReddYNo ratings yet

- Actual Costs Across Multiple Company Codes Using A New Business Function in SAP Enhancement Package 5 For SAP ERP 6 0Document12 pagesActual Costs Across Multiple Company Codes Using A New Business Function in SAP Enhancement Package 5 For SAP ERP 6 0aliNo ratings yet

- Err in Acc Det FF709Document5 pagesErr in Acc Det FF709PavilionNo ratings yet

- TDS Provision EntryDocument5 pagesTDS Provision EntryvijayshedgeNo ratings yet

- FF63 Create Memo RecordDocument3 pagesFF63 Create Memo RecordloanltkNo ratings yet

- SAP General Controlling Configurationgfdgfdfdgfdsgdsg: Step 1: Define Your Controlling AreaDocument20 pagesSAP General Controlling Configurationgfdgfdfdgfdsgdsg: Step 1: Define Your Controlling AreaJyotiraditya BanerjeeNo ratings yet

- Withholding TaxDocument18 pagesWithholding Taxraju aws100% (1)

- Clearing and Posting Specific To Ledger GroupsDocument5 pagesClearing and Posting Specific To Ledger GroupsNaveen SgNo ratings yet

- Sabrix Tax Trouble Shooting GuideDocument14 pagesSabrix Tax Trouble Shooting GuideSanthosh DevassyNo ratings yet

- FI - Bank AccountingDocument9 pagesFI - Bank Accountingpuditime100% (2)

- EBS For SAPDocument1 pageEBS For SAPZahid Hussain100% (1)

- BRS Confg in Sap PDFDocument25 pagesBRS Confg in Sap PDFSANTOSH VAISHYANo ratings yet

- SAP Automatic Payment ProgramDocument13 pagesSAP Automatic Payment Programmpsingh1122No ratings yet

- Foreign Currency Valuation Process in SapDocument4 pagesForeign Currency Valuation Process in Sappepeillo75No ratings yet

- AXA GUIDE - Distributor Agreement PDFDocument16 pagesAXA GUIDE - Distributor Agreement PDFunfriendly.gy22680% (1)

- Ratio Analysis in SAPDocument2 pagesRatio Analysis in SAPunfriendly.gy2268No ratings yet

- ChartOfAccount YAIN 2013Document20 pagesChartOfAccount YAIN 2013unfriendly.gy2268No ratings yet

- Year End Break Anecdotes Ebook - FinalDocument40 pagesYear End Break Anecdotes Ebook - Finalunfriendly.gy2268No ratings yet

- Sap Accounting EntriesDocument8 pagesSap Accounting Entriesashish sawantNo ratings yet

- PF27212D - COPA Planning - Revenue.v1Document29 pagesPF27212D - COPA Planning - Revenue.v1unfriendly.gy2268No ratings yet

- BirthdayDocument53 pagesBirthdayunfriendly.gy2268100% (1)

- Mt940 Format IdbiDocument2 pagesMt940 Format Idbiunfriendly.gy2268No ratings yet

- Hand Book - SAP-Taxation IndiaDocument116 pagesHand Book - SAP-Taxation IndiaNpsw Social-workers100% (5)

- Guidebook Kidney DialysisDocument88 pagesGuidebook Kidney Dialysisunfriendly.gy2268No ratings yet

- Physician & Dialysis - Economics Matters: Umesh KhannaDocument3 pagesPhysician & Dialysis - Economics Matters: Umesh Khannaunfriendly.gy2268No ratings yet

- Cats FaqDocument19 pagesCats Faqunfriendly.gy2268No ratings yet

- UntitledDocument2 pagesUntitledunfriendly.gy2268No ratings yet

- IMA Statement of EthicsDocument2 pagesIMA Statement of Ethicsunfriendly.gy2268No ratings yet

- Ima Icwai 5Document5 pagesIma Icwai 5unfriendly.gy2268No ratings yet

- Accounting ManualDocument86 pagesAccounting ManualSaeed Rasool100% (1)

- Management Study Case - Martinez ConstructionDocument5 pagesManagement Study Case - Martinez ConstructionCristina IonescuNo ratings yet

- Anual Report of WiproDocument29 pagesAnual Report of WiproSuman GumansinghNo ratings yet

- Egypt Innovation EcosystemDocument40 pagesEgypt Innovation EcosystememanNo ratings yet

- Plastic Syring and Disposable Needle Making PlantDocument25 pagesPlastic Syring and Disposable Needle Making PlantJohnNo ratings yet

- Buscom Lecture-3Document4 pagesBuscom Lecture-3Dai SyNo ratings yet

- MICON EngineeringDocument39 pagesMICON EngineeringAnbalagan AnbaNo ratings yet

- The Social Responsibility of Business Is To Increase Its ProfitsDocument12 pagesThe Social Responsibility of Business Is To Increase Its ProfitsRobert PalmerNo ratings yet

- Aegon Gtaa PresDocument23 pagesAegon Gtaa PresRohit ChandraNo ratings yet

- Project Proposal by Nigah-E-Nazar FatimiDocument8 pagesProject Proposal by Nigah-E-Nazar Fatiminazarfcma5523100% (3)

- Syllabus MGMT E-2790 Private Equity Spring 2016 1-1Document8 pagesSyllabus MGMT E-2790 Private Equity Spring 2016 1-1veda20No ratings yet

- Ambit Capital - Strategy - Can 'Value' Investors Make Money in India (Thematic) PDFDocument15 pagesAmbit Capital - Strategy - Can 'Value' Investors Make Money in India (Thematic) PDFRobert StanleyNo ratings yet

- Investor Awareness ProgramDocument7 pagesInvestor Awareness Programdeepti sharmaNo ratings yet

- Capital Investment Decisions and The Time Value of Money PDFDocument89 pagesCapital Investment Decisions and The Time Value of Money PDFKelvin Tey Kai WenNo ratings yet

- Investment Options Physical and Financial Products Investment ManagementDocument24 pagesInvestment Options Physical and Financial Products Investment ManagementluvnehaNo ratings yet

- Issue Date Issue Type Issuer Industry: US$ Bond Issues From High Grade Companies in US (Mar-09) - (Hypothetical Data)Document10 pagesIssue Date Issue Type Issuer Industry: US$ Bond Issues From High Grade Companies in US (Mar-09) - (Hypothetical Data)ayush jainNo ratings yet

- Audit Planning Memorandum FinalDocument12 pagesAudit Planning Memorandum Finalnirmaldeval80% (5)

- Chapter 1Document28 pagesChapter 1WilliamNo ratings yet

- Internal Audit ManualDocument92 pagesInternal Audit Manualdhuvadpratik100% (8)

- ACCA F7 Revision Mock June 2013 ANSWERS Version 4 FINAL at 25 March 2013 PDFDocument24 pagesACCA F7 Revision Mock June 2013 ANSWERS Version 4 FINAL at 25 March 2013 PDFPiyal Hossain100% (1)

- United States Bankruptcy Court Southern District of New YorkDocument178 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Engro Equity AnalysisDocument59 pagesEngro Equity Analysissazk07No ratings yet

- A Study On Financial Performance Analysis at City Union BankDocument15 pagesA Study On Financial Performance Analysis at City Union BankManjunath ShettyNo ratings yet

- Grameen Bank: Voluntary Social Systems in ActionDocument48 pagesGrameen Bank: Voluntary Social Systems in ActionAvedhesh VyasNo ratings yet

- Chapter 23 CPWD ACCOUNTS CODEDocument17 pagesChapter 23 CPWD ACCOUNTS CODEarulraj1971No ratings yet

- ACCA P4 Study Guide OpenTuition PDFDocument5 pagesACCA P4 Study Guide OpenTuition PDFHamd ImranNo ratings yet

- Ong v. Tiu Case DigestDocument3 pagesOng v. Tiu Case DigestNa-eehs Noicpecnoc Namzug0% (1)

- International Marketing Plan For Tata Swach Water PurifierDocument45 pagesInternational Marketing Plan For Tata Swach Water PurifierHitesh Goyal100% (3)

- SPL Annual Report 2010 FinancialDocument65 pagesSPL Annual Report 2010 FinancialHAFIZJEE9041No ratings yet

- Final Investment Banking Black BookDocument106 pagesFinal Investment Banking Black BookVikash Maurya86% (28)