Professional Documents

Culture Documents

Derivatives Trading by Financial Companies, 2013

Uploaded by

Jay LeeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derivatives Trading by Financial Companies, 2013

Uploaded by

Jay LeeCopyright:

Available Formats

Financial Supervisory Service www.fss.or.

kr

Press Release

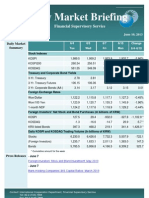

April 1, 2014 Derivatives Trading by Financial Companies, 2013 Trading volume Financial companies traded derivatives of KRW57,121 trillion in 2013, down 5.7% or KRW3,443 trillion from a year earlier. Exchange-traded derivatives declined, contributing to the drop in total derivatives trading volume, while OTC derivatives trading remained similar to the previous year. Table 1. Derivatives Trading by Financial Companies

2011 Exchange-traded OTC Total 70,011 12,940 82,951 2012 48,420 12,144 60,564 (In trillions of KRW, percent) Chng 2013 Amount Pct 45,101 -3,319 -6.9 12,020 -124 -1.0 57,121 -5.7 -3,443

Stock-related and currency-related derivatives trading declined, while interest raterelated and credit- related derivatives trading increased. Stock-related derivatives declined 8.6% to KRW37,456 trillion, due to a drop in securities companies proprietary trading of futures and options amid low volatility of the index. Currency-related derivatives also declined 3.4% to KRW9,957 trillion, due to a drop in currency forwards by banks amid low foreign exchange rate volatility. In the meantime, interest rate-related derivatives increased 4.7% to KRW9,634 trillion, due to a rise in interest rate swaps by banks and securities companies with high speculative and hedging demand amid increased volatility of interest rates. Creditrelated derivatives also increased 46.1% to KRW41 trillion, due to a rise in credit default swap trading by securities companies.

1/3

Financial Supervisory Service www.fss.or.kr

Table 2. Derivatives Trading by Type and Sector

(In trillions of KRW) 2013 2012 Total Bank Securities Insurance Trust1 Others2 Stock-related 40,988 37,456 83 36,879 25 153 316 Futures & options 40,825 37,334 58 36,786 21 153 316 Interest rate-related 9,203 9,634 3,605 5,352 32 152 493 Interest rate swaps 2,320 2,588 2,199 385 1 2 1 Currency-related 10,307 9,957 8,721 668 43 381 144 Currency forwards 9,107 8,695 8,089 252 26 322 6 Credit-related 28 41 3 37 1 0 0 CDS 21 33 3 30 0 0 0 Others3 38 33 12 14 0 6 1 Total 60,564 57,121 12,424 42,950 101 692 954 1 Trust sector includes funds of asset management firms and trust accounts of banks and securities firms. 2 Other financial companies include merchant banks, futures companies, and credit card companies 3 Other derivatives include jewelries, other metals, and agricultural, livestock and fisheries products.

Securities companies accounted for 75.2% of total derivatives trading, mostly with stock-related derivatives that account for the lions share, followed by banks 21.7%, futures companies 1.7%, trust 1.2% and insurance companies 0.2%. The majority of counterparties to OTC derivatives trading were foreign financial companies (35.6%) and foreign bank branches in Korea (31.1%). Outstanding volume The outstanding balance of total derivatives at the end of 2013 came to KRW6,904 trillion, up 0.7% or KRW46 trillion from a year earlier. Both exchange-traded and OTC derivatives increased and, in particular, the outstanding balance of exchange-traded derivatives increased due to the extended holding period, despite a drop in trading volume. A rise in OTC derivatives holdings by securities companies driven by increased hedging demand greatly contributed to the rise in total OTC derivatives balance. Table 3. Outstanding Balance of Derivatives

2011 Exchange-traded OTC Total 70 6,911 6,981 2012 76 6,782 6,858 (In trillions of KRW, percent) Chng 2013 Amount Pct 83 7 9.5 6,821 39 0.6 6,904 46 0.7

By sector, banks accounted for 88.0% as they mostly trade currency-related and interest rate-related derivatives with relatively long maturity, followed by securities companies 10.6%, insurance companies 0.6% and trust 0.6%. Despite continued slump in exchange-traded derivatives trading, OTC derivatives trading remained stable due to its growing popularity as a tool of long-term risk management. The share of securities companies in OTC derivatives market has been on the rise from 5.2% in 2011 to 10.0% in 2013. In addition, the type of the underlying assets of ELS and DLS is having a greater impact on the trading in the derivatives

2/3

Financial Supervisory Service www.fss.or.kr

markets as the ELS and DLS market grew steadily.

###

Contact Person: Park Mi-Kyung Foreign Press Spokesperson Public Affairs Office Financial Supervisory Service Tel: +82-2-3145-5803 Fax: +82-2-3145-5808 E-mail: pmk620@fss.or.kr

3/3

You might also like

- STOCK INDICES & MARKET PERFORMANCEDocument15 pagesSTOCK INDICES & MARKET PERFORMANCEKayshiel Agus100% (1)

- OTC Derivatives Market OverviewDocument58 pagesOTC Derivatives Market Overviewharishsingh313027No ratings yet

- Summary - The 5 Secrets To Highly Profitable Swing TradingDocument2 pagesSummary - The 5 Secrets To Highly Profitable Swing TradingSweety Das100% (2)

- Lehman Brothers: Guide To Exotic Credit DerivativesDocument60 pagesLehman Brothers: Guide To Exotic Credit DerivativesCrodoleNo ratings yet

- ForexDocument59 pagesForexMehul MalaviyaNo ratings yet

- ABM APPLIED ECONOMICS 12 - Q1 - W1 - Mod1 Revised PDFDocument14 pagesABM APPLIED ECONOMICS 12 - Q1 - W1 - Mod1 Revised PDFArlene Astoveza100% (4)

- Strategic Management Simulation ReportDocument8 pagesStrategic Management Simulation ReportSoorajKrishnanNo ratings yet

- Principles of Marketing - Q2 Module 9 - Grade-11Document27 pagesPrinciples of Marketing - Q2 Module 9 - Grade-11Michael Fernandez Arevalo100% (1)

- Guide To Profitable Forex TradingDocument75 pagesGuide To Profitable Forex TradingDenys ShyshkinNo ratings yet

- Marble Industry AFG AISA 2012Document62 pagesMarble Industry AFG AISA 2012rasselahsanNo ratings yet

- Case Study of MaricoDocument48 pagesCase Study of MaricoDhruv Mehra67% (9)

- Monopoly Market StructureDocument17 pagesMonopoly Market StructureMeet PasariNo ratings yet

- The Comprehensive Management Plan For Algorithmic Trading in The KRX Derivatives MarketDocument26 pagesThe Comprehensive Management Plan For Algorithmic Trading in The KRX Derivatives MarketJay LeeNo ratings yet

- Banks 1st Q 2012Document36 pagesBanks 1st Q 2012annawitkowski88No ratings yet

- Ecnm Derivados Financieros OCC Dq112Document36 pagesEcnm Derivados Financieros OCC Dq112Bentejui San Gines MolinaNo ratings yet

- Wells Fargo Company and US BancorpDocument9 pagesWells Fargo Company and US BancorpKassem MoukaddemNo ratings yet

- Balance SheetDocument6 pagesBalance Sheet012345asNo ratings yet

- Statistical Release: OTC Derivatives Statistics at End-December 2013Document28 pagesStatistical Release: OTC Derivatives Statistics at End-December 2013Κούλα ΒάμβαNo ratings yet

- FBM Klci - Daily: Near Term ConsolidationDocument3 pagesFBM Klci - Daily: Near Term ConsolidationFaizal FazilNo ratings yet

- Introduction to Currency ExchangeDocument54 pagesIntroduction to Currency ExchangeMansi KotakNo ratings yet

- 379WeeklyJuly23 2006Document2 pages379WeeklyJuly23 2006partha_biswas_uiuNo ratings yet

- Mortgage Covered Bonds Investor ReportDocument3 pagesMortgage Covered Bonds Investor ReportPaulo Jorge OliveiraNo ratings yet

- How Can Derivatives Be Used For Risk Management?: How It Works (Example)Document4 pagesHow Can Derivatives Be Used For Risk Management?: How It Works (Example)melissa cardozNo ratings yet

- Q6, June 2015Document16 pagesQ6, June 2015HafsaNo ratings yet

- Stock Market Decline Individual Assignment ReportDocument3 pagesStock Market Decline Individual Assignment ReportFerdaus RaihanNo ratings yet

- SSRN Id2404449Document14 pagesSSRN Id2404449David IoanaNo ratings yet

- Financial Performance of Dhaka BankDocument6 pagesFinancial Performance of Dhaka Bankdiu_diptoNo ratings yet

- The Australian Otc Derivatives Market Insights From New Trade Repository DataDocument22 pagesThe Australian Otc Derivatives Market Insights From New Trade Repository DataFaizaNo ratings yet

- Definition of Money MarketsDocument21 pagesDefinition of Money Marketsnelle de leonNo ratings yet

- Market Outlook 23rd December 2011Document4 pagesMarket Outlook 23rd December 2011Angel BrokingNo ratings yet

- Financial RiskxDocument8 pagesFinancial Riskxjulita08No ratings yet

- ICI Research - CEFDocument16 pagesICI Research - CEFmuzizhuNo ratings yet

- Press Release - 20 January, 2012: ST STDocument7 pagesPress Release - 20 January, 2012: ST STNimesh MomayaNo ratings yet

- An Overview of The Emerging Market Credit Derivatives MarketDocument7 pagesAn Overview of The Emerging Market Credit Derivatives MarketprashantanhNo ratings yet

- Banking Industry ReportDocument9 pagesBanking Industry Reporthayisco_fc456No ratings yet

- Roaring Bangladesh Capital Market 2010Document7 pagesRoaring Bangladesh Capital Market 2010Sajid RahmanNo ratings yet

- NTB - 1H2013 Earnings Note - BUY - 27 August 2013Document4 pagesNTB - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkNo ratings yet

- Bond Market Development in East Asia: Reserve Bank of Australia BulletinDocument8 pagesBond Market Development in East Asia: Reserve Bank of Australia BulletinjirachavalitNo ratings yet

- 1 Eng Report 06 eDocument8 pages1 Eng Report 06 eNora SafwatNo ratings yet

- Practice Essentials Understanding Commodities and The SP GsciDocument7 pagesPractice Essentials Understanding Commodities and The SP GsciPhilip LeonardNo ratings yet

- FY 2012-13 First Quarter Results: Investor PresentationDocument31 pagesFY 2012-13 First Quarter Results: Investor PresentationSai KalyanNo ratings yet

- Banking Sector January 2011Document2 pagesBanking Sector January 2011Sharon ManziniNo ratings yet

- Daily Trade Journal - 18.06.2013Document7 pagesDaily Trade Journal - 18.06.2013Randora LkNo ratings yet

- Daily Trade Journal - 03.12.2013Document6 pagesDaily Trade Journal - 03.12.2013Randora LkNo ratings yet

- Case StudyDocument10 pagesCase StudykarthinathanNo ratings yet

- Key Points To Note On Financial Markets (AutoRecovered)Document13 pagesKey Points To Note On Financial Markets (AutoRecovered)SAP PI AUTOMATIONSNo ratings yet

- Asteri Capital (Glencore)Document4 pagesAsteri Capital (Glencore)Brett Reginald ScottNo ratings yet

- Market Review Week Ending Jan 4Document2 pagesMarket Review Week Ending Jan 4Moses Michael-PhiriNo ratings yet

- Act4220 Portfolio Ex03695Document14 pagesAct4220 Portfolio Ex03695NANTHINI A/P VIJEYAN / UPMNo ratings yet

- Icici Bank: Performance HighlightsDocument16 pagesIcici Bank: Performance HighlightsAngel BrokingNo ratings yet

- Bank's Risk Management ProcessDocument2 pagesBank's Risk Management ProcessJudith CastroNo ratings yet

- Article Reivew of Financial Institution & MarketDocument21 pagesArticle Reivew of Financial Institution & MarketKetema AsfawNo ratings yet

- DemonstraDocument78 pagesDemonstraBVMF_RINo ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Debt InstrumentsDocument5 pagesDebt InstrumentsŚáńtőśh MőkáśhíNo ratings yet

- Original FCDocument106 pagesOriginal FCSneha SwethaNo ratings yet

- Deutche Bank Doc 1 - Deutsche Bank at A GlanceDocument14 pagesDeutche Bank Doc 1 - Deutsche Bank at A GlanceUriGrodNo ratings yet

- Vietnam Money Market: Íinstruments, Participants and Trading ProcessDocument34 pagesVietnam Money Market: Íinstruments, Participants and Trading ProcessNguyen Thi Phuong DungNo ratings yet

- Money Market TMDocument6 pagesMoney Market TMpetut zipagangNo ratings yet

- td140220 2Document7 pagestd140220 2Joyce SampoernaNo ratings yet

- Derivatives Report 31st DecDocument3 pagesDerivatives Report 31st DecAngel BrokingNo ratings yet

- CNH Tracker Aug 12 2011Document2 pagesCNH Tracker Aug 12 2011Kevin PlumbergNo ratings yet

- Achieving High Returns Safely: Use Safe Money Market InstrumentsFrom EverandAchieving High Returns Safely: Use Safe Money Market InstrumentsNo ratings yet

- The Investment Industry for IT Practitioners: An Introductory GuideFrom EverandThe Investment Industry for IT Practitioners: An Introductory GuideNo ratings yet

- Weekly Market Briefing (January 13, 2014)Document1 pageWeekly Market Briefing (January 13, 2014)Jay LeeNo ratings yet

- Weekly Market Briefing (April 7, 2014)Document1 pageWeekly Market Briefing (April 7, 2014)Jay LeeNo ratings yet

- Weekly Market Briefing (January 6, 2014)Document1 pageWeekly Market Briefing (January 6, 2014)Jay LeeNo ratings yet

- Investigation Results On Unfair Securities Trading Practices, First Half 2014 PDFDocument2 pagesInvestigation Results On Unfair Securities Trading Practices, First Half 2014 PDFJay LeeNo ratings yet

- Weekly Newsletter (December 23, 2013, Vol. XIV, No. 51)Document1 pageWeekly Newsletter (December 23, 2013, Vol. XIV, No. 51)Jay LeeNo ratings yet

- Weekly Market Briefing (July 1, 2013)Document1 pageWeekly Market Briefing (July 1, 2013)Jay LeeNo ratings yet

- Weekly Market Briefing (September 16, 2013)Document1 pageWeekly Market Briefing (September 16, 2013)Jay LeeNo ratings yet

- Weekly Market Briefing (September 23, 2013)Document1 pageWeekly Market Briefing (September 23, 2013)Jay LeeNo ratings yet

- Weekly Market Briefing (Aug 26, 2013)Document1 pageWeekly Market Briefing (Aug 26, 2013)Jay LeeNo ratings yet

- Weekly Market Briefing (December 30, 2013)Document1 pageWeekly Market Briefing (December 30, 2013)Jay LeeNo ratings yet

- Weekly Newsletter (September 9, 2013)Document1 pageWeekly Newsletter (September 9, 2013)Jay LeeNo ratings yet

- Weekly Market Briefing (July 1, 2013)Document1 pageWeekly Market Briefing (July 1, 2013)Jay LeeNo ratings yet

- Weekly Market Briefing (July 1, 2013)Document1 pageWeekly Market Briefing (July 1, 2013)Jay LeeNo ratings yet

- Weekly Market Briefing (Aug 7, 2013)Document2 pagesWeekly Market Briefing (Aug 7, 2013)Jay LeeNo ratings yet

- Weekly Market Briefing (July 22)Document1 pageWeekly Market Briefing (July 22)Jay LeeNo ratings yet

- Weekly Market Briefing (May 27, 2013, Vol. XIV, No. 21)Document1 pageWeekly Market Briefing (May 27, 2013, Vol. XIV, No. 21)Jay LeeNo ratings yet

- Weekly Market Briefing (Aug 12, 2013)Document1 pageWeekly Market Briefing (Aug 12, 2013)Jay LeeNo ratings yet

- Weekly Newsletter (June 24, 2013, Vol. XIV, No. 25)Document1 pageWeekly Newsletter (June 24, 2013, Vol. XIV, No. 25)Jay LeeNo ratings yet

- Weekly Market Briefing (July 1, 2013)Document1 pageWeekly Market Briefing (July 1, 2013)Jay LeeNo ratings yet

- Weekly Market Briefing (July 1, 2013)Document1 pageWeekly Market Briefing (July 1, 2013)Jay LeeNo ratings yet

- Weekly Market Briefing (June 3, 2013)Document1 pageWeekly Market Briefing (June 3, 2013)Jay LeeNo ratings yet

- Best Execution Policy For Korean ATSDocument5 pagesBest Execution Policy For Korean ATSJay LeeNo ratings yet

- Weekly Market Briefing (July 1, 2013)Document1 pageWeekly Market Briefing (July 1, 2013)Jay LeeNo ratings yet

- 24 Weekly Newsletter June 17, 2013Document1 page24 Weekly Newsletter June 17, 2013Jay LeeNo ratings yet

- Korea Stock Market VolatilityDocument5 pagesKorea Stock Market VolatilityJay LeeNo ratings yet

- Weekly Market Brifing June 10, 2013Document1 pageWeekly Market Brifing June 10, 2013Jay LeeNo ratings yet

- Weekly Newsletter (May 13, 2013, Vol. XIV, No. 19)Document1 pageWeekly Newsletter (May 13, 2013, Vol. XIV, No. 19)Jay LeeNo ratings yet

- Weekly Newsletter (May 13, 2013, Vol. XIV, No. 19)Document1 pageWeekly Newsletter (May 13, 2013, Vol. XIV, No. 19)Jay LeeNo ratings yet

- Study Materials: Vedantu Innovations Pvt. Ltd. Score High With A Personal Teacher, Learn LIVE Online!Document17 pagesStudy Materials: Vedantu Innovations Pvt. Ltd. Score High With A Personal Teacher, Learn LIVE Online!Krish ModiNo ratings yet

- Theories of Regulation and Appl To Acc and Aud PracticesDocument31 pagesTheories of Regulation and Appl To Acc and Aud PracticesWan Mohd Rujhan RaqibiNo ratings yet

- The Use of Marketing Management Tools in E-CommerceDocument11 pagesThe Use of Marketing Management Tools in E-CommerceAnuraag AgarwalNo ratings yet

- A Study On Financial Derivatives (Future and Option)Document56 pagesA Study On Financial Derivatives (Future and Option)Avadhut0% (2)

- E-Tailing - The Mantra of Modern Retailer'S Success: Mr. P. Sathish Chandra, Dr. G. SunithaDocument7 pagesE-Tailing - The Mantra of Modern Retailer'S Success: Mr. P. Sathish Chandra, Dr. G. SunithaGourav ChaudharyNo ratings yet

- Lawn Master Manufactures Riding Lawn Mowers That It Sells ToDocument1 pageLawn Master Manufactures Riding Lawn Mowers That It Sells ToAmit PandeyNo ratings yet

- NISM certification exams and fees overviewDocument2 pagesNISM certification exams and fees overviewPraveen TiwariNo ratings yet

- Vegetable Price Surge in KathmanduDocument1 pageVegetable Price Surge in KathmanduGulEFarisFaris50% (2)

- Module 2 - Marketing Mix of ServicesDocument23 pagesModule 2 - Marketing Mix of Serviceseshu agNo ratings yet

- Lecture-3: Market Equilibrium and Applications: Abdul Quadir XlriDocument37 pagesLecture-3: Market Equilibrium and Applications: Abdul Quadir Xlrianu balakrishnanNo ratings yet

- Aakash Maan: ContactDocument2 pagesAakash Maan: ContactAakash MaanNo ratings yet

- Marketing Strategy RevisedDocument50 pagesMarketing Strategy RevisedpayalNo ratings yet

- Case 2-4 Ethics and AirbusDocument2 pagesCase 2-4 Ethics and AirbusJhoana Sanchez50% (4)

- Order 57002 - Urban OutfittersDocument27 pagesOrder 57002 - Urban OutfittersWandera BonfaceNo ratings yet

- Edited Version of Micro-Economics Tutorial Sheet 33333Document2 pagesEdited Version of Micro-Economics Tutorial Sheet 33333FaithNo ratings yet

- Case Study On Sales & Distribution ManagementDocument9 pagesCase Study On Sales & Distribution ManagementMOHD.ARISH100% (1)

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument48 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. Brownsumairjawed8116No ratings yet

- Project Consumer BehaviorDocument5 pagesProject Consumer BehaviorBilalNo ratings yet

- Britinnia Cheese: A Class Assignment ReportDocument15 pagesBritinnia Cheese: A Class Assignment ReportAshwani RaiNo ratings yet

- Name: Theng Kimay Class: Year: T204Document4 pagesName: Theng Kimay Class: Year: T204ALex LimNo ratings yet

- Case Study South Dakota MicrobreweryDocument1 pageCase Study South Dakota Microbreweryjman02120No ratings yet

- 1 Introduction To ConsumerDocument100 pages1 Introduction To ConsumermhlakNo ratings yet