Professional Documents

Culture Documents

8 Valuation Techniques to Value Any Stock

Uploaded by

Night LightOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

8 Valuation Techniques to Value Any Stock

Uploaded by

Night LightCopyright:

Available Formats

The Ultimate Guide to

by Jae Jun

Learn and Profit using 8 Valuation

Techniques to Value Any Stock

Stock

Valuation

03. How to Use and What to Expect

04. Introduction to Stock Valuation

05. Taking a Bird's Eye View

08. Benjamin Graham's "Net Net" Stocks

12. Graham's Growth Formula for Value

Stocks

18. Intrinsic Value of a Business

20. How to Value Stocks Using DCF

26. How to Value a Stock with Reverse DCF

28. Katsenelson's Absolute PE Model

http://www.oldschoolvalue.com

Table of Contents

35. Valuing Stocks with EBIT Multiples

38. What is Asset Reproduction Value?

45. The Full Earnings Power Value (EPV)

51. Your Valuation, Your Art, Your Way

52. Bonus: Top 7 Books on Valuation and

Analysis

56. About the Author

57. Get Started with Old School Value

The Ultimate Guide to Stock Valuation

How to Use & What to Expect

http://www.oldschoolvalue.com

The Ultimate Guide to Stock Valuation

Thank you for your interest in this book.

This book is best served as a companion to the Old

School Value Stock Analyzer and its sole focus is

to guide you through a variety of ways to value

stocks.

It assumes that you already have a working

knowledge of accounting and understanding of

financial numbers.

Throughout the book, you will see examples and

screenshots that were taken from various parts of

the Stock Analyzer to help you visualize and

understand.

Even if you are not a user of the Stock Analyzer, you

will find it easy to follow along and apply yourself.

Click on images that look too small. It will open up a

bigger version in your browser.

Links you come across will take you to various

helpful resources for further reading and

understanding.

Feel free to distribute this to your family, friends and

anyone else interested in the art of valuing stocks.

The stock market is filled

with individuals who know

the price of everything, but

the value of nothing.

- Philip Fisher

Introduction to Stock Valuation

Valuation Matters

You can purchase the best stock in the world, but if

you buy it at a lofty premium, it is a bad investment.

Vice versa, the stock could be the worst company in

the world, but if you buy it at such a cheap price that

it cannot go down any further, it may just turn out to

be your best investment.

That is why valuation is a huge part of the game.

The problem I fell into as I started my investing

journey was trying to value every stock the same

way.

If you play golf, do you use the same club to hit

every shot? It is the same with valuation. Just

because you know how to do a DCF, it does not

mean you should apply it to every company you

come across.

You must use the right tool in the right situation.

http://www.oldschoolvalue.com

Valuation is an Art

Valuation is important, but it is not black and white.

It is an art.

Every valuation method requires assumptions and

inputs because valuation itself is a forward looking

calculation. A stock price is made up of an asset

value and a growth value. Without considering the

growth value, you end up with just half the equation.

Make realistic assumptions and the inputs will be

acceptable. Do not use numbers to match what you

want the output to be.

Your role as an investor is to be a realist. Not an

optimist or a pessimist or to have your views

confirmed.

There will be people who disagree with the methods

used in this book and with how you end up valuing

stocks. Who cares? Stocks are valued in all sorts of

ways and you will learn 8 valuation techniques from

this book.

It is time to let your art shine.

The Ultimate Guide to Stock Valuation

Hold up.

Before you go off racing, let's go through a brief

overview of each valuation method.

8 Valuation Techniques That Will Help

You Value Any Stock

1. Net Net Working Capital and Net Current Asset

Value

Type: Balance sheet and tangible asset valuation

When to Use: Liquidation valuation, net net stocks,

and when trying to determine the stock price relative

to a stock's net assets. Does not work well for

service or low asset companies such as software.

Description: When Ben Graham was around, the

main types of businesses that existed were industrial

businesses. Mainly factories, manufacturers and

retailers. There were no consulting, software, or

high tech companies you see today. He would

analyze the balance sheet and invest in stocks with

high tangible assets as it protected the downside.

http://www.oldschoolvalue.com

2. Benjamin Graham Valuation Formula

Type: Earnings and growth stock valuation method

When to Use: Cyclical companies, volatile cash

flows, growth stocks, and young companies

investing in growth.

Description: Ben Graham was a balance sheet

investor first and foremost, but he created this

formula to simulate growth investing with value

investing principles.

Since the companies that existed back in Graham's

day did not have the growth of today's environment,

I have made adjustments to the final formula to

make it more applicable to today.

3. Discounted Cash Flow (DCF) Stock Valuation

Type: Cash flow valuation

When to Use: Companies with consistent free cash

flow, predictable companies.

Taking a Bird's Eye View

The Ultimate Guide to Stock Valuation

http://www.oldschoolvalue.com

version. Instead of using whatever a competitor is

being valued as the benchmark for the valuation,

the multiple is calculated based on the business

fundamentals. Created by Vitaliy Katsenelson,

author of Active Value Investing.

6. EBIT Multiple Valuation

Type: Multiples method

When to Use: Capable of valuing all companies

Description: Used by many on Wall Street and a

good back of the envelope calculation method. It

has the advantage of being simple and concise.

EBIT is the main driver of the valuation which

makes it applicable for all companies.

7. Asset Reproduction Value

Type: Balance sheet valuation

When to Use: Calculate asset value by making

adjustments to the balance sheet. Also used to see

how much a competitor would have to spend in

order to replicate the company's business.

Description: In a way, this is a health and moat

test. If the value of the balance sheet after making

Description: No need for any introductions to the

DCF method.

It has its weaknesses and advantages which I will

discuss, but overall, it is a highly effective tool for

calculating predictable companies or with realistic

projections and to test scenarios.

The DCF I use is derived from F Wall Street which

is a practical real world version and great for small

investors.

4. Reverse DCF

Type: Cash flow valuation of market expectation

When to Use: Any situation to figure out what the

market is expecting from the stock.

Description: A backwards valuation to find what the

market is expecting from the stock. Instead of

entering the future growth rate, the goal is to find out

what the market is expecting the stock to achieve.

5. Katsenelson Absolute PE Model

Type: Fundamentals based multiples

When to Use: Companies with positive earnings

Description: When you think of multiples for valuing

stocks, it is relative. This version is an absolute

The Ultimate Guide to Stock Valuation

adjustments to its line items are strong, the

company is protected by its assets and it is easy to

identify the floor for the stock price.

The way it acts as a moat test is that if the asset

reproduction value is high relative to its stock price,

then new entrants will have difficulty entering the

market.

8. Earnings Power Value (EPV)

Type: Adjusted earnings valuation

When to Use: For all companies but even better for

cyclical, volatile, and young companies.

Description: It is best to use EPV in conjunction

with the Asset Reproduction Value method. It is a

technique for valuing stocks by making an

assumption about the sustainability of current

earnings, and the cost of capital but assuming no

further growth.

Sound complicated? It is at first, but you will get it.

Important Note as You Value Stocks

As you learn about each method and start to

perform these valuations, get in the habit of finding

values based on different scenarios.

http://www.oldschoolvalue.com

This will give you a range of valuations instead of

anchoring on a single absolute fair value.

Think about the low end, high end, and market

expected scenario to form a rounded conclusion

about what the stock is worth.

Key Old School Value Subscriber Tips

Each of the valuation techniques and ratios

mentioned in this book is included in the Old

School Value Stock Analyzer.

Follow the examples with the Stock Analyzer and

maximize your time by quickly identifying and

valuing profitable stock ideas.

The Ultimate Guide to Stock Valuation

Benjamin Graham's "Net Net" Stocks

In 1932 at the bottom of the Great Crash, Ben

Graham's fund had lost 70% of its value.

It was precisely at this time when he wrote a Forbes

article stating how cheap the market was. In fact,

Graham remarked about how the market was selling

the United States for free.

What made Graham make this claim?

Deep Value Companies

It all came down to the way Graham looked at

companies.

Stocks were being quoted in the market for much

less than its liquidating value, priced as if they were

destined to be doomed.

This still happens today.

But does it make sense to be quoted for less than

the cash in your hand?

Such deep value stocks are referred to as "net nets"

and the idea is to calculate the liquidation value.

http://www.oldschoolvalue.com

The common definition used is Net Current Asset

Value.

NCAV = Current Assets - Total Liabilities

You can see how conservative the above definition

is.

But the term current assets is rather broad. It

consists of cash, accounts receivables, inventory,

and other assets easily convertible to cash. A

company with 100% cash is much better off than a

company with 100% in prepaid assets.

And so, to define it clearer, I use a variation of

NCAV which is stricter, but makes more sense and

offers extra security when valuing and selecting net

net stocks.

That variation is called Net Net Working Capital.

Liquidation Value

Graham defined liquidating value

very conservatively.

The Ultimate Guide to Stock Valuation

Net Net Working Capital

The formula for NNWC is

Net Net Working Capital =

Cash and Short-term Investments

+ (75% x Accounts Receivable)

+ (50% x Inventory)

- Total Liabilities

The formula states that

cash and short term investments are worth

100% of its value

accounts receivables should be taken at 75%

of its stated value because some might not

be collectible

inventories should be discounted by 50% in

the event a close out sale occurs

NNWC places importance on the main parts that

make up current assets; cash, accounts receivables

and inventory.

When it comes to valuing net nets, you want to find

high quality ones. This is an oxymoron because net

nets are trading at deep value ranges for a reason,

but out of the dump, you can find a few stocks that

shine brighter than the rest.

http://www.oldschoolvalue.com

Let's look at a couple of examples.

ADDvantage Technologies (AEY) is a net net with

Cash and equivalents: $7.54m

Accounts receivables: $3.42m

Total inventory: $21.54m

Total Current assets: $33.63m

Total liabilities: $4.62m

Shares outstanding: 10.03m

NCAV = $2.89 per share | NNWC = $1.62 per share

The Ultimate Guide to Stock Valuation

iGo Inc (IGOI) is a company that is extremely

cheap.

Cash and equivalents: $8.21m

Accounts receivables: $3.53m

Total inventory: $6.03m

Total Current assets: $20.35m

Total liabilities: $3.04m

Shares outstanding: 2.91m

NCAV = $5.95 per share | NNWC = $4.46 per share

iGo is a typical net net selling well below its net net

value. Numbers look good, but always consider the

history of losses and business model.

http://www.oldschoolvalue.com

The key to valuing and investing in net nets is to

purchase a basket of them.

A few days after writing this, iGo was bought out at

a 50% premium to its stock price.

This is the way net nets make you money.

By buying a basket of them at dirt cheap prices, you

protect the downside even though the company has

a horrible business model and operational issues.

There are always bigger companies who may see

value in acquiring such companies. For bigger

companies, it is easy because they can strip out

money losing divisions and merge it into their

existing lines or distribution networks. This will

immediately return results whereas the acquired

company may never have been able to achieve

such returns on its own.

You can calculate the NNWC of any stock. For

some stocks, the NNWC will be negative and that

just means that the company has more liabilities

than the net net value. A negative NNWC does not

indicate a bad business. Apple currently has one of

the strongest balance sheets in the world but it has

a NNWC of -$24. It just means that referencing

NNWC is unimportant for such companies.

"Normal" companies like MIcrosoft have stock

prices far higher than its NNWC. Compare the

The Ultimate Guide to Stock Valuation

http://www.oldschoolvalue.com

Key Old School Value Subscriber Tips

The Net Net section of the Stock Analyzer will

import the necessary balance sheet items

automatically to make it easy to calculate.

Experiment with the percentage multipliers. You

can increase or decrease the values depending

on your situation. There is no hard rule that it has

to be 75% of receivables and 50% of inventory.

numbers for Microsoft with ADDvantage or iGo and

you will get a good idea of how cheap a stock can

really get.

Microsoft has a NNWC and NCAV of $3.24 and

$4.32 respectively. The total stock price is always

made up of two parts, the asset value and the

growth value.

$3.24 is the asset value which means that $31.57 of

the stock price is attributable to growth and future

returns.

The Ultimate Guide to Stock Valuation

NCAV or NNWC is not a pure valuation. It is

designed to be used as a measuring stick for

cheapness and show you what the assets of a

company is worth.

Benjamin Graham liked cheap net net stocks. What

you may not have known is that Graham also came

up with an intrinsic value formula to simulate growth

investing valuation but applied a value investing

twist.

The Graham Growth Valuation Formula

This is the formula that Benjamin Graham published

in The Intelligent Investor.

V = EPS x (8.5 + 2g)

V is the intrinsic value

EPS is the trailing 12 month (TTM) Earnings

Per Share

8.5 is the PE ratio of a stock with 0% growth

g is the expected growth rate for the next 7-

10 years

The formula was later revised as Graham included a

required rate of return.

http://www.oldschoolvalue.com

Graham's Growth Formula for Value Stocks

The Corporate Bond Rate

The 4.4 was the average yield of high-grade

corporate bonds in 1962 when this model was

introduced.

The entire formula is then divided by Y which is the

current AAA corporate bond rate, which you find it

on Bloomberg or Yahoo. Dividing by the AAA rate

normalizes the 4.4% bond rate to today's

environment.

The reason for the inclusion is that Graham wanted

a minimum required rate of return for investing in

stocks.

You see, Graham knew that intrinsic value was more

than just growth rates and EPS estimates. He knew

that intrinsic value was related to fixed income rates

or bond rates and that stocks and bonds compete

with each other and are therefore related.

Graham wrote a lot about how the stock PE ratios

were affected by the bond yield levels as well as the

changes.

Here is a quote from Graham that talks about this.

The Ultimate Guide to Stock Valuation

The common consensus is that you should use

forward estimates of EPS. However, Graham did

not intend the formula to be used in this way.

Use a 5 to 7 year average of EPS to normalize the

value. If the company is a high growth company,

then the EPS should be calculated by using rolling

averages.

Remember that if you use analyst EPS estimates, it

tends to be on the optimistic side and will result in a

valuation at the upper range.

What To Do About Growth?

Growth for a value investor?

Yes, and that is what Graham wanted to mimic.

Although trying to estimate growth in general is a

drawback, it is a big element of the whole valuation

method.

There are two parts that make up the growth

variable.

The PE of 8.5

and the growth rate, g

Graham defined 8.5 as the PE for a company with

zero growth. There is no clear indication of how this

number was derived, so I will have to take Graham's

word and his research.

As you test the formula yourself, you will notice that

bond rates affect valuation.

The lower the yield the higher the price. This goes

back to bond basics. If the yield is low, the price is

high. If the yield is high, the price is low.

Graham designed the formula to replicate this line

of thought. Think of it as inflation adjusting.

So it is important to understand the current bond

environment as you value stocks with the Graham

formula.

Adjust Earnings Per Share

Further discussion on how to use the EPS value of

the formula is required.

It seems logical to me that the

earnings/price ratio of stocks generally

should bear a relationship to bond

interest rates.

Viewing the matter from another angle, I should

want the Dow or Standard & Poor's to return an

earnings yield of at least four-thirds that on AAA

bonds to give them competitive attractiveness with

bond investments. - Ben Graham

The Ultimate Guide to Stock Valuation

http://www.oldschoolvalue.com

Final Adjusted Graham Formula

Here is what the final formula looks like.

Time for some examples.

The Graham Formula in Action

Let's run this formula through a couple of stocks.

Microsoft (MSFT) is up first.

I am going break the rules of what I wrote already,

but follow along to see why.

First, here are the inputs that I will be using for the

calculation.

EPS = $2.51

g = 13.9%

Y = 4%

For a company like Microsoft with a huge moat and

good predictability, you do not need to worry so

much about using the past 5 - 7 year averages.

But instead of using 8.5 as the no growth PE, I have

reduced it to a PE of 7 in my version of the formula.

Nowadays, even if a company has zero growth

prospects, if it is able to maintain cash flows and

distribute dividends, the PE is easily higher than

8.5.

And I prefer to err on the side of conservatism.

Choosing the growth rate is very much the same as

how you find the EPS.

Instead of using a single forward estimate, calculate

the average 5-6 years of growth experienced by the

company. If a company has 3 years of operating

history, then take the average of the three years.

Next is the "2" multiplier which I find to be too

aggressive. This is understandable if you take

things into context. Graham never experienced

companies with growth rates of 20-30% which is

common today. There was no Amazon or Facebook

in Graham's time.

Instead of 2, you can reduce the multiplier to 1.5 or

1. From all the valuations I have performed using

the Graham formula, I have found that using 1 is

completely satisfactory and still yields an optimistic

value.

The Ultimate Guide to Stock Valuation

http://www.oldschoolvalue.com

Applying it to Slow Growth Companies

Although the Graham formula is meant for growth

stocks, it works even better for low growth stocks.

Take a look at American States Water Company

(AWR). It is a utility stock with low growth prospects

but pays regular dividends.

The inputs used are:

Companies like MSFT do not grow or die overnight.

In this case, I like to average the past 2-3 years

instead.

That is how I get the EPS of $2.51.

To find growth, I looked at the 5 year and 10 year

rolling median. Surprisingly, the growth rate

between the 5 year and 10 year rolling periods are

identical at 13.9%, which is what I will stick with.

Get the 20 year AAA corporate bond from Yahoo. It

is currently 3.2%. About one to two years ago, the

bond rate was in the 5% range. As discussed in the

previous section on bond rates, the low yield is

going to give a high valuation.

So do you use the 3.2% yield or something else?

Since the other inputs use averages and the bond

rate is bound to go up, the long term bond rate

comes out to be 4%, which is why I have chosen to

use it for the basis of this valuation.

Current Price: $33.49

Graham Formula @ 3.2%: $72.31

Graham Formula @ 4%: $57.70

See the difference in the values when different bond

rates are used?

Click to enlarge the screenshot and view in your

browser.

The Ultimate Guide to Stock Valuation

http://www.oldschoolvalue.com

EPS = $2.63

g = 7.8%

Y = 4%

Refer to the calculations in the screenshot below.

Current Price: $53.05

Graham Formula @ 3.2%: $53.31

Graham Formula @ 4%: $42.65

If the valuation in today's environment was most

important, then 3.2% bond rate shows that AWR is

fairly valued at the moment.

However, if you consider what bonds might do in

the future, it is overpriced.

Super Duper Growth Stocks

For a company to grow at rapid speeds, what does

the Graham formula show?

A hot stock like Netflix (NFLX) with an expected

growth rate of 36%.

Since Netflix has such high growth expectations, it

is impossible to use an average.

This is where you have no choice but to use the

analyst estimates.

The inputs are:

EPS = $1.41

g = 36.1%

Y = 4%

The Ultimate Guide to Stock Valuation

http://www.oldschoolvalue.com

Current Price: $223.52

Graham Formula @ 3.2%: $83.65

Graham Formula @ 4%: $66.92

Regardless of whether I value Netflix for the present

or for the future, the Ben Graham model has

decided that Netflix is extremely overvalued.

Out of curiosity, I wanted to see what growth rate

the market is expecting from Netflix.

I will get into the details of this later, but by

performing a reverse Graham valuation, using an

EPS of $1.41 and bond rate of 3.2%, the expected

growth comes out to be 108%!

In other words, Netflix must be able to grow by

108% for the current stock price to be justified.

Download this free excel spreadsheet of the

Graham formula valuation and try it.

Now go find three stocks. One that you believe is

undervalued, fairly valued and over valued and test

it out for yourself.

Key Old School Value Subscriber Tips

Practice makes perfect.

Load different types of companies and look at

how the valuation is affected based on the inputs

you enter.

Understanding the inputs is the key to valuation

success.

The Ultimate Guide to Stock Valuation

http://www.oldschoolvalue.com

So far, you have been introduced to two valuation

methods. I want to break it up here with some

background before diving into the more complicated

valuation models.

This discussion ties in with how you should value

stocks using the DCF model.

Valuing a Business, not a Stock

Learning to use all the valuation methods laid out in

this book is fine and dandy, but there is one big

theme I want you to recognize.

Each method focuses on finding the intrinsic value

as if it were a business and not just a stock.

As an example, let's say McDonalds' earnings

tanked. Immediately, Wall Street will publish sell

reports and how the company is doing horribly.

But for the value investor, if the fundamental core of

the business is operating strongly, then why worry?

One bad quarter does not change the outlook of a

business.

A business does not survive from quarter to quarter.

http://www.oldschoolvalue.com

Small companies can witness events occurring

quickly, but for bigger companies like McDonalds, a

Big Mac will taste like a Big Mac even if earnings

come in lower or higher than expected.

How to Value a Business

When it comes to the idea of valuing businesses,

there is no one better to ask than Warren Buffett.

What is the Intrinsic Value of a Business?

Intrinsic value can be defined simply: It

is the discounted value of the cash that

can be taken out of a business during

its remaining life. - Warren Buffett

This brings me to the discussion of the DCF

valuation method used at Old School Value. The

method is derived from F Wall Street with some

adjustments.

The main components to valuing a business using a

DCF centers on:

1. Finding the sum of the future cash flows

2. Adding the excess cash

3. Subtracting interest bearing debt

The Ultimate Guide to Stock Valuation

http://www.oldschoolvalue.com

The intrinsic value as defined by the seller is very

simple.

You have gross income to show how much the

business makes in a year, net cash flow, inventory,

real estate and FF&E (Furniture Fixtures &

Equipment) aka PPE.

These are assets that produce cash flow and

anything remaining will then be added to the

intrinsic value. Subtract any debt like bank loans

and you get the formula highlighted previously.

In business school, where valuation is taught as an

absolute measure, you will fail if you value stocks

like this, but valuation is an art and in the real world,

this is how it is done. The next chapter will show you

how this comes together.

The intrinsic value of a

business in a broad

sense becomes:

Intrinsic Value =

Present Value of Future

Cash Flow

- Excess Cash

- Interest Bearing Debt

A Real Life Small Business Example

To put it into perspective, toss aside the modern

financial modeling hat for a second and think of

yourself as a small business owner.

The truth is that most small business owners do not

understand financial statements or much about

accounting beyond the basics.

However, what the small business owner does

understand is how much cash the business

generates and what their business is worth.

If you look in the local papers or do a quick search

for businesses on sale on the internet, you will find a

common theme in the asking price.

Take a look at this example of a B&B in the state of

Washington where I live.

The Ultimate Guide to Stock Valuation

How to Value Stocks Using DCF

Now let's dive into the technical side of a DCF

model. There are many people against the use of

DCF's. The main argument is that it requires too

many input assumptions.

This is only true if you do not understand the

components and the makeup of a DCF.

Do not do blind DCF's. By understanding each

component of a DCF, you will be able to make

accurate valuations and test ranges of values based

on different scenario assumptions.

Disadvantages of the DCF

1. Projecting Future Cash Flow

The main weakness with the DCF is that you have to

project the future cash flows far into the future.

How do you know whether a business will still exist 5

years later?

How can you predict the cash flow figure 10 years or

20 years out?

With such forecasting, a small error can result in big

differences in the final DCF valuation.

2. Sensitive to Discount Rates

The discount rate you use has a great impact on the

final valuation.

If you are unfamiliar with discount rates, it is a rate of

return you desire by quantifying the importance of

current value of cash versus the future value of

cash. I encourage you to read this full explanation

on discount rates.

A discount rate of 6% could value a company at

$114 per share. Increase it to 9% and it drops to

$88.17. That is a big range and shows you that the

higher the discount rate, the cheaper you want to

buy tomorrows cash flow today.

3. Choosing a Growth Rate

There is no way to accurately predict the growth rate

of a company.

In fact, it is impossible and the same points made for

projecting future cash flows applies here.

Nevertheless, you still need to determine a growth

rate to project future cash and to make the DCF

work.

http://www.oldschoolvalue.com

The Ultimate Guide to Stock Valuation

But there are Advantages

It is not all doom and gloom for DCF.

There is some art required to get good inputs, but

the benefit is that it will give you a good estimate of

intrinsic value.

Remember the Buffett quote?

The intrinsic value of a business is the sum of its

future cash flows.

That is exactly what a DCF model does.

You can also use it as a quick sanity check because

you can work backwards to figure out what the

market is expecting. This is known as reverse DCF

which you will get to in the next section.

The Real DCF Formula

This is the discounted cash flow formula.

Getting That Discount Rate

You need to know what discount rate you want to

use. After all, the word "discount" is in the name of

the valuation method for a reason.

Find the sum of the future cash flow of the business

and discount it back to the present value.

When a bank lends out money, the interest rate it

receives is the discount rate. Remember that

discount rate is another way of saying rate of return.

How much do you want to earn off your

investments?

If the bank and fed are risk free investments at 3%,

then would you use 3% as the discount rate? No

you would not because it would be safer and easier

to buy treasury bills for a risk free return of 3%.

Instead of trying to calculate it, here is a quick way

of quantifying a discount rate.

Discount Rate = Risk Free Rate + Risk Premium

The long term risk free rate is around 4% which is

what I prefer to use. Then decide how much you

want to be compensated for investing in the stock

market.

For most situations, the risk premium is around 5%

which makes the discount rate 9%. However, for

http://www.oldschoolvalue.com

Don't worry. It is easier than it looks. I will break it

down to the following formula.

DCF = Present Value of Future Cash Flow + Non

Operating Assets + Excess Cash - Interest Bearing

Debt

The Ultimate Guide to Stock Valuation

small and micro cap companies, I prefer to increase

the risk premium to around 8%.

This means that I use 9% as a minimum for stable

and predictable companies like Coca Cola (KO),

while 12% is a good return for smaller and less

predictable companies.

What about WACC?

I do not use WACC and other modern finance

theories because it over complicates things.

The approach I take is from a real world point of

view. When you think of discount rates in terms of

how real businesses operate, it is simple and it

makes sense. That is all you need to get good

valuation results.

Remember it is all about finding the valuation range.

Not whether your discount rate is accurate to the

second decimal place.

Choosing a Growth Rate

When it comes to growth, I err on the side of

conservatism and place more emphasis on the

present data rather than what will happen in the

future.

Do not purely rely on analyst growth rates for one

year estimates. Wall Street and the reports they put

out are too short term focused.

To find a growth rate based on past performance,

calculate the CAGR over multiple short term periods and

then calculate the median of all those values. This will

smooth out the data and eliminate any one time years

that are either great or horrible.

For example, in the OSV Stock Analyzer, the growth

rate is calculated by taking the median over 5 years and

10 years.

For the 5 year period, the CAGR rolling periods are

2007-2011 (4 year period)

2008-2012 (4 year period)

2007-2010 (3 year period)

2008-2011 (3 year period)

2009-2012 (3 year period)

2007-2009 (2 year period)

2008-2010 (2 year period)

2009-2011 (2 year period)

2010-2012 (2 year period)

Then take the median of all these values to get the

median growth rate over the five year span. Apply the

same concept over 10 years. This growth rate is then

used to calculate the projected free cash flow.

http://www.oldschoolvalue.com

In the business world, the rearview

mirror is always clearer than the

windshield. - Warren Buffett

The Ultimate Guide to Stock Valuation

Terminal Value

Once the FCF has been projected, you need to calculate

the company's cash flows when the company enters

its mature stage grows at a slower pace.

Since the terminal value is so far out in the future, it

does not affect the final valuation by large amounts

since the present value of cash 20 or even 30 years

away is worth very little today.

Keep it easy and use 2% or 3% for the terminal

value.

Include Non Operating Assets

For the final piece of the DCF, you want to find out

what the public stock is worth by including non-

operating assets and subtracting the debt that bears

interest. In other words, you are finding the equity

value of the shares.

A company uses assets to generate FCF. This can

include buildings, equipment, chairs, phones and

computers.

However, there are assets that do not generate any

cash flow. For example, a company may own a car

park that is sitting in the middle of nowhere doing

nothing. The property has value though. Such

assets are referred to as non-operating and should

be added back to the DCF calculation.

Determining the value of non-operating assets is

time intensive. Consider looking for this information

once you find a company worth digging into and not

right away.

Add Excess Cash and Subtract Debt

Same with cash. There is cash that you need to run

the business and cash that exceeds what the

business needs. This non-operating cash does not

help create cash flow and so it is classified as a

non-operating cash, aka excess cash.

Use the following formula to calculate excess cash.

Excess Cash = Total Cash MAX(0,Current

Liabilities-Current Assets)

Subtracting debt is tricky because you need to use

the market value of debt which is rarely available.

Instead, calculate the present value of any long

term debt.

Optional Additions to the DCF

A more advanced DCF model involves a multi-stage

approach. This is where several growth rates are

used, instead of a single growth rate. The benefit in

using a multi-stage DCF is that you can simulate the

business cycle better.

http://www.oldschoolvalue.com

The Ultimate Guide to Stock Valuation

The OSV Stock Analyzer is a powerful 3-stage

DCF and the inputs have been simplified for ease of

use.

Instead of guessing what the future performance will

be, the model starts off with the default value for

growth and then reduces it by 10% in years 4-7 and

then reduces the growth rate further by another 10%

in years 8-10. Thus the 3-stage approach.

The idea is to simulate the business cycle.

The last optional piece to include in the DCF is

related to intangibles.

If a discounted cash flow is designed to calculate

the value of a stock based on cash producing

assets, certain companies must have their

intangibles added to get the fair value.

Coca Cola (KO) outsells all other cola due to its

brand recognition. By leaving out the intangibles,

you will be missing out on one of the biggest cash

generating assets.

Here is the formula again with intangibles added.

The brackets around intangibles is to show that it is

optional.

DCF =

Present Value of Future Cash Flow

+ Non Operating Assets

+ Excess Cash

- Interest Bearing Debt

- [intangibles]

Discounted Cash Flow in Action

Using the Stock Analyzer to load Microsoft (MSFT),

the assumptions used for the DCF are as follows:

Discount rate: 9%

Growth rate: 10%

Starting FCF: $27,522m

Terminal rate: 2%

Intangibles to add back: 10%

Microsoft is a very predictable cash flow generator.

It is in the mature stage of its business cycle, so

growth above 15% is unlikely.

In fact, the growth rate over the past 5 years is

12.3% compared to a growth rate of 7.8% in the

past 10 year period.

By taking the average of the 5 and 10 year periods,

I get my 10% growth rate.

http://www.oldschoolvalue.com

The Ultimate Guide to Stock Valuation

The FCF to end 2012 was $29,321m but the TTM

number is $27,522m which is what I use as the

starting point of the DCF.

If the numbers were reversed, I would still start with

the smaller number.

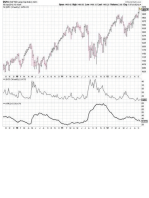

The projected future cash flows looks like this.

click to enlarge

.

http://www.oldschoolvalue.com

For intangibles, I like to add 10%. You may think it

is too little considering Microsoft is synonymous

with Windows and Office, but even if I increase it to

50%, the difference in the stock valuation comes

out to be a mere $0.15.

The final DCF calculation shows the following:

Present value of future cash is $477,429m

Excess cash of $74,483m

Interest bearing debt of $8,701m

Total Present Value of $543,534m

Divide the Total Present Value by the shares

outstanding to get the final per share value.

Key Old School Value Subscriber Tips

Download and follow along with this Stock

Analyzer PDF report on Microsoft (MSFT).

Look at the numbers and see how I use it in this

example.

Download this Free DCF Excel template here.

The fair value is $65. Compared to the stock

price of $33.67, the margin of safety then

becomes 48%.

The Ultimate Guide to Stock Valuation

How to Value A Stock with Reverse DCF

The advantage of a reverse DCF is that it eliminates

a lot of the inputs required in a DCF.

Instead of starting with a given FCF, and then

projecting towards an unknown, the purpose of the

reverse DCF is to calculate what growth rate the

market is applying to the current stock price.

By taking this backwards approach, it simplifies the

DCF thought process and output from what is the

future growth rate?, to is the expected growth rate

realistic?.

Take Lumber Liquidators (LL).

The current stock price is $80 and has climbed

dramatically on the tailwinds of a housing market

"recovery". Using a discount rate of 9% with the TTM

FCF number of $35.2m, the required growth rate to

come to a valuation equal to the stock price of $80 is

30%.

Is 30% a sustainable growth rate? In this particular

industry? At the current lofty valuations, is there

more upside or downside?

Such questions are much easier to answer with the

reverse DCF.

Application of Reverse DCF

Here are the details of the Lumber Liquidators

reverse DCF valuation. Click the image to see the

full size with notes.

1. Start with the TTM FCF number

Enter the TTM value because you want to work

backwards from today's valuation.

The current valuation is best represented by the

TTM figures because the market is short term

orientated.

2. Change discount rate to 9%

You are looking for market expectations and a 9%

discount rate best represents the historical average.

http://www.oldschoolvalue.com

The Ultimate Guide to Stock Valuation

3. Adjust growth rate

Change the growth rate so that the fair value

number matches the current price.

This will show you what the market expectation for

growth is. Remember that this is an approximation

and a measuring stick to quickly see whether a

stock is cheap or expensive.

In the case of Lumber Liquidators, a 30% growth

rate is unsustainable for a cyclical company.

Lumber Liquidators could continue to go up but from

a value investor's point of view, the current numbers

and expectations are too lofty to merit an

investment.

The Temperature Test

When you walk into a room, it is obvious whether it

is hot, cold, or comfortable. You do not need to

concern yourself with knowing the exact

temperature.

Stock valuation is the same concept. The reverse

DCF will help you with this as you can see in the

next example.

Identifying Cheap Stocks

Lumber Liquidators is an example with high market

expectations. Take a look at Cisco for an example

of a company with low market expectations.

Cisco shows that with the TTM FCF and 9%

discount rate, the expected growth priced into the

stock price is -1%. Back in 2011, I calculated a

growth rate of -9.6%.

Although the market has eased up a little on Cisco,

there is still pessimism and uncertainty surrounding

the company.

Is Cisco still cheap and worth further investigation?

You bet, and the reverse DCF method will help you

identify such stocks quickly so that you can focus on

research instead of wandering around looking for

companies to analyze.

http://www.oldschoolvalue.com

Key Old School Value Subscriber Tips

The reverse valuation section is the same as the

DCF valuation section in the Stock Analyzer.

The only difference is how you enter the inputs.

The Ultimate Guide to Stock Valuation

Katsenelson's Absolute PE Model

This model is named after Vitaliy Katsenelson, Chief

Investment Officer of Investment Management

Associates, based in Denver.

In his book, Active Value Investing, Katsenelson lays

out a valuation model using absolute measurements

instead of relative numbers.

A relative valuation is where you value a stock by

comparing it to other stocks. E.g. if company A has a

multiple of 15x but a competitor has a multiple of 20x

then company A is cheap.

The problem with this is that it depends on the

market conditions. In a recession, a company could

have a multiple of 10x and be considered fairly

valued or expensive just because a bear market

pushes down all stocks.

The Katsenelson approach assigns a company with

PE "points" and then calculates the fair value by

multiplying it with a final multiple factor. This is an

absolute approach to remove the effects of market

dependency and competitor bias.

Katsenelson's Absolute PE Model

The model derives the intrinsic value of the stock

based on the following five conditions.

1. Earnings growth rate

2. Dividend yield

3. Business risk

4. Financial risk

5. and earnings visibility

Like all valuation models, there is some subjectivity

involved. In this case, you are required to grasp an

understanding of the business to identify the level of

risk involved for points 3, 4 and 5.

Core Idea of the Absolute PE Model

No Growth PE

Part of the reason why I created the no growth PE

screen was for the purpose of this valuation method.

I needed to know whether my conservative nature of

using a PE of 7 for no growth was factually correct.

My results show that a PE range of 7 to 8.5 is

perfectly acceptable so you are free to use whatever

suits you.

http://www.oldschoolvalue.com

The Ultimate Guide to Stock Valuation

Graham used 8.5 in his growth formula, and

Katsenelson uses a PE of 8 in the book.

I will stick to a PE of 7 because if you flip the PE

over, the earnings yield is 14.2% compared to

11.8% and 12.5% for Graham and Katsenelson

respectively.

With the small caps I analyze, demanding an

earnings yield of 14.2% is better than 11.8%.

However, if I analyze large blue chips such as

Microsoft, I am content to adjust the PE to 8.5.

Earnings Growth and PE Relationship

Instead of calculating growth projections,

Katsenelson's Absolute PE method reverse

engineers the PE ratio to come up with a growth

rate according to the table on the right.

The table has been adjusted to have 0% growth for

stocks with a PE of 7 and below. The "Original PE"

column is what is used in the book.

For every percentage of earnings growth from 0% to

16%, the PE increases by 0.65 points.

Once the growth rate reaches a certain level, in this

case 17%, the PE value increases by 0.5 points and

maxes out at 25% growth. So any stock with a PE

higher than 21.9 is capped to a 25% growth rate.

The Value of Dividends

Dividends are tangible to the investor whereas

earnings are not. Dividends provide you with a hard

return whereas you may never get to see earnings.

http://www.oldschoolvalue.com

The Ultimate Guide to Stock Valuation

In contrast to the non-linear points relationship

between earnings growth and PE in the table, the

dividend yield and PE has a linear point system.

Every dividend yield percentage receives an

equivalent PE point. If the dividend yield is below

1%, give a bonus of 0.5 points.

PE Factors for Business, Financial Risk

and Earnings Visibility

This is where some subjectivity is involved as it

requires you to come up with a single number to

summarize the risks and earnings visibility.

For business risk, you want to consider the industry

the company is in, the products, the life cycle,

concentration of products and customers,

environmental risks, and anything else related to

the operations of the business.

The level of financial risk can be determined by

examining the capital structure of the business as

well as the strength of the cash flow in relation to

debt and interest payments.

Earnings visibility is analyzed in much the same

way.

How Business Risk is Quantified

In order to quantify business risk, I went through

various ratios and numbers to identify what makes a

business good.

Everybody has a different definition of business risk,

but what I have tried to do is come up with four

items that the majority of investors would agree to.

The four are:

1. Return on Equity

2. Return on Assets

3. Cash Return on Invested Capital

4. Intangibles % of Book Value

The first three are self explanatory. Businesses

capable of sustaining above average returns or

increasing returns each year has a good business

model, moat, and capable management.

The fourth needs some explaining.

I have added intangibles as a percentage of book

value because I do not want businesses to grow by

acquisition which could lead to issues later on.

Growth through intangibles is not a good business

model and has no competitive advantage.

High intangibles do not reflect business risk, but

http://www.oldschoolvalue.com

The Ultimate Guide to Stock Valuation

continually growing intangibles is a red flag.

How Financial Risk is Quantified

The four factors that make up financial risk are:

1. Current Ratio

2. Total Debt/Equity Ratio

3. Short Term Debt/Equity Ratio

4. FCF to Total Debt

A company with a strong current ratio does not run

the risk of going under.

Total debt/equity and short term debt/equity is

included because total debt may not give the whole

picture. A large upcoming debt payment is much

more worrisome than a low interest, long term debt

due in 10 years.

FCF/Total Debt displays the financial strength

because it shows whether the company is able to

pay back its debt through FCF instead of taking on

new debt.

Earnings Predictability

Trying to quantify earnings predictability is more

difficult, so it is best to keep it as simple as possible.

1. Gross Margin

2. Net Margin

3. Earnings

4. Cash from Operations

For a company to be predictable, it has to have

stable margins, stable or increasing earnings and

cash from operations.

As much as I like FCF or owner earnings, I do not

use it for this valuation model as it is volatile and not

a good measurement for predictability.

The Absolute PE Formula

The formula to calculate the fair value PE is

Fair Value PE =

Basic PE

x [1 + (1 - Business Risk)]

x [1 + (1 - Financial Risk)]

x [1 + (1 - Earnings Visibility)]

where the Basic PE is the starting PE from the

table.

Business risk, financial risk, and earnings visibility

scores are calculated automatically in the Stock

Analyzer. However, to do it manually, follow these

quick hand instructions.

http://www.oldschoolvalue.com

The Ultimate Guide to Stock Valuation

For any stock you look at, it will fall into one of three

categories. Average, above average, or below

average.

For each of the three business quality factors,

if the company is an average company, give

it a value of 1.

if the company is a market leader, select a

number less than 1. If you believe a market

leader deserves a 10% premium, then use a

value of 0.9. If a 15% premium is deserved,

then 0.85 is the number to use.

if the company is a market lagger, select a

number greater than 1. Poor companies

should be discounted and so by giving it a

higher number, it will minus some points in

the final calculation. E.g. a stock is in horrible

shape and cannot pay its bills, then you may

want to give it a 20% penalty for financial

risk. For this, you would assign a value of

1.2.

Checking Out Wal-Mart

Starting with Wal-Mart (WMT), the company rules

retail and its competitors. Strong balance sheet,

huge competitive advantage capable of swallowing

any small competitor.

Consistent dividend payouts, FCF cow, stable

margins, CROIC of 9% with ROE of 20+% makes

this one of the best retailers in the world. Debt is not

an issue as FCF can cover all interest payments. It

also makes earnings growth and visibility easier to

determine.

Based on the past 5 year median EPS growth, Wal-

Mart achieved 11% earnings growth which sounds

about right. Although WMT is the best of breed, it

only gets a 6% premium for the business as retail is

still a tough industry to be in regardless of who you

are competing against.

The financials are wonderful. The balance sheet is

powerful and extremely efficient. Wal-Mart leads the

competitors easily and deserves a 10% premium

over its competitors.

For earnings visibility, Wal-Mart scores an 8%

premium to competitors. It loses a couple of points

from down years, but other than that, the company

is very easy to predict.

Combine all this together and the inputs for the

Absolute PE valuation become:

Expected Earnings Growth: 11%

Dividend Yield: 2.5%

Business Risk: 6% premium = 0.94

Financial Risk: 10% premium = 0.90

Earnings Visibility: 8% premium = 0.92

http://www.oldschoolvalue.com

The Ultimate Guide to Stock Valuation

For a great business such as WMT, the fair value

PE comes out to 21.65. However, since WMT is in

the retailing business, a business risk of 1.00 could

have been applied due to the competitive nature of

the industry. As a rule, apply a maximum premium

of 30% to the basic PE which means that the final

fair value PE should be capped at 22.35.

According to this calculation, Wal-Mart is priced

attractively with its current PE of 14.69 with room to

move up if the business continues to operate

strongly.

Comparing with Target

Target (TGT) is number two behind Wal-Mart.

Margins are solid and consistent, with a sub par

CROIC average of 6%. ROE of 18% and no issues

with debt or financial risks. Earnings growth has

been a lackluster 5% and likely will be the same.

Expected Earnings Growth: 14%

Dividend Yield: 2.50%

Business Risk: 3% premium

Financial Risk: 5% premium

Earnings Visibility: 5% premium

http://www.oldschoolvalue.com

The fair value PE of 21.2 gives an expected

future growth rate of 23% compared to the

current expected growth of 14% and adjusted PE

of 18.7.

Some room to move, but the margin of safety is

slim.

The Ultimate Guide to Stock Valuation

An Example of a Bad Company

Both Wal-Mart and Target are great companies. On

the other side of the spectrum is RadioShack

(RSH).

Unlike Wal-Mart and Target, RadioShack is a

consumer electronics goods and services retailer

struggling to turn a profit. It is loaded with debt and

does not have a PE as earnings is negative.

In a situation like this, the Katsenelson model will

not work because the adjusted base PE is zero to

begin with.

See the image below to see why.

http://www.oldschoolvalue.com

Summing Up

The advantage of using this method is that you do

not have to value the company based on another

company's multiple.

The disadvantage is that the calculation uses the

current PE as the anchoring and starting point of the

valuation. If the PE is already high, and the

business fundamentals are strong, it will add on

more points to the already overvalued PE.

To improve on this and to be able to apply it for

companies with negative earnings, you can try

substituting PE for EV/EBIT, EV/EBITDA or another

variation.

One important point to end with is that you need to

have a systematic way of quantifying the business

risk, financial risk and earnings predictability. It is

too easy to randomly apply a premium based on

what you feel the company deserves. Having a set

of rules and systems will keep the way you value

companies consistent and prevent bias.

Key Old School Value Subscriber Tips

If the starting growth rate is too high, don't be

afraid to adjust the "Expected PE" box for a value

more inline with what is expected.

The Ultimate Guide to Stock Valuation

Although the downside of relative valuation was

described in the previous chapter, there are times

where it is useful for valuing stocks.

The important part is to know how to perform a

relative valuation properly, and not just slapping on a

multiple to come up with a fair value.

PE multiples are thrown around a lot when talking

about stocks, but the better way to value stocks is to

use EBIT multiples.

EBIT: Earnings Before Interest and Tax.

Difference between EBIT and EBITDA? EBIT

recognizes that depreciation and amortization are

real expenses related to the use and wear of assets.

How People Perform Multiples Valuation

The All Too Common Way

Have you heard or read something like this?

DELL is trading at a PE of 10.6x with a

Forward PE of 8.7x. Its competitors are

trading between 9x to 14x.

http://www.oldschoolvalue.com

If DELL corrects their problems, it should

trade at similar multiples to its competitors.

Therefore DELL is worth $18.

Keeping things simple is important, but it should not

be simplified to the point where it becomes garbage

in, garbage out.

Problems Doing it This Way

The problem is that PE is a broad metric which can

vary greatly depending on adjustments to the

income statement.

Such adjustments are:

goodwill charges: this can reduce earnings

drastically even though it does not affect the

business operation

income from discontinued operations can

inflate PE

share repurchases: reduces the number of

shares outstanding which increases the EPS

Valuing Stocks with EBIT Multiples

The Ultimate Guide to Stock Valuation

Doing it the EBIT Way

First, start with a normalized revenue estimate. To

get a normalized revenue value, take the average

revenue over anywhere from 3 to 5 years,

depending on the history of the company.

Multiply revenue with a conservative, normal and

aggressive operating margin to get the range of

EBIT values.

Then decide what multiplier you want to multiply the

EBIT value by. A normal case multiplier is

considered to be between 8-10.

Now add cash and subtract debt to get the total

equity value.

It is that easy, and that is the attractiveness of the

multiples method.

Use the online EBIT calculator to see the details of

what inputs are required in the calculation.

The EBIT multiple valuation also makes it easy to

perform a sum of the parts analysis. If a company

has several subsidiaries or operating segments, you

can perform a EBIT valuation for each segment and

then add it up to get the total equity value.

http://www.oldschoolvalue.com

Valuing DELL with EBIT Multiples

DELL makes for an interesting case study because

it is in the middle of a buyout with several big

investors coming up with their own valuation targets.

Michael Dell will buy out DELL at $13.36

Carl Icahn has come out and said that he

wants DELL to issue a $9 special dividend

because he values it at $22.81

Jim Chanos has revealed that he is short

DELL going into the deal citing issues with

the balance sheet and cash flow. (In other

words, he does not think it was worth $13.65)

Three different valuations. Three different scenarios.

Lets jump straight into the numbers and see how

this works.

The numbers and assumptions used for the

normalized case are:

normalized revenue over 5-6 years is $59b

normalized operating margin of 5.3%

fair value EBIT multiple of 8x

add cash and subtract debt

These numbers result in the following valuation.

The Ultimate Guide to Stock Valuation

http://www.oldschoolvalue.com

The three fair value targets are:

conservative fair value of $10.87

normal case fair value of $16.51

aggressive fair value of $21.12

Although Jim Chanos has not revealed his target

price, it will likely be closer to $10 which is the lower

end of the range.

Michael Dell is hovering below the normalized value

to get a cheaper deal than the fair value. Current

news has Michael Dell not budging on his buy out

price.

Carl Icahn is the optimistic and aggressive investor

of the group.

But this example should give you an idea of how to

value a business using EBIT multiples.

Coming up with the EBIT multiple is the hardest part

and this is where you will want to compare to a

competitor to find a fair EBIT multiple.

The numbers for cash and debt came from the

Stock Analyzer and verified against the latest 10-K.

Free EBIT Multiple Calculator

Use the EBIT Multiple Calculator for free today.

The Ultimate Guide to Stock Valuation

What is Asset Reproduction Value?

Calculating the reproduction value of a company's

assets is the first part of the Earnings Power

Valuation.

But what does it mean to find the cost of reproducing

an asset?

Reproduction value looks at how much it will cost a

competitor to purchase the assets required to run a

competing company.

As an example, based on book value, machinery

and equipment could have been depreciated over 5

years and is now worth $1m on the books compared

to the purchase price of $2m.

However, a competitor will have to pay $2m to

purchase the same equipment. Not $1m.

There are several items like this in the balance sheet

where the current value may be more or less than

what is required for a new entrant.

Another quick example is brand recognition. For a

new cola beverage company to compete with Coca-

Cola, a huge amount of money must be spent to

http://www.oldschoolvalue.com

replicate the brand recognition. Coca-Cola's

intangible value may be listed as $1b on the balance

sheet, but for any new competitor, it will have to

spend in excess of that to build momentum and

market penetration.

To really understand the details of asset

reproduction, let's dig into National Presto's (NPK)

2010 annual report.

Key Old School Value Subscriber Tips

You can adjust values in the balance sheet by

going to the EPV valuation and using the

"Adjustment" section.

There is an adjustment section for both assets

and liabilities.

The Ultimate Guide to Stock Valuation

1. Make Adjustments to Current Assets

Start by grabbing a copy of National Presto's 2010

annual report or load the latest numbers for National

Presto into the OSV Stock Analyzer.

Using National Presto's numbers, I have organized

the data into the following format showing the book

value and the adjustment amount.

Cash and market securities will always be 100%.

Cash is what it is. No more, no less.

You need to add the doubtful reserve to accounts

receivables. A competitor will not have the luxury of

being able to perform at the same level without a

doubtful account for A/R.

Inventory is increased by $4.2 million because

National Presto uses the LIFO inventory method.

Restating it in terms of FIFO results in an increase

of $4.2m.

http://www.oldschoolvalue.com

The only adjustments made were to accounts

receivables, finished inventory and deferred tax

assets.

Quick Tip

To see whether LIFO or FIFO is used, do a search

in the 10-K using CTRL+F and type in "LIFO" or

"FIFO".

Deferred taxes. National Presto expects to receive

$6.3m from overpaying taxes. This 2010 report was

released at the end of its fiscal year so at the time

this report came out, I am assuming that the

company received a quarter's worth of deferred

taxes.

$1.6m is a quarter of the deferred taxes ($6.3m/4),

so subtract $1.6 from the original amount to

represent the adjusted value of $4.7m

No adjustments to other current assets.

The Ultimate Guide to Stock Valuation

2. Make Adjustments to PP&E

Basic PP&E is $58m but as you go through the

report, you will realize that it is worth more.

Qualitative research is required to properly identify

whether assets are over or undervalued.

Thankfully, National Presto is very easy to analyze

because the company provides all the stated and

adjusted values in its report.

The 2010 value of PP&E was $58m, however, $49m

was deducted for accumulated depreciation.

Depreciation is a non-cash expense so when you

add it back in, the adjusted value is $107m.

National Presto is over 100 years old. This means

that they have assets that have been written off to

zero. However, it will cost a competitor to own those

same assets.

National Presto owns land and buildings and uses a

straight line depreciation method giving 15-40 years

of depreciation to buildings and it will be worth more

than what is stated on the balance sheet.

To take your analysis one step further, you could

get an appraiser to value surrounding land and

property to determine how much you should adjust

the value.

A quicker and cheaper way is to perform online

searches on real estate services like Zillow to get

estimates.

According to the 2010 report, NPK has a facility

where 314,000 sq ft is used for industrial purposes,

and 140,000 sq ft is used for offices.

Commercial property searches show that value of

industrial buildings are much cheaper than offices.

In Wisconsin, where its building is located, industrial

buildings go for a range of $2 $5 per sq ft

compared to $7 $12 per sq ft for office buildings.

So you can do something like 314,000 x $5 +

140,000 x $12 = $3.25m for this facility.

Repeat for other buildings and land values and then

continue making those adjustments.

Machinery and equipment in National Presto's

business is very specialized. In a liquidation event,

highly specialized equipment will be discounted as

the number of buyers are limited.

http://www.oldschoolvalue.com

The Ultimate Guide to Stock Valuation

The demand will also be much lower compared to

common high end equipment like photocopiers.

But as an ongoing asset, National Presto's

equipment is expensive and requires a competitor to

pay the full price in order to do business.

3. Make Adjustments to Goodwill

For National Presto, R&D is negligible but it does

have important patents for its housewares/small

appliance business. The housewares segment

make up 30% of revenue and its patents protect that

revenue to a certain degree. I have assigned a

value of $2m for its patents which is a conservative

amount compared to the revenue.

National Presto sells its products through

distributors and there are no long term contracts set

with any of their buyers. I do not see any monetary

value here. If you are a big company and you have

good products, it is easy to get distribution.

Competitors can replicate their distribution channel

easily.

The Absorbent Segment requires in-depth know

how and special training to operate the machines

and to maintain quality. It costs money and time to

train employees to ensure that product quality

meets specifications and orders.

http://www.oldschoolvalue.com

The next move is to adjust for goodwill which is

trickier. To do it properly, it is important that you

learn and understand the business.

Goodwill means that a company has overpaid to

buy another company. What the additional cost

does not specify is the relationship with customers,

the brand image, network effect, patents and other

skills that cannot be valued on the balance sheet.

This is why you need to know the business. It is up

to you to think things through and adjust for special

cases.

$2m in value for this

skill is a small yet fair

amount.

The Ultimate Guide to Stock Valuation

4. Complete Asset Side Adjustments

After completing steps 1-3, the total adjusted asset

side of the balance sheet is shown below.

By going through the line items of the balance

sheet, it forces you to think about all aspects of the

business. You start with a broad view and then with

each line item, you try to break it into smaller

pieces. The end result of doing this exercise is to

find hidden value the market may be overlooking.

The process is quite long, but once you practice and

find yourself in a rhythm, it will become quicker and

easier. The Stock Analyzer will also help with this.

Now let's move on to the liabilities side.

Adjusting the Liabilities

The accounting definition of the balance sheet is

Assets = Liabilities + Equity

but the business definition of a balance sheet is

Liabilities and Equity are the sources of funds that

support the assets.

You have the asset reproduction value, but a new

business will not pay the same amount. That is

because a business has debt. Just like what you

saw on the asset side, the same adjustments have

to be applied to the liabilities side. Do not subtract

total liabilities because you only need to exclude the

liabilities that do not support the assets.

http://www.oldschoolvalue.com

The Ultimate Guide to Stock Valuation

Bruce Greenwald, calls these types of liabilities

"spontaneous" and "circumstantial liabilities" as a

new entrant is not subject to the same cost.

Spontaneous Liabilities or Non Interest

Bearing Debt

Circumstantial Liabilities

As the name implies, circumstantial liabilities are

incurred by circumstances in the past.

Examples include

paying penalties for insider trading

lawsuits from former employees

inventory catching on fire

Remove these liabilities as it adds no value to

assets. A competitor is not required to pay for these

circumstances to start a competing business.

Subtract Cash not Required to Run the

Business

The final step to calculate the reproduction value is

to subtract cash that is not required in the business

because you want to value the assets based on how

much a competitor will pay for the same things

today.

As a rule of thumb, it costs about 1% of sales to run

one year of operations so the remaining 99% of

cash can be subtracted.

http://www.oldschoolvalue.com

Other examples include accounts payable, deferred

taxes and accrued expenses.

Liabilities of a company that are

accumulated automatically as a result

of the firms day-to-day business.

Spontaneous liabilities can be tied to

changes in sales - such as the cost of

goods sold and accounts payable. These liabilities

can also be fixed, as seen with regular payments

on long-term debt. - Investopedia

Such liabilities that occur due

to day to day operations is

not required by a new

entrant. Remove such values

from the reproduction value

to get an accurate picture of

the final value.

The Ultimate Guide to Stock Valuation

Final Net Reproduction Value

Net Reproduction Value =

Adjusted Asset Value

- Spontaneous & Circumstantial Liabilities

- Cash not Required in Business

The final value comes out to

$669.2m

- $66.7m (spontaneous)

- $4.5m (deferred tax liability)

- $4.8m (1% of sales)

= $593.2m (Net Asset Reproduction Value)

National Presto's asset reproduction value comes

out to be $593.2m compared to its book value of

$426.5m.

Putting it Together

On Dec 31, 2010 at the time of the annual report,

the stock price was $130 with 6.86m shares

outstanding.

Market valuation of equity: $889m

Enterprise value: $955.7m

Both book value and net reproduction value made

up about half the market value. This means that half

the stock price was supported by the assets. The

remaining half of the stock price was made up of

growth expectations, which you can consider as the

speculative value making up the stock price.

So far, National Presto was a very straightforward

example. The company is shareholder friendly

which is evident in the way the financial data is

presented. Other companies will be more difficult

because the required information may be buried

deep in the report.

If you try the same exercise for a company like

Groupon (GRPN), you will see that the adjusted

balance sheet will be considerably lower than what

is stated on the books. This will be the same for

companies that are asset light such as software and

services companies.

As a final tip, compare the net reproduction value to

the market cap and enterprise value. If the

reproduction value is close to the market cap, the

market is pessimistic towards the stock and that is

where you can find hidden value.

Further Reading

Liz Claiborne Asset Reproduction

Sealed Air Valuation Case Study

http://www.oldschoolvalue.com

The Ultimate Guide to Stock Valuation

The Full Earnings Power Value (EPV)

There are really two parts to Earnings Power Value.

Asset reproduction and the EPV itself. To fully grasp

the entire method and concept, be sure to have a

good understanding of the asset reproduction

chapter.

To help you see how both net asset reproduction

and earnings power value go together, let's go

through the asset reproduction of Microsoft and then

follow that up with the EPV calculation. This way you

can see how the numbers relate to each other and

how you should interpret the calculations.

If you feel this is too much repetition and wish to skip

it, jump to the EPV calculation section.

Reproducing the Assets of Microsoft

Company PrintyInk is in the business of selling ink

for printers and has a market value of $1m. But

when you look at the assets, the company assets

are worth around $500k.

By performing the asset reproduction, you should be

able to determine what it will cost you to do business

competing with PrintyInk. That cost is going to be

$500k.

Now look at Microsoft. Take a step back and think

about its products, brand, moat, scale, marketing

and more.

How much will a competitor have to realistically pay

in order to enter Microsoft's market?

It has a huge OS market share, Office suite, internet

explorer, the name Microsoft is synonymous with the

term PC, they have MSN, Bing, Skype and more.

Microsoft has huge names and a huge moat.

Because there are so many strong assets, in the

balance sheet adjustment, there is no need to

subtract anything from Microsoft's balance sheet.

http://www.oldschoolvalue.com

Key Old School Value Subscriber Tips

Load MSFT into the Stock Analyzer and go to the

EPV section.

Follow along with the latest numbers because the

process is still the same.

The Ultimate Guide to Stock Valuation

The only adjustment I made was to reduce goodwill