Professional Documents

Culture Documents

Chapter From NanoMarkets Report OLED Lighting Markets 2014

Uploaded by

NanoMarkets0 ratings0% found this document useful (0 votes)

22 views19 pagesSix years ago, OLED lighting was first being proposed as a serious commercial product. Back then, 2014 was projected as the year when OLED lighting would first make its impact felt on general illumination. It didn’t happen. OLED lighting has been available for four years now, but with few signs of its moving beyond the luxury and specialist lighting sector. Also, the disappearance of GE from this space is another reason to treat OLED lighting with a little less respect than it once had.

So is it time to wave goodbye to OLED lighting as a large-scale business opportunity and label it “niche only?” The case can be made. But then again some large lighting suppliers remain bullish on this technology and appear to mean what they say.

Also, the fate of OLED lighting remains of importance well beyond the lighting sector. Because OLED consist of large panels, their success or failure has major implications for both the OLED materials sector and the OLED market itself. Even a modest success for OLED lighting could quickly make it the largest segment of the OLED business; which would completely change the market orientation of the OLED market from one that is currently oriented towards small mobile displays.

In this complex market environment, NanoMarkets believes that it is time for a detailed and honest assessment of both the current value proposition and future revenue timeframes for OLED lighting. This is the objective of this report, which includes eight-year (volume and value) projections of OLED lighting in all the major market sectors along with an assessment of how OLED lighting can effectively compete with LEDs and CFLs in those segments. In addition, this report analyzes the core strategies of leading players in the OLED lighting space, including their plans for building manufacturing capacity for OLED lighting.

See more at: http://nanomarkets.net/market_reports/report/oled-lighting-markets-2014

Original Title

Chapter from NanoMarkets report OLED Lighting Markets 2014

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSix years ago, OLED lighting was first being proposed as a serious commercial product. Back then, 2014 was projected as the year when OLED lighting would first make its impact felt on general illumination. It didn’t happen. OLED lighting has been available for four years now, but with few signs of its moving beyond the luxury and specialist lighting sector. Also, the disappearance of GE from this space is another reason to treat OLED lighting with a little less respect than it once had.

So is it time to wave goodbye to OLED lighting as a large-scale business opportunity and label it “niche only?” The case can be made. But then again some large lighting suppliers remain bullish on this technology and appear to mean what they say.

Also, the fate of OLED lighting remains of importance well beyond the lighting sector. Because OLED consist of large panels, their success or failure has major implications for both the OLED materials sector and the OLED market itself. Even a modest success for OLED lighting could quickly make it the largest segment of the OLED business; which would completely change the market orientation of the OLED market from one that is currently oriented towards small mobile displays.

In this complex market environment, NanoMarkets believes that it is time for a detailed and honest assessment of both the current value proposition and future revenue timeframes for OLED lighting. This is the objective of this report, which includes eight-year (volume and value) projections of OLED lighting in all the major market sectors along with an assessment of how OLED lighting can effectively compete with LEDs and CFLs in those segments. In addition, this report analyzes the core strategies of leading players in the OLED lighting space, including their plans for building manufacturing capacity for OLED lighting.

See more at: http://nanomarkets.net/market_reports/report/oled-lighting-markets-2014

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views19 pagesChapter From NanoMarkets Report OLED Lighting Markets 2014

Uploaded by

NanoMarketsSix years ago, OLED lighting was first being proposed as a serious commercial product. Back then, 2014 was projected as the year when OLED lighting would first make its impact felt on general illumination. It didn’t happen. OLED lighting has been available for four years now, but with few signs of its moving beyond the luxury and specialist lighting sector. Also, the disappearance of GE from this space is another reason to treat OLED lighting with a little less respect than it once had.

So is it time to wave goodbye to OLED lighting as a large-scale business opportunity and label it “niche only?” The case can be made. But then again some large lighting suppliers remain bullish on this technology and appear to mean what they say.

Also, the fate of OLED lighting remains of importance well beyond the lighting sector. Because OLED consist of large panels, their success or failure has major implications for both the OLED materials sector and the OLED market itself. Even a modest success for OLED lighting could quickly make it the largest segment of the OLED business; which would completely change the market orientation of the OLED market from one that is currently oriented towards small mobile displays.

In this complex market environment, NanoMarkets believes that it is time for a detailed and honest assessment of both the current value proposition and future revenue timeframes for OLED lighting. This is the objective of this report, which includes eight-year (volume and value) projections of OLED lighting in all the major market sectors along with an assessment of how OLED lighting can effectively compete with LEDs and CFLs in those segments. In addition, this report analyzes the core strategies of leading players in the OLED lighting space, including their plans for building manufacturing capacity for OLED lighting.

See more at: http://nanomarkets.net/market_reports/report/oled-lighting-markets-2014

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 19

wwwecisolutionscom

OLED Lighting Markets 2014

Nano-721

NanoMarkets

May 2014

2014 NanoMarkets, LC

www.nanomarkets.net

OBJECTIVES AND SCOPE OF THIS REPORT

The main objective of this report is to provide a comprehensive overview of the OLED lighting

market, thus assessing the future potential and to provide detailed eight-year forecasts for the OLED

lighting business by segregating the market under different segments with separate revenue and

volume estimations.

In compiling our forecasts, we examine the product development and marketing strategies of the

leading and influential players in the OLED lighting sector, including both large and small lighting

firms and the key OLED material suppliers.

We also take into consideration announcements by current and prospective players in the OLED

lighting space regarding pricing, product types, capacity, and production timetables. These

announcements are reviewed critically, because, in some cases, the expectations/projections of

some players seemhighly unrealistic to us.

Applications for OLED lighting covered by this report include:

Designer kits and related products

Luxury lighting

Decorative and large-scale installations

Residential OLED lighting

Office lighting and other commercial lighting applications, and

Automotive applications for OLED lighting

www.nanomarkets.net 2014 NanoMarkets, LC

METHODOLOGY AND INFORMATION SOURCES

This report is the latest fromNanoMarkets that looks closely at the trends in OLED lighting.

The basic forecasting approach is to identify and quantify the underlying addressable lighting markets for OLED lighting panels over

the next eight years, and then to assess and quantify the potential for OLED lighting to actually penetrate these markets via

substitution for LED lightinga key factor in any forecast, because OLEDs represent a completely new form of lighting that will not

replace existing light bulbs and tubes on a one-to-one basis.

As part of the analysis, we also assess the competitive landscape in order to determine the likely level of competition from other

lighting technologies in the different addressable markets. And, we consider how technical developments in OLED lighting can

accelerate, slow, or, in some cases, halt the ability of this technology to gain widespread commercialization.

To determine where the opportunities lie, we have based this report on both primary and secondary research.

Primary information is gathered largely through NanoMarkets' analysis of relevant applications markets and market trends based on

ongoing discussions with key players in the OLED lighting segment, including entrepreneurs, business development and marketing

managers, and technologists.

Secondary research is drawn from the technical literature, relevant company websites, trade journals and press articles, and various

collateral items from trade shows and conferences. This research also includes the complete library of our own reports in this field,

which is now quite extensive. Where data has been used from another report, it has been reinvestigated, reanalyzed, and

reconsidered in light of current information and updated accordingly.

This report is international in scope. The forecasts here are worldwide forecasts and we have not been geographically selective in the

firms that we have covered in this report or interviewed in order to collect information.

www.nanomarkets.net 2014 NanoMarkets, LC

PLAN OF THIS REPORT

In Chapter Two of this report, we review the technological challenges that need to be ironed out to make room for large-scale

commercialization of OLED lighting. We look at how the performance specifications and standards are evolving, as well as demand-

side challenges such as reducing cost and creating a market-pull for OLED lighting. Special emphasis has been put on the discussion

behind the need for a cost-effective manufacturing technique that can eventually reduce retail prices in the coming years.

Finally, in Chapter Three we review the addressable markets with the goal of identifying where and how OLED lighting is most likely to

have commercial success. We focus on those firms that are actively involved in developing strategies to improve the performance

parameters of OLED panels and those that have the potential to commercialize the technology in a big way. For this purpose, we have

considered both OLED panel and luminaire manufacturers and OLED material manufacturers.

At the same time, we provide the core forecasts for OLED lighting on an application-by-application basis, and forecasts are given for

the two main scenariosthe low-growth scenario in which OLED lighting remains as a luxury application and the scenario in which

OLED lighting breaks into mass-market applications. We describe assumptions about pricing, market trends, and other factors that

may influence the forecasts. The forecasts are broken out by application type and by product type (OLED panel vs. luminaire).

www.nanomarkets.net 2014 NanoMarkets, LC

wwwecisolutionscom

Chapter One: Introduction

2014 NanoMarkets, LC

www.nanomarkets.net

wwwecisolutionscom

www.nanomarkets.net 2014 NanoMarkets, LC

GLOBAL PRESENCE OF THE OLED LIGHTING INDUSTRY

Government backed financial support to

help LG Chemmove ahead with its volume

production initiatives.

The addressable market for OLED lighting panels can easily surpass the $1 billion mark by

2021 from the current market that is worth a couple of million dollars.

Mitsubishi Pioneer, Konica

Minolta, Sumitomo and

Lumiotec will lead the OLED

lighting commercialization drive

UDC to dominate OLED materials

space while US DOE backed

projects undertaken by

OLEDWorks and Moser Baer

Technologies* can spur domestic

OLED lighting production

Strong market for OLED lighting

given the presence of Philips

Government backed

R&D projects to favor

the likes of Fraunhofer

and Osram

China can emerge as a cost-

effective volume production

destination; First-o-light to have

a first mover advantage

* A US subsidiary of Moser Baer India Ltd.

wwwecisolutionscom

www.nanomarkets.net 2014 NanoMarkets, LC

COMMERCIAL APPLICATION TRENDS

OLED Lighting

Ecosystem

Professional

lighting

Companies are already

targeting commercial

buildings, office,

automotive and large

public gatherings as

the medium to

improve adoption rate.

Residential

lighting

Only a few attempts

made to experiment

with indoor

functional lighting

products, such as

table lamps, for

residential purposes.

PERFORMANCE COMPARISON : KEY PARAMETERS

The ability of OLEDs to offer

numerous designing capabilities can

offset, to an extent, the requirement

for improvement of lifetime and

efficacy in premium applications.

While OLED lighting players have

started offering premium solutions,

there is room for enhancing material

characteristics (such as stable blue

emitters) and fabrication techniques

(such as continuous roll-to-roll

processing.)

On a broader horizon, the current

performance of OLEDs is

comparable with LEDs, making

OLEDs a suitable substitute for a

wide range of lighting applications.

However, it is the premium cost of

OLEDs that must be brought down

to cater to the mass market.

www.nanomarkets.net 2014 NanoMarkets, LC

* OLED panel parameters have been estimated based on the panels made available by LG Chem

Design flexibility

Better thermal

management

Prospect of solution

processable

fabrication

technique

Ultra-thin form factor enables the true integration of

lighting elements into architecture and the creation

of free-form luminous objects that can find

applications in staircases, windows, partition walls,

wall cladding and premium furniture.

Unlike LEDs, OLEDs do not require a thermal

management system, leading to better control over

efficacy and lifetime.

Active interest demonstrated by Mitsubishi,

Sumitomo, Fraunhofer and Konica Minolta have

increased the possibility of transforming OLED

printing lines into cost-effective commercial

production lines in the long run.

FAVORABLE FACTORS FOR THE INDUSTRY

www.nanomarkets.net 2014 NanoMarkets, LC

g

KEY ISSUES FACED BY THE INDUSTRY

Cost-effective

production

scalability

quickly

Improvement of

electrical

efficiency

Better control

of internal

quantum

efficiency

Improvement of

external

quantum

efficiency

A critical challenge to tackle while ensuring performance parameters on a large scale; already

proved to be a dampener with Panasonic Idemitsu and GE deciding not to move ahead with

their OLED lighting initiatives.

Although lumen depreciation process can be slowed down, this can lead to complexity in

manufacturing process, rising costs and lowering yields. Novaled and Toshiba are the firms to

watch for further developments in this space.

Despite research around phosphorescent materials, producing stable blue emitters with high

quantum efficiency has been difficult, making it a weak link on the materials front. Konica

Minolta and UDC are the key players to watch here.

Need to improve light extraction efficiency from the current level of 20-25% by optimizing the

mismatch of refractive index of organic material, underlying substrate and air. LG Chemand

Novaled are the noteworthy players here.

www.nanomarkets.net 2014 NanoMarkets, LC

TRENDS IN OLED MATERIAL DEPOSITION TECHNIQUES

Philips,

LG Chem,

Osram,

Lumiotec,

Fraunhofer

Konica

Minolta,

Sumitomo

Mitsubishi

Pioneer

Vapor

deposition

process

Solution

printing

process

Both processes

Majority of OLED players are still

dependent on expensive vapor deposition

technique and it will take the industry a few

more years to adopt an efficient and cost-

effective OLED material deposition

technique.

It must be noted that solution-printing

technique is yet to deliver the performance

comparable to the currently utilized vapor

deposition technique.

While nozzle printing techniques have been

adapted to OLED displays by the likes of Du

Pont and Dai Nippon, ink-jet printing

techniques (IJT) have been experimented

with for manufacturing OLED lighting

panels.

This can be gauged by the fact that

Sumitomo, one of the early adopters of IJT,

is expected to roll out OLED lighting panels

via IJT and utilizing its polymer based

materials by 2015.

www.nanomarkets.net 2014 NanoMarkets, LC

WAYS TO ACHIEVE COST REDUCTION TARGETS

Brightness/efficacy Improved lifetime Cost-effective

Overall low costs

Highly efficient blue emitters

Enhanced external quantum

efficiency

Improved vapor deposition

/solution processing

technique

Improved light extraction

capability

Reduced material wastage

Improved yields

Efficient active organic

material sets

Low voltage and current

architecture

Low-cost and effective

substrates

Improved encapsulation

technology

Integrated substrates

Strong IP portfolio

New breakthroughs

Improved material

ecosystem

Efficient

manufacturing

process

Product development

initiatives

www.nanomarkets.net 2014 NanoMarkets, LC

MATERIAL AND PROCESS IMPROVEMENT TIMELINE

2014 2016 2018 2020 2022

Overall material utilization > 60%

Overall yield > 70%

Light extraction efficiency

> 40%

Emergence of alternatives

to expensive and

inefficient encapsulation

process

Material

development

milestones

Process

development

milestones

Improvement in light extraction structures

Emergence of R2R

approach in commercial

lines

Emergence of efficient

blue emitter

Near to full capacity utilization of

existing lines

Alternatives to expensive glass substrates

Evolution of wet chemistry process to ensure uniform coating via a cost-

effective and faster process compared to the currently operational small

scale solution processing lines.

Emergence of transparent materials and ITO alternatives

Light extraction efficiency > 70%

www.nanomarkets.net 2014 NanoMarkets, LC

CURRENT PRODUCTION FACILITY OF KEY OLED LIGHTING PLAYERS

Production Facility

Philips

LG Chem

Osram

Konica Minolta

Lumiotec

Mitsubishi

Pioneer

Fraunhofer *

Expected to set up Gen 3 line by 2014 end

Expected to set up Gen 2 line by 2014 end

Currently working

on a Gen 4.5 line

Expected to set up

Gen 5 line by

2015

Current Facility Expected Expansion Plans

Pilot line

Gen 5

Gen 4.5

Gen 3

Gen 2

Gen 2

Gen 2

Gen 2

Gen 2

Gen 2 lines are expected to enable the industry to commercialize OLED lighting applications; however

Philips and LG Chemwill remain at the forefront to migrate to larger substrate sizes in a move to take

advantage of better material usage offered by higher generation lines.

www.nanomarkets.net 2014 NanoMarkets, LC

* Fraunhofer is an institute and not intend to make mass production. It may license its technology.

STATUS OF COMMERCIAL AVAILABILITY OF OLED LIGHTING

LG Chemand

Mitsubishi

Pioneer are

expected to

lead the OLED

lighting mass

production

initiatives in

2014 with

Konica Minolta

likely to follow

both firms in

2015.

Philips and

Lumiotec likely

to support

additional

commercial

grade lighting

panels from

2015 onward.

Commercially available Prototype/ pilot production Volume production

www.nanomarkets.net 2014 NanoMarkets, LC

Note: Fraunhofer is an institute and not intend to make mass production. It may license its technology.

POTENTIAL APPLICATIONS

Designer

kits

Office

Luxury

Decorative

Automotive

Given the current

developments in the OLED

lighting industry, luxury lighting

and decorative lighting are

expected to have the maximum

commercialization potential

followed by office and

automotive lighting segments.

Residential lighting segment is

unlikely to receive a major

impetus anytime before five

years from now.

Acuity Brands

Astron Fiamm

Blackbody

First-o-light

Kaneka

Konica Minolta

LG Chem

Lumiotec

Mitsubishi Pioneer

Osram

Philips

Sumitomo

www.nanomarkets.net 2014 NanoMarkets, LC

Big Value

Investments -

mainly within Asia

COMPANIES INVOLVED AND MAJOR INVESTMENTS

Panel manufacturers

Luminaire

manufacturers

OLED material suppliers

Konica Minolta (Japan)

Around $100 million investment

to mass produce (by 2014 end)

color-tunable and flexible panel

with maximum monthly panel

production capacity of around 1

million panels.

While Osram is expected to channel its past OLED R&D investment to come up with automotive lighting solutions

within the next two years, Philips will likely rely on the office and commercial lighting segment to reap benefits

out of its 40 million investment in production line that started producing OLED lighting panels (early 2013) in

addition to the already existing pilot line.

LG Chem(South Korea)

LG Chemwill also look at

recouping its initial investment

in migrating to a higher

generation line by moving

ahead with large scale

production within the next

three to five years.

www.nanomarkets.net 2014 NanoMarkets, LC

R&D facility

OLED LIGHTING INDUSTRY: PROBABLE MARKET SCENARIOS

Case 1: Domination of LEDs

OLED lighting finds only limited use

in designer high-value applications

in luxury set-ups.

LEDs manage to offer better

aesthetic and performance

possibilities at a relatively lower

price point, thus undermining

OLEDs.

OLED lighting industry struggles to

improve lifetime and encapsulation

issues, thus hindering volume

production.

Case 2: Market Acceptance for OLEDs

The industry rides past production scalability issues and

comes up with a cost-effective roll-to-roll process with

an acceptable production yield and better material

utilization levels.

Stable, efficient and long-lasting blue emitters are

commercially developed on a large scale.

Large sized OLED lighting panels with a reasonably high

brightness level (>5,000 cd/m2) are produced to cater

to the residential segment.

Total cost of owning an OLED panel is made attractive

as Japanese, Korean and Taiwanese manufacturers on

government initiatives.

Primary OLED Winners

Material IP holders like UDC and LG

Chemwho can thwart the initial

efforts extended by Osram and

Philips, although these two

companies can still cater to majority

of the European market a key high-

value lighting destination. Others

like Blackbody (France) can also be a

winner by providing customized

premium luminaires.

Primary OLED Winners

Dominance by material IP holders like UDC and Asian

panel and luminaire makers with strong distribution

channels; however the European market will witness

an increased penetration of Philips and Osram that will

look at leveraging their well-established network.

Case 3: OLEDs Never Take Off

OLED lighting fails and is unable to

take off in a significant manner

even in premium commercial

applications.

Possible due to the inability of the

panel makers to standardize and

make the material deposition and

panel fabrication techniques cost-

effective.

Wet-chemistry and roll-to-roll

processes may also turn out

unsuitable for large scale OLED

panel production.

Lifetime issues of OLEDs might not

get resolved as quickly as

envisaged previously.

Encapsulation solution providers

might also face difficulty in

migrating toward a standard glass

based alternative that is less

expensive.

www.nanomarkets.net 2014 NanoMarkets, LC

Most likely scenario to happen

3

CONTACT US

2013 NanoMarkets, LC www.nanomarkets.net

facebook.com/pages/NanoMarkets/

twitter.com/nanomarkets

linkedin.com/in/nanomarkets

nanomarkets.net/rssfeeds

Address:

NanoMarkets, LC

PO Box 3840

Glen Allen, VA 23058

Telephone / Fax

804-270-1718

804-360-7259

Email / Web

info@nanomarkets.net

www.nanomarkets.net

You might also like

- Opportunities For Transparent DisplaysDocument13 pagesOpportunities For Transparent DisplaysNanoMarketsNo ratings yet

- Opportunities For Thin-Film BatteriesDocument15 pagesOpportunities For Thin-Film BatteriesNanoMarketsNo ratings yet

- Articles-"Opportunities For BIPV"Document3 pagesArticles-"Opportunities For BIPV"NanoMarketsNo ratings yet

- Opportunities For BIPVDocument15 pagesOpportunities For BIPVNanoMarketsNo ratings yet

- Worldwide Medical Ceramics Markets: 2013 Chapter OneDocument10 pagesWorldwide Medical Ceramics Markets: 2013 Chapter OneNanoMarketsNo ratings yet

- Chapter From NanoMarkets' Report, "Worldwide Medical Polymer Markets: 2013-2020"Document9 pagesChapter From NanoMarkets' Report, "Worldwide Medical Polymer Markets: 2013-2020"NanoMarketsNo ratings yet

- PowerPoint Slides From NanoMarkets Report On Medical CeramicsDocument20 pagesPowerPoint Slides From NanoMarkets Report On Medical CeramicsNanoMarketsNo ratings yet

- Worldwide Smart Coatings Markets: 2013-2020 Chapter OneDocument15 pagesWorldwide Smart Coatings Markets: 2013-2020 Chapter OneNanoMarketsNo ratings yet

- Chapter From The NanoMarkets Report, "Transparent Conductor Markets 2013"Document11 pagesChapter From The NanoMarkets Report, "Transparent Conductor Markets 2013"NanoMarketsNo ratings yet

- Article - "Markets and Opportunities For NanoSensors"Document5 pagesArticle - "Markets and Opportunities For NanoSensors"NanoMarketsNo ratings yet

- Chapter From NanoMarkets' Report On Quantum Dots in Lighting and DisplaysDocument12 pagesChapter From NanoMarkets' Report On Quantum Dots in Lighting and DisplaysNanoMarketsNo ratings yet

- 3D Printing Markets: Hope, Hype and Strategies - ExcerptDocument12 pages3D Printing Markets: Hope, Hype and Strategies - ExcerptNanoMarketsNo ratings yet

- Smart Windows Webinar SlidesDocument22 pagesSmart Windows Webinar SlidesNanoMarketsNo ratings yet

- Powered Smart Cards, Preview ChapterDocument13 pagesPowered Smart Cards, Preview ChapterNanoMarketsNo ratings yet

- Rethinking OLED LightingDocument6 pagesRethinking OLED LightingNanoMarketsNo ratings yet

- Smart Windows Markets, Exec SummaryDocument24 pagesSmart Windows Markets, Exec SummaryNanoMarketsNo ratings yet

- Transcript From Nanomarkets Q&A On Oled Materials Markets: September 2012Document15 pagesTranscript From Nanomarkets Q&A On Oled Materials Markets: September 2012NanoMarketsNo ratings yet

- Radiation Detection Materials and Device MarketsDocument18 pagesRadiation Detection Materials and Device MarketsNanoMarketsNo ratings yet

- Low Cost Sensor Markets, PreviewDocument12 pagesLow Cost Sensor Markets, PreviewNanoMarketsNo ratings yet

- Markets For OLED Encapsulation Materials PreviewDocument18 pagesMarkets For OLED Encapsulation Materials PreviewNanoMarketsNo ratings yet

- Advanced Glazing Systems PreviewDocument11 pagesAdvanced Glazing Systems PreviewNanoMarketsNo ratings yet

- Transcript From Nanomarkets Q&A On Transparent Conductors: September 2012Document17 pagesTranscript From Nanomarkets Q&A On Transparent Conductors: September 2012NanoMarketsNo ratings yet

- NanoMarkets Report LED Phosphors Markets - 2012Document17 pagesNanoMarkets Report LED Phosphors Markets - 2012NanoMarketsNo ratings yet

- Self Cleaning Windows Preview ChapterDocument10 pagesSelf Cleaning Windows Preview ChapterNanoMarketsNo ratings yet

- Bio-Plastics Markets Preview ChapterDocument10 pagesBio-Plastics Markets Preview ChapterNanoMarketsNo ratings yet

- Smart Grid Energy StorageDocument6 pagesSmart Grid Energy StorageNanoMarketsNo ratings yet

- Metal Oxide Thin-Film Transistor MarketsDocument19 pagesMetal Oxide Thin-Film Transistor MarketsNanoMarketsNo ratings yet

- Smart Windows Markets 2012Document25 pagesSmart Windows Markets 2012NanoMarketsNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 205 Unit 1 L04 Superposition TheoremDocument5 pages205 Unit 1 L04 Superposition TheoremBINOSHI SAMUVELNo ratings yet

- DLC Da+dg Aw03Document336 pagesDLC Da+dg Aw03zotya54No ratings yet

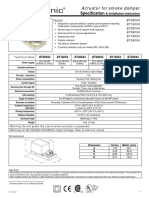

- Specification: Actuator For Smoke DamperDocument2 pagesSpecification: Actuator For Smoke Dampermartin saadNo ratings yet

- 3500/60 & /61 Temperature Monitors: Product DatasheetDocument12 pages3500/60 & /61 Temperature Monitors: Product Datasheet666plc11No ratings yet

- Paper 58-Modeling of Arduino Based Prepaid Energy MeterDocument5 pagesPaper 58-Modeling of Arduino Based Prepaid Energy MeterAshwini Bhoy100% (1)

- Dece 1040-3040 SyllabusDocument220 pagesDece 1040-3040 Syllabusnanobala15100% (1)

- (Guide) To Installing S-Off, Unlocking, ClockWork, Root, SuperCID & S-OnDocument7 pages(Guide) To Installing S-Off, Unlocking, ClockWork, Root, SuperCID & S-Onr0y51No ratings yet

- High Voltage EngineeringDocument38 pagesHigh Voltage EngineeringsjNo ratings yet

- JSA07898E-AA-i-con (2.0) Control System Instruction (VVVF)Document21 pagesJSA07898E-AA-i-con (2.0) Control System Instruction (VVVF)Eusebio EspinozaNo ratings yet

- Quick Start Guide: Carel EVD Evolution MODBUS Device E2 Setup For 527-0355Document10 pagesQuick Start Guide: Carel EVD Evolution MODBUS Device E2 Setup For 527-0355Prince RajaNo ratings yet

- Broch Specs EnglDocument12 pagesBroch Specs EnglSteve WanNo ratings yet

- Datasheet SerialCamera en 1Document9 pagesDatasheet SerialCamera en 1RicardoAlvarezNo ratings yet

- Circuit Note: Adrv-PackrfDocument15 pagesCircuit Note: Adrv-PackrfwesNo ratings yet

- PIC18F13K22 DatasheetDocument382 pagesPIC18F13K22 DatasheettomNo ratings yet

- Webmeetme Installation on Linux-Asterisk Server ProposalDocument2 pagesWebmeetme Installation on Linux-Asterisk Server ProposalmaruthiganNo ratings yet

- Tarot x6 User Manual 1Document35 pagesTarot x6 User Manual 1El CuriosoNo ratings yet

- Xilinx Device Drivers ApiDocument1,213 pagesXilinx Device Drivers ApihypernuclideNo ratings yet

- 7 Control of Circulating Current in Parallel Three-PhaseDocument7 pages7 Control of Circulating Current in Parallel Three-PhaseRizwan UllahNo ratings yet

- 34OJWN3gb Installation and OperatingDocument16 pages34OJWN3gb Installation and OperatingluanagueNo ratings yet

- IAT-II Question Paper With Solution of 15EC53 Verilog HDL Nov-2017 - Sunil Kumar K.H PDFDocument10 pagesIAT-II Question Paper With Solution of 15EC53 Verilog HDL Nov-2017 - Sunil Kumar K.H PDFKavyashreeMNo ratings yet

- Bender A-Isometer IRDH575 User ManualDocument96 pagesBender A-Isometer IRDH575 User ManualAndreea Mitu HlandanNo ratings yet

- Additional List of KWH Meter ManufactureDocument4 pagesAdditional List of KWH Meter ManufactureGENERAL CNTICNo ratings yet

- Sony - HCD rg110, MHC rg110Document21 pagesSony - HCD rg110, MHC rg110Marin VlahovićNo ratings yet

- GSM Based Home Security SystemDocument20 pagesGSM Based Home Security SystemDhirendra Singh Rajput79% (14)

- Network Interface CardDocument4 pagesNetwork Interface CardKuldeep AttriNo ratings yet

- Inventory list of electronic equipment and accessoriesDocument2 pagesInventory list of electronic equipment and accessoriessmuralirajNo ratings yet

- HP-AN346 - A Guideline For Designing External DC Bias CircuitsDocument10 pagesHP-AN346 - A Guideline For Designing External DC Bias Circuitssirjole7584No ratings yet

- Vendor documentation for distribution transformersDocument148 pagesVendor documentation for distribution transformersCu TíNo ratings yet

- Lab 2 Universal Logic GatesDocument4 pagesLab 2 Universal Logic GatesIfthakharul Alam ShuvoNo ratings yet

- Art of Metering and ExposureDocument39 pagesArt of Metering and ExposureklladoNo ratings yet