Professional Documents

Culture Documents

At Long Last, Inflation: By: Jens Erik Gould Published: May 12, 2014

Uploaded by

Theng Roger0 ratings0% found this document useful (0 votes)

13 views3 pagesInflationary pressure

Original Title

At Long Last

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInflationary pressure

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views3 pagesAt Long Last, Inflation: By: Jens Erik Gould Published: May 12, 2014

Uploaded by

Theng RogerInflationary pressure

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

At Long Last, Inflation

By: Jens Erik Gould

Published: May 12, 2014

For the past two and a half years, inflation in the developed world has been the

bogeyman that never shows his face. Growth in consumer prices has done nothing

but decelerate, even as economic growth prospects have improved. Whether that is

good or bad is debatable. On one hand, it has made it easier for the U.S. Federal

Reserve to justify loose monetary policy aimed at strengthening the economic

recovery. On the other, its fueled investor concern over Europe, where the specter

of actual deflation complicates the future value of debt repayments and has raised

concerns about future growth.

In any case, the issue may soon be moot, as inflation is set to stage a long-awaited

comeback, according to Credit Suisses April 25 report Inflation: The Noise is the

Signal. In the U.S., an improving labor market will start to stimulate inflation,

according to Fed Chair Janet Yellen. She also thinks that factors currently keeping

consumer prices down, such as a deceleration in energy cost growth, wont last. The

Fed therefore expects inflation to return to the banks 2 percent target in 2015 after

nearly two years of falling beneath it. To some extent, the low rate of inflation seems

due to influences that are likely to be temporary, Yellen said in an April 16 speech.

Longer-run inflation expectations have remained remarkably steady, however.

In Europe, a continuing, albeit slow, economic recovery is expected to push prices

up as well. While GDP growth rates forecasted by the European Commission1.2

percent this year and 1.7 percent next are modest enough, theyre nevertheless a

definite improvement over the continents deep recession of 2011 and 2012. And the

Commissions forecast of 0.8 percent inflation this year and 1.2 percent next year

should put concerns about deflation and disinflation on the backburner. According

to preliminary data, annual inflation was 0.7 percent in the euro zone in April, more

than the 0.5 percent reading in March and just under Credit Suisses forecast of 0.8

percent. Finally, Japan appears on a path to perhaps finally shake off its dogged

deflation. Its central bank said last week that inflation will exceed 2 percent in fiscal

year 2016.

Forthcoming April data, says Credit Suisse, will likely show that the turnaround in

consumer prices has already begun, with core inflation on the rise in all of the U.S.,

Europe and Japan. Japan, in fact, is expected to show its largest monthly increase in

the last 15 years, driven by an increase in the consumption tax rate from 5 to 8

percent on April 1, which led core consumer inflation in Tokyo to jump to a 22-year

high. In the U.S., the year-on-year April figure is expected to jump due to last years

reduction in Medicare payments tied to federal budget cuts. European prices should

actually fall in May relative to April because of the unusual timing of Easter last year.

While that kind of volatility might normally suggest more hawkish monetary policy, its

driven largely by seasonal factors and recent policy changes, which will make the

seeming acceleration short-lived. That, along with the fact that the economic

recovery is still weak, means markets are still not expecting the first Fed rate hike

until mid- to late-2015. For now, the markets implied path of when hikes begin, how

quickly rates rise, and where terminal rates will be remains reasonably close to the

Feds guidance, analysts Axel Lang and James Sweeney say in the Credit Suisse

report.

But that scenario wont last forever. Markets will become increasingly sensitive as

soon as inflation reverses course for good later this year, the job outlook continues to

strengthen, and the Fed further reduces its asset purchases, according to Credit

Suisse. At that point, investors will view the Feds forward guidance as less relevant,

and will take on more varied views about the path of inflation. Consequently, Lang

and Sweeney conclude, the volatility in the rates market will come back in [a] more

permanent fashion.

You might also like

- The Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceFrom EverandThe Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceRating: 4 out of 5 stars4/5 (1)

- The World Overall 06:21 - Week in ReviewDocument5 pagesThe World Overall 06:21 - Week in ReviewAndrei Alexander WogenNo ratings yet

- Inflation Is A Threat To The EurozoneDocument2 pagesInflation Is A Threat To The Eurozonecheshirecat96No ratings yet

- Swedbank Economic Outlook Update, November 2015Document17 pagesSwedbank Economic Outlook Update, November 2015Swedbank AB (publ)No ratings yet

- The World Overall 03:22 - Week in ReviewDocument4 pagesThe World Overall 03:22 - Week in ReviewAndrei Alexander WogenNo ratings yet

- Is This The Turning Point For Interest RatesDocument7 pagesIs This The Turning Point For Interest RatesJasmine MagdyNo ratings yet

- Kimberly - Economics Internal AssesmentDocument8 pagesKimberly - Economics Internal Assesmentkimberly.weynata.4055No ratings yet

- Global Central Banking in 2014, A First Quarter Update For 23 Economies - Real Time Economics - WSJDocument16 pagesGlobal Central Banking in 2014, A First Quarter Update For 23 Economies - Real Time Economics - WSJawang90No ratings yet

- International Macroeconomic Environment: Weaker Global Growth and Geopolitical Tensions Rekindle Financial Sector VolatilitiesDocument11 pagesInternational Macroeconomic Environment: Weaker Global Growth and Geopolitical Tensions Rekindle Financial Sector VolatilitiesБежовска СањаNo ratings yet

- Global Data Watch: Bumpy, A Little Better, and A Lot Less RiskyDocument49 pagesGlobal Data Watch: Bumpy, A Little Better, and A Lot Less RiskyAli Motlagh KabirNo ratings yet

- The World Overall 06:07 - Week in ReviewDocument5 pagesThe World Overall 06:07 - Week in ReviewAndrei Alexander WogenNo ratings yet

- PIMCO CyclicalOutlook Amey Bosomworth Pagani Sep2015Document4 pagesPIMCO CyclicalOutlook Amey Bosomworth Pagani Sep2015kunalwarwickNo ratings yet

- The World Overall 05:24 - Week in ReviewDocument6 pagesThe World Overall 05:24 - Week in ReviewAndrei Alexander WogenNo ratings yet

- Financial Times 2014-09-24 Euro Weakness Strengthens Hand of ECB Policy Makers, p1Document2 pagesFinancial Times 2014-09-24 Euro Weakness Strengthens Hand of ECB Policy Makers, p1luckyboy77No ratings yet

- Inflation OutlookDocument6 pagesInflation OutlookAdwiteeya ChaudhryNo ratings yet

- Ier Nov 11Document2 pagesIer Nov 11derek_2010No ratings yet

- Global Weekly Economic Update - Deloitte InsightsDocument8 pagesGlobal Weekly Economic Update - Deloitte InsightsSaba SiddiquiNo ratings yet

- The World Overall 03:29 - Week in ReviewDocument5 pagesThe World Overall 03:29 - Week in ReviewAndrei Alexander WogenNo ratings yet

- Forex and Interest Rate Outlook: 13th February 2014Document6 pagesForex and Interest Rate Outlook: 13th February 2014ThienTrangNo ratings yet

- Fomc Pres Conf 20160615Document21 pagesFomc Pres Conf 20160615petere056No ratings yet

- Interim Economic Outlook: Puzzles and UncertaintiesDocument8 pagesInterim Economic Outlook: Puzzles and Uncertaintiesapi-296228558No ratings yet

- The Economy and Housing Continue To Tread Water: Two-Year Yields On Greek Debt SurgeDocument6 pagesThe Economy and Housing Continue To Tread Water: Two-Year Yields On Greek Debt SurgeRossy JonesNo ratings yet

- Bank of England MustDocument4 pagesBank of England MustAli ShadanNo ratings yet

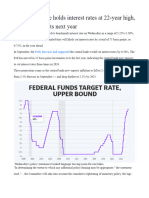

- 2023-12-13-Federal Reserve Holds Interest Rates at 22-Year High, Signals Three Cuts Next YearDocument3 pages2023-12-13-Federal Reserve Holds Interest Rates at 22-Year High, Signals Three Cuts Next YearAurel AchilNo ratings yet

- JPM Global Data Watch Se 2012-09-21 946463Document88 pagesJPM Global Data Watch Se 2012-09-21 946463Siddhartha SinghNo ratings yet

- Eurobank Monthly Global Economic Market Monitor September 2016Document24 pagesEurobank Monthly Global Economic Market Monitor September 2016nikoulisNo ratings yet

- 47 Economic Outlook RecoverDocument28 pages47 Economic Outlook RecovergirishrajsNo ratings yet

- Investment Markets and Key Developments Over The Past WeekDocument2 pagesInvestment Markets and Key Developments Over The Past WeekArtur SilvaNo ratings yet

- Wisdom of Wealth: BIG NEWS: Baby Is On The Way! Time To Get Moving!Document8 pagesWisdom of Wealth: BIG NEWS: Baby Is On The Way! Time To Get Moving!TriangleFinancialNo ratings yet

- MPC 1411Document15 pagesMPC 1411Sandip BhattNo ratings yet

- The Bank of Canada's Changing LanguageDocument3 pagesThe Bank of Canada's Changing Languageapi-99106451No ratings yet

- Weekly Economic Commentary 06-27-2011Document3 pagesWeekly Economic Commentary 06-27-2011Jeremy A. MillerNo ratings yet

- The World Overall: Last Week in ReviewDocument4 pagesThe World Overall: Last Week in ReviewAndrei Alexander WogenNo ratings yet

- MFM Jun 17 2011Document13 pagesMFM Jun 17 2011timurrsNo ratings yet

- 59 - Fundamental Breakdown 05.02.23Document13 pages59 - Fundamental Breakdown 05.02.23Yar Zar AungNo ratings yet

- ScotiaBank AUG 06 Europe Weekly OutlookDocument3 pagesScotiaBank AUG 06 Europe Weekly OutlookMiir ViirNo ratings yet

- Yellen HHDocument7 pagesYellen HHZerohedgeNo ratings yet

- Calm Before The Storm: Thursday, 23 May 2013Document11 pagesCalm Before The Storm: Thursday, 23 May 2013Marius MuresanNo ratings yet

- Out of The Shadows For Now.: LPL Compliance Tracking #1 LPL Compliance Tracking #1-456099Document8 pagesOut of The Shadows For Now.: LPL Compliance Tracking #1 LPL Compliance Tracking #1-456099Clay Ulman, CFP®No ratings yet

- Weekly Market CompassDocument4 pagesWeekly Market CompassYasahNo ratings yet

- Fundamental Analysis 31 October 08Document3 pagesFundamental Analysis 31 October 08Robert PetrucciNo ratings yet

- 1 - Investment Analysis Report EURUSD Rate PredictionDocument15 pages1 - Investment Analysis Report EURUSD Rate PredictionTycoonNo ratings yet

- Weekly Economic Commentary 07-30-2012Document4 pagesWeekly Economic Commentary 07-30-2012Jeremy A. MillerNo ratings yet

- Christopher WallerDocument29 pagesChristopher WallerTim MooreNo ratings yet

- Article Review TemplateDocument12 pagesArticle Review TemplateAshli GrantNo ratings yet

- MPC Statement July 2015Document11 pagesMPC Statement July 2015MatthewLeCordeurNo ratings yet

- ScotiaBank JUL 30 Europe Weekly OutlookDocument3 pagesScotiaBank JUL 30 Europe Weekly OutlookMiir ViirNo ratings yet

- Prof. Lalith Samarakoon As US Interest Rates Rise, No Space For Sri Lanka To Wait and SeeDocument8 pagesProf. Lalith Samarakoon As US Interest Rates Rise, No Space For Sri Lanka To Wait and SeeThavam RatnaNo ratings yet

- Daily Breakfast Spread: EconomicsDocument6 pagesDaily Breakfast Spread: EconomicsShou Yee WongNo ratings yet

- Macro IADocument7 pagesMacro IAKaj currency0% (1)

- Silverbullet 02Document7 pagesSilverbullet 02Matthias DtNo ratings yet

- Economist - The Federal Reserve MeetsDocument3 pagesEconomist - The Federal Reserve MeetsJeniffer GuillenNo ratings yet

- The World Overall 03:01 - Week in ReviewDocument4 pagesThe World Overall 03:01 - Week in ReviewAndrei Alexander WogenNo ratings yet

- 2011-06-08 DBS Daily Breakfast SpreadDocument6 pages2011-06-08 DBS Daily Breakfast SpreadkjlaqiNo ratings yet

- MPC StatementDocument11 pagesMPC StatementMatthewLeCordeurNo ratings yet

- Macroeconomics Commentary Number 2Document8 pagesMacroeconomics Commentary Number 2gqf94jy9rtNo ratings yet

- MPC Statement 23 September 2015Document10 pagesMPC Statement 23 September 2015MatthewLeCordeurNo ratings yet

- The World Overall 04:12 - Week in ReviewDocument6 pagesThe World Overall 04:12 - Week in ReviewAndrei Alexander WogenNo ratings yet

- Ecb Press CoDocument4 pagesEcb Press Conimish2No ratings yet

- US Jobs Seen Growing With Resilient Economy - Eco Week - BloombergDocument12 pagesUS Jobs Seen Growing With Resilient Economy - Eco Week - BloombergVineet YagnikNo ratings yet

- Singapore's IPO Market Roars Back To Life in H1, More Big ListiDocument2 pagesSingapore's IPO Market Roars Back To Life in H1, More Big ListiTheng RogerNo ratings yet

- Super FoodsDocument16 pagesSuper FoodsTheng Roger100% (1)

- Lifestyle Gets Blame For 70Document3 pagesLifestyle Gets Blame For 70Theng RogerNo ratings yet

- Double Protection Against StrokeDocument4 pagesDouble Protection Against StrokeTheng RogerNo ratings yet

- Super FoodsDocument16 pagesSuper FoodsTheng Roger100% (1)

- Lifestyle Gets Blame For 70Document3 pagesLifestyle Gets Blame For 70Theng RogerNo ratings yet

- Super FoodsDocument16 pagesSuper FoodsTheng Roger100% (1)

- High Level of Iron and Manganese inDocument1 pageHigh Level of Iron and Manganese inTheng RogerNo ratings yet

- Danish Krone Stages Biggest Fall Vs Euro Since 2001Document2 pagesDanish Krone Stages Biggest Fall Vs Euro Since 2001Theng RogerNo ratings yet

- The Dangers in Rising Bond YieldsDocument2 pagesThe Dangers in Rising Bond YieldsTheng RogerNo ratings yet

- Weak Oil and Euro Drive Europe's QE-fuelled Rally: Greece Ukraine Quantitative EasingDocument3 pagesWeak Oil and Euro Drive Europe's QE-fuelled Rally: Greece Ukraine Quantitative EasingTheng RogerNo ratings yet

- Hedge Funds' Oil Shorts Reach Peak For The Year: David SheppardDocument3 pagesHedge Funds' Oil Shorts Reach Peak For The Year: David SheppardTheng RogerNo ratings yet

- Noble GroupDocument5 pagesNoble GroupTheng Roger100% (1)

- Growth Hormone Guidance: Editor'S Choice in Molecular BiologyDocument2 pagesGrowth Hormone Guidance: Editor'S Choice in Molecular BiologyTheng RogerNo ratings yet

- Fight in Iraq Has Oil Traders Holding Their BreathDocument2 pagesFight in Iraq Has Oil Traders Holding Their BreathTheng RogerNo ratings yet

- Globalrisk: Friday, January 17, 2014 6:13 AmDocument2 pagesGlobalrisk: Friday, January 17, 2014 6:13 AmTheng RogerNo ratings yet

- Look Out Below If Gold Fails This Technical TestDocument2 pagesLook Out Below If Gold Fails This Technical TestTheng RogerNo ratings yet

- Colon CancerDocument12 pagesColon CancerTheng RogerNo ratings yet

- Look Out Below If Gold Fails This Technical TestDocument2 pagesLook Out Below If Gold Fails This Technical TestTheng RogerNo ratings yet

- S Merger Activity Back at The TrillionDocument3 pagesS Merger Activity Back at The TrillionTheng RogerNo ratings yet

- Sellout AgainDocument2 pagesSellout AgainTheng RogerNo ratings yet

- Good Intentions Paved Way To Market MayhemDocument3 pagesGood Intentions Paved Way To Market MayhemTheng RogerNo ratings yet

- Greenspan WorryDocument1 pageGreenspan WorryTheng RogerNo ratings yet

- HereDocument2 pagesHereTheng RogerNo ratings yet

- Markets Fear UDocument2 pagesMarkets Fear UTheng RogerNo ratings yet

- MarketDocument2 pagesMarketTheng RogerNo ratings yet

- 15percent CorrectionDocument2 pages15percent CorrectionTheng RogerNo ratings yet

- That Police Officer IsDocument3 pagesThat Police Officer IsTheng RogerNo ratings yet

- Buy OpportunityDocument1 pageBuy OpportunityTheng RogerNo ratings yet

- Credit CrunchDocument2 pagesCredit CrunchTheng RogerNo ratings yet

- MCBDocument1 pageMCBAbdul Habib MirNo ratings yet

- Itr2 2019 PR4Document134 pagesItr2 2019 PR4Dhruv ChitkaraNo ratings yet

- Mega Walk-In Drive For Financial Analyst: Job DescriptionDocument3 pagesMega Walk-In Drive For Financial Analyst: Job DescriptionRaj JoshiNo ratings yet

- Assignment Eco211 MacroeconomicDocument15 pagesAssignment Eco211 MacroeconomicNur Ika0% (2)

- Dissertation of Cash Flow RatiosDocument309 pagesDissertation of Cash Flow Ratioszozo001100% (1)

- Unit 2 Assignment Managing Financial Resources & Decisions SamDocument9 pagesUnit 2 Assignment Managing Financial Resources & Decisions SamBenNo ratings yet

- UW Computational-Finance & Risk Management Brochure Final 080613Document2 pagesUW Computational-Finance & Risk Management Brochure Final 080613Rajel MokNo ratings yet

- Human Resource Management Policy of Al Arafah Islami BankDocument68 pagesHuman Resource Management Policy of Al Arafah Islami BankFatema Chowdhury100% (1)

- Accounting EquationDocument37 pagesAccounting Equationzubbu111No ratings yet

- Soal-Soal Chap 017 Understasnding Accounting and Information SystemDocument52 pagesSoal-Soal Chap 017 Understasnding Accounting and Information SystemNurhayati SitorusNo ratings yet

- Variation Proforma For Journal Entries: S.No Transactions Chart of Accounts Accounting Pillars Reasons Debit CreditDocument11 pagesVariation Proforma For Journal Entries: S.No Transactions Chart of Accounts Accounting Pillars Reasons Debit CreditZaheer Ahmed SwatiNo ratings yet

- AppppDocument3 pagesAppppMaria Regina JavierNo ratings yet

- MusharkahDocument44 pagesMusharkahAsad AliNo ratings yet

- MC 1110Document24 pagesMC 1110mcchronicleNo ratings yet

- Philippine SEC Mandate and FunctionsDocument2 pagesPhilippine SEC Mandate and FunctionsfccarlosNo ratings yet

- The Norway ModelDocument15 pagesThe Norway Modelrutty7No ratings yet

- RushilDocument382 pagesRushilReetika KashivNo ratings yet

- Case 1Document176 pagesCase 1EllieNo ratings yet

- Certificate in Advanced Business Calculations Level 3/series 3-2009Document18 pagesCertificate in Advanced Business Calculations Level 3/series 3-2009Hein Linn Kyaw100% (10)

- Kinds of SharesDocument16 pagesKinds of SharesMridulGodhaNo ratings yet

- Private Equity Real Estate FirmsDocument13 pagesPrivate Equity Real Estate FirmsgokoliNo ratings yet

- MGT201 A Huge File For Quizzes 1140 PagesDocument1,140 pagesMGT201 A Huge File For Quizzes 1140 PagesWaseem AliNo ratings yet

- NapsDocument4 pagesNapsOyem SamuelNo ratings yet

- Investment ManagementDocument82 pagesInvestment ManagementSabita LalNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerSushmanth ReddyNo ratings yet

- TD Ameritrade Free Etf List PDFDocument6 pagesTD Ameritrade Free Etf List PDFjjy1234No ratings yet

- Chennai MetroDocument41 pagesChennai Metrobumeshrai2026No ratings yet

- Benefits of Franolaxy Consulting ServiceDocument1 pageBenefits of Franolaxy Consulting ServiceVikramNo ratings yet

- Diffrence Between Conventional Bank and Islamic BankDocument1 pageDiffrence Between Conventional Bank and Islamic BankChowdhury Mahin Ahmed100% (1)

- IM PandeyDocument28 pagesIM PandeyPrabhat Kumar100% (9)