Professional Documents

Culture Documents

ONGC Stock Price Analysis

Uploaded by

knowme730 ratings0% found this document useful (0 votes)

16 views8 pagesStock Market Analysis

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentStock Market Analysis

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views8 pagesONGC Stock Price Analysis

Uploaded by

knowme73Stock Market Analysis

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

November 18, 2013

ICICI Securities Ltd | Retail Equity Research

Result Update

WHAT S CHANGED

PRICE TARGET........................................................................changed from | 349 to | 306

EPS (FY14E)..........................................................................changed from | 34.3 to | 28.6

EPS (FY15E)..........................................................................changed from | 48.5 to | 40.8

RATING...............................................................................................................Unchanged

Negatives factored in

ONGC declared its Q2FY14 results with revenues at | 22414.7 crore (our

estimate: | 22489.5 crore) and PAT at | 6063.9 crore (our estimate:

| 5587.5 crore). The topline is in line with our estimates, with total

production at 6.5 MMT (our estimate: 6.6 MMT) and net realisations of

$44.8/bbl (our estimate $47.1/ bbl). Net realisations are lower than

estimates as subsidy burden is | 13,796 crore against our estimate of

| 12,330 crore. The bottomline is above our estimates due to higher other

income & lower depreciation. We have reduced our earnings estimate as

we have increased our subsidy share burden for ONGC. We recommend

a BUY rating on the stock, with a target price of | 306.

Domestic production from marginal fields to begin

ONGC has maintained its crude oil production guidance at 27.2 MMT for

FY14, implying a higher production in H2FY14 against that in H1FY14. The

production pick-up is expected from marginal fields like B-193 and Cluster

7 in Q4FY14, where substantial development work has already been

done. Current production from D1 field is 20,000 bopd. In KG DWN 98/2,

since columns of oil have been discovered, the company will submit

revised DOC in December 2013, with reserve accretion likely to happen in

FY15E. We expect the standalone production (domestic + JV) of oil & gas

to be ~ 26.5 MMT & ~ 24.9 BCM, respectively in FY14E.

Overseas assets-reserve accretion & volume ramp-up

Production from HEG field, Azerbaijan is estimated at 0.9 MMT in FY14E.

Production from South Sudan has started with production estimated at

0.28 MMT in FY14E. The ramp-up to pre-partition levels in South Sudan is

expected to happen in FY15E. Production in the A3 block in Myanmar has

also started in July 2013, where gas production is estimated at 0.09 BCM

in FY14E, with a subsequent ramp-up to 0.5 BCM in FY15E. Reserves from

the Mozambique block will get added to reserves in FY15E, once the

acquisition is complete in FY14E while reserves from BC-10 block will get

accounted for in FY14E itself. The current price offers a favourable risk-

reward ratio as it is already factoring in high subsidy burden. If no gas

price hike takes place, then our target price would be | 250, which shows

the stock price is hardly factoring in any gas price hike. We recommend

BUY rating on the stock, with a target price of | 306.

Exhibit 1: Financial Performance

(| Crore) Q2FY14A Q2FY14E Q2FY13 Q1FY14 YoY Gr.(%) QoQ Gr.(%)

Revenues 22414.7 22489.5 19885.1 19308.9 12.7 16.1

EBITDA 12103.6 12032.7 10368.7 8488.4 16.7 42.6

EBITDA Margin (%) 54.0 53.5 52.1 44.0 190 bps 1000 bps

Depreciation 4497.2 5013.4 3727.4 3900.7 20.7 15.3

Interest 0.1 5.0 3.1 0.2 -97.1 -57.1

Reported PAT 6063.9 5587.5 5896.6 4016.0 2.8 51.0

EPS (|) 7.1 6.5 6.9 4.7 2.8 51.0

Source: Company, ICICIdirect.com Research

Oil and Natural Gas Corporation (ONGC)

| 270

Rating matrix

Rating : Buy

Target : | 306

Target Period : 12-15 months

Potential Upside : 13%

Key Financials

( | Crore)

FY12 FY13 FY14E FY15E

Revenues 147306.8 162386.3 167854.3 192840.2

EBITDA 58706.4 54900.5 53592.8 72743.7

Net Profit 28428.9 23990.3 24610.1 35042.8

Valuation summary

FY12 FY13 FY14E FY15E

EPS (Rs) 32.9 28.3 28.6 40.8

PE (x) 8.2 9.5 9.4 6.6

Target PE (x) 9.3 10.8 10.7 7.5

EV to EBITDA (x) 3.5 4.0 4.2 2.9

Price to book (x) 1.7 1.5 1.4 1.2

RoNW (%) 20.8 15.7 15.0 18.7

RoCE (%) 24.9 19.6 19.5 25.7

Stock data

Market Cap. | 231000.1 Crore

Debt (FY13) | 8842.7 Crore

Cash + Liq. Invsts (FY13) | 19619.1 Crore

EV | 220223.8 Crore

52 week H/L 355 / 234

Equity capital | 140 Crore

Face value | 10

MF Holding (%) 13.7

FII Holding (%) 15.3

Price movement

50

100

150

200

250

300

350

400

Nov-13 Aug-13 May-13 Feb-13 Nov-12

2,000

3,000

4,000

5,000

6,000

7,000

Price (R.H.S) Nifty (L.H.S)

Analysts name

Mayur Matani

mayur.matani@icicisecurities.com

Nishit Zota

nishit.zota@icicisecurities.com

ICICI Securities Ltd | Retail Equity Research

Page 2

Exhibit 2: Assumption

Unit FY12 FY13 FY14E FY15E

Exchange rate |/$ 47.8 54.4 59.9 60.0

Gross Under-recoveries Rs. Crore 138541.1 161029.0 137495.5 126028.3

Gross realisation $/barrel 120.3 110.7 108.4 109.0

Net realisation $/barrel 55.3 47.9 44.0 45.5

Oil Production (Domestiv+JV) MMT 26.9 26.1 26.5 28.2

Oil Production (OVL) MMT 6.2 4.3 5.4 5.6

Gas Production (Domestic+JV) BCM 25.5 25.3 24.9 25.6

Gas Production (OVL) BCM 2.5 2.9 2.5 2.6

Source: ICICIdirect.com Research, Company

Exhibit 3: Crude oil production trend

6.5 6.6

6.5 6.5 6.5

0.0

1.5

3.0

4.5

6.0

7.5

Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14

m

m

t

Source: Company, ICICIdirect.com Research

Exhibit 4: Crude oil realisation trend

109.9 110.2

114.0

102.9

109.0

46.8 48.0

50.9

40.2

44.8

0

30

60

90

120

150

Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14

$

/

b

a

r

r

e

l

60

62

64

66

68

70

$

/

b

a

r

r

e

l

Gross Realised Price Realised Price after Subsidy / Discount Subsidy / Discount

Source: Company, ICICIdirect.com Research

Crude oil production remained flat YoY at 6.5 MMT in

Q2FY14. We estimate oil production at 26.5 MMT and 28.2

MMT in FY14E and FY15E, respectively

Upstream companies share in the gross under-recoveries

came at 47.4% in Q2FY14. The net crude oil realisation

declined 4.3% YoY to US$44.8/barrel in Q2FY14

ICICI Securities Ltd | Retail Equity Research

Page 3

Exhibit 5: Gas production trend

6.4 6.3

6.2 6.2 6.2

0.0

1.5

3.0

4.5

6.0

7.5

Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14

b

c

m

Source: Company, ICICIdirect.com Research

Exhibit 6: EBITDA & EBITDA margins trend

12104

8488

10734

11342

10369

44.0

49.2

53.8

52.1

54.0

0

3000

6000

9000

12000

15000

Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14

|

C

r

o

r

e

0

10

20

30

40

50

60

E

B

I

T

D

A

m

a

r

g

i

n

(

%

)

EBITDA EBITDA margin

Source: Company, ICICIdirect.com Research

Exhibit 7: Quarterly profit & loss account

(| Crore) Q2FY14 Percent. (%) Q2FY13 Percent. (%)

Revenues 22414.7 100.0 19885.1 100.0

(Increase) / Decrease in stock in trade -7.5 0.0 -113.1 -0.6

Consumption of raw materials 126.2 0.6 116.6 0.6

Employees Cost 442.7 2.0 544.9 2.7

Statutory Levies 5824.2 26.0 5585.3 28.1

Other Expenditure 3924.8 17.5 3382.0 17.0

Total Expenditure 10311.1 46.0 9516.4 47.9

EBITDA 12103.6 54.0 10368.7 52.1

Depreciation 4497.2 20.1 3727.4 18.7

EBIT 7606.4 33.9 6641.4 33.4

Interest 0.1 0.0 3.1 0.0

Other Inc /Exp /Extra Ordinary Item 1483.0 6.6 1901.1 9.6

PBT 9089.2 40.6 8539.4 42.9

Total Tax 3025.4 13.5 2642.9 13.3

PAT 6063.9 27.1 5896.6 29.7

Source: Company, ICICIdirect.com Research

Natural gas production declined 3.1% to 6.2 bcm in

Q2FY14. We estimate gas production at 24.9 bcm and 25.6

in FY14E and FY15E, respectively

ICICI Securities Ltd | Retail Equity Research

Page 4

Valuations

Our estimates of gross under-recoveries stand at ~| 1,37,496 crore and

~| 1,26,028 crore in FY14E and FY15E, respectively. The current price

offers a favourable risk-reward ratio as it is already factoring in high

subsidy burden. If no gas price hike takes place, then our target price

would be | 250, which shows that the stock price is hardly factoring in

any gas price hike. The stock is currently trading at 6.6 x FY15E EPS. We

recommend BUY rating on the stock with a target price of | 306 (average

of 8x FY15E EPS and 1.4x FY15E BVPS).

Exhibit 8: Valuation

Year

Sales

(| Crore)

Sales Gr.

(%)

EPS

(|)

EPS Gr.

(%)

PE

(x)

EV/EBITDA (x) RoNW (%) RoCE (%)

FY12 147306.8 113.0 32.9 48.7 8.2 3.5 20.8 24.9

FY13 162386.3 10.2 28.3 -13.9 9.5 4.0 15.7 19.6

FY14E 167854.3 3.4 28.6 1.1 9.4 4.2 15.0 19.5

FY15E 192840.2 14.9 40.8 42.6 6.6 2.9 18.7 25.7

Source: Company, ICICIdirect.com Research

Exhibit 9: Valuation

Valuation based on P / BV multiple

Adjusted Book Value for FY15E (|Crore) 185309.9

Adjusted number of shares (Crore) 855.6

Adjusted Book Value per share (|) 216.6

Multiple 1.4

Value of core business (| per share) 303.2

Add: Listed investments (25% discount to CMP) (| per share) 6.4

Fair Value per share (|) 310

Valuation based on P / E multiple

Profit after tax for FY15E (| Crore) 35042.8

Less: Other Income adjusted for tax (| Crore) 3457.3

Adjusted profit after tax for FY15E (| Crore) 31585.5

Number of shares (Crore) 855.6

Adjusted EPS for FY15E (|) 36.9

Multiple 8.0

Fair value per share without investments (|) 295.3

Add: Value of Investments (| per share)

Listed investments (25% discount to CMP) 6.4

Other Investments 1.5

Fair value per share (|) 303

Weighted Target Price (| per share) 306

Source: ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research

Page 5

Financial summary

Profit and loss statement

(| Crore)

(Year-end March) FY12 FY13 FY14E FY15E

Revenue 147,306.8 162,386.3 167,854.3 192,840.2

Growth (%) 22.3 9.9 4.1 14.7

(Inc.)/Dec. in stock trade -464.1 -1120.5 -44.2 0.0

Raw material Costs 46787.2 61730.4 59185.6 60877.9

Employee Costs 1695.8 2458.5 3279.9 4343.9

Statutory Levies 23125.1 25688.6 27554.0 31012.4

Other Expenditure 17456.5 18728.9 24286.1 23862.1

Op. Expenditure 88,600.4 107,485.9 114,261.5 120,096.4

EBITDA 58,706.4 54,900.5 53,592.8 72,743.7

Growth (%) 20.7 -6.5 -2.4 35.7

Depreciation 23,434.3 23,191.7 20,428.0 23,410.6

EBIT 35,272.2 31,708.8 33,164.9 49,333.1

Interest 434.9 485.0 519.1 516.3

Other Income 4,825.7 5,518.5 5,217.0 4,926.6

PBT 42,803.5 36,742.2 37,862.7 53,743.3

Growth (%) 24.7 -14.2 3.0 41.9

Tax 14,374.6 12,751.9 13,252.6 18,700.5

Reported PAT 28,428.9 23,990.3 24,610.1 35,042.8

Growth (%) 24.6 -15.6 2.6 42.4

Source: Company, ICICIdirect.com Research

Cash flow statement

(| Crore)

(Year-end March) FY12 FY13 FY14E FY15E

Profit after Tax 28,428.9 23,990.3 24,610.1 35,042.8

Less: Dividend Paid 9,702.7 9,432.9 11,736.6 11,736.6

Add: Depreciation 23,434.3 23,191.7 20,428.0 23,410.6

Add: Others -72.3 0.0 0.0 0.0

Cash Profit 44,195.0 40,151.7 32,605.1 47,868.9

Increase/(Decrease) in CL 16,067.0 -626.2 -5,285.0 7,642.1

(Increase)/Decrease in CA -13,410.0 -6,899.9 9,725.2 -294.0

CF from Operating Activities 46852.0 32625.6 37045.2 55217.0

Purchase of Fixed Assets 41,810.7 47,181.6 41,674.1 45,475.3

(Inc)/Dec in Investments 435.4 792.5 -1,206.3 0.0

Others 0.0 0.0 1.0 1.0

CF from Investing Activities -41375.3 -46389.1 -42880.5 -45475.3

Inc/(Dec) in Loan Funds -534.9 3,961.6 321.6 150.0

Inc/(Dec) in Sh. Cap. & Res. 2,385.8 1,531.5 -805.0 -877.1

Others 0.0 0.0 1.0 1.0

CF from financing activities 1850.9 5493.0 -483.4 -727.1

Change in cash Eq. 7,327.6 -8,270.5 -6,318.7 9,014.6

Op. Cash and cash Eq. 20,562.0 27,889.6 19,619.1 13,300.4

Cl. Cash and cash Eq. 27889.6 19619.1 13300.4 22315.1

Source: Company, ICICIdirect.com Research

Balance sheet

(| Crore)

(Year-end March) FY12 FY13 FY14E FY15E

Source of Funds

Equity Capital 4,277.8 4,277.8 4,277.8 4,277.8

Reserves & Surplus 132,161.4 148,250.3 160,318.8 182,748.0

Shareholder's Fund 136,439.2 152,528.1 164,596.6 187,025.8

Loan Funds 5,208.6 8,842.7 6,439.5 5,389.5

Abandon cost liability 20398.1 20725.5 23450.4 24650.4

Deferred Tax Liability 12,184.6 14,849.0 14,842.3 15,994.3

Minority Interest 2,208.4 1,946.6 2,052.9 2,052.9

Source of Funds 176439.0 198892.0 211381.7 235112.9

Application of Funds

Net Block 38,542.0 49,104.1 68,740.8 77,322.1

Capital WIP 38,042.9 39,739.7 21,506.5 18,839.5

Producing Properties 60,800.4 70,545.0 84,784.2 97,841.6

Pre-Producing Properties 11,655.3 13,641.7 19,245.1 22,338.0

Total Fixed Assets 149,040.5 173,030.4 194,276.6 216,341.2

Investments 2,920.7 2,128.2 3,334.5 3,334.5

Inventories 13,168.0 12,780.4 15,308.5 17,107.0

Debtor 11,714.3 15,395.6 13,090.7 14,261.3

Cash 27,889.6 19,619.1 13,300.4 22,315.1

Loan & Advance, Other CA 26,897.4 30,503.7 20,555.3 17,880.3

Total Current assets 79,669.3 78,298.8 62,254.9 71,563.6

Current Liabilities 49,044.5 48,946.4 40,514.5 46,108.5

Provisions 6,147.1 5,619.0 8,765.8 10,814.1

Total CL and Provisions 55,191.6 54,565.4 49,280.4 56,922.5

Net Working Capital 24,477.7 23,733.4 12,974.5 14,641.1

Miscellaneous expense 0.0 0.0 796.0 796.0

Application of Funds 176439.0 198892.0 211381.7 235112.9

S

Key ratios

(Year-end March) FY12 FY13 FY14E FY15E

Per share data (|)

Book Value 159.5 178.3 192.4 218.6

Cash per share 32.6 22.9 15.5 26.1

EPS 32.9 28.3 28.6 40.8

Cash EPS 60.3 55.4 52.5 68.2

DPS 9.8 10.8 11.8 11.8

Profitability & Operating Ratios

EBITDA Margin (%) 39.9 33.8 31.9 37.7

PAT Margin (%) 19.3 14.8 14.7 18.2

Fixed Asset Turnover (x) 1.0 0.9 0.9 0.9

Inventory Turnover (Days) 62.3 56.2 65.8 58.9

Debtor (Days) 55.4 67.7 56.3 49.1

Current Liabilities (Days) 231.9 215.3 174.2 158.8

Return Ratios (%)

RoE 20.8 15.7 15.0 18.7

RoCE 24.9 19.6 19.5 25.7

RoIC 31.0 22.4 21.1 29.1

Valuation Ratios (x)

PE 8.2 9.5 9.4 6.6

Price to Book Value 1.7 1.5 1.4 1.2

EV/EBITDA 3.5 4.0 4.2 2.9

EV/Sales 1.4 1.4 1.3 1.1

Leverage & Solvency Ratios

Debt to equity (x) 0.0 0.1 0.0 0.0

Interest Coverage (x) 81.1 65.4 63.9 95.5

Debt to EBITDA (x) 0.1 0.2 0.1 0.1

Current Ratio 1.4 1.4 1.3 1.3

Quick ratio 1.2 1.2 1.0 1.0

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research

Page 6

Company Descri pti on

Oil & Natural Gas Corporation (ONGC), Indias largest national oil & gas

company, is primarily engaged in exploration, development and

production of crude oil and natural gas in both India and abroad. ONGCs

core strength lies in its strong resource base and increasing production

resulting from aggressive capex. The company has managed to maintain

a diversified portfolio of yielding assets through its wholly owned

subsidiary ONGC Videsh Ltd (OVL). ONGC is also involved in production

of LPG and other value added products, alternative energy projects and

exploring the feasibility of setting up a nuclear power project.

Exhibit 10: Recommendation History

0

50

100

150

200

250

300

350

400

450

Nov-13 Sep-13 Aug-13 Jul-13 May-13 Apr-13 Feb-13 Jan-13 Nov-12

Price Target Price

Source: ICICIdirect.com Research

Exhibit 11: Recent Releases

Date Event CMP Target Price Rating

9-Nov-12 Q2FY13 Result Update 257 312 BUY

19-Feb-13 Q3FY13 Result Update 330 388 BUY

6-Jun-13 Q4FY13 Result Update 325 382 BUY

1-Jul-13 Oil & Gas Sector Update 320 425 BUY

13-Aug-13 Q1FY14 Result Update 273 349 BUY

14-Nov-13 Q2FY14 Result Update 270 306 BUY

Source: ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research

Page 7

ICICIdirect.com Coverage Universe (Oil & Gas)

CMP M Cap

(|) TP(|) Rating (| Cr) FY13 FY14E FY15E FY13 FY14E FY15E FY13 FY14E FY15E FY13 FY14E FY15E FY13 FY14E FY15E

Aban Offshore (ABALLO) 234 280 Buy 1,018 37.2 74.5 77.6 6.3 3.1 3.0 5.7 4.8 4.5 10.9 11.9 12.4 6.1 10.8 10.6

Bharat Petroleum (BHAPET) 346 410 Buy 25,019 36.6 24.6 26.5 9.5 14.1 13.0 7.6 9.5 9.3 10.3 6.8 7.2 15.9 10.2 10.4

Cairn India (CAIIND) 320 364 Buy 60,693 41.6 63.1 62.7 7.7 5.1 5.1 4.8 4.2 4.1 20.0 23.5 19.3 16.4 25.3 21.1

GAIL (India) (GAIL) 336 349 Hold 42,621 31.7 32.6 30.2 10.6 10.3 11.1 7.5 7.1 7.3 16.9 15.5 13.5 16.6 15.3 13.1

Gujarat Gas (GUJGAS) 274 259 Hold 3,514 22.3 25.3 25.1 12.3 10.8 10.9 8.5 7.2 6.8 38.3 39.1 35.4 32.3 31.9 28.3

Gujarat State Petronet (GSPL) 60 65 Hold 3,375 9.6 8.2 7.9 6.3 7.3 7.6 4.5 4.8 5.1 20.3 16.8 14.5 18.3 13.9 11.9

Hindustan Petroleum (HINPET) 210 233 Buy 7,119 26.7 17.5 25.5 7.9 12.0 8.2 10.8 9.6 7.4 4.2 4.1 6.0 6.6 4.3 6.1

Indian Oil Corporation (INDOIL) 210 200 Hold 50,987 20.6 6.3 22.0 10.2 33.2 9.6 3.7 4.8 3.1 5.7 3.5 7.8 8.2 2.5 8.3

Indraprastha Gas Ltd. (INDGAS) 279 277 Hold 3,785 25.3 28.5 27.7 11.0 9.8 10.1 5.5 4.8 4.5 31.1 30.1 25.5 23.7 22.1 18.5

Oil India Limited (OILIND) 461 562 Buy 27,712 59.7 55.6 81.4 7.7 8.3 5.7 3.6 3.5 1.9 18.5 16.0 23.1 18.7 15.8 19.8

ONGC (ONGC) 270 306 Buy 231,000 26.2 32.9 28.3 10.3 8.2 9.5 4.5 3.5 4.0 26.6 24.9 19.6 19.8 20.8 15.7

Petronet LNG (PETLNG) 125 132 Hold 9,375 15.3 10.8 12.0 8.2 11.6 10.4 5.7 8.2 7.6 24.4 14.1 12.9 25.8 16.1 15.7

RoCE (%) RoE (%)

Sector / Company

EPS (|) P/E (x) EV/EBITDA (x)

ICICI Securities Ltd | Retail Equity Research

Page 8

RATING RATIONALE

ICICIdirect.com endeavours to provide objective opinions and recommendations. ICICIdirect.com assigns

ratings to its stocks according to their notional target price vs. current market price and then categorises them

as Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the notional

target price is defined as the analysts' valuation for a stock.

Strong Buy: >15%/20% for large caps/midcaps, respectively, with high conviction;

Buy: >10%/15% for large caps/midcaps, respectively;

Hold: Up to +/-10%;

Sell: -10% or more;

Pankaj Pandey Head Research pankaj.pandey@icicisecurities.com

ICICIdirect.com Research Desk,

ICICI Securities Limited,

1

st

Floor, Akruti Trade Centre,

Road No. 7, MIDC,

Andheri (East)

Mumbai 400 093

research@icicidirect.com

ANALYST CERTIFICATION

We /I, Mayur Matani MBA Nishit Zota MBA research analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our

personal views about any and all of the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or

view(s) in this report. Analysts aren't registered as research analysts by FINRA and might not be an associated person of the ICICI Securities Inc.

Disclosures:

ICICI Securities Limited (ICICI Securities) and its affiliates are a full-service, integrated investment banking, investment management and brokerage and financing group. We along with affiliates are leading

underwriter of securities and participate in virtually all securities trading markets in India. We and our affiliates have investment banking and other business relationship with a significant percentage of

companies covered by our Investment Research Department. Our research professionals provide important input into our investment banking and other business selection processes. ICICI Securities

generally prohibits its analysts, persons reporting to analysts and their dependent family members from maintaining a financial interest in the securities or derivatives of any companies that the analysts

cover.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and

meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without

prior written consent of ICICI Securities. While we would endeavour to update the information herein on reasonable basis, ICICI Securities, its subsidiaries and associated companies, their directors and

employees (ICICI Securities and affiliates) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities

from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities

policies, in circumstances where ICICI Securities is acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This

report and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial

instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their

receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific

circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment

objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate

the investment risks. The value and return of investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities and affiliates accept no liabilities for any

loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the

risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to

change without notice.

ICICI Securities and its affiliates might have managed or co-managed a public offering for the subject company in the preceding twelve months. ICICI Securities and affiliates might have received

compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of public offerings, corporate finance, investment

banking or other advisory services in a merger or specific transaction. It is confirmed that Mayur Matani MBA Nishit Zota MBA research analysts and the authors of this report have not received any

compensation from the companies mentioned in the report in the preceding twelve months. Our research professionals are paid in part based on the profitability of ICICI Securities, which include earnings

from Investment Banking and other business.

ICICI Securities or its subsidiaries collectively do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the

research report.

It is confirmed that Mayur Matani MBA Nishit Zota MBA research analysts and the authors of this report or any of their family members does not serve as an officer, director or advisory board member of

the companies mentioned in the report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. ICICI Securities and affiliates may act upon or make use

of information contained in the report prior to the publication thereof.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution,

publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and

to observe such restriction.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Sigachi Quaterly and Annual ResultsDocument18 pagesSigachi Quaterly and Annual Resultsknowme73No ratings yet

- HDFC Bank Financial-Results-for-Quarter-and-Nine-months-ended-December-31,-2021Document7 pagesHDFC Bank Financial-Results-for-Quarter-and-Nine-months-ended-December-31,-2021knowme73No ratings yet

- Sigachi Earnings PresentationDocument16 pagesSigachi Earnings Presentationknowme73No ratings yet

- L 02 - An Introduction To Wave MechanicsDocument30 pagesL 02 - An Introduction To Wave Mechanicsknowme73No ratings yet

- HAGAR Bible Study - 1Document5 pagesHAGAR Bible Study - 1knowme73No ratings yet

- Practical Propeller Modeling: From Concept To 3D Cad Model: A Hydrocomp Technical ReportDocument4 pagesPractical Propeller Modeling: From Concept To 3D Cad Model: A Hydrocomp Technical Reportknowme73No ratings yet

- HAGAR Bible StudyDocument5 pagesHAGAR Bible Studyknowme73No ratings yet

- Bible Crossword I: by PhilologusDocument2 pagesBible Crossword I: by Philologusknowme73No ratings yet

- Unit 5 Property and Power 1.0Document30 pagesUnit 5 Property and Power 1.0knowme73No ratings yet

- Unit 3 Scarcity Work and Choice 1.0Document32 pagesUnit 3 Scarcity Work and Choice 1.0knowme73No ratings yet

- Unit 2 Technological Change Population and Growth 1.0Document33 pagesUnit 2 Technological Change Population and Growth 1.0knowme73No ratings yet

- Unit 1 The Capitalist Revolution 1.0Document33 pagesUnit 1 The Capitalist Revolution 1.0knowme73No ratings yet

- Introduction To Turbulence ModellingDocument16 pagesIntroduction To Turbulence Modellingknowme73No ratings yet

- Thesis - Nigeria's Shipbuilding CapabilityDocument250 pagesThesis - Nigeria's Shipbuilding Capabilityknowme73No ratings yet

- Seakeeping LectureDocument30 pagesSeakeeping Lectureknowme73100% (1)

- Synopsis of Midway PaperDocument6 pagesSynopsis of Midway Paperknowme73No ratings yet

- Assignment Coupled Heaving and PitchingDocument1 pageAssignment Coupled Heaving and Pitchingknowme73No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- List of MaharatnaDocument4 pagesList of MaharatnaVenu GopalNo ratings yet

- Toaz - Info Ongc India in Search For New Growth Strategy New PRDocument16 pagesToaz - Info Ongc India in Search For New Growth Strategy New PRDhruv BhartiNo ratings yet

- KeshDocument6 pagesKeshrfvz6sNo ratings yet

- Petroleum Exploration: 1. IntroductionDocument16 pagesPetroleum Exploration: 1. IntroductionAshish SinghNo ratings yet

- Ongc Report @skandDocument26 pagesOngc Report @skandSkand JhaNo ratings yet

- Baramula & Konaban Well Lat LonDocument6 pagesBaramula & Konaban Well Lat Lonbrahm DuttNo ratings yet

- CPO-5 Block - Llanos Basin - Colombia, South AmericaDocument4 pagesCPO-5 Block - Llanos Basin - Colombia, South AmericaRajesh BarkurNo ratings yet

- M 1 ReserviorDocument58 pagesM 1 ReserviorHarshith RenikindhiNo ratings yet

- Leroy Dmello 2022 Updated Resume.Document5 pagesLeroy Dmello 2022 Updated Resume.LeroyNo ratings yet

- Cbe News FinalDocument32 pagesCbe News FinalShraddha GhagNo ratings yet

- General Awareness Questions For Snap - : (Paper-I)Document9 pagesGeneral Awareness Questions For Snap - : (Paper-I)Shruti VinyasNo ratings yet

- Multiple Choice Questions On Oil Gas and Petrochemicals PDFDocument327 pagesMultiple Choice Questions On Oil Gas and Petrochemicals PDFShakerMahmood100% (2)

- Industry Analysis of ONGCDocument8 pagesIndustry Analysis of ONGCHarshil ShahNo ratings yet

- Chapter1: Introduction 1.1 Industry ProfileDocument93 pagesChapter1: Introduction 1.1 Industry Profileankith636No ratings yet

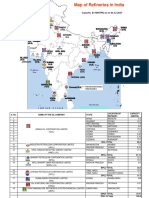

- RefineriesMap PDFDocument2 pagesRefineriesMap PDFkutikuppalaNo ratings yet

- Student PDFDocument12 pagesStudent PDFshweta bambuwalaNo ratings yet

- 9 AcquisitionDocument4 pages9 AcquisitionNikhil KarwaNo ratings yet

- 17-HDD Design CalculationDocument22 pages17-HDD Design CalculationAmit Shrivastava100% (6)

- OngcDocument518 pagesOngcUday KumarNo ratings yet

- Training and DevelopmentDocument74 pagesTraining and DevelopmentTAKY30360% (10)

- BreezeAIR - March 2023Document29 pagesBreezeAIR - March 2023darkladsNo ratings yet

- Sep 2021 (A)Document38 pagesSep 2021 (A)Woody MarcNo ratings yet

- 09.40 10.00 G. K. Acharya Deputy General Manager IOC Indian Oil Corporation 1Document36 pages09.40 10.00 G. K. Acharya Deputy General Manager IOC Indian Oil Corporation 1ra1958jaNo ratings yet

- ONGC - Stock Update 240921Document14 pagesONGC - Stock Update 240921Mohit MauryaNo ratings yet

- Project IBDocument90 pagesProject IBfromanshulNo ratings yet

- Prashant Final Project-OnGCDocument127 pagesPrashant Final Project-OnGCvpceb22enNo ratings yet

- China's New Diplomacy in Africa: Zhiqun ZhuDocument36 pagesChina's New Diplomacy in Africa: Zhiqun ZhuAnonymous bk7we8No ratings yet

- Scope of WorkDocument10 pagesScope of WorkSai AmithNo ratings yet

- Roy & Shenoy IntroDocument1 pageRoy & Shenoy IntroPremanand ShenoyNo ratings yet

- Oil and Gas Company ProfileDocument4 pagesOil and Gas Company ProfileApeksha HegdeNo ratings yet