Professional Documents

Culture Documents

How To Guide: Return On Investment

Uploaded by

Ekonomistet Klub100%(1)100% found this document useful (1 vote)

33 views9 pagesThis document provides guidance on using a spreadsheet tool to calculate return on investment (ROI) for projects. It includes sections on navigating between sheets to enter a project name, list benefits and costs, and view the dividend (ROI calculation). Limitations are outlined such as the tool only calculating benefits from allocated resources rather than cashable savings. Instructions are provided on completing the benefits, costs, and dividend sheets to analyze a project's ROI.

Original Description:

ROI Calculator v5r

Original Title

ROI Calculator v5r

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides guidance on using a spreadsheet tool to calculate return on investment (ROI) for projects. It includes sections on navigating between sheets to enter a project name, list benefits and costs, and view the dividend (ROI calculation). Limitations are outlined such as the tool only calculating benefits from allocated resources rather than cashable savings. Instructions are provided on completing the benefits, costs, and dividend sheets to analyze a project's ROI.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

33 views9 pagesHow To Guide: Return On Investment

Uploaded by

Ekonomistet KlubThis document provides guidance on using a spreadsheet tool to calculate return on investment (ROI) for projects. It includes sections on navigating between sheets to enter a project name, list benefits and costs, and view the dividend (ROI calculation). Limitations are outlined such as the tool only calculating benefits from allocated resources rather than cashable savings. Instructions are provided on completing the benefits, costs, and dividend sheets to analyze a project's ROI.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 9

Return on Investment:

How To Guide Version 4r

Navigation bar:

Sheet Description

Enter your project

name here

Benefits Enter your list of benefits here and also calculate the potential or

actual financial value of those benefits. Enter data into the

yellow shaded cells only.

Cost Input your project costs here. These should include both start-up

and any ongoing costs. Enter data into the yellow shaded cells

only.

Dividend A summary table showing the potential or actual return on the

investment you made.

Evidence A blan sheet for you to record the raw data behind the benefits

listed on the !enefit sheet.

How do I use this too!

". Enter your project name in the yellow shaded bo#

$. Gather your improvement evidence and enter it into the Evidence sheet if you want to

%optional&

'. (omplete the Bene"it sheets

). (omplete the Cost sheet

*. +iew your ,-I on the Dividend sheet

How do I move around!

.se the /avigation bar at the top of each screen to move between sheets. (lic on the

button for the sheet you want such as0

#imitations

1e have deliberately designed this spreadsheet to be as simple as possible. The

limitations are outlined below. 1e recommend that teams use and interpret the results in

collaboration with their finance colleagues.

(1) The financial benefits sheet shows the benefits from allocated resources. Estimating

actual cashable benefit needs to be done outside of this spreadsheet. Savings from

allocated resources can often be cashed through changes to the capacity or structure of

the system. Allocated resources can alternatively be diverted to other value adding

activity, for eample, reducing outpatients appointments can be converted into additional

discharge rounds.

(!)The spreadsheet allows for the insertion of one benefit percentage value per year. "e

recommend that teams conduct a number of #what if$ scenarios to cover your full

confidence range.

(%) The &epartment of 'ealth(s standard for discounting benefits over time is !), but

this will vary by organisation*industry*pro+ect depending on individual assessments of

pro+ect ris,. -ou can change the default setting of !) on the &ivident sheet.

(.) The spreadsheet does not distinguish between revenue and capital ependiture in

the costs sheet. This is o, for calculating /01 but recognise that you will need to access

funds from separate budgets.

(2) There is no option for intangible benefits.

(3) The spreadsheet does not separate fied and variable costs over time in detail.

How To Guide How To Guide Benefits Benefits Cost Cost Dividend Dividend

How do I use this too!

". Enter your project name in the yellow shaded bo#

$. Gather your improvement evidence and enter it into the Evidence sheet if you want to

%optional&

'. (omplete the Bene"it sheets

). (omplete the Cost sheet

*. +iew your ,-I on the Dividend sheet

How do I move around!

.se the /avigation bar at the top of each screen to move between sheets. (lic on the

button for the sheet you want such as0

#imitations

1e have deliberately designed this spreadsheet to be as simple as possible. The

limitations are outlined below. 1e recommend that teams use and interpret the results in

collaboration with their finance colleagues.

(1) The financial benefits sheet shows the benefits from allocated resources. Estimating

actual cashable benefit needs to be done outside of this spreadsheet. Savings from

allocated resources can often be cashed through changes to the capacity or structure of

the system. Allocated resources can alternatively be diverted to other value adding

activity, for eample, reducing outpatients appointments can be converted into additional

discharge rounds.

(!)The spreadsheet allows for the insertion of one benefit percentage value per year. "e

recommend that teams conduct a number of #what if$ scenarios to cover your full

confidence range.

(%) The &epartment of 'ealth(s standard for discounting benefits over time is !), but

this will vary by organisation*industry*pro+ect depending on individual assessments of

pro+ect ris,. -ou can change the default setting of !) on the &ivident sheet.

(.) The spreadsheet does not distinguish between revenue and capital ependiture in

the costs sheet. This is o, for calculating /01 but recognise that you will need to access

funds from separate budgets.

(2) There is no option for intangible benefits.

(3) The spreadsheet does not separate fied and variable costs over time in detail.

Version 4r

How do I use this too!

". Enter your project name in the yellow shaded bo#

$. Gather your improvement evidence and enter it into the Evidence sheet if you want to

%optional&

'. (omplete the Bene"it sheets

). (omplete the Cost sheet

*. +iew your ,-I on the Dividend sheet

How do I move around!

.se the /avigation bar at the top of each screen to move between sheets. (lic on the

button for the sheet you want such as0

#imitations

1e have deliberately designed this spreadsheet to be as simple as possible. The

limitations are outlined below. 1e recommend that teams use and interpret the results in

collaboration with their finance colleagues.

(1) The financial benefits sheet shows the benefits from allocated resources. Estimating

actual cashable benefit needs to be done outside of this spreadsheet. Savings from

allocated resources can often be cashed through changes to the capacity or structure of

the system. Allocated resources can alternatively be diverted to other value adding

activity, for eample, reducing outpatients appointments can be converted into additional

discharge rounds.

(!)The spreadsheet allows for the insertion of one benefit percentage value per year. "e

recommend that teams conduct a number of #what if$ scenarios to cover your full

confidence range.

(%) The &epartment of 'ealth(s standard for discounting benefits over time is !), but

this will vary by organisation*industry*pro+ect depending on individual assessments of

pro+ect ris,. -ou can change the default setting of !) on the &ivident sheet.

(.) The spreadsheet does not distinguish between revenue and capital ependiture in

the costs sheet. This is o, for calculating /01 but recognise that you will need to access

funds from separate budgets.

(2) There is no option for intangible benefits.

(3) The spreadsheet does not separate fied and variable costs over time in detail.

Cost Cost

Dividend Dividend Evidence Evidence

How do I use this too!

". Enter your project name in the yellow shaded bo#

$. Gather your improvement evidence and enter it into the Evidence sheet if you want to

%optional&

'. (omplete the Bene"it sheets

). (omplete the Cost sheet

*. +iew your ,-I on the Dividend sheet

How do I move around!

.se the /avigation bar at the top of each screen to move between sheets. (lic on the

button for the sheet you want such as0

#imitations

1e have deliberately designed this spreadsheet to be as simple as possible. The

limitations are outlined below. 1e recommend that teams use and interpret the results in

collaboration with their finance colleagues.

(1) The financial benefits sheet shows the benefits from allocated resources. Estimating

actual cashable benefit needs to be done outside of this spreadsheet. Savings from

allocated resources can often be cashed through changes to the capacity or structure of

the system. Allocated resources can alternatively be diverted to other value adding

activity, for eample, reducing outpatients appointments can be converted into additional

discharge rounds.

(!)The spreadsheet allows for the insertion of one benefit percentage value per year. "e

recommend that teams conduct a number of #what if$ scenarios to cover your full

confidence range.

(%) The &epartment of 'ealth(s standard for discounting benefits over time is !), but

this will vary by organisation*industry*pro+ect depending on individual assessments of

pro+ect ris,. -ou can change the default setting of !) on the &ivident sheet.

(.) The spreadsheet does not distinguish between revenue and capital ependiture in

the costs sheet. This is o, for calculating /01 but recognise that you will need to access

funds from separate budgets.

(2) There is no option for intangible benefits.

(3) The spreadsheet does not separate fied and variable costs over time in detail.

Return on Investment:

(alculate the benefits

Navigation bar:

$art %ne: %ngoing bene"its

Bene"its B& $atient Cost per unit Total Benefit

" Reduction in length of stay

$ Reduction in waiting for appointment

' Reduction in outsourcing to the private sector

)

*

Bene"its B& Incident or Event Incident Cost Total Benefit

" Reduction in re-admitting patients

$ Reduction in adverse incidents (drugs/infection)

' Reduction in unnecessary procedures

) Reduction in cancelled appointments/procedures or in DNAs

*

Bene"its "or Sta"" Total Benefit

" Reduction in staff sickness

$ Reduction in absence

' Reduction in time spent

)

*

'ota %ngoing Bene"its ()

$art 'wo: %ne*o"" bene"its

Description Value

"

$

'

)

*

'ota %ne*o"" Bene"it ()

Patient Value

before

change

Patient Value

after change

Difference

Per Patient

How Many

Patients Per

Year

Total

Difference

Per Year

No of

Incidents per

year before

change

No of

Incidents per

year after

change

Total

Difference

Per Year

Value Before

in Hours per

onth

Value !fter in

Hours per

onth

Difference In

Hours Per

onth

Nuber of

"taff affected

Total

Difference

Per Year

"alary Hourly

#ate

How To Guide How To Guide Benefits Benefits Cost Cost Dividend Dividend Evidence Evidence

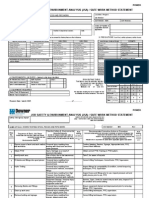

Return on Investment:

(alculate the cost of implementation and maintenance

Navigation bar:

%ngoing +aintenance Costs

Costs $er $atient Cost per Patient Total Cost per year

"

$

'

)

*

Cost o" Sta"" $T% "taff

"

$

'

)

*

%ther maintenance costs Total Cost per year

"

$

'

)

*

'ota +aintenance Costs ()

$ro,ect Impementation Costs

Description Total Cost

"

$

'

)

*

'ota Impementation Costs ()

How Many Patients

per year

!nnual "alary

including oncosts

Total "taff costs per

year

How To Guide How To Guide Benefits Benefits Cost Cost Dividend Dividend Evidence Evidence

$'2$343$$.#ls

-ear . -ear / -ear 0 -ear 4 -ear 1 'ota

52 52 52 52 52

6 of total benefit achieved each year

!enefit achieved each year 52 52 52 52 52 52

-ne -ff !enefits 52 52

'ota bene"its achieved () () () () () ()

-ear . -ear / -ear 0 -ear 4 -ear 1 'ota

(ost of implementation 52 52

(ost of 7aintaining (hange 52 52 52 52 52 52

'ota costs () () () () () ()

-ear . -ear / -ear 0 -ear 4 -ear 1 'ota

2nnua Return on Investment ( () () () () () ()

8iscount 9actor:Time Adjustment '.*26 The percentage by which the annual return depreciates per year

Net $resent Vaue ( () The cumulative return e#pressed at today;s value

Bene"it

-ngoing Annual benefit from Bene"it sheet

Cost

Dividend

Return on Investment:

Evidence sheet

Navigation bar:

'ite:

Description

How To Guide

How To Guide

Benefits

Benefits

Cost

Cost

Dividend

Dividend

Dividend

Dividend

Evidence

Evidence

You might also like

- BPMN by Example GuideDocument17 pagesBPMN by Example Guideyogie baskaraNo ratings yet

- User Guide Plan View 2005Document618 pagesUser Guide Plan View 2005yummybiryani100% (1)

- Budgeting Section Head Job Role DesignDocument5 pagesBudgeting Section Head Job Role DesignImam Kesuma DilagaNo ratings yet

- Quality Costs and Productivity: Measurement, Reporting, and ControlDocument44 pagesQuality Costs and Productivity: Measurement, Reporting, and ControlAkuntansi Internasional 2016No ratings yet

- Ahp Matrix TemplateDocument79 pagesAhp Matrix TemplateArun MathewNo ratings yet

- Jakarta Strategi Bisnis R2 Concept: Bisnis Objective, Marketing, Credit, Collection, AssetDocument41 pagesJakarta Strategi Bisnis R2 Concept: Bisnis Objective, Marketing, Credit, Collection, AssetRicky NovertoNo ratings yet

- Leave Management System: Software Design DescriptionDocument17 pagesLeave Management System: Software Design DescriptionUdhyanNo ratings yet

- IC ISO 27001 Sample Form 10838Document3 pagesIC ISO 27001 Sample Form 10838Lakshya SadanaNo ratings yet

- (WEEK 2) Process Identification 1Document36 pages(WEEK 2) Process Identification 1AVICENA NAUFALDONo ratings yet

- MSL Uat Issue Log - 20140607Document77 pagesMSL Uat Issue Log - 20140607laluseriousNo ratings yet

- Customer-Focused Development With QFD (By Kenneth Crow)Document7 pagesCustomer-Focused Development With QFD (By Kenneth Crow)Agg GlezNo ratings yet

- CJ Cheiljedang 2018 Sustainability ReportDocument42 pagesCJ Cheiljedang 2018 Sustainability ReportHau SinâuđaNo ratings yet

- Clean Sweep v3Document19 pagesClean Sweep v3AGNo ratings yet

- Cost Benefit Analysis ToolDocument96 pagesCost Benefit Analysis ToolRaluca Alexandra ApostolNo ratings yet

- CySA Chapter 3 Slide HandoutsDocument48 pagesCySA Chapter 3 Slide HandoutsShehzad HaleemNo ratings yet

- Jadwal Internal Audit SMKIDocument20 pagesJadwal Internal Audit SMKIRosyid SNo ratings yet

- Monthly Business Budget TemplateDocument1 pageMonthly Business Budget TemplateRashed Un NabiNo ratings yet

- Strategy: One-Page Strategic Plan (OPSP) : Grupo Reverdeciendo SAS People (Reputation Drivers)Document2 pagesStrategy: One-Page Strategic Plan (OPSP) : Grupo Reverdeciendo SAS People (Reputation Drivers)Cristian H CuellarNo ratings yet

- CMMI - Appraisal - Results - An ExampleDocument30 pagesCMMI - Appraisal - Results - An ExampleSofiansyah FadlieNo ratings yet

- Assessment 1 (Semester 1) (Marketing)Document11 pagesAssessment 1 (Semester 1) (Marketing)Yesith Yasarathna0% (1)

- 8 Step Problem Solving MethodologyDocument73 pages8 Step Problem Solving MethodologyHandi RahmadiansyahNo ratings yet

- What Is A Pareto Chart?: B Asic Tools For Process Im Provem EntDocument25 pagesWhat Is A Pareto Chart?: B Asic Tools For Process Im Provem EntklyiNo ratings yet

- Functional Point Estimation MethodsDocument14 pagesFunctional Point Estimation MethodsShalaka KulkarniNo ratings yet

- What Is QFD?: Dr. Yoji AkaoDocument6 pagesWhat Is QFD?: Dr. Yoji AkaoANo ratings yet

- The Application of ISO 9001 To Agile SoftwareDocument17 pagesThe Application of ISO 9001 To Agile Softwarenacho perez0% (1)

- Burndown Chart ExamplesDocument12 pagesBurndown Chart ExamplesSpeedriserNo ratings yet

- EndDocument4 pagesEndbiorad88No ratings yet

- Presentasi Measurement TheoryDocument38 pagesPresentasi Measurement TheoryNovrizal NugrohoNo ratings yet

- In-Class Training: Enhancing Leadership Skills To Achieve Business GoalsDocument85 pagesIn-Class Training: Enhancing Leadership Skills To Achieve Business GoalsKayerinna PardosiNo ratings yet

- A6. QCC Transformer - PT Astra Honda MotorDocument15 pagesA6. QCC Transformer - PT Astra Honda MotorMindiRahayuNo ratings yet

- Lean Operations PDFDocument5 pagesLean Operations PDFRamón G. PachecoNo ratings yet

- Group 5 - Ebook Marketing Theories and ConceptDocument167 pagesGroup 5 - Ebook Marketing Theories and ConceptVcore MusicNo ratings yet

- Gage Repeatability and Reproducibility Analysis: R&R Plot - by PartsDocument1 pageGage Repeatability and Reproducibility Analysis: R&R Plot - by Partsravindra erabattiNo ratings yet

- Talent Performance Evaluation Template: The Audience Motivation CompanyDocument4 pagesTalent Performance Evaluation Template: The Audience Motivation CompanyOli Ooi (MY)No ratings yet

- UAS Ngr. Putu Raka Novandra Asta Dan Nomer Tugas: 2.2 Examination Questions, Pn. 74Document10 pagesUAS Ngr. Putu Raka Novandra Asta Dan Nomer Tugas: 2.2 Examination Questions, Pn. 74Kuda BetinaNo ratings yet

- Quality Control Circle QCC & 7 QC Tools Training Course OutlineDocument4 pagesQuality Control Circle QCC & 7 QC Tools Training Course OutlineeddiekuangNo ratings yet

- A Comparison Study of Capability Maturity Model and ISO StandardsDocument74 pagesA Comparison Study of Capability Maturity Model and ISO Standardsapi-3738458No ratings yet

- Midterm Exam: Deadline: December 04, 2021Document13 pagesMidterm Exam: Deadline: December 04, 2021Jannatul FerdaousNo ratings yet

- Sertifikat Training InfografisDocument2 pagesSertifikat Training Infografisida rahmawatiNo ratings yet

- CMMI ArtifactDocument2 pagesCMMI ArtifactsivaniranjanNo ratings yet

- Hasil SPSS PDFDocument61 pagesHasil SPSS PDFAf DelNo ratings yet

- Assignment NO.2: Abdul Moiz Asim Aziz Aqib Arif Binyameen Aslam Huba RanaDocument12 pagesAssignment NO.2: Abdul Moiz Asim Aziz Aqib Arif Binyameen Aslam Huba RanaRana_hubaNo ratings yet

- COBIT 2019 Design Toolkit With Description - Group X.XLSX - DF2Document8 pagesCOBIT 2019 Design Toolkit With Description - Group X.XLSX - DF2Aulia NisaNo ratings yet

- Daftar Hotel Rekanan Pertamina-2010Document69 pagesDaftar Hotel Rekanan Pertamina-2010Azmidi NazarudinNo ratings yet

- Problem Solving-1 m3Document12 pagesProblem Solving-1 m3NickyStephens100% (1)

- BK - Scrum and CMMIDocument132 pagesBK - Scrum and CMMIcoolgoroNo ratings yet

- ISO 55001 Standard Certification Plant Wellness WayDocument19 pagesISO 55001 Standard Certification Plant Wellness WayPMO WORKNo ratings yet

- Agile Internal AuditDocument11 pagesAgile Internal AuditBerenice La Rosa GonzalesNo ratings yet

- Analysis of Internal and External Factors For Competitive Advantage of Indonesian ContractorsDocument17 pagesAnalysis of Internal and External Factors For Competitive Advantage of Indonesian ContractorsLau Tsz LokNo ratings yet

- 04 The Six Sigma MethodologyDocument53 pages04 The Six Sigma Methodologychteo1976No ratings yet

- Process Identification in the BPM LifecycleDocument36 pagesProcess Identification in the BPM LifecycleAmmulia RizqieNo ratings yet

- Henkaten Introductionenglish 160630200536 PDFDocument43 pagesHenkaten Introductionenglish 160630200536 PDFtatosumartoNo ratings yet

- Project Quality Plan: Put Your Logo HereDocument3 pagesProject Quality Plan: Put Your Logo Herephuc haNo ratings yet

- Customer Satisfaction For ISO 9001 - 2015 With ExamplesDocument5 pagesCustomer Satisfaction For ISO 9001 - 2015 With ExamplesSudheer23984No ratings yet

- Audit Berbasis Risiko Untuk Auditor InternDocument65 pagesAudit Berbasis Risiko Untuk Auditor InternFitriansyah MonasfalyNo ratings yet

- Appraisal Form - FY 2018-2019Document30 pagesAppraisal Form - FY 2018-2019Siva ManiNo ratings yet

- 3G and 7 QC Tools - PomDocument26 pages3G and 7 QC Tools - Pombinga35No ratings yet

- Customer Satisfaction Levels A Complete Guide - 2020 EditionFrom EverandCustomer Satisfaction Levels A Complete Guide - 2020 EditionRating: 1 out of 5 stars1/5 (1)

- ROI Calculator: 40-Step GuideDocument9 pagesROI Calculator: 40-Step GuidebeoptimNo ratings yet

- Programi KURSE ALPHA BUSINESS A1 A2 B1 B2 C1 C2Document7 pagesProgrami KURSE ALPHA BUSINESS A1 A2 B1 B2 C1 C2Ekonomistet KlubNo ratings yet

- Kurse Alpha BusinessDocument15 pagesKurse Alpha BusinessEkonomistet KlubNo ratings yet

- Kurse Alpha BusinessDocument15 pagesKurse Alpha BusinessEkonomistet KlubNo ratings yet

- Chapter 01Document58 pagesChapter 01Shiveta Kumar Pandita100% (2)

- 3.1 Income Elasticity of DemandDocument35 pages3.1 Income Elasticity of DemandBighnesh MahapatraNo ratings yet

- Ranjit CVR Calaveras Vineyard CaseDocument7 pagesRanjit CVR Calaveras Vineyard CaseAdityaSinghNo ratings yet

- Revue Technique Hyndai I10Document147 pagesRevue Technique Hyndai I10ossoski100% (5)

- 2015 TTT Loading Master Program Oil Gas ChemicalsDocument6 pages2015 TTT Loading Master Program Oil Gas ChemicalstenggarayNo ratings yet

- Paper18b PDFDocument47 pagesPaper18b PDFAnonymous SgD5u8R100% (1)

- STOCKS PLUNGE FOR THIRD DAYDocument2 pagesSTOCKS PLUNGE FOR THIRD DAYEhsan KarimNo ratings yet

- 5 PracticeDocument12 pages5 PracticeAyush DhamijaNo ratings yet

- Aviral Mishra - Mechanical Engineer with Leadership and Sales ExperienceDocument1 pageAviral Mishra - Mechanical Engineer with Leadership and Sales ExperienceAVIRAL MISHRANo ratings yet

- Lecture19 150211 PDFDocument34 pagesLecture19 150211 PDFAbhishek SinghNo ratings yet

- Jivo 245 Di 4 PagerDocument2 pagesJivo 245 Di 4 PagerAthul50% (2)

- MSC Banking and International FinanceDocument62 pagesMSC Banking and International FinancePruthvi GyandeepNo ratings yet

- Chem ChinaDocument18 pagesChem Chinamfarhad2No ratings yet

- Level 4Document7 pagesLevel 4Tudor PricopNo ratings yet

- High-quality, reliable standard modulus carbon fiber for traditional manufacturingDocument2 pagesHigh-quality, reliable standard modulus carbon fiber for traditional manufacturingmaraNo ratings yet

- Modicon M241 Programming Guide PDFDocument240 pagesModicon M241 Programming Guide PDFak4diliNo ratings yet

- Astrocad User ManualDocument23 pagesAstrocad User ManualMichael Gasperi0% (1)

- Vda de REcinto V InciongDocument5 pagesVda de REcinto V InciongEnma KozatoNo ratings yet

- Kinetika Kimia: Bambang WidionoDocument77 pagesKinetika Kimia: Bambang WidionoFardaawNo ratings yet

- Philippine Education Department's GSP Action PlanDocument2 pagesPhilippine Education Department's GSP Action PlanCharie P. Gracia100% (1)

- Intellectual Property and Engineering EthicsDocument4 pagesIntellectual Property and Engineering EthicsDipak YadavNo ratings yet

- Healy World Compensation Plan Global 22 en EUDocument32 pagesHealy World Compensation Plan Global 22 en EUTamara Alvarado CastilloNo ratings yet

- JSA M36 Hydro Testing Spool Pieces & PipeworkDocument4 pagesJSA M36 Hydro Testing Spool Pieces & PipeworkMianNo ratings yet

- 3BSE086207 Webinar Presentation - Freelance Formulation 2016Document49 pages3BSE086207 Webinar Presentation - Freelance Formulation 2016Fabio Passos GuimaraesNo ratings yet

- Water Supply Engineering Course IntroductionDocument40 pagesWater Supply Engineering Course Introduction1pallabNo ratings yet

- Symmetry: SIAT: A Distributed Video Analytics Framework For Intelligent Video SurveillanceDocument20 pagesSymmetry: SIAT: A Distributed Video Analytics Framework For Intelligent Video SurveillanceData LOG NGUYENNo ratings yet

- Raspberry Pi: The Complete Beginner's GuideDocument26 pagesRaspberry Pi: The Complete Beginner's GuideAnadiKashyapNo ratings yet

- Process SynthesisDocument30 pagesProcess Synthesismiza adlin100% (1)

- Ruling on Revocation of Power of AttorneyDocument2 pagesRuling on Revocation of Power of AttorneyLilibeth Dee Gabutero100% (1)

- 2010 Marketing Review 360 Degree Touchpoint ManagementDocument7 pages2010 Marketing Review 360 Degree Touchpoint ManagementZain SondeNo ratings yet

- Portea Home Health CareDocument17 pagesPortea Home Health CareAbhai Pratap SinghNo ratings yet

- Theoretical Analysis of Business RisksDocument7 pagesTheoretical Analysis of Business RisksresearchparksNo ratings yet