Professional Documents

Culture Documents

Lanka Bangla

Uploaded by

Monowar HossainCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lanka Bangla

Uploaded by

Monowar HossainCopyright:

Available Formats

Finance Industry:

As financial intermediary, Non-Bank Financial Institution plays vital role in the development of the country. They provide additional financial services that are not

always provided by the banking industry. According to latest Bangladesh Bank (BB) statistics, out of 31 NBFIs, 3 are Government-owned, 10 are joint venture and

the rest 18 are locally private-owned. Meanwhile, the branch network reached to 170 as on 30 June 2013. So far 23 NBFIs are listed in our capital market. Major

sources of funds of NBFIs are term deposits, credit facilities from banks and other NBFIs, the call money market, as well as bonds and securitizations. A

comparison from December 2012 to June 2013 showed that, aggregate industry assets increased by 13.36% to BDT 378.5 bn, liabilities by 15.31% to BDT 316.3

bn and equity by 9.51% to BDT 62.2 bn. Non-performing loan (NPL) situation deteriorated; as on June 30 2013, NPL was 6.2% whereas in December 2012 it was

5.4%.

Company Information:

LankaBangla Finance Limited was incorporated and commenced its operation on November 05, 1996. The principal activities of the Company are providing

integrated financial services including corporate financial services, retail financial services, SME financial services, stock broking, corporate advisory and wealth

management services. The firm conducts its operation with 19 branches (including subsidiaries). The Company displayed its strong presence in capital market

through three subsidiaries LankaBangla Investment Ltd. (99%), LankaBangla Securities Ltd. (90%) and LankaBangla Asset Management Company Ltd. (99%).

The firm enlisted with DSE on October 17, 2006 and CSE on October 31, 2006. Currently, around 38.67% of shares are held by Sponsors and 61.33% of shares are

held by General Investors.

Financial Postion :

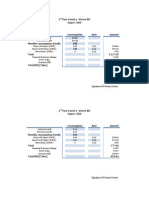

Particulars 2013 ( MN) 2012 (MN)

%

Change

Operating Income

1,325,832,983

596,259,991 122%

net profit after tax

997,135,949

510,309,775 95%

Investment

3,515,894,297

3,395,216,186 4%

Loans and Advancements

24,841,142,850

18,633,845,150 33%

Net Interest Income

785,109,671

529,976,451 48%

Total Equity

6,839,911,824

6,473,960,231 6%

Retained Surplus

842,462,762

75,690,921 1013%

Table : Financial Position Pic : Share Holder Position

LANKABANFIN is showing a great prospective interms of their

operating income which has increased by 122% as well their Net

profit after Tax which has increased by 95%. LANKABANFIN

recently has realized its profit in their investment in capital market

for which their profit has gone up. Projecting on this factor alone

last year it has showed EPS of 4.58 per share. Depending on

current years performance the annualized EPS stands at 1.24 per

share which is alarming.

A comparison from December 2012 to June 2013 showed that,

aggregate industry assets increased by 13.36% to BDT 378.5 bn,

liabilities by 15.31% to BDT 316.3 bn and equity by 9.51% to BDT

62.2 bn. Meanwhile, total deposit stood at BDT 174.0 bn (19.67%

growth) and loan portfolio was BDT 273.6 bn (8.5% growth). As on

June 30, 2013, primary investment focus of the industry was on

industrial sector (43.8%) followed by real estate (16.7%), trade

and commerce (11.3%), margin loans (5.0%), merchant banking

(4.0%), agriculture (1.5%) and others (17.7%).

Technical Analysis :

PIC : LANBANFIN

Current Trend is downtrend. As the overall Market is undervalued

and preparing itself for a uptrend or non trending phase, it could

give a spike for couple of days and generate a supply at 49 price

level. Monthly the script is in ground to get stabilize but the down

trend is really strong and the price level might get a strong support

at 35 price level.

BASIC INFO SECTOR DETAILS

EPS

1.24

Sector: Financial Institutions

No Of Securities: 218,766,759.00 Sector PE: 23.09

Current PE 32.66 Sector Cap 138,008,200,205.00

Reserve: 3,561.40 Sector Earnings: 5,976,263,935.04

Last AGM Held: 31/03/2014 Sector Beta: 1.00

CAPITAL DETAILS

Paidup Capital: 2188 M

Market Capital: 8860.05 M

Trade % of MCAP: 0.00

Public Securities 134,410,297.00

Public Cap 2015M

Table : Company Information

Daily Trend Weekly Trend Monthly Trend

RSI (18) 24.73 Down Trend 33.28 Down Trend 42.19 stabilizing

MFI(18) 13.33 Down Trend 14.21 Down Trend 65.75 Down Trend

ADX (14) 45.42 Up Trend 27.85 Up Trend 13.79 Stabilizing

MACD -3.31 Stabilizing -5.02 Down Trend -3.62 Down Trend

ATR 1.50 Uptrend 4.16 Stabilizing 11.25 Down Trend

Recommendation :

Signal Price Fluctuation Current Price: 40.40. Retracement in

Upward Trend. A supply might come at 6.10

Tk Price Level. If the Price Trend Remains

Upward then the price will move towards

8.50 and again a supply will generate.

Daily Buy Moderate

Weekly Buy Moderate

Monthly sell High

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- 12 FebruaryDocument1 page12 FebruaryMonowar HossainNo ratings yet

- Sheltech Ceramics LTD.: Daily ReportDocument1 pageSheltech Ceramics LTD.: Daily ReportMonowar HossainNo ratings yet

- Health & Safety at Work: WorkerDocument25 pagesHealth & Safety at Work: WorkerEng Urimubenshi DonatNo ratings yet

- SCB 12 - 19V1 PDFDocument40 pagesSCB 12 - 19V1 PDFMonowar HossainNo ratings yet

- Sheltech Ceramics LTD.: Daily ReportDocument2 pagesSheltech Ceramics LTD.: Daily ReportMonowar HossainNo ratings yet

- 13 FebruaryDocument1 page13 FebruaryMonowar HossainNo ratings yet

- Sheltech Ceramics LTD.: Daily ReportDocument1 pageSheltech Ceramics LTD.: Daily ReportMonowar HossainNo ratings yet

- 08 FebruaryDocument1 page08 FebruaryMonowar HossainNo ratings yet

- Icbi BankDocument2 pagesIcbi BankMonowar HossainNo ratings yet

- IELTS Advantage Writing SkillsDocument129 pagesIELTS Advantage Writing SkillsJoann Henry94% (117)

- Sample Daily Market Commentary and Technical Analysis of Dhaka Stock ExchangeDocument1 pageSample Daily Market Commentary and Technical Analysis of Dhaka Stock ExchangeMonowar HossainNo ratings yet

- 21 Candlestick Patterns Every Trader Should KnowDocument83 pages21 Candlestick Patterns Every Trader Should KnowAlex Dela RosaNo ratings yet

- Signature of House OwnerDocument3 pagesSignature of House OwnerMonowar HossainNo ratings yet

- 21 Candlestick Patterns Every Trader Should KnowDocument83 pages21 Candlestick Patterns Every Trader Should KnowAlex Dela RosaNo ratings yet

- Sample Daily Market Commentary and Technical Analysis of Dhaka Stock ExchangeDocument1 pageSample Daily Market Commentary and Technical Analysis of Dhaka Stock ExchangeMonowar HossainNo ratings yet

- DSE Analysis 01 03 2012Document5 pagesDSE Analysis 01 03 2012Monowar HossainNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Eje Delantero Fxl14 (1) .6Document2 pagesEje Delantero Fxl14 (1) .6Lenny VirgoNo ratings yet

- Formato MultimodalDocument1 pageFormato MultimodalcelsoNo ratings yet

- Subeeka Akbar Advance NutritionDocument11 pagesSubeeka Akbar Advance NutritionSubeeka AkbarNo ratings yet

- Sociology A Brief Introduction Canadian Canadian 5th Edition Schaefer Test Bank DownloadDocument44 pagesSociology A Brief Introduction Canadian Canadian 5th Edition Schaefer Test Bank DownloadJohn Blackburn100% (20)

- SCIENCE 11 WEEK 6c - Endogenic ProcessDocument57 pagesSCIENCE 11 WEEK 6c - Endogenic ProcessChristine CayosaNo ratings yet

- DG Oil SpecificationDocument10 pagesDG Oil SpecificationafsalmohmdNo ratings yet

- Fce Use of English 1 Teacher S Book PDFDocument2 pagesFce Use of English 1 Teacher S Book PDFOrestis GkaloNo ratings yet

- Addendum ESIA Oct 2019Document246 pagesAddendum ESIA Oct 2019melkamuNo ratings yet

- PDF BrochureDocument50 pagesPDF BrochureAnees RanaNo ratings yet

- Ethical Hacking IdDocument24 pagesEthical Hacking IdSilvester Dian Handy PermanaNo ratings yet

- Stratum CorneumDocument4 pagesStratum CorneumMuh Firdaus Ar-RappanyNo ratings yet

- Parrot Mk6100 Userguide Zone1Document100 pagesParrot Mk6100 Userguide Zone1Maria MartinNo ratings yet

- Lesson Plan For DemoDocument9 pagesLesson Plan For DemoJulius LabadisosNo ratings yet

- Partnership Digest Obillos Vs CIRDocument2 pagesPartnership Digest Obillos Vs CIRJeff Cadiogan Obar100% (9)

- Learning Competency PDFDocument1 pageLearning Competency PDFLEOMAR PEUGALNo ratings yet

- Sharat Babu Digumarti Vs State, Govt. of NCT of Delhi (Bazee - Com Case, Appeal) - Information Technology ActDocument17 pagesSharat Babu Digumarti Vs State, Govt. of NCT of Delhi (Bazee - Com Case, Appeal) - Information Technology ActRavish Rana100% (1)

- 1Document2 pages1TrầnLanNo ratings yet

- Outlook of PonDocument12 pagesOutlook of Ponty nguyenNo ratings yet

- The DIRKS Methodology: A User GuideDocument285 pagesThe DIRKS Methodology: A User GuideJesus Frontera100% (2)

- Handbook of Storage Tank Systems: Codes, Regulations, and DesignsDocument4 pagesHandbook of Storage Tank Systems: Codes, Regulations, and DesignsAndi RachmanNo ratings yet

- 02 CT311 Site WorksDocument26 pages02 CT311 Site Worksshaweeeng 101No ratings yet

- 2015 Student Handbook 16 January 2015Document66 pages2015 Student Handbook 16 January 2015John KhanNo ratings yet

- Agrinome For Breeding - Glossary List For Mutual Understandings v0.3 - 040319Document7 pagesAgrinome For Breeding - Glossary List For Mutual Understandings v0.3 - 040319mustakim mohamadNo ratings yet

- Institutions and StrategyDocument28 pagesInstitutions and StrategyFatin Fatin Atiqah100% (1)

- ES Parent Bulletin Vol#19 2012 May 25Document13 pagesES Parent Bulletin Vol#19 2012 May 25International School ManilaNo ratings yet

- French Cuisine RecipeDocument6 pagesFrench Cuisine RecipeJimmy AchasNo ratings yet

- Corelink Mmu600ae TRM 101412 0100 00 enDocument194 pagesCorelink Mmu600ae TRM 101412 0100 00 enLv DanielNo ratings yet

- Kiraan Supply Mesin AutomotifDocument6 pagesKiraan Supply Mesin Automotifjamali sadatNo ratings yet

- Forensic IR-UV-ALS Directional Reflected Photography Light Source Lab Equipment OR-GZP1000Document3 pagesForensic IR-UV-ALS Directional Reflected Photography Light Source Lab Equipment OR-GZP1000Zhou JoyceNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet