Professional Documents

Culture Documents

RDC Bank Working Capital

Uploaded by

Anil MakvanaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RDC Bank Working Capital

Uploaded by

Anil MakvanaCopyright:

Available Formats

Page 1 of 110

INTRODUCTION

The word BANK acts as the bridge between the people who needs money and

who have excess money with them. n the past! when barter system was in the

existence! at that time there is no any "se of money. B"t with changing in time! money

became the medi"m for each and every prod"cts as well as services. #ater on money

became very important tool for smooth r"nning of economy. $oney became the main

tool for every transaction.

%ith the passage of time! every b"siness is grown li&e anything and people need

to transfer their f"nd from one place to another place at '((s or '(((s of &ms far away

from each other. t ta&es time to transfer money physically by any bro&er or c"rrier

services. This creates necessity of one intermediate which ma&es this problem easy and

it gives birth to BANK.

n the initial stage! ban&s are generally provides services of transferring money

for which they have started. They are simply receives money who wants to save

and lend to those who ware in the need of it.

B"t with passage of time wor&ing of ban&ing sector got changed. Now a day it

becomes very important service sector. Ban&s have to perform vario"s activities

other than its basic activity.

They have to start other f"nction by which smooth r"nning of b"siness becomes

possible. The Ban&ing system has a significant role to play in the rapid growth

of the economy thro"gh planned efforts.

)esearch confirms that co"ntries with a well developed Ban&ing system grow

faster then those with a wea&er one.

Page 2 of 110

*verall one thing we have to accept that without efficient banking sector

todays corporate world can not exist and we can not deny the importance of

banks in current corporate world.

Page 3 of 110

BANKING STYTEM IN INDIA

n the N+A! the ban&ing system was started many years ago.

This system was started in the second or third cent"ry A.+.! $an"! the great ,ind"

-"rist! devoted a section of his wor& to deposits and advances and laid down r"les

relating to rates of interest to be paid or charged.

At that time the same activity was done at local level by any landlord person of the

village. .very town! big or small! had a Sheth also &nown as a /0hah1 or Shroff

who performed a n"mber of ban&ing f"nctions. ,e was respected by all sections of

people as an important citi2en. They were instr"mental in transferring f"nds from

place to place and doing collection b"siness mainly thro"gh Hu!"# an accepted

mode of transfer of money for commercial transactions. By the passage of time this

system was developed very rapidly.

n time of east ndia 3ompany "se of ban&ing sector was increased li&e anything.

n the wa&e of the 0wadeshi movement! a n"mber of ban&s with ndian management

were established in the co"ntry.

The P"n4ab National Ban& #td! was fo"nded in '567

The Ban& of ndia #td! in '6(8.

The 3anara ban& #td! in '6(8.

The ndian Ban& #td! in '6(9.

The Ban& of Baroda #td! in '6(5! and

The 3entral Ban& of ndia #td! in '6''.

After increased "se of ban&ing system! s"ggestions ware made that ndia sho"ld

have central ban&. And on the 8

th

$arch '6:; the )eserve Ban& of ndia started

f"nctioning with effect from '

st

April '6:7. Ban&ing )eg"lation Act was passed in

'6;6.

Page $ of 110

The ma4or participants of the ndian financial system are the commercial

ban&s! <inancial nstit"tions! encompassing term lending instit"tions! investment

instit"tions! speciali2ed financial instit"tions! and the state=level development ban&s!

Non=Ban& <inancial 3ompanies>NB<3s? and other mar&et intermediaries s"ch as

the stoc& bro&ers and moneylenders. The commercial ban&s and certain variants of

the NB<3s are among the oldest of the mar&et participants. The <s! on the other

hand! are relatively new entities in the financial mar&etplace.

Ban& means@@

A ban& is a financial intermediary! a dealer in loans and debt.

= C%"r&ro#e#

Accepting for the p"rpose of lending of investment of deposits of money from

p"blic repayable on demand or otherwise and withdraw able by cheA"es! +raft! order

or otherwise.

' I!"% B%(") Re)u*%t"o A&t 1+$+

Page , of 110

Page - of 110

TY.ES O/ BANK

Cetr%* B%( %! Moet%r0 Author"t0

Reserve Bank of India

Page 1 of 110

Apex ban&ing instit"tion

National

,o"sing

Ban&

.B$

Ban&

NABA)+

+B

0mall nd"strial

+evelopment Ban&

of ndia

Ban&ing nstit"tions

Private

0ector

P"blic 0ector

3o=operative Ban&s

).).B.

>)egional )"ral Ban&?

3ommercial Ban&s

#ocal Area

Ban&s

New

Ban&s

*ld

Ban&s

Nationali2ed Ban&s 0tate Ban& Cro"p

ndian <oreign

0"bsidiary

Ban&s

0B main

Itro!u&t"o of &o'o2er%t"3e 4%(

*ver the year the difference between co=operative ban&s D commercial ban&s has

bl"rred as they all have come "nder a common law. All prod"cts D services are offered by

co=operative ban&s are on the par with commercial ban&s! with a few exceptions related to

government b"siness.

n '6(; the co=operative movement started in ndia with a view to provide finance

to the agric"lt"rist at a low rate of interest. The co=operative society has to ta&e the place of

the money lenders D provide cheap loan to the farmers for prod"ctive p"rposes. .ven

tho"gh many types of co=operative societies have been started partic"larly for the artisans D

others! the most common form of s"ch societies deal in r"ral credits. And today co=operative

ban&s have started verities of services with different technologies.

0o! after having s"ch easy government policy! today many co=operative ban&s have

started in ndia. And they are catering to the all section of the society! D also today co=

operative sector has grown in all over the world! with globali2ation of the world they have

also started to implement new technologies D vario"s management tools. Now! they are in

same mar&et with all the other ban&s. 0o! by this way the co=operative ban&s are in the &ey

position in the economy.

As a form of organi2ation which procreations vol"ntary associate together on a

basis of eA"ality for the promotion of their economic interests.

-COO.ERATION .5ANNING COMMITTEE

1+$-

Page 6 of 110

.RINCI.5ES 7 CHARACTERISTICS

3aref"l analyses of the above definitions will reveal the following principles D

characteristics of co=operative organi2ation.

VOLUNT!" ##O$%T%ON &&'

3o=operative organi2ation is p"rely a vol"ntary association if individ"al who 4oin

together for betterment of their economic interest thro"gh collective efforts. A

member is at liberty to leave the organi2ation at any time D withdrawal his capital

by giving d"e notice. B"t it sho"ld be remembered that a member is not allowed to

transfer his shares to another person as fo"nd in the company organi2ation.

O()N *)*+)!#,%( &&'

$embership of co=operative organi2ation is open to all irrespective of religion caste!

color! creed! political affiliations belief D stat"s to which a person belongs. The

membership fees D the entrance fees are &ept relatively low so as to enable the

economically wea& to become the members.

E8UA5 9OTING RIGHTS ::'

.A"ality is the A"intessence of co=operative organi2ation. $embers have eA"al voice

in the management of it1s affairs with the "nderlying principle ;ONE /OR ONE

9OTE< ;

#)!V%$) *OT%V) &&'

t is mainly intended to goods first to it1s members D then to o"tsiders at profit the

primary aim of any co=operative organi2ation is to render service to its member. 0o

these are the primary motive or principles. There are other principles! co=operative

Page + of 110

Organizational

structure of

co-operative

banks

State

co-operative

bank

District

co-operative

banks

Primary

co-operative

banks

organi2ation has to follow those principles li&e state control! democratic

organi2ation etc.

T02e# of &o'o2er%t"3e 4%(#

The fo**o=") &h%rt #ho=") the or)%">%t"o%* #tru&ture of &o o2er%t"3e 4%(#<

Page 10 of 110

#TT) $O'O()!T%V) +N-# &&'

These ban&s are also &nown as apex ban& D are registered "nder co=operative

societies act E '6'F. n fact these ban&s are established to f"nction as a leading co=operative

financial instit"tion of the state offer co=operative societies sho"ld grow. The Apex ban&s

as they are called are they to render financial help as D when the co=operative societies are

in need of their help.

$)NT!L $O'O()!T%V) +N-# &&'

A district level of central co=operative ban&s is f"nctioning as a commercial ban& D

that too as an independent "nit. They are there in order to strengthen the co=operative

movement in the co"ntry. n fact these ban&s are the &ey lin& between people D apex ban&

D render val"able services to downtrodden D r"ral fol& in ta&ing them o"t of the financial

wood central co=operative ban&s get f"nds from >A? 0hare capital >B? +eposits >3?

<inancial help from state co=operative ban&s >+? 0tate ban& of ndia D >.? 3ommercial

ban&s. Their wor&ing capital is "s"ally provided by state government.

U!+N $O'O()!T%V) +N-# &&'

Page 11 of 110

Grban co=operative ban&s are organi2ed D established in towns on the pattern of

4oint E stoc& ban&s b"t are established "nder co=operative societies act E '6'F. <or f"nds

these ban&s depend on their own so"rces. ,owever central co=operative ban&s are helping

them in financially viable. 3entral co=operative ban&s are directly lin&s with the state co=

operative ban&s. Grban primary co=operative ban&s provide f"nds to r"ral fol& in easy terms

to help them in agric"lt"re wor& aid its development today they have started playing a

significant role in r"ral "pliftment. They are in t"ne with the government policies D

program.

RO5E O/ CO'O.ERATI9E BANKS

Now=a=days co=operative ban&s are progressing very fast then any commercial or

nationali2ed ban&s. The c"stomer service lending services D other ban&ing facilities given

to the society is being better than other ban&s. 0o people are also being attracted D

interested in co=operative ban&s.

The main aim of the ban& is to extend credit facilities to the small traders! wor&ers D

other middle class people. This ban& derive their f"nds for wor&ing partly thro"gh share

capital contrib"ted by the members D partly thro"gh deposits collected from members!

general p"blic D render "s"al ban&ing services. The liability of members is normally

"nlimited. This enables the society to raise f"nds from o"tside agencies D also enco"rages

member to ta&e &een interest in wor&ing of the society.

;If &o'o2er%t"3e f%"*# %t the"r =or(")? there ="** f%"* the 4e#t ho2e of I!"%@

Page 12 of 110

And it must succeed because co-operatives are really

For the people, of the people, by the people.

Page 13 of 110

REGISTRATION 7 5ICENSING

There sho"ld be co=ordination between the state co=operative department D )B for

the registration D licensing of "rban ban&s. Grban ban&s sho"ld b"ild "p their share capital

D reserve to the revised minim"m level with in period of : year which can be extendedly by

the )B to a f"rther period of F years whenever necessary.

<or organi2ation or "rban co=operative ban& in each state there sho"ld 4ointly s"rvey

local areas D identify the potential growth centers where "rban ban&s co"ld be organi2ed

once s"ch centers are located prominent person of the locality might be contacted to see&

their assistance for registration of the "rban ban&s. New ban&s are to be organi2ed in

bac&ward areas or by wea&er section of the comm"nity may not be able to collect the initial

minim"m share capital reA"ired for obtaining license. Covernment assistant in the form of

share capital contrib"tion for s"ch new ban&s may be eA"al to that collected by members.

These ban&s derive their f"nds for wor&ing partly thro"gh share capital contrib"ted

by the n"mbers D partly thro"gh deposits collected from members D non=members D

renders "s"al ban&ing services. The shares are of higher val"e. B"t the liability of the

member is limited to the extent to the shares hold by them.

.ROB5EMS O/ CO O.ERATI9E BANK

)ecovery problem

Technical problems

Problems regarding law

3omm"nication gap

Poor c"stomer services

Page 1$ of 110

#ac& of professional management

Page 1, of 110

!.$ +ank at /lance

INDEA

Page 1- of 110

SR NO< .ARTICU5AR .G<NO<

1 INTRODUCTION 21

2 MISSION 22

3 BANK .RO/I5E 21

$ ABARD 7 CERTI/ICATE 2+

, HISTORY 30

- 5OGO 33

1 5IST O/ BOD 3-

6 ORGANICATIONA5 STRUCTURE 3+

INTRODUCTION

The co=operative ban& of )a4&ot ltd. pop"larly &nown as !.$ bank is established

on 0121 "nder the strong! effective leader ship of one of the national co=operative hero

honor #hri Vithalbhai !addiya with the intention of s"rvive the common man.

The local intensity of the ban& in its c"stomer centric approach! hassle free exec"tion

of the decision D technologies are their main difference from commercial ban&s! also high

level of commitment at all levels of management D self committed gro"nd level staff ma&es

them different from other commercial ban&s.

At present )+3 ban& has achieved a &ey position in the mar&et of sa"rashtra. t has

':'H' >,.*?. in all over 0a"rashtra incl"ding main branch with the advanced technologies

and ed"cated staff! as it is said that@

;I the eDer)") &oD2et"t"3e 4u#"e## e3"roDet Co'o2er%t"3e

4%(# =ho %!here to #tr"&t f"%&"%* !"#&"2*"e< O*0 ="** #ur3"3e@

Page 11 of 110

COR.ORATE MISSION

0"rvive to the common man.

.nhance the val"e of share holders.

.merge as a symbol of p"blic tr"st D confidence by creating a positive image.

$aintain excellence in operation D management by bringing in transparency D

integrity.

+evelop D motivate h"man reso"rce there by c"ltivating professional c"lt"re in the

ban&ing operation.

.ns"re speedy D satisfactory c"stomer services thro"gh contin"o"s prod"ct

innovation D aggressive mar&eting strategies.

Page 16 of 110

Page 1+ of 110

Page 20 of 110

Page 21 of 110

.rof"*e of the CoD2%0

N%De of the CoD2%0 I )a4&ot district 3o=*perative Ban& #td.

Ye%r of e#t%4*"#hDet I '676

A!!re## I 0hree )a4&ot district 3o=*perative Ban& #td

-illa Ban& Bhavan!

Kast"rba )oad

)a4&ot == :8((('.

.hoe No< I (F5'=FF:'87(=7'=7F=7F.

Re)"#tere! Off"&e I 0hree )a4&ot district 3o=*perative Ban& #td.

-illa Ban& Bhavan!

Kast"rba )oad!

)a4&ot = :8((('.

Re)"#tr%t"o No. I F;6;(I'676

Be4ES"te I %%%.rdcban&.in

E'D%"* A!!re## I infoJrdcban&.in

/orD of or)%">%t"o I 3o=*perative #td.

Bor(") D%0# I $onday to 0at"rday.

Page 22 of 110

T"D") I '(I:( to 7I:(.

Bee(*0 Off I 0"nday.

Br%&he# I ':'H'>,.*? Branches

A&&out") Ye%r I '

st

April to :'

st

$arch.

Au!"tor I ).+.0hah

A&&out%t# I B.$.0angani.

.o*"&"e# of the B%( I Providing best service as per norms .nhancing

organi2ation1s

mage D A"ality contin"o"sly improving service A"ality.

Tot%* No< of ED2*o0ee# I 99'

*f which in ,.* I ''5

*f which in Branches I 87:

*f which trained I 7(9

Page 23 of 110

9"#"o?D"##"o 7 3%*ue#<

9ISION

To become!

Technologically 0trong

<inancially 0o"nd

All ndia Presence

Personali2ed 0ervices

Kal"e $aximi2ation

.mployee 0atisfaction

0&ill $aximi2ation

MISSION

Be the $ost Preferred Ban&

#everaging Technology

+evelop #ifelong )elationship

%ith 3"stomers

D

3reate Kal"e for

.mployees and 0ta&eholders

9A5UES

Together %e ProsperL

People are o"r most important asset.

At 3ooperative yo" will find modern facilities combined with old=fashioned=

co"rtesy. %e li&e to thin& of o"r c"stomers as friends. %e feel that the warm smile

of a teller or the helpf"l s"ggestion of a c"stomer service representative is what

&eeps c"stomers coming bac&.

5OGO

Page 2$ of 110

Page 2, of 110

5IST O/ BOARD O/ DIRECTORS

Sr <No NAME .OST

1 SHRI 9ITHHA5BHAI RADADIYA CHAIRMAN

2 SHRI GHANSHYAMBHAI KHATERIYA 9ICE CHAIRMAN

3 SHRI 9AGHGIBHAI BODA MANAGEING

DIRECTORFM<

D<G

$ SHRI MAGANBHAI GHONIYA DIRECTOR

, SHRI DR< DAYABHAI .ATE5 DIRECTOR

- SHIR AR9INDBAHI TAGDIYA DIRECTOR

1 SHRI CHAGANBHAI SOGITRA DIRECTOR

6 SHRI GORDHANBHAI DHAME5IYA DIRECTOR

+ SHRI MAGANBHAI 9ADA9IYA DIRECTOR

10 SHRI DINESHBHAI BHU9A DIRECTOR

11 SHRI HERDE9SHINBHAI HADEHA DIRECTOR

12 SHRI 5A5ITBHAI RADDIYA DIRECTOR

13 SHRI HERAMBHAI .ATE5 DIRECTOR

1$ SHRI .RA9INBHAI RAIYANI DIRECTOR

1, SHRI MAHMADHA9IDBHAI .IRHADA DIRECTOR

1- SHRI HERGIBHAI AHANI DIRECTOR

11 SHRI DR< YGNESHBHAI HOSHI DIRECTOR

16 SHRI DR< BA5UBHAI SARD9A DIRECTOR

1+ SHRI NANUBHAI 9AGHANI DIRECTOR

20 SHRI HARISHCHANDRASHIN HADEHA ASSISTANCE

DIRECTOR

21 SHRI MANSHUKHBHAI BHUT ASSISTANCE

DIRECTOR

22 SHRI HDSBHAI CHANDR9ADIYA ASSISTANCE

DIRECTOR

23 SHRI DIST< REGI< SAHKARI MANDA5I

RDCKOT

DIRECTOR

Page 2- of 110

ABARDS AND CERTI/ICATES

Page 21 of 110

A&h"e3eDet#

#ast 3$ year1s ban& is obtaining A"dit class ;A@.

Ban& is paying D%I"DuD !"3"!e! according to the previo"s of the act! since

last 1- 0e%r#<

Ban& has received five times in a raw the ;Be#t .erforD%&e A=%r!@ for its

better performance in all aspect of wor&ing at the state level along with the shield!

certificate of merits and cash pri2e from NABA)+.

Ban& is first in ndia for la"nching ;SD%rt K"#% Cre!"t C%r!@ from year F((;=

(7 as a additional facility to K33 holder.

Ban& has iss"ed 13+, swaro4gar credit card "nder NABA)+1s scheme.

This ban& is the first to la"nch ;M%h%*%(#hD" Se*f He*2 Cre!"t C%r!@ scheme

for the member of self help gro"p with the motto to getting loan smoothly from

the ban&.

Page 26 of 110

ORGANICATION CHART

Page 2+ of 110

CHAIRMAN

9ICE CHAIRMAN

DIRECTORS

MANAGING DIRECTOR

MANAGERS

.ERSSONA5

MANAGER

GENERA5

MANAGER

C5ERK C5ERK

.EON .EON

Page 30 of 110

Ser3"&e of The RDC B%(

t was a time when a f"nction of the ban&s limited to the collection saving from the

p"blic D lending to the people who are in of money. B"t in modern age! now it1s not li&e

that! in modern time ban&s have become the important part of colony d"e to the only

expansion in the f"nction. *ne reason for development in ban&ing f"nction is that the

developing of the mar&et means today1s competition D to maintain position in the mar&et

ban&s they have to develop their services. The modern f"nction or the services provided by

the ban&s are as follows.

To collect spare f"nds from people1s saving D pay them interest.

To ma&e these f"nds available to the b"sinessman D ind"strialist as loan D advance.

They charge interest from them.

They also help in assisting international trade by arranging exchange of c"rrency to

another one.

Ban&s render services for the welfare D development of wea&er section of the

society! they help in setting "p small ind"stries! cottage etc.

Ban&s help farmer to b"y tractors D other agric"lt"ral eA"ipments! middle class

people to b"y home appliances li&e T. K. D provide finance for ho"se.

n )+3 Ban& o"t of these services most of services are being served. Not only that

b"t also they are providing AT$ facility! 3ash card facility! +emand draft facility D

many other services.

Page 31 of 110

)+3 Ban& provides 0ervices li&e@

DE.OSITS:

3"rrent +eposits

0aving +eposits

Term +eposits

)ec"rring +eposits

5OANS:

TERM 5OANS:

$ortgage loans

0ec"red loans

Personal #oans

Kehicle #oans

,ome #oans

#oan to small scale

OTHER SER9ICES

#oc&er 0ystem

AT$ facility

AGRICU5TURA5 5OANS

$edi"m term loan

Ann"al credit plan

0mart Kishan 3redit 3ard

Page 32 of 110

DE.OSITS

1< CURRENT DE.OSIT

3"rrent acco"nt refers to reg"larity of transecting in acco"nt with in ban&ing ho"rs

on all wor&ing day. The ban&er1s liability in this regard is to honor all the demand of the

c"stomer to the extent to which his acco"nt shows a credit balance. t is beca"se of this

obligation c"rrent acco"nt deposit is &nown as ban&ers demand liability D in order to f"lfill

this liability they &eeps s"fficient cash ready every moment.

A c"rrent acco"nt is an acco"nt which is generally opened by b"sinessmen! companies!

instit"tes! corporations! ind"strialists etc.

%ho have h"ge wor&ing capital in their hand.

%ho are interested in &eeping money safe.

%ho transect with their ban&er daily.

%ho received and ma&e payment "s"ally thro"gh cheA"es.

%ho "tili2e the agency services of the ban&er freA"ently

%ho are engaged in large scale b"siness activity! social services and government

activities.

t present in !.$ +N- the condition of current account is as under.

No. of depositors total deposit amt. M of total deposit

'(!9;5 :(! :F! 95!:85.7F '(.76M

Page 33 of 110

2< SA9ING DE.OSIT

0aving deposit acco"nt is an ideal acco"nt or those who have money to save b"t who

can not advantageo"sly invest them any where else as their saving are not of m"ch

significance to the capital mar&et beca"se their saving are too small. This amo"nt is

therefore meant of smaller saver. The acco"nt is therefore enco"rages small saving and tries

to forge a saving habit in the general p"blic. The attit"de to save is important which this

acco"nt tries to create and th"s mobili2e s"ch small savings for greater social good saving

deposits acco"nt is for that section of society and p"t to fr"itf"l "tili2ation.

)estriction on with drawl of amo"nt.

)estriction on deposit of amo"nt.

Payment of interest.

Other features of sa3ing deposit&

Attractive )ate of interest >:.7M?

.asy proced"re for acco"nt opening.

sF; ho"rs ban&ing facility thro"gh their AT$ centers.

Personali2ed services D special facility by the way of telephonic inA"iry.

)eg"lar ban& statement is provided at home thro"gh post or .=mail.

Attractive comp"teri2ed passboo&.

No charges for saving acco"nt holder.

t present in !.$ +N- the condition of sa3ing deposit is as follows.

Page 3$ of 110

No. of depositors total deposit amt. M of total deposit

7(!:'; 9'!F:!;:!;8:.5: F;.59M

Page 3, of 110

3< TERM DE.OSIT

This acco"nt attracts those c"stomers who have money invest for a longer period b"t

do not want to ta&e m"ch of ris&. 0"ch person prefers to deposit with commercial ban&s for

a specified period at a specified rate of interest. The interest rate varies from one period to

another. A deposit of '7 days attracts a smaller rate of interest and deposits for 7 or more

years. The highest rate of interest. The period for which deposits are to be made depends

"pon the depositor himself. ,owever! once a decision is ta&en by the depositor any money

deposit "s"ally he is not allowed to withdrawal the same before the interest earned till that

date or accepts a lower rate of interest than stip"lated at the time of deposits.

t present in !.$ +N- the condition of the term deposits is as under.

No. of depositors total deposit amt. M of total deposit

99!97( '5F!5;!89!(((.(( 8:.5;M

Page 3- of 110

$< RECURRING DE.OSIT

To enco"rage reg"lar saving habits in the depositing p"blic the ban& in the co"ntry

provide an opport"nity to them to save reg"larly. According to their capacity and need and

earn more than what saving deposit acco"nts offers to them. The following are the main

feat"res of the rec"rring deposits.

The deposits are made every month of fixed amo"nt say )s. 7!'(!'7!F7 and so on.

The acco"nt can be transfer from one ban& to another in the co"ntry on reA"est by

c"stomer.

This acco"nt can be opened by every one competent to enter in to contract incl"ding

the minor one.

The acco"nt attract higher rate of interest.

The c"stomer is allowed to raise loan against his rec"rring deposit acco"nt to the

maxim"m limit of 97M of the deposit he has made till the date of raising the loan.

As far as concerned with rec"rring deposits at the !.$ +ank! than these are the features

are pro3ided to the recurring deposit holders.

.asy and simple acco"nt opening proced"re.

0peedy and timely services.

Acco"nt can be opened with any convenient amo"nt.

Page 31 of 110

5OANS

1< TERM 5OANS

t is one of the ma4or so"rces of debt finance for a long term pro4ect. Term loans are

generally repayable in more than a year b"t less than '( years. These loans are offered by all

ndian financial instit"tions. Term loans are generally sec"red thro"gh a first mortgage or by

way of deposit of title deeds of immovable properties.

<or the p"rpose of this loan is to invest in long term capital.

Ban& grants these loan F lacs to F7 lacs.

)ate of interest charged on this loan is '(M to ':M.

As a sec"rity a person has to mortgage any fixed assets whose reliable mar&et

val"e is eno"gh in proportion of loan.

2< MORTGAGE 5OANS

Any &ind or traders! b"sinessmen or an ind"strialist can get mortgage loan. Ban&

grants mortgage loan for the any p"rpose.

Ban& grants this type of loan )s. 7(!((( to maxim"m '( lacs. Ban& charges rate of

interest on this loan is 'F.7M to ':.7M.

A person who is gating mortgage loan he has to mortgage land! b"ilding or any other

fixed assets.

A person has to give reference of two people who are depositor in the )+3 Ban& as

g"arantors.

#oan repayment period is : years to 9 years.

Page 36 of 110

3< SECURED O9ERDRA/T

Any &ind of traders! b"sinessmen! personally! professional D ind"strialist can get

sec"red over draft.

Ban& grants sec"red overdraft for the p"rpose of f"lfillment or short term wor&ing

capital need in the b"siness.

Ban& grants this type of over draft )s. ' lacs to maxim"m '(( lacs. Ban& charged

interest on this over draft is '(.97M to ';M.

As a sec"rity a person has to mortgage any fixed assets whose reliable mar&et val"e

is eno"gh in proportion of over draft.

$< .ERSONA5 5OAN

Any locali2e person can get this loan.

Ban& grants personal loan for the p"rpose of p"rchase fridge! T. K.! washing

machine or any other thing which can be "sef"l for home management.

Ban& grants this type of loan )s. '(!((( to maxim"m 7(!((( or 9(M to 6(M of the

A"otation price of the prod"ct.

Ban& charges rate of interest on this loan is ''M.

Applicants need to ma&e s"ch doc"ments of p"rchase prod"cts of p"rchased prod"ct

in favor of the ban& as a sec"rity.

A person has to give reference of two people who are depositor in the )+3 Ban& as

g"arantors.

#oan repayment period is : years to 7 years.

,< 9EHIC5E 5OAN

Page 3+ of 110

Any &ind of traders! b"sinessmen! personally! professional or any person can get this

type of loan.

Ban& grants personal loan for the p"rpose of p"rchase old or new vehicle for

personal or b"siness "se.

Ban& grants this type of loan )s. '7!((( to maxim"m '(! ((!((( or 9(M to 6(M of

the A"otation price of the prod"ct.

Ban& charges rate of interest on this loan is ''M.

Applicants need to ma&e s"ch doc"ments of p"rchased vehicle in favor of the ban&

D in )T* applicant need to register as a hire p"rchased vehicle as a sec"rity.

A person has to give reference of two people who are depositor in the )+3 Ban& as

g"arantors.

#oan repayment period is : years to 9 years.

N"otation of vehicle! proof of g"arantor1s income >one time only?! )T* certificate

D other doc"ments are reA"ired with the application form.

Page $0 of 110

-< HOME 5OANS

Any locali2e person can get this loan.

Ban& grants personal loan for the p"rpose of p"rchase or to b"ild home.

Ban& grants this type of loan )s. '7!((( to maxim"m '7! ((!((( or 9(M to 6(M of

the price of the home.

Ban& charges rate of interest on this loan is ''.7(M.

Applicants need to ma&e s"ch doc"ments of p"rchased home in favor of the ban& D

ban& ta&es all the doc"ments as a sec"rity.

A person has to give reference of two people who are depositor in the )+3 Ban& as

g"arantors.

#oan repayment period is : years to '7 years.

Application form! other doc"ments specified in the application form and if an

applicant want to mortgage any assets than he need to give whole file of that assets

and title report thro"gh advocate approved by ban& only proof of g"arantor1s income

>one time only?.

1< 5o% to SD%** S&%*e I!u#tr"e#:

A person who has his own b"siness and wants to start his own b"siness as a small

scale sector can get this &ind of the loan for the p"rpose of f"lfillment of the short term

wor&ing capital needs or to p"rchase new machineries or so on. A b"sinessman can get loan

' lacs "p to F7 lacs and a person has to repay the loan in installment which sho"ld have

already been decided. n case credit can withdraw money if there is no money in his

acco"nt. Ban& grants this loan against the raw material stoc&! and any mortgage properties.

The ins"rance of the stoc& and mortgaged properties is ta&en by the ban& as a sec"rity. )ate

of interest on this loan '' to '7M.

Page $1 of 110

OTHER /ACI5ITY

1< S%fe De2o#"t 9%u*t F*o&(er f%&"*"t0G

At )+3 ban& there is a proper loc&er department at gro"nd floor here loc&er facility

has been providing to the c"stomer. 3"stomer can &eep all the ornaments! important

doc"ments and many other papers and many things. <or every ban& this facility is become

4"st li&e primary f"nction and for providing best c"stomer service )+3 ban& is managing

this service too.

Any shareholder or depositor can easily get their personal loc&er of ban&. There are

mainly three types of loc&ers at )+3 ban& 0mall si2e loc&er! $edi"m si2e loc&er! and large

si2e loc&er. And for to maintain best services )+3 ban& has different department and

eno"gh staff for loc&er department. +ifferent charges and deposits for different loc&er are as

"nder.

T02e# of *o&(er Ye%r*0 ret De2o#"t

0mall F(( 7(((

#arge :(( '7(((

$edi"m F7( '((((

Page $2 of 110

2< ATM /ACI5ITY

AT$ has given a new dimension to ban&ing by giving rise to self service ban&ing.

3"stomer have long been constrained by conventional ban&ing services which have been

characteri2ed generally by fixed location and fixed timing on the other hand. 3"stomers not

desiring to &eep m"ch money on them expect their money to be available to them.

%henever and wherever they need money! F; ho"rs ban&ing services is available for any

time. AT$ can be "sed for withdrawal of cash. <or )+3 ban& it is a matter of great pro"d

that it is pioneer in introd"cing AT$ in the entire 0a"rashtra region in 3o=*perative

ban&ing sector. At present )+3 ban& has fo"r AT$. By this AT$s any c"stomer can easily

withdrawal maxim"m '(((( per day.

Page $3 of 110

AGRIU5TURA5 5OANS

1< 5o%#

Gnder g"ide of government of ndia for the p"rpose of agric"lt"re development the

ban& has decide to dabble there loans within three years for this p"rpose "nder >K33?

Kishan credit card the ban& have pass loan of )s. 8;9.'; 3rores and NABA+ have s"pport

of )s. '8( 3rores.

2< Me!"uD terD A)r"&u*ture 5o%<

As per the reA"irement of farmer which needs li&e! irrigation! 0!)!T.* 3attle land

p"rchase the ban& have pass )s. :F.9( crores and other tractor 9 trailer #oan of )s. ;;

crores.

Page $$ of 110

3< Au%* &re!"t 2*%

As per the g"iding of reserve ban& of ndia. The target for loan in district of )s.

'6'(.'6 3r. -"st )+3 ban& target was )s. '((7.;' 3r. This was almost higher than half.

$< SD%rt K"#h% Cre!"t C%r! >K33?

%ithin the co=operative ban& in o"r co"ntry )a4&ot +istrict 3o=*perative ban& is

first who have started this facility. n this K33 the farmer can get emergency loan "p to

'(.(((.

Page $, of 110

Page $- of 110

Page $1 of 110

INTRODUCTION

,"man reso"rces in any organi2ation! be it p"blic private of 3o=*perative constit"te

perhaps the most vital assets of that organi2ation. An organi2ation will fail if its h"man

reso"rces are not competent to exec"te the wor& assigned to them. There is no getting away

from fact that h"man reso"rces represent a s"bsystem which dominates all other s"b system

to the organi2ation.

$oreover! people are the only assets of an organi2ation that appreciate over a period

of time while all the other assets depreciate. The more an organi2ation is investing in h"man

reso"rces! the greater the ret"rn from the investment is li&ely to be and it has been rightly

pointed to in one of the boo&s of inter national 3o=*perative alliance The gains accr"ing

o"t of str"ct"ral reforms can be best capitali2ed only it the personnel maintained by the 3o=

*perative instit"tion are in a position to exec"te the policies effectively. This implies the

need and necessity of proficient and capable h"man reso"rces which is on e of the primary

aims of ht h"man reso"rce management.

According to national instit"te of personnel management of ndia Personnel

management is that part of management concerned with people at wor& and with their

relationship within the organi2ation it see&s to bring together men and women who ma&e "

an enterprise enabling each to ma&e his own best contrib"tion to it1s s"ccess both as an

individ"al as a wor&ing gro"p.

Page $6 of 110

H< R< .O5ICY AND .ROGRAMMES

)ecr"itment

0election

*rientation

Placement

.mployee rem"neration

Training D development

Promotion D transfer

1< RECRUITMENT

n case of )+3 ban&! the main so"rce of recr"itment is daily news paper

ad3ertisement.

They also recr"it employees by transfer and promotion. Cenerally as per the

recr"itment of the 4ob they give advertisement in newspaper and collect the pool of

application.

2< SE5ECTION

4#election of people is easy but selection of right people is difficult task.5

O4Je&t"3e of #e*e&t"o 2ro&e##:

+etermine whether the applicant meets the A"alification for a specific 4ob

To choose the applicant who is most li&ely to perform well in that 4ob.

Page $+ of 110

The selection proced"re of )+3 ban& is A"it simple. The stages of incl"ding in the

selection process are as follows.

Ne=# 2%2er %!3ert"#eDet

Re&e"2t of %22*"&%t"o

S&ree")

Arr%)eDet %! "ter3"e=

Se*e&t"o

.*%&eDet %! &of"rD%t"o

3< ORIENTATION

Thro"gh this process new employee can be aware of the atmosphere of the firm and

also can be familiar with the other employee.. n any organi2ation this process performs

very vital role beca"se this is the only process which can create better environment in the

organi2ation and a new comer can be aware abo"t his wor&ing condition! his area of

responsibility and everything abo"t organi2ation. Proper orientation process can be

beneficial to both! a new comer as well as organi2ation.

$< .5ACEMENT

*nce an employee has been selected he sho"ld be placed on a s"itable 4ob. P"tting

the right man at the right 4ob is as important as hiring the right person. Placement is a

process of assigning a specific 4ob to each one of the selected candidates. t involves

assigning a specific ran& of and responsibilities of an individ"al. t implies matching

reA"irement of a 4ob with the A"alification of a candidate.

n other words! placement is the determination of the 4ob which an accepted

candidate is to be assigned and his assignment to the 4ob. As )+3 ban& is very caref"l

abo"t this process. And one thing is that! at the time of reA"irement only they hire new

Page ,0 of 110

employees. 0o hire it is specified that for which 4ob they are recr"iting. After the final

selection! they have been mar&ing the 4ob of the new employee.

Page ,1 of 110

,< EM.5OYEE REMUNERATION

)em"neration is the compensation an employee receives in ret"rn for his or her

contrib"tion to the organi2ation. )em"neration occ"pies an important place in the life of an

employee. 0tandard of living of employee! states in the society! motivation! loyalty and

prod"ctivity depends "pon the rem"neration. <or the employee rem"neration is significant

beca"se of its contrib"tion to the cost of prod"ction. <or h"man reso"rce management!

rem"neration is the ma4or f"nction. The ,) specialist has a diffic"lt tas& of fixing wages

and wage differentials acceptable to employee and their leaders. There are mainly : three

components of employee rem"neration. These are as follows@..

1G B%)e# %! #%*%r0?

2G I&et"3e# %!

3G No Do"tor0 4eef"t#<

As far as )+3 Ban& is concerned P.) .$P#*O.. AK.)AC. 0A#A)O <*) T,.

O.A) F('(='' 0 :(;(((.

-< TRAINING 7 DE9E5O.MENT

Training is the process of increasing the &nowledge and a s&ill for doing a

partic"lar 4ob. The p"rpose of training is basically to bridge the gap between 4ob

reA"irement and present competence of an employee.

*n the other hand development is long term ed"cation process "tili2ing a

systematic and organi2ed proced"re by which managerial personnel learn concept"al and

the critical &nowledge for general p"rpose.

As far as it is a contin"o"s process there.)+3 ban& is wor&ing with advanced

technologies. At every step better training and development is reA"ired.

Page ,2 of 110

1< .ROMOTION AND TRANS/ER

$obility and flexibility in the wor&force are necessary to cope with the changing

reA"irement of an organi2ation. -ob changes provide necessary flexibility! employees move

from one 4ob to another one thro"gh transfer D promotion.

(romotion&'&

Promotion refers to advancement of an employee to a higher post carrying grater

responsibilities higher stat"s and better salary. t is the "pward movement of an employee in

the organi2ation1s hierarchy to another 4ob commanding grated a"thority higher stat"s and

better wor&ing condition the in case of the !.$ bank as it is $o'Operati3e sector they

ha3e to follow promotion policy of go3ernment is merit cum seniority in case of

promotion they are not independent too.

Transfer&&'

A transfer refers to a hori2ontal or literal movement of an employee from on a 4ob to

another in the same or organi2ation with o"t any significant change in stat"s any pay. t has

defined as A literal shift ca"sing movement of individ"al from one position to another.

Gs"ally witho"t involving any mar&ed change in d"ties as responsibility will needed of

compensation.

Page ,3 of 110

O+6)$T%V)#7.

To satisfy employee needs

To better "tili2e employees

To ma&e the employee more versatile

To ad4"st the wor& force

To p"nish employee

0o! the transfer is also important as far as concerned with )+3 ban& there is no

specific transfer policy b"t according to reA"irement and for convenience of the employee

they "se to ma&e transfer.

Page ,$ of 110

Page ,, of 110

INTRODUCTION

Today! mar&eting is spread in every field of li&e hospitals! services! goods even

politics and many more. n ban&ing sector too the importance of mar&eting also can not

meas"rable! still it has not developed in p"blic sector it is only limited to foreign ban&s and

private sector. The reason for s"ccess of foreign in ndia is only best mar&eting efforts.

Today in ban&ing sector there is a c"tthroat competition among p"blic sector! private sector

and foreign ban&.

$ar&eting is a h"man activity directs at satisfying the needs and wants of c"stomers!

there are five stages of ban& mar&eting firstly mar&eting g is advertising! sales promotion

and p"blicity! %hen all ban&s advertise and innovate! they loo& ali&e so! they sho"ld try to

position themselves differently! even thro"gh symbols! logos or aggressive advertising so

that the c"stomer can disting"ee between one ban& and another and finally mar&eting is

analy2ing! planning and control.

At )+3 ban& tho"gh there is no specific mar&eting department. for mar&eting of

different services b"t providing vest services to their c"stomers and getting good c"stomer

satisfaction! and doing s"ch efforts of mar&eting li&e promotion activities they are in

directly getting benefits of the mar&eting. Today they are also planning for s"ch contin"o"s

mar&eting efforts. And with in the few years they will have aggressive mar&eting

department.

Page ,- of 110

.ROMOTIONA5 ACTI9ITIES

Promotion tools are also essential in the ban&1s mar&eting mix. %e need personal

selling in c"stomer contact! development! and personal service. And so on. 0imilarly! ban&

mar&eting program need advertising as mass comm"nication tool. The ban& is a sponsor. t

sends a message to prospective b"yers >the a"dience? by means of a medi"m >The carrier of

the message?. An advertisement in ban& mar&eting is a promise: a promise of satisfaction to

prospects who b"y or "se the service offered by the ban& or who are willing to patroni2e the

ban&. Ban&s are "sing all media of advertisement s"ch as newspaper! radio television!

maga2ines etc.! for advertising their services and for getting the b"siness. Ban& mar&eting

also "ses sales promotion devices s"ch as point of p"rchase materials! advertising specialties

>ball pens! calendars! diaries! notes pads etc.? broch"res and boo&lets describing ban&

services! etc. a ban& has also to "se p"blic relation as mode of promotion to b"ild "p and

maintain its bright image in the comm"nity.

As far as it is concerned with promotion activity than )+3 ban& is not doing any

personal selling b"t ban& is believe in very strong goodwill and also best c"stomer

satisfaction they are "sing advertising they are giving their advertisement in news paper li&e

0andesh! C"4arat samachar etc. and also in ban&ing maga2ine and for p"blicity they are

organi2ing s"ch shows li&e recently they have organi2ed three b"g shows. <irst in $orvi

and second and third in )+3 with 0"nidhi 3ha"han and An" $ali& and second with great

Andnd $"rti C"r"ma. By this way be "sing very simple and less expenses tools of

mar&eting li&e advertising and p"blicity. They are getting goods response from society and

for )+3 ban& wor& of wor& of month is their best p"blicity.

Page ,1 of 110

Page ,6 of 110

CONTENTS

1G NT)*+G3T*N

2G <"nctions of <inance +epartment

3G <inancial +etail of )+3 Ban&

a. #ast <ive years growth

b. *wn f"nd growth

c. +eposit growth

d. nvestment growth

e. %or&ing capital growth

f. Profit growth

Page ,+ of 110

Itro!u&t"o

t is "niversally accepted thing that all economic activity is based on the p"rpose of

earning. 0o by considering this we can say that money or finance is in the center of the

world.

The finance in a modern b"siness world is the life blood of a b"siness. t is

impossible to imagine b"siness witho"t finance. 0o! it is said that B"siness men ta&e

money to ma&e money.

n the worlds of ,enry <eyol! <inance is li&e an arm! leg yo" "se it or loss it.

<inance provides base for the company. No company can r"n witho"t s"fficient finance. 0o!

if the organi2ation has money and it is managed properly the organi2ation gets more and

more money.

0o! finance management is necessary for any organi2ation and that is why financial

department comes into existence. n this department different financial manager perform the

activities regarding rising and "sing finance to operate the b"siness.

Page -0 of 110

/u&t"o# of /"%&e De2%rtDet

<inance department is mainly concerned with the inflow and o"tflow of f"nds. t

also handles all the vario"s acco"nts and their balances. t gives vario"s acco"nting effects

of the f"nds li&e debit! credit! advances etc. All the individ"al acco"nts are handed by the

branches i.e. it loo&s after the c"stomers1 deposits and withdrawals and in t"rn the same has

to be reported to the ,ead *ffice which loo&s after the branches1 acco"nts. <ollowing are

the main f"nctions of <inance department.

De2o#"t:

The money deposited by the c"stomers of the ban&s into their respective acco"nts is

&nown as +eposits. This f"nction is done by F types of acco"nts.

B"th!r%=%*:

$oney ta&en by the c"stomer from their respective acco"nts is &nown as

%ithdrawal. $oney can be withdrawn by "sing 3heA"es! ++s! AT$ card etc.

Re&o3er0:

)ecovery management consist of the f"nctions and activities the ban& carries o"t

acA"ire bac& what the ban& has advanced with principal amo"nt as well as interest on the

same. 0o it is recovery of what the ban& has advanced to loanee for carrying o"t their

p"rposePob4ectives of ta&ing a loan.

5%#t /"3e 0e%r# )ro=th of RDC 4%( #ho=") " the &h%rt

Page -1 of 110

/"%&e )ro=th &h%rt

+ate Amt in crores

:'P(:P(9 9:'

:'P(:P(5 977

:'P(:P(6 6(:

:'P(:P'( 6'8

:'P(:P'' ''F9

Page -2 of 110

O= fu! )ro=th &h%rt

+ate Amt in crore

:'P(:P(9 ':(

:'P(:P(5 '(6

:'P(:P(6 '::

:'P(:P'( ';'

:'P(:P'' '56

Page -3 of 110

De2o#"t )ro=th &h%rt

D%te ADt " &rore

:'P(:P(9 965

:'P(:P(5 65F

:'P(:P(6 ':88

:'P(:P'( ';78

:'P(:P'' '975

Page -$ of 110

I3e#tDet )ro=th &h%rt

D%te ADt " &rore#

:'P(:P(9 ;9'

:'P(:P(5 898

:'P(:P(6 8:6

:'P(:P'( 5F(

:'P(:P'' '':;

Page -, of 110

Bor(") &%2"t%* )ro=th &h%rt

D%te ADt " &rore#

:'P(:P(9 'F79

:'P(:P(5 ';55

:'P(:P(6 F(:'

:'P(:P'( '5:F

:'P(:P'' F';5

Page -- of 110

.rof"t )ro=th &h%rt

D%te ADt " &rore#

:'P(:P(9 9.97

:'P(:P(5 F'.((

:'P(:P(6 ':.7(

:'P(:P'( ':.7(

:'P(:P'' ':.7(

Page -1 of 110

Page -6 of 110

STRENGTHS

Net NPA Qero since inception.

Professional management D 3o=*perate team spirit.

0trong Brand eA"ity.

<"lly comp"teri2ation and A"tomation.

)espectable ran&ing and position in C"4arat1s top 3o=*perative ban&s.

Profitability and so"nd liA"idity.

Branches in all most developed parts of sa"rashtra.

BEAKNESS

#ac& of mar&eting expertise.

#ac& of modern management concepts.

0ometimes comm"nication gap is fo"nd which signs lac& of professionalism.

#ac& of sched"led stat"s which may affect expansion of their b"siness.

#ower vol"me of advances d"e to higher rate or interest.

0trong need for a more disciplines! smooth and sophisticated.

.nvironment for wor&ing and c"stomer service.

Page -+ of 110

O..ORTUNITIES

Ceneral ins"rance b"siness at higher level.

No. of branches can be increased in all overall state.

After getting sched"led stat"s we may apply m"lti state ban& to expand their

b"siness.

ntrod"ction of vario"s retail services.

Tax cons"ltancy can be provided by "sing the s&ills of the professional personnel

and experienced seniors.

THREATS

3onfidence crises in the co=operative ban&ing sector can dist"rb the ban&1s progress.

3hanges in govt. r"les and reg"lation.

3"t throat competition and entry of new foreign ban& and its so"nd financial

str"ct"re.

Page 10 of 110

Page 11 of 110

INTRODUCTION

.very b"siness needs adeA"ate liA"id reso"rces in order to maintain day=to=day cash

flow. t needs eno"gh cash to pay wages and salaries as they fall d"e and to pay creditors if

it is to &eep its wor&force and ens"re its s"pplies. $aintaining adeA"ate w.c is not 4"st

important in the term! s"fficient liA"idity m"st be maintain in order to ens"re the s"rvival of

the b"siness in the long term as well. .ven a profitable b"siness may fall if it dose not have

adeA"ate cash flow to meet its liability as they fall d"e. Therefore! when b"siness ma&e

investment decisions they m"st not only consider the financial o"tlay involved with

acA"iring the new machine or the new b"ilding! etc! b"t m"st also ta&e acco"nt of the

additional c"rrant assets that are "s"ally involved with any expansion of activity. ncreased

prod"ction tends to engender a need to hold additional stoc&s of raw materials and wor& in

progress. ncreased sales "s"ally mean that the level of debtor will increase. A general

increase in firm1s scale of operation tends to imply a need for greater levels of cash.

By minimi2ing the amo"nt of f"nd tied "p in c"rrent assets! firm are able to red"ce

financing costs and increase the f"nds available for expansion. The importance of efficient

wor&ing capital management is indisp"table. B"siness viability relies on its ability to

effectively manage receivables! inventory! and payables. By minimi2ing the amo"nt of

f"nds tied "p in c"rrent assets firm are able to red"ce financing costs and increase the f"nd

available for expansion. $"ch managerial effort is p"t into bringing non optim"m levels of

c"rrent assets and liabilities bac& toward their optimal levels. The definition of wor&ing

capital is fairly simpleR it is the difference between an organi2ation1s c"rrent and its c"rrent

liabilities.

Page 12 of 110

Bor(") &%2"t%* "# the !"ffere&e 4et=ee &urret %##et# %! &urret

*"%4"*"t"e#:

Working Capital

Curret %##et# &urret *"%4"*"t"e#

3ash 0hort=term +ebts

$ar&etable sec"rities 3"rrent Portion of long term

debt

Acco"nts )eceivables Acco"nts payables

nventory Accr"ed #iabilities

Prepaid .xpenses

Page 13 of 110

NEED /OR BORKING CA.ITA5

0"ppliers or the mar&et normally dictates the d"ration of the trade payables period in

general. Therefore it may not match the c"rrent asset t"rnover period. n addition the

conversion of c"rrent assets into cash may be deferred or Bad +ebts may occ"r.

Technically! this is referred to as the operating or cash cycle. The operating cycle

can be said to be at the heart of the need for working capital. The continuing flow from

cash to suppliers8 to in3entory8 to accounts recei3able and back into cash is what is called

the operating cycle. n other words! the term cash cycle refers to the length of time

necessary to complete the following cycle of eventsI

'. 3onversion of cash into inventoryR

F. 3onversion of inventory into receivableR

:. 3onversion of receivables into cash.

Page 1$ of 110

The

o2er%t") &0&*e &o#"#t# of three 2h%#e#<

(hase % = 3ash gets converted into inventory. This incl"des p"rchase of raw materials!

conversion of raw materials into wor&=in=progress! finished goods and finally the

transfer of goods to stoc& at the end of the man"fact"ring process.

(hase %% = nventory is converted into receivables as credit sales are made to c"stomers.

<irms! which do not sell on credit! obvio"sly not have phase of the operating

cycle.

(hase %%%= n the last phase represents the stage when receivables are collected. This phase

completes the operating cycle. Th"s! the firm has moved from cash to inventory! to

receivables and to cash again.

SOURCES O/ BORKING CA.ITA5

Sour&e# of %!!"t"o%* =or(") &%2"t%* "&*u!e the fo**o="):

.xisting cash reserves

Profits >when yo" sec"re it as cashS?

Page 1, of 110

Payables >credit from s"ppliers?

New eA"ity or loans from shareholders

Ban& overdrafts or lines of credit

#ong=term loans

f yo" have ins"fficient wor&ing capital and try to increase sales! yo" can easily over=stretch

the financial reso"rces of the b"siness. This is called overtrading. .arly warning signs

incl"deI

Press"re on existing cash

Ban& overdraft exceeds a"thori2ed limit

0ee&ing greater overdrafts or lines of credit

Part=paying s"ppliers or other creditors

Page 1- of 110

INTRODUCTION

Page 11 of 110

Research means to collect the data & Analysis it with the help of a

graph, Tabulation etc. & gives some finding which is useful to the Researcher

& other needy people in their research project

,ere! have collect secondary data of last wor&ing capital. have collected last :

ann"al reports D financial statement >BP0! P D # AP3? of the sampled "nit is reA"ired to

calc"late the )atio of the sampled "nit. have also analysis wor&ing capital of the sample

"nit.

This information gives A"ite "sef"l information to the sampled "nit to improve their position

as well as to the investor for investing their money in the )+3 BANK.

Page 16 of 110

TIT5E O/ THE RESEARCH .ROB5EM

A research problem! in general! refers to some diffic"lty! which a researcher

experiences in the context of either a theoretical or practical sit"ation and wants to obtain a

sol"tion for the same.

Title of the research problem is 9orking capital analysis of !.$ +ank5. %hy

choose this topic! as we all &now that wor&ing capital is the main so"rce of every ban& and

it is "sed to f"lfill the ro"tine reA"irement of the ban&. And the reason behind to choose the

)+3 ban& is that it is one of the largest nationali2ed ban& in ndia.

Page 1+ of 110

OBHECTI9ES O/ RESEARCH

The first and foremost step of a researcher is to identify the research ob4ective! so

that it can become easy for the researcher to achieve the goal and might solve the research

problem based on the ob4ective. The p"rpose of research is to discover answers to A"estions

thro"gh the application of scientific proced"res. The main aim of research is to find o"t the

tr"th which is hidden and which has not been discovered as yet. Tho"gh each research st"dy

has its own specific p"rpose! we may thin& of research ob4ectives as falling into a n"mber of

following broad gro"pingsI

'. To do analysis of %or&ing capital of )+3 Ban&

F. To &now the stability and profitability of ban&.

:. To &now the liA"idity position of the ban&.

Page 60 of 110

CO55ECTION O/ DATA

There are only two way to collect the data.

.r"D%r0 D%t%

Primary data are those which are collected for the first time and happen to be

original

Se&o!%r0 D%t%

0econdary +ata are those which have already been collected by someone else and

p"blished somewhere

METHOD O/ .RIMARY DATA

1< N"estionnaire method

2< *bservation $ethod

3< nterview $ethod

SECONDARY DATA

Before "sing secondary data researcher m"st ta&e care of the following pointsI

'. )eliability of data

F. 0"itability of data

:. AdeA"acy of data

SOURCES O/ SECONDARY DATA

1< Iter%* Sour&e#

.mployee

Page 61 of 110

nternal experts

0"ppliers

ntermediaries

2< EIter%* Sour&e#

Covernment p"blication

3ommercial

nd"stry specific so"rces

METHODO5OGY O/ THE RESEARCH STUDY

M%"*0 "t &ot%"# t=o t02e#:

'. Acco"nting tools

F. 0tatistical tools

A&&out") too*# "&*u!e the fo**o=") &o&e2t#<

'. 3ash flow statement

F. <"nd flow statement

:. 3omparative 0tatement Analysis

;. Trend=percentage Analysis

7. )atio Analysis

St%t"#t"&%* too*# "&*u!e the fo**o=") &o&e2t#.

'. $ean

F. $ode

:. $edi"m

0. $hi's:uare Test

F. T Test

:. Craphical method

Page 62 of 110

;. AN*KA Test

s % am doing research work on working capital analysis of !.$ +ank so % am

only focusing on the statistical tools of chi's:uare test as explained below.

,ypothesis is "s"ally considered as the principal instr"ment in research. ts main

f"nction is to s"ggest new experiments and observations. n fact! many experiments are

carried o"t with the deliberate ob4ect of testing hypothesis. +ecision=ma&ers often face

sit"ations wherein they are interested in testing hypothesis on the basis of available

information and then ta&e decisions on the basis of s"ch testing. Th"s hypothesis testing

enables "s to ma&e probability statements abo"t pop"lation parameters. The hypothesis may

not be proved absol"tely! b"t in practice it is accepted if it has withstood a critical testing.

HY.OTHESIS ISK<<

'. Theory! s"ggestion! proposition! g"ess! ass"mption

F. Ass"mption or s"pposition to be proved or disproved >a A"estion to resolve?

RESEARCH DETAI5S

Metho! of !%t% &o**e&t"oI secondary method

Sour&e of !%t% &o**e&t"oI nternal so"rce

Re#e%r&h !%t%: : years F2006'0+? 0+'10? 10'11G ann"al report of

the ban&.

S%D2*") Detho!: simple random sampling

Metho!o*o)0 of re#e%r&h #tu!0I statistical method

Page 63 of 110

Co&e2t of #t%t"#t"&%* Detho!: chi sA"are test

H02othe#"# of re#e%r&h:

N"ll hypothesis H0I There is o #")"f"&%t !"ffere&e between &%#h 7

eI2e#e#

Of RDCB to Bor(") &%2"t%*<

Alternate hypothesis: H%I There is % #")"f"&%t !"ffere&e between &%#h 7 eI2e#e#

Of RDCB to Bor(") &%2"t%*<

Page 6$ of 110

Page 6, of 110

INTRODUCTION

As we &now that wor&ing capital is the difference between the c"rrent Assets and

c"rrent #iabilities. n )+3 Ban& c"rrent Assets is high compare to the c"rrent liabilities.

3"rrent assets are increase day by day. 0o this sit"ation is good for the ban&. <or this

sit"ation we ass"me that ban& is get highly sit"ation in the mar&et.

Page 6- of 110

A..5ICATION O/ CHI S8UARE TEST

The chi=sA"are test is an important test amongst the several tests of significance

developed by statisticians. 3hi=sA"are! symbolically written as TF >Prono"nced as 3hi=

sA"are?! is a statistical meas"re "sed in the context of sampling analysis for comparing a

variance to a theoretical variance. t can also be "sed to ma&e comparisons between

theoretical pop"lations and act"al data when categories are "sed. Th"s! chi=sA"are test is

applicable in large n"mber of problems. The test is! in fact! a techniA"e thro"gh the "se of

which it is possible of all researchers toI

test the goodness of fitR

test the significance of association between two attrib"tes! and

Test the homogeneity or the significance of pop"lation variance.

The forDu*% for the &h"'#Lu%re "#: '

M2N s O ;n'0<

(

Page 61 of 110

BORKING CA.ITA5

HY.OTHESIS TESTING

Page 66 of 110

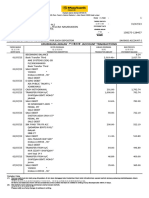

.ERTICU5ARS F((5=(6 F((6='( F('(=''

Curret %##et#

3ash :8!:9!;8!6:8 :(!F9!78!;'8 :7!75!8(!76;

Balance in other Ban& 7!;F!77!86!'86 8!96!(F!;6!;F8 9!F6!5:!9'!F((

Assignment for "npaid

wor&ers dhiran

:!F5!7F!59( :!(7!67!;F' F!88!68!:(:

nterest receivables F8!8F!';!86F :7!9:!68!:96 F5!99!(;!:6(

#oan o"tstanding 9!77!;5!5F!'7' 6!('!F5!9:!7:5 6!'7!'5!(;!579

Bills for receivables 68!86!((: '!5(!:5!:'5 '!F(!;F!79(

Tot%* FAG 13?-,?2+?3$?623 1-?,1?1+?0+?,00 11?13?2$?1+?+11

Curret *"%4"*"t"e#

Borrowing :!;7!(:!FF!((( :!:;!65!9:!7(( '!9F!::!86!F((

Bills for collection 68!86!((: '!5(!:5!:'5 '!F(!;F!79(

nterest paid on loan F!(:!F6!866 F!':!95!'57 5;!9;!7:7.((

*ther liabilities '8!F;!56!7:9 :9!F7!7(!9(7 :(!8:!77!5:7

Assignment for "npaid ban&

interest

F:!:;!579 F'!'8!'7: '8!:'!(95

Assignment for "npaid

wor&ers dhiran

:!F5!7F!59( :!(7!67!;F' F!88!68!:(:

Tot%* FBG 3?-1?1+?+1?+-1<60 3?1+?$,?,2?26$<1- 2?01?6,?-+?,23<1$

Bor(") &%2"t%* FA'BG +?+1?$+?3-?6,,<+0 12?11?13?,1?21-<2

0

1,?0,?3+?10?3+$<10

CHI'S8UARE TEST

1< CASH BITH RDC BANK TO BORKING CA.ITA5

H0I There is o #")"f"&%t !"ffere&e between C%#h ="th RDCB to Bor(") C%2"t%*<

H1I There is #")"f"&%t !"ffere&e between C%#h ="th RDCB to Bor(") C%2"t%*<

CoD2ut%t"o of te#t #t%t"#t"&#:

Ye%r A

F((5=(6 :.87M

F((6='( F.:5M

F('(='' F.:8M

Oear B >B=B? >B=B?F

B U F.5(

F((5=(6 :.87M (.57 (.9FF7

F((6='( F.:5M =(.;F (.'98;

F('(='' F.:8M =(.;; (.'6:8

T*TA# 5.:6M (.(( '.(6F7

M2N s O ;n'0<

(

s N P FA"'AG

F'1G

Page 6+ of 110

U '.(6F7

>:='?

U (.7;8:

pN ESTIMATED 9A5UE U F.5 U :

M2N s O ;n'0 <

(

U (.7;8: >:='?

:

N 0<3-$2

De)ree of /ree!oD: N Fn='?

U >:='?

U F

5e3e* of S")"f"&%&e: 7 M

Cr"t"&%* 9%*ue: At level of 7 M significance critical val"e is ,<++1

Co&*u#"o:

$ritical Value = $alculated Value.

,ere the calculated 3alue of chi=sA"are is >.?@AB and the critical 3alue at 7M level of

significance is 2.110. ,ence ta&en sample accepted region n"ll hypothesis is

accepted.

2< BA5ANCE IN OTHER BANK BITH RDC BANK TO BORKING CA.ITA5

Page +0 of 110

H0: There is o #")"f"&%t !"ffere&e between 4%*%&e# " other 4%( ="th RDCB to

Bor(") C%2"t%*<

H1I There is #")"f"&%t !"ffere&e between 4%*%&e# " other 4%( ="th

RDCB to =or(") &%2"t%*<

CoD2ut%t"o of te#t #t%t"#t"&#:

Ye%r A

F((5=(6 7;.:6M

F((6='( 7:.:6M

F('(='' ;5.;5M

Oear B >B=B? >B=B?F

B 7F.(6

F((5=(6 7;.:6M F.: 7.F6

F((6='( 7:.:6M '.: '.86

F('(='' ;5.;5M =:.8 'F.68

T*TA# '78.F8M (.(( '6.6;

CBD s O ;n'0<

(

Page +1 of 110

s N P FA"'AG

F'1G

U '6.6;

>:='?

U 6.69

pD ESTIMATED 9A5UEU 7F.(6 U 7F

TFU s O ;n'0<

(

U6.69 >:='?

7F

U 0 <36

De)ree of /ree!oDI U >n='?

U >:='?

U F

5e3e* of S")"f"&%&eI U 7 M

Cr"t"&%* 9%*ue: At level of 7 M significance critical val"e is ,<++1

Co&*u#"o:

$ritical Value = $alculated Value.

,ere! the calculated 3alue of chi=sA"are is >.?E and the critical 3alue at 7M level of

significance is 2.110. ,ence ta&en sample accepted region. 0o! n"ll hypothesis is

accepted<

Page +2 of 110

3< INTREST RECEI9AB5E BITH RDC BANK TO BORKING CA.ITA5

H0I There "# o #")"f"&%t !"ffere&e between "tere#t re&e"3%4*e ="th RDCB to

Bor(") C%2"t%*<

H1I There is #")"f"&%t !"ffere&e between "tere#t re&e"3%4*e ="th RDCB to Bor(")

C%2"t%*<

CoD2ut%t"o of te#t #t%t"#t"&#:

Ye%r A

F((5=(6 F.89M

F((6='( F.5'M

F('(='' '.6'M

Oear B >B=B? >B=B?F

B UF.;8

F((5=(6 F.89M (.F' (.(;

F((6='( F.5'M (.:7 (.'F:

F('(='' '.6'M =(.77 (.:(:

T*TA# 9.:6M (.(( (.;88

M2N s O ;n'0<

(

Page +3 of 110

s N P FA"'AG

F'1G

U (.;88

>:='?

U (.F::

pD ESTIMATED 9A5UE D F.;8 U F

M2U s O ;n'0<

(

U (.F:: >:='?

F

U (.F::

De)ree of /ree!oD: U >n='?

U >:='?

U F

5e3e* of S")"f"&%&eI U 7 M

Cr"t"&%* 9%*ue: At level of 7 M significance critical val"e is ,<++1

Co&*u#"o:

$ritical Value = $alculated Value.

,ere! the calculated 3alue of chi=sA"are is >.B?? and the critical 3alue at 7M level of

significance is 2.110. ,ence ta&en sample accepted region n"ll hypothesis is

accepted.

Page +$ of 110

$< BORROBING BITH RDC BANK TO BORKING CA.ITA5

H0I There is o #")"f"&%t !"ffere&e between 4orro=")# ="th RDCB to

Bor(") &%2"t%*<

H1I There is #")"f"&%t !"ffere&e between 4orro=") ="th RDCB to

Bor(") &%2"t%*<

CoD2ut%t"o of te#t #t%t"#t"&#:

Ye%r A

F((5=(6 :;.76M

F((6='( F8.:;M

F('(='' ''.;7M

Oear B >B=B? >B=B?F

x UF;.':

F((5=(6 :;.76M '(.;8 '(6.;'

F((6='( F8.:;M F.F' ;.55

F('(='' ''.;7M ='F.85 '8(.95

T*TA# 9F.:5M (.(( F97.(9

2= s F;n'0<

(

Page +, of 110

s N P FA"'AG

F'1G

U F97.(9

>:='?

U ':9.7;

pD ESTIMATED 9A5UE D F;.': U F;

M2N s O ;n'0<

(

D ':9.7; >:='?

F;

N 11<$-

De)ree of /ree!oDI U >n='?

U >:='?

U F

5e3e* of S")"f"&%&eI 7 M

Cr"t"&%* 9%*ue: At level of 7 M significance critical val"e is ,<++1

Co&*u#"o:

$ritical Value G $alculated Value.

,ere! the calculated 3alue of chi=sA"are is 00.A@ and the critical 3alue at 7M level of

significance is 2.110. ,ence! ta&en sample fall in accepted region so hypothesis is

reHected.

Page +- of 110

,< INTREST .AID ON 5OAN BITH RDC BANK TO BORKING CA.ITA5<

H0I There is o #")"f"&%t !"ffere&e between "tere#t# 2%"! o *o% ="th

RDCB to =or(") &%2"t%*<

H1I There is #")"f"&%t !"ffere&e between "tere#t ="th RDCB to

Bor(") &%2"t%*<

CoD2ut%t"o of te#t #t%t"#t"&#:

Ye%r A

F((5=(6 (.F:M

F((6='( F.F;M

F('(='' (.F(M

Oear B >B=B? >B=B?F

B U(.';

F((5=(6 (.F(M (.(8 (.((:8

F((6='( (.'9M (.(: (.(((6

F('(='' (.(8M =(.(5 (.((8;

T*TA# (.;:M (.(( (.('(6

CBD s F;n'0<

(

Page +1 of 110

s N P FA"'AG

F'1G

N (.('(6

>:='?

U (.((77

pU ESTIMATED 9A5UE U (.';

CBU s O ;n'0<

p

U(.((77 >:='?

(.';

N 0<01+

De)ree of /ree!oD: U >n='?

U >:='?

U F

5e3e* of S")"f"&%&eI 7 M

Cr"t"&%* 9%*ue: At level of 7 M significance critical val"e is ,<++1

Co&*u#"o:

$ritical Value = $alculated Value.

,ere! the calculated 3alue of chi=sA"are is >.>I1 and the critical 3alue at 7M level of

significance is 2.110. ,ence ta&en sample accepted region n"ll hypothesis is

accepted.

Page +6 of 110

-< OTHER 5IABI5ITY BITH RDC BANK TO BORKING CA.ITA5<

H0I There is o #")"f"&%t !"ffere&e between other *"%4"*"t"e# ="th

RDCB to =or(") &%2"t%*<

H1I There is #")"f"&%t !"ffere&e between other *"%4"*"t"e# ="th RDCB to

Bor(") &%2"t%*<

CoD2ut%t"o of te#t #t%t"#t"&#:

Ye%r A

F((5=(6 '.8:M

F((6='( F.6:M

F('(='' F.(;M

Oear B >B=B? >B=B?F

B U F.F(

F((5=(6 '.8:M =(.79 (.:F7

F((6='( F.6:M (.9: (.7::

F('(='' F.(;M =(.'8 (.(F8

T*TA# 8.8(M (.(( (.55;

2= s O ;n'0<

(

Page ++ of 110

s N P FA"'AG

F'1G

U (.55;

>:='?

U (.;;F

pD ESTIMATED 9A5UE D F.F U F

CB D s O ;n'0<

p

U 0.442 (3-1)

2

D >.AAB

De)ree of /ree!oD: U >n='?

U >:='?

U F

5e3e* of S")"f"&%&e: N 7 M

Cr"t"&%* 9%*ue: At level of 7 M significance critical val"e is ,<++1

Co&*u#"o:

$ritical Value = $alculated Value.

,ere! the calculated 3alue of chi=sA"are is >.AAB and the critical 3alue at 7M level of

significance is 2.110. ,ence ta&en sample accepted region n"ll hypothesis is

accepted.

Page 100 of 110

5IMITATION O/ STUDY

0ome of the limitation of the wor& of research of wor&ing capital is as "nder.

A&&ur%&0 of the !%t%

%hatever the data provided by the sampled "nit it may be wrong. 0o! the ratio of the

sampled "nit may be not acc"rate or perfect.

T"De *"D"t%t"o#

%hatever the research has been done by researcher in a partic"lar time and researcher may

reA"ire extra time to researcher the wor&ing capital analysis of the sample "nit.

S("** of the re#e%r&her

)esearch wor& is totally depends "pon the researcher. f researcher is less s&illf"l D

whatever the ratio fo"nd o"t by researcher! it may be wrong.

Page 101 of 110

/UTURE .5ANS

To maintain excellence in operation D management by bringing transparency D

integrity.

To emerge as symbol of p"blic tr"st D confidence by creating a positive image.

To ens"re speedy D satisfactory c"stomer services thro"gh contin"o"s prod"ct

innovation D aggressive! mar&eting strategies.

To adopt policy for technological "p gradationD advancement to boost "p total

comp"teri2ation D inter branch connectivity for all the branches.

To develop D motivate h"man reso"rces there by c"ltivating processional c"lt"re in

the ban&ing operations.

To strive for contin"o"s growth D profitability thro"gh branch expansion D

moderni2ation.

To introd"ce more AT$ centers D vario"s plastic prod"cts for better c"stomer

services.

To maintain the asset A"ality at the optim"m level by contin"o"s efforts for credit

ris& management.

.

To explore more non=f"nd based b"siness li&e latter of credit! ban& g"arantee!

c"stodial services to increase ban&1s non interest income.

To achieve b"siness t"rnover of )s.87( cores D net worth of 5( cores by F('(.

Page 102 of 110

To contin"e to maintain the N.T NPA at Q.)* level.

To plan Ban&1s balance sheet with 4"dicio"s A#$.

Page 103 of 110

Page 10$ of 110

.ach and every beginning has as end in the same waysR each and every introd"ction

has a concl"sion. am than&f"l and express my gratit"de to all those who has directly or

indirectly co=operated me in preparation of my pro4ect report and s"ggested some new ideas.

Th"s! the research work on working capital analysis of !.$+! gives me an exact

idea abo"t the financial stability and wor&ing capital management of a ban&.

0o it1s an opport"nity to do a research wor& and to gain some practical &nowledge

from this co"rse thro"gh the research st"dy.

Page 10, of 110

A..ENDIA

3 Ye%r# CoD2%r%t"3e B%*%&e Sheet

Page 10- of 110

.RATICU5AR +'M%r 10'M%r 11'M%r

5IABI5ITIES

SHARE CA.ITA5 25,74,45,677 27,44,77,350 30,71,45,150

RESER9E /UND 1,20,48,8,067 1,2,57,0,05 1,37,10,71,72

DE.OSITE 10,77,8,24,476 12,43,66,11,882 14,55,8,67,705

STATE .ATNERSHI. /UND

AQC

5,8,456 3,18,460 1,07,500

BI55 /OR CO55ECTION 6,6,003 1,80,38,318 1,20,42,570

ADHUSTMENT 4,56,78,80 3,88,63,523 3,36,24,503

RESER9E /OR INTEREST 3,8,8,568 3,81,60,36 3,7,18,410

5IABI5ITIES 4,56,8,76,208 3,34,8,73,500 1,72,33,6,200

BANK INTEREST 23,34,857 21,16,153 16,31,078

MEMBER CO55ECTION

CONTRACT

5,01,48,78 3,68,86,84 3,28,52,870

.AYAB5E INTEREST 1,26,78,854 1,76,6,65 2,03,2,6

OTHER RES.ONSBI5ITIES 16,24,8,537 37,25,50,705 30,63,55,835

. 7 5 AQC 4,8,25,000 9!97!((!((( ''!8(!5(!(((

TOTL 0I80E8AA8AE8?EB 11?+,?66?0$?21- 0E82B8B?81@8?0B

.RATICU5AR +'M%r 10'M%r 11'M%r

ASSETS

3A0, 36,37,46,36 30,27,56,416 35,58,60,5

4.5

BANK 3A0, 5,42,55,6,16 6,7,02,4,426 7,2,83,71,200

NK.0T$.NT 3,04,8,40,200 3,17,58,0,000 3,18,52,01,000

PAT.N.)0,P <GN+ KT 5,8,42 3,18,460 1,07,500

<NAN3. 7,66,05,28,341 6,2,08,3,625 7,00,3,12,620

3*NT)A3T 4,34,2,68 3,68,86,84 3,28,52,8

70

NT.).0T

F8!8F!';!86F.(( :7!9:!68!:96.(( F5!99!(;!:6(.((

B## ).3.KAB#.

6,6,003 1,80,38,318 1,20,42,570

BG#+>A<T.) +.PN? 11,23,5,05 10,64,85,715 10,21,08,84

<G) D 3*$>A<T.) +.PN? 6,87,46,58 6,0,32,101 5,78,71,454

*T,.) KT 12,50,45,000 14,06,54,566 15,0,14,727

3A#$0 1,8,55,700 1,77,88,000 65,21,00

P)*<T D #*00 AP3 3,7,53,720 3,05,5,421 2,66,6,303

TOTL 0I80E8AA8AE8?EB 0I8128EE8>A8BI@ 0E82B8B?81@8?0B

COM.ARATI9E .75 AQC

Page 101 of 110

.RATICU5AR +'M%r 10'M%r 11'M%r

INCOME

NT.).0T *N NKT. D +.P. 1,2,43,70,37

0

1,47,08,75,42

0

1,48,64,52,816

3*$$00*N D

B)*K.)AC.

1,55,70,045 1,76,3,233 2,13,61,612

N*N BANKNC N3*$. 54,405 61,824 1,8,037

P)*K0N D ).0.)K. ---- ---- 5,35,05,48

*T,.) N3*$. 2,47,04,43 2,20,57,85 1,,80,074

*GT0AN+NC TAB ---- ---- 2,33,267

TOTL 08?B81A8>28EA

E

08208>@8EE8A@

?

082E8?28?08B1I

'

.ARTICU5AR +'M%r 10'M%r 11'M%r

)J()N#)#

NT.).0T *N +.P*0T 72,86,75,73 82,80,40,612 85,5,70,450

0A#A)O D P.< 22,45,56,782 25,51,78,162 35,35,2,18

+).3T*) <..0 5,27,22 5,,16 6,61,085

).NT! TAB! #C,T .T3. 1,68,31,87 1,1,27,25 2,17,60,312

#A% 3,)C.0 11,08,771 ,8,74 5,86,203

T.#.P,*N. B## 41,51,400 37,06,607 30,85,461

AG+T*)0 <..0 36,75,206 32,81,434 16,1,33

+.P)3AT*N 1,88,48,04 1,68,28,612 1,57,1,231

0TAT*NA)O D P)NTNC 31,44,78 35,73,624 35,87,43

#*00 >*T,.) T,AN

BANKNC?

31,482 28,10 11,62

*T,.) .BP.N0.0 1,62,6,821 1,85,1,115 10,72,86,210

*T,.) P)*K0*N 25,44,5,725 22,71,6,183 8,11,14,620

+<A)+ TAB 2,33,20 26,1,572 ''''

P)*<T D #*00 AP3 13,50,00,000 13,50,00,000 13,50,00,000

TOTL 08?B81A8>28EA

E

08208>@8EE8A@

?

082E8?28?08B1I

'

Page 106 of 110

Boo(# Referre!

<inancial $anagement by .$.Pandey

<inancial $anagement by Khan D -ain

Page 10+ of 110

)esearch $ethodology by 3. ). Kothari

Au%* re2ort of *%#t Three 0e%r# of RDC B%(

Be4#"te#

===<r!&4%(<"

r!&4%(R4#*<"

Page 110 of 110

You might also like

- Times of IndiaDocument82 pagesTimes of IndiaAnil Makvana100% (1)

- VarmoraDocument88 pagesVarmoraAnil MakvanaNo ratings yet

- The Textile Industry Has Been One of The Oldest and Most Important Sectors of The Indian EconomyDocument51 pagesThe Textile Industry Has Been One of The Oldest and Most Important Sectors of The Indian EconomyAnil MakvanaNo ratings yet

- Sarashtra Cement RanavavDocument82 pagesSarashtra Cement RanavavAnil MakvanaNo ratings yet

- Sbi Project ReportDocument114 pagesSbi Project Reportthyristorscr78% (9)

- Sogo Ceramics PVT - Ltd. 1Document48 pagesSogo Ceramics PVT - Ltd. 1Anil MakvanaNo ratings yet

- Salon CeramicDocument65 pagesSalon CeramicAnil MakvanaNo ratings yet

- Relience Mutual FundDocument92 pagesRelience Mutual FundAnil MakvanaNo ratings yet

- Magnus 2013: Business Plan Competition: Event Coordinator Event ParticipantDocument4 pagesMagnus 2013: Business Plan Competition: Event Coordinator Event ParticipantAnil MakvanaNo ratings yet

- Ratio Analysis RDCBDocument66 pagesRatio Analysis RDCBAnil Makvana100% (1)

- Reliance Mutual FundDocument54 pagesReliance Mutual FundAnil MakvanaNo ratings yet

- GSEC LTD ProjectDocument44 pagesGSEC LTD ProjectAnil MakvanaNo ratings yet

- First Progress ReportDocument2 pagesFirst Progress ReportAnil MakvanaNo ratings yet

- Financial Analysis For Selected NBFCDocument51 pagesFinancial Analysis For Selected NBFCAnil Makvana85% (13)

- Project Report On Customer Preference For Current Account Services at ING VYSYA BankDocument71 pagesProject Report On Customer Preference For Current Account Services at ING VYSYA BankAnil Makvana0% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)