Professional Documents

Culture Documents

Road Sector Update 10 Nov10

Uploaded by

priyankjsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Road Sector Update 10 Nov10

Uploaded by

priyankjsCopyright:

Available Formats

Amit Srivastava

amit.srivastava@karvy.com

+91-22-22895029

November 10, 2010

India Research

Institutional Equities

INFRASTRUCTURE

SECTOR UPDATE

Road sector on a path to 20km/day

Karvy Institutional Equities 2nd Floor, Regent Chambers, Nariman Point - Mumbai 400 021 +91-22-2289 5000.

For Private Circulation only. For important information about Karvys rating system and other disclosures refer to the end of this material.

Karvy Stock Broking Research is also available on: Bloomberg - KRVY <GO>, Thomson Publisher & Reuters.

We recently hosted an 'Investor Conference' with Mr. Kamal Nath (Minister of

Road Transport and Highways) in Delhi with an objective to facilitate in-depth

communication between the government and investors about the road sector.

The conference was focused towards the issues like government's perspective

on road sector development, reason for delay in awarding of orders, bottlenecks

in execution of projects, funding of the projects, differences with state

governments.

Key takeaways:

The government is focused toward its target of constructing 7,000km/year

(with a run rate of 20km/day) of highways. About 60% of these projects

would be BOT toll projects, 25% as annuity projects and the remaining

15% would be developed as EPC contracts.

The government has planned to award 9,000-9,500km for FY11 in which

~4,000km has been already awarded and 5000km-5500km is due for

awarding in next four months. Post awarding of all these projects the WIP

of road projects would increase to around 18,000-19,000km from 14,000

km which will lead towards the path for construction of 20km/day in FY12.

Delay in awarding of projects if any was due to shortage of manpower at

NHAI and request from banks to staggered awarding of projects.

The government has undertaken various measures to streamline its policy

framework in the model concession agreement and it would continue to do

the same in future.

Land acquisition has been the major cause of delay and cost over runs in

the past. NHAI has set up a special land acquisition units at the state level

to quickly resolve issues of land. .

Concern of unviable project is due to conservative approach of forecast

for traffic at 5% rate. Over the last one year, strong auto growth is indicative

of the strong traffic potential.

The government has planned to set-up ~$50bn infra debt fund (not specific

to road sector) which should take off in next three months. This fund will

be used for refinancing of bank loans or direct investment in physical

infrastructure projects through PPP route. This will increase the interest

of banks in financing the long term projects and speed up the financial

closure of the projects.

November 10, 2010

Road Sector

Institutional Equities

2

Total Length (Km) Already 4-Laned (Km) U/Imp Balance

GQ 5,846 5801 45 0

NS -EW Ph. I & II 7,300 5258 1567 475

NHDP Ph III 12,109 1851 5353 4,905

NHDP Ph IV 14,799 176 177 14,446

NHDP Ph V 6,500 302 2015 4,183

NHDP Ph VI 1,000 1,000

NHDP Ph VII 700 43 657

SARDP-NE 388 113 275

Port Connectivity 380 290 90 0

Others 965 923 28 14

NHDP Total 49,987 14,601 9,431 25,955

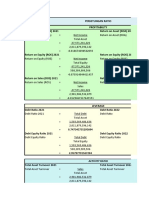

ROAD SECTOR ANNEXURE:

Opportunity in Road Sector:

Funding of road projects till 2030:

Uses of fund Rs bn Sources of fund Rs bn

Project construction 3380 Cess funds 3606

Payment to annuity 2076 External assistance (grant and Loan) 98

Interest on borrowed funds 783 Net surplus from toll revenue 1174

Repayment of Borrowing 1888 Negative grant 33

Total expenditure 8127 Budgetary support 14

Addl. budgetary support 393

Share of private sector 2113

Borrowings 1919

Total Funds 9351

Mega Highway projects

State Project KM

Andhra Pradesh Six laning of Ichapuram-Srikakulam-Vishakhapatnam-

Rajahnundri 436

Ori ssa Bahargora-Sambalpur 370

Rajasthan and Gujarat Six laning of Kishangarh-Udaipur-Ahmedabad 557

Punjab/Haryana Six laning of Jullunder-Jind 350

Maharashtra Four laning of Gujarat-Maharashtra border-Dhule- 485

Madhya Pradesh Four laning of Gwalior-Shivpur-Biaora-Dewas 450

Maharashtra Four laning of Indapur-Goa/Maharashtra border 390

Gujarat Four laning of Ahmedabad-Bamanbore-Samakhili 425

Gujarat Six/four/two lanes with paved shoulders of Bhavnagar- 445

Total 3908

Source: NHAI & Karvy Institutional Research

Source: NHAI & Karvy Institutional Research

Source: NHAI & Karvy Institutional Research

November 10, 2010

Road Sector

Institutional Equities

3

3280

925

1200

6732

1710

1230

624

2950

4000

9500

0

1000

2000

3000

4000

5000

6000

7000

8000

9000

10000

F

Y

0

3

F

Y

0

4

F

Y

0

5

F

Y

0

6

F

Y

0

7

F

Y

0

8

F

Y

0

9

F

Y

1

0

Y

T

D

S

e

p

'

1

0

F

Y

1

1

E

Projects award trend (Kms):

Project execution (Kms):

Rate (km/day):

412

1350

2355

754

645

1620

2148

2716

2544

0

500

1000

1500

2000

2500

3000

FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 YTD

Sep'10

-

5

10

15

20

25

30

F

Y

0

3

F

Y

0

4

F

Y

0

5

F

Y

0

6

F

Y

0

7

F

Y

0

8

F

Y

0

9

F

Y

1

0

Y

T

D

S

e

p

'

1

0

Execution rate Awarding

Source: NHAI & Karvy Institutional Research

Source: NHAI & Karvy Institutional Research

Source: NHAI & Karvy Institutional Research

Hemindra Hazari

(Head of Research)

hemindra.hazari@karvy.com

For further enquiries please contact:

research@karvy.com

Tel: +91-22-22895000

Disclosures Appendix

Analyst certification

The following analyst(s), who is (are) primarily responsible for this report, certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies)

and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer

The information and views presented in this report are prepared by Karvy Stock Broking Limited. The information contained herein is based on our analysis and upon sources that we consider reliable.

We, however, do not vouch for the accuracy or the completeness thereof. This material is for personal information and we are not responsible for any loss incurred based upon it. The investments

discussed or recommended in this report may not be suitable for all investors. Investors must make their own investment decisions based on their specific investment objectives and financial

position and using such independent advice, as they believe necessary. While acting upon any information or analysis mentioned in this report, investors may please note that neither Karvy nor

Karvy Stock Broking nor any person connected with any associate companies of Karvy accepts any liability arising from the use of this information and views mentioned in this document.

The author, directors and other employees of Karvy and its affiliates may hold long or short positions in the above mentioned companies from time to time. Every employee of Karvy and its associate

companies are required to disclose their individual stock holdings and details of trades, if any, that they undertake. The team rendering corporate analysis and investment recommendations are

restricted in purchasing/selling of shares or other securities till such a time this recommendation has either been displayed or has been forwarded to clients of Karvy. All employees are further

restricted to place orders only through Karvy Stock Broking Ltd. This report is intended for a restricted audience and we are not soliciting any action based on it. Neither the information nor any

opinion expressed herein constitutes an offer or an invitation to make an offer, to buy or sell any securities, or any options, futures nor other derivatives related to such securities.

Karvy Stock Broking Limited

Institutional Equities

2nd Floor, Regent Chambers, Nariman Point - Mumbai 400 021.

Regd Off : 46, Road No 4, Street No 1, Banjara Hills, Hyderabad 500 034.

Stock Ratings Absolute Returns

Buy : > 25%

Out Performer : 16 - 25%

Market Performer : 0 - 15%

Under Performer : < 0%

Sell : <(25%)

Institutional Equities

Karvy Stock Broking Research is also available on: Bloomberg - KRVY <GO>, Thomson Publisher & Reuters.

You might also like

- Trial Balance: Private Sector Financing for Road Projects in IndiaFrom EverandTrial Balance: Private Sector Financing for Road Projects in IndiaNo ratings yet

- Investor Presentation December 2016 (Company Update)Document28 pagesInvestor Presentation December 2016 (Company Update)Shyam SunderNo ratings yet

- Realizing the Potential of Public–Private Partnerships to Advance Asia's Infrastructure DevelopmentFrom EverandRealizing the Potential of Public–Private Partnerships to Advance Asia's Infrastructure DevelopmentNo ratings yet

- Investor Presentation November 2016 (Company Update)Document28 pagesInvestor Presentation November 2016 (Company Update)Shyam SunderNo ratings yet

- Presentation - Analysts Meet (Company Update)Document35 pagesPresentation - Analysts Meet (Company Update)Shyam SunderNo ratings yet

- SBI Securities Morning Update - 10-10-2022Document4 pagesSBI Securities Morning Update - 10-10-2022deepaksinghbishtNo ratings yet

- SBI Securities Morning Update - 12-12-2023Document4 pagesSBI Securities Morning Update - 12-12-2023deepaksinghbishtNo ratings yet

- Construction: Clearer Road AheadDocument4 pagesConstruction: Clearer Road AheadNimish TodankarNo ratings yet

- Investor Presentation (Company Update)Document32 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- North Bihar Highway Limited: Instrument Amount RatingDocument3 pagesNorth Bihar Highway Limited: Instrument Amount RatingJagadeesh YathirajulaNo ratings yet

- Highways Sector ReportDocument1 pageHighways Sector ReportEden Capital AdvisorsNo ratings yet

- SBI Securities Morning Update - 04-10-2022Document5 pagesSBI Securities Morning Update - 04-10-2022deepaksinghbishtNo ratings yet

- Infrastructure Finance News March 30 2015 April 05 2015Document3 pagesInfrastructure Finance News March 30 2015 April 05 2015YaIpha NaOremNo ratings yet

- MMFSL Analyst Meet 15Document43 pagesMMFSL Analyst Meet 159125103046No ratings yet

- Infrastructure Finance News April 20 2015-April 26 2015Document2 pagesInfrastructure Finance News April 20 2015-April 26 2015YaIpha NaOremNo ratings yet

- SBI Securities Morning Update - 16-09-2022Document4 pagesSBI Securities Morning Update - 16-09-2022deepaksinghbishtNo ratings yet

- Tvs CreditDocument19 pagesTvs CreditAkash RajputNo ratings yet

- SBI Securities Morning Update - 14-12-2023Document4 pagesSBI Securities Morning Update - 14-12-2023deepaksinghbishtNo ratings yet

- Teaching Notes Project Finance Appraisal Highway: SynopsisDocument17 pagesTeaching Notes Project Finance Appraisal Highway: SynopsisAkriti BhardwajNo ratings yet

- Adilabad Expressway R 07032014Document3 pagesAdilabad Expressway R 07032014Jagadeesh YathirajulaNo ratings yet

- 17 STEPS in The Direction of DevelopmentDocument3 pages17 STEPS in The Direction of DevelopmentGautamChakrabortyNo ratings yet

- SBI Securities Morning Update - 09-01-2023Document7 pagesSBI Securities Morning Update - 09-01-2023deepaksinghbishtNo ratings yet

- SBI Securities Morning Update - 21-10-2022Document5 pagesSBI Securities Morning Update - 21-10-2022deepaksinghbishtNo ratings yet

- 1313 File782244817 PDFDocument249 pages1313 File782244817 PDFvarunraghuNo ratings yet

- Costain Final ReportDocument46 pagesCostain Final ReportPrashant NikamNo ratings yet

- SBI Securities Morning Update - 12-09-2022Document5 pagesSBI Securities Morning Update - 12-09-2022deepaksinghbishtNo ratings yet

- Brochure 3 4eba8dda4c64fDocument8 pagesBrochure 3 4eba8dda4c64fDebabrata PaulNo ratings yet

- Two Wheeler Clutch Market in India - Feedback OTS - 2014Document6 pagesTwo Wheeler Clutch Market in India - Feedback OTS - 2014Feedback Business Consulting Services Pvt. Ltd.No ratings yet

- SBI Securities Morning Update - 14-12-2022Document4 pagesSBI Securities Morning Update - 14-12-2022deepaksinghbishtNo ratings yet

- SBI Securities Morning Update - 06-10-2022Document5 pagesSBI Securities Morning Update - 06-10-2022deepaksinghbishtNo ratings yet

- SBI Securities Morning Update - 30-09-2022Document5 pagesSBI Securities Morning Update - 30-09-2022deepaksinghbishtNo ratings yet

- Project Report (NIT Jaipur) PDFDocument34 pagesProject Report (NIT Jaipur) PDFMaheshSukhadiyaNo ratings yet

- SBI Securities Morning Update - 14-09-2022Document5 pagesSBI Securities Morning Update - 14-09-2022deepaksinghbishtNo ratings yet

- Public Private Partnerships: Presented by Jerry Fay, PEDocument29 pagesPublic Private Partnerships: Presented by Jerry Fay, PEPrav Srivastava100% (1)

- IRB Invit FundDocument6 pagesIRB Invit FundPavanNo ratings yet

- Mewarvivek Project FDocument87 pagesMewarvivek Project FAseem KhanNo ratings yet

- ExpansionDocument3 pagesExpansionmakbimhrdNo ratings yet

- Financial Viability Analysis of The Road Sector Projects inDocument115 pagesFinancial Viability Analysis of The Road Sector Projects inanon_777502935100% (2)

- Infrastructure FinanceDocument49 pagesInfrastructure Financeatul1691No ratings yet

- SBI Securities Morning Update - 04-11-2022Document4 pagesSBI Securities Morning Update - 04-11-2022deepaksinghbishtNo ratings yet

- PmreportDocument15 pagesPmreportKeerat KhroadNo ratings yet

- DCF Valuation AnalysisDocument19 pagesDCF Valuation AnalysisdeepaNo ratings yet

- Roads - HSBC - 3sep2010Document8 pagesRoads - HSBC - 3sep2010PranjayNo ratings yet

- SBI Securities Morning Update - 28-10-2022Document5 pagesSBI Securities Morning Update - 28-10-2022deepaksinghbishtNo ratings yet

- Ashish Srivastava ProjectDocument112 pagesAshish Srivastava ProjectSachin LeeNo ratings yet

- SBI Securities Morning Update - 11-10-2022Document5 pagesSBI Securities Morning Update - 11-10-2022deepaksinghbishtNo ratings yet

- Guidelines For Investment in Road Sector (As On 15 January 2013)Document47 pagesGuidelines For Investment in Road Sector (As On 15 January 2013)Sarkar RakeshNo ratings yet

- Nhai RFPDocument18 pagesNhai RFPdaobvpNo ratings yet

- SBI Securities Morning Update - 01-09-2022Document5 pagesSBI Securities Morning Update - 01-09-2022deepaksinghbishtNo ratings yet

- SBI Securities Morning Update - 16-12-2022Document6 pagesSBI Securities Morning Update - 16-12-2022deepaksinghbishtNo ratings yet

- A Case Study Shriram Transport Finance Company LimitedDocument20 pagesA Case Study Shriram Transport Finance Company Limitedrambok4No ratings yet

- Auto Sector: Ktas of Meeting With Mr. Chirag Katira (SNGT, Aimtc, Bgta)Document3 pagesAuto Sector: Ktas of Meeting With Mr. Chirag Katira (SNGT, Aimtc, Bgta)Romelu MartialNo ratings yet

- National HighwayDocument12 pagesNational Highwayanuj19iitNo ratings yet

- SBI Securities Morning Update - 29-09-2022Document4 pagesSBI Securities Morning Update - 29-09-2022deepaksinghbishtNo ratings yet

- SBI Securities Morning Update - 15-09-2022Document5 pagesSBI Securities Morning Update - 15-09-2022deepaksinghbishtNo ratings yet

- Acuite - Railway - Reforms - Final PR - July 2020Document3 pagesAcuite - Railway - Reforms - Final PR - July 2020Santosh HiredesaiNo ratings yet

- SBI Securities Morning Update - 13-12-2022Document6 pagesSBI Securities Morning Update - 13-12-2022deepaksinghbishtNo ratings yet

- SBI Securities Morning Update - 12-01-2023Document6 pagesSBI Securities Morning Update - 12-01-2023deepaksinghbishtNo ratings yet

- SBI Securities Morning Update - 18-11-2022Document4 pagesSBI Securities Morning Update - 18-11-2022deepaksinghbishtNo ratings yet

- Group4 IVM Project FinalDocument60 pagesGroup4 IVM Project FinalVaibhav GargNo ratings yet

- An Appraisal of Banker Customer Relationship in NigeriaDocument60 pagesAn Appraisal of Banker Customer Relationship in NigeriaAkin Olawale Oluwadayisi87% (15)

- Diversification StrategiesDocument9 pagesDiversification StrategiesJebin JamesNo ratings yet

- Comparative Analysis of Index of 3 Industries (Publicly Listed Companies) With DSEX IndexDocument21 pagesComparative Analysis of Index of 3 Industries (Publicly Listed Companies) With DSEX IndexPlato KhisaNo ratings yet

- Paper Individual ODCM - Kokoh RonaldDocument17 pagesPaper Individual ODCM - Kokoh RonaldAndy ZhengNo ratings yet

- Lithuanian Association of Basketball CoachesDocument1 pageLithuanian Association of Basketball CoachesLietuvos Krepšinio Trenerių AsociacijaNo ratings yet

- Membership Updated Form 06.10.22Document5 pagesMembership Updated Form 06.10.22Sirajia CngNo ratings yet

- LEER PRIMERO Christian Suter - Debt Cycles in The World-Economy - Foreign Loans, Financial Crises, and Debt Settlements, 1820-1990-Westview Press - Routledge (1992)Document247 pagesLEER PRIMERO Christian Suter - Debt Cycles in The World-Economy - Foreign Loans, Financial Crises, and Debt Settlements, 1820-1990-Westview Press - Routledge (1992)Juan José Castro FrancoNo ratings yet

- Accounting ProjectDocument2 pagesAccounting ProjectAngel Grefaldo VillegasNo ratings yet

- Finance Module 8 Capital Budgeting - InvestmentDocument8 pagesFinance Module 8 Capital Budgeting - InvestmentKJ Jones100% (1)

- Chapter 7 Risk and Return Question and Answer From TitmanDocument2 pagesChapter 7 Risk and Return Question and Answer From TitmanMd Jahid HossainNo ratings yet

- Dutch Bangla Bank Online BankingDocument9 pagesDutch Bangla Bank Online BankingNazmulHasanNo ratings yet

- Module 2 HWDocument5 pagesModule 2 HWdrgNo ratings yet

- The White Paper-Equity And: Excellence - Implications For GpsDocument24 pagesThe White Paper-Equity And: Excellence - Implications For GpsTim SandleNo ratings yet

- Topic 2 - Deferred TaxDocument2 pagesTopic 2 - Deferred Tax靖怡No ratings yet

- Draftsman (Electrical)Document7 pagesDraftsman (Electrical)suhail ahmadNo ratings yet

- Direct Deposit Authorization Form - Controlled PDFDocument2 pagesDirect Deposit Authorization Form - Controlled PDFNatilee CampbellNo ratings yet

- A. Balance Sheet: Hytek Income Statement Year 2012Document3 pagesA. Balance Sheet: Hytek Income Statement Year 2012marc chucuenNo ratings yet

- Proyeksi INAF - Kelompok 3Document43 pagesProyeksi INAF - Kelompok 3Fairly 288No ratings yet

- 1st Quarter - Fundamentals of Accounting 2 - ANSWER KEYDocument7 pages1st Quarter - Fundamentals of Accounting 2 - ANSWER KEYDin Rose Gonzales50% (2)

- HW On ReceivablesDocument4 pagesHW On ReceivablesJazehl Joy ValdezNo ratings yet

- The Financial BehaviorDocument12 pagesThe Financial BehaviorAkob KadirNo ratings yet

- ACC3022H+2021+Nov+2021 Scenario+and+RequiredDocument13 pagesACC3022H+2021+Nov+2021 Scenario+and+RequiredkateNo ratings yet

- JE InFINeeti Nemani Sri Harsha 28KADocument2 pagesJE InFINeeti Nemani Sri Harsha 28KAMehulNo ratings yet

- Consumer Durable LoansDocument10 pagesConsumer Durable LoansdevrajkinjalNo ratings yet

- Activity Questions 6.1 Suggested SolutionsDocument6 pagesActivity Questions 6.1 Suggested SolutionsSuziNo ratings yet

- 7e - Chapter 10Document39 pages7e - Chapter 10WaltherNo ratings yet

- International Trading Regulation Hannan Aminatami AlkatiriDocument11 pagesInternational Trading Regulation Hannan Aminatami AlkatiriAlyssa Khairafani GandamihardjaNo ratings yet

- Bus. & Entrep. Module 4aDocument3 pagesBus. & Entrep. Module 4aamie abriamNo ratings yet

- Advanced CandlestickPatterns 2Document23 pagesAdvanced CandlestickPatterns 2jcferreiraNo ratings yet

- Completing The Tests in The Acquisition and Payment Cycle: Verification of Selected AccountsDocument8 pagesCompleting The Tests in The Acquisition and Payment Cycle: Verification of Selected Accountsዝምታ ተሻለNo ratings yet