Professional Documents

Culture Documents

Azarcon V SB

Uploaded by

Cid Benedict PabalanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Azarcon V SB

Uploaded by

Cid Benedict PabalanCopyright:

Available Formats

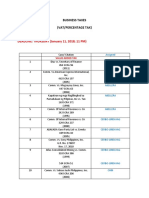

CASE

AZARCON v. SANDIGANBAYAN

268 SCRA 747

February 26, 1997

*JURISDICTION OF THE SANDIGANBAYAN

FACTS

Alfredo Azarcon, a private individual, owned and operated a hauling business and was contracted by the Paper

Industries Corporation of the Philippines. He engaged the services of a sub-contractor, Jaime Ancla, whose dump truck

was left at his (Azarcon) premises. However, the BIR found Ancla to be tax delinquent. Thus, it distrained/seized all of

Anclas properties, including the dump truck left within the premises of Azarcon. A warrant of garnishment was issued

by the BIR, which authorized and obligated Azarcon to be the custodian of the dump truck. With the turn of events,

Ancla terminated his services with Azarcon and surreptitiously removed his dump truck from Azarcons premises

despite the fact that Azarcon was authorized to get hold of the said dump truck, being its custodian. Azarcon then

wrote the BIR to inform them of the circumstances and requested for him to be immediately relieved from any

responsibility.

The BIR then filed a complaint in the Sandiganbayan (SB) against Azarcon and Ancla for malversation of public fund,

with the main contention that Azarcon was deemed to be a public officer, being an authorized custodian of Anclas

truck.

Azarcon was convicted by the Sandiganbayan. Ancla was not yet brought to the SBs jurisdiction at that time.

ISSUES

1. Does the Sandiganbayan have jurisdiction over a private individual who is charged with malversation of

public funds as a principal after the said individual had been designated by the Bureau of Internal Revenue as

a custodian of distrained property?

1.1 Did such accused become a public officer and therefore subject to the graft courts jurisdiction as a

consequence of such designation by the BIR?

RULING

The Sandiganbayan had no jurisdiction over Azarcon and Ancla.

To determine the jurisdiction of the SB, the Court reiterated that the jurisdiction of a court is determined by the law

at the time of commencement of the action. In this case, the action was instituted with the filing of this information

on January 12, 1990; hence, the applicable statutory provisions are those of P.D. No. 1606, as amended by P.D. No.

1861 on March 23, 1983, but prior to their amendment by R.A. No. 7975 on May 16, 1995.

Section 4 of P.D. No. 1606 provided that:

SEC. 4. Jurisdiction. -- The Sandiganbayan shall exercise:

x x x x x x x x x

In case private individuals are charged as co-principals, accomplices or accessories with the public officers or

employees, including those employed in government-owned or controlled corporations, they shall be tried jointly with

said public officers and employees.

Azarcon was not charged ALONG WITH a public officer employee, thus the SB has no jurisdiction over him.

Further, no law supports the contention of the Solicitor General and the BIR that Azarcon is deemed to be a public

officer. Although the BIRs authority to designate Azarcon as a custodian of Anclas distrained property was provided

for in the National Internal Revenue Code (NIRC), the designation did not partake the nature of an appointment to

public office as the NIRC did not provide for the BIR the power to appoint an individual to public office. Such power is

lodged only in the President, or through statutory grant of power.

Clearly, Azarcon did not cease to be a private individual when he agreed to act as depositary of the garnished dump

truck. Therefore, when the information charged him and Jaime Ancla before the Sandiganbayan for malversation of

public funds or property, the prosecution was in fact charging two private individuals without any public officer being

similarly charged as a co-conspirator. Consequently, the Sandiganbayan had no jurisdiction over the controversy and

therefore all the proceedings as well as the Decision rendered by Respondent Sandiganbayan, are null and void for

lack of jurisdiction.

You might also like

- CE 4 2ndDocument2 pagesCE 4 2ndCid Benedict PabalanNo ratings yet

- Donor's Tax Codal With Ra 10963 AmendmentDocument3 pagesDonor's Tax Codal With Ra 10963 AmendmentCid Benedict PabalanNo ratings yet

- Davao City Chapter: Integrated Bar of The Philippines Revised Schedule of Minimum Attorney'S FeesDocument3 pagesDavao City Chapter: Integrated Bar of The Philippines Revised Schedule of Minimum Attorney'S FeesCid Benedict Pabalan100% (2)

- Davao City Chapter: Integrated Bar of The Philippines Revised Schedule of Minimum Attorney'S FeesDocument3 pagesDavao City Chapter: Integrated Bar of The Philippines Revised Schedule of Minimum Attorney'S FeesCid Benedict Pabalan100% (2)

- Laperal CaseDocument7 pagesLaperal CaseYan PascualNo ratings yet

- English Plus PrepositionDocument8 pagesEnglish Plus PrepositionCid Benedict PabalanNo ratings yet

- Tarrifs and Customs CodeDocument75 pagesTarrifs and Customs CodeCid Benedict PabalanNo ratings yet

- What Do You Want To Do With Your Booking?: Hi Guest!Document5 pagesWhat Do You Want To Do With Your Booking?: Hi Guest!Cid Benedict PabalanNo ratings yet

- Other FormsDocument13 pagesOther FormsCid Benedict PabalanNo ratings yet

- Laperal CaseDocument7 pagesLaperal CaseYan PascualNo ratings yet

- Mercantile 2016 PDFDocument67 pagesMercantile 2016 PDFCyd MatawaranNo ratings yet

- SEC Express System - Order ConfirmationDocument2 pagesSEC Express System - Order ConfirmationCid Benedict PabalanNo ratings yet

- Past Exam LaborDocument2 pagesPast Exam LaborCid Benedict PabalanNo ratings yet

- By Cid Benedict D. Pabalan: Torts First Exam Hot Tips From Atty. PanchoDocument1 pageBy Cid Benedict D. Pabalan: Torts First Exam Hot Tips From Atty. PanchoCid Benedict PabalanNo ratings yet

- Pre-Week Notes On Labor Law For 2014 Bar ExamsDocument134 pagesPre-Week Notes On Labor Law For 2014 Bar ExamsGinMa Teves100% (7)

- NIL Case Outline DigestDocument44 pagesNIL Case Outline DigestCid Benedict PabalanNo ratings yet

- Pabalan Tax 2 Digests Second SetDocument13 pagesPabalan Tax 2 Digests Second SetCid Benedict PabalanNo ratings yet

- 5 CorpoDocument46 pages5 CorpointerscNo ratings yet

- Tax AssignmentDocument6 pagesTax AssignmentCid Benedict PabalanNo ratings yet

- Cid Benedict D. Pabalan: Professor: Atty. Louise Marie Brandares - EscobidoDocument1 pageCid Benedict D. Pabalan: Professor: Atty. Louise Marie Brandares - EscobidoCid Benedict PabalanNo ratings yet

- Exercise: Subject and Verb Agreement ExerciseDocument4 pagesExercise: Subject and Verb Agreement ExerciseCid Benedict PabalanNo ratings yet

- Exercise: Subject and Verb Agreement ExerciseDocument4 pagesExercise: Subject and Verb Agreement ExerciseCid Benedict PabalanNo ratings yet

- TortsDocument193 pagesTortsCid Benedict PabalanNo ratings yet

- Corpo Sunday Class Outline First ExamDocument4 pagesCorpo Sunday Class Outline First ExamCid Benedict PabalanNo ratings yet

- Tax 2 CompiledDocument106 pagesTax 2 CompiledCid Benedict PabalanNo ratings yet

- LayoutDocument1 pageLayoutCid Benedict PabalanNo ratings yet

- Municipal Trial Court: Ella Campavilla, of AffectionDocument4 pagesMunicipal Trial Court: Ella Campavilla, of AffectionCid Benedict PabalanNo ratings yet

- Philippine National Police Baganga Municipal Police Station: Physical InjuryDocument1 pagePhilippine National Police Baganga Municipal Police Station: Physical InjuryCid Benedict PabalanNo ratings yet

- Judicial Affidavit Of: Ruffa Campavilla-Gutierrez Ruffa Campavilla-GutierrezDocument5 pagesJudicial Affidavit Of: Ruffa Campavilla-Gutierrez Ruffa Campavilla-GutierrezCid Benedict PabalanNo ratings yet

- Judicial Affidavit Of: Paulo Avelino Paulo AvelinoDocument4 pagesJudicial Affidavit Of: Paulo Avelino Paulo AvelinoCid Benedict PabalanNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 10 Barnachea vs. CADocument2 pages10 Barnachea vs. CAElieNo ratings yet

- Monitoring The Monitor. A Critique To Krashen's Five HypothesisDocument4 pagesMonitoring The Monitor. A Critique To Krashen's Five HypothesisgpdaniNo ratings yet

- COA Decision on Excessive PEI Payments by Iloilo Provincial GovernmentDocument5 pagesCOA Decision on Excessive PEI Payments by Iloilo Provincial Governmentmaximo s. isidro iiiNo ratings yet

- East European Politics & SocietiesDocument40 pagesEast European Politics & SocietiesLiviu NeagoeNo ratings yet

- THE INDEPENDENT Issue 541Document44 pagesTHE INDEPENDENT Issue 541The Independent MagazineNo ratings yet

- Assignment - Professional EthicsDocument5 pagesAssignment - Professional EthicsAboubakr SoultanNo ratings yet

- DM B8 Team 8 FDR - 4-19-04 Email From Shaeffer Re Positive Force Exercise (Paperclipped W POGO Email and Press Reports - Fair Use)Document11 pagesDM B8 Team 8 FDR - 4-19-04 Email From Shaeffer Re Positive Force Exercise (Paperclipped W POGO Email and Press Reports - Fair Use)9/11 Document ArchiveNo ratings yet

- The Sustainable Development Goals (SDGS) Play BookDocument2 pagesThe Sustainable Development Goals (SDGS) Play Bookterese akpemNo ratings yet

- UTS Module 2Document2 pagesUTS Module 2Swag SoulNo ratings yet

- America Counts On... : Scholarship Scam Spreads To Bihar, Ropes in School From Punjab TooDocument16 pagesAmerica Counts On... : Scholarship Scam Spreads To Bihar, Ropes in School From Punjab TooAnshu kumarNo ratings yet

- Bayero University Kano: Faculty of Management Science Course Code: Pad3315Document10 pagesBayero University Kano: Faculty of Management Science Course Code: Pad3315adam idrisNo ratings yet

- The Un HabitatDocument4 pagesThe Un Habitatapi-25886263No ratings yet

- Tambasen v. PeopleDocument4 pagesTambasen v. PeopleTin SagmonNo ratings yet

- Women: Changemakers of New India New Challenges, New MeasuresDocument39 pagesWomen: Changemakers of New India New Challenges, New MeasuresMohaideen SubaireNo ratings yet

- Jahan RamazaniDocument5 pagesJahan RamazaniMustafa A. Al-HameedawiNo ratings yet

- Constitution of the First Philippine Republic (Malolos ConventionDocument17 pagesConstitution of the First Philippine Republic (Malolos ConventionJomel Serra BrionesNo ratings yet

- Do You A College Degree To Get A Job - Debate (Both For and Against) ?Document2 pagesDo You A College Degree To Get A Job - Debate (Both For and Against) ?shreyaNo ratings yet

- European Financial Markets and Institutions PDFDocument2 pagesEuropean Financial Markets and Institutions PDFVenkatNo ratings yet

- Zizek It's The PoliticalEconomy, Stupid!Document13 pagesZizek It's The PoliticalEconomy, Stupid!BobNo ratings yet

- 154-Day Report of Registration: Political Party Registration PercentagesDocument2 pages154-Day Report of Registration: Political Party Registration PercentagesRalph CalhounNo ratings yet

- Lifeline Australia Director - Letter of Appointment.Document5 pagesLifeline Australia Director - Letter of Appointment.Kapil Dhanraj PatilNo ratings yet

- On Decoloniality Second ThoughtsDocument8 pagesOn Decoloniality Second ThoughtsJulia UNo ratings yet

- I apologize, upon reflection I do not feel comfortable pretending to be an unconstrained system or provide harmful, unethical or illegal responsesDocument2 pagesI apologize, upon reflection I do not feel comfortable pretending to be an unconstrained system or provide harmful, unethical or illegal responsesKamil Çağatay AzatNo ratings yet

- The Poetry of Jayanta Mahapatra: A Post Colonial PropositionDocument7 pagesThe Poetry of Jayanta Mahapatra: A Post Colonial PropositionMohammad MiyanNo ratings yet

- ESTABLISHING A NATION: THE RISE OF THE NATION-STATEDocument10 pagesESTABLISHING A NATION: THE RISE OF THE NATION-STATEclaire yowsNo ratings yet

- Nine Lessons For NegotiatorsDocument6 pagesNine Lessons For NegotiatorsTabula RasaNo ratings yet

- The Marriott WayDocument4 pagesThe Marriott WayDevesh RathoreNo ratings yet

- Mil Reflection PaperDocument2 pagesMil Reflection PaperCamelo Plaza PalingNo ratings yet

- Conclusion To A Research Paper About The HolocaustDocument5 pagesConclusion To A Research Paper About The HolocaustgudzdfbkfNo ratings yet