Professional Documents

Culture Documents

Capital Asset Priceing Model

Uploaded by

aloo+gubhi0 ratings0% found this document useful (0 votes)

28 views5 pagesBrief Introduction to CAPM

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBrief Introduction to CAPM

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views5 pagesCapital Asset Priceing Model

Uploaded by

aloo+gubhiBrief Introduction to CAPM

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

ASSIGNMENT ON CAPITAL ASSET PRICING MODEL

CAPITAL ASSET PRICEING MODEL

In financial markets, people invest in assets (a security / equity / tradable stocks / portfolio

etc) with the expectation of return in future from such assets. But, with the expectation there

is always uncertainty that is with such investments risk is associated and for which such

assets categorized as risky assets. The relationship between expected return from a risky asset

and risk associated with it and to quantify the relationship, has been an interested research

area in financial economics. To minimize the risk of an asset Markowitz (1952) suggested

diversification of investments in different assets known as portfolio theory, a seminal work in

the relationship between risk and return. Sharpe (1964) extended the work of Markowitzs

portfolio theory with some assumption and developed a model known as Capital Asset

Pricing Model (CAPM). Thus CAPM is based on two parameter portfolio analysis model

developed by Markowitz (1952). In CAPM model risk decomposed in two parts. One is the

risk of being in the market, which Sharpe called systematic risk. This risk, later dubbed

"beta," cannot be diversified away. The otherunsystematic riskis specific to a company's

fortunes and this risk can be mitigated through appropriate diversification. Thus according to

CAPM model a portfolio's expected return hinges solely on its betaits relationship to the

overall market based on this Sharpe (1964) developed a linear model, CAPM. The CAPM

helps measure portfolio risk and the return an investor can expect for taking that risk.

CAPM model is based on the following assumptions,

- All investors are rational and risk-averse and have homogeneous expectations.

- They hold diversified portfolio. It implies that they deal only with systemic risk.

- Investors are price takers, i.e., they cannot influence prices.

- They can lend and borrow unlimited amounts under the risk free rate of interest.

- All assets are perfectly divisible and liquid

- All information such as covariances, variances, mean rates of return of stocks and so

on is freely available at the same time to all investors

- There is no transaction or taxation costs.

- There is large numbers of buyers and sellers in the market.

Based on above assumption, the linear relationship between the expected return required on

an investment in a risky assets and its systematic risk is represented by the CAPM formula as

follows

( ) [ ( ) ]

( )

i f i m f

m f

im

f

m m

E R R E r R

E R R

R

|

o

o o

= +

= +

`

)

(1)

Where,

( )

i

E R is expected return on asset i,

f

R is the risk free rate of return,

( )

m

E R is expected return on market proxy generally measured on market portfolio

i

| is a measure of risk specific to asset i

im m

and o o are covariance between asset i and market portfolio and variance of market

portfolio respectively.

The relationship between expected return on asset i and expected return on market portfolio is

also called security market line. If CAPM holds true, all securities will lie in a straight line

called the security market line (SML) in the ( ),

i i

E R | frontier. The security market line

implies that return is a linearly increasing function of risk.

Figure 1: Security Market Line

Thus SML essentially graphs the results from the capital asset pricing model (CAPM)

formula. The x-axis represents the risk (beta), and the y-axis represents the expected return.

The market risk premium is determined from the slope of the SML. The relationship between

and required return is plotted on the securities market line (SML), which shows expected

return as a function of . The intercept is the nominal risk-free rate available for the market,

while the slope is the market premium, E(R

m

) R

f

. The securities market line can be regarded

as representing a single-factor model of the asset price, where Beta is exposure to changes in

value of the Market. So the equation of the SML is same as equation 1

The parameter

i

| measure of risk for the asset i. We are often interested in

i

| being equal to

1, less than 1, or greater than 1. If beta is greater than 1, the asset's returns are more volatile

than the market's rate of return; if it's less than 1, its returns are less volatile than the market's;

and if it's equal to 1, its returns are just as volatile as the market's rate of return.

The equation can be reformulated in terms of risk premium as follows

( ) [ ( ) ]

i f i m f

E R R E r R | = (2)

The variable on the left side of equation (2) is the risk premium for the asset i and, on the

right side of equation (2), this asset's beta is multiplied by the risk premium on the market

portfolio.

The CAPM is called an asset-pricing model, even though it is most often expressed in terms

of a required expected rate of return rather than in terms of an appropriate price. Fortunately,

the two are equivalentone can always work with the CAPM return rst, and discount the

expected cash ow into an appropriate price second. A given expected rate of return implies a

given price. It is called certainty equivalence.

Advantages of CAPM model

The CAPM has several advantages over other methods of calculating required return,

explaining why it has remained popular for more than 40 years:

- It considers only systematic risk, reflecting a reality in which most investors have

diversified portfolios from which unsystematic risk has been essentially eliminated

- It generates a theoretically-derived relationship between required return and

systematic risk which has been subject to frequent empirical research and testing.

Criticism of CAPM

CAPM mostly has been criticised for its simplistic assumptions

- The model assumes that the variance of returns is an adequate measurement of risk.

Which is not a sufficient measure of risk, as risk in financial investments is not

variance in itself, rather it is the probability of losing: it is asymmetric in nature in

real world.

- The model assumes that all active and potential shareholders have access to the same

information and agree about the risk and expected return of all assets which does not

hold true in real market.

- The model assumes that there are no taxes or transaction costs, which also does not

hold true in real practice. Although this assumption may be relaxed with more

complicated versions of the model.

- It also assumes that all assets are infinitely divisible as to the amount which may be

held or transacted. This is also not valid in real market activities.

- CAPM assumes that all active and potential shareholders will consider all of their

assets and optimize one portfolio. This is in sharp contradiction with portfolios that

are held by individual shareholders: humans tend to have fragmented portfolios or,

rather, multiple portfolios: for each goal one portfolio

- Empirical tests show market anomalies like the size and value effect that cannot be

explained by the CAPM.

CONCLUSION

Research has shown the CAPM to stand up well to criticism, although attacks against it have

been increasing in recent years. Until something better presents itself, however, the CAPM

remains a very useful item in the financial management toolkit.

References:

Sharpe, William F. (1964). Capital asset prices: A theory of market equilibrium under

conditions of risk, Journal of Finance, 19 (3), 425-442.

Markowitz, H. (1952) Portfolio Selection. The Journal of Finance, 7 (1): 77-91.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

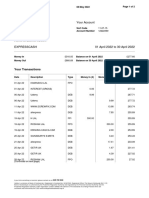

- 2022 April StatementDocument2 pages2022 April StatementAvishekNo ratings yet

- Comparative Analysis Credit RatingDocument103 pagesComparative Analysis Credit RatingRoyal Projects100% (1)

- History of Private Banking & Wealth ManagementDocument4 pagesHistory of Private Banking & Wealth Managementkinky_zg100% (1)

- Advance Tally Erp9Document3 pagesAdvance Tally Erp9Kalpesh SutharNo ratings yet

- World Transfer Pricing 2016Document285 pagesWorld Transfer Pricing 2016Hutapea_apynNo ratings yet

- Feasibility StudyDocument74 pagesFeasibility StudyAhmad Alawaddin83% (6)

- A Guide To The Matlab Toolbox For Interacted Panel VAR Estimations (IPVAR)Document17 pagesA Guide To The Matlab Toolbox For Interacted Panel VAR Estimations (IPVAR)aloo+gubhiNo ratings yet

- Final Base Module Guide PDFDocument362 pagesFinal Base Module Guide PDFmohansusiNo ratings yet

- Pabrik Fruktosa Dari Tepung Tapioka Dengan Hidrolisis Menggunakan Enzim by Rezki Ika PratiwiDocument95 pagesPabrik Fruktosa Dari Tepung Tapioka Dengan Hidrolisis Menggunakan Enzim by Rezki Ika PratiwiDebora PasaribuNo ratings yet

- Recent Trends in Industrial Growth in IndiaDocument8 pagesRecent Trends in Industrial Growth in Indiaanubhav mishraNo ratings yet

- Recent Trends in Industrial Growth in IndiaDocument8 pagesRecent Trends in Industrial Growth in Indiaanubhav mishraNo ratings yet

- 1 2+Book+FormatDocument44 pages1 2+Book+Formataloo+gubhiNo ratings yet

- Recent Trends in Industrial Growth in IndiaDocument8 pagesRecent Trends in Industrial Growth in Indiaanubhav mishraNo ratings yet

- Install Guide For Sandisk® Memory Zone App To Use Along With Your Sandisk Ultra® Dual DrivesDocument7 pagesInstall Guide For Sandisk® Memory Zone App To Use Along With Your Sandisk Ultra® Dual DrivesGalih PranayudhaNo ratings yet

- 180 Sample-Chapter PDFDocument15 pages180 Sample-Chapter PDFhanumanthaiahgowdaNo ratings yet

- OECD Composite Leading Indicators:: February 2017Document48 pagesOECD Composite Leading Indicators:: February 2017aloo+gubhiNo ratings yet

- India's Trade Reforms: Past Developments and Future DirectionDocument68 pagesIndia's Trade Reforms: Past Developments and Future Directionaloo+gubhiNo ratings yet

- UGC Maulana Azad National Fellowship Continuation CertificateDocument1 pageUGC Maulana Azad National Fellowship Continuation CertificateSonam TobgyalNo ratings yet

- Guide To BibliographyDocument46 pagesGuide To Bibliographyaloo+gubhiNo ratings yet

- UGC Maulana Azad National Fellowship Continuation CertificateDocument1 pageUGC Maulana Azad National Fellowship Continuation CertificateSonam TobgyalNo ratings yet

- UGC Maulana Azad National Fellowship Continuation CertificateDocument1 pageUGC Maulana Azad National Fellowship Continuation CertificateSonam TobgyalNo ratings yet

- Annexure I: Departmental Assistance at Rs. 3000/-P.a. Per Student To The Host Institution For Pursuing InfrastructureDocument1 pageAnnexure I: Departmental Assistance at Rs. 3000/-P.a. Per Student To The Host Institution For Pursuing InfrastructureSonam TobgyalNo ratings yet

- Workshop Brochure - Fin EconometricsDocument3 pagesWorkshop Brochure - Fin EconometricsjamesNo ratings yet

- Growth Rate at Factor Cost at Constant PricesDocument2 pagesGrowth Rate at Factor Cost at Constant Pricesaloo+gubhiNo ratings yet

- DatabookDec2014 10Document2 pagesDatabookDec2014 10anirbanccim8493No ratings yet

- Journal Quality List: Fifty-Seventh Edition, 18 April 2016Document25 pagesJournal Quality List: Fifty-Seventh Edition, 18 April 2016aloo+gubhiNo ratings yet

- Application For Birth Certificate PDFDocument1 pageApplication For Birth Certificate PDFAjayAsthanaNo ratings yet

- Journal ListDocument2 pagesJournal Listaloo+gubhiNo ratings yet

- Chapter BibDocument5 pagesChapter Bibaloo+gubhiNo ratings yet

- (A) Bimetallism:: Monetary Standards: Bimetallism, Monometallism and Paper StandardDocument8 pages(A) Bimetallism:: Monetary Standards: Bimetallism, Monometallism and Paper Standardaloo+gubhiNo ratings yet

- Abhi J It SenguptaDocument33 pagesAbhi J It Senguptaaloo+gubhiNo ratings yet

- Journals at IDEASDocument158 pagesJournals at IDEASaloo+gubhiNo ratings yet

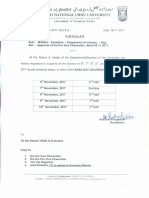

- Suspension of Classess - 6nov2017Document1 pageSuspension of Classess - 6nov2017aloo+gubhiNo ratings yet

- Ts DynDocument86 pagesTs Dynaloo+gubhiNo ratings yet

- Mohanty2005 PDFDocument41 pagesMohanty2005 PDFaloo+gubhiNo ratings yet

- IfyDocument6 pagesIfyVibhor MittalNo ratings yet

- 1 PDFDocument30 pages1 PDFaloo+gubhiNo ratings yet

- How Well Have You Learnt About Fractions?Document28 pagesHow Well Have You Learnt About Fractions?aloo+gubhiNo ratings yet

- Quiz 1 and 2 ReviewDocument39 pagesQuiz 1 and 2 ReviewThu Hien NguyenNo ratings yet

- Oracle Applications 11i Oracle Applications 11i: Using GLDocument95 pagesOracle Applications 11i Oracle Applications 11i: Using GLappsloaderNo ratings yet

- Capital Markets & Securities Analyst (CMSA) ® Certification ProgramDocument2 pagesCapital Markets & Securities Analyst (CMSA) ® Certification ProgramMantu KumarNo ratings yet

- PhonePe Statement Feb2024 Mar2024Document7 pagesPhonePe Statement Feb2024 Mar2024jtularam15No ratings yet

- Is This The End of The Abu Dhabi Group in Pakistan? and Who Is To Blame?Document4 pagesIs This The End of The Abu Dhabi Group in Pakistan? and Who Is To Blame?Malik NayyarNo ratings yet

- Accounting DefinationDocument3 pagesAccounting DefinationNooray MalikNo ratings yet

- Annualreport2019 PDFDocument422 pagesAnnualreport2019 PDFZain Wahab GmNo ratings yet

- Savera HotelsDocument21 pagesSavera HotelsMansi Raut Patil100% (1)

- Kaplan Constructed Response Workshop on Equity and Fixed Income Portfolio ManagementDocument16 pagesKaplan Constructed Response Workshop on Equity and Fixed Income Portfolio Managementhammad haqNo ratings yet

- MCO 7120 AssignmentDocument3 pagesMCO 7120 AssignmentAnusree SasidharanNo ratings yet

- Philippine Tax Form Requirements and DeadlinesDocument1 pagePhilippine Tax Form Requirements and DeadlinesLhyraNo ratings yet

- DBH 1st Mutual FundDocument34 pagesDBH 1st Mutual Fundrishav_agarwal_1No ratings yet

- Amazon Financial Case Study AnalysisDocument18 pagesAmazon Financial Case Study AnalysisDeddy Prio EkwandonoNo ratings yet

- Practice Questions For Exam 1Document5 pagesPractice Questions For Exam 1Sherene 亻可No ratings yet

- ATS - Daily Trading Plan 27agustus2018Document1 pageATS - Daily Trading Plan 27agustus2018wahidNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument79 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeAulia Eka PutriNo ratings yet

- Illustrative Example PDFDocument16 pagesIllustrative Example PDFTanvir AhmedNo ratings yet

- Professional Real EstateDocument23 pagesProfessional Real Estatetruedream realityNo ratings yet

- A Step Towards Clients Financial Inclusion Financial LiteracyDocument34 pagesA Step Towards Clients Financial Inclusion Financial LiteracyAlfonsius YogbakciNo ratings yet

- Ma Tax ReturnDocument11 pagesMa Tax ReturnMark ThomasNo ratings yet

- Residentail LeaseDocument17 pagesResidentail LeaseMuzammil ZargarNo ratings yet

- Slides Tan (2017) AFA 3e PPT Chap02Document61 pagesSlides Tan (2017) AFA 3e PPT Chap02Uyên Phạm PhươngNo ratings yet