Professional Documents

Culture Documents

Rhetorical Analysis

Uploaded by

api-257139043Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rhetorical Analysis

Uploaded by

api-257139043Copyright:

Available Formats

Mendoza 1

Gwendolyn Mendoza

Steffen Guenzel

ENC 1102

4 June 2014

Rhetorical Analysis of Potential Adoption of IFRS by the United States: A Critical View

As the world shifts to a global market, where countries trade and conduct business

together to improve political and economical alliances, the issue of global accounting standards

rises. In the U.S. accounting community, accountants discuss the implementation of International

Financial Reporting Standards (IFRS) and whether or not it is beneficial to the United States. In

Potential Adoption of IFRS by the United States: A Critical View, authors Devrimi Kaya and

Julian A. Pillhofer discuss the issue of IFRS conversion in the United States. Kaya and Pillhofer

give a critical view on the implementation of IFRS in the United States, claiming that an

international treaty to oversee the International Accounting Standards Board (IASB) would be a

better solution than adopting IFRS. The author supports this claim by providing information on

the flaws of the current overseer of IFRS, the IASB, and giving financial reports showing little

difference between current U.S. accounting standards and IFRS.

The article was published in 2013 in the academic journal Accounting Horizons, which is

published quarterly by the American Accounting Association (Accounting Horizons).

Devrimi Kaya, which is credited as the corresponding author, is an Assistant Professor at

Friedrick-Alexander University in Nuremburg, Germany. He received his degree in auditing and

taxation from this university, where he was awarded the PhD award of the Hermann Gutman

Mendoza 2

Foundation for best doctoral thesis in Economics. Kaya also had experience as an audit assistant

("Dr. Devrimi Kaya."). The other author who contributed to this work is Julian A. Pillhofer. He

is a Senior Associate with Unicredit Bank in Germany. He specializes in policy in the

department of accounting (Julian Pillhofer). Upon further research, no education credentials

was found for Pillhofer.

The authors intended audience is anyone interested in the current debate of IFRS in the

United States. Kaya and Pillhofer also intend for their study to be beneficial for the Securities

Exchange Committee (SEC) and the Financial Accounting Standards Board (FASB) of the U.S

(273). The author intends for this article to open the discussion of IFRS substitutions around the

world and how to create a more harmonious accounting system. This source would provide a

good argumentative source in my research because the authors provide insight on the issue using

logical and ethical appeal to their audience.

Kaya and Pillhofer break up their essays in different sections: Introduction, Literature

Review, IFRS Reporting in the U.S., Monopoly Problems and Standard Setting Efficiency,

Organizational Problems with the IASB, and Conclusion. The way the authors broke down their

essay helps the authors build on previous information stated to help support their claim. It is also

very logical for the authors to write their essay in some sort of timeline/organized fashion to help

their audience contextualize the issue. In the introduction, Kaya and Pillhofer establish their

research space and provide a claim. The introduction then leads into Literature Review, where

the authors give empirical data examining the consequences of adopting an international standard

around the world and giving differences between the current U.S. Generally Accepted

Accounting Principals (GAAP) and IFRS (274). The empirical data used gives the audience

more reason to believe the authors claim. The Literature Review also introduces the audience to

Mendoza 3

the current discussion amongst the accounting community about the United States while

introducing the sources being used in later sections.

Kaya and Pillhofer give much of their logical appeal in the Literature Review section of

the article. For example, the authors discuss a study published in 2012 Are IFRS-Standard and

U.S. GAAP-based Accounting Amounts Comparable conducted by M.E. Barth, W.R. Landsman,

M.H. Lang, and C. Williams. In this particular study, after examining the comparability of

accounting information between non-U.S. firms applying IFRS and U.S. firms applying U.S.

GAAP, it was found that the comparability of financial records amongst U.S. firms and non-

U.S. firms is more noticeable after non-U.S. firms mandatorily adopt IFRS (274). The source

refutes the argument that implementing international accounting standards in the United States

would help the comparability of financial records globally. If the current U.S. GAAP is more

practical for comparing records internationally than with IFRS, there is no need to implement

IFRS in the United States. Kaya and Pillhofer uses this source as a support for their claim that

the United States would be better off without the implementation of global standards.

After the Literature Review section, the authors flow into the IFRS Reporting in the U.S.

section. In this section, Kaya and Pillhofer discuss the recent developments of the IFRS and the

analysis they did on current IFRS filers in the United States. The evidence Kaya and Pillhofer

found presents another support to their claim; only 23% of the sample of 903 companies in 2010

actually file IFRS with the SEC (279). The remaining 77% use U.S. GAAP standards when filing

financial records (279). The authors prove that there is reluctance in the adoption of IFRS in the

U.S. helping prove their claim that the current state of accounting standards in the United States

should not be touched. The authors giving their own examination of financial records shows the

intended audience that they have enough knowledge to not only give sources to support their

Mendoza 4

claim, but they have some expertise in financial records to properly analyze them. The authors

have appealed ethically to the intended audience.

As part of their conclusion, Kaya and Pillhofer offer a solution to implementing the IFRS.

The authors propose that there should be an international treaty to establish a better structure

and put the IASB on solid ground by agreeing on a legally binding framework (293). In other

words if the IASB who pushes the IFRS agenda had more of a solid framework, there could

possible be some sort of international standard put in place. The solution the authors came up

with provide further support for their claim that the U.S. can do without IFRS. Their solution is

based on predictions by various accounting models. By providing a solution, the audience will

find that the authors have more insight than just accounting. This ethically appeals to the

audience, implying that Kaya and Pillhofer have also background knowledge in law. This is a

false assumption since the authors could have background knowledge of law, but there is no way

to prove that. The only assumption that could be made is that based on the authors profession,

they would only provide logical accounting evidence.

Kaya and Pillhofer provide a strong Aristotelian argument for not implementing global

accounting standards in the United States. The authors only talk about their opposition of the

adoption of IFRS in America They support their argument well, giving a lot of sources to back

their claim and statistics. One of the strengths of this article is the authors own research of

financial records. Since the authors include how they came to their conclusions, their evidence is

more credible than just listing a source taken from another study. Kaya and Pillhofer establish

their authority as accounting specialists. One of the weakest points in the article is when Kaya

and Pillhofer give a solution to the problem. With Kaya and Pillhofers background in solely

accounting, their suggestion of putting a international treaty as a replacement for IFRS could not

Mendoza 5

be as credible as someone who has prior experience in international law. Kaya and Pillhofer had

the intention of opening up the discussion of the future accounting standards in America. Their

article ultimately gave support using logical and ethical appeal more than emotional appeal,

which makes the article a better source to include in a research paper.

Mendoza 6

Works Cited

"Accounting Horizons." Accounting Horizons. N.p., n.d. Web. 4 June 2014.

<http://aaahq.org/pubs/horizons.htm>.

"Dr. Devrimi Kaya." Lehrstuhl fr Rechnungswesen und Prfungswesen. N.p., n.d. Web. 4 June

2014. <http://www.pw.wiso.unierlangen.de/lehrstuhlteam/wissenschaftlichemitarbeiter/dr

devrimi-kaya.shtml>.

"Julian Pillhofer - Spezialist Grundsatzabteilung Accounting - Unicredit Bank AG." XING AG.

N.p., n.d. Web. 4 June 2014. <http://www.xing.com/profile/Julian_Pillhofer>.

Kaya, Devrimi, and Julian A. Pillhofer. "Potential Adoption of IFRS by the United States: A

Critical View." Accounting Horizons 27.2 (2013): 271-99. Web. 4 June 2014.

You might also like

- Srloint ScribdDocument9 pagesSrloint ScribdsirloindNo ratings yet

- International Financial ReportDocument2 pagesInternational Financial Reportmaneesh.aasusNo ratings yet

- Gapenski's Healthcare Finance: An Introduction to Accounting and Financial Management, Seventh EditionFrom EverandGapenski's Healthcare Finance: An Introduction to Accounting and Financial Management, Seventh EditionRating: 5 out of 5 stars5/5 (1)

- IFRS and XBRL: How to improve Business Reporting through Technology and Object TrackingFrom EverandIFRS and XBRL: How to improve Business Reporting through Technology and Object TrackingNo ratings yet

- Why We Do International Accounting Research: Ray Ball The University of ChicagoDocument6 pagesWhy We Do International Accounting Research: Ray Ball The University of ChicagoackolozNo ratings yet

- 1 s2.0 S1045235422000661 MainDocument10 pages1 s2.0 S1045235422000661 MainMuhammad IchsanNo ratings yet

- Intermediate Accounting 17Th Edition by Donald E Kieso Full ChapterDocument41 pagesIntermediate Accounting 17Th Edition by Donald E Kieso Full Chapterlaura.lively760100% (23)

- Longsworthkailah ArdraftDocument4 pagesLongsworthkailah Ardraftapi-375843571No ratings yet

- Literature Review On Financial Management PDFDocument5 pagesLiterature Review On Financial Management PDFeyewhyvkg100% (2)

- ACT301 - Week 4 Tutorial Chapter 4: International AccountingDocument3 pagesACT301 - Week 4 Tutorial Chapter 4: International Accountingjulia chengNo ratings yet

- GaapDocument10 pagesGaapraj4473No ratings yet

- 16.the Myth of Rigorous Accounting ResearchDocument20 pages16.the Myth of Rigorous Accounting ResearchBhupendra RaiNo ratings yet

- Investment Literature ReviewDocument7 pagesInvestment Literature Reviewc5qp53ee100% (1)

- A Perspective On The SEC's Proposal To Accept Financial Statements Prepared in Accordance With International Financial Reporting Standards (IFRS) Without ReconciliationDocument9 pagesA Perspective On The SEC's Proposal To Accept Financial Statements Prepared in Accordance With International Financial Reporting Standards (IFRS) Without ReconciliationBhupendra RaiNo ratings yet

- Tax Policy and the Economy, Volume 33From EverandTax Policy and the Economy, Volume 33Robert A. MoffittNo ratings yet

- Financial Accounting Research, Practice, and Financial AccountabilityDocument22 pagesFinancial Accounting Research, Practice, and Financial AccountabilityBhupendra RaiNo ratings yet

- Accounting Diversity PDFDocument13 pagesAccounting Diversity PDFNico AfrizelaNo ratings yet

- The Diversity Index: The Alarming Truth About Diversity in Corporate America...and What Can Be Done About ItFrom EverandThe Diversity Index: The Alarming Truth About Diversity in Corporate America...and What Can Be Done About ItNo ratings yet

- Tutorial Questions Chap 4Document8 pagesTutorial Questions Chap 4Jane Susan ThomasNo ratings yet

- The Allocator's Edge: A modern guide to alternative investments and the future of diversificationFrom EverandThe Allocator's Edge: A modern guide to alternative investments and the future of diversificationRating: 4.5 out of 5 stars4.5/5 (3)

- The Process of Financial Planning, 2nd Edition: Developing a Financial PlanFrom EverandThe Process of Financial Planning, 2nd Edition: Developing a Financial PlanNo ratings yet

- Case 3-5 International vs. US Standards - SampleDocument7 pagesCase 3-5 International vs. US Standards - SampleSMWNo ratings yet

- Longsworthkailah ArrevisedDocument4 pagesLongsworthkailah Arrevisedapi-375843571No ratings yet

- International Financial Reporting Standards IFRS Pros and Cons For Investors by Ray BallDocument65 pagesInternational Financial Reporting Standards IFRS Pros and Cons For Investors by Ray BallBrankoNo ratings yet

- Are IFRS and U.S. GAAP ConvergingDocument24 pagesAre IFRS and U.S. GAAP Convergingalynna_1885100% (1)

- Investigating and Prioritizing Factors Affecting The Perceptions of Professionals For Implementation of IFRS: An Analytic Hierarch y Process (AHP) ApproachDocument25 pagesInvestigating and Prioritizing Factors Affecting The Perceptions of Professionals For Implementation of IFRS: An Analytic Hierarch y Process (AHP) ApproachutopiaNo ratings yet

- 5.1 Artikel 1 - Reality and Accounting The Case For Interpretive Accounting ResearchDocument15 pages5.1 Artikel 1 - Reality and Accounting The Case For Interpretive Accounting ResearchThessa 123No ratings yet

- Case Study 2.1: New Accounting Rules Don't Add Up'Document7 pagesCase Study 2.1: New Accounting Rules Don't Add Up'abrori100% (1)

- Political Standards: Corporate Interest, Ideology, and Leadership in the Shaping of Accounting Rules for the Market EconomyFrom EverandPolitical Standards: Corporate Interest, Ideology, and Leadership in the Shaping of Accounting Rules for the Market EconomyNo ratings yet

- Literature Review On Financial DeepeningDocument5 pagesLiterature Review On Financial Deepeningafmzadevfeeeat100% (2)

- Queen's University School of Business: Accounting and The Truth of Earnings Reports: Philosophical ConsiderationsDocument39 pagesQueen's University School of Business: Accounting and The Truth of Earnings Reports: Philosophical ConsiderationsjohnjairNo ratings yet

- The Relevance of The Value Relevance Literature For Financial Accounting Standard Setting: Another ViewDocument42 pagesThe Relevance of The Value Relevance Literature For Financial Accounting Standard Setting: Another ViewalfikooNo ratings yet

- Evolution of Research On International Accounting Harmonization: A Historical and Institutional PerspectiveDocument5 pagesEvolution of Research On International Accounting Harmonization: A Historical and Institutional PerspectiveTâm Nguyễn NgọcNo ratings yet

- Transparency in Financial Reporting: A concise comparison of IFRS and US GAAPFrom EverandTransparency in Financial Reporting: A concise comparison of IFRS and US GAAPRating: 4.5 out of 5 stars4.5/5 (3)

- Don't Forget The Audience: Topic: Business, IASDocument3 pagesDon't Forget The Audience: Topic: Business, IASurkerNo ratings yet

- Glover - 2014 OkDocument10 pagesGlover - 2014 OkMariene Resende CunhaNo ratings yet

- Chambers 1993Document26 pagesChambers 1993ayuduNo ratings yet

- The Essentials of Finance and Accounting for Nonfinancial ManagersFrom EverandThe Essentials of Finance and Accounting for Nonfinancial ManagersNo ratings yet

- Accounting Standard Setting: Thoughts On Developing A Conceptual FrameworkDocument22 pagesAccounting Standard Setting: Thoughts On Developing A Conceptual Frameworkningjw0425No ratings yet

- Successful Investing Is a Process: Structuring Efficient Portfolios for OutperformanceFrom EverandSuccessful Investing Is a Process: Structuring Efficient Portfolios for OutperformanceRating: 3.5 out of 5 stars3.5/5 (1)

- 2016 International Valuation Handbook: Guide to Cost of CapitalFrom Everand2016 International Valuation Handbook: Guide to Cost of CapitalNo ratings yet

- Accounting and Accountability in Fiji-Literature Review 19 September 2014Document35 pagesAccounting and Accountability in Fiji-Literature Review 19 September 2014AmiteshNo ratings yet

- Mergers and Acquisitions Basics: Negotiation and Deal StructuringFrom EverandMergers and Acquisitions Basics: Negotiation and Deal StructuringRating: 1 out of 5 stars1/5 (1)

- The Economics of Business Valuation: Towards a Value Functional ApproachFrom EverandThe Economics of Business Valuation: Towards a Value Functional ApproachRating: 5 out of 5 stars5/5 (1)

- Chapter-1 Introducti ONDocument61 pagesChapter-1 Introducti ONprashant mhatreNo ratings yet

- Financial Planning Literature ReviewDocument7 pagesFinancial Planning Literature Reviewea44a6t7100% (1)

- Ifrs Thesis TopicsDocument8 pagesIfrs Thesis Topicsdwhkp7x5100% (2)

- Business and Politics Noelke The Globalization of Accounting StandardsDocument9 pagesBusiness and Politics Noelke The Globalization of Accounting StandardsDiana KovacicNo ratings yet

- IFRS Covergance in IndiaDocument5 pagesIFRS Covergance in IndiaSneha KadamNo ratings yet

- Capital Structure Decision Jordan ReviewDocument6 pagesCapital Structure Decision Jordan ReviewMeareg MebratuNo ratings yet

- The New Wealth Management: The Financial Advisor's Guide to Managing and Investing Client AssetsFrom EverandThe New Wealth Management: The Financial Advisor's Guide to Managing and Investing Client AssetsNo ratings yet

- Best Conference in FinanceDocument40 pagesBest Conference in FinanceLe Hai TrungNo ratings yet

- HRM and Performance: Achievements and ChallengesFrom EverandHRM and Performance: Achievements and ChallengesDavid E GuestNo ratings yet

- M 3. Process AnalysisDocument60 pagesM 3. Process Analysishardlex313No ratings yet

- A SWOT Analysis On Six SigmaDocument10 pagesA SWOT Analysis On Six SigmasmuNo ratings yet

- Wa0010.Document7 pagesWa0010.nitish.thukralNo ratings yet

- Resources and Capabilities: Their Importance How To Analyse ThemDocument34 pagesResources and Capabilities: Their Importance How To Analyse Themvishal7debnat-402755No ratings yet

- Caase 31Document17 pagesCaase 31Mohamed ZakaryaNo ratings yet

- Lingua Franca Online - English Lessons For Professionals and Business PeopleDocument1 pageLingua Franca Online - English Lessons For Professionals and Business Peoplejoysedan03No ratings yet

- Final Exam Review-VrettaDocument4 pagesFinal Exam Review-VrettaAna Cláudia de Souza0% (2)

- Test Bank For Business Statistics For Contemporary Decision Making 7th Edition by BlackDocument33 pagesTest Bank For Business Statistics For Contemporary Decision Making 7th Edition by Blacka2430110010% (1)

- F FFF FFFFFFFFDocument9 pagesF FFF FFFFFFFFvirenderjpNo ratings yet

- All About Electronic Credit Reversal N Re-Claimed Statement - CA Swapnil MunotDocument4 pagesAll About Electronic Credit Reversal N Re-Claimed Statement - CA Swapnil MunotkevadiyashreyaNo ratings yet

- Business Plan FINALDocument13 pagesBusiness Plan FINALFrances BarenoNo ratings yet

- U.S. Foreign Corrupt Practices ActDocument28 pagesU.S. Foreign Corrupt Practices ActGray InternationalNo ratings yet

- Letter To Participants For ConfirmationDocument1 pageLetter To Participants For ConfirmationMmdNo ratings yet

- Market Research OrientationDocument13 pagesMarket Research Orientationapi-19867504No ratings yet

- 1843 Owner Financing Mortgage ContractDocument3 pages1843 Owner Financing Mortgage ContractRichie Battiest-CollinsNo ratings yet

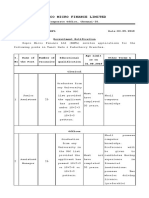

- Repco Micro Finance Limited: Corporate Office, Chennai-35Document4 pagesRepco Micro Finance Limited: Corporate Office, Chennai-35Abaraj IthanNo ratings yet

- GE Suit Against UptakeDocument41 pagesGE Suit Against UptakeAnonymous 6f8RIS6100% (2)

- Essay Test 2021 (Practice Test)Document3 pagesEssay Test 2021 (Practice Test)Philani HadebeNo ratings yet

- Introduction To NAV 2013 PDFDocument57 pagesIntroduction To NAV 2013 PDFMorning FlowerNo ratings yet

- Harden V. Benguet Consolidated Mining Company (G.R. No. L-37331, March 18, 1933)Document7 pagesHarden V. Benguet Consolidated Mining Company (G.R. No. L-37331, March 18, 1933)Rizza TagleNo ratings yet

- Chapter 6-Asset ManagementDocument22 pagesChapter 6-Asset Managementchoijin987No ratings yet

- New Audit Report Format Including CARO 2016Document8 pagesNew Audit Report Format Including CARO 2016CA Shivang SoniNo ratings yet

- Custom Made Jeweler - Business PlanDocument39 pagesCustom Made Jeweler - Business Planfazins85% (13)

- 12 Chapter2Document36 pages12 Chapter2lucasNo ratings yet

- Presentation detailingto3DdetailingforRCDetailing PDFDocument39 pagesPresentation detailingto3DdetailingforRCDetailing PDFErnie ErnieNo ratings yet

- Vsa PDFDocument7 pagesVsa PDFGerrard50% (2)

- Pemasaran Produk PerikananDocument12 pagesPemasaran Produk Perikananunang17No ratings yet

- Capital Investment Decisions and The Time Value of Money PDFDocument89 pagesCapital Investment Decisions and The Time Value of Money PDFKelvin Tey Kai WenNo ratings yet

- BIR-1905 Updated1Document3 pagesBIR-1905 Updated1Kevin CordovizNo ratings yet

- Focus Group Discussion On Perception About Food Delivery Apps, Swiggy Vs Uber EatsDocument3 pagesFocus Group Discussion On Perception About Food Delivery Apps, Swiggy Vs Uber EatsSwarnim BarmeraNo ratings yet