Professional Documents

Culture Documents

FA C01 - 2 Tangible Fixed Assets

Uploaded by

reader05050 ratings0% found this document useful (0 votes)

37 views17 pagesTangible fixed assets cont.

Original Title

FA C01_2 Tangible Fixed Assets

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTangible fixed assets cont.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

37 views17 pagesFA C01 - 2 Tangible Fixed Assets

Uploaded by

reader0505Tangible fixed assets cont.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 17

1

IAS 16: the systematic allocation of the depreciable amount

of an asset over its useful life

Process of allocating the cost of a long term asset in a rational

and systematic manner over its useful life. (matching principle)

Applies to all classes of tangible assets:

Land improvements

Buildings

Equipment.

..

NOT LAND!

4. Depreciation

The revenue-producing ability of an asset declines

during its useful life because of wear and tear.

A decline in revenue-

producing ability may

also occur because of

obsolescence.

4. Depreciation

2

Depreciation is

The process of allocating to expense the cost of a

tangible asset over its useful life in a rational and

systematic manner.

A process of cost allocation, not a process of asset

valuation.

4. Depreciation

Land

Does not depreciate since its usefulness and revenue producing

ability generally remain intact, or increase.

4. Depreciation

3

The balance in Accumulated

Depreciation is not a cash fund.

4. Depreciation

Factors in Computing Depreciation

4. Depreciation

4

4. Depreciation

Acquisition cost 50-

Estimated residual value 10

Depreciable amount 40

Useful life 4 years

Depreciation affects the balance sheet through accumulated

depreciation, which is reported as a reduction from plant

assets. Book Value = Cost Accumulated Depreciation

Depreciation affects the income statement through

depreciation expense.

Income statement impact of the

different depreciation methods

(p.254) (6=2)

Affects of Depreciation

4. Depreciation

5

4. Depreciation

Choice of a depreciation method

IAS 16: the depreciation method used shall reflect the pattern

in which the assets future economic benefits are expected

to be consumed by the entity.

Methods:

Time based

Activity level based

Most commonly used:

Straight-line

Declining-balance

Units-of-activity

4. Depreciation

6

4. Depreciation

Depreciable amount (cost)*

________________________________________________________________________________________________________

The asset's useful life measured in years

*(cost of the asset less its residual/salvage value)

Straight-line Method

4. Depreciation

7

Straight-Line Depreciation Formula

4. Depreciation

Straight-line

Method

Is the most widely

used method of

depreciation.

Depreciation is the

same for each year

of the asset's useful

life.

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

Year

4. Depreciation

8

Declining-Balance

Method

Is an accelerated

method.

Accelerated methods

of depreciation result

in more depreciation

in the early years of

an asset's life and

less depreciation in

the later years.

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

Year

4. Depreciation

Units-of-Activity

Method

The life of an asset

is expressed in

terms of the total

units of production

or the use expected

from the asset.

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

Year

4. Depreciation

9

An equipment bought in December 2006 with 6.000 lei,

is depreciated in 6 years. For 2007 the depreciation

under straight method is 1.000

4. Depreciation

Partial Year Depreciation

If an asset is purchased during the year rather than on January

1, the annual depreciation is prorated for the proportion of a

year it is used.

4. Depreciation

Ex. A building is bought in 10 september 2007, for 65.000 lei.

Company options are: residual value 5.000

usefull life 50 years

straight method depreciation

Establish the depreciation value for 2007, 2008 and the last year.

10

Like a company

manager what

depreciation method

you will use and why?

RO : straight line

fiscal recognized

Questions/Discussion

4. Depreciation

must be disclosed in the notes to financial

statements.

The choice of depreciation method

The useful life

Revising Periodic Depreciation

When a change in an estimate is required, the change is made

in current and future years but not to prior periods.

Significant changes in estimates must be disclosed in the

financial statements.

Extending an asset's estimated life reduces depreciation

expense and increases net income for the period.

4. Depreciation

11

Impairment

A permanent decline in the market value of

an asset.

Is written down to the new market value

during the year in which the decline occurs.

4. Depreciation

Sale of

Tangible Assets

In the sale of an asset, the book

value of the asset is compared

with the proceeds from the sale.

If the proceeds exceed the book

value a gain on disposal occurs.

Conversely, if proceeds from the

sale are less than the book value

a loss on disposal occurs.

3. Tangible assets

12

Is recorded by decreasing Accumulated

Depreciation for the full amount of depreciation

taken over the life of the asset.

The asset account is reduced for the original cost of

the asset.

The loss is equal to the asset's book value at the

time of retirement.

Retirement of Tangible Assets

3. Tangible assets

Analyzing tangible assets

Returns on Asset Ratio

Indicates the amount of net income generated by each dollar

invested in assets

Net Income

Average Assets

Asset Turnover Ratio

Indicates

how efficiently a company eses its assets?

how many dollars of sales are generated by each dollar

invested in assets?

Net Sales

Average Total Assets

3. Tangible assets

13

Two ways a company can increase its return on assets:

Increase profit per sale--measured by profit margin ratio.

Increase its volume of sales--measured by the asset turnover

ratio=

Net Sales

Average Total Assets

3. Tangible assets

acc

Group 21. Tangible assets

211 Land and land improvements

2111 Land

2112 Land improvements

212 Buildings

213 Plant and machinery, motor vehicles, animals and plantations

2131 Plant and machinery

2132 Measurement, control and adjustment devices

2133 Motor vehicles

2134 Animals and plantations

214 Furniture, office equipment, protection equipment of human and material

values and other tangible assets

Group 23. Non-current assets in progress and advance payments

for non-current assets

231 Tangible assets in progress

232 Advance payments for tangible non-current assets

5. Recording the transactions

14

General functioning rules for

asset accounts

present only debit closing

balance and represent the

existences of assets at a

certain time;

debit - the initial existences

of asset, undertaken from the

initial balance sheets asset;

debit - the asset increases

determined by the economic

operations, inscribed in the

supporting documents;

credit - the asset decreases

determined by the economic

operations, inscribed in the

supporting documents;

D Tangible Asset C

Group 28. Amortisation of non-current assets

281 Depreciation of tangible assets

2811 Depreciation of land improvements

2812 Depreciation of buildings

2813 Depreciation of plant and machinery, motor vehicles, animals and plantations

2814 Depreciation of other tangible assets

Group 29. Adjustment for impairment or loss in value of NCA

291 Impairment of tangible assets

2911 Impairment of land and land improvements

2912 Impairment of buildings

2913 Impairment of plant and machinery, motor vehicles, animals and plantations

2914 Impairment of other tangible assets

293 Impairment of non-current assets in progress

2931 Impairment of tangible assets in progress

2933 Impairment of intangible assets in progress

5. Recording the transactions

15

General functioning rules for

depreciation/impairement of asset

present only credit closing

balance and represent the

existences at a certain time;

credit - the initial existences

undertaken from the initial

balance sheets asset;

credit - the increases

determined by the economic

operations, inscribed in the

supporting documents;

debit - the decreases

determined by the economic

operations, inscribed in the

supporting documents;

D Depreciation/impairement C

Practical example

1.Entity purchases 2 computers from a supplier with an

invoice value of 2.000 lei and VAT 19% per unit.

2.The invoice is acquitted as follows: 400 lei from the

bank account, 2.600 lei from a long term bank loan,

the difference will be paid in one month.

3.The computers useful life is 5 years and the

depreciation method is straight-line.

4.After 4 years one computer is sold with 1.000 lei and

VAT 19%.

5. Recording the transactions

16

GENERAL JOURNAL

O

p

Explanation Corresponding Accounts SUMS

D C

1 1

The computers

purchases

% = 404 Suppliers of non.

2132 Measurement, control and ...

4426 Input VAT

4000

720

4720

2 2 The invoice to a

supplier is acquitted

404 Suppliers of non. = %

Cash at bank in lei 5121

Long term bank loans 1621

3000

400

2600

3 3 Computers

depreciation 1yr,2,3,4

6811 = 2813

Expences with depr Depreciation of ..

800 800

4 4 Selling one computer

after 4 yrs

461 = %

Sundry debtors 7583Proceeds from...

4427 Output WATT

1190

1000

190

5 Evidence discharging % = 2132 Measurement, ..

2813 Depreciation of..

6583 Net value of assets disposed

1600

400

2000

5. Recording the transactions

GENERAL JOURNAL

O

p

Explanation Corresponding Accounts SUMS

D C

5 6 Receivables

collected through

bank transfer

5121 = 461

Cash at bank in lei Sundry debtors

1190 1190

6 7 Ordinary repairs 611 = 5311

Expenses with current repairs Cash

200 200

7 8 Computer

depreciation yr 5

6811 = 2813

Expences with depr Depreciation of ..

400 400

7 9 Evidence

discharging

2813Depreciation of..= 2132 Measurement, 2000 2000

5. The counter value is collected through bank transfer

6. Some ordinary repairs are invoiced by the supplier 200 lei, paid in cash.

7. After 5 years the other computer is disposed

5. Recording the transactions

17

Key point

Disposal

Definition

recognition

Acquisition cost

Production cost

Depreciation

methods

Capital/Subsequent

expenditures

Tangible assets

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Section 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsDocument27 pagesSection 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsMhya Thu UlunNo ratings yet

- Dr. Eduardo M. Rivera: This Is A Riveranewsletter Which Is Sent As Part of Your Ongoing Education ServiceDocument31 pagesDr. Eduardo M. Rivera: This Is A Riveranewsletter Which Is Sent As Part of Your Ongoing Education ServiceNick FurlanoNo ratings yet

- Danby Dac5088m User ManualDocument12 pagesDanby Dac5088m User ManualElla MariaNo ratings yet

- Uppsc Ae GSDocument18 pagesUppsc Ae GSFUN TUBENo ratings yet

- Convention On The Rights of Persons With Disabilities: United NationsDocument13 pagesConvention On The Rights of Persons With Disabilities: United NationssofiabloemNo ratings yet

- Embedded Systems DesignDocument576 pagesEmbedded Systems Designnad_chadi8816100% (4)

- Audit On ERP Implementation UN PWCDocument28 pagesAudit On ERP Implementation UN PWCSamina InkandellaNo ratings yet

- CHAPTER 3 Social Responsibility and EthicsDocument54 pagesCHAPTER 3 Social Responsibility and EthicsSantiya Subramaniam100% (4)

- HRD DilemmaDocument4 pagesHRD DilemmaAjay KumarNo ratings yet

- ARUP Project UpdateDocument5 pagesARUP Project UpdateMark Erwin SalduaNo ratings yet

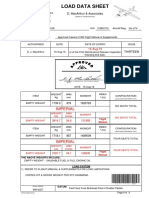

- Load Data Sheet: ImperialDocument3 pagesLoad Data Sheet: ImperialLaurean Cub BlankNo ratings yet

- Gardner Denver PZ-11revF3Document66 pagesGardner Denver PZ-11revF3Luciano GarridoNo ratings yet

- RYA-MCA Coastal Skipper-Yachtmaster Offshore Shorebased 2008 AnswersDocument28 pagesRYA-MCA Coastal Skipper-Yachtmaster Offshore Shorebased 2008 AnswersSerban Sebe100% (4)

- Manufacturing StrategyDocument31 pagesManufacturing Strategyrajendra1pansare0% (1)

- SEERS Medical ST3566 ManualDocument24 pagesSEERS Medical ST3566 ManualAlexandra JanicNo ratings yet

- SCDT0315 PDFDocument80 pagesSCDT0315 PDFGCMediaNo ratings yet

- Securitron M38 Data SheetDocument1 pageSecuritron M38 Data SheetJMAC SupplyNo ratings yet

- The Internal Environment: Resources, Capabilities, Competencies, and Competitive AdvantageDocument5 pagesThe Internal Environment: Resources, Capabilities, Competencies, and Competitive AdvantageHenny ZahranyNo ratings yet

- Delta AFC1212D-SP19Document9 pagesDelta AFC1212D-SP19Brent SmithNo ratings yet

- Forecasting of Nonlinear Time Series Using Artificial Neural NetworkDocument9 pagesForecasting of Nonlinear Time Series Using Artificial Neural NetworkranaNo ratings yet

- Binary File MCQ Question Bank For Class 12 - CBSE PythonDocument51 pagesBinary File MCQ Question Bank For Class 12 - CBSE Python09whitedevil90No ratings yet

- Ytrig Tuchchh TVDocument10 pagesYtrig Tuchchh TVYogesh ChhaprooNo ratings yet

- Hayashi Q Econometica 82Document16 pagesHayashi Q Econometica 82Franco VenesiaNo ratings yet

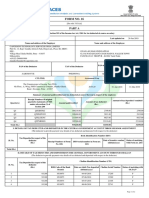

- Form16 2018 2019Document10 pagesForm16 2018 2019LogeshwaranNo ratings yet

- SPH4U Assignment - The Wave Nature of LightDocument2 pagesSPH4U Assignment - The Wave Nature of LightMatthew GreesonNo ratings yet

- Water Hookup Kit User Manual (For L20 Ultra - General (Except EU&US)Document160 pagesWater Hookup Kit User Manual (For L20 Ultra - General (Except EU&US)Aldrian PradanaNo ratings yet

- MORIGINADocument7 pagesMORIGINAatishNo ratings yet

- CA Inter Group 1 Book November 2021Document251 pagesCA Inter Group 1 Book November 2021VISHAL100% (2)

- Wiley Chapter 11 Depreciation Impairments and DepletionDocument43 pagesWiley Chapter 11 Depreciation Impairments and Depletion靳雪娇No ratings yet

- X-17 Manual Jofra PDFDocument124 pagesX-17 Manual Jofra PDFBlanca Y. Ramirez CruzNo ratings yet