Professional Documents

Culture Documents

Credit Management

Uploaded by

Ahamed IbrahimCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Management

Uploaded by

Ahamed IbrahimCopyright:

Available Formats

Credit Management

Sound credit management is a prerequisite for a financial institutions stability and continuing

profitability, while deteriorating credit quality is the most frequent cause of poor financial

performance and condition. The prudent management of credit risk can minimize operational

risk while securing reasonable returns.

Ensuring lending staff comply with the credit union's lending licence and by-laws is the first

step in managing risk. The second step is to ensure board approved policies exist to limit or

manage other areas of credit risk, such as syndicated and brokered loans, and the

concentration of lending to individuals and their connected parties (companies, partnerships

or relatives).

The board and management should also set goals or targets for their loan portfolio mix, as

part of their annual planning process. The loan portfolio should be monitored on an ongoing

basis, to determine if performance meets the board's expectations, and the level of risk

remains within acceptable limits.

Standardized lending procedures should be adopted to reduce risk of transactional error, and

ensure compliance with regulatory requirements and board policy. Approval and

disbursements, documentation, lending staff and loan security are just some of the procedures

recommended in this chapter.

A credit union can meet standards of sound business and financial practices by ensuring it has

developed and implemented credit policies, risk and performance measurement techniques,

and risk management procedures comparable to those contained in this chapter. Policies,

measurement techniques and procedures should be appropriate for the size

Management and lending staff should be apprised of the comprehensive lending legislation

set out in the Act and Regulation 76/95, as well as relevant legislation in other Acts.

Members of the board should also be familiar with the major aspects of lending legislation.

Referring to or repeating lending legislation in board policy and operational procedures is an

effective means to ensure compliance.

The following is a summary of important lending legislation which defines lending powers,

limits and restrictions, both in the Act and Regulations, as well as in other relevant statutes

and bodies of law.

Lending Powers

A credit union's lending powers are formally defined by its lending licence, which it obtains

either by designation under the Act, or through an application to FSCO.

Credit union by-laws also impact lending powers. A by-law is required to request a change

to the credit union's lending licence, and determines membership eligibility for the credit

union, thereby impacting who can borrow from the organization.

The Act additionally prescribes lending powers, restrictions and limits. Refer to Schedule 5.1

for a summary of important lending legislation. For actual text, refer to the appropriate

sections of the Act and Regulation 76/95. Violations of the Act will cause manager/director

liability, and may lead to penalties or economic damages.

Lending Licences

Under section 196(5) of the Act, a grandfathering provision effective March 1, 1995

established for each credit union a deemed lending licence comparable to the lending powers

prescribed by the credit union's then existing by-laws.

The legislation proclaimed in 1995 introduces different classes of loans, each associated with

a different class of lending licence, which are as follows: agricultural, commercial,

institutional, personal, residential mortgage and bridge loan, syndication and unincorporated

association lending. The loan classes are defined in sections 51 to 57 of Regulation 76/95.

In order to make a loan of a particular class, the credit union must have the appropriate

lending licence. A credit union may only make an agricultural loan if it has an agricultural

lending licence. It may only make a commercial loan if it has a commercial lending licence.

A credit union must apply to the Superintendent of Financial Services (the Superintendent)

for a new lending licence if it wishes to expand into a new class of loans, or to expand

lending limits for a particular class. When considering expanding the line of loan products, it

is recommended that an adequate study of required liquidity, equity and qualified,

experienced staff resources be made prior to such a request.

Licence Non-Compliance

The Superintendent may revoke or amend a lending licence at any time, should the credit

union fail to comply with its licence or with a provision of the Act or Regulation 76/95.

An amendment might include the addition of conditions or restrictions, or the reduction of a

lending limit on a particular class of loans. Revoking a lending licence is considered a last

resort by the Superintendent, and would most likely only follow should other remedial

measures (conditions or restrictions, or a reduction in lending limits) prove ineffective.

Lending Limits and Lending Limit Matrices

Lending licences can carry lending limits that are either set at fixed amounts, or determined

under growth matrices set out in sections 61 and 62 of Regulation 76/95. Where a lending

licence has a limit fixed in the licence, the credit union will have to apply to the

Superintendent any time it wants to increase the limit due to increased loan demand or

increased asset size and lending expertise.

However, where the lending licence utilizes lending limit matrices, lending limits will

automatically adjust with growth in the credit union (growth being measured by total

regulatory capital and deposits as per annual audited financial statements). There are two

separate lending limit matrices. The first matrix, authorized under section 61 of Regulation

76/95, details three sets of graduated limits on the amount of personal, residential mortgage

and bridge loans, that can be made to an individual. (Loan limit matrices do not exist for

commercial or agricultural lending) The second matrix, prescribed by section 62, provides

graduated limits on the amount of total loans (any number of loans of any type) that a credit

union can make to a particular person and his/her connected persons.

Not every credit union will automatically qualify for the use of lending limit matrices. A

credit union must specifically request the use of a lending limit matrix through a lending

licence amendment, and must provide the Superintendent with a rationale for the use of the

graduated lending limit matrix.

Illegal Credit Transactions

Any loans in excess of a credit union's lending limits, as defined by the organization's lending

licence and by-laws, are illegal. Additionally, a credit union may only offer those loan

classes authorized in its lending licence (e.g. personal loans, mortgages, commercial,

agricultural, etc.) to authorized members, otherwise it is lending illegally.

Authorizing illegal loans is a contravention of the Act and is considered an offence under

section 322 of the Act. Any director, officer or agent of a credit union who commits such an

offence, authorized, or acquiesced to the offence, is liable. (Penalties prescribed in the Act

include a maximum fine of $100,000 or maximum imprisonment for two years). Therefore,

it is recommended that directors, officers and credit committee members object to the

existence of illegal loans known to them, and advise the Superintendent in writing of any

loans which violate the Act, the lending licence, or the by-laws.

In order to assist the credit committee and staff in their responsibilities to grant proper loans,

board policy should define what constitutes a legal and an acceptable loan. Additionally,

senior management, the credit committee and the board should monitor for illegal loans and

large loans that approach regulatory limits.

TO GET THIS PROJECT EMAIL TO : apsprojectz@gmail.com

You might also like

- Job Satisfaction Project Report Download For MbaDocument4 pagesJob Satisfaction Project Report Download For MbaAhamed Ibrahim0% (1)

- Customer Query ManagementDocument1 pageCustomer Query ManagementAhamed IbrahimNo ratings yet

- Mba Project Report On Organizational CultureDocument17 pagesMba Project Report On Organizational CultureAhamed Ibrahim0% (2)

- Financial Performance Analysis Mba Project Report DownloadDocument3 pagesFinancial Performance Analysis Mba Project Report DownloadAhamed Ibrahim100% (3)

- Working Capital Management Mba Project HelpDocument10 pagesWorking Capital Management Mba Project HelpAhamed IbrahimNo ratings yet

- Project RiskDocument6 pagesProject RiskAhamed IbrahimNo ratings yet

- Mba Marketing Project Report Dissertation HelpDocument3 pagesMba Marketing Project Report Dissertation HelpAhamed IbrahimNo ratings yet

- MBA Project Report Service Quality of BanksDocument5 pagesMBA Project Report Service Quality of BanksAhamed IbrahimNo ratings yet

- Supply Chain Management Mba Project DownloadDocument7 pagesSupply Chain Management Mba Project DownloadAhamed Ibrahim100% (2)

- Consumer Behaviour Mba Project Report DownloadDocument2 pagesConsumer Behaviour Mba Project Report DownloadAhamed Ibrahim0% (1)

- Property Investment Project For MbaDocument3 pagesProperty Investment Project For MbaAhamed IbrahimNo ratings yet

- Export Finance Project ReportDocument1 pageExport Finance Project ReportAhamed IbrahimNo ratings yet

- Service Marketing MBA Project ReportDocument7 pagesService Marketing MBA Project ReportAhamed IbrahimNo ratings yet

- Marketing Mba Project ReportDocument7 pagesMarketing Mba Project ReportAhamed IbrahimNo ratings yet

- Leadership Vs ManagementDocument1 pageLeadership Vs ManagementAhamed IbrahimNo ratings yet

- Functions of Statistics Project Report MbaDocument7 pagesFunctions of Statistics Project Report MbaAhamed IbrahimNo ratings yet

- Global Warming: Energy Conservation and Environmental ProtectionDocument13 pagesGlobal Warming: Energy Conservation and Environmental ProtectionAhamed IbrahimNo ratings yet

- Portfolio Optimization SoftwareDocument2 pagesPortfolio Optimization SoftwareAhamed IbrahimNo ratings yet

- Family FunDocument1 pageFamily FunAhamed IbrahimNo ratings yet

- MCA and BCA Projects Download With Source CodeDocument1 pageMCA and BCA Projects Download With Source CodeAhamed IbrahimNo ratings yet

- Organisational Appraisal Project ReportDocument2 pagesOrganisational Appraisal Project ReportAhamed IbrahimNo ratings yet

- Project Finance-Dissertation ReportDocument2 pagesProject Finance-Dissertation ReportAhamed IbrahimNo ratings yet

- Portfolio Optimization SoftwareDocument2 pagesPortfolio Optimization SoftwareAhamed IbrahimNo ratings yet

- Work Culture in IndiaDocument2 pagesWork Culture in IndiaAhamed IbrahimNo ratings yet

- Mba Project NeededDocument1 pageMba Project NeededAhamed IbrahimNo ratings yet

- Industrial Revolution Project ReportDocument1 pageIndustrial Revolution Project ReportAhamed IbrahimNo ratings yet

- ModemLog - Sony Ericsson Device 1039 USB WMC Data ModemDocument1 pageModemLog - Sony Ericsson Device 1039 USB WMC Data ModemAhamed IbrahimNo ratings yet

- Model Questions: Name of The Paper: MI0007 Time: 2 Hrs. Total Marks: 140Document2 pagesModel Questions: Name of The Paper: MI0007 Time: 2 Hrs. Total Marks: 140Ahamed IbrahimNo ratings yet

- Model Questions: Part - ADocument3 pagesModel Questions: Part - AAhamed IbrahimNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Comprehensive Reviewer For Law On Obligations From Article 1156-1206Document17 pagesComprehensive Reviewer For Law On Obligations From Article 1156-1206K.A.100% (4)

- Topic 3 Managing A Law FirmDocument34 pagesTopic 3 Managing A Law FirmsyakirahNo ratings yet

- Banking Laws Bar Q - ADocument18 pagesBanking Laws Bar Q - ANurRjObeidat100% (1)

- Final Dissertation Project On Ratio AnalysisDocument61 pagesFinal Dissertation Project On Ratio Analysisangel100% (1)

- Jawaban AKL2 Kuis 18 April 2018Document3 pagesJawaban AKL2 Kuis 18 April 2018agung kusumaNo ratings yet

- Acn202 AssignmentDocument5 pagesAcn202 AssignmentAvijit Kumar SahaNo ratings yet

- Compilation Credit Trans FinalsDocument27 pagesCompilation Credit Trans FinalsJoVic2020100% (1)

- Shareholder Agreement: Parties: T A, - , 20 - , "P ," C A, (L. Ipsum P, INC, "C "Document4 pagesShareholder Agreement: Parties: T A, - , 20 - , "P ," C A, (L. Ipsum P, INC, "C "caperpNo ratings yet

- Business Law - ObligationsDocument26 pagesBusiness Law - ObligationsAnonymous vQLbaAONo ratings yet

- Entrepreneurship The Art Science and Process For Success 2nd Edition Bamford Solutions Manual DownloadDocument39 pagesEntrepreneurship The Art Science and Process For Success 2nd Edition Bamford Solutions Manual DownloadRyan Barrett100% (19)

- Moa TempDocument4 pagesMoa TemphambogalagaNo ratings yet

- Hull-OfOD8e-Homework Answers Chapter 05Document3 pagesHull-OfOD8e-Homework Answers Chapter 05hammernickyNo ratings yet

- Concurrence and Preference of CreditsDocument8 pagesConcurrence and Preference of CreditsKC ToraynoNo ratings yet

- Consumer FinanceDocument16 pagesConsumer Financenageshalways100% (1)

- Penn Foster 986033 Consumer Math, Part 2 Study GuideDocument5 pagesPenn Foster 986033 Consumer Math, Part 2 Study GuidesidrazeekhanNo ratings yet

- Faq'S & Guidlines On Income TaxDocument50 pagesFaq'S & Guidlines On Income TaxRavikarthik GurumurthyNo ratings yet

- Customer Service PolicyDocument26 pagesCustomer Service PolicyThol Lyna100% (1)

- Term Paper On DebentureDocument13 pagesTerm Paper On DebentureAakanchhya BhattaNo ratings yet

- IS314 Lab Manual - 1Document22 pagesIS314 Lab Manual - 1Septo Aji Passat0% (1)

- Sources of Finance and Its CostsDocument34 pagesSources of Finance and Its CostsVyakt MehtaNo ratings yet

- Bloomberg Market Concepts With Perfect Solution Rated A 5Document17 pagesBloomberg Market Concepts With Perfect Solution Rated A 5milkah mwauraNo ratings yet

- Assignment 1Document20 pagesAssignment 1SarthakAryaNo ratings yet

- Ferrel L. Agard,: DebtorDocument20 pagesFerrel L. Agard,: DebtorJfresearch06100% (1)

- Bank Management: PGDM Iimc 2020 Praloy MajumderDocument40 pagesBank Management: PGDM Iimc 2020 Praloy MajumderLiontiniNo ratings yet

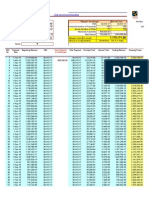

- Sbi Maxgain CalculatorDocument4 pagesSbi Maxgain CalculatorAnkit ChawlaNo ratings yet

- SECRET PRESENTATION FL Legislature On Foreclosures Dec 2010Document231 pagesSECRET PRESENTATION FL Legislature On Foreclosures Dec 201083jjmackNo ratings yet

- Besan Mill ProjectDocument14 pagesBesan Mill Projectshreyans01100% (1)

- Task 4 Report PDFDocument45 pagesTask 4 Report PDFvedant85% (13)

- TCG March Report 2023 1681756740Document17 pagesTCG March Report 2023 1681756740Dan CyglerNo ratings yet

- Niraj Report On NMB BankDocument45 pagesNiraj Report On NMB BankNiraj SinghNo ratings yet