Professional Documents

Culture Documents

Building A Business1

Uploaded by

Oluwasegun Modupe0 ratings0% found this document useful (0 votes)

49 views3 pageshi

Original Title

Building a Business1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenthi

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

49 views3 pagesBuilding A Business1

Uploaded by

Oluwasegun Modupehi

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

NATURE BIOTECHNOLOGY VOLUME 27 NUMBER 7 JULY 2009 1

BUI LDI NG A BUSI NESS

Francesco De Rubertis is a partner and Roman

Fleck is a principal at Index Ventures, Geneva,

Switzerland. Werner Lanthaler is CEO at Evotec

AG, Hamburg, Germany.

e-mail: Francesco@indexventures.com

management teams at those firms all pos-

sess the above elements. Although assets

and technology drive overall market value,

having the right management team (usually

based around 34 cofounders) and cash

from the very beginning is key to success.

You should form your management team

to be ready to adapt and evolve. Your team

must be able to absorb failure and learn

from disappointments.

Two other factors play a critical role in

forming companies that earn long-term

success. First, the quality of the origi-

nal idea and founding vision behind the

companys formation must always remain

constanteven when the business grows

larger and adapts to change. Second, the

original founders and entrepreneurs should

remain and lead the company through the

inevitable peaks and troughs. Although the

founders roles and responsibilities will no

doubt change, founders tend to confer the

same enthusiasm and passion that they did

when they first set up their business, which

keeps an entrepreneurial spirit at the heart

of the company. A good example is Actelion

in Allschwil, Switzerland, which still has its

original founders involved in the goings-on

of the company.

and energized. Combined with leadership abil-

ity, management teams with these characteris-

tics help drive a company forward and exploit

opportunities.

Employees: getting the most out of employees

is vital to the success of your businessyou

want to attract and retain the best people.

Management must also be open to new ideas

and suggestions.

Experience: good management will be famil-

iar with many positive and negative situations

(both internally and externally), which means

they will be able to make decisions quickly and

respond effectively.

Networks: well-connected management teams

have access to cash, strategic advice, informa-

tion, markets and opportunities.

Success: management teams with a record

of success are more likely to attract VCs and

greater amounts of cash. They also understand

what makes a successful company and how to

run one.

Consider the top 20 biotech companies

across the United States and Europe. The

E

ach individual biotech business is unique:

founding entrepreneurs have their own

visions, strategies and goals; the science and

technology that drive companies is inherently

exclusive; and every business is exposed to a

wide range of external factors, risks and mar-

ket forces. With that said, do successful biotechs

share common characteristics?

Yes, they do, and this article looks at the main

facets of sustainable and long-term biotech

businesses. Of course, it always starts with the

science, but then youll need to focus on man-

agement, adaptation, timing, location and cash

(Table 1).

Management: the right team

Having a strong, experienced and stable man-

agement team is essential to the success of any

business, because venture capitalists (VCs) are

investing in the people at the top rather than the

assets, technology or product. Why? Because a

good management team keeps a business work-

ing effectively and efficiently and sets out the

companys values, visions, commitment and cul-

ture. Additionally, with start-ups, it is not always

clear which product(s) or service(s) will be suc-

cessful, and there is little historical data on which

to base a decision. That leaves management as the

most concrete aspect for a VC to evaluate (though

products and services will still be scrutinized).

VCs consider the following when evaluating the

cofounders and leadership teams:

Characteristics: successful management team

members are people who are entrepreneurial,

motivational, flexible, determined, committed

Six secrets to successhow to build a sustainable

biotech business

Francesco De Rubertis, Roman Fleck & Werner Lanthaler

What are the core elements of a successful biotech?

Table 1 Six factors to achieve biotech heaven

Factor Strategy

Management Build a team that shares an ambitious common vision, intellectual honesty and an

entrepreneurial culture in which the driving founders have a long-term commitment

Ability to adapt Stick to your vision, but be prepared for your original business plan to change

Timing Where is the market going to be in seven years time? You should know the answer

Location Choose somewhere accessible that will raise your equity value

Cash Attract venture capitalists from day one

Science Make sure your science is world class, but remember: science alone does not make

a successful company

2 VOLUME 27 NUMBER 7 JULY 2009 NATURE BIOTECHNOLOGY

BUI LDI NG A BUSI NESS

risks to potential investors. One such risk is

the location of your company. Although you

may think that setting up your company in

lush countryside will provide your employees

with a tranquil setting that encourages free

thinking and innovation, potential investors

will be shaking their heads in dismay at the

distance they must travel. Following a few

simple rules can ensure your choice of location

and increase both investment and, ultimately,

long-term equity value.

Biotech start-ups should locate near estab-

lished firms for many reasons. Clustering has

several advantages: first, it enables companies to

be tuned into an industrys strategic shifts and

become successful together; second, it provides

an environment that will attract world-class

talentrecruits have the security of knowing

that if things dont work out with one company

then there are others nearby; third, it allows

mixing of skill sets, and many important dis-

coveries and scientific advancements have come

from the convergence of different disciplines

and cultures.

Only a few global geographic centers have

succeeded in establishing solid biotech clus-

ters. In the United States, these include San

Franciscos Bay Area and the Boston/Cambridge

axis in Massachusetts. In Europe, the clusters are

less concentrated, but include the UKs Golden

Triangle of Oxford, Cambridge and London; the

Basel/Zurich region in Switzerland; Munich/

Martinsried in Germany; and the Medicon

Valley in Sweden/Denmark.

Biotech, more than almost any other high-

tech business, depends on close ties with leading

academic institutions both at inception and for

continued survival. More often than not, criti-

cal technologies are discovered and developed

in academia. Close personal and professional

relationships between industry and academia

provide the main source for the most promising

ideas. Quite frequently, universities also provide

initial staff for biotech companies, in the form

of consulting professors, graduate students and

postdoctorates participating in the research that

produced the commercial ideas.

Location can also play a critical role in exit

strategies. Take the example of Ribopharm

in Kulmbach, Germany, and Alnylam in

Cambridge, Massachusettstwo world lead-

ers in therapeutic RNA interference. For

Ribopharm, although it had critical parts of

the technology and very compelling intellec-

tual property, it was unable to create critical

mass partly due to its location, and it became

attractive to rival suitors. In the end, Alnylam,

located in a biotech hotspot and owning com-

parable intellectual property and technology,

bought Ribopharm and became the dominant

player in the RNA interference space.

capable of absorbing failure and changing it

into opportunities. When you start your own

firm, be sure you do the same. A key will be not

throwing good money after bad.

Currently, fewer than 15 companies in

Europe have a market capitalization equal to

or more than $500 million. Of those, only three

have passed the $1 billion thresholdActelion,

Intercell in Vienna and Genmab in Copenhagen.

Most of those companies were formed in the

mid- to late nineties, largely by the same entre-

preneurs running them today. Again, most of

them have gone through remarkably similar

changes and evolution in their business plans,

seen their leading assets fail and, in some cases,

witnessed their share price plummet by 7080%

in a single day. Yet they have returned stronger

and well positioned to grow back.

Timing: predicting the future

Some people argue that timing is luck and that

you cant plan for things. They are wrong. You

can plan, but only if you are open-minded and

position your start-up correctly. For example,

the Human Genome Project created huge

excitement, and companies that were founded

two or three years before the project were well

supported by the market. Also, consider that in

the early 1990s nobody was looking at antibod-

ies, but from 1998 onward they became huge.

Timing can be everything and a real determi-

nant of success.

Good founders, entrepreneurs and manage-

ment teams will be able to take a macro view

and predict how the industry (or a particular

sector) will develop and what it will look like in

57 years. The rule of thumb is that it is easier

to predict how a market or sector will develop

during the next few years than it is to predict the

destiny of your drug or molecule. If antibodies

are going to be valuable for the next decade, ask

if your company should be developing alterna-

tive platform technologies, new delivery routes

or generics. Always look ahead.

Roche in Basel, Switzerland, for example, is

well positioned for the near future because of

two visionary decisions taken by the compa-

nys management several years ago: significant

exposure to biologicals (antibodies in par-

ticular) and diagnostics. The judgments were

based on the conviction that these areas would

become major growth drivers in the industry,

and Roche is now reaping the rewards of those

decisions. But there will always be the long term,

and Roches management is deciding what it

needs to do now for the company to remain

competitive.

Location: choose wisely

If you are building a business from scratch,

a key objective is to minimize the number of

Evolve or die: adapting your business

One of the main reasons biotech companies

fail is because they believe they have the best

potential drug and that the world will adapt

to accommodate their business. They assume

that they will be able to hire the best people,

raise the most cash and make lots of money.

This couldnt be further from the truth.

Other than perhaps Genzyme, of Cambridge,

Massachusetts, very few companies got their

drug right the first time.

This is why the majority of the worlds top

biotech companies are very different today

compared with their formative years. Their

original products and/or technology were

shelved or deprioritized as they quickly adapted

and evolved to changing market forces and

consumer needs. Amgen, of Thousand Oaks,

California, for example, was formed to capi-

talize on recombinant DNA and genetic engi-

neering. It wasnt until years later that it focused

on erythropoietin, which brought in billions

of dollars. Another example is Millennium

Pharmaceuticals, of Cambridge, Massachusetts,

which even though it was originally founded

as a genomics company, bought Leukosite (a

Cambridge, Massachusetts-based company

developing therapeutics for cancer, autoimmune

and inflammatory disease) in a stock-for-stock

deal worth about $635 million. This ultimately

led to the approval of the new ubiquitin pro-

teasome inhibitor Velcade (bortezomib) and

an investment in an oncology drug pipeline,

transforming Millennium into a drug company.

That led to Osaka, Japanbased Takeda buying

Millennium in May 2008 for $8.8 billion.

Founders who have established long-term,

sustainable companies understand that they

will, at some point, need to adapt or evolve their

business model. Its a tough decision, but they

mark pivotal moments in a companys history.

When choosing whom to invest in, VCs look for

management teams that completely understand

a business and are fully committed to it, that

demonstrate the ability to quickly terminate

unsuccessful projects and that are able to absorb

failure, adapt and move on. Successful founders

are able to articulate their reasons rationally

while remaining true to their original vision.

Arguably, those types of entrepreneurs are

able to win the renewed backing of their inves-

tors, thus setting the stage for their businesses

to adapt and evolve as necessary. Possessing

both the clarity and conviction to make (and

follow through on) tough decisions early and

the strength to commit to entrepreneurial

ventures have been common features of the

start-up teams at Genzyme; Gilead in Foster

City, California; Millennium; and Genentech in

South San Francisco. They didnt just have the

right sciencetheir management teams were

NATURE BIOTECHNOLOGY VOLUME 27 NUMBER 7 JULY 2009 3

BUI LDI NG A BUSI NESS

to cash, adaptability, timing and location. By

recognizing, leveraging and capitalizing on

all the possible opportunities, you will give

yourself a head start on the road to building a

successful company. After all, although it can

be done (Box 1), starting a biotech business

from scratch and developing it into a truly

global player that can evolve and adapt with

the industry is something that almost defies

natural selection in todays competitive mar-

ket. So dont focus all your energy into a drug

that most likely will not succeed; rather, look

to build a unique business, with great sci-

ence, that is forward-looking and can adapt

to the market several years from now. This will

make your company more attractive to VCs at

an earlier stage because you are minimizing

investors risks.

With these elements, combined with a

long-term vision, an entrepreneurial spirit,

good management, drive and passion, you will

possess the keys to having a successful biotech

company.

choose will be your long-term partner in build-

ing your company.

Of course, it helps if your business generates

cash, because that decreases the dependence

on equity and/or debt financing. Most compa-

nies will not have a revenue-generating profit

stream early on. Forming strategic alliances

with corporate partners as soon as possible

can provide valuable endorsement in addition

to financial support. However, it is important

to weigh the long-term implications of such

deals. Generous up-front and milestone pay-

ments can be to the detriment of downstream

royalties as well as providing a hurdle in the

event of a business sale. The distance, mea-

sured in cash, to independence from equity

fund raisings is a key parameter in evaluat-

ing the attractiveness of an investment and its

intrinsic level of risk.

Conclusions

Starting a sustainable biotech company means

having the right blend of management, access

Cash: VCs equal success

Drug discovery and development is very capi-

tal intensivecompanies need to invest hun-

dreds of millions of dollars before they can start

generating profits. Unfortunately, financing is

probably the greatest risk companies face in

their early stages. A common feature of success-

ful biotechs has been their financing strategies

and the investment from VCs. The earlier you

can get VC backing, the greater your chances

of success.

VCs have, from an early stage, backed about

60% of current public European biotechs at

some point. Late-stage investors, private equity

funds, bankers and institutional investors often

use the presence of blue chip VCs as a first-se-

lection criterion to identify potential start-ups

in which to invest. Venture capital can be seen

as the very first bit of leverage that an entrepre-

neur may possessessentially a key strategic

tool. Serial entrepreneurs who have previously

accessed venture capital recognize this and are

more likely to look for venture capital earlier

than first-time entrepreneurs. One very fair

concern of entrepreneurs is that VCs often

pay attention to only a few value drivers in

the companys portfolio while neglecting the

remaining assets. Although this forced focus

may seem to be a limitation on the early aspi-

rations and vision of entrepreneurs, in reality

this strategy does not rule out pipeline expan-

sion and diversification of the asset base. It

instead focuses limited early investment on

reaching major inflection points that allow

further financing at a more attractive cost of

capital.

And you should look to VCs right from

the outset. Bringing in VCs gives you access

not only to cash but also to advice, informa-

tion, market knowledge and networks. The

VCs can help you build the company, make

it more financially attractive to other poten-

tial investors and increase the chances of your

company going public. Essentially, the VC acts

as a founding partner and gives you a solid

financial platform from which to build your

company.

When you do look for money, dont try to

play VCs against each other to gain more invest-

ment for less equity. VCs know what they are

talking about, they understand the market and

will do their utmost to raise the value of your

company. It is best to stick to one or two VCs

that you trust, have previously worked with

or that have been recommended. The VC you

Box 1 Growing up Intercell AG

I was the former Chief Financial Officer at Intercell in Vienna, a developer of antigens,

adjuvants and vaccines. To grow the business, the companys management followed many

of the principles discussed in this article. Founded in 1999 as an academic spin-off of the

University of Vienna and the Institute of Molecular Pathology in Vienna, founders Alexander

von Gabain and Max Birnstiel left academic jobs to focus on the company. The company

raised more than 150 million (about $201 million) before listing on the Vienna stock

exchange in 2005 and achieved profitability in 2007, even before selling its first product.

How?

Success came from having the right blend of skills and experience, and making the most

of opportunities. It also helped that the company had the same management team for

almost nine years.

In the early years, Intercell was able to attract venture capitalist money by having a

modest valuation and by seeking out venture capitalists that complemented the business

and direction. In some cases, investment was rejected because the founders felt the

investors were not a good fit for the company. The management team also leveraged the

companys platform to score meaningful partnerships with several global pharmaceutical

companies, including Novartis in Basel, Switzerland; Merck in Whitehouse Station, New

Jersey; Wyeth in Madison, New Jersey; Sanofi Pasteur in Lyon, France; Kirin in Tokyo

and the Statens Serum Institut in Copenhagen. Many biotechs think that you only need

products to be successful and that partnering is a bad ideathat youre giving away your

secrets and value. Part of Intercells success resulted from partnering: it was a smart way of

early risk diversification.

Finally, when the company beat the odds and had success with its first product, the

seasoned management team was prepared.Its no use having a product and not knowing

what to do with it. The team at Intercell was lucky because the first product was successful.

But you create your own luckand I and the other members of Intercells team saw an

opportunity and capitalized on it. WL

You might also like

- Venture Catalyst (Review and Analysis of Laurie's Book)From EverandVenture Catalyst (Review and Analysis of Laurie's Book)No ratings yet

- CE Articles ReviewDocument10 pagesCE Articles ReviewNiharika YadavNo ratings yet

- 5 Steps To Successfully Collaborate With StartupsDocument31 pages5 Steps To Successfully Collaborate With StartupsllanojairoNo ratings yet

- Innovation ExamplesDocument5 pagesInnovation ExamplesMahmoud RefaatNo ratings yet

- Innovation and Disruption: Unleashing the Power of Creative Thinking in BusinessFrom EverandInnovation and Disruption: Unleashing the Power of Creative Thinking in BusinessNo ratings yet

- Stumbling Into Entrepreneurship: Lessons For Success. The mindset needed to become your own bossFrom EverandStumbling Into Entrepreneurship: Lessons For Success. The mindset needed to become your own bossNo ratings yet

- Only the Paranoid Survive (Review and Analysis of Grove's Book)From EverandOnly the Paranoid Survive (Review and Analysis of Grove's Book)No ratings yet

- Lessons from Private Equity Any Company Can UseFrom EverandLessons from Private Equity Any Company Can UseRating: 4.5 out of 5 stars4.5/5 (12)

- Summary and Analysis of The Innovator's Dilemma: When New Technologies Cause Great Firms to Fail: Based on the Book by Clayton ChristensenFrom EverandSummary and Analysis of The Innovator's Dilemma: When New Technologies Cause Great Firms to Fail: Based on the Book by Clayton ChristensenRating: 4.5 out of 5 stars4.5/5 (5)

- InnovMgmt - AssignmentDocument19 pagesInnovMgmt - AssignmentAngelika BautistaNo ratings yet

- How Corporations Can Partner with Startups to Drive InnovationDocument49 pagesHow Corporations Can Partner with Startups to Drive Innovationseti2016No ratings yet

- Entrepreneurship Management FINALDocument12 pagesEntrepreneurship Management FINALshahaayushi2704No ratings yet

- Biobusines Plan: Ernst & YoungDocument16 pagesBiobusines Plan: Ernst & YoungBeatriz MontaneNo ratings yet

- The Explainer: Technopreneurship: January 2018Document18 pagesThe Explainer: Technopreneurship: January 2018Roselyn Jane Ramos OloresNo ratings yet

- PHD Thesis Venture CapitalDocument7 pagesPHD Thesis Venture Capitald0t1f1wujap3100% (2)

- Innovating Through The Downturn Booz 010509Document4 pagesInnovating Through The Downturn Booz 010509Tamar DayanNo ratings yet

- Is Your Innovation Breaking DownDocument3 pagesIs Your Innovation Breaking Downma ChakaNo ratings yet

- Term PaperDocument7 pagesTerm Paperuniteddesyibel2018No ratings yet

- Lead and Disrupt: How to Solve the Innovator's Dilemma, Second EditionFrom EverandLead and Disrupt: How to Solve the Innovator's Dilemma, Second EditionRating: 5 out of 5 stars5/5 (1)

- Chapter 1Document15 pagesChapter 1marjanNo ratings yet

- Fundamentals of EntrepreneurshipDocument11 pagesFundamentals of EntrepreneurshipKiki KymsNo ratings yet

- New Venture Creation - Chapter 8Document32 pagesNew Venture Creation - Chapter 8elizlewin95100% (3)

- Innovation Management Framework for Business Success & GrowthDocument14 pagesInnovation Management Framework for Business Success & GrowthDivya KiranNo ratings yet

- Entrepreneurship Thesis TitleDocument7 pagesEntrepreneurship Thesis Titlemelanierussellvirginiabeach100% (2)

- Start BusinessDocument3 pagesStart BusinessBayari E EricNo ratings yet

- The Business of Innovation: Managing the Corporate Imagination for Maximum ResultsFrom EverandThe Business of Innovation: Managing the Corporate Imagination for Maximum ResultsNo ratings yet

- Innovación FinalDocument20 pagesInnovación FinalVictor CorderoNo ratings yet

- Innovation ManagementDocument15 pagesInnovation ManagementJustin Abad FernandezNo ratings yet

- Integrated Innovation PLIDocument5 pagesIntegrated Innovation PLISnehasish SamaddarNo ratings yet

- ANDREI JUSTINE SALES - Assign GazelleDocument4 pagesANDREI JUSTINE SALES - Assign GazelleAndrjstne SalesNo ratings yet

- Creating Innovation Spaces: Impulses for Start-ups and Established Companies in Global CompetitionFrom EverandCreating Innovation Spaces: Impulses for Start-ups and Established Companies in Global CompetitionVolker NestleNo ratings yet

- The Innovator's Solution (Review and Analysis of Christensen and Raynor's Book)From EverandThe Innovator's Solution (Review and Analysis of Christensen and Raynor's Book)No ratings yet

- White Paper Innovation 1108Document7 pagesWhite Paper Innovation 1108Satish RaoNo ratings yet

- What Every CEO Should Know About Creating New BusinessesDocument3 pagesWhat Every CEO Should Know About Creating New Businessesmozenrat20No ratings yet

- Entrep Chapter 1 LessonDocument25 pagesEntrep Chapter 1 LessonMyrna Delos Santos AbuniawanNo ratings yet

- Building An Innovation DynastyDocument13 pagesBuilding An Innovation Dynastynach66No ratings yet

- Name: Samuel Dave D. Heroy Course & Year: BSIT - IV Id Number: 17-0111-720Document4 pagesName: Samuel Dave D. Heroy Course & Year: BSIT - IV Id Number: 17-0111-720Andrjstne SalesNo ratings yet

- Module 1: The Entrepreneurial MindsetDocument18 pagesModule 1: The Entrepreneurial MindsetSamillano Bajala Rolen100% (1)

- 1.3 You Need An Innovation StrategyDocument16 pages1.3 You Need An Innovation StrategySiti Hazirah SemuminNo ratings yet

- Building an innovation culture - KPMG GlobalDocument4 pagesBuilding an innovation culture - KPMG GlobalVaaniNo ratings yet

- Comprehensive Review of Big and Small Firm Strengths and WeaknessesDocument15 pagesComprehensive Review of Big and Small Firm Strengths and WeaknessesTayyab AhmadNo ratings yet

- About InnovationDocument7 pagesAbout InnovationFrederick Fanen UkulaNo ratings yet

- Thesis Entrepreneurship DevelopmentDocument7 pagesThesis Entrepreneurship Developmentmandyfroemmingfargo100% (2)

- 8 Workplace Challenges and How To Overcome ThemDocument13 pages8 Workplace Challenges and How To Overcome Themchrmolc2022No ratings yet

- Entrepreneurial MindsetDocument9 pagesEntrepreneurial Mindsetjenielyn madarangNo ratings yet

- The Strategic Role of Accountants in New Product DevelopmentDocument6 pagesThe Strategic Role of Accountants in New Product DevelopmentandychukseNo ratings yet

- The Entrepreneurship 2024: How to adopt mindset for EntrepreneurshipFrom EverandThe Entrepreneurship 2024: How to adopt mindset for EntrepreneurshipNo ratings yet

- Basics of Innovation in Business: Business Success Secrets SeriesFrom EverandBasics of Innovation in Business: Business Success Secrets SeriesNo ratings yet

- Entrepreneurship book in hindi pdf download guideDocument3 pagesEntrepreneurship book in hindi pdf download guideSundar MauryaNo ratings yet

- Entrepreneurship (1st Term Notes)Document4 pagesEntrepreneurship (1st Term Notes)azfarulhaqNo ratings yet

- The Entrepreneurial MindsetDocument10 pagesThe Entrepreneurial Mindsetdarkmontero8285No ratings yet

- New Venture Consulting: Insight Paper 1: Santhosh Srinivas GJ21TM026 Individual Assignment-1Document5 pagesNew Venture Consulting: Insight Paper 1: Santhosh Srinivas GJ21TM026 Individual Assignment-1SANTHOSH SRINIVASNo ratings yet

- The Multimillion-Dollar Business Idea: An Entrepreneur’s Guide to SuccessFrom EverandThe Multimillion-Dollar Business Idea: An Entrepreneur’s Guide to SuccessNo ratings yet

- Techno Preneur ShipDocument33 pagesTechno Preneur ShipJohn Billy EscardaNo ratings yet

- The 10x Growth Machine: How established companies create new waves of growthFrom EverandThe 10x Growth Machine: How established companies create new waves of growthNo ratings yet

- Strategic Alliances: Three Ways to Make Them WorkFrom EverandStrategic Alliances: Three Ways to Make Them WorkRating: 3.5 out of 5 stars3.5/5 (1)

- (2018) Building An Innovation Culture - KPMG GlobalDocument4 pages(2018) Building An Innovation Culture - KPMG GlobalHon CheongNo ratings yet

- EntrepreneurshipDocument6 pagesEntrepreneurshiptommybrookNo ratings yet

- Strategies For Self-Care and Developing Resilience in NursesDocument2 pagesStrategies For Self-Care and Developing Resilience in NursesOluwasegun ModupeNo ratings yet

- MASc PHD Living Expenses and International TuitionDocument4 pagesMASc PHD Living Expenses and International TuitionOluwasegun ModupeNo ratings yet

- ImperialDocument1 pageImperialOluwasegun ModupeNo ratings yet

- Presentazione Standard1Document4 pagesPresentazione Standard1Oluwasegun ModupeNo ratings yet

- Tetfund Annexxure 1 FormDocument2 pagesTetfund Annexxure 1 FormOluwasegun Modupe89% (9)

- Tissue Engineering II. ScaffoldsDocument11 pagesTissue Engineering II. ScaffoldsOluwasegun ModupeNo ratings yet

- Fisher, Functional Tissue Engineering ofDocument29 pagesFisher, Functional Tissue Engineering ofAdhit Setya HutamaNo ratings yet

- CIP Tanks Antifoam: Line Key DescriptionDocument1 pageCIP Tanks Antifoam: Line Key DescriptionOluwasegun ModupeNo ratings yet

- Microbial Physiology and Biochemistry Part 1: Enzymes and Membrane TransportDocument9 pagesMicrobial Physiology and Biochemistry Part 1: Enzymes and Membrane TransportOluwasegun ModupeNo ratings yet

- TB TransmissionDocument468 pagesTB TransmissionOluwasegun Modupe100% (1)

- Growth Factor For Bone RegenerationDocument17 pagesGrowth Factor For Bone RegenerationOluwasegun ModupeNo ratings yet

- Presentation 1Document1 pagePresentation 1Oluwasegun ModupeNo ratings yet

- Shell Imperial Membranes PHDDocument1 pageShell Imperial Membranes PHDOluwasegun ModupeNo ratings yet

- Scaffold For Bone Tissue RegenerationDocument13 pagesScaffold For Bone Tissue RegenerationOluwasegun ModupeNo ratings yet

- Oxidative Stress in Aquatic EcosystemsDocument2 pagesOxidative Stress in Aquatic EcosystemsOluwasegun ModupeNo ratings yet

- Joyner-Matos Et Al. 2013 CBPADocument3 pagesJoyner-Matos Et Al. 2013 CBPAOluwasegun ModupeNo ratings yet

- FTPDocument11 pagesFTPOluwasegun ModupeNo ratings yet

- Industry Perspective FDA Draft ValidationDocument6 pagesIndustry Perspective FDA Draft ValidationOluwasegun ModupeNo ratings yet

- FTPDocument11 pagesFTPOluwasegun ModupeNo ratings yet

- Bone EngineeringDocument1 pageBone EngineeringOluwasegun ModupeNo ratings yet

- Deindoerfer and HumphreyDocument9 pagesDeindoerfer and HumphreyOluwasegun ModupeNo ratings yet

- Tissue Engineering II. ScaffoldsDocument11 pagesTissue Engineering II. ScaffoldsOluwasegun ModupeNo ratings yet

- Islam The True ReligionDocument3 pagesIslam The True ReligionOluwasegun ModupeNo ratings yet

- Scaffold in Tissue EngDocument13 pagesScaffold in Tissue EngOluwasegun ModupeNo ratings yet

- Group Two'S Seminar Work: Topic: Enzyme Regulation Allosteric Regulation and Models OutlineDocument13 pagesGroup Two'S Seminar Work: Topic: Enzyme Regulation Allosteric Regulation and Models OutlineOluwasegun ModupeNo ratings yet

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Nelson and CoxDocument1 pageNelson and CoxOluwasegun ModupeNo ratings yet

- Deloitte Supply Chain Analytics WorkbookDocument0 pagesDeloitte Supply Chain Analytics Workbookneojawbreaker100% (1)

- AdvancingDocument114 pagesAdvancingnde90No ratings yet

- FEU V TrajanoDocument1 pageFEU V TrajanoPeperonii0% (2)

- 1Document10 pages1himanshu guptaNo ratings yet

- G.R. No. 161759, July 02, 2014Document9 pagesG.R. No. 161759, July 02, 2014Elaine Villafuerte AchayNo ratings yet

- MD - Nasir Uddin CVDocument4 pagesMD - Nasir Uddin CVশুভবর্ণNo ratings yet

- Jesd 48 BDocument10 pagesJesd 48 BLina GanNo ratings yet

- Annex D Internship Contract AgreementDocument7 pagesAnnex D Internship Contract AgreementCamille ValdezNo ratings yet

- Living To Work: What Do You Really Like? What Do You Want?"Document1 pageLiving To Work: What Do You Really Like? What Do You Want?"John FoxNo ratings yet

- Allen Solly (Retail Managemant Project Phase 1) (Chandrakumar 1501009)Document9 pagesAllen Solly (Retail Managemant Project Phase 1) (Chandrakumar 1501009)Chandra KumarNo ratings yet

- MOTIVATION - Strategy For UPSC Mains and Tips For Answer Writing - Kumar Ashirwad, Rank 35 CSE - 2015 - InSIGHTSDocument28 pagesMOTIVATION - Strategy For UPSC Mains and Tips For Answer Writing - Kumar Ashirwad, Rank 35 CSE - 2015 - InSIGHTSDhiraj Kumar PalNo ratings yet

- Management TheoryDocument63 pagesManagement TheoryFaisal Ibrahim100% (2)

- Hotel PlanDocument19 pagesHotel Planlucky zee100% (2)

- ERP at BPCL SummaryDocument3 pagesERP at BPCL SummaryMuneek ShahNo ratings yet

- 048 Barayuga V AupDocument3 pages048 Barayuga V AupJacob DalisayNo ratings yet

- Personal Finance Canadian Canadian 5th Edition Kapoor Test BankDocument25 pagesPersonal Finance Canadian Canadian 5th Edition Kapoor Test BankMollyMoralescowyxefb100% (43)

- FM S Summer Placement Report 2024Document12 pagesFM S Summer Placement Report 2024AladeenNo ratings yet

- SGI Monthly Newsletter Title Under 40 CharactersDocument13 pagesSGI Monthly Newsletter Title Under 40 Charactersgj4uNo ratings yet

- Starting A Caf or Coffee Shop BusinessDocument11 pagesStarting A Caf or Coffee Shop Businessastral05No ratings yet

- Solid Edge Mold ToolingDocument3 pagesSolid Edge Mold ToolingVetrivendhan SathiyamoorthyNo ratings yet

- Catalogue 2012 Edition 6.1 (2012-11) PDFDocument382 pagesCatalogue 2012 Edition 6.1 (2012-11) PDFTyra SmithNo ratings yet

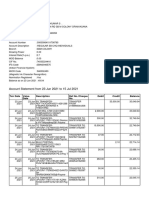

- Account Statement From 23 Jun 2021 To 15 Jul 2021Document8 pagesAccount Statement From 23 Jun 2021 To 15 Jul 2021R S enterpriseNo ratings yet

- Magnus - The Heart of SuccessDocument12 pagesMagnus - The Heart of SuccessClint MendozaNo ratings yet

- Case Study: When in RomaniaDocument3 pagesCase Study: When in RomaniaAle IvanovNo ratings yet

- Nike's Winning Ways-Hill and Jones 8e Case StudyDocument16 pagesNike's Winning Ways-Hill and Jones 8e Case Studyraihans_dhk3378100% (2)

- VivithaDocument53 pagesVivithavajoansaNo ratings yet

- Washer For Piston Screw: Service LetterDocument2 pagesWasher For Piston Screw: Service LetterRonald Bienemi PaezNo ratings yet

- Google SWOT 2013Document4 pagesGoogle SWOT 2013Galih Eka PutraNo ratings yet

- Prince2 - Sample Paper 1Document16 pagesPrince2 - Sample Paper 1ikrudisNo ratings yet

- Partnership Worksheet 7Document4 pagesPartnership Worksheet 7Timo wernereNo ratings yet