Professional Documents

Culture Documents

Michigan Finance Authority Successfully Sells Bonds On Behalf of The Public Lighting Authority

Uploaded by

Michigan News0 ratings0% found this document useful (0 votes)

94 views2 pagesMichigan Finance Authority Sells $185 million in bonds on behalf of Public Lighting Authority. The long-term, fixed rate financing refunded the $60 million interim financing. The issuance received strong investment grade ratings of "A-" from Standard and poor's.

Original Description:

Original Title

Michigan Finance Authority Successfully Sells Bonds on Behalf of the Public Lighting Authority

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMichigan Finance Authority Sells $185 million in bonds on behalf of Public Lighting Authority. The long-term, fixed rate financing refunded the $60 million interim financing. The issuance received strong investment grade ratings of "A-" from Standard and poor's.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

94 views2 pagesMichigan Finance Authority Successfully Sells Bonds On Behalf of The Public Lighting Authority

Uploaded by

Michigan NewsMichigan Finance Authority Sells $185 million in bonds on behalf of Public Lighting Authority. The long-term, fixed rate financing refunded the $60 million interim financing. The issuance received strong investment grade ratings of "A-" from Standard and poor's.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Today at 4:42 PM

--- PRESS RELEASE ---

For Immediate Release

June 25, 2014 Contact: Jeremy Sampson, Treasury (517) 335-2167

Sara Wurfel, Governor (517) 335-6397

Kelsey Hartung, Berg Muirhead and Associates (313) 872-2202

Michigan Finance Authority Successfully

Sells Bonds on Behalf of the Public

Lighting Authority

Permanent Financing Allows for Completion of Street Lighting Project

in the City of Detroit

The Michigan Finance Authority (MFA) Wednesday sold $185 million in bonds on

behalf of the Public Lighting Authority (PLA) through its Local Government Loan

Program to complete the funding necessary to relight the streets of Detroit.

The long-term, fixed rate financing refunded the $60 million interim financing sold in

December 2013 and provides additional funds for the completion of the street lighting

project. The issuance received strong investment grade ratings of A-from Standard

and Poors and BBB+ from Fitch. Both agencies highlighted the legal and statutory

strengths of the transaction.

Lighting is an essential component to revitalizing Detroit, said Governor Rick

Snyder. Not only is it important to public safety, but it is a demonstration of the real

improvements happening in the City every day.

The interim financing has allowed for the construction of 9,000 new street lights to

date. The remaining 55,000 will be funded from this issuance.

As anticipated, investors did their homework and demonstrated an appreciation for the

credit strength of our deal, said Odis Jones, Chief Executive Officer of the

PLA. Every week we are adding 500 state of the art, LED lights throughout the

City. As a result the new system will be far more reliable and energy efficient than

what was here before. We are investing in the latest technology to ensure the system is

built to last for our citizens.

Investor demand was robust across the transaction, which was 2.5 times

oversubscribed, allowing yields to be lowered during the pricing process. 35 separate

institutions and several dozen individual retail accounts placed orders for the bonds,

resulting in an all-in interest cost of 4.53% for the 30-year transaction.

This project has been a priority for the state, and the MFA was proud to have assisted

the PLA to reach its financing goals, said Joseph Fielek, Executive director of the

MFA. It was important to us to find a long-term solution at a low cost, and we have

achieved those objectives. It highlights the ability of communities to finance essential

projects during financially challenging times if a bond issuance is well structured.

The MFA offers effective low-cost financing to public and private agencies providing

essential services to the citizens of Michigan, including municipalities, healthcare

providers, public, private, and charter schools, higher education and loans to college

students.

Citibank served as the senior manager on the transaction and BMO and Loop Capital

were co-managers. Dickinson Wright served as Bond Counsel to the MFA and Miller

Canfield served as Bond Counsel to the PLA. Robert W. Baird & Co. served as the

Municipal Advisor.

# # # #

You might also like

- To Our Customers: DuMouchellesDocument1 pageTo Our Customers: DuMouchellesMichigan NewsNo ratings yet

- MPSC Fines DTE Energy $840,000 For Improper Billing, ShutoffsDocument2 pagesMPSC Fines DTE Energy $840,000 For Improper Billing, ShutoffsMichigan NewsNo ratings yet

- Lincoln Park Man To Pay $45,650 in Restitution For Embezzling Charitable Groups' FundsDocument2 pagesLincoln Park Man To Pay $45,650 in Restitution For Embezzling Charitable Groups' FundsMichigan NewsNo ratings yet

- Massage Therapist Summarily Suspended For Criminal Sexual ConductDocument1 pageMassage Therapist Summarily Suspended For Criminal Sexual ConductMichigan NewsNo ratings yet

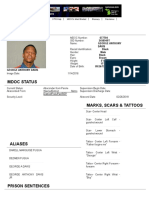

- Offender Tracking Information System (OTIS) - Offender ProfileDocument2 pagesOffender Tracking Information System (OTIS) - Offender ProfileMichigan NewsNo ratings yet

- Michigan Liquor Control Commission Suspends Oakland County Gas Station's Liquor License For 102 DaysDocument1 pageMichigan Liquor Control Commission Suspends Oakland County Gas Station's Liquor License For 102 DaysMichigan NewsNo ratings yet

- Schuette Seven Current and Former Police Officers Charged With 101 Felony Counts Related To Fraudulent Auto InspectionsDocument3 pagesSchuette Seven Current and Former Police Officers Charged With 101 Felony Counts Related To Fraudulent Auto InspectionsMichigan NewsNo ratings yet

- Schuette Files For Reinstatement of Charges Against CMU Sexual Assault Suspect, New Court Date SetDocument1 pageSchuette Files For Reinstatement of Charges Against CMU Sexual Assault Suspect, New Court Date SetMichigan NewsNo ratings yet

- Schuette Charges Two in Insurance Fraud Scheme After Joint Investigation With Department of Insurance and Financial ServicesDocument2 pagesSchuette Charges Two in Insurance Fraud Scheme After Joint Investigation With Department of Insurance and Financial ServicesMichigan NewsNo ratings yet

- Shots FiredDocument2 pagesShots FiredMichigan NewsNo ratings yet

- West Michigan Physician Summarily Suspended For Alleged Criminal Sexual Conduct With PatientsDocument1 pageWest Michigan Physician Summarily Suspended For Alleged Criminal Sexual Conduct With PatientsMichigan NewsNo ratings yet

- Tuberculosis Exposure at Three Southeast Michigan Healthcare Facilities Being InvestigatedDocument2 pagesTuberculosis Exposure at Three Southeast Michigan Healthcare Facilities Being InvestigatedMichigan NewsNo ratings yet

- ShootingsDocument4 pagesShootingsMichigan NewsNo ratings yet

- $18M in Federal Grants Available To Public and Non-Profit Groups To Provide Services To Crime VictimsDocument2 pages$18M in Federal Grants Available To Public and Non-Profit Groups To Provide Services To Crime VictimsMichigan NewsNo ratings yet

- Detroit Crime Blotter For Thursday, March 21, 2018Document18 pagesDetroit Crime Blotter For Thursday, March 21, 2018Michigan NewsNo ratings yet

- Lt. Gov. Calley: Nearly 5,700 Naloxone Orders Dispensed in Last Six Months 1,800 Through Standing OrderDocument2 pagesLt. Gov. Calley: Nearly 5,700 Naloxone Orders Dispensed in Last Six Months 1,800 Through Standing OrderMichigan NewsNo ratings yet

- Southfield Physician's Controlled Substance License Summarily Suspended For OverprescribingDocument1 pageSouthfield Physician's Controlled Substance License Summarily Suspended For OverprescribingMichigan NewsNo ratings yet

- Michigan's Statewide Graduation Rate Hits 80 Percent Graduation Rate Increases 0.53 Percent, Dropout Rate DeclinesDocument3 pagesMichigan's Statewide Graduation Rate Hits 80 Percent Graduation Rate Increases 0.53 Percent, Dropout Rate DeclinesMichigan NewsNo ratings yet

- Detroit Pharmacist Summarily Suspended For $6 Million Health Care and Wire FraudDocument1 pageDetroit Pharmacist Summarily Suspended For $6 Million Health Care and Wire FraudMichigan NewsNo ratings yet

- Detroit Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesDocument1 pageDetroit Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesMichigan NewsNo ratings yet

- 2018 Lake Sturgeon Season On Black Lake Begins Feb. 3 at 8 A.M.Document3 pages2018 Lake Sturgeon Season On Black Lake Begins Feb. 3 at 8 A.M.Michigan NewsNo ratings yet

- DNR Deer Poaching Investigation Results in Sentencing of Allegan County ManDocument2 pagesDNR Deer Poaching Investigation Results in Sentencing of Allegan County ManMichigan NewsNo ratings yet

- Prosecutor Worthy Charges Police Officers With Murder, Misconduct and Other ChargesDocument7 pagesProsecutor Worthy Charges Police Officers With Murder, Misconduct and Other ChargesMichigan NewsNo ratings yet

- State Police Motor Carrier Officers Join Forces To Fight Human TraffickingDocument1 pageState Police Motor Carrier Officers Join Forces To Fight Human TraffickingMichigan NewsNo ratings yet

- Schuette: Orchard Lake Restaurant Sushi Samurai Sentenced in Tax Embezzlement Scheme, Owners Will Pay Almost $1 Million in RestitutionDocument2 pagesSchuette: Orchard Lake Restaurant Sushi Samurai Sentenced in Tax Embezzlement Scheme, Owners Will Pay Almost $1 Million in RestitutionMichigan NewsNo ratings yet

- West Nile Virus Found in Michigan Ruffed GrouseDocument6 pagesWest Nile Virus Found in Michigan Ruffed GrouseMichigan NewsNo ratings yet

- Meijer Joins Growing Group of Retail Pharmacies To Integrate With MAPS To Prevent Opioid AbuseDocument2 pagesMeijer Joins Growing Group of Retail Pharmacies To Integrate With MAPS To Prevent Opioid AbuseMichigan NewsNo ratings yet

- Livonia Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesDocument2 pagesLivonia Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesMichigan NewsNo ratings yet

- Have You Been The Victim of Sexual Harassment? Consider Filing A Complaint Under Michigan Civil Rights LawDocument3 pagesHave You Been The Victim of Sexual Harassment? Consider Filing A Complaint Under Michigan Civil Rights LawMichigan NewsNo ratings yet

- State Police To Participate in Multi-State Commercial Vehicle Enforcement Operation Involving I-94Document2 pagesState Police To Participate in Multi-State Commercial Vehicle Enforcement Operation Involving I-94Michigan NewsNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument12 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSiddhant A. KhankalNo ratings yet

- The First ICO With 200 Million Active SersDocument1 pageThe First ICO With 200 Million Active SersSunny DineshNo ratings yet

- Macro Environment and PESTDocument11 pagesMacro Environment and PESTSai SabariNo ratings yet

- Pat - CodalDocument33 pagesPat - CodalLeyy De GuzmanNo ratings yet

- Contact: Email Id:: Vinod Kumar MishraDocument2 pagesContact: Email Id:: Vinod Kumar MishraRajkumar CNo ratings yet

- Solution Manual For Managerial Economics 12th Edition by HirscheyDocument37 pagesSolution Manual For Managerial Economics 12th Edition by Hirscheytubuloseabeyant4v9n100% (12)

- 2018MNRC Template Aibl 181015Document17 pages2018MNRC Template Aibl 181015Jackielyn PachesNo ratings yet

- PPM MCQDocument109 pagesPPM MCQM.t.s.k.tejesh100% (2)

- Nebosh IG2 Risk Assessment Rigging Site PDFDocument16 pagesNebosh IG2 Risk Assessment Rigging Site PDFNishanthNo ratings yet

- Avocado Women Group Poultry Farming ProjectDocument5 pagesAvocado Women Group Poultry Farming ProjectMoses TarkoNo ratings yet

- Feasibility Study Example 35Document132 pagesFeasibility Study Example 35Cyrene JamesNo ratings yet

- Mechanized Methods of Work Transport in Material HandlingDocument3 pagesMechanized Methods of Work Transport in Material Handlingolyad ahmedinNo ratings yet

- Go-Kart Tire Production ExamDocument4 pagesGo-Kart Tire Production ExamCheick Omar CompaoreNo ratings yet

- OD427065186294445100Document3 pagesOD427065186294445100AmritNo ratings yet

- Environmental plan for highway projectDocument36 pagesEnvironmental plan for highway projectkikiau91% (11)

- Acco 20073 - Cost Accounting & Control: ApplicationsDocument23 pagesAcco 20073 - Cost Accounting & Control: ApplicationsMaria Kathreena Andrea AdevaNo ratings yet

- J Kotter Accelerating Change at MicrosoftDocument4 pagesJ Kotter Accelerating Change at MicrosoftmarijaNo ratings yet

- SWIFTDocument15 pagesSWIFTArushi Gupta100% (2)

- 2020 Tysons Annual ReportDocument198 pages2020 Tysons Annual ReportBenjamin WilesNo ratings yet

- Delta Life Insurance Company LimitedDocument79 pagesDelta Life Insurance Company LimitedKS BiplobNo ratings yet

- C. I - A II - C: B. People Prefer To Keep Their Wealth in Relativel !table F Orei"n C#rrencDocument14 pagesC. I - A II - C: B. People Prefer To Keep Their Wealth in Relativel !table F Orei"n C#rrencRica RegorisNo ratings yet

- Commercial Bank PDFDocument13 pagesCommercial Bank PDFTanhaNo ratings yet

- Conduct SWOT analysis and critique ABSA's sustainabilityDocument6 pagesConduct SWOT analysis and critique ABSA's sustainabilitystanely ndlovuNo ratings yet

- Market IntegrationDocument11 pagesMarket IntegrationEllie EileithyiaNo ratings yet

- A3 2014 - Compliance Dept.: Focus: Labor Plan 2014Document12 pagesA3 2014 - Compliance Dept.: Focus: Labor Plan 2014Yan RDNo ratings yet

- FinanceDocument7 pagesFinanceMahabbat DzhenbekovaNo ratings yet

- Gildemeister - Nef-Plus 710 / 2.000 MM Distance Between CentersDocument9 pagesGildemeister - Nef-Plus 710 / 2.000 MM Distance Between CentersMarko DekanićNo ratings yet

- Brand Management Lesson 8Document14 pagesBrand Management Lesson 8Jhagantini PalaniveluNo ratings yet

- Elementary Statistics 9th Edition Weiss Solutions ManualDocument25 pagesElementary Statistics 9th Edition Weiss Solutions ManualRyanFernandezqxzkc100% (50)

- Brief History of Radio Pakistan and its Role in Rural DevelopmentDocument2 pagesBrief History of Radio Pakistan and its Role in Rural DevelopmentSadaf Nazir75% (4)