Professional Documents

Culture Documents

Examining Exchange Rates

Uploaded by

KofikoduahCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Examining Exchange Rates

Uploaded by

KofikoduahCopyright:

Available Formats

Forces Behind Exchange Rates

Aside from factors such as interest rates and inflation, the exchange rate is one of the most important

determinants of a country's relative level of economic health. Exchange rates play a vital role in a country's

level of trade, which is critical to most every free market economy in the world. For this reason, exchange

rates are among the most watched, analyzed and governmentally manipulated economic measures. But

exchange rates matter on a smaller scale as well they impact the real return of an investor's portfolio. !ere

we look at some of the ma"or forces #ehind exchange rate movements.

Overview

Before we look at these forces, we should sketch out how exchange rate movements affect a nation's trading

relationships with other nations. A higher currency makes a country's exports more expensive and imports

cheaper in foreign markets$ a lower currency makes a country's exports cheaper and its imports more

expensive in foreign markets. A higher exchange rate can #e expected to lower the country's #alance of

trade, while a lower exchange rate would increase it.

Determinants of Exchange Rates

%umerous factors determine exchange rates, and all are related to the trading relationship #etween two

countries. &emem#er, exchange rates are relative, and are expressed as a comparison of the currencies of

two countries. 'he following are some of the principal determinants of the exchange rate #etween two

countries. %ote that these factors are in no particular order$ like many aspects of economics, the relative

importance of these factors is su#"ect to much de#ate.

1. Differentials in inflation: As a rule of thum#, a country with a consistently lower inflation rate exhi#its a

rising currency value, as its purchasing power increases relative to other currencies. (uring the last half of

the twentieth century, the countries with low inflation included )apan, *ermany and +witzerland, while the

,.+. and -anada achieved low inflation only later. 'hose countries with higher inflation typically see

depreciation in their currency in relation to the currencies of their trading partners. 'his is also usually

accompanied #y higher interest rates. .'o learn more, see Cost-Push Inflation Versus Demand-Pull Inflation./

2. Differentials in interest rates: 0nterest rates, inflation and exchange rates are all highly correlated. By

manipulating interest rates, central #anks exert influence over #oth inflation and exchange rates, and

changing interest rates impact inflation and currency values. !igher interest rates offer lenders in an economy

a higher return relative to other countries. 'herefore, higher interest rates attract foreign capital and cause the

exchange rate to rise. 'he impact of higher interest rates is mitigated, however, if inflation in the country is

much higher than in others, or if additional factors serve to drive the currency down. 'he opposite relationship

exists for decreasing interest rates 1 that is, lower interest rates tend to decrease exchange rates. .For further

reading, see What Is Fiscal Policy?/

3. Crrent!accont deficits: 'he current account is the #alance of trade #etween a country and its trading

partners .see Understanding The Current Account In The Balance f Payments/, reflecting all payments

#etween countries for goods, services, interest and dividends. A deficit in the current account shows the

country is spending more on foreign trade than it is earning, and that it is #orrowing capital from foreign

sources to make up the deficit. 0n other words, the country re2uires more foreign currency than it receives

through sales of exports, and it supplies more of its own currency than foreigners demand for its products.

'he excess demand for foreign currency lowers the country's exchange rate until domestic goods and

services are cheap enough for foreigners, and foreign assets are too expensive to generate sales for

domestic interests.

". #$lic de$t: -ountries will engage in large1scale deficit financing to pay for pu#lic sector pro"ects and

governmental funding. 3hile such activity stimulates the domestic economy, nations with large pu#lic deficits

and de#ts are less attractive to foreign investors. 'he reason4 A large de#t encourages inflation, and if

inflation is high, the de#t will #e serviced and ultimately paid off with cheaper real dollars in the future.

0n the worst case scenario, a government may print money to pay part of a large de#t, #ut increasing the

money supply inevita#ly causes inflation. 5oreover, if a government is not a#le to service its deficit through

domestic means .selling domestic #onds, increasing the money supply/, then it must increase the supply of

securities for sale to foreigners, there#y lowering their prices. Finally, a large de#t may prove worrisome to

foreigners if they #elieve the country risks defaulting on its o#ligations. Foreigners will #e less willing to own

securities denominated in that currency if the risk of default is great. For this reason, the country's de#t rating

.as determined #y 5oody's or +tandard 6 7oor's, for example/ is a crucial determinant of its exchange rate.

%. &erms of trade: A ratio comparing export prices to import prices, the terms of trade is related to current

accounts and the #alance of payments. 0f the price of a country's exports rises #y a greater rate than that of

its imports, its terms of trade have favoura#ly improved. 0ncreasing terms of trade shows greater demand for

the country's exports. 'his, in turn, results in rising revenues from exports, which provides increased demand

for the country's currency .and an increase in the currency's value/. 0f the price of exports rises #y a smaller

rate than that of its imports, the currency's value will decrease in relation to its trading partners.

'. #olitical sta$ilit( and economic )erformance: Foreign investors inevita#ly seek out sta#le countries with

strong economic performance in which to invest their capital. A country with such positive attri#utes will draw

investment funds away from other countries perceived to have more political and economic risk. 7olitical

turmoil, for example, can cause a loss of confidence in a currency and a movement of capital to the

currencies of more sta#le countries.

Conclsion

'he exchange rate of the currency in which a portfolio holds the #ulk of its investments determines that

portfolio's real return. A declining exchange rate o#viously decreases the purchasing power of income and

capital gains derived from any returns. 5oreover, the exchange rate influences other income factors such as

interest rates, inflation and even capital gains from domestic securities. 3hile exchange rates are determined

#y numerous complex factors that often leave even the most experienced economists flummoxed, investors

should still have some understanding of how currency values and exchange rates play an important role in

the rate of return on their investments.

You might also like

- Constant Capital Ghana Inflation Index UpdateDocument2 pagesConstant Capital Ghana Inflation Index UpdateKofikoduahNo ratings yet

- Welcome IVRDocument1 pageWelcome IVRKofikoduahNo ratings yet

- Cocktail Menus - GH NEWDocument5 pagesCocktail Menus - GH NEWKofikoduahNo ratings yet

- Update On Series 7 ApplicabilityDocument1 pageUpdate On Series 7 ApplicabilityKofikoduahNo ratings yet

- JPM DCMDocument1 pageJPM DCMKofikoduahNo ratings yet

- The Rothschild FoundationDocument28 pagesThe Rothschild FoundationKofikoduah100% (1)

- Tullow Oil 2013 Investor Forum FINAL2Document22 pagesTullow Oil 2013 Investor Forum FINAL2KofikoduahNo ratings yet

- Update On Series 7 ApplicabilityDocument1 pageUpdate On Series 7 ApplicabilityKofikoduahNo ratings yet

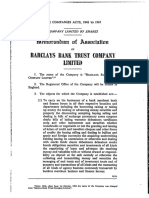

- Barclays Bank TrustDocument18 pagesBarclays Bank TrustKofikoduahNo ratings yet

- Business Rescue PlanDocument21 pagesBusiness Rescue PlanKofikoduahNo ratings yet

- Scribd Definition of SubstantialDocument1 pageScribd Definition of SubstantialKofikoduahNo ratings yet

- SDT Model Trust Deed December2012 (Recovered)Document24 pagesSDT Model Trust Deed December2012 (Recovered)KofikoduahNo ratings yet

- VDA ConnectDocument1 pageVDA ConnectKofikoduahNo ratings yet

- How To Model RothschildDocument1 pageHow To Model RothschildKofikoduahNo ratings yet

- Introduction To Exploration and ProductionDocument1 pageIntroduction To Exploration and ProductionKofikoduahNo ratings yet

- Kiddos FX Arb LinksDocument1 pageKiddos FX Arb LinksKofikoduahNo ratings yet

- Asset SwapDocument1 pageAsset SwapKofikoduahNo ratings yet

- Eqty RSRCHDocument1 pageEqty RSRCHKofikoduahNo ratings yet

- Volans CDO PitchDocument1 pageVolans CDO PitchKofikoduahNo ratings yet

- KKS CallingDocument1 pageKKS CallingKofikoduahNo ratings yet

- Stylistics and MeDocument1 pageStylistics and MeKofikoduahNo ratings yet

- DCM OverviewDocument1 pageDCM OverviewKofikoduahNo ratings yet

- Structured NotesDocument20 pagesStructured NotesjosecambaNo ratings yet

- For The Glencore MTN ProgramDocument1 pageFor The Glencore MTN ProgramKofikoduahNo ratings yet

- Wholesale Power Markets in The United StatesDocument60 pagesWholesale Power Markets in The United StatesKofikoduahNo ratings yet

- Triangular ArbitrageDocument5 pagesTriangular ArbitrageAnil BambuleNo ratings yet

- EFGH File DLDocument1 pageEFGH File DLKofikoduahNo ratings yet

- Calculadora MentalDocument3 pagesCalculadora MentalAlex Garcia Ximenes QuintansNo ratings yet

- Triangular ArbitrageDocument5 pagesTriangular ArbitrageAnil BambuleNo ratings yet

- World Bank Financing OpportunitiesDocument21 pagesWorld Bank Financing OpportunitiesKofikoduahNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Energy and Petroleum Stats Report 2023Document58 pagesEnergy and Petroleum Stats Report 2023OdhiamboOdhiamboNo ratings yet

- BVT 1 SolDocument5 pagesBVT 1 SolJimmy JenkinsNo ratings yet

- Unit-12 Transformational Leadership PDFDocument25 pagesUnit-12 Transformational Leadership PDFJitendra GuptaNo ratings yet

- Project Report: "Transfer Pricing"Document34 pagesProject Report: "Transfer Pricing"Dev RaiNo ratings yet

- Profit CenterDocument3 pagesProfit CenterMAHENDRA SHIVAJI DHENAKNo ratings yet

- Project Feasibility Study Output-MarketingDocument8 pagesProject Feasibility Study Output-MarketingViancaPearlAmoresNo ratings yet

- A Perpetual System ToDocument16 pagesA Perpetual System ToCharmine de la CruzNo ratings yet

- Retail ManagementDocument74 pagesRetail ManagementayushdixitNo ratings yet

- Litigation Complaint 122107Document13 pagesLitigation Complaint 122107AndrewCatNo ratings yet

- Small Business Management Study Questions - CH 6 The Business Plan - Visualizing The DreamDocument19 pagesSmall Business Management Study Questions - CH 6 The Business Plan - Visualizing The DreamStacey Strickling Nash100% (1)

- SCOPE OF FCTDocument6 pagesSCOPE OF FCTPhương NguyễnNo ratings yet

- 6351 01 Que 20070118Document20 pages6351 01 Que 20070118Xin Ying LNo ratings yet

- Reading 22 InventoriesDocument58 pagesReading 22 InventoriesNeerajNo ratings yet

- Agreement DetailsDocument43 pagesAgreement DetailsTejbirNo ratings yet

- Standard Costing AnalysisDocument106 pagesStandard Costing AnalysisUsama RiazNo ratings yet

- 15-IFRS 15 - SummaryDocument6 pages15-IFRS 15 - SummaryhusseinNo ratings yet

- Examination 1Document68 pagesExamination 1Paul Antonio Rios MurrugarraNo ratings yet

- Algorithmic Trading and Quantitative StrategiesDocument7 pagesAlgorithmic Trading and Quantitative StrategiesSelly YunitaNo ratings yet

- Cityam 2012-06-26Document32 pagesCityam 2012-06-26City A.M.No ratings yet

- Unit-II Elements of Market Promotion MixDocument34 pagesUnit-II Elements of Market Promotion MixAbin VargheseNo ratings yet

- CVP Analysis Techniques for Profit PlanningDocument3 pagesCVP Analysis Techniques for Profit PlanningMadielyn Santarin MirandaNo ratings yet

- Dance Unlimited Plans To Sell 10000 Ballet Shoes ...Document2 pagesDance Unlimited Plans To Sell 10000 Ballet Shoes ...Skyler LeeNo ratings yet

- Test Bank - Chapter 16Document25 pagesTest Bank - Chapter 16Jihad NakibNo ratings yet

- Tikz Package For EconomistsDocument29 pagesTikz Package For Economistsskydiver_tf8156No ratings yet

- NseDocument18 pagesNseishan chughNo ratings yet

- The Griffons Saddlebag - BookTwo - CraftingGuideDocument70 pagesThe Griffons Saddlebag - BookTwo - CraftingGuideAusten Sprake67% (3)

- June 2021 Paper 21 Insert - 230302 - 151503Document5 pagesJune 2021 Paper 21 Insert - 230302 - 151503Vivaan KothariNo ratings yet

- Havaianas International Expansion BT Version PDFDocument15 pagesHavaianas International Expansion BT Version PDFpreeti_tak_1No ratings yet

- Slide - 10 Principles For Successful Investing by Sir John TempletonDocument24 pagesSlide - 10 Principles For Successful Investing by Sir John Templeton林耀明No ratings yet

- EProcurement System Government of IndiaDocument2 pagesEProcurement System Government of IndiaavmrNo ratings yet