Professional Documents

Culture Documents

NYS Consumer Bill of Right Regarding Tax Preparers 2010

Uploaded by

sfuss0 ratings0% found this document useful (0 votes)

182 views2 pagesAccess our Answer Center for answers to frequently asked questions. Fax-on-demand forms are available 24 hours a day, seven days a week. Lobbies, offices, meeting rooms and other facilities are accessible to persons with disabilities. To file a complaint about a tax preparer, Visit www.nystax.gov.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccess our Answer Center for answers to frequently asked questions. Fax-on-demand forms are available 24 hours a day, seven days a week. Lobbies, offices, meeting rooms and other facilities are accessible to persons with disabilities. To file a complaint about a tax preparer, Visit www.nystax.gov.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

182 views2 pagesNYS Consumer Bill of Right Regarding Tax Preparers 2010

Uploaded by

sfussAccess our Answer Center for answers to frequently asked questions. Fax-on-demand forms are available 24 hours a day, seven days a week. Lobbies, offices, meeting rooms and other facilities are accessible to persons with disabilities. To file a complaint about a tax preparer, Visit www.nystax.gov.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Need help?

Internet access: www.nystax.gov.

Consumer

Access our Answer Center for answers to

frequently asked questions; check your

refund status; check your estimated tax

Bill of Rights

Know your rights before account; download forms, publications or get tax updates

and other information. Regarding Tax Preparers

you hire a tax preparer

Fax-on-demand forms: Forms are avail-

Most tax preparers act within the law and able 24 hours a day, seven days a week.

1 800 748-3676

treat their clients fairly. But there are some

who don’t.

Telephone assistance is available from

This brochure contains important informa- 8:00 A.M. to 5:00 P.M. (eastern time),

tion about how to protect yourself when Monday through Friday.

you hire a tax preparer. Refund Status: (518) 457-5149

In-state callers without free long distance: 1 800 443-3200

(Automated service for refund status is available 24 hours

To file a complaint about a day, seven days a week)

Personal Income Tax Information Center: (518) 457-5181

a tax preparer: In-state callers without free long distance: 1 800 225-5829

To order forms and publications: (518) 457-5431

• Visit our Web site at www.nystax.gov In-state callers without free long distance: 1 800 462-8100

• Call (518) 457-2721 (in-state callers

without free long distance call Text Telephone (TTY) Hotline (for persons

with hearing and speech disabilities using

1 800 417-2678) a TTY): If you have access to a TTY,

• If your preparer is located in New York contact us at 1 800 634-2110. If you do not own a TTY,

check with independent living centers or community

City, contact the NYC Department of action programs to find out where machines are available

Consumer Affairs by calling 311 or for public use.

(212) NEW-YORK from outside

New York City Persons with disabilities: In compliance

with the Americans with Disabilities Act,

we will ensure that our lobbies, offices,

meeting rooms and other facilities are

accessible to persons with disabilities. If you have

questions about special accommodations for persons Para espanol: Veya la publicación 135-SP,

with disabilities, call the information center. La Declaración de Derechos del Consumidor

con Respecto a los Preparadores de

Declaraciones de Impuestos.

Pub 135 (10/09)

Before you hire a tax preparer, What is a Refund What is a Refund

you should: Anticipation Loan (RAL)? Anticipation Check (RAC)?

• ask for a written estimate of all fees • A RAL is not a quick, fast, or instant • A RAC is a check or other type of

before giving your tax records to refund, it is a high-interest loan. payment that allows you to get your

the preparer refund money.

• ask if the preparer will e-file your return • The lender will charge you interest and

fees, which will reduce your refund. • RAC fees are deducted from the refund

• ask if the preparer will represent you if amount shown on your return. The fees

you are audited • Before you enter into a RAL agreement include charges for tax preparation and

with a tax preparer, the preparer must a fee for the RAC.

give you a written disclosure statement

A tax preparer should never do • Before you enter into a RAC agreement

that explains:

any of the following: with a tax preparer, the preparer must

- you aren’t required to take a RAL in

• ask you to sign order to receive your tax refund

give you a written disclosure statement

- a blank return that explains:

- an incomplete return, or - the amount of fees and interest you

- you aren’t required to take a RAC in

- a return with false information on it will have to pay if you take a RAL

order to receive your tax refund

• prepare your return without reviewing - the amount you will receive after the

- the amount of fees you will have to

the records required to complete an fees and interest are deducted

pay if you take a RAC

accurate return, such as information - the annual percentage rate of interest

about your dependents, child care that you will be charged

expenses, or tuition payments - the amount your refund will be if you

• guarantee that you’ll receive a tax refund don’t take out a RAL

• guarantee that you won’t be audited by

the IRS or the New York State

Tax Department

When your return is completed, To learn more:

you should always:

Contact the NYS Tax Department You can get your state and federal

• review the entire return before you sign • www.nystax.gov income tax refunds without a loan.

• make sure your preparer signs the return • (518) 457-5181 (in-state callers without Ask your preparer to:

• get your papers back, including copies free long distance call 1 800 225-5829)

• e-file both your federal and New

of all final returns

Contact the IRS: York State tax returns; and

• get a receipt that contains the • www.irs.gov • have the refunds deposited directly

preparer’s address and phone number

• 1 800 829-1040 into your bank account

Pub 135 (10/09) (back)

You might also like

- NYS Tax Registration 2010Document1 pageNYS Tax Registration 2010sfussNo ratings yet

- E File BrochureDocument2 pagesE File BrochuresfussNo ratings yet

- Notch Consulting Red Flag Rules Policy 09 11 NETDocument3 pagesNotch Consulting Red Flag Rules Policy 09 11 NETsfussNo ratings yet

- Notch Notary BrochureDocument2 pagesNotch Notary Brochuresfuss50% (2)

- Notch Consulting Privacy Policy - 06Document1 pageNotch Consulting Privacy Policy - 06sfussNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Managing Cash: Merits & Demerits of Holding CashDocument4 pagesManaging Cash: Merits & Demerits of Holding Cashverty asdNo ratings yet

- LTB Form For Maintenance IssuesDocument12 pagesLTB Form For Maintenance IssuesJason StoddartNo ratings yet

- Ale Aubrey - Bsma 3 1.exercise123Document28 pagesAle Aubrey - Bsma 3 1.exercise123Astrid XiNo ratings yet

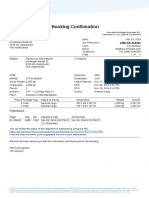

- Amazing Hotel Sapa Booking ConfirmationDocument2 pagesAmazing Hotel Sapa Booking Confirmationanh thoNo ratings yet

- Miss Jane Citizen Level 1, 8 Name Street Sydney NSW 2000: Account Details Account DetailsDocument3 pagesMiss Jane Citizen Level 1, 8 Name Street Sydney NSW 2000: Account Details Account DetailsYoutube MasterNo ratings yet

- GSRTCDocument1 pageGSRTCHeena RathodNo ratings yet

- X Scope - Air Export Shipment Booking ConfirmationDocument1 pageX Scope - Air Export Shipment Booking ConfirmationyudaNo ratings yet

- Fmeritpharm 2019Document55 pagesFmeritpharm 2019SaifNo ratings yet

- 123123Document100 pages123123Carlo SolanoNo ratings yet

- Bank Reconciliation: Sir. JP MoralesDocument30 pagesBank Reconciliation: Sir. JP MoralesAshley Niña Lee Hugo100% (1)

- Mastercard Services in IndiaDocument21 pagesMastercard Services in IndiaKuldeep GuptaNo ratings yet

- NLi 1 Uc 03 Ltyr 9 Wi ZDocument15 pagesNLi 1 Uc 03 Ltyr 9 Wi ZDhanush MenduNo ratings yet

- DBH Global Freight Co ProfileDocument17 pagesDBH Global Freight Co ProfileMohd Afif SukriNo ratings yet

- Statement of Account: Invoice Number Invoice Description Due Date Invoice Amount Current BalanceDocument1 pageStatement of Account: Invoice Number Invoice Description Due Date Invoice Amount Current BalanceRITESH RATHORENo ratings yet

- TM 4Document5 pagesTM 4Jai VermaNo ratings yet

- Finacle Wiki, Finacle Tutorial & Finacle Training For BankersDocument11 pagesFinacle Wiki, Finacle Tutorial & Finacle Training For BankersAnkur Agarwal40% (5)

- Tally Accounting Book by Ca MD ImranDocument6 pagesTally Accounting Book by Ca MD ImranMd ImranNo ratings yet

- Selection LetterDocument4 pagesSelection LetterAjit Pal SinghNo ratings yet

- Fye 06 Trial BalanceDocument307 pagesFye 06 Trial BalanceAnn Arbor Government DocumentsNo ratings yet

- Motor - Assist - Booklet (Done Excel, Done CC) PDFDocument52 pagesMotor - Assist - Booklet (Done Excel, Done CC) PDFCK AngNo ratings yet

- 31 October: Not BookedDocument4 pages31 October: Not BookeddanielNo ratings yet

- RMC 13-03 (Termination of Audit or Investigation of Tax Returns)Document4 pagesRMC 13-03 (Termination of Audit or Investigation of Tax Returns)ArvinNo ratings yet

- Income Taxation - Finals QuizzesDocument12 pagesIncome Taxation - Finals QuizzesJalyn Jalando-onNo ratings yet

- Tev - Mrsia Final (Aleiah)Document20 pagesTev - Mrsia Final (Aleiah)Aleiah Jean LibatiqueNo ratings yet

- Computer Services LTD Bookkeeping ProjectDocument8 pagesComputer Services LTD Bookkeeping ProjectAlex GrecuNo ratings yet

- Spain: Tax Free FormDocument1 pageSpain: Tax Free Formpedro joseNo ratings yet

- Calculating Cost of Services for a CPA FirmDocument45 pagesCalculating Cost of Services for a CPA Firmcarl patNo ratings yet

- Euronet White Paper P2P Payments Hub - September 2011Document8 pagesEuronet White Paper P2P Payments Hub - September 2011Iye OknNo ratings yet

- SCM600 Exercise 2 HWDocument9 pagesSCM600 Exercise 2 HWEvander Yosafat Holiness SinagaNo ratings yet

- High-Speed Rail Freight Sub-Report in Efficient Train Systems For Freight TransportDocument93 pagesHigh-Speed Rail Freight Sub-Report in Efficient Train Systems For Freight Transportwizz33No ratings yet