Professional Documents

Culture Documents

BPI - Finalizirano

Uploaded by

Sead Dzananovic0 ratings0% found this document useful (0 votes)

28 views13 pagessfsef

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsfsef

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views13 pagesBPI - Finalizirano

Uploaded by

Sead Dzananovicsfsef

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 13

TABLE 1.

Row Elements Product / service 1 Product / service 2 Product / service 3 TOTAL

1 Product name / service

kolski prevoz Izleti Druge destinacije

2 Unit of measure

1 1 1

3 Volume of production /service 2,855 2,100 1,697

4 Sale price

5 5 5

5 Sales 14,275.00 10,500.00 8,485.00 33,260.00

-

Base year

1st year 2nd year 3rd year

Sales growth per year 1.00 1.40 1.80

Sesonal oscilations according to months (fill if there are seasonal oscilations)

Product group/ month 1 2 3 4 5 6

(Average: 8.3333% / 1 month) 0.0833 0.0833 0.0833 0.0833 0.0833 0.0833

7 8 9 10 11 12

0.0833 0.0833 0.0833 0.0833 0.0833 0.0833

Control sum (100.00) 1.00

B. Value Chain: Investment in Vaule Chain/ Costs

Investment Costs

TABLE 2.1. TABLE 2.2.

Investments in Value Chain Depreciation

Form of investment- total Amount Asset Historical price Useful life (in

years)

% of depreciation 1st year 2nd year 3rd year Remained

value

1- Investments in long-term assets Intangible assets 39,737 10.00 3,974 3,974 3,974 27,816

1.0 - Intangible assets 39737

Buildings 500 0.00 0 0 0 500

1.1. Land 0.00 Equipment 3,400 20.00 680 680 680 1,360

1.2. Infrastruture and buildings 500.00

1.3. Equipment 1,800.00 Total 3,900 4,654 4,654 4,654 1,860

1.4. Base herd 0.00

2- Investments in working capital 10,000.00 Working capital is going to be calculated in D. based on logic of business process (T.4.5.) - formula

Total 49,737.00

Detailed specification of investments:

Land Amount Working capital category Connecting days

1. Materials inventory

2. Work in progress inventory

3. Finished goods inventory

Total 0.00 4. Accounts Receivable

5. Cash 10000

Detailed specification of investments

Infrastructure and buildings Amount

Table 2.3. Costs of (material) inputs

Renta 500.00

Dva kombija 39,737.00 Row Elements Product / service 1 Product / service 2 Product / service 3 1st year

Elektrina energija Voda Plin

5 Sales 80.00 40.00 90.00 33,260.00

Control

Total 40,237.00 Cost of tangible inputs (to be estimated as % of sales) 1.00% 1.00% 1.00% 0.03

0.80 0.40 0.90 2.10

Costs

Detailed specification of investments: 1.

Equipment Amount

2.

Oprema (raunar, tampa, skener) 2,200.00

Sitni inventar 300.00 M1 Production: costs of materials - inputs, energy, packaging, ... 0

Uredska oprema 800.00 M2 Trade: costs of buyed goods, all costs related to buyed goods to be sold

Telefax 100.00 M3 Service: costs directly related to delivering service, very often these costs are incorporated in "Other business expenses" (T.3.2.)

Total 3,400.00

Table 2.4.Cost of goods sold (COGS) being calculated automatically from T. 2.2. and T. 3.1. (direct labor) 1st year

Detailed specification of investments: Product / service 1 Product / service 2 Product / service 3

Base herd Amount Cost of tangible inputs 210.00 0.40 0.90 211.30

Direct labor (direct wages) 600.00 4,800.00 4,800.00 10,200.00

COGS 810.00 4,800.40 4,800.90 10,411.30

Note: COGS = Costs of material inputs+Direct wages being calculated automatically from T. 2.2. and T. 3.1. (direct labor)

Total - Key for costs allocation 8% 46% 46% 1

C. Organization&Mgmt/ Costs

TABLE 3.1. Number of employees (Salary Expense)

Phase of business process Total Average net

monthly

salary

1st year 2nd year 3rd year Food

allowance and

travelling

expenses

1. Basic business process - Direct salaries (first year) 1,200 14,400 20,160 25,920

2. Other parts of the business process - Indirect salaries: 372 4,464 4,464 4,464

2.1. Administration 100 1,200 1,200 1,200

2.2. Marketing 50 600 600 600

2.3. Other phase of the business process 0 0 0

Total employees 2 1,200.00 18,864 24,624 30,384

Contributions 69.30% 1.69

TABLE 3.2. Other business expenses - treated as fixed costs

Cost Monthly 1st year 2nd year 3rd year

1. Office materials 100 x 1,200.00 1,200.00 1,200.00

2. Maintenance 50 x 600.00 600.00 600.00

3. Rent 500 x 6,000.00 6,000.00 6,000.00

4. Utilities 210 x 2,520.00 2,520.00 2,520.00

5. Tranportation costs / mainteinance of vehicles 600 x 7,200.00 7,200.00 7,200.00

6. Advertising cost 50 x 600.00 600.00 600.00

7. Travell allowance x 0.00 0.00 0.00

8. Research&Design x 0.00 0.00 0.00

9. Expert fees x 0.00 0.00 0.00

10. Insurance 170 x 2,040.00 2,040.00 2,040.00

11. Business taxes x 0.00 0.00 0.00

12. Outsorucing 1 80 x 960.00 960.00 960.00

13. Outsourcing 2 x 0.00 0.00 0.00

14. Other expenses x 0.00 0.00 0.00

Total 1,760.00 21,120.00 21,120.00 21,120.00

Note:

In general, "Other business expenses" could be treated as "fixed costs"

x - fixed costs

TABELA 4.1.1.

Total asset requirements

Mode of investments Amount %

0 - Intangible assets 39,737.00 94.53%

1.1. Land - 0.00%

1.2. Infrastruture and buildings 500.00 1.19%

1.3. Equipment 1,800.00 4.28%

1.4. Base herd - 0.00%

Investments in long-term assets 42,037.00 80.78%

Investment in working capital 10,000.00 19.22%

Total 52,037.00 100.00%

TABELA 4.1.2.

Sources of financing

Mode of investments Amount %

1.Long-term assets 42,037.00

1.1.Own funds 2,300.00

1.2. Support

Venture Capital, Angel Capital, Grant, ...

1.3. Loan 39,737.00

Loan

2. Working capital 10,000.00

2.1. Own funds 10,000.00

2.1. Support FALSE

2.3. Loan

Loan

%

Own funds 12,300.00 23.64 Own funds 12,300.00 100.00

Support - -

FALSE

External owners - -

Loan 39,737.00 76.36

Loan Total-Equity

12,300.00 100.00

Total 52,037.00 100.00

TABELA 4.1.2.1.

Terms of loan (if there is a need for loan)

Loan amount (in KM) 39,737.00

Grace-period (in months) 6

Maturity (u mjesecima) 60

Interest rate (%) 7.59

Annuity repayment (monthly, quarterly, ...) monthly

Number of annuities/ number of periods 54

Number of periods in a year 12

Annuity repayment (monthly, quarterly, ...) 870.98

Ownership structure

TABELA 4.2.

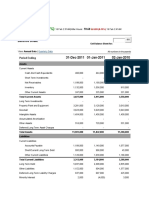

Balance Sheet

Elements Starting

I Long term assets 43,640.00

- Goodwill 39,737.00

Land -

Buildings 500.00

Equipment 3.00

- Long term investments 3,400.00

II Current assets 10,000.00

Inventories 10,000.00

Accounts Receivables -

Short term Invesments -

Cash and cash equivalents -

Total Assets 53,640.00

Owners equity 12,300.00

Common stock 12,300.00

Retained earnings -

Liabilities 39,737.00

1) Long-term liabilities 39,737.00

- Long-term liabilities -

- Long-term loans 39,737.00

2) Short-term liabilities -

- Loans -

- Accounts payable -

- Taxes and contributions -

- Other liabilities -

Total Liabilities and Owner's Equity 52,037.00

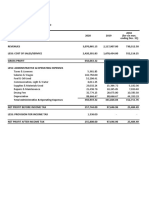

TABELA 4.3.1.

Forming and allocation of total income (Profit&Loss statement)

Elements 1st year 2nd year 3rd year

Sales 33,260 46,564 59,868

Cost of goods sold (Cost of materials + direct labor) 10,411.30

Gross profit 41 46,564 59,868

Salaries and contribution 4,464 4,464 4,464

Depreciation 4,654 4,654 4,654

Other operating expenses 21,120 21,120 21,120

EBIT 0 0 0

Interest expense 2,957 2,455 1,826

EBT -2,957 -2,455 -1,826

Income tax (10%) -296 -245 -183

Net profit (loss) -2,661 -2,209 -1,644

Dividends (50%) -1,331 -1,105 -822

Retained earnings (50%) -1,331 -1,105 -822

TABELA 4.3.2.

Balance sheet

Elements Starting 1st year 2nd year 3rd year

I Long-term assets 43,640.00 44,486.30 39,832.60 35,178.90

- Intangible assets 39,737.00 35,763.30 31,789.60 27,815.90

- Land - - - -

- Buildings 500.00 6,000.00 6,000.00 6,000.00

- Equipment 3.00 (677.00) (1,357.00) (2,037.00)

- Long-term investments 3,400.00 3,400.00 3,400.00 3,400.00

II Current assets 10,000.00 530.80 11,059.03 34,891.26

- Inventories 10,000.00 10,000.00 10,000.00 10,000.00

- Accounts Receivable - - - -

- Short-term investments - - - -

- Cash and cash equivalents - (9,469.20) 1,059.03 24,891.26

TOTAL ASSETS 53,640.00 45,017.10 50,891.63 70,070.16

I Owners equity 12,300.00 10,969.46 9,864.73 9,042.83

- Paid-in capital 12,300.00 12,300.00 12,300.00 12,300.00

- Retained earnings - (1,330.54) (2,435.27) (3,257.17)

II Liabilities 39,737.00 34,333.63 24,986.60 15,356.73

1) Long-term liabilities 39,737.00 35,959.85 27,963.04 19,337.71

- Long-term liabilities - - - -

- Long-term loans 39,737.00 35,959.85 27,963.04 19,337.71

2) Short-term liabilities - (1,626.21) (2,976.44) (3,980.99)

- Loans - - - -

- Accounts payable - - - -

- taxes and employee contributions - (295.68) (541.17) (723.82)

- other liabilities - (1,330.54) (2,435.27) (3,257.17)

TOTAL OWNERS EQUTY AND LIABILITIES 52,037.00 45,303.10 34,851.33 24,399.56

TABLE 4.4.1.

Calculation Budget costs

Elements/ cost carriers Total Product /

service 1

Product / service

2

Product / service

3

1. Costs of material inputs 211 210 0 1

2. Direct salaries 10,200 600 4,800 4,800

A. Cost I (COGS) 10,411 810 4,800 4,801

Cost of production I/ per unit 0.28 2.29 2.83

3. Other operating costs 21,120 1,643 9,738 9,739

4. Indirect salaries 4,464 347 2,058 2,058

5. Depreciation 4,654 362 2,146 2,146

6. Interest expense 2,957 230 1,363 1,363

B. Cost of production II 43,606 3,393 20,106 20,108

Cost of production II/ per unit #DIV/0! #DIV/0! #DIV/0!

Note: taxes are not treated in calculating costs

TABLE 4.4.2.

Structure of fixed and variable costs: break-even point

Elements/ cost carriers Total Product /

service 1

Product / service

2

Product / service

3

1. Cost of Materials 1,200

2. Direct labor costs

A. Total variable costs 15,229 0

3. Other operating expenses 0

4. Indirect labor costs 0

5. Depreciation 0

6. Interest expense 0

B. Total fixed costs 22,207

C. Total cost (A+B) 37,436

Production Volume

Unit variable cost

Total unit costs

Average sales price/ unit 5.00

Brake-even (%)

Tabele 4.5. Investments into working capital

1st year 2nd year 3rd year

Turnover

coefficient

Days

connecting Needed working capital

Needed working

capital

Needed working

capital

Asset category 1st year 2nd year 3rd year

1. Materials inventory 1,200 1,680 3,024 12 30 100 140 252

2. Work in progress inventory 12 30 0 0 0

3. Finished goods inventory 43,605.75 32,692.66 32,064.14 12 30 3,634 2,724 2,672

4. Accounts receivables 43,606 32,693 32,064 12 30 3,634 2,724 2,672

5. Cash 37,752 26,359 24,386 28 30 1,359 949 878

A. Total working capital 8,727 6,538 6,474

6. Accounts payable 21,122 21,120 21,120 12 30 1,760 1,760 1,760

7. Salaries 18,864 24,624 30,384 12 30 1,572 2,052 2,532

8. Depreciation 4,654 4,654 4,654 12 30 388 388 388

9. Finanance cost 2,957 2,455 1,826 12 30 246 205 152

10. Income taxes -296 -245 -183 12 30 -25 -20 -15

B. Sources from operation 3,966 4,404 4,832

C. Needed fixed working capital 4,761 2,134 1,642

INVESTMENTS INTO WORKING CAPITAL. 4,761 -2,627 -491

TABELA 4.6.1.

NPV IRR

Ukupna ulaganja Neto dobit I godina

-53640 4,949

9.00

Dynamic indicators

Internal rate of return (IRR) - % (1.78)

Net present value (NPV) 29,871.94

Payback period calculate

T. 4.6.2. Ratios

1st year 2nd year

Liquidity:

Current ratio (0.33) (3.72)

Quick ratio - (17.84)

Operating:

Accounts receivables turnover 0.76 1.42

Inventory turnover 27.72 27.72

Long-term assets turnover 0.75 1.17

Total asset turnover 0.74 0.91

Debt:

Debt to equity 3.13 2.53

Times interest earned - -

Profitability:

Gross margin 0.00 1.00

EBIT - -

Net profit (0.08) (0.05)

Return on assets (0.06) (0.04)

Return on equity (0.24) (0.22)

Growth

Sales 0.40

All ratios are calculated based on the end year balances

Neto dobit II godina Neto dobit II godina

4,899 4,836 4,836 4,836 4,836 4,836

period 10 years

period 10 years

3rd year

(8.76)

0.10

1.87

19.80

1.70

0.85

1.70

-

1.00

-

(0.03)

(0.02)

(0.18)

0.80

4,836 4,836 4,836

TABELE 4.6.3.

Cash flow

Elements Grace Total

1 2 3 4 5 6 7 8 9 10 11 12 1st Year 2nd Year 3rd Year

Receipts

Cash sales 2,771.67 2,771.67 2,771.67 2,771.67 2,771.67 2,771.67 2,771.67 2,771.67 2,771.67 2,771.67 2,771.67 2,771.67 33,260.00 46,564.00 59,868.00

Sources of financing 42,037.00 10,000.00 52,037.00

Balance

Total receipts 42,037.00 12,771.67 2,771.67 2,771.67 2,771.67 2,771.67 2,771.67 2,771.67 2,771.67 2,771.67 2,771.67 2,771.67 2,771.67 85,297.00 46,564.00 59,868.00

Payments

Payments for long-term assets 42,037.00 42,037.00

Disbursements for working capital 10,000.00 10,000.00

Materials 867.61 867.61 867.61 867.61 867.61 867.61 867.61 867.61 867.61 867.61 867.61 867.61 10,411.30 - -

Other operating expenses 1,760.00 1,760.00 1,760.00 1,760.00 1,760.00 1,760.00 1,760.00 1,760.00 1,760.00 1,760.00 1,760.00 1,760.00 21,120.00 21,120.00 21,120.00

Gross salaries and contributions 372.00 372.00 372.00 372.00 372.00 372.00 372.00 372.00 372.00 372.00 372.00 372.00 4,464.00 4,464.00 4,464.00

Finance cost (interest expenses) 251.34 251.34 251.34 251.34 251.34 251.34 251.34 247.42 243.47 239.50 235.51 231.49 2,956.75 2,454.96 1,826.44

Total disbursemets 42,037.00 13,250.94 3,250.94 3,250.94 3,250.94 3,250.94 3,250.94 3,250.94 3,247.03 3,243.08 3,239.11 3,235.12 3,231.10 90,989.05 28,038.96 27,410.44

Net receipts - (479.28) (479.28) (479.28) (479.28) (479.28) (479.28) (479.28) (475.36) (471.41) (467.45) (463.45) (459.43) (5,692.05) 18,525.04 32,457.56

Beginning cash - (479.28) (958.56) (1,437.83) (1,917.11) (2,396.39) (2,875.67) (3,974.59) (5,073.51) (6,172.44) (7,271.36) (8,370.28) (9,469.20) (9,469.20) 1,059.03

Cash after inflows from financing - (479.28) (958.56) (1,437.83) (1,917.11) (2,396.39) (2,875.67) (3,354.95) (4,449.95) (5,544.93) (6,639.88) (7,734.81) (8,829.71) (15,161.26) 9,055.83 33,516.59

Loan amount 39,737.00

Loan annuity (repayment) 619.64 623.56 627.51 631.48 635.47 639.49 3,777.15 7,996.81 8,625.33

Cash balance - (479.28) (958.56) (1,437.83) (1,917.11) (2,396.39) (2,875.67) (3,974.59) (5,073.51) (6,172.44) (7,271.36) (8,370.28) (9,469.20) (9,469.20) 1,059.03 24,891.26

Remaining loan 39,737.00 39,737.00 39,737.00 39,737.00 39,737.00 39,737.00 39,737.00 39,117.36 38,493.79 37,866.28 37,234.81 36,599.34 35,959.85 35,959.85 27,963.04 19,337.71

The first year

Tabela br. 7.2.1.

Loan terms, repayment plan, (adjustment is necessary if there is change in grace-period, repayment period, or change in repayment of annuity)

Loan terms

loan amount 39,737.00

grace-period 6

repayment period 60

interest rate 7.59

annuity monthly

number of annuities 54

number of periods in a year 12

annuity 870.98

interkalarna kamata 1,508.02

You might also like

- Ats Consolidated (Atsc), Inc. Fiscal Fitness Analysis (Draft)Document6 pagesAts Consolidated (Atsc), Inc. Fiscal Fitness Analysis (Draft)Marilou CagampangNo ratings yet

- Financial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsDocument5 pagesFinancial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsUrvashi BaralNo ratings yet

- InternationalCorporateTaxDocument14 pagesInternationalCorporateTaxrodney hackerNo ratings yet

- VUICO Projected Financial StatementsDocument18 pagesVUICO Projected Financial StatementsRoseinthedark TiuNo ratings yet

- Financial Analysis 4Document10 pagesFinancial Analysis 4Alaitz GNo ratings yet

- C 1Document10 pagesC 1biniamNo ratings yet

- Financial PlanDocument13 pagesFinancial Planpogia24koNo ratings yet

- Discussion Problems - Consolidation Subsequent To Date of AcquisitionDocument2 pagesDiscussion Problems - Consolidation Subsequent To Date of AcquisitionMikee CincoNo ratings yet

- ECO280 LastYear Quiz1Document4 pagesECO280 LastYear Quiz1görkem kayaNo ratings yet

- PR 117 Part 2Document9 pagesPR 117 Part 2viswadevassociates.tvmNo ratings yet

- MTP 17 48 Answers 1709809437Document12 pagesMTP 17 48 Answers 1709809437cloudstorage567No ratings yet

- EXERCISE 5 Last SlidesDocument7 pagesEXERCISE 5 Last SlidesJaime222No ratings yet

- CFAB - Accounting - QB - Chapter 13Document14 pagesCFAB - Accounting - QB - Chapter 13Huy NguyenNo ratings yet

- CH 4 and 5 Sanjay Ind Sol Finacman 6th EdDocument8 pagesCH 4 and 5 Sanjay Ind Sol Finacman 6th EdAnshika100% (2)

- Financial Statement Analysis Funds FlowDocument15 pagesFinancial Statement Analysis Funds FlowSAITEJA ANUGULANo ratings yet

- Enb FinalDocument11 pagesEnb Finalkevin kipkemoiNo ratings yet

- FINANCIAL PLANDocument7 pagesFINANCIAL PLANRocheal DecenaNo ratings yet

- Financial Plan for Tycoon's Express CompanyDocument9 pagesFinancial Plan for Tycoon's Express CompanyMekay OcasionesNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- 108 Efe 94 F 05642 C 6 BcfeDocument11 pages108 Efe 94 F 05642 C 6 BcfeKryzha RemojoNo ratings yet

- Acc hw2Document5 pagesAcc hw2pujaadiNo ratings yet

- 01 Lap Keuangan Balance SeteDocument1 page01 Lap Keuangan Balance Seteachmad rachmadiNo ratings yet

- CommercialMetals SolutionDocument5 pagesCommercialMetals SolutionFalguni ShomeNo ratings yet

- P.P. On Paper PlatesDocument16 pagesP.P. On Paper PlatesShyamal DuttaNo ratings yet

- Net Cash Flows From Operating ActivitiesDocument7 pagesNet Cash Flows From Operating ActivitiesShaneNiñaQuiñonezNo ratings yet

- SFP and SCF - Practice QuestionsDocument3 pagesSFP and SCF - Practice QuestionsFazelah YakubNo ratings yet

- IBM Balance SheetDocument7 pagesIBM Balance Sheettahseen7fNo ratings yet

- Credit AppraisalDocument17 pagesCredit AppraisalAditi SinghNo ratings yet

- Convention CentreDocument21 pagesConvention CentrerootofsoulNo ratings yet

- SuleeDocument8 pagesSuleefuadzeyniNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Kosofe Consolidated GPFS 2020Document6 pagesKosofe Consolidated GPFS 2020Oluranti SijuwolaNo ratings yet

- CABWAD Balance Sheet 2019Document5 pagesCABWAD Balance Sheet 2019EunicaNo ratings yet

- Additional Illustrations-5Document19 pagesAdditional Illustrations-5goyalmanasvi06No ratings yet

- Project Two. Process Financial Transactions and Prepare Financial The Accounts in The Ledger ofDocument11 pagesProject Two. Process Financial Transactions and Prepare Financial The Accounts in The Ledger ofGetahunNo ratings yet

- Kunci Jawaban Laporan KeuanganDocument16 pagesKunci Jawaban Laporan KeuanganreiNo ratings yet

- Lembar Jawaban Mahesa - SalinDocument10 pagesLembar Jawaban Mahesa - Salinricoananta10No ratings yet

- Module 7 ExcelDocument5 pagesModule 7 ExcelElla EspenesinNo ratings yet

- Financial Analysis DashboardDocument11 pagesFinancial Analysis DashboardZidan ZaifNo ratings yet

- Simple Company Financial StatementDocument3 pagesSimple Company Financial StatementNicole FidelsonNo ratings yet

- Financial StatementDocument10 pagesFinancial StatementRaven PandacNo ratings yet

- Problem SolutionsDocument5 pagesProblem Solutionsmd nayonNo ratings yet

- Evi13 104949Document2 pagesEvi13 104949Al QadriNo ratings yet

- Accounting Fundamentals Practice-ASH - IVADocument12 pagesAccounting Fundamentals Practice-ASH - IVAalitohdezsalNo ratings yet

- Kellogg Company Balance SheetDocument5 pagesKellogg Company Balance SheetGoutham BindigaNo ratings yet

- MAY Financial ReportingDocument32 pagesMAY Financial ReportingKizito KizitoNo ratings yet

- Serco Group PLC: Cash Flow (Indirect) - Annual - Standardised in Millions of GBPDocument4 pagesSerco Group PLC: Cash Flow (Indirect) - Annual - Standardised in Millions of GBPfcfroicNo ratings yet

- Additional Questions 5Document13 pagesAdditional Questions 5Sanjay SiddharthNo ratings yet

- CASH FLOW 2024 SPCCDocument54 pagesCASH FLOW 2024 SPCCTCPS UNFILTEREDNo ratings yet

- FM Question BookletDocument66 pagesFM Question Bookletdeepu deepuNo ratings yet

- Cash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Document15 pagesCash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Đỗ LinhNo ratings yet

- Example Problems W Solutions in SFP & SCFDocument7 pagesExample Problems W Solutions in SFP & SCFQueen Valle100% (1)

- Jomer's FSDocument3 pagesJomer's FSJessa Rodene FranciscoNo ratings yet

- Problem 1Document4 pagesProblem 1Rio De LeonNo ratings yet

- TsefaDocument4 pagesTsefaAhmed SaeedNo ratings yet

- Leray Business SolutionsDocument5 pagesLeray Business SolutionsKyla Andrea GammadNo ratings yet

- Latihan Cash Flow Soal No 2Document3 pagesLatihan Cash Flow Soal No 2Munisa LailaNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- The Easiest Way To Get Your Name Into The Newspaper Is To Read Them While You're Crossing The Street."Document1 pageThe Easiest Way To Get Your Name Into The Newspaper Is To Read Them While You're Crossing The Street."Sead DzananovicNo ratings yet

- BPI - FinaliziranoDocument13 pagesBPI - FinaliziranoSead DzananovicNo ratings yet

- Šifrarnik Artikala - AmilaDocument1 pageŠifrarnik Artikala - AmilaSead DzananovicNo ratings yet

- Šifrarnik Artikala - AmilaDocument1 pageŠifrarnik Artikala - AmilaSead DzananovicNo ratings yet