Professional Documents

Culture Documents

Tainin

Uploaded by

Nitin KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tainin

Uploaded by

Nitin KumarCopyright:

Available Formats

About Us

Mynd Solutions is a leading global service provider in business process and technology management,

offering broad spectrum of services in Finance and Accounting (FAO), Human Resource Outsourcing

(HRO), ustomer Relationship Management (RM) and onsulting! "e deliver the integrated solutions

coupled #ith deep process $no#ledge and insights #ith focused %& capabilities!

Having started in year '(() #ith small team of five people in *elhi, the company has '+++, professionals

around the %ndia and Asia to deliver services to its more than '-+ customers! Mynd has .an %ndia .resence

in more than /+ cities #ith regional offices in *elhi, Mumbai, 0angalore and centrally located state of the art

bac$ end processing facilities in 1urgaon!

%n 2+'2, Mynd has e3tended its o#n presence in Singapore and reach in more than 4+ countries #ith

channel of cohesive partner net#or$ in Asia, 5M5A 6 America!

Mynd collaborates #ith each client to deliver customi7ed business process outsourcing solutions that range

in comple3ity from individual transaction8based functions to highly scaled up operations! %n this endeavor,

our core competencies in .latform 0ased Service offering and ability to leverage relevant professional

e3pertise, resources strengthens our domain e3pertise and gives us a leading edge over any competitors!

More

9ear of 5stablishment '(()

:egal Status of Firm .rofessional Association

;ature of 0usiness Service .rovider

;umber of 5mployees more than '+++ .eople

Contact Us

Company name < Mynd Solutions .vt! :td

Contact Person < Mr! An$ur Sharma

Mobile / Cell Phone < ,((')8(='==4>>>>

Telephone < ,((')8('2/)8/>>-/++

Address < ;o! 2=+, ?dyog @ihar, .hase8 %v, 1urgaon 8 '22 ++', Haryana,

%ndia

:oading!!!

Call Toll-Free: 1800-00-!!!!

0uy A

o .ost your 0uy ReBuirementSubscribe &rade AlertsSearch .roducts 6 Suppliers

Sell A

o :atest 0uy :eadsreate your Free atalog*isplay Free .roductsSubscribe &rade Alerts

Help

Sign %n

Coin FR55

My %ndiaMAR&

;e# m"indiamart"com

.roducts 6 Suppliers

Sell Offers

0uy :eads

&enders

.roducts

.roducts Suppliers Sell Offers 0uy :eads &enders

5nter product D se

Submit

or .ost 0uy ReBuirement

ompany *irectory E all enters 6 0.O Services E *ata .rocessing Services E

Share<

Ads by 1oogle

#ob $acancies"

Find '+++Fs of Cobs in your ity! onnect #ith 5mployers! Apply ;o#G

Hui$r!comDCobs

%ata &ntry 'ome (anted

Find *ata 5ntry Home Cobs Here ;o#G '++I Free! 1et Found! 1et Cobs!

S$ill.ages!comD*ata85ntry8Home8Cobs

Payroll )utsourcin* +ndia

all us today to for the best payroll and HR solution

###!topsource!inDpayroll!html

Are ,ou a Fresher-

Coin .lacement Oriented / Month %& ourse *esigned for Fresh 1rads

;%%&!comD%&8&raining

'%FC 'irin* .or #une/10

=+++,.!O! Cobs for 53p< >8'+ years! ?pload Resume, Apply to H*F ;o#G

&imesCobs!comD0an$8Openings8?rgent

#obs Australia

- urgent positions left! Apply no#G Cobs Australia

Jobrapido!comDJobs,australia

1ubmit 2esume 3o4

%mmediate ReBuirement! Sign up to Apply 6 Find Cobs

###!monsterindia!com

Citiban56 Credit Card

Rs '+++ "orth Activation 0enefits, '+ &imes &he Re#ard .oints! ApplyG

citi!comDreditard

Mynd 1olutions P7t" 8td

1urgaon, Haryana

9ear of 5stablishment< 199:

+ndiaMA2T Member 1ince: 010

Services K(L

Mobile< ,((')8(='==4>>>>

HOM5

A0O?& ?S

P2)%UCT1 ; 1&2$+C&1

O;&A& ?S

S5;* 5;H?%R9

.roducts 6 Services

Accounting

Outsouring Service

onsultancy

Service

*ata

Management Service

Fi3ed Asset

Management Service

Help *es$

Service

%fsr onsulting

6 &raining Service

Manpo#er

Outsourcing Service

.ayroll 6

.ension Accounting

Service

&ime 6

53pense Management

Service

1er7ices

Accountin* )utsourin* 1er7ice

Managing efficient accounting processes is one of our core competencies!

"hatever your bac$ office needs, Mynd Solutions delivers the right information at

the right time! %n addition to long8term outsourcing arrangements, Mynd SolutionsFs

team of AFs and accounting personnel provide various other services on a short8

term proJect basis! &hey leverage their e3perience in accounting along #ith their

$no#ledge of best practices and accounting standards to provide the follo#ing

services <

Offshore Accounting!

&ransition of accounting processes from overseas and local entities!

Set up of centrali7ed accounting processes 6 its management for 1:

Accounting!

.ayables processing and management!

%nventory accounting and reconciliations!

apitali7ation and Fi3ed asset management!

Sales accounting (0illing and collections)!

Reimbursements D 53pense sheets!

M%S (Financial 6 operational reporting)!

Product Code: ')>2)4'/

Consultancy 1er7ice

Mynd Solutions provides consultancy in various areas that concern set up of

business and also the day to day functioning! "e are a one stop shop for any

entity coming into or setting up ne# business in %ndia, covering company formation

to all statutory approvals from an R0%, company la#, Soft#are technology par$s,

S5M or *irect D indirect ta3 perspectives! "e believe in providing tailor made

solutions and guide each company through the various statutory options available!

Our service range in consultancy covers areas such as <

%ncorporation of companies!

&a3 consultancy including registration #ith %ncome ta3 authorities!

ompany la# consultancy and compliance!

%ndirect ta3es 8 consultancy on Sales ta3 D @A& D 53cise and customs!

onsulting for R0% related compliances in %ndia!

onsulting for R0% related compliances in %ndia!

onsulting for ta3ation in %ndia!

onsulting for ta3ation in %ndia!

onsulting for ompliances %n %ndia!

onsulting for ompliances %n %ndia!

*irect &a3 and %ndirect &a3 ompliances in %ndia!

*irect &a3 and %ndirect &a3 ompliances in %ndia!

R0% Related ompliances in %ndia !

R0% Related ompliances in %ndia!

ompliance ?nder Shops and 5stablishment Act !

ompliance ?nder Shops and 5stablishment Act!

0usiness Advisory services!

%ata Mana*ement 1er7ice

Mynd has a dedicated facility and a large pool of resources for e3ecuting data

entry Jobs! "e #or$ #ith the leading telecom companies in %ndia to help them

manage their reBuirements of data entry and data management! "e add value to a

simple data entry Job by adding validation processes that thro#s up errors and

conducts sanity D logical chec$s! "e have also developed soft#ares to ensure

faster and accurate M%S reports for clients and providing a much needed lin$age

from the data record to the physical record at a clic$ of a button!

%n addition, #e are currently engaged in carrying out a '- year proJect #ith a state

government in the role of a database management partner #here #e are

converting transport records into digitised format using smart card technology!

"e are also responsible for handling subscriber application forms (SAFsDAFs) for

telecom companies across ;orth %ndia! &his includes *ata entry, @erification,

Scanning and "arehousing of very large volume of documents and data!

Fi<ed Asset Mana*ement 1er7ice

"e assist many corporates in managing and reconciling their fi3ed asset database!

"e underta$e complete physical verification and affi3 bar coded tags on each type

of assets available! &hereafter the ne3t time the activity is capable of being done

by hand held bar code scanners #hich is e3tremely accurate and efficient! On

carrying out a reconciliation of the physical vis a vis accounting records #e provide

a location8#ise or asset #ise variance report! Our activities are broadly as

mentioned under <

Fi3ed Asset Management %ndia!

.reparation and maintenance of fi3ed asset register!

Fi3ed Asset Management %ndia!

Running depreciation calculations as per statutory la#s and ?S 1AA.!

Monthly capitali7ation and inventory reconciliation!

.hysical verification including a fi3ing of tags!

?sing barcode technology for identification of assets!

'elp %es5 1er7ice

@endor helpdes$ (@H*) assists the company is trac$ing each and every vendor

invoice as it travels through the departments in the company for approvals #hile

monitoring the S:A committed to the vendor for payment! &his is mainly set up to

handle large volumes of vendor invoices or as a help to a centrali7ed payable

process running in corporates!

"hile mostly the @H* is customi7ed to suit the reBuirements of the clients,

ho#ever broadly it aims to achieve the follo#ing <

entrali7e the vendor bill receipt D trac$ing!

hec$ invoices for relevant supporting and provide email confirmation to

vendors for receipt of invoices!

For#ard to departments for approvals!

For#ard to Finance for cheBue preparation!

heBue issuance to vendor #ith details!

Monitor turn around time for payment!

M%S!

Handling all correspondence #ith vendors!

&*S certificates and form reBuest receipt and for#arding to concerned

department!

+.sr Consultin* ; Trainin* 1er7ice

%FRS are the %nternational Financial Reporting Standards issued by %nternational

Accounting Standard 0oard (%AS0)!%FRS literature consists of %FRS, %AS, %FR% 6

S% %nterpretations!

%FRS convergence is li$ely to ta$e place by 'st April 2+'' in %ndia and

comparatives to be developed by 'st April 2+'+ (i!e!, by >'st March 2+'+)!

At Mynd 1roup, #e are #or$ing to#ards aligning the business processes and

reporting reBuirements for meeting the %FRS ReBuirements! ertainly, #e can help

you to comply #ith %FRS reBuirements by doing the gap analysis against the

reBuirements and support organi7ation to prepare themselves to implement the

process reBuired for same!

)..erin* .rom Mynd :

%FRS onsulting in %ndia

orporate and %nstitutional &rainings

&ransition from 1AA. to %FRS

Support to %ntegrate %FRS #ith lients Accounting Soft#are

.lanning lients Financials 6 Neeping their disclosures %ntact

2eadiness 4ith Mynd :

ombination of e3perience on 5R. systems, ?S1AA., %1AA. 6 %FRS in

diverse areas!

Mynd team have prior e3perience of implementation for large clients!

Mynd team is part of training faculty of reputed %nstitutes!

Manpo4er )utsourcin* 1er7ice

Mynd Solutions through its group entity Aapt onsultants, is dedicated to helping

you find the right people to fill your reBuirements! "e identify Bualified candidates

#hose s$ills match the specific disciplines you reBuire! "hether your needs are

temporary, short8term or permanent, Mynd Solutions has highly motivated

professionals to accomplish your goals!

Fle3ibility in hiring

ost and time saving in hiring process

;o permanent liability of people!

Availability of e3perts for short duration D proJect related #or$!

Availability of large resume data ban$!

Statutory obligations such as provident fund, gratuity, bonus, maternity

benefits, professional ta3, etc! are no longer a clientFs responsibility!

Payroll ; Pension Accountin* 1er7ice

At Mynd Solutions, #e believe a company should have more po#er over its single

largest e3pense! Our comprehensive methodology brings efficiencies to payroll

processing at the front end, #here more than )-I of costs associated #ith this

function e3ist!

At Mynd Solution, #e positively transform payroll 6 pension administration for your

company #ith a scalable, cost8effective solution that enables your HR personnel to

focus on $eeping your enterprise moving for#ard, #hile still treating employees

from the past #ith all the respect theyFve earned! lients and their employees have

access to real8time data through a personali7ed #ebsite and one8on8one personal

help!

.ayroll Outsourcing, .ayroll Administration!

Salary processing including ta3 calculation as per applicable ta3 la#s!

.ayroll Outsourcing, .ayroll Administration!

Registration #ith the Office of the Regional .rovident Fund ommissioner

(R.F)!

.ayroll Outsourcing, .ayroll Administration!

Record $eeping 6 Administration!

.ayroll Outsourcing %ndia, .ayroll Administration %ndia!

Monthly 5mployer D Statutory compliance!

.ayroll Outsourcing %ndia, .ayroll Administration in %ndia!

Annual 5mployer D Statutory compliance!

%nterface #ith the R.F!

All %ndia ompliances ?nder Shops and 5stb! Act and related la#s!

Set up and Management of Retiral 0enefits 6 &rusts!

Huery solving!

Time ; &<pense Mana*ement 1er7ice

.rocessing time 6 e3pense data for employees of company across the

#orld!

&he e3pense sheets are audited as per ompany policy!

&he employees are reimbursed on periodical basis!

Accurate, timely and complete time and e3pense reports!

%mproves employee accountability!

:oading!!!

Ads by 1oogle

#et Air4ays Academy

&raining in Aviation 6 Hospitality!

:imited seats available! Apply ;o#G

CetAir#ays!comD&rainingAcademy

+C+C+ =an5 )..icial 1ite

1et "ide Range Of 0an$ing Services

6 53perience 0an$ing At %ts 0estG

###!iciciban$!com

CA1 118:-!-! 1upplier

:eading supplier of AS ''=)8/28/

2,>8*iaminomaleonitrile, contact us

###!harvechem!com

Related .roduct atalogs

"allcliffs 5ntrepreneurs %nternational .vt :td

Offering services li$e database related services, database

services, #eb database services and online database services!

@ie# more details

EE @ocal Heart %nfo

&ech .rivate

:imited, 0hopal

?nited 0usiness

Machines

Offering data entry

services, corporate data

entry services, bul$ data

entry services, rapid

data entry services,

business data entry

services, accurate data

entry services and

computer data entry

services!

.roviding data

conversion services,

data entry services, data

processing services,

offline data entry

services, online data

entry services and .*F

data entry services!

@ie# more details

EE

Suggested Companies

A! *! ;! SBuare %nfonet

1enius *igital Solutions

Rishi 0iotech

0la7on Soft#ares

Meilleur &echnologies

2elated Cate*ories

*ata 0an$

Mail Scanning Services

*ata "arehousing Service

e0oo$ onversion Services

8oo5in* .or >%ata Processin* 1er7ices> -

2ecei7e response .rom *enuine ; pre-7eri.ied ser7ice pro7ider only

&nter ,our Contact %etails

%ndia

,('

Send 9our 0uy ReBuirement

ompany ;ame<

Mode of shipment<

.referred payment mode<

*estination port<

"ebsite<

http<DD

Ho# soon do you #ant this service<

%mmediate "ithin '- *ays "ithin ' Month

.referred service provider location<

:ocal Any "here in %ndia Any "here in the "orld Any Specific :ocation

City 1 City City 0

"hen do you need the delivery<

%mmediate "ithin '- *ays "ithin ' Month

%s this your<

One &ime ReBuirement Regular ReBuirement

About ?s

Success Stories

.ress Section

Services

Advertise #ith ?s

Cobs 6 areers

ontact ?s

Feedbac$

omplaints

Help

=uyers Tool ?it

Send 0uy ReBuirement

Subscribe &rade Alerts

Search .roducts 6 Suppliers

1uppliers Tool ?it

.ost .roducts 8 FR55

reate your Free atalog

:atest 0uy :eads

Trade 1ho4s

&rade Sho#s by %ndustry

&rade Sho#s by ountry

onferences

Mobile hannel< onnect #ith us<

&erms of ?se 8 .rivacy .olicy 8 :in$ to ?s

opyright O '((482+'> %ndiaMAR& %nterM5SH :td! All rights reserved!

)ur @oals

Our 1oal is to be a trusted partner in each and every clients business by bringing value on our clients terms,

serving as an e3tension of our client s business and delivering service e3cellence coupled #ith innovative,

solutions and shape our services to reflect the changing dynamics of todays #or$place!

)ur Approach

"ith more than '+ years of e3perience in this industry, Mynd understands todayFs business environment and

has defined its services and solutions accordingly! :everaging the e3perience of its team and its innovative

delivery tools, Mynd Solutions has the ability to develop a solution aligned #ith a companys uniBue needs!

Mynd begins the process of defining a custom solution by $eeping the end in mind! Revie#ing a companys

current bac$ office processes and #or$ing #ith a companys management team to identify inefficiencies

helps to simplify and then optimi7e the processes! %n addition, MyndFs team of Hualified finance

professionals and functional e3perts help validate that the defined solutions are accordance #ith accounting

and human resources regulations and standards!

Clients

&elecom!

%nfrastructure!

%nformation 6 &echnology!

N.OS 6 all enters!

Retail!

0an$s!

Hospitality!

Manufacturers 6 &raders!

*esigners!

Clientele

&elecommunication

%nfrastructure

%nformation 6 &echnology

Retail

58ommerce

Hospitality

Manufactures 6 &raders

Achie7ements

0est Supporting Services for the year 2+'+8''P

- By CEO of Leading Tower Infrastructure Organization

QPSatisfactory .erformance of Mynd Solutions during the Accounts .ayable, Accounts Receivable, Fi3ed

Assets, .roJect System, Sales 6 *istribution and Materials Management Modules!P

- By GM Accounting & Tax of Leading Teleco Co!any

QPMynd Solutions introduced autoamtion in our Accounts Receivable .rocess! &heir S:A Approach has

helped us to streamline the order fulfillment process in line #ith our company policy 6 collect old outstanding

dues from customers 6 reducing debtor days! &heir support is highly appreciableP

- By "irector of #inance !f Leading Medical "e$ices Co!any

QP"e #ish to put on record that the activity of .hysical @erification and its reconciliation #ith the boo$s of

accounts #as carried out to the satisfaction of the management and auditors and #ithin the timeline

schedule agreed!P

- By Leading Teleco Co!any

QP.ayroll &eam of Mynd has done a good Job in managing .ayroll Bueries, Helpdes$s, oncalls #ith our

team across the statesDunion territories, sending provisional salary slips in advance, Buic$ response to

employee concerns, conscious approach to improvise the process! hallenges #ill remain but the #ay this

team has #or$ed closely #ith us is commendable! "e appreciate the effortsGGP

1end your enAuiry to this supplier

Remaining haracters< 000

Submit

R ?sername D 58mail

R .ass#ord

Forgot .ass#ordS

For*ot Pass4ord- 5nter your 58mail %d <

ityDState

Ads by 1oogle

Home

ompany Overvie# T

Services T

lientele T

areer T

ontact us T

8o*in

Company )7er7ie4

Company Pro.ile

'istory

)ur Companies

)ur Approach

A4ards and 2eco*nition

Company Pro.ile

Having started in year '(() #ith small team of five people in *elhi, the company has '+++, professionals

around %ndia and Asia to deliver services to its more than '-+ customers! Mynd has .an %ndia .resence in

more than /+ cities #ith regional offices in *elhi, Mumbai, 0angalore and centrally located state of the art

bac$ end processing facilities in 1urgaon!

%n 2+'2, Mynd has e3tended its o#n presence in Singapore and reach in more than 4+ countries #ith

channel of cohesive partner net#or$ in Asia, 5M5A 6 America!

Mynd collaborates #ith each client to deliver customi7ed business process outsourcing solutions that range

in comple3ity from individual transaction8based functions to highly scaled up operations! %n this endeavor,

our core competencies in .latform 0ased Service offering and ability to leverage relevant professional

e3pertise, resources strengthens our domain e3pertise and gives us a leading edge over any competitors!

Mynd has successfully created a uniBue space for itself by delivering speciali7ed service offerings tailored

for specific business and industry needs! "e offer our platform as SaaS (Soft#are as a Service) #hich

complements the services delivered, to suit customers across the globe! Mynd platforms are structured for

best practices and can achieve customer needs vide configuration and least of customi7ation!

&he platforms demand 7ero cape3 cost from customers and therefore, customers can enJoy the benefit of

fle3ible service offerings! Mynd Us priority is to put the process forefront, understanding the value processes

bring to a company in driving front end results such as customer satisfaction and retention, revenue

generation and profitability! "e combine a#ard nominated technology #ith highly e3perienced multi8lingual

client service team and Sarbanes8O3ley compliant systems and processes to deliver bespo$e outsourcing

solutions of e3ceptional Buality! &his is helping clients to ta$e smarter and Buic$ decisions!

Accreditation ; Certi.ications

%SMS (%SO 2)++'<2++-) certified for %nformation Security Management<

SSA5 '4 &ype %% certified (formerly SAS )+ &ype %%)

?ey 1tren*ths

BPlat.orm =ased )..erin*

?niBue industry specific offerings leads to high client retention rates of (-I,

B+ndustry 1peci.ic 1olutions

Sector specific solutions #ith uniBue onsite8offsite delivery model creates a high barrier to entry

B8on*-term contracts and bac5lo*

:arge amount of une3ecuted contracts and more than (+I contracts #ith annual rene#als, #ith contracts

ranging from 28/ years

BCost Control

Focus on automation, an asset8light strategy and presence in &ier %%D%%% cities

B&<perienced Mana*ement Team

An e3ceptional employee profile comprising As, cost accountants, and post graduates strengthens service

delivery

BConsultin* Approach

?niBue approach to business development,

B&<perience 4ith Multiple &2P plat.orms

Ability to Buic$ly adapt to customer platforms and deliver solutions

3e4s ; Updates

A4ards ; 2eco*nition

Follo4 Us :

Faceboo$

&#itter

:in$edin

All O reserved to Myndsolutions .vt! :td

.rivacy .olicy

&erms of ?se

Sitemap

ontractual Staffing

Accounting Solutions

.o#ered 0y

'istory

5merged as a $no#ledge management company

Service delivery in many spheres including F6A management,

RM and HRO

(+, employees in company

HeadBuarters established in 1urgaon

53pansion into maJor cities including Mumbai and 0angalore,

#ith teams present in '- cities

ollaborations #ith global service providers to address client

reBuirements in %ndia

:aunched VSaaSW model8based services

*eveloped and implemented #or$ flo# soft#are for vendor

management for a leading telecom company

Services utili7ed by leading &elecom, Retail and %nfrastructure

companies

&eam si7e crosses >++

ompany enters global mar$ets

Mynd selected as preferred outsourcing partner for Finance 6

accounts by a maJor ?S8based telecom provider for operations in the ?S

and ?N

Received ;ASSOM X 5merge :eader a#ard for gro#th in

2++(8'+

Mynd introduces eHR%S, a niche product, for managing HR

processes on the SaaS model

&eam si7e e3ceeds '+++

A#arded a contract for '- years by the 1overnment of

Narnata$a for the *epartment of &ransportation

:aunched the niche %FRS services in %ndia

Received %SO 2)++' certification

;ominated for the Avaya customer responsiveness a#ards for

2+'+

Received the 0est Service .rovider A#ard from %ndus &o#ers

:td! for .A;8%ndia Services

A#arded as the V0est .rofessional Service 0usiness of the 9ear

2+''W by Franchise %ndia and Mee 0usiness

53tended our presence in international mar$ets #ith a ne# office

in Singapore and strong partner net#or$ in more than 4+ countries

Secured business contract in the F6A domain from a leading

aviation company based in Africa

)ur Approach

Over a decade of e3perience in this industry, Mynd understands todayYs business environment and has

defined its services and solutions accordingly! :everaging the e3perience of its team and its innovative

delivery tools! "e possess the ability to develop a solution aligned #ith a companyYs uniBue needs!

Mynd begins the process of defining a custom solution by $eeping the end in mind! Revie#ing a companyFs

current bac$ office processes and #or$ing #ith a companyFs management team to identify inefficiencies

helps to simplify and then optimi7e the processes! %n addition, our team of Bualified professionals and

functional e3perts helps validate that the defined solutions are in accordance #ith regulations and standards!

&he result is a fle3ible solution that is client defined and client driven!

CThin5in* MyndsDD"Creati7e 1olutionsE

)ur Companies

1eAuel Mynd 1olutions P7t" 8td"

A Joint venture bet#een Mynd Solutions .rivate :imited and SeBuel, the company operates in "estern %ndia

to deliver its services to several global and national corporate customers in the areas of

Q HR consultancy

Q .ayroll administration

Q Retrials benefits administration

Q Accounts and finance outsourcing

Q Manpo#er outsourcing activities

&he company is e3hibiting robust gro#th in a short time through its innovative customer8focused services

and customi7ed products!

Aapt )utsourcin* 1olutions P7t" 8td"

Aapt Outsourcing Solutions is a '++I8o#ned subsidiary of Mynd Solutions .vt! :td! &he company is offering

services in manpo#er outsourcing! &he company #or$s #ith leading %ndian and international companies to

deliver outsourced services! Outsourced employees are enrolled in Aapt for document handling, ban$

account opening and .F and 5S% registrations, leave trac$ing and salary payments of clients! ustomers are

benefited due to reduced employees and smoother administrative tas$s!

Mynd Mana*ement Ad7isors P7t" 8td"

Mynd Management Advisors .vt! :td! is a management consulting arm of Mynd Solutions that offers

consulting services on critical proJects such as %FRS %mplementation!

Mynd 1olutions Asia PT&" 8td"

&he international sister concern of Mynd Solutions .vt! :td!, is based in Singapore to deliver #orld8class

services to clients spread all across the globe! &his ne# venture is assisting Mynd Solutions in e3tending

and gro#ing its international #ings across Asia, 5M5A and America!

Estimating Realistic Startup Costs

by Tim Berry

in 1hare7

7

in 1hare

in 1hare

Businesses spend money before they ever open their doors. Start-up expenses are those expenses incurred

before the business is running. Many people underestimate start-up costs and start their business in a

haphazard, unplanned way. This can work but is usually a harder way to do it. Customers are wary of

brand new businesses with makeshift logistics.

Use a start-up worksheet to plan your initial fnancing. Youll need this information to set up initial business

balances and to estimate startup expenses. Dont underestimate costs.

Startup expenses. These are expenses that happen before the beginning of the plan, before the

frst month. For example, many new companies incur expenses for legal work, logo design,

brochures, site selection and improvements, and other expenses.

Start-up assets. Typical start-up assets are cash (the money in the bank when the company

starts), and in many cases starting inventory. Other starting assets are both current and long-term,

such as equipment, ofce furniture, machinery, etc.

Start-up fnancing. This includes both capital investment and loans. The only investment amounts

or loan amounts that belong in the Start-up table are those that happen before the beginning of the

plan. Whatever happens during or after the frst month should go instead into the Cash Flow table,

which will automatically adjust the Balance Sheet.

Timing is everything

Some people are confused by the specifc defnition of start-up expenses, start-up assets, and start-up

fnancing. They would prefer to have a broader, more generic defnition that includes, say, expenses incurred

during the frst year, or the frst few months, of the plan. Unfortunately this would also lead to double counting

of expenses and non standard fnancial statements. All the expenses incurred during the frst year have to

appear in the Proft and Loss statement of the frst year, and all expenses incurred before that have to

appear as start-up expenses.

Dont count expenses twice: they go in Start-up or Proft and Loss, but not both. The only diference is timing.

Dont buy assets twice: they go into the Start-up if you acquire them before the starting date. Otherwise, put

them in the Proft and Loss.

Expenses vs. assets

Many people can be confused by the accounting distinction between expenses and assets. For example,

theyd like to record research and development as assets instead of expenses, because those expenses

create intellectual property. However, standard accounting and taxation law are both strict on the distinction:

Expenses are deductible against income, so they reduce taxable income.

Assets are not deductible against income.

What a company spends to acquire assets is not deductible against income. For example, money spent on

inventory is not deductible as expense. Only when the inventory is sold, and therefore becomes cost of

goods sold or cost of sales, does it reduce income.

Generally companies want to maximize deductions against income as expenses, not assets, because this

minimizes the tax burden. With that in mind, seasoned business owners and accountants will always want to

account for money spent on development as expenses, not assets. This is generally much better than

accounting for this expenditure as buying assets, such as patents or product rights. Assets look better on the

books than expenses, but there is rarely any clear and obvious correlation between money spent on

research and development and market value of intellectual property. Companies that account for

development as generating assets can often end up with vastly overstated assets, and questionable

fnancials statements.

Another common misconception involves expensed equipment. The U.S. Internal Revenue Service allows a

limited amount of ofce equipment purchases to be called expenses, not purchase of assets. You should

check with your accountant to fnd out the current limits of this rule. As a result, expensed equipment is

taking advantage of the allowance. After your company has used up the allowance, then additional

purchases have to go into assets, not expenses. This treatment also indicates the general preference for

expenses over assets, when you have a choice.

Why you dont want to capitalize expenses

Sometimes people want to treat expenses as assets. Ironically, thats usually a bad idea, for several reasons:

Money spent buying assets isnt tax deductible. Money spent on expenses is deductible.

Capitalizing expenses creates the danger of overstating assets.

If you capitalized the expense, it appears on your books as an asset. Having useless assets on the

accounting books is not a good thing.

Types of start-up fnancing

Investment is you or someone else puts in the company. It ends up as Paid-in Capital in the

Balance Sheet. This is the classic concept of business investment, taking ownership in a company,

risking money in the hope of gaining money later.

Accounts payable are debts that will end up as Accounts Payable in the Balance Sheet. Generally

this means credit-card debt. This number becomes the starting balance of your Balance Sheet.

Current borrowing is standard debt, borrowing from banks, Small Business Administration, or

other current borrowing.

Other current liabilities are additional liabilities that dont have interest charges. This is where you

put loans from founders, family members, or friends. We arent recommending interest-free loans

for fnancing, by the way, but when they happen, this is where they go.

Long-term liabilities are long-term debt, long-term loans.

Expect a Loss at Start-up

The loss at start-up is very commonat this point in the life of the company, youve already incurred tax-

deductible expenses, but you dont have sales yet. So you have a loss. Dont be surprised; its normal.

Cash Balance on Starting Date

Cash requirements is an estimate of how much money your start-up company needs to have in its checking

account when it starts. In general, your Cash Balance on Starting Date is the money you raised as

investments or loans minus the cash you spend on expenses and assets. As you build your plan, watch your

cash fow projections. If your cash balance drops below zero then you need to increase your fnancing or

reduce expenses. Many entrepreneurs decide they want to raise more cash than they need so theyll have

money left over for contingencies.

However, although that makes good sense when you can do it, it is hard to explain that to investors. The

outside investors dont want to give you more money than you need, for obvious reasonsits their money!

About the author: Founder and President of Palo Alto Software and a renowned planning expert. He is listed

in the index of "Fire in the Valley", by Swaine and Freiberger, the history of the personal computer industry.

Tim contributes regularly to the bplans blog, the Hufngtonpost.com as well as his own blogs, Planning,

Startups, Stories, Up and Running, and others. His full biography is available at timberry.com. More

How LivePlan makes your business more

successful

If you're writing a business plan, you're in luck. Online business planning software makes it easier than ever

before to put together a business plan for your business.

As you'll see in a moment, LivePlan is more than just business plan software, though. It's a knowledgable

guide combined with a professional designer coupled with a fnancial wizard. It'll help you get over the three

most common business hurdles with ease.

Let's take a look at those common hurdles, and see how producing a top-notch business plan sets your

business up for success

Executive Summary

TLC Wedding Consultants is a full service company that provides complete consulting services for

weddings, holy unions and anniversaries. Our consultants are experienced and dedicated professionals with

many years of event planning experience. TLC is unique in that we give our clients our undivided attention.

We listen to their needs and work with them to create the event of their dreams. Our clients' wishes become

our commands. So whether our client wants a Western, Tropical, Las Vegas or more traditional wedding, we

can help. Our services include weddings, honeymoons, receptions, anniversary consultations, budget

planning, answers to etiquette questions, as well as full-service referrals to forists, hair stylists, entertainers,

musicians, etc.

1.1 Mission

TLC Wedding Consultants is a full service company that provides complete consulting services for

weddings, holy unions and anniversaries. Our consultants are experienced and dedicated professionals with

many years of event planning experience. TLC is unique in that we give our clients our undivided attention.

We listen to their needs and work with them to create the event of their dreams. Our clients' wishes become

our commands. So whether our client wants a Western, Tropical, Las Vegas or more traditional wedding or

anniversary party, we can help. Our services include weddings, honeymoons, receptions, anniversary

consultations, budget planning, answers to etiquette questions, as well as full-service referrals to forists, hair

stylists, entertainers, musicians, etc.

1.2 Objectives

Whether this is our client's frst wedding, a renewal of their vows or their anniversary, we want every detail of

their event to be both a pleasurable and a memorable experience. Therefore we ofer a host of packages

and services specifcally tailored to the needs of each couple. We are confdent that this business venture

will be a success and we estimate that our net income will increase modestly by the second year.

1.3 Keys to Success

The keys to our success are as follows:

1. Service our clients' needs promptly and efciently.

2. Maintain an excellent working relationships with vendors such as forists, hair salons and bridal

shops.

3. Maintain a professional image at all times

Read more:

http://www.bplans.com/wedding_consultant_business_plan/executive_summary_fc.php#ixzz2XJH3Y1cSC

ompany Summary

TLC Wedding Consultants is a start-up company that provides wedding, holy union, and

anniversary consulting services to brides, grooms and other family members. We are a full-

service bridal consulting group and our goal is to put the "fun" back into planning a wedding, holy

union or anniversary party. Too many people become overly stressed and frustrated when

planning these wonderful events. We are experienced and professional consultants and will use

our expertise to help create memorable and stress free events for our customers. By doing this,

our clients can sit back and enjoy their event. The result? We create events suited to the couple's

unique style--a true expression of their relationship and individuality as a couple.

2.1 Company wners!ip

This business will start out as a simple proprietorship, owned by its founders, Darla and Micah

Johnson. As the operation grows, the owners will consider re-registering as a limited liability

company or as a corporation, whichever will better suite the future business needs.

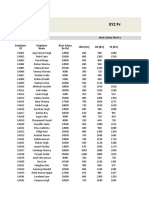

2.2 Start"up Summary

The company founders, Darla and Micah Johnson, will handle day-to-day operations of the plan

and will work collaboratively to ensure that this business venture is a success.

We estimate that our start-up costs will be $3,000 (including legal costs, logo design, advertising,

direct mail, and related expenses). An additional $5,000 will be required in the bank account as

an operating capital for the frst two months of operation. The start-up costs are to be fnanced in

equal portions by the owners' personal funds (i.e., Darla and Micah Johnson are investing $4,000

each).

Need actual charts?

We recommend using LivePlan as the easiest way to create graphs for your own business plan.

Create your own business plan

Start-up Requirements

Start-up Expenses

Legal $200

Stationery etc. $450

Brochures $450

Insurance $300

Research and development $200

Expensed equipment $900

Other $500

Total Start-up Expenses $3,000

Start-up Assets

Cash Required $5,000

Other Current Assets $0

Long-term Assets $0

Total Assets $5,000

Total Requirements $8,000

Need real fnancials?

We recommend using LivePlan as the easiest way to create automatic fnancials for your own

business plan.

Create your own business plan

Start-up Funding

Start-up Expenses to Fund $3,000

Start-up Assets to Fund $5,000

Total Funding Required $8,000

Assets

Non-cash Assets from Start-up $0

Cash Requirements from Start-up $5,000

Additional Cash Raised $0

Cash Balance on Starting Date $5,000

Total Assets $5,000

Liabilities and Capital

Liabilities

Current Borrowing $0

Long-term Liabilities $0

Accounts Payable (Outstanding Bills) $0

Other Current Liabilities (interest-free) $0

Total Liabilities $0

Capital

Planned Investment

Darla Johnson $4,000

Micah Johnson $4,000

Additional Investment Requirement $0

Total Planned Investment $8,000

Loss at Start-up (Start-up Expenses) ($3,000)

Total Capital $5,000

Total Capital and Liabilities $5,000

Total Funding $8,000

2.# Company Locations an$ %acilities

Initially this will be a home-based business; however, by Year 5, we intend to expand our facilities

into a well-equipped and operational ofce.

Read more:

http://www.bplans.com/wedding_consultant_business_plan/company_summary_fc.php#ixzz2XJHLW9kw

Services

We are a full-service wedding consultant group and provide the following services: etiquette advice, event

scheduling, discounted invitations and products, vendor confrmation, rehearsal attendance, supervision of

both ceremony and reception setup and budget planning

Read more: http://www.bplans.com/wedding_consultant_business_plan/services_fc.php#ixzz2XJHkRBXl

Market Analysis Summary

Nearly $35 billion are spent every year on weddings and receptions. Therefore, professional wedding

consultants are a commodity, not a calamity. TLC Wedding Consultants are full-service wedding consultants

that ofer a variety of services to our clients. We pride ourselves on being professional and courteous at all

times and we have packages to suit everyone's needs.

As previously stated, marriage is a billion dollar industry, therefore, just about everyone we meet is a

potential client. However, we mostly advertise to brides, grooms, and family members.

4.1 Market Segmentation

Although the fash and excitement of impending nuptials can be intoxicating, it can also be overwhelming.

Therefore, we primarily market our services to the people who need them most--brides and grooms. In 1997,

2.4 million marriages took place in the United States. According to the Encarta Encyclopedia, the current US

marriage rate of nine marriages per 1,000 people is still the highest rate among the industrialized countries.

This marriage rate is expected to remain at the same level in the near future. In the Eugene, OR area where

TLC Wedding Consultants plans to operate their business, over 1,500 marriages are registered each year,

which creates a sizable market potential for this line of business.

Another customer segment is represented by the numerous family members and guests attending weddings,

anniversaries, and similar events. This segment requires event preparation services like gift ideas, etiquette

tips, etc.

Besides the wedding arrangements, which TLC Wedding Consultants believe to be their major client

assignments, other events the company will provide services to include corporate retreats, etiquette training,

etc. This customer segment is estimated to have the annual volume of 1,000 orders in the Eugene, OR area.

Need actual charts

Read more:

http://www.bplans.com/wedding_consultant_business_plan/market_analysis_summary_fc.php#ixzz2XJHwCf

yK

Market Analysis

Year 1 Year 2 Year 3 Year 4 Year 5

Potential Customers Growth CAGR

Brides & Grooms 5% 1,500 1,575 1,654 1,737 1,824 5.01%

Family Members 5% 5,000 5,250 5,513 5,789 6,078 5.00%

Other 5% 1,000 1,050 1,103 1,158 1,216 5.01%

Total 5.00% 7,500 7,875 8,270 8,684 9,118 5.00%

Need real fnancials?

We recommend using LivePlan as the easiest way to create automatic fnancials for your own business plan.

Create your own business plan

4.2 Target Market Segment Strategy

TLC Wedding Consultants will ofer its services mostly to the brides and grooms, as well as to the family

members. The company will position itself as an experienced provider of wedding planning services. Unlike

most of its competitors, TLC will be ofering a full range of services and thus provide the convenience of one-

stop shopping for its clients. This will signifcantly reduce the customers' time and eforts preparing for such

an important event as a wedding. Moreover, by utilizing numerous supplier contacts that the company

owners have established and economies of scale, TLC Wedding Consultants will be able to pass on to its

customers sizable cost savings.

4.2.1 Market Needs

The market needs for wedding planning services are strongly shaped by the customers' desire to have a

perfectly planned and executed wedding ceremony. Although both major customer segments, brides and

grooms and family members, plan and budget for the wedding ceremony as far as a year or more in

advance, they often realize that they cannot make all the necessary preparations by themselves in a cost

efective manner. Strongly afected by the established social values, such customers seek professional

advice to ensure that all the important aspects of the wedding ceremony meet or exceed perceived

expectations.

4.3 Service Business na!ysis

The wedding services market is fragmented with the overwhelming majority of the incumbents ofering only a

limited line of services. There are numerous forists, hair stylists, and caterers to choose from. However,

there are almost no companies that will provide the full range of services associated with the wedding

planning and execution.

4.3.1 "om#etition and Buying $atterns

Competitive analysis conducted by the company owners has shown that there are 20 companies currently

ofering some sort of wedding planning services in the Eugene area. However, the majority of the incumbent

competitors ofer only a limited line of services like catering, fower arrangements or gifts. In fact, of these 25

competitors only three ofered a range of services comparable with what TLC Wedding Consultants plan to

ofer to its customers. The following is the list of the major competitors with a brief description of their

services:

Rent-An-Action ofers ceremony preparation, rehearsing and execution services.

Cross & Reeves provide fower and catering arrangements and wedding consulting services.

Lafayette Wedding ofers its clients entertaining, catering, foral design and hair styling services.

The market research has also shown that customers anticipate the complete wedding consulting services to

be expensive and they budget accordingly. In fact, lower prices are very often associated with poor service

quality. By aggregating a complete range of wedding services under one roof, TLC Wedding Consultants will

ofer its customers the ease of one-stop shopping.

Read more:

http://www.bplans.com/wedding_consultant_business_plan/market_analysis_summary_fc.php#ixzz2XJI2yIv

W

Market Analysis Summary

Nearly $35 billion are spent every year on weddings and receptions. Therefore, professional wedding

consultants are a commodity, not a calamity. TLC Wedding Consultants are full-service wedding consultants

that ofer a variety of services to our clients. We pride ourselves on being professional and courteous at all

times and we have packages to suit everyone's needs.

As previously stated, marriage is a billion dollar industry, therefore, just about everyone we meet is a

potential client. However, we mostly advertise to brides, grooms, and family members.

4.1 Market Segmentation

Although the fash and excitement of impending nuptials can be intoxicating, it can also be overwhelming.

Therefore, we primarily market our services to the people who need them most--brides and grooms. In 1997,

2.4 million marriages took place in the United States. According to the Encarta Encyclopedia, the current US

marriage rate of nine marriages per 1,000 people is still the highest rate among the industrialized countries.

This marriage rate is expected to remain at the same level in the near future. In the Eugene, OR area where

TLC Wedding Consultants plans to operate their business, over 1,500 marriages are registered each year,

which creates a sizable market potential for this line of business.

Another customer segment is represented by the numerous family members and guests attending weddings,

anniversaries, and similar events. This segment requires event preparation services like gift ideas, etiquette

tips, etc.

Besides the wedding arrangements, which TLC Wedding Consultants believe to be their major client

assignments, other events the company will provide services to include corporate retreats, etiquette training,

etc. This customer segment is estimated to have the annual volume of 1,000 orders in the Eugene, OR area.

Need actual charts?

We recommend using LivePlan as the easiest way to create graphs for your own business plan.

Create your own business plan

Market Analysis

Year 1 Year 2 Year 3 Year 4 Year 5

Potential Customers Growth CAGR

Brides & Grooms 5% 1,500 1,575 1,654 1,737 1,824 5.01%

Family Members 5% 5,000 5,250 5,513 5,789 6,078 5.00%

Other 5% 1,000 1,050 1,103 1,158 1,216 5.01%

Total 5.00% 7,500 7,875 8,270 8,684 9,118 5.00%

Need real fnancials?

We recommend using LivePlan as the easiest way to create automatic fnancials for your own business plan.

Create your own business plan

4.2 Target Market Segment Strategy

TLC Wedding Consultants will ofer its services mostly to the brides and grooms, as well as to the family

members. The company will position itself as an experienced provider of wedding planning services. Unlike

most of its competitors, TLC will be ofering a full range of services and thus provide the convenience of one-

stop shopping for its clients. This will signifcantly reduce the customers' time and eforts preparing for such

an important event as a wedding. Moreover, by utilizing numerous supplier contacts that the company

owners have established and economies of scale, TLC Wedding Consultants will be able to pass on to its

customers sizable cost savings.

4.2.1 Market Needs

The market needs for wedding planning services are strongly shaped by the customers' desire to have a

perfectly planned and executed wedding ceremony. Although both major customer segments, brides and

grooms and family members, plan and budget for the wedding ceremony as far as a year or more in

advance, they often realize that they cannot make all the necessary preparations by themselves in a cost

efective manner. Strongly afected by the established social values, such customers seek professional

advice to ensure that all the important aspects of the wedding ceremony meet or exceed perceived

expectations.

4.3 Service Business na!ysis

The wedding services market is fragmented with the overwhelming majority of the incumbents ofering only a

limited line of services. There are numerous forists, hair stylists, and caterers to choose from. However,

there are almost no companies that will provide the full range of services associated with the wedding

planning and execution.

4.3.1 "om#etition and Buying $atterns

Competitive analysis conducted by the company owners has shown that there are 20 companies currently

ofering some sort of wedding planning services in the Eugene area. However, the majority of the incumbent

competitors ofer only a limited line of services like catering, fower arrangements or gifts. In fact, of these 25

competitors only three ofered a range of services comparable with what TLC Wedding Consultants plan to

ofer to its customers. The following is the list of the major competitors with a brief description of their

services:

Rent-An-Action ofers ceremony preparation, rehearsing and execution services.

Cross & Reeves provide fower and catering arrangements and wedding consulting services.

Lafayette Wedding ofers its clients entertaining, catering, foral design and hair styling services.

The market research has also shown that customers anticipate the complete wedding consulting services to

be expensive and they budget accordingly. In fact, lower prices are very often associated with poor service

quality. By aggregating a complete range of wedding services under one roof, TLC Wedding Consultants will

ofer its customers the ease of one-stop shopping

Read more:

http://www.bplans.com/wedding_consultant_business_plan/market_analysis_summary_fc.php#ixzz2XJIF4B

yC

Strategy and Implementation Summary

Our strategy is simple: we intend to provide our customers with a wide range of services custom tailored to

their individual needs. Therefore, whether they require a complete package, or simply consulting on a

particular service, we can help.

%.1 "om#etitive &dge

By aggregating a complete range of wedding services under one roof, TLC Wedding Consultants will ofer its

customers the ease of one-stop shopping. The company will leverage its owners' expertise in planning such

events to competitively position itself as a premier provider of wedding services. Both owners have very

strong communication skills that will help develop the 'buzz' about the high quality of the services ofered by

TLC Wedding Consultants.

%.2 Sa!es Strategy

The company's sales strategy will be based on the following elements:

Advertising in the Yellow Pages - two inch by three inch ads describing the services will be placed

in the local Yellow Pages.

Placing advertisements in the local press, including The Register Guard, Eugene Weekly, The

Oregon Daily Emerald.

Developing afliate relationships with other service providers (forists, hair stylists, caterers) that

would receive a percentage of sales to the referred customers.

Word of mouth referrals - generating sales leads in the local community through customer referrals.

Need actual charts?

We recommend using LivePlan as the easiest way to create graphs for your own business plan.

Create your own business plan

Need actual charts?

We recommend using LivePlan as the easiest way to create graphs for your own business plan.

Create your own business plan

Sales Forecast

Year 1 Year 2 Year 3

Sales

Brides & Grooms $54,200 $65,040 $71,544

Family Members $25,800 $30,960 $34,056

Other $15,300 $18,360 $20,196

Total Sales $95,300 $114,360 $125,796

Direct Cost of Sales Year 1 Year 2 Year 3

Row 1 $0 $0 $0

Row 1 $0 $0 $0

Other $0 $0 $0

Subtotal Direct Cost of Sales $0 $0 $0

Read more:

http://www.bplans.com/wedding_consultant_business_plan/strategy_and_implementation_summary_fc.php#

ixzz2XJIq1NBA

Management Summary

Our wedding consultants are Darla and Micah Johnson. Collaboratively they have planned and

serviced over 150 weddings and receptions. They are knowledgeable about all areas of planning,

decorating, as well as budgeting. Darla has a BS in Communications and a minor in Interior

Decorating. She has been a wedding consultant for fve years and became interested in providing

consultant services when she successfully planned her frst fve weddings for family and friends.

Since then, Darla has received extensive training in wedding planning and her certifcation from

the National Association of Wedding Consultants and Professional Wedding Planners. Micah has

an Associates Degree in Fashion Design, and, like Darla, she became interested in becoming a

consultant when she successfully planned her frst three weddings. Micah received her

certifcation from the National Association of Wedding Consultants and has been a wedding

planner for three years. Micah enjoys all aspects of planning traditional and nontraditional

weddings.

&.1 Personnel Plan

Initially, TLC Wedding Consultants' personnel will include only the two owners, both of whom will

be working full time. As the personnel plan shows, we expect to hire an additional wedding

consultant in the next year This person will work full time, but will not be included in the

management decisions.

Personnel Plan

Year 1 Year 2 Year 3

Owner $53,100 $76,200 $85,800

Other $0 $0 $0

Total People 0 0 0

Total Payroll $53,100 $76,200 $85,800

Read more:

http://www.bplans.com/wedding_consultant_business_plan/management_summary_fc.php#ixzz2XJJC8B6H

Financial Plan

The following subtopics represent the fnancial plan of TLC Wedding Consultants.

'.1 (reak"even )nalysis

The following table and chart summarize our break-even analysis.

Need actual charts?

We recommend using LivePlan as the easiest way to create graphs for your own business plan.

Create your own business plan

Break-even Analysis

Monthly Revenue Break-even $4,804

Assumptions:

Average Percent Variable Cost 0%

Estimated Monthly Fixed Cost $4,804

Need real fnancials?

We recommend using LivePlan as the easiest way to create automatic fnancials for your own

business plan.

Create your own business plan

'.2 Pro*ecte$ Pro+t an$ Loss

Our projected proft and loss is shown in the following table.

Need actual charts?

We recommend using LivePlan as the easiest way to create graphs for your own business plan.

Create your own business plan

Need actual charts?

We recommend using LivePlan as the easiest way to create graphs for your own business plan.

Create your own business plan

Need actual charts?

We recommend using LivePlan as the easiest way to create graphs for your own business plan.

Create your own business plan

Need actual charts?

We recommend using LivePlan as the easiest way to create graphs for your own business plan.

Create your own business plan

Pro Forma Proft and Loss

Year 1 Year 2 Year 3

Sales $95,300 $114,360 $125,796

Direct Cost of Sales $0 $0 $0

Other $0 $0 $0

Total Cost of Sales $0 $0 $0

Gross Margin $95,300 $114,360 $125,796

Gross Margin % 100.00% 100.00% 100.00%

Expenses

Payroll $53,100 $76,200 $85,800

Sales and Marketing and Other Expenses $4,550 $1,000 $2,000

Depreciation $0 $0 $0

Leased Equipment $0 $0 $0

Utilities $0 $0 $0

Insurance $0 $0 $0

Rent $0 $0 $0

Payroll Taxes $0 $0 $0

Other $0 $0 $0

Total Operating Expenses $57,650 $77,200 $87,800

Proft Before Interest and Taxes $37,650 $37,160 $37,996

EBITDA $37,650 $37,160 $37,996

Interest Expense $0 $0 $0

Taxes Incurred $9,443 $9,290 $9,657

Net Proft $28,208 $27,870 $28,339

Net Proft/Sales 29.60% 24.37% 22.53%

'.# Pro*ecte$ Cas! %low

The following chart and table show our cash fow projections.

Need actual charts?

We recommend using LivePlan as the easiest way to create graphs for your own business plan.

Create your own business plan

Pro Forma Cash Flow

Year 1 Year 2 Year 3

Cash Received

Cash from Operations

Cash Sales $38,120 $45,744 $50,318

Cash from Receivables $45,494 $66,279 $74,075

Subtotal Cash from Operations $83,614 $112,023 $124,394

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $0 $0 $0

Subtotal Cash Received $83,614 $112,023 $124,394

Expenditures Year 1 Year 2 Year 3

Expenditures from Operations

Cash Spending $53,100 $76,200 $85,800

Bill Payments $12,748 $10,689 $11,545

Subtotal Spent on Operations $65,848 $86,889 $97,345

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $0 $0 $0

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $65,848 $86,889 $97,345

Net Cash Flow $17,766 $25,134 $27,049

Cash Balance $22,766 $47,900 $74,949

General Assumptions

Year 1 Year 2 Year 3

Plan Month 1 2 3

Current Interest Rate 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00%

Tax Rate 25.42% 25.00% 25.42%

Other 0 0 0

'., Pro*ecte$ (alance S!eet

Three years of annual totals are presented in the Projected Balance Sheet below. First year

monthly fgures are included in the appendix.

Pro Forma Balance Sheet

Year 1 Year 2 Year 3

Assets

Current Assets

Cash $22,766 $47,900 $74,949

Accounts Receivable $11,686 $14,023 $15,426

Other Current Assets $0 $0 $0

Total Current Assets $34,452 $61,923 $90,374

Long-term Assets

Long-term Assets $0 $0 $0

Accumulated Depreciation $0 $0 $0

Total Long-term Assets $0 $0 $0

Total Assets $34,452 $61,923 $90,374

Liabilities and Capital Year 1 Year 2 Year 3

Current Liabilities

Accounts Payable $1,245 $846 $958

Current Borrowing $0 $0 $0

Other Current Liabilities $0 $0 $0

Subtotal Current Liabilities $1,245 $846 $958

Long-term Liabilities $0 $0 $0

Total Liabilities $1,245 $846 $958

Paid-in Capital $8,000 $8,000 $8,000

Retained Earnings ($3,000) $25,208 $53,078

Earnings $28,208 $27,870 $28,339

Total Capital $33,208 $61,078 $89,416

Total Liabilities and Capital $34,452 $61,923 $90,374

Net Worth $33,207 $61,078 $89,416

Need real fnancials?

We recommend using LivePlan as the easiest way to create automatic fnancials for your own

business plan.

Create your own business plan

'.- (usiness Ratios

The following table outlines some of the more important ratios from the Personal

Services industry. The fnal column, Industry Profle, details specifc ratios based on the industry

as it is classifed by the Standard Industry Classifcation (SIC) code, 7299.

Ratio Analysis

Year 1 Year 2 Year 3 Industry Profle

Sales Growth 0.00% 20.00% 10.00% 17.90%

Percent of Total Assets

Accounts Receivable 33.92% 22.65% 17.07% 11.10%

Other Current Assets 0.00% 0.00% 0.00% 37.10%

Total Current Assets 100.00% 100.00% 100.00% 52.80%

Long-term Assets 0.00% 0.00% 0.00% 47.20%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities 3.61% 1.37% 1.06% 33.90%

Long-term Liabilities 0.00% 0.00% 0.00% 28.00%

Total Liabilities 3.61% 1.37% 1.06% 61.90%

Net Worth 96.39% 98.63% 98.94% 38.10%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 100.00% 100.00% 100.00% 0.00%

Selling, General & Administrative Expenses 70.37% 75.63% 77.35% 72.70%

Advertising Expenses 3.52% 0.87% 1.59% 2.20%

Proft Before Interest and Taxes 39.51% 32.49% 30.20% 4.00%

Main Ratios

Current 27.68 73.22 94.32 1.81

Quick 27.68 73.22 94.32 1.33

Total Debt to Total Assets 3.61% 1.37% 1.06% 61.90%

Pre-tax Return on Net Worth 113.38% 60.84% 42.49% 6.30%

Pre-tax Return on Assets 109.28% 60.01% 42.04% 16.60%

Additional Ratios Year 1 Year 2 Year 3

Net Proft Margin 29.60% 24.37% 22.53% n.a

Return on Equity 84.94% 45.63% 31.69% n.a

Activity Ratios

Accounts Receivable Turnover 4.89 4.89 4.89 n.a

Collection Days 57 68 71 n.a

Accounts Payable Turnover 11.24 12.17 12.17 n.a

Payment Days 27 37 28 n.a

Total Asset Turnover 2.77 1.85 1.39 n.a

Debt Ratios

Debt to Net Worth 0.04 0.01 0.01 n.a

Current Liab. to Liab. 1.00 1.00 1.00 n.a

Liquidity Ratios

Net Working Capital $33,207 $61,078 $89,416 n.a

Interest Coverage 0.00 0.00 0.00 n.a

Additional Ratios

Assets to Sales 0.36 0.54 0.72 n.a

Current Debt/Total Assets 4% 1% 1% n.a

Acid Test 18.29 56.64 78.22 n.a

Sales/Net Worth 2.87 1.87 1.41 n.a

Dividend Payout 0.00 0.00 0.00 n.a

Read more:

http://www.bplans.com/wedding_consultant_business_plan/fnancial_plan_fc.php#ixzz2XJJshxOz

Appendix

Sales Forecast

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9

Month

10

Month

11

Month

12

Sales

Brides & Grooms 0% $2,900 $3,100 $3,300 $3,500 $4,000 $5,400 $4,600 $5,000 $5,200 $5,500 $5,700 $6,000

Family Members 0% $1,600 $1,700 $1,800 $1,900 $2,000 $2,100 $2,200 $2,300 $2,400 $2,500 $2,600 $2,700

Other 0% $1,200 $1,200 $1,200 $1,200 $1,200 $1,300 $1,300 $1,300 $1,300 $1,300 $1,400 $1,400

Total Sales $5,700 $6,000 $6,300 $6,600 $7,200 $8,800 $8,100 $8,600 $8,900 $9,300 $9,700 $10,100

Direct Cost of Sales Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9

Month

10

Month

11

Month

12

Row 1 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Row 1 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal Direct Cost of

Sales

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Need real fnancials?

We recommend using LivePlan as the easiest way to create automatic fnancials for your own business plan.

Create your own business plan

Personnel Plan

Month

1

Month

2

Month

3

Month

4

Month

5

Month

6

Month

7

Month

8

Month

9

Month

10

Month

11

Month

12

Owner 0% $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $5,700 $5,700 $5,700

Other 0% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total People 0 0 0 0 0 0 0 0 0 0 0 0

Total Payroll $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $5,700 $5,700 $5,700

General Assumptions

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9Month 10Month 11

Month

12

Plan Month 1 2 3 4 5 6 7 8 9 10 11 12

Current Interest

Rate

10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Long-term Interest

Rate

10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Tax Rate 30.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00%

Other 0 0 0 0 0 0 0 0 0 0 0 0

Pro Forma Proft and Loss

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11

Month

12

Sales $5,700 $6,000 $6,300 $6,600 $7,200 $8,800 $8,100 $8,600 $8,900 $9,300 $9,700 $10,100

Direct Cost of Sales $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Cost of Sales $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Gross Margin $5,700 $6,000 $6,300 $6,600 $7,200 $8,800 $8,100 $8,600 $8,900 $9,300 $9,700 $10,100

Gross Margin % 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

Expenses

Payroll $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $5,700 $5,700 $5,700

Sales and Marketing

and Other Expenses

$1,100 $250 $250 $250 $600 $250 $250 $250 $600 $250 $250 $250

Depreciation $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Leased Equipment $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Utilities $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Insurance $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Rent $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Payroll Taxes 15% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Operating

Expenses

$5,100 $4,250 $4,250 $4,250 $4,600 $4,250 $4,250 $4,250 $4,600 $5,950 $5,950 $5,950

Proft Before Interest

and Taxes

$600 $1,750 $2,050 $2,350 $2,600 $4,550 $3,850 $4,350 $4,300 $3,350 $3,750 $4,150

EBITDA $600 $1,750 $2,050 $2,350 $2,600 $4,550 $3,850 $4,350 $4,300 $3,350 $3,750 $4,150

Interest Expense $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Taxes Incurred $180 $438 $513 $588 $650 $1,138 $963 $1,088 $1,075 $838 $938 $1,038

Net Proft $420 $1,313 $1,538 $1,763 $1,950 $3,413 $2,888 $3,263 $3,225 $2,513 $2,813 $3,113

Net Proft/Sales 7.37% 21.88% 24.40% 26.70% 27.08% 38.78% 35.65% 37.94% 36.24% 27.02% 28.99% 30.82%

Pro Forma Cash Flow

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9Month 10Month 11Month 12

Cash Received

Cash from Operations

Cash Sales $2,280 $2,400 $2,520 $2,640 $2,880 $3,520 $3,240 $3,440 $3,560 $3,720 $3,880 $4,040

Cash from Receivables $0 $114 $3,426 $3,606 $3,786 $3,972 $4,352 $5,266 $4,870 $5,166 $5,348 $5,588

Subtotal Cash from

Operations

$2,280 $2,514 $5,946 $6,246 $6,666 $7,492 $7,592 $8,706 $8,430 $8,886 $9,228 $9,628

Additional Cash Received

Sales Tax, VAT, HST/GST

Received

0.00% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Current Borrowing $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Other Liabilities (interest-

free)

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Long-term Liabilities $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Sales of Other Current Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Sales of Long-term Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Investment Received $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal Cash Received $2,280 $2,514 $5,946 $6,246 $6,666 $7,492 $7,592 $8,706 $8,430 $8,886 $9,228 $9,628

Expenditures Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9Month 10Month 11Month 12

Expenditures from Operations

Cash Spending $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $5,700 $5,700 $5,700

Bill Payments $43 $1,260 $690 $765 $851 $1,255 $1,382 $1,217 $1,349 $1,655 $1,091 $1,191

Subtotal Spent on Operations $4,043 $5,260 $4,690 $4,765 $4,851 $5,255 $5,382 $5,217 $5,349 $7,355 $6,791 $6,891

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid

Out

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Principal Repayment of Current

Borrowing

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Other Liabilities Principal

Repayment

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Long-term Liabilities Principal

Repayment

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Purchase Other Current Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Purchase Long-term Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Dividends $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal Cash Spent $4,043 $5,260 $4,690 $4,765 $4,851 $5,255 $5,382 $5,217 $5,349 $7,355 $6,791 $6,891

Net Cash Flow ($1,763) ($2,746) $1,256 $1,481 $1,815 $2,237 $2,210 $3,489 $3,081 $1,531 $2,437 $2,737

Cash Balance $3,237 $491 $1,747 $3,228 $5,043 $7,280 $9,491 $12,980 $16,061 $17,592 $20,029 $22,766

Need real fnancials?

We recommend using LivePlan as the easiest way to create automatic fnancials for your own business plan.

Create your own business plan

Pro Forma Balance Sheet

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9Month 10Month 11Month 12

Assets

Starting

Balances

Current Assets

Cash $5,000 $3,237 $491 $1,747 $3,228 $5,043 $7,280 $9,491 $12,980 $16,061 $17,592 $20,029 $22,766

Accounts Receivable $0 $3,420 $6,906 $7,260 $7,614 $8,148 $9,456 $9,964 $9,858 $10,328 $10,742 $11,214 $11,686

Other Current Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Current Assets $5,000 $6,657 $7,397 $9,007 $10,842 $13,191 $16,736 $19,455 $22,838 $26,389 $28,334 $31,243 $34,452

Long-term Assets

Long-term Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Accumulated Depreciation $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Long-term Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Assets $5,000 $6,657 $7,397 $9,007 $10,842 $13,191 $16,736 $19,455 $22,838 $26,389 $28,334 $31,243 $34,452

Liabilities and Capital Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9Month 10Month 11Month 12

Current Liabilities

Accounts Payable $0 $1,237 $665 $737 $810 $1,208 $1,341 $1,172 $1,293 $1,619 $1,051 $1,148 $1,245

Current Borrowing $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Other Current Liabilities $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal Current

Liabilities

$0 $1,237 $665 $737 $810 $1,208 $1,341 $1,172 $1,293 $1,619 $1,051 $1,148 $1,245

Long-term Liabilities $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Liabilities $0 $1,237 $665 $737 $810 $1,208 $1,341 $1,172 $1,293 $1,619 $1,051 $1,148 $1,245

Paid-in Capital $8,000 $8,000 $8,000 $8,000 $8,000 $8,000 $8,000 $8,000 $8,000 $8,000 $8,000 $8,000 $8,000

Retained Earnings ($3,000) ($3,000) ($3,000) ($3,000) ($3,000) ($3,000) ($3,000) ($3,000) ($3,000) ($3,000) ($3,000) ($3,000) ($3,000)

Earnings $0 $420 $1,733 $3,270 $5,033 $6,983 $10,395 $13,283 $16,545 $19,770 $22,283 $25,095 $28,208

Total Capital $5,000 $5,420 $6,733 $8,270 $10,033 $11,983 $15,395 $18,283 $21,545 $24,770 $27,283 $30,095 $33,208

Total Liabilities and

Capital

$5,000 $6,657 $7,397 $9,007 $10,842 $13,191 $16,736 $19,455 $22,838 $26,389 $28,334 $31,243 $34,452

Net Worth $5,000 $5,420 $6,733 $8,270 $10,033 $11,983 $15,395 $18,283 $21,545 $24,770 $27,282 $30,095 $33,207

Read more:

http://www.bplans.com/wedding_consultant_business_plan/fnancial_plan_fc.php#ixzz2XJMR8QJG

Accounting and Bookkeeping Business Plan

The Sorcerer's Accountant

Start your own business plan

Page

1

2

3

4

5

6

7

8

9

Previous Page Next Page

Executive Summary

The Sorcerer's Accountant is a small, successful, one-person accounting and tax preparation

service owned and run by Max Greenwood, CPA in Chicago, Illinois. The frm ofers tax

accounting, management accounting, and QuickBooks set-up and training for small business

clients. To move beyond a one person model, the business will expand its services to include

bookkeeping services for small businesses. This will require an investment in marketing and staf

to grow the business to include this complementary line of business. This business plan

organizes the strategy and tactics for the business expansion and set objectives for growth over

the next three years.

The business will ofer clients bookkeeping services with the oversight of a CPA at a price they

can aford. To do this involves hiring undergraduate student bookkeepers and a graduate student

manager, keeping fxed costs as low as possible, and continuing to defne the expertise of

Sorcerer's Accountant through its website resources. The efect will be sales more than doubling

over three years as 8 part-time bookkeepers are deployed to client businesses as needed, and

salary and dividends to Greenwood increase substantially.

Need actual charts?

We recommend using LivePlan as the easiest way to create graphs for your own business plan.

Create your own business plan

b*ectives

The Sorcerer's Accountant seeks to launch a new line of services - small business bookkeeping -

which will be ofered to the same ongoing clients as Sorcerer's Accountant currently seeks.

Sorcerer's Accountant has set the following objectives:

To launch the bookkeeping services slowly, beginning with two part-time bookkeepers

To achieve bookkeeping service annual revenues equal or greater to the current total

revenues within three years (efectively doubling revenue)

To achieve net proft of $60,000 in three years

To employ 8 part-time bookkeepers in three years

.ission

The Sorcerer's Accountant seeks to provide a full suite of tax and management accounting

services for small businesses in Chicago, Illinois, allowing business owners to not only save

money over in-house accounting and ensure their compliance with tax laws, but to make valuable

management decisions from their numbers.

/eys to Success

The keys to success for the accounting business include:

Building trust with clients