Professional Documents

Culture Documents

Anshul Mittal

Uploaded by

aakkii028Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Anshul Mittal

Uploaded by

aakkii028Copyright:

Available Formats

MAJOR RESEARCH PROJECT

SYNOPSIS

TITLED

The impact of subsidy given by Central & State government to cotton ginning & pressing

units in India.

A Research synopsis submitted as partial fulfillment for the award of Degree of Master of

Business Administration MBA (Full Time)

Batch(2012-2014)

Submitted by: Guided by:

Anshul Mittal Dr. C. K. Goyal

MBA III SEM

Dept. IBMR,IPS ACADEMY

Rajendra Nagar, AB ROAD Indore-452012(MP)

Affiliated to Devi Ahilya Vishwavidyalaya, indore

INDEX

Sr.no

1

Topic

2

Introduction

a) Back ground Research

b) Detail of the company

3

Literature review

4

Rationale of study

5

Objective of study

6

Research Methodology

7

Biblography/ Webilography

Topic of research

THE IMPACT OF TAX SUBSIDY GIVEN BY CENTRAL & STATE GOVERNMENT

TO COTTON GINNING & PRESSING UNITS IN INDIA.

INTRODUTION

Back ground of Research Area

Subsidy

A subsidy is a form of financial or in kind support extended to an economic sector (or institution, business, or

individual) generally with the aim of promoting economic and social policy. Although commonly extended

from Government, the term subsidy can relate to any type of support - for example from NGOs or implicit

subsidies. Subsidies come in various forms including: direct (cash grants, interest-free loans), indirect (tax

breaks, insurance, low-interest loans, depreciation write-offs, rent rebates). Furthermore, they can be broad or

narrow, legal or illegal, ethical or unethical. The most common forms of subsidies are those to the producer or

the consumer. Producer/Production subsidies ensure producers are better off by supplying market price

support, direct support, or payments to factors of production. Consumer/Consumption subsidies commonly

reduce the price of goods and services to the consumer.

Tax subsidy

Government can create exactly the same outcome through selective tax breaks as through cash

payment. For example, suppose a government sends monetary assistance that reimburses 15% of

all health expenditures to a group that is paying 15% income tax. Exactly the same subsidy is

achieved by giving a health tax deduction. Tax subsidies are also known as tax expenditure. Tax

subsidies are one of the main explanations for why the tax code is so complicated.

Tax subsidies are the result of selective tax legislation that benefits particular groups of people or industries in

the economy. In effect, they share the costs of certain actions between the private sector and the government

and impact investment decisions by increasing the expected returns associated with a particular pattern of

economic activity. Tax subsidies may be applied in a number of ways to any one or a combination of

economic variables (land, labor, capital).

The stated goal of tax subsidies, according to the U.S. General Accounting Office, is to promote

some policy objective such as "economic growth or a desirable expenditure pattern by

taxpayers." However, there is a great deal of disagreement over whether particular tax benefits

typically encourage "socially desirable" economic behavior. Further, even if the policies are

effective, they are static and may become ineffective or counterproductive as circumstances (be

they demographic, technological, or economic) change.

How Tax Subsidies Work

Tax subsidies increase expected returns by decreasing the costs associated with taxation. This is

accomplished in four main ways: providing tax credits; altering the statutory tax rate; altering the

taxable basis (i.e., the activities and expenses which are or are not included in the calculation of the

tax base); and altering the taxable entity (such as by allowing losses from one corporation to off-

set profits of another). Each of these methods of subsidizing private activity via the tax code has

additional variants as well, which are described in more detail below.

Details of industry

Cotton ginning & pressing factory is one of the oldest business in the world. In ancient time people

use to gin the cotton by their hands to prepare the yarn. But now a days there are big unit involve

in ginning and pressing the raw cotton. They produce number of cotton bales and these bales are

supplied to many yarn mills in India as well as outside of India.

In previous year 2013-2014 number of cotton bales produced in India 3.25 cr.

Out of which 1.5 cr. bales are exported to other countries like china, Pakistan, Indonesia

We can say that these industry plays and important part in total export of the country.

Main products produce by industry

Cotton bales: - It is first and most important product of this industry. It is prepared after proper

ginning & pressing of raw cotton. It is the raw product for yarn industry.

Cotton seeds: - Cotton seeds are comes when ginning process is done. It is used as cattle food and

it is also supplied to oil mills to extract oil from these seed.

Cotton seed cake: - It is by product when oil is extracted from seeds. It also used as cattle food.

Review of literature

Cotton Corporation of India(CCI)

The Govt. of India launched Technology Mission on Cotton in February 2010.

TMC had four Mini Missions as under

Mini Mission I: Cotton Research & Technology Generation

Mini Mission II: Transfer of Technology & Development

Mini Mission III: Development of Market Infrastructure

Mini Mission IV: Modernization / Setting up of new G&P factories.

For MM-IV Ministry of Textiles was the nodal agency and The Cotton Corporation of

India Ltd. (CCI) was the implementing agency.

Under Mini Mission-IV, there was a target of modernization of 1000 G&P units. Against the said

target, 1011 G&P units were sanctioned, however, only 859 G&P units reported completion of

their projects. GOI subsidy of Rs.184.75 crores was released to these beneficiaries. Thus, 85.9% of

the laid down target was achieved. The state-wise details of G&P units sanctioned for

modernization / completed their projects are as under:

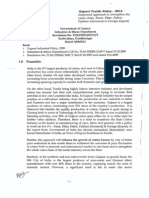

STATE-WISE NUMBER OF G&P UNITS SANCTIONED/COMPLETED AND PAID FOR

MODERNIZATION UNDER TMC MINI MISSION- IV DURING 9TH, 10TH & 11TH

PLANS

Rupees in crore

State

G & P Factories

Sanctioned Projects Completed Projects GOI Share Released

Diu (U.T.) 1 1 0.27

Punjab 19 11 2.18

Haryana 7 5 1.32

Rajasthan 2 0 0.00

Madhya Pradesh 53 46 9.69

Gujarat 557 506 106.97

Andhra Pradesh 34 22 4.99

Karnataka 15 13 2.66

Tamil Nadu 2 1 0.31

Orissa 8 6 1.21

Maharashtra 313 248 55.15

Total 1011 859 184.74

The Economic Times, keyur dhandeo, Sep 5 2012

AHMEDABAD: Gujarat government on Wednesday announced new textile policy for next five

years. It expects an investment of Rs 20,000 crore over five years, 25 lakh new jobs, of which 50%

will be for rural women. It focuses on 4Fs (farm, fibre, fabric, foreign). It focuses on value addition of

cotton within the state. At present 90% of state's cotton is sold in other states. Gujarat produces close

to 30% of country's cotton.

1. Envisages doubling of spinning capacity 25 lakh spindles to 50 lakh spindles in five years,

encourage cotton spinning and weaving in cotton producing areas of the state

2. Interest subsidy of 5% for technology upgradation for ginning, spinning weaving processing and

ready made garments and 7% subsidy for purchase of plant and machinery

3. Exemption on VAT on produce

4. Relief of Rs 1 per unit on power tariff for spinning and weaving for five years, assured lignite

for captive power plant

5. Assistance of 50% or upto Rs 50,000 for Audit of energy, Environment, Water conservation.

6. Relief of 20% or Rs 20 lakh on plant machinery for audit.

K. R. Mandovra (advocate & legal advisor)

Technology Mission on Cotton (Mini Mission III & IV)

Under MM-III 60% of the cost of development is borne by the Government of India and

the balance by the Agricultural Produce Marketing Committee (APMC) / State

Government concerned. GOI assistance is limited to Rs. 1.50 crores for setting up of new

yards and Rs. 0.90 crores for improvement of existing market yards.

Under MM-IV, capital incentive @ 25% of the total cost of modernization / upgradation of Ginning

and Pressing factory with a ceiling of Rs. 20 lakh per unit is borne by the GOI and the rest by

the entrepreneur. Further, for installation of new bale press and HVI/MVI laboratories,

additional incentive of Rs 7 lakh and Rs. 4 lakh respectively has also been allowed.

Rationale of study

The outcome of study will be to now the impact on the production capacity of cotton ginning &

pressing units after giving subsidies to this industry by government.

The study is conducted to know number of ginning & pressing units increased after subsidy is

given by government.

Objective of study

1. To study the tax subsidy given by government to cotton industries.

2.To understand the effect of the subsidy on production capacity.

3.To understand increment in the number of new units of cotton ginning & pressing.

Research methodology

Method of reseaech is Descriptive.

Sample size

Total sample size 50

30 from Madhya Pradesh & 20 from Maharashtra

Tools for data collection

1. Primary data through personal meetings.

2. Secondary data through online.

Bibliography

Books:

Subsidies in India (2006) New century publication by Rishi Muni Dwivedi

Research method and techniques (2007) wishwaprakashan New Delhi by C.P. Kothari

Paying for it 2009 revised edition published by Harvard crimson

Webliography

Links:

1. www.earthtrack.net

2. www.wikipedia.org

3. www.business_satandard.com

4. www.economictimes.com

5. www.treasury.gov

6. www.google.com

9

You might also like

- ROLE OF SIDBIDocument7 pagesROLE OF SIDBISonamNo ratings yet

- 8098 pt1Document385 pages8098 pt1Hotib PerwiraNo ratings yet

- Tariff and Customs LawDocument15 pagesTariff and Customs LawJel LyNo ratings yet

- Lok SabhaDocument8 pagesLok SabhaAjeeta SrivastavaNo ratings yet

- Gujarat Textile Policy 2012Document15 pagesGujarat Textile Policy 2012Michael KingNo ratings yet

- Need of Small-Scale Industries For The General Prosperity of The CountryDocument4 pagesNeed of Small-Scale Industries For The General Prosperity of The CountryashutoshNo ratings yet

- MSMEandroleof Governmentin MSMEdevelopmentDocument10 pagesMSMEandroleof Governmentin MSMEdevelopmentSarvesh ParabNo ratings yet

- Covid 19 and MSME-Loksabha SecretariatDocument6 pagesCovid 19 and MSME-Loksabha Secretariatanshulpatel0608No ratings yet

- Daily Current Affairs IAS | UPSC Prelims and Mains Exam – 9th April 2020Document9 pagesDaily Current Affairs IAS | UPSC Prelims and Mains Exam – 9th April 2020Yogesh BantanurNo ratings yet

- PRESS INFORMATION BUREAU PIB IAS UPSC 1st June To 7th June 2020Document17 pagesPRESS INFORMATION BUREAU PIB IAS UPSC 1st June To 7th June 2020Shivangi SahuNo ratings yet

- 2020 DecDocument61 pages2020 DecLokeshNo ratings yet

- Atmanirbhar Bharat AbhiyanDocument9 pagesAtmanirbhar Bharat Abhiyanrajamech30No ratings yet

- National Manufacturing Policy Discussion PaperDocument23 pagesNational Manufacturing Policy Discussion PaperAnugrah Narain SaxenaNo ratings yet

- FMCG Industry AnalysisDocument58 pagesFMCG Industry Analysisavinash singhNo ratings yet

- Effects of Public Expenditure On Economy Production DistributionDocument6 pagesEffects of Public Expenditure On Economy Production DistributionNøthîñgLîfèNo ratings yet

- Since Assuming Office in May 2014, The New Government Has Undertaken A Number of New Reform Measures Whose Cumulative Impact Could Be SubstantialDocument9 pagesSince Assuming Office in May 2014, The New Government Has Undertaken A Number of New Reform Measures Whose Cumulative Impact Could Be SubstantialOkay PlusNo ratings yet

- Economic Notes: What Is Poverty Alleviation?Document7 pagesEconomic Notes: What Is Poverty Alleviation?Rishab ToshniwalNo ratings yet

- BE MergedDocument105 pagesBE MergedXyz YxzNo ratings yet

- Model Answer Key Economics-IiDocument17 pagesModel Answer Key Economics-Iisheetal rajputNo ratings yet

- Sector: FMCG: Government InitiativesDocument19 pagesSector: FMCG: Government InitiativesRahul DudejaNo ratings yet

- FPC From Quantity to QualityDocument18 pagesFPC From Quantity to QualityrichamailNo ratings yet

- S&A KS - MSME Stimulus - UpdateV7Document5 pagesS&A KS - MSME Stimulus - UpdateV7Shatir LaundaNo ratings yet

- MsmeDocument10 pagesMsmeFurqan AhmedNo ratings yet

- PM-GKAY Extension, OSP Guidelines LiberalizedDocument60 pagesPM-GKAY Extension, OSP Guidelines LiberalizedprashantNo ratings yet

- Stimulating Msme Economy in The Face of Covid-19: BackgroundDocument4 pagesStimulating Msme Economy in The Face of Covid-19: BackgroundRakesh SinghNo ratings yet

- National Skill Development Policy 12th PlanDocument5 pagesNational Skill Development Policy 12th PlanSohamsNo ratings yet

- Atmanirbhar BharathDocument8 pagesAtmanirbhar BharathsantoshsadanNo ratings yet

- Banking and Financial Awareness August 2013Document9 pagesBanking and Financial Awareness August 2013Digambar JangamNo ratings yet

- EconomyDocument10 pagesEconomyjyothisaiswaroop satuluriNo ratings yet

- PLI Scheme Encourages Local Production and Job CreationDocument6 pagesPLI Scheme Encourages Local Production and Job CreationNidhi VajhaNo ratings yet

- FMCGDocument6 pagesFMCGRahul DudejaNo ratings yet

- News Analysis (22 Sep, 2022)Document25 pagesNews Analysis (22 Sep, 2022)shivansh shahNo ratings yet

- 10 Best Government Subsidy For Small Business in IndiaDocument6 pages10 Best Government Subsidy For Small Business in IndiaDeeplakhan BhanguNo ratings yet

- Top 10 Government Startup Support Schemes in IndiaDocument3 pagesTop 10 Government Startup Support Schemes in India153KAPIL RANKANo ratings yet

- Accounts-Small Scale IndustriesDocument7 pagesAccounts-Small Scale IndustriesdevugoriyaNo ratings yet

- Weekly News Updates and Special TopicsDocument25 pagesWeekly News Updates and Special TopicsPhysics UniverseNo ratings yet

- Ca 2012 1Document779 pagesCa 2012 1Manjunath ThamminidiNo ratings yet

- Genesis Ias Academy - Hyd Bad 9949 363 363: Appsc Group1 (Mains) Current Affairs Answer Writing Session - 2020 Test 3Document9 pagesGenesis Ias Academy - Hyd Bad 9949 363 363: Appsc Group1 (Mains) Current Affairs Answer Writing Session - 2020 Test 3CyrilMaxNo ratings yet

- Athbanirbar SchemeDocument8 pagesAthbanirbar Schemesunilrs1980No ratings yet

- Atma Bharat NirmaanDocument5 pagesAtma Bharat Nirmaansimran yadavNo ratings yet

- Final Rudra EcoDocument15 pagesFinal Rudra EcoRudra Pratap TripathiNo ratings yet

- Eps Unit 5Document21 pagesEps Unit 5Anonymous 0zM5ZzZXCNo ratings yet

- FGHMDocument101 pagesFGHMArchana AwasthiNo ratings yet

- Thesis. Final FileDocument25 pagesThesis. Final FileSoumitree MazumderNo ratings yet

- What Is Startup IndiaDocument41 pagesWhat Is Startup IndiaannetteNo ratings yet

- Economic Policies in Indian Textile IndustryDocument14 pagesEconomic Policies in Indian Textile IndustryAtul GuptaNo ratings yet

- 3 Year Action AgendaDocument12 pages3 Year Action AgendaUmar FarooqNo ratings yet

- Policy Support To Small Scale IndustriesDocument21 pagesPolicy Support To Small Scale Industriesmanvim_1No ratings yet

- Karnataka Industrial Policy 2014-19 Final Draft SummaryDocument72 pagesKarnataka Industrial Policy 2014-19 Final Draft SummarysidrubNo ratings yet

- Eco Growth in Developing CountriesDocument7 pagesEco Growth in Developing CountriesRishab ToshniwalNo ratings yet

- Capacity Building For Micro EnterprisesDocument7 pagesCapacity Building For Micro EnterprisesAditya SharmaNo ratings yet

- Assignment 1Document11 pagesAssignment 1MuntakhabNo ratings yet

- Pib Feb 2022Document70 pagesPib Feb 2022Shubhendu VermaNo ratings yet

- Deodhar Final Production Linked Incentive PLI SchemeDocument28 pagesDeodhar Final Production Linked Incentive PLI SchemeAmlan RayNo ratings yet

- Porter & PestDocument6 pagesPorter & PestArman YadavNo ratings yet

- Environmental Analysis of Textile IndustryDocument6 pagesEnvironmental Analysis of Textile IndustryTanmay Varshney100% (1)

- Atmanirbhar Bharat AbhiyanDocument30 pagesAtmanirbhar Bharat AbhiyanRANJEET TEHRANo ratings yet

- Submitted To: Prof. Priyanka Chatta Professor Pillais Institute of Management Studies and Research, Panvel Mumbai UniversityDocument18 pagesSubmitted To: Prof. Priyanka Chatta Professor Pillais Institute of Management Studies and Research, Panvel Mumbai UniversityajinkyapolNo ratings yet

- Measures by Indian Government and Institutions to Promote ExportsDocument4 pagesMeasures by Indian Government and Institutions to Promote ExportsJohn rathodNo ratings yet

- Asia’s Fiscal Challenge: Financing the Social Protection Agenda of the Sustainable Development GoalsFrom EverandAsia’s Fiscal Challenge: Financing the Social Protection Agenda of the Sustainable Development GoalsNo ratings yet

- Supporting Post-COVID-19 Economic Recovery in Southeast AsiaFrom EverandSupporting Post-COVID-19 Economic Recovery in Southeast AsiaNo ratings yet

- Micro or Small Goat Entrepreneurship Development in IndiaFrom EverandMicro or Small Goat Entrepreneurship Development in IndiaNo ratings yet

- PMT Machines LTD Inspection and Test Plan For Bogie Frame FabricationDocument6 pagesPMT Machines LTD Inspection and Test Plan For Bogie Frame FabricationAMIT SHAHNo ratings yet

- Statutory Audit Fee Estimate for CNC Firm FY20-21Document1 pageStatutory Audit Fee Estimate for CNC Firm FY20-21Saad AkhtarNo ratings yet

- Neypes VS. Ca, GR 141524 (2005)Document8 pagesNeypes VS. Ca, GR 141524 (2005)Maita Jullane DaanNo ratings yet

- UCPB Violated Truth in Lending Act in Loan to SpousesDocument4 pagesUCPB Violated Truth in Lending Act in Loan to SpousesMark Xavier Overhaul LibardoNo ratings yet

- Acts and Statutory Instruments: The Volume of UK Legislation 1850 To 2019Document24 pagesActs and Statutory Instruments: The Volume of UK Legislation 1850 To 2019Adam GreenNo ratings yet

- Vdkte: LA-9869P Schematic REV 1.0Document52 pagesVdkte: LA-9869P Schematic REV 1.0Analia Madeled Tovar JimenezNo ratings yet

- 20% DEVELOPMENT UTILIZATION FOR FY 2021Document2 pages20% DEVELOPMENT UTILIZATION FOR FY 2021edvince mickael bagunas sinonNo ratings yet

- Catholic Theology ObjectivesDocument12 pagesCatholic Theology ObjectivesChristian Niel TaripeNo ratings yet

- CRPC 1973 PDFDocument5 pagesCRPC 1973 PDFAditi SinghNo ratings yet

- Disaster Management Training Program Ethics UNDPDocument65 pagesDisaster Management Training Program Ethics UNDPTAKI - TAKINo ratings yet

- Legal Notice: Submitted By: Amit Grover Bba L.LB (H) Section B A3221515130Document9 pagesLegal Notice: Submitted By: Amit Grover Bba L.LB (H) Section B A3221515130Amit GroverNo ratings yet

- National Dairy Authority BrochureDocument62 pagesNational Dairy Authority BrochureRIKKA JELLEANNA SUMAGANG PALASANNo ratings yet

- People of The Philippines vs. OrsalDocument17 pagesPeople of The Philippines vs. OrsalKTNo ratings yet

- ICPC Members 24 July 2023Document6 pagesICPC Members 24 July 2023Crystal TsangNo ratings yet

- Pension Field Verification FormDocument1 pagePension Field Verification FormRaj TejNo ratings yet

- Description of A Lukewarm ChristianDocument2 pagesDescription of A Lukewarm ChristianMariah GolzNo ratings yet

- Problematika Pengembangan Kurikulum Di Lembaga Pendidikan Islam: Tinjauan EpistimologiDocument11 pagesProblematika Pengembangan Kurikulum Di Lembaga Pendidikan Islam: Tinjauan EpistimologiAhdanzulNo ratings yet

- 44B Villegas V Hiu Chiong Tsai Pao Ho PDFDocument2 pages44B Villegas V Hiu Chiong Tsai Pao Ho PDFKJPL_1987No ratings yet

- Environmental PolicyLegislationRules & RegulationsDocument14 pagesEnvironmental PolicyLegislationRules & RegulationsNikin KannolliNo ratings yet

- Intermediate Accounting 1 - Cash Straight ProblemsDocument3 pagesIntermediate Accounting 1 - Cash Straight ProblemsCzarhiena SantiagoNo ratings yet

- The Art of War: Chapter Overview - Give A Brief Summary of The ChapterDocument3 pagesThe Art of War: Chapter Overview - Give A Brief Summary of The ChapterBienne JaldoNo ratings yet

- English The Salem Witchcraft Trials ReportDocument4 pagesEnglish The Salem Witchcraft Trials ReportThomas TranNo ratings yet

- Microsoft Word - I'm Secretly Married To A Big S - Light DanceDocument4,345 pagesMicrosoft Word - I'm Secretly Married To A Big S - Light DanceAliah LeaNo ratings yet

- KSDL RameshDocument10 pagesKSDL RameshRamesh KumarNo ratings yet

- PART VII - Passive Fire Protection Requirements (By-Laws Sections 133 - 224)Document13 pagesPART VII - Passive Fire Protection Requirements (By-Laws Sections 133 - 224)Heng Seok TeikNo ratings yet

- Call LetterDocument1 pageCall Letterஉனக்கொரு பிரச்சினைனா நான் வரேண்டாNo ratings yet

- Bible Verses Proving Jesus Is GodDocument5 pagesBible Verses Proving Jesus Is GodBest OfAntonyNo ratings yet

- Agreement For Consulting Services Template SampleDocument6 pagesAgreement For Consulting Services Template SampleLegal ZebraNo ratings yet