Professional Documents

Culture Documents

Testing - Fringe Ben - Use of Vehicle

Uploaded by

Julian A.0 ratings0% found this document useful (0 votes)

24 views100 pagesTesting_Fringe Ben_Use of Vehicle

Original Title

Testing_Fringe Ben_Use of Vehicle

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTesting_Fringe Ben_Use of Vehicle

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views100 pagesTesting - Fringe Ben - Use of Vehicle

Uploaded by

Julian A.Testing_Fringe Ben_Use of Vehicle

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 100

Purpose: To determine if the District is in compliance with state and federal regulations for employee use of District Vehicle

Source: 26CFR, Section 1.61-21

IRS Publication 15B 2014 Employer's Guide to Fringe Benefits

Conclusion:

Auditor Notes: Imputed tax is calculated on Gross pay plus Gr Term LI plus fringe benefit for use of District Vehicle less income deferred for retirement plan contributions.

None of the employees tested kept a log of mileage based on personal vs business use and did not record the purpose of each trip.

Since we were unable to verify commuter or personal use mileage vs. business mileage, we took a conservative approach and considered the use of the vehicle to be 100% personal use.

We recorded the mileage of the vehicle at December 31, 2013 and used Kelly Blue Book to obtain the FMV of the vehicle.

We used the FMV to determine the value to be included in income per IRS Publication 15B -- Annual Lease Table.

ASSIGN Employee ID

VEHICLE

ID

BRYANT, DAN 1088 503

MICHAEL TOLLEY 27510 518

MCEVOY, PEGI 2286 550

Additional Procedure: We compared payroll records to vehicle assignments prepared by the Fleets Management department and noted one employee assigned a vehicle for personal use that was not included

in the payroll analysis for imputed tax. As a result the employee paid no tax on the use of a district vehicle for school year 2013. see line highlighted in orange.

Ref

ASSIGNED

DRIVER

VEHICLE

ID

1 MICHELE DRORBAUGH(HOME ONLY JAN, FEB, MAR) 609

2 BRYANT, DAN 503

3 DORSEY, LARRY 596

4 ERIC BERSTROM(HOME ONLY)/DONALD ABELES 475

5 MICHAEL TOLLEY 518

6 NORIEGA, ANNETTE 619

7 SMITH, WRIGHT 611

8 YVONNE CARPENTER(HOME ONLY JAN, FEB, MAR) 610

9 EVELYN GREEN 566

10 JOHN JACKSON 138

11 LIEBL, ED 552

12 MCEVOY, PEGI 550

13 MICHELE A WHITE 564

14 PITTMAN, RANSOM 488

Personal use of a district vehicle encompasses any activity that is not business related, including commuting. An employee using a district vehicle is required to keep a log that

includes date, mileage and purpose of each trip. At the end of the year the percentage of mileage used for business vs. personal use can be determined based on the log. If the

employee does not have a vehicle log and business vs. personal use cannot be substantiated, the IRS will assume the vehicle was used entirely for personal use. Any use of a

district provided vehicle that cannot be substantiated as business use is included in income.

Based on our testing of the 14 employees using District vehicles for commuter purposes only 3 were complete and accurately reported to the IRS. Of the remaining 11 employees, the fringe benefit reported to the IRS was

undervalued due to incomplete information and/or the use of an incorrect valuation method.

To determine if the District is in compliance with state and federal regulations for employee use of District Vehicle

IRS Publication 15B 2014 Employer's Guide to Fringe Benefits

Imputed tax is calculated on Gross pay plus Gr Term LI plus fringe benefit for use of District Vehicle less income deferred for retirement plan contributions.

None of the employees tested kept a log of mileage based on personal vs business use and did not record the purpose of each trip.

Since we were unable to verify commuter or personal use mileage vs. business mileage, we took a conservative approach and considered the use of the vehicle to be 100% personal use.

We recorded the mileage of the vehicle at December 31, 2013 and used Kelly Blue Book to obtain the FMV of the vehicle.

We used the FMV to determine the value to be included in income per IRS Publication 15B -- Annual Lease Table.

COST CENTER Type1 MAKE MODEL YEAR

36197641CM PICKUP FORD RANGER 1999

41001211A0 PASSENGER CAR CHEVROLET CAVALIER 1997

3A197671C0 PASSENGER CAR DODGE AVENGER 2008

We compared payroll records to vehicle assignments prepared by the Fleets Management department and noted one employee assigned a vehicle for personal use that was not included

in the payroll analysis for imputed tax. As a result the employee paid no tax on the use of a district vehicle for school year 2013. see line highlighted in orange.

COST CENTER Type1 MAKE MODEL YEAR

34199511A0 PASSENGER CAR CHEVROLET CAVALIER 2001

36197641CM PICKUP FORD RANGER 1999

3A197671C0 PASSENGER CAR CHEVROLET COBALT 2010

3A197671C0 PASSENGER CAR JEEP LIBERTY 2005

41001211A0 PASSENGER CAR CHEVROLET CAVALIER 1997

34199511A0 PASSENGER CAR CHEVROLET CAVALIER 2000

34199511A0 PASSENGER CAR CHEVROLET CAVALIER 2001

34199511A0 PASSENGER CAR CHEVROLET CAVALIER 2001

34199511A0 PASSENGER CAR CHEVROLET CAVALIER 1999

34199511A0 PASSENGER VAN CHEVROLET ASTRO 1999

3A197671C0 PASSENGER CAR FORD ESCAPE 2009

3A197671C0 PASSENGER CAR DODGE AVENGER 2008

34199511A0 PASSENGER CAR CHEVROLET CAVALIER 1999

34199511A0 PASSENGER VAN FORD WINDSTAR 2000

Personal use of a district vehicle encompasses any activity that is not business related, including commuting. An employee using a district vehicle is required to keep a log that

includes date, mileage and purpose of each trip. At the end of the year the percentage of mileage used for business vs. personal use can be determined based on the log. If the

employee does not have a vehicle log and business vs. personal use cannot be substantiated, the IRS will assume the vehicle was used entirely for personal use. Any use of a

district provided vehicle that cannot be substantiated as business use is included in income.

Based on our testing of the 14 employees using District vehicles for commuter purposes only 3 were complete and accurately reported to the IRS. Of the remaining 11 employees, the fringe benefit reported to the IRS was

undervalued due to incomplete information and/or the use of an incorrect valuation method.

Imputed tax is calculated on Gross pay plus Gr Term LI plus fringe benefit for use of District Vehicle less income deferred for retirement plan contributions.

Since we were unable to verify commuter or personal use mileage vs. business mileage, we took a conservative approach and considered the use of the vehicle to be 100% personal use.

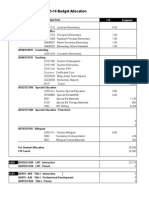

Mileage as of 12/31/13 FMV per KBB

Auditor Calc

Lease Value Dist Reported Difference

131,437 1,211 $ 850 $ $687 163 $

66,761 2,000 $ 1,100 $ $726 374 $

46,000 8,300 $ 2,600 $ $723 1,877 $

2,414 $

We compared payroll records to vehicle assignments prepared by the Fleets Management department and noted one employee assigned a vehicle for personal use that was not included

in the payroll analysis for imputed tax. As a result the employee paid no tax on the use of a district vehicle for school year 2013. see line highlighted in orange. A=

B=

VIN # PLATE

VEHICLE

LOCATION

AT END OF

WORK SHIFT AREA Employee ID

1G1JC524X17342078 58482C HOME TRANSPORTATION 801917

1FTYR10V6XTA99779 74622C HOME CRITICAL 1088

1G1AB5F5IA7197080 46697D HOME SECURITY 27356

1J4GL48565W696519 76499C HOME SECURITY 3449

1G1JC5247V7284842 44036C HOME EDUCATION DIRECTOR 27510

1G1JC5246Y7457805 41958C HOME TRANSPORTATION 4723

1G1JC524117342177 58481C HOME TRANSPORTATION 18913

1G1JC524617277455 56682C HOME TRANSPORTATION 807763

1G1JC52F937328242 65965C HOME TRANSPORTATION 11486

1GNDM19W7XB186841 53421C HOME TRANSPORTATION 5709

1FMCU927X9KA57531 88600C HOME SECURITY 19434

1B3LC46R78N253284 85704C HOME SECURITY 2286

1G1JC524XX7321420 51748C HOME TRANSPORTATION 21086

2FMZA5048YBD02937 77096C HOME TRANSPORTATION 489

Personal use of a district vehicle encompasses any activity that is not business related, including commuting. An employee using a district vehicle is required to keep a log that

includes date, mileage and purpose of each trip. At the end of the year the percentage of mileage used for business vs. personal use can be determined based on the log. If the

employee does not have a vehicle log and business vs. personal use cannot be substantiated, the IRS will assume the vehicle was used entirely for personal use. Any use of a

district provided vehicle that cannot be substantiated as business use is included in income.

Attribute

Based on our testing of the 14 employees using District vehicles for commuter purposes only 3 were complete and accurately reported to the IRS. Of the remaining 11 employees, the fringe benefit reported to the IRS was

undervalued due to incomplete information and/or the use of an incorrect valuation method.

Included in IRS reporting of FB

Calc and Correct Method applied

DATE

ASSIGNED A B

10/7/2013 Y Y Benefit Calc for 3 mos per instructions

10/12/2013 Y N Incorrect method applied

9/25/2013 Y N Calc for 6 mos only

9/27/2013 N N No commuter benefit reported

9/23/2013 Y N Incorrect method applied

9/4/2013 Y Y

9/4/2013 Y N Calc for 6 mos only

10/7/2013 Y Y Benefit Calc for 3 mos per instructions

10/3/2013 Y N Calc for 6 mos only

10/13/2013 Y N Calc for 6 mos only

9/25/2013 Y N Calc for 6 mos only

10/1/2013 Y N Incorrect method applied

10/7/2013 Y N Calc for 6 mos only

9/4/2013 N N No commuter benefit reported

Attribute

You might also like

- Wright Ballard ResponseDocument25 pagesWright Ballard ResponseJulian A.No ratings yet

- Final ELL Staffing For 10-12-2015 Updated at 2 10pmDocument12 pagesFinal ELL Staffing For 10-12-2015 Updated at 2 10pmJulian A.No ratings yet

- 2015-2016 Service-Based Budgeting Follow-Up ADocument27 pages2015-2016 Service-Based Budgeting Follow-Up AJulian A.No ratings yet

- Proposed Prioritization by Type - 050715 v3Document301 pagesProposed Prioritization by Type - 050715 v3Julian A.No ratings yet

- Seattle Schools Staffing Adjustment 10/2015Document2 pagesSeattle Schools Staffing Adjustment 10/2015westello7136No ratings yet

- Schoolid Equity Factor NBR % of Below Grade Level StudentsDocument5 pagesSchoolid Equity Factor NBR % of Below Grade Level StudentsJulian A.No ratings yet

- SPS CDHL Final ReportDocument48 pagesSPS CDHL Final ReportJulian A.No ratings yet

- CSIHS Sped Funds IBDocument5 pagesCSIHS Sped Funds IBJulian A.No ratings yet

- 2015-16 WSS School BudgetsDocument667 pages2015-16 WSS School BudgetsJulian A.No ratings yet

- 5 Year Projections 2015 To 2020Document1,132 pages5 Year Projections 2015 To 2020Julian A.No ratings yet

- Master MayShowRate ProjbygradeupdatedwbrentstaticforimportDocument558 pagesMaster MayShowRate ProjbygradeupdatedwbrentstaticforimportJulian A.No ratings yet

- Teacher FTE IA FTEDocument45 pagesTeacher FTE IA FTEJulian A.No ratings yet

- Seattle Schools Staffing Adjustment 10/2015Document2 pagesSeattle Schools Staffing Adjustment 10/2015westello7136No ratings yet

- Seattle Schools Staffing Adjustment Appendix 2015Document6 pagesSeattle Schools Staffing Adjustment Appendix 2015westello7136No ratings yet

- Whats ProjectedDocument2 pagesWhats ProjectedJulian A.No ratings yet

- Too Much TrainingDocument7 pagesToo Much TrainingJulian A.No ratings yet

- DRAFT Resolution To Suspend SBAC (Common Core) Testing PETERS & PATU (Seattle)Document4 pagesDRAFT Resolution To Suspend SBAC (Common Core) Testing PETERS & PATU (Seattle)Julian A.No ratings yet

- Oct FTE Adjustment Matrix V3 20141015Document4 pagesOct FTE Adjustment Matrix V3 20141015LynnSPSNo ratings yet

- Seattle SBAC Resolution Board Action Report Doc DRAFT Revision 5.0Document3 pagesSeattle SBAC Resolution Board Action Report Doc DRAFT Revision 5.0Julian A.No ratings yet

- Kroon Decides Whats OkayDocument6 pagesKroon Decides Whats OkayJulian A.No ratings yet

- Brent Kroon Interim Director, Enrollment Planning Seattle Public Schools (206) 252-0747Document2 pagesBrent Kroon Interim Director, Enrollment Planning Seattle Public Schools (206) 252-0747Julian A.No ratings yet

- But Were Not ReadyDocument3 pagesBut Were Not ReadyJulian A.No ratings yet

- Non Rep Upgrades - 5-14-14 Thru 5-26-15Document12 pagesNon Rep Upgrades - 5-14-14 Thru 5-26-15Julian A.No ratings yet

- Not For DistributionDocument3 pagesNot For DistributionJulian A.No ratings yet

- Who Reqd PRRDocument2 pagesWho Reqd PRRJulian A.No ratings yet

- Sanctioned Students Enrollment ProcessDocument1 pageSanctioned Students Enrollment ProcessJulian A.No ratings yet

- Suspended or Expelled From Another DistrictDocument1 pageSuspended or Expelled From Another DistrictJulian A.No ratings yet

- February Enrollment NumbersDocument70 pagesFebruary Enrollment NumbersJulian A.No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Servolectric E 09Document18 pagesServolectric E 09Fahrurrazi HaronNo ratings yet

- CitigomanDocument18 pagesCitigomanblastmcNo ratings yet

- Research Proposal: 1) Executive SummaryDocument3 pagesResearch Proposal: 1) Executive SummaryBhavin Lakhani0% (2)

- Ferrari 365gt2+2 - Buyers - Guide PDFDocument10 pagesFerrari 365gt2+2 - Buyers - Guide PDFBennyLouPlummerNo ratings yet

- H PointDocument3 pagesH Pointer.nikhilpathak1No ratings yet

- HINO Technical White Paper - International PDFDocument11 pagesHINO Technical White Paper - International PDFThànhHseNo ratings yet

- TourismoDocument20 pagesTourismoPhilippine Bus Enthusiasts SocietyNo ratings yet

- Book 2Document139 pagesBook 2Safianu Abbas Abdul-RaheemNo ratings yet

- Customer Satisfaction RefDocument58 pagesCustomer Satisfaction RefArjun NbNo ratings yet

- Anti Roll Bar or Stabilizer and AnglesDocument13 pagesAnti Roll Bar or Stabilizer and AnglesPavan KumarNo ratings yet

- Zf-Meritor Sureshift Diagrama ElectricoDocument5 pagesZf-Meritor Sureshift Diagrama ElectricoOvidio Rios100% (1)

- 9 Fele Katonai Angol VeglegesDocument18 pages9 Fele Katonai Angol VeglegesAmmar Syahid Rabbani100% (1)

- Standard With Standard DrumDocument2 pagesStandard With Standard DrumRobinson GuanemeNo ratings yet

- RD 006Document32 pagesRD 006deeNo ratings yet

- John Deere Funk DrivetrainDocument5 pagesJohn Deere Funk DrivetrainTimon2005100% (1)

- Coils Catalogue1Document200 pagesCoils Catalogue1Julio CervantesNo ratings yet

- Croma UputstvoDocument258 pagesCroma UputstvoBwana Srbin100% (1)

- Final Theory TestDocument2 pagesFinal Theory TestMichelle HengNo ratings yet

- Audi Q5 2017 BrochureDocument40 pagesAudi Q5 2017 BrochureDavid Oscar VellaNo ratings yet

- Isuzu Forward2000Document2 pagesIsuzu Forward2000SAULNo ratings yet

- Maruti SuzukiDocument30 pagesMaruti SuzukiChaitanya KulkarniNo ratings yet

- Subaru Legacy Liberty Outback 2003-09Document12 pagesSubaru Legacy Liberty Outback 2003-09dontsurfNo ratings yet

- 1957 1958 Plymouth Service ManualDocument517 pages1957 1958 Plymouth Service Manual2506223100% (1)

- LTB00478NAS2Document3 pagesLTB00478NAS2Massahiro FilhoNo ratings yet

- Bridgestone Data BookDocument152 pagesBridgestone Data BookTekeba Birhane100% (1)

- A Seminar ON Retrofitting of A Hydraulic Continously Variable Transmission To A Rear Wheel Drive AutomobileDocument23 pagesA Seminar ON Retrofitting of A Hydraulic Continously Variable Transmission To A Rear Wheel Drive AutomobileLungmuaNa RanteNo ratings yet

- 07 SmaintDocument4 pages07 SmaintEndri StafaNo ratings yet

- AAM Applications Chassis and SuspensionDocument4 pagesAAM Applications Chassis and SuspensionBejai Alexander MathewNo ratings yet

- EvicDocument3 pagesEvicAbd Elrahman HamdyNo ratings yet

- OBD II Diagnostic Interface PinoutDocument6 pagesOBD II Diagnostic Interface PinoutgeorgedragosNo ratings yet