Professional Documents

Culture Documents

SSD 2013 Accountability Audit Procedure Report

Uploaded by

Julian A.Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SSD 2013 Accountability Audit Procedure Report

Uploaded by

Julian A.Copyright:

Available Formats

Seattle School District No.

1

General

Code: 03Seattle-AC13-SA13

Name: Seattle School District No. 1

Group: Central King County

Type: 03-School District

Location: King

Scope: Accountability, Financial, SA

Team

Lead: Heidi Wiley

Manager: Anastassia Efanova

Procedures

B.1.PRG - Accountability Planning - Local Govt

Procedure Step: Entity, Environment & COSO Evaluation

Prepared By: AB1, 12/3/2013

Reviewed By: AVE, 4/15/2014

Purpose/Conclusion:

Seattle School District No. 1

Purpose:

To identify potential accountability risks to consider in the planning conference brainstorm by gaining an understanding of the entity's operations,

environment and entity-wide COSO elements.

Conclusion:

Based on our understanding of entity operations, environment and entity-wide COSO elements, we noted the following potential accountability

risks to be discussed at our planning conference brainstorm.

Excessive turnover and transition in leadership

District has numerous large capital projects scheduled due to BEX IV levy funding.

Accountability over transportation including: failure to report personal use of district vehicle to IRS, lack of cross training resulting in

excessive OT costs, no allocation of transportation costs by school.

Safeguarding assets -- No centralized authority over use of fleet vehicles. No screening procedures to ensure statutory compliance with

DOL (auto license is current, no recent suspensions) No centralized fleet maintenance schedule.

Team SP recommends basic enrollment and transportation testing be performed at the local level.

Testing Strategy:

The following procedures are required to be done:

Review the applicable planning guide(s)

Update the "COSO Evaluation" step in the permanent file

Update the "Entity Operations" step in the permanent file

Maintain a current understanding of significant internal control systems.

To maintain a current understanding of significant internal systems, determine when systems were last reviewed and/or tested. Updates

may be done as part of planning procedures or may be addressed as part of the accountability plan when areas are selected for testing. A

significant internal control systems include controls over safeguarding significant public resources and managing significant compliance

requirements.

Auditors may also consider additional procedures, based on the entitys size, complexity and anticipated risk and the auditors

experience. Additional procedures may include:

Scan the entity's annual report, budget and/or comprehensive plan.

Seattle School District No. 1

Review recent Client Helpdesk questions submitted by the government. Any accounting and auditing questions and answers can be

viewed in Helpdesk tab of EIS.

Review list of resolutions passed during the period.

Review the entity's organizational chart.

Obtain a list of departments and/or programs.

Review the entity's website.

Tour facilities.

Inquire with management and other key employees as to any significant events or changes occurring since the prior audit (ex: new debt,

major construction, new software, etc).

Identify restricted funds held by the entity.

Review list of contracts awarded or contract activity reports.

Identify significant revenue and expenditure streams.

Identify cash receipting locations.

Obtain a list of petty cash, change funds and imprest funds.

Review permanent file documentation on controls over key systems.

Scan bank account and investment statements or financial statement notes to determine the types of investments and deposits the entity

is holding.

Review Public Disclosure Commission filings for elected officials or request information on personal or family businesses and land holdings

from appointed officials and/or key employees.

Inquire with management to determine whether the entity self-insures for any risks.

Policy/Standards:

SAO Audit Policy 4210 - Planning Accountability Audits

BACKGROUND

The purpose of planning procedures is to identify and assess risks of fraud, loss or abuse of public resources; non-compliance with laws and

regulations; and the internal controls over such matters. Selected risks to audit must be significant to the public and other users either

quantitatively or qualitatively. This is based on auditor judgment. To address those risks, auditors must develop effective audit tests and

strategies.

REQUI REMENTS

1. Auditors will perform the following planning procedures to identify and assess accountability risks:

Seattle School District No. 1

Review the planning guide.

Review meeting minutes of the governing body.

Gain an understanding of the entity and its control environment.

Maintain a current understanding of the relevant policies, procedures and internal controls over significant accounting systems.

Review the prior audit, the future audit work file (FAWF) and citizen hotline referrals.

Review fraud investigations (including in-process) and other relevant engagements.

Perform planning analytical procedures.

The nature, timing and extent of planning procedures vary with the size and complexity of the entity, and with the auditors experience

with the entity. Auditors will consider whether other planning procedures are necessary to identify risks.

2. Supervisory review of the results of planning procedures will be completed before the planning conference brainstorm.

Supervisors will ensure potential risks are specifically and clearly described to enable an effective discussion during the brainstorm and

provide the basis for developing testing strategies that appropriately respond to selected risks.

3. A planning conference brainstorm will be conducted to finalize the assessment, sort and prioritize risks, and develop

procedures to ensure risks are properly addressed.

The audit manager, supervisor, auditor-in-charge, among others, will hold a planning brainstorm to sort and prioritize risks identified during

planning and to strategize audit tests. The following factors will be considered:

Relevance, considering public sensitivity, the expressed concerns or questions of management and those charged with governance, as

well as the primary activities, systems or events occurring at the government.

Potential impact, considering the likelihood and magnitude of potential impacts such as fraud, abuse, loss or questioned costs

associated with noncompliance.

Sometimes a risk may be addressed by more than one type of engagement. Auditors must sort the risks to determine what audit type

would be most appropriate to address them.

The analysis of risks and decisions made during the brainstorm will be documented in sufficient detail to support the focus and scope of the

audit.

Seattle School District No. 1

4. An audit plan will be prepared from the results of the brainstorm, and a detailed budget will be developed to track budgeted

and actual audit hours.

Supervisory review is important to determine whether adjustments to the plan are needed based on changing circumstances. Significant

revisions to the audit plan must be approved and documented.

5. Auditors will communicate information about the planned audit to client management and those charged with governance.

Auditors must also ensure significant changes to the planned audit are communicated to the client in a timely manner. All communications

must be documented. Refer to Policies 2130 (Inviting Elected Officials to Entrance/Exit Conferences), and 2210 (Conducting Entrance

Conferences).

RELATED POLI CI ES

4110 Objectives and Authority for Accountability Audits

Record of Work Done:

Procedures Performed to Update Understanding

We reviewed the Entity, Environment & COSO Evaluation at G.1.PRG and G.1.PRG

We reviewed the 2012-2013 budget. See B.1.5 The district continues to face shortfalls in available resources with a $24.8M shortfall for

2012-2013 budget which is approximately 4% of the total general fund budget of $590M. Risks identified: Strained classroom funding

takes precedence over compliance issues. District staff will continue furlough days during 2012-13 school year. Senior management will

take four unpaid days; and the majority of staff will take two unpaid days.

We reviewed the District's organization.SPS_OrgChart_All Excessive turnover and transition in leadership poses uncertainties of the tone

at the top. The organization hierarchy is a work in process. In J une 2012 the District hired J ose Banda to replace interim Superintendent

Susan Enfield. The District hired Kenneth Gotsch as Assistant Superintendent Business & Finance, who will begin December 2nd 2013,

replacing Duggan Harman. Mr Gotsch has held positions in the Chicago and Los Angeles Public Sch Districts. In addition he has served

as Deputy Director for Chicago Dept of Revenue and as Bond Analyst for Illinois Economic and Fiscal Commission. In August 2012 the

District hired Charles Wright, J r. as Deputy Superintendent and Dr. Lester Flip Herndon J r. as Assistant Superintendent, Capital,

Facilities and Enrollment Planning. Mr. Wright is the former Chief Strategy Officer with Denver Public Schools, and Dr. Herndon was

Superintendant of Bremerton Public Schools.

In response to our audit recommendations the district created the Office of Internal Audit IAO and hired Andrew Medina as Director of

IA. IAO focus is on improvement opportunities and finding sustainable solutions. IAO reports to the Audit and Finance committee and

Seattle School District No. 1

results are reported directly to the School Board. We will review changes in significant positions to determine if accountability is clearly

defined by org and coordinate our efforts with Internal Auditor to ensure our accountability audit work does not overlap or duplicate the

work of the IA.

For informational purposes only, we obtained the total number of schools operated, by type (HS, MS, ES etc.). The District has a total of

95 schools which breaks out as follows: Elementary - 59, K-8 - 10, Middle -9, High - 12, and Service (Alternative) - 5.We obtained FY2013

enrollment report from Kathie Technow. See B.1.8 Overall enrollment is consistent with prior year. Gains in enrollment at the ninth grade

level are lost by grade 12 indicating students entering at the ninth grade level do not complete their eduction through the twelfth grade or

they leave the district prior to completion. Bilingual and special education combined enrollment increased by approximately 11% based on

adopted budget.

Significant Resources: State funding provides the largest portion of district funds at $305.7 million or 51.7% of total resources. Of this

amount $240 million is based on apportionment (no of attending students x legislative funding formula); and 66.1 million are state special

purpose funds for special ed, bilingual ed, student transportation, tutor programs etc. The second largest funding resource -- $154 million (

26% of resources) is a taxpayer supported levy for general education programs and operations. Federal funds provide $73.5 million or

12.4% of resources to fund Title I and Head Start programs and supplemental funding for Special Ed, free and reduced rate lunch

programs. Other revenue funding provides $31.1 million or 5.3% of budgeted resources from rental or lease of district property, investment

earnings, food service fees, and donations. Other resources account for $27.4 million or 4.6% of total resources and includes funds from

prior year school balances carried forward and reserve funds.

Significant Expenditures: Based on budgeted 2012-13 FY expenditures of $590 million, the district budgeted $468 million or 79% for

instruction; and $122 million or 21% for support services.

We reviewed the list of active employees as of 8/31/2013. We noted total employees of 9,712 is comparable to prior year and total

management staff and certificated employees is equal to the prior year. See B.1.9

The District has 100 buildings in current inventory; more than 1/3 are 40+years old. The District relies primarily on Levy funding for capital

improvement of its school buildings. There were two levy measures approved in 2013; both replace expiring levies. Operations Levy

(551.9 million) supports educational programs not fully funded by the state. Capital Levy -- Building Excellence IV (BEX IV) funds the

construction or renovation of 17 schools; retrofit improvements for 37 schools, security camera system at 19 schools and other major

maintenance and technology improvements throughout the District.

We reviewed the meeting minutes at B.1.3 including resolutions passed during the audit period.

Risks Noted from review of Planning Guide: G.2.1

Per review of the planning guide, we noted the following:

Required Risks to Assess

We reviewed the Planning Guide for school districts at G.2.1 with updates made by CKC audit team.

Alternative Learning Experience Programs -- ALE audits are being planned under a separate process. Team School Programs will conduct

all ALE audits. In 2012 Team schools performed a file review resulting in no significant issues that would impact our audit.

Seattle School District No. 1

Financial Condition We performed financial analysis in prior year audits and there were no indicators of substantial financial

distress. Taxpayers continue to support the District with levy funding for operations and capital improvements.

Evaluating the District's financial condition is required per SAO Schools Planning Guide. We evaluated the financial condition of the school

district using financial indicators posted on the OSPI website as of March 2013 for FY 2012. B.1.7 We summarized the fiscal score for SDS

and for other Districts in its peer group. Districts with higher scores generally have more ability to adapt to unforeseen budget cuts,

revenue losses, unexpected expenditures, etc. In comparion, SDS scores slightly higher than other districts in its peer group and the

score over the last three years has remained consistent. We will perform additional review in our accountability work at D.6.PRG

From the District's F-196, we performed a 3 year trend of non-voted debt to determine if there have been increases in non-voted

debt. For Debt Service Load, 20% is the benchmark given for a high debt load for school districts, according to the Handbook of Debt

Management, edited by Gerald Miller. The SSD averages 11.7% and has been consistent over the past three years.

F-196 Financial Statement FY11 FY12 FY13 $ Change % Change

Total Non-Voted Notes/Bonds $ 32,925,000 $ 32,030,000 $31,045,000 ($985,000) -3%

Red Flags:

Excessive turnover in management and staff positions. Uncertainty of tone at top. Interim Superintendant's contract is renewed and

extended quarterly until the position is permanently filled.

District has a number of large capital projects scheduled due to influx of BEX IV levy funds that will impact communities and result in

students being reassigned to other schools while construction is taking place.

Decentralized control environment resulted in a number of issues affecting accountability over transportation, including

undocumented personal use of fleet vehicles, failure of District to report benefit of district vehicle on employee's W-2, payment of OT not

authorized by Collective Bargaining Agreement, no cross training of transportation salaried employees resulting in excessive OT charges

by select employees, no allocation of transportation costs by school, no review of fuel costs for reasonableness.

No centralized budget/cost center for fleet management. Fleet manager does not have authority to question use of fleet vehicles by

management and staff or establish screening process for appropriate use of fleet vehicle. In addition, there are no screening procedures

in place to ensure statutory compliance with DOL (no review to determine if auto license is expired or currently suspended prior to

granting permission for use of fleet vehicle.)

No maintenance schedule for fleet vehicles. Maintenance is at the discretion of the employee currently assigned use of the vehicles.

Risks Noted from other procedures:

Based on other procedures performed, we noted the following:

We met with Andrew Medina, CPA and Internal Auditor for the District on 11/18/2013. Due to turnover of significant positions Mr Medina

indicated that although the District's internal audits result in a request for corrective action plans, the action plans are not completed within a 6

month framework but rather are pushed back and rescheduled due to management and staffing changes. The IAO continues to review control

Seattle School District No. 1

environment and ensure procedures are documented. For 2013-14 the IAO will review controls over capital projects, controls over special

education administration, staff mix, testing integrity -- addressing cheating scandals, and tone at the top to determine that District goverernance

and practices address COSO framework.

Apportionment - This is the largest revenue source for the District and is based on three funding drivers - Enrollment, Staff-Mix and

Transportation. The Schools Team suggests we audit basic enrollment for FY13. Enrollment was last reviewed in FY09 and errors were noted in

FTE calculations. Team SP suggests testing enrollment data from two schools (elementary and/or middle school) for September 2012. We will

perform testing at D.3.PRG

We will consider staff mix for review during our planning brainstorm. Transportation regulations and reporting requirements have changed

recently. Team SP suggests local teams plan transportation audits using the 6 step procedure outlined in TeamMate. We will perform testing of

transportation reporting at D.4.PRG.

B.1.PRG - Accountability Planning - Local Govt

Procedure Step: Other Engagements & FAWF

Prepared By: AB1, 12/9/2013

Reviewed By: AVE, 1/6/2014

Purpose/Conclusion:

Purpose:

To identify potential accountability risks to consider in the planning conference brainstorm from other engagements and the FAWF.

Conclusion:

Based on our review of other engagements and the FAWF, we noted the following potential accountability risks:

Payroll OT reporting was identified as a risk in the prior year.

Payroll benefit personal use of District vehicle and inadequate support of reimbursed fuel expense

Disbursements to personal service contractors prior to signed contract agreement.

Inadequate documentation for sole source determination for personal service contracts

Lack of sufficient and effective monitoring over transportation invoice payments, fuel accountability, personal use of District vehicles

Seattle School District No. 1

No cost allocation plan for fuel usage.

Insufficient controls over accounts receivable for use of facilities by third party

In prior year we identified exceptions in testing of staff mix; however, District verified that files contained required transcript data. We will

discuss in our brainstorm if staff mix should be included as a risk area.

PY audit identified new asset monitoring system for tracking capital as a risk area. We will consider including this FAWF item in our

brainstorm meeting.

Testing Strategy:

Auditors are required to review the following for information relevant to accountability audit objectives:

FAWF

Review Future Audit Work File (FAWF) items.

OTHER ENGAGEMENTS & STUDI ES

Identify other audits or engagements that may be relevant to accountability audit objectives. Check the Entity Information Suite (EIS) to identify

prior and in-progress SAO audits and special investigations. Auditors should specifically consider:

Prior accountability audit exceptions

Prior accountability audit scope (from plan, exit document or history/cycling matrixes)

Fraud investigations (note: open investigations must be coordinated with Sarah Walker)

Hotline referrals (note: open examinations must be coordinated with J eana Gillis)

Financial, single audit, performance or other SAO reports

Non-SAO audits, attestation engagements or studies that directly relate to accountability audit objectives (see Audit Policy 3530 related

to grant or oversight agency work)

Work of internal auditors (see Audit Policy 3520 for requirements on use of work of internal auditors)

Review identified audits that relate to accountability audit objectives for relevant work and exceptions.

Follow up on any relevant recommendations or findings to determine whether corrective actions were implemented. Follow-up procedures may

Seattle School District No. 1

be performed at this point or incorporated into the audit plan and referenced in this step.

Policy/Standards:

SAO Audit Policy 3410 Follow Up on Previous Audits (effective 6/ 3/ 08

BACKGROUND

Government Auditing Standards (Yellow Book) require auditors to consider the results of previous audits, attestation engagements and other

studies and follow up on significant findings and recommendations that directly relate to the objectives of the audit.

For example, when conducting an audit under the federal Office of Management and Budgets (OMB) Circular A-133, auditors must follow up on

prior audit findings relative to federal awards. If any uncorrected federal findings were reported in the prior single audit, auditors must then

perform procedures to assess the reasonableness of the summary schedule of prior audit federal findings prepared by the auditee, and report, as

a current year audit finding, when the auditor concludes that the summary schedule to prior audit federal findings materially misrepresents the

status of the prior audit finding. Auditors would also inquire about other reports or reviews on federal programs such as reviews done by

granting agencies and consider these as part of the auditors risk assessment or audit of that federal program.

REQUI REMENTS

1. In planning an audit, auditors will consider findings and recommendations from previous engagements.

Auditors will ask entity management to help identify previous audits, attestation engagements, performance audits or other studies directly

related to the objectives of the audit. This includes work done by other independent auditors, internal auditors, program or grant

auditors.

Auditors will then determine if any significant findings or recommendations were reported and use this information in assessing risk and

determining audit procedures. Refer to Policy 3530 for additional requirements on use of grant or program monitors work as audit

evidence.

2. Auditors will follow up on findings and recommendations from previous engagements that directly relate to the objectives of

the audit and evaluate whether appropriate corrective action has been taken.

Professional judgment is used to determine the level of work necessary to follow up on findings and recommendations.

Seattle School District No. 1

3. The status of prior audit findings will be reported according to the guidelines provided in the Audit Reports Standards

Manual.

RELATED POLI CI ES

3530 Use of Grant/Program Monitors Work

4210 Planning Accountability Audits

5210 Planning Single Audits

6210 Planning Financial Statement Audits

7210 Planning Performance Audits

REFERENCES

Government Auditing Standards (Yellow Book) 4.09, 7.36

OMB Circular A-133 Audits of States, Local Governments, and Non-Profit Organizations

______________________________________________________________

SAO Audit Policy 4210 - Planning Accountability Audits

BACKGROUND

The purpose of planning procedures is to identify and assess risks of fraud, loss or abuse of public resources; non-compliance with laws and

regulations; and the internal controls over such matters. Selected risks to audit must be significant to the public and other users either

quantitatively or qualitatively. This is based on auditor judgment. To address those risks, auditors must develop effective audit tests and

strategies.

REQUI REMENTS

1. Auditors will perform the following planning procedures to identify and assess accountability risks:

Review the planning guide.

Review meeting minutes of the governing body.

Gain an understanding of the entity and its control environment.

Maintain a current understanding of the relevant policies, procedures and internal controls over significant accounting systems.

Review the prior audit, the future audit work file (FAWF) and citizen hotline referrals.

Review fraud investigations (including in-process) and other relevant engagements.

Perform planning analytical procedures.

Seattle School District No. 1

The nature, timing and extent of planning procedures vary with the size and complexity of the entity, and with the auditors experience

with the entity. Auditors will consider whether other planning procedures are necessary to identify risks.

2. Supervisory review of the results of planning procedures will be completed before the planning conference brainstorm.

Supervisors will ensure potential risks are specifically and clearly described to enable an effective discussion during the brainstorm and

provide the basis for developing testing strategies that appropriately respond to selected risks.

3. A planning conference brainstorm will be conducted to finalize the assessment, sort and prioritize risks, and develop

procedures to ensure risks are properly addressed.

The audit manager, supervisor, auditor-in-charge, among others, will hold a planning brainstorm to sort and prioritize risks identified during

planning and to strategize audit tests. The following factors will be considered:

Relevance, considering public sensitivity, the expressed concerns or questions of management and those charged with governance, as

well as the primary activities, systems or events occurring at the government.

Potential impact, considering the likelihood and magnitude of potential impacts such as fraud, abuse, loss or questioned costs

associated with noncompliance.

Sometimes a risk may be addressed by more than one type of engagement. Auditors must sort the risks to determine what audit type

would be most appropriate to address them.

The analysis of risks and decisions made during the brainstorm will be documented in sufficient detail to support the focus and scope of the

audit.

4. An audit plan will be prepared from the results of the brainstorm, and a detailed budget will be developed to track budgeted

and actual audit hours.

Supervisory review is important to determine whether adjustments to the plan are needed based on changing circumstances. Significant

revisions to the audit plan must be approved and documented.

5. Auditors will communicate information about the planned audit to client management and those charged with governance.

Seattle School District No. 1

Auditors must also ensure significant changes to the planned audit are communicated to the client in a timely manner. All communications

must be documented. Refer to Policies 2130 (Inviting Elected Officials to Entrance/Exit Conferences), and 2210 (Conducting Entrance

Conferences).

RELATED POLI CI ES

4110 Objectives and Authority for Accountability Audits

Record of Work Done:

We will consider the following information in planning our accountability audit:

FAWF

The District implemented a new monitoring system for tracking assets and holding staff accountable for missing assets. The new system

was effective 6/2012. We will review the change in procedures and determine the effectiveness of controls in mitigating risk of lost or

misappropriated assets.

Risk identified: Policies for hiring substitute or special instructors were circumvented at Garfield High School. This was due to a lack of

timeliness for clearing background and fingerprint testing at the District level.

Kiro News summarized results of public records request and reported abuses in OT charges by exempt management. Per news report

dated 11/12/2013, Supervisor of Nathan Hale school radio station, Gregg Neilson made $70,000 in overtime and $80,000 in regular paid

wages during 2012-13 school year. Additional OT payments were made to exempt employees in Transportation Services, including

Transportation Analyst C. Martin, Transportation Mgr, M. Drorbaugh and Team Lead, S. Richard all earned OT during 2012-13 school

year.

In same news reporting of 11/12/2013, Kiro News reported abuse of IRS standards for personal use of the District's fleet vehicles. The

Kiro report is based on internal audit performed by Andrew Medina who was hired to review and report District activities directly to the

Board. In addition, the District does not track fuel use or require employees to keep mileage logs to support business use.

Kiro News reported in May 2013 that the District places students at risk by providing door to door cab services by drivers that work under

contract. Although all taxi drivers must have a valid taxi license and receive a background check by the City or King County, they are not

trained or screened by District standards.

SAO AUDITS

We noted the following weaknesses in internal controls in our prior year audit:

Seattle School District No. 1

Payroll procedures are not sufficiently documented.

Salary overrides performed in the SAP system are not supported and documented by authorized rate changes. Per PY audit payroll

transactions were also made outside the SAP system.

The payroll module PA30 allows edits to be made to the Master payroll file without an audit trail.

Additional risk that classified employees put on the displaced list continue to receive a paycheck after their position has been eliminated.

Access to the master file by payroll staff was unlimited in the prior year.

Approval of rate increases were made verbally and no confirmation of rate changes or overrides were made for the file or to the

employee.

There were no requests for exception reports or data from IT to identify staff edits to the payroll master file by IP address.

Edits made to the hourly rate in the payroll master file allow the annual salary to increase beyond the grade and step level identified per

the contract.

Adjustments to annual pay were not reported to the budget oversight committee and finance staff thus not ensuring sufficient funds were

available to cover additional payroll expenditures.

The District allowed personal service contract modifications without proper explanation or justification. In addition payouts were made

prior to contract approval.

Unnecessary contract procurement for tasks that could be performed in house by Facilities Dept staff.

The District lacked internal controls to ensure all revenue owed was collected for its numerous properties and facilities.

The District charged salaries to the incorrect fund resulting in improper coding of salaries to capital expenditures.

Overtime payments were issued without authorization by a supervisor with direct knowledge of the employee's work hours.

The District did not hold employees accountable to policy for inventory and return of tools upon termination, allowed employees to exceed

the maximum allowed for lost or damaged tools and allowed one employee to charge tool purchases to the District after being

terminated.

The District does not hold employees accountable for policies over use of fuel cards and fleet vehicles. Employees were not required to

sign a vehicle use agreement; fuel cost invoices were submitted for reimbursement without approval from an immediate supervisor or

review for reasonableness. Employees were not required to document business use via mileage logs and thus no allocation of business to

personal use was performed. In addition the District did not adjust inventory for vehicles acquired and did not mark new vehicles with the

District logo as required per District policy.

Prior audits noted risk of the District not providing after hours tutoring services to students although funding may be available.

FRAUD I NVESTIGATIONS

We will follow-up on our SAO fraud investigations at I.1.PRG

In February 2011, our Office issued a Special I nvestigation Report on the Districts Regional Small Business Development Program (RSBDP). We

Seattle School District No. 1

found the District paid $1,519,965 for services with a questionable public purpose and $280,005 for services it did not receive and that benefitted

a private company. In October 2011, the King County Prosecuting Attorney filed criminal charges against the former RSBDP Program Manager and

two other individuals who, according to Prosecutors Office documents, billed the District for little or no work.

On October 25, 2011, as required by state law (RCW 43.09.185), the District's Accounting Manager reported a suspected loss of public funds to

our Office. the District stated it had paid $83,430 on nine separate invoices to a vendor for cleaning at Garfield High School. During the period of

this investigation, the Small Works Program and the RSBDP Program were managed by the same individual. Based on the results of this

investigation, the Seattle School District incurred unnecessary costs of $1,279,310 due to a lack of adequate internal controls. These costs were

authorized by the small works program manager who was a part of our previous report. Many of the invoices lacked adequate supporting

documentation.

HOTLINE

We received multiple citizen concerns regarding the illegal occupation of the Horace Mann School building located in the Central district at 24th &

Cherry. We will refer to Hotline Ref Nos. H-13-498; 489;488; 485; and 491

as Hotline Ref No 13-487. We noted the following additional citizen concerns that were open as of the date of our audit: We reviewed details

at B.1.4. We will followup with the District as part of our accountability audit work located at H.1.PRG

Hotline Issue ID Status First Last Submitted Date Sent To Team

H-13-174 Open Chris J ackins 4/1/2013 4/1/2013

H-13-415 Open Chris J ackins 9/16/2013 9/16/2013

H-13-487 Open Anonymous

10/29/2013 10/29/2013

H-13-507 Open Rita Green 11/13/2013 11/13/2013

NON-SAO AUDITS & STUDIES

Internal audit reports are located at http://www.seattleschools.org/modules/cms/pages.phtml?sessionid=&pageid=249073

Based on the internal audit of disbursements by the Transportation Dept through November 2012, the District does not have sufficient and

effective monitoring over transportation invoice payments, fuel accountability, OT charges, use of take home vehicles and sole source justification

of personal service contracts.

Based on IA over accountability of maintenance of school property, the District does not have a systems in place to account for tools valued under

$1,000. The District receives one invoice for the fleets total fuel consumption. In addition costs associated with fuel usage is not charged to cost

center to which the vehicle is assigned.

Seattle School District No. 1

B.1.PRG - Accountability Planning - Local Govt

Procedure Step: Minutes

Prepared By: AB1, 11/18/2013

Reviewed By: AVE, 1/6/2014

Purpose/Conclusion:

Purpose:

To identify potential accountability risks to consider in the planning conference brainstorm by reviewing minutes of the governing body.

Conclusion:

Based on our review of minutes, we noted the following potential accountability risks

The District lacked internal controls to ensure all revenue owed was collected for its numerous properties and facilities.

Budget constraints, and decreases in funding present a risk of misuse of restricted funds for general fund expenditures

District signs contingency contracts with prospective employees -- risk of insufficient budget oversight and monitoring of resources to

ensure all program expenditures benefit the District.

New information system for student data collection (Power School)-- risk that enrollment/transfer activity will be under/overreported

during the transition process.

District has numerous public works projects resulting from BEXIV levy funds - risk of non compliance with statutory laws.

Testing Strategy:

Auditors should check with the AIC to determine if there are any known risks or items to look for.

Examples of common risk indicators and important information to note are as follows:

Resolutions, ordinances or policies relevant to accountability objectives.

Discussion of citizen, vendor or management concerns relevant to accountability objectives.

Seattle School District No. 1

Any actions that appear unreasonable, unexpected or outside the scope of the entitys authority.

Decisions in which board members are abstaining due to potential conflicts of interest.

Debt issuance.

Discussion of possible financial difficulties or business risks.

Significant awarded contracts or public works projects or risk indicators such as:

Governing body approval to waive bidding requirements for purchases or public works projects (ie: for sole source or emergency

reasons).

Use of alternative public works procedures such as design-build or general contractor / construction manager procedures.

Discussion of vendor protests or complaints about bid procedures or results.

Approval of large or numerous change orders.

Discussion of significant cost over-runs or other problems with public works projects.

New software or conversions.

Situations that may trigger major liabilities or impairments, such as disasters, significant losses of capital or infrastructure assets or major

lawsuits.

Transfers or interfund loans.

New grants, revenue sources or rate changes.

New cost allocation plans.

New entities, joint ventures, programs, or activities

Compliance with Open Public Meetings Laws:

During the review of minutes auditors should be alert for any apparent non-compliance with open public meetings requirements, such as:

Absence of quorum

Official actions of governing body do not appear to be documented in minutes

Actions or decisions known to have occurred are absent from minutes

Purpose of executive sessions not identified in minutes

Executive sessions appear to be for unallowable purposes

Minutes do not appear to have been taken for regular meetings, workshops and special meetings

Business conducted at special meetings was not for the published reason meeting was scheduled

Seattle School District No. 1

Policy/Standards:

SAO Audit Policy 4210 - Planning Accountability Audits

BACKGROUND

The purpose of planning procedures is to identify and assess risks of fraud, loss or abuse of public resources; non-compliance with laws and

regulations; and the internal controls over such matters. Selected risks to audit must be significant to the public and other users either

quantitatively or qualitatively. This is based on auditor judgment. To address those risks, auditors must develop effective audit tests and

strategies.

REQUI REMENTS

1. Auditors will perform the following planning procedures to identify and assess accountability risks:

Review the planning guide.

Review meeting minutes of the governing body.

Gain an understanding of the entity and its control environment.

Maintain a current understanding of the relevant policies, procedures and internal controls over significant accounting systems.

Review the prior audit, the future audit work file (FAWF) and citizen hotline referrals.

Review fraud investigations (including in-process) and other relevant engagements.

Perform planning analytical procedures.

The nature, timing and extent of planning procedures vary with the size and complexity of the entity, and with the auditors experience

with the entity. Auditors will consider whether other planning procedures are necessary to identify risks.

2. Supervisory review of the results of planning procedures will be completed before the planning conference brainstorm.

Supervisors will ensure potential risks are specifically and clearly described to enable an effective discussion during the brainstorm and

provide the basis for developing testing strategies that appropriately respond to selected risks.

3. A planning conference brainstorm will be conducted to finalize the assessment, sort and prioritize risks, and develop

procedures to ensure risks are properly addressed.

The audit manager, supervisor, auditor-in-charge, among others, will hold a planning brainstorm to sort and prioritize risks identified during

Seattle School District No. 1

planning and to strategize audit tests. The following factors will be considered:

Relevance, considering public sensitivity, the expressed concerns or questions of management and those charged with governance, as

well as the primary activities, systems or events occurring at the government.

Potential impact, considering the likelihood and magnitude of potential impacts such as fraud, abuse, loss or questioned costs

associated with noncompliance.

Sometimes a risk may be addressed by more than one type of engagement. Auditors must sort the risks to determine what audit type

would be most appropriate to address them.

The analysis of risks and decisions made during the brainstorm will be documented in sufficient detail to support the focus and scope of the

audit.

4. An audit plan will be prepared from the results of the brainstorm, and a detailed budget will be developed to track budgeted

and actual audit hours.

Supervisory review is important to determine whether adjustments to the plan are needed based on changing circumstances. Significant

revisions to the audit plan must be approved and documented.

5. Auditors will communicate information about the planned audit to client management and those charged with governance.

Auditors must also ensure significant changes to the planned audit are communicated to the client in a timely manner. All communications

must be documented. Refer to Policies 2130 (Inviting Elected Officials to Entrance/Exit Conferences), and 2210 (Conducting Entrance

Conferences).

RELATED POLI CI ES

4110 Objectives and Authority for Accountability Audits

Record of Work Done:

We reviewed the District's board meeting minutes for the period of 9/1/2012 through 8/31/2013 and through the most recent

Seattle School District No. 1

meeting of 10/2/2013 to gain an understanding of the District and its activities.

See minutes review at B.1.3

Based on our review of the meeting minutes the District is is compliance with the Open Public Meetings Act. Specifically we tested for

compliance with the following requirements:

For all meetings a quorum of 4 Board members were present.

Official actions of the governing body appear to be documented in the minutes.

Actions or decisions known to have occurred are not omitted from the minutes.

Purpose and length of executive sessions are identified in the minutes.

Executive sessions are held for allowable purposes.

Business conducted at special meetings is for reasons scheduled and publicly disclosed.

Minutes for regular, special meetings and retreats were approved at the next regularly scheduled meeting

Items noted in the minutes that may impact our accountability audit include:

Numerous public works contracts (both Design/Build and GC/CM contracts were awarded during the audit period. The

District notes increased enrollment and is planning to reopen and expand current inventory plus construct new schools to

meet capacity needs.

The District notes decreases in enrollment and funding for Head Start programs

District notes budget constraints that pose risk of misuse of restricted funds for general fund expenditures.

District must address retiring work force and high turnover of new staff.

Minutes of 9/18/2013 allude to non paying tenants at Horace Mann School facilities.

District rolls out a new system PowerSchool to replace the ESIS.

B.1.PRG - Accountability Planning - Local Govt

Seattle School District No. 1

Procedure Step: Planning Analytical Procedures

Prepared By: AB1, 1/14/2014

Reviewed By: AVE, 1/22/2014

Purpose/Conclusion:

Purpose:

To identify potential accountability risks to consider in the planning conference brainstorm by performing planning analytical procedures.

Conclusion:

Based on our planning analytical procedures, we noted the following potential accountability risks :

We identified vendors paid a significant increase in 2013. We will consider testing of these vendors in our brainstorm session.

We noted one hourly employee with a 40% increase in pay from the prior year and will include in our testing as follow-up to deficiencies in

internal control over payroll at D.5.PRG

Testing Strategy:

NOTE: Planning AP differs from AP used as a substantive test in that the purpose of the procedure is discovery rather than

substantiation. Although expectations of some sort are necessary for effective AP, expectations used for planning AP are often very general and

do not need to be documented. Expectations may be derived from events or changes in activity noted during other planning steps, budgets, prior

year figures, figures for comparable entities, or general understanding of relationships between activities and financial figures.

Auditors are encouraged to develop analytics to match the entity's circumstances, activities and risks. The following are examples of general

considerations for planning analytical procedures:

Trend analysis of revenues and expenditures

Auditors would generally start with high level analyticals (such as revenues by fund and 2-digit BARS or expenditures by fund and object)

before considering more detailed trends (ie: to sub-account) for certain high risk funds or accounts.

Total payments by vendor

Seattle School District No. 1

Total payroll by employee

Trend payroll by department or type of pay (ie: overtime, recognition leave, time loss, exchange time, etc)

Amount of expenditures passing through petty cash funds, imprest accounts and/or credit cards

Surprise cash counts

CAATS Considerations

When analytical procedures involve CAATS, the following documentation guidelines should be followed:

Databases should not be included in TeamMate. Only relevant query results should be included in audit documentation. This can be

done with imported report documents, copied query excerpts, narrative description of queries and results, or other means.

When used as audit evidence, auditors should document where and how they obtained data, how they verified or were reasonably

assured of the completeness and accuracy of the data, and results. NOTE: FAP data has not been validated by Team Local ISA. For

downloads from ASP, BIAS, BiTech, CompuTech, Eden, Springbrook and WSIPC software, data validation testing strategy workpapers are

available in the SAOStore in the Planning & Audit Plan | Accountability folder.

Policy/Standards:

SAO Audit Policy 4210 - Planning Accountability Audits

BACKGROUND

The purpose of planning procedures is to identify and assess risks of fraud, loss or abuse of public resources; non-compliance with laws and

regulations; and the internal controls over such matters. Selected risks to audit must be significant to the public and other users either

quantitatively or qualitatively. This is based on auditor judgment. To address those risks, auditors must develop effective audit tests and

strategies.

REQUI REMENTS

1. Auditors will perform the following planning procedures to identify and assess accountability risks:

Review the planning guide.

Review meeting minutes of the governing body.

Gain an understanding of the entity and its control environment.

Seattle School District No. 1

Maintain a current understanding of the relevant policies, procedures and internal controls over significant accounting systems.

Review the prior audit, the future audit work file (FAWF) and citizen hotline referrals.

Review fraud investigations (including in-process) and other relevant engagements.

Perform planning analytical procedures.

The nature, timing and extent of planning procedures vary with the size and complexity of the entity, and with the auditors experience

with the entity. Auditors will consider whether other planning procedures are necessary to identify risks.

2. Supervisory review of the results of planning procedures will be completed before the planning conference brainstorm.

Supervisors will ensure potential risks are specifically and clearly described to enable an effective discussion during the brainstorm and

provide the basis for developing testing strategies that appropriately respond to selected risks.

3. A planning conference brainstorm will be conducted to finalize the assessment, sort and prioritize risks, and develop

procedures to ensure risks are properly addressed.

The audit manager, supervisor, auditor-in-charge, among others, will hold a planning brainstorm to sort and prioritize risks identified during

planning and to strategize audit tests. The following factors will be considered:

Relevance, considering public sensitivity, the expressed concerns or questions of management and those charged with governance, as

well as the primary activities, systems or events occurring at the government.

Potential impact, considering the likelihood and magnitude of potential impacts such as fraud, abuse, loss or questioned costs

associated with noncompliance.

Sometimes a risk may be addressed by more than one type of engagement. Auditors must sort the risks to determine what audit type

would be most appropriate to address them.

The analysis of risks and decisions made during the brainstorm will be documented in sufficient detail to support the focus and scope of the

audit.

4. An audit plan will be prepared from the results of the brainstorm, and a detailed budget will be developed to track budgeted

and actual audit hours.

Seattle School District No. 1

Supervisory review is important to determine whether adjustments to the plan are needed based on changing circumstances. Significant

revisions to the audit plan must be approved and documented.

5. Auditors will communicate information about the planned audit to client management and those charged with governance.

Auditors must also ensure significant changes to the planned audit are communicated to the client in a timely manner. All communications

must be documented. Refer to Policies 2130 (Inviting Elected Officials to Entrance/Exit Conferences), and 2210 (Conducting Entrance

Conferences).

RELATED POLI CI ES

4110 Objectives and Authority for Accountability Audits

Record of Work Done:

CAATS Considerations Details:

We obtained G/L and Payroll data from SSD and imported the data into a Microsoft Access database. We verified the integrity of the data by

agreeing total revenues, expenses, and certain balance sheet account line items from the database to the F-196. Amounts were identical;

therefore, it appears the database is accurate and complete. We will use this information to analyze data and identify areas that have unusual

discrepancies based upon unusual items or large discrepancies between CY & PY. The MS Access "front-end" for the database is on the server in

our dedicated work space at the District's administrative offices (the path follows: \\SAOPSCKC003\TeamMate\SSD Share\FY13. The actual data

tables are located on secure servers in our Olympia offices, and the Access front-end pulls data from the database in Olympia.

We performed a four year trend analysis for:

Revenue AP B.1.10 No risks identified

Expenditure AP B.1.11 We identified vendors paid a significant increase in 2013. We will consider testing of these vendors as part of our

follow-up to PY issue re personal service contracts in our brainstorm session.

Payroll AP B.1.12 We performed payroll trend analytical procedures to identify risks to bring to the accountability brainstorm. Trend

results coincide with our understanding of high turnover of teachers due to the high percentage of new teachers that do not return the

following school year. We selected employees with a high percentage increase and verified current pay is within the pay scale of the

Seattle School District No. 1

position. We noted one hourly employee with a 40% increase in pay from the prior year and will include in our testing as follow-up to

deficiencies in internal control over payroll at D.5.PRG.

B.1.PRG - Accountability Planning - Local Govt

Procedure Step: AC Brainstorm & Audit Plan

Prepared By: AB1, 2/5/2014

Reviewed By: AVE, 4/15/2014

Purpose/Conclusion:

Purpose / Conclusion:

To evaluate accountability risks and develop an audit plan.

Testing Strategy:

EXPECTATI ON: The planning conference brainstorm should take place in person or on the phone after all planning steps have

been completed. The AI C should be prepared in accordance with team expectations - with a proposed priority of risks to

include in the audit. This will allow the brainstorming process to effectively evaluate and finalize scope decisions and design

further audit procedures.

STEP 1: Brainstorming Discussion (Planning Conference)

Professional judgment should be used in determining which audit team members should be included in the discussion. The brainstorm should

include, at minimum, the key members of the audit team. Normally, this would be the AIC, Supervisor and Audit Manager. This could also

include other members of the current audit team, the prior AIC, specialists or program manager or others. Managers should consider the

experience of the AIC and Supervisor and the size and risk of the audit in determining who should attend and the timing and extent of

brainstorming discussion.

Seattle School District No. 1

The auditor must document how and when the discussion(s) occurred and participants.

STEP 2: Overall Accountability Risk

Assess overall risk for safeguarding of public resources and compliance. When determining overall risk, auditors should consider risks that relate

pervasively to safeguarding and compliance as a whole and potentially affect many audit areas. For example:

Issues with overall COSO elements, such as the control environment or information systems

Use of the County Treasurer

Ability to segregate duties effectively

Major financial distress

Planning should reflect the overall risk assessment in staffing, supervision, audit budget and the overall level of testing.

STEP 3: Determine Accountability Audit Plan

Identify accountability areas selected for testing. The plan should describe each risk selected for testing (what could go wrong) and our planned

audit response (further audit procedures).

Changes to Audit Plan:

Document both the original plan and any changes made during the course of the audit. Changes to the original plan may be documented in the

"Changes to Audit Plan" step or in the Record of Work Done (ie: using a different font color for changes or listing changes in a separate section at

the end of the plan).

Staffing:

Identify the AIC and AAM of the audit in the Team tab of the Profile, considering the knowledge, skill, and ability of personnel assigned significant

audit responsibilities and the appropriate level of supervision.

Independence and Competence:

Determine whether assigned staff are independent with respect to the entity under audit (Policy 3110). Also, ensure the assigned staff

collectively possesses adequate professional competence for the tasks required (Policy 3140).

Reliance on Work of Others:

If the audit will require the use of outside specialists (Policy 3230) or rely on the work of other auditors (Policy 3510), internal auditors (Policy

3520), or grant monitors (Policy 3530), the plan should describe the anticipated nature of this reliance.

Budget:

Develop a detailed audit budget, considering risks, staffing and other circumstances. Initial budget information can be obtained from

Seattle School District No. 1

TABS. Inform your supervisor and audit manager if TABS is not correct so that changes can be requested.

STEP 4: Communicate risks or information relevant to other SAO audits

Information or risks identified in the planning may affect or be better addressed with a different type of engagement (for example, a financial

statement audit), a future engagement, an engagement of another local government or state agency, or by other parties, such as regulatory

bodies or law enforcement.

Policy/Standards:

SAO Audit Policy 4110 - Objectives and Authority for Accountability Audits

BACKGROUND

Our Office has statutory authority (RCW 43.09 and RCW 43.88.160) to audit financial information and compliance with state, federal and local

laws on the part of all local governments and all state agencies.

Under this authority, we conduct accountability audits. These audits are unique in that they are not required to follow professional auditing

standards although the general standards in Government Auditing Standards have been fully incorporated as policy for all engagements (including

accountability audits) in the Audit Policy 3100 series. A risk-based approach is used to provide meaningful and timely feedback about state and

local governments by focusing on significant risks that may not be material to a financial or federal compliance audit.

REQUI REMENTS

1. Accountability audits will be designed to detect and respond to areas of significant risk.

Accountability risks include fraud, loss or abuse of public resources; non-compliance with laws and regulations; and the internal controls

over such matters. These risks are considered significant when they matter to the public and other users quantitatively or qualitatively.

Fraud involves employees or contractors dishonestly or illegally taking public funds or assets.

Losses include frauds but may also result from a lack of prudent business practices such as inadequate insurance and inadequate financial

planning.

Abuse involves behavior that is improper or unethical when compared with prudent, reasonable and necessary business practices. For

example, creating unneeded overtime, making travel choices that are unnecessarily extravagant or expensive or making procurement or

vendor selections that are unnecessarily extravagant or expensive.

Non-Compliance with laws and regulations that have a public interest. For example, complying with the Open Public Meetings Act, conflict

of interest laws, the proper use of restricted funds, and requirements for investments and deposits.

Seattle School District No. 1

RELATED POLI CI ES

1210 State and Local Government Audits

REFERENCES

Chapter 43.09 RCW

RCW 43.88.160 (6)

------------------------------------------------------------------------------

SAO Audit Policy 4210 - Planning Accountability Audits

BACKGROUND

The purpose of planning procedures is to identify and assess risks of fraud, loss or abuse of public resources; non-compliance with laws and

regulations; and the internal controls over such matters. Selected risks to audit must be significant to the public and other users either

quantitatively or qualitatively. This is based on auditor judgment. To address those risks, auditors must develop effective audit tests and

strategies.

REQUI REMENTS

1. Auditors will perform the following planning procedures to identify and assess accountability risks:

Review the planning guide.

Review meeting minutes of the governing body.

Gain an understanding of the entity and its control environment.

Maintain a current understanding of the relevant policies, procedures and internal controls over significant accounting systems.

Review the prior audit, the future audit work file (FAWF) and citizen hotline referrals.

Review fraud investigations (including in-process) and other relevant engagements.

Perform planning analytical procedures.

The nature, timing and extent of planning procedures vary with the size and complexity of the entity, and with the auditors experience

with the entity. Auditors will consider whether other planning procedures are necessary to identify risks.

2. Supervisory review of the results of planning procedures will be completed before the planning conference brainstorm.

Seattle School District No. 1

Supervisors will ensure potential risks are specifically and clearly described to enable an effective discussion during the brainstorm and

provide the basis for developing testing strategies that appropriately respond to selected risks.

3. A planning conference brainstorm will be conducted to finalize the assessment, sort and prioritize risks, and develop

procedures to ensure risks are properly addressed.

The audit manager, supervisor, auditor-in-charge, among others, will hold a planning brainstorm to sort and prioritize risks identified during

planning and to strategize audit tests. The following factors will be considered:

Relevance, considering public sensitivity, the expressed concerns or questions of management and those charged with governance, as

well as the primary activities, systems or events occurring at the government.

Potential impact, considering the likelihood and magnitude of potential impacts such as fraud, abuse, loss or questioned costs

associated with noncompliance.

Sometimes a risk may be addressed by more than one type of engagement. Auditors must sort the risks to determine what audit type

would be most appropriate to address them.

The analysis of risks and decisions made during the brainstorm will be documented in sufficient detail to support the focus and scope of the

audit.

4. An audit plan will be prepared from the results of the brainstorm, and a detailed budget will be developed to track budgeted

and actual audit hours.

Supervisory review is important to determine whether adjustments to the plan are needed based on changing circumstances. Significant

revisions to the audit plan must be approved and documented.

5. Auditors will communicate information about the planned audit to client management and those charged with governance.

Auditors must also ensure significant changes to the planned audit are communicated to the client in a timely manner. All communications

must be documented. Refer to Policies 2130 (Inviting Elected Officials to Entrance/Exit Conferences), and 2210 (Conducting Entrance

Conferences).

RELATED POLI CI ES

Seattle School District No. 1

4110 Objectives and Authority for Accountability Audits

Record of Work Done:

Step 1: Brainstorm

Date: J an 7, 2014 we held a meeting at the District.

Attendees: Anastassia Kavanaugh, J im Griggs, Heidi Wiley, Annette Boulmetis

We prepared an index of audit risks at: B.1.13

Step 2: Overall Accountability Risk

We assessed the overall risk as HIGH and will conduct the audit accordingly.

Step 3: Accountability Audit Plan

Based on planning procedures and the planning conference brainstorm, we identified the following risks to be addressed by the accountability

audit, in order of priority:

Accountability Risk Audit Response

Financial Condition

We plan to perform procedures using the OSPI

financial indicators to determine if the District has a

healthy financial position. Financial Condition

Required Risk

Enrollment - This area is a significant funding driver

for the District's state apportionment. This area

was last reviewed in FY09 and errors in calculating

FTE were noted. Due to complex reporting

requirements, there is a risk of non-compliance that

puts the District at risk of significant repayments of

apportionment funding.

Special Education Enrollment Risks are that

evaluations and timelines will not be completed in a

timely fashion.

We plan to perform a review of enrollment in

accordance with Team SP's suggestions, to

determine if the District is in compliance with basic

enrollment reporting requirements.

See Enrollment

Team Schools Program will perform testing to

determine if the District is in compliance with

Special Education Enrollment requirements. See

work performed at Special Education Enrollment

Required Risk

Transportation This area was last reviewed in

2007 with exceptions in ridership reporting that

We plan to perform a review of transportation in

accordance with Team SPs suggestions to

Seattle School District No. 1

resulted in the District receiving an inappropriate

amount of funding for transportation ridership.

determine if the District is in compliance with

transportation reporting

requirements. Transportation

Facilities We noted a PY findingthe District does

not have adequate controls to ensure that it collects

all revenue for facilities usage. Due to the Districts

size and considerable number of assets there is a

risk that contract agreements for use of facilities are

not sufficiently monitored and that the expense of

operating these facilities is not being sufficiently

offset by potential revenue putting the District at

risk of financial hardship.

We plan to select contracts for testing to determine

if the District is monitoring contracts and is in

compliance with permitting and

insurance requirements for all parties concerned.

Also to verify the District has a collection process in

place to ensure timely invoicing and monitoring of

delinquent accounts and payment. Facilities

Payroll We noted several issues in the PY of

inadequate internal controls over access to HR and

payroll data files. I n addition we noted payroll costs

related to the general fund were charged to capital

and that changes made to the employee pay were

not adequately supported by Personnel Change

forms and authorization by Management and failure

to report personal use of district vehicle to IRS

We plan to follow-up on prior year issues and

determine if the District has made progress toward

addressing these issues and document if corrective

action is in process or is in draft form. Payroll

Ineligible Capital Expenditures We noted durring the

py audit the District continued charging non-capital

costs to Capital Project Fund.

We will follow up on management letter issue

regarding

charging of noncapital costs to Capital Project Fund

at Central Administrative Costs

Fleet Management -- How does the District

inventory

and perform maintenance on its fleet. To follow up

on a finding

that we issued for FY 2011 ( no follow up was done for

FY 2012).

We will obtain the District's current fleet inventory

to

determine if it is updated and maintenance

schedules

are being monitored. Fleet Management

Staffing - The auditor in charge and supervisor, as well as all assistants, are listed in the Team tab of the Profile. We have planned the audit

staffing to ensure that all staff are adequately supervised.

Seattle School District No. 1

Independence and Competence - Assigned personnel are independent and collectively have the technical knowledge, skills and experience

necessary to perform the audit.

Reliance on work of others - We considered the use of specialists and the potential for reliance on other SAO audits or the work other CPAs,

internal auditors or grant monitors. We do not plan to rely on specialists, other SAO audits, or work of others.

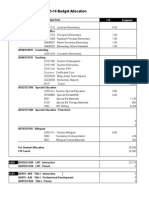

Budget -We developed a detailed audit budget as documented in 2013 Budget vs. Actual Audit Hours.

Step 4: I nformation to be considered in other SAO audits:

We identified no significant information that should be considered for other SAO audits or communication to outside parties.

B.1.PRG - Accountability Planning - Local Govt

Procedure Step: AC Entrance Conference

Prepared By: AB1, 1/28/2014

Reviewed By: AVE, 1/28/2014

Purpose/Conclusion:

Purpose / Conclusion:

To communicate our audit responsibilities and the planned scope and timing of the audit to management and the governing body.

Testing Strategy:

If no entrance conference was held, explain the situation in the record of work done (and the Entrance Conference Explanation

Field in the custom tab in the profile). The record of work done must describe how the required information above was

communicated to management and those charged with governance.

BEFORE the Entrance Conference:

Seattle School District No. 1

If not clearly evident from the governance structure, determine those charged with governance for purposes of audit communication

and document our conclusion.

Those charged with governance are those responsible for overseeing the strategic direction of the government and fulfillment of the

governments objectives and obligations. In some governments, multiple parties may be charged with governance, including oversight

bodies contracting for the audit, members or staff of legislative committees, boards or audit committees. The auditors evaluation would

consider how the government delegates authority and establishes accountability for management.

Communicate with management who will conduct and attend the Entrance conference.

Set up the Entrance conference at a time convenient for client and SAO staff.

Invite elected officials to the Entrance conference (see template letter available in the SAOStore).

Prepare the Entrance conference handout the using the required template available in the SAOStore. The template must be adjusted as

necessary for each audit.

The entrance document is normally used in lieu of an engagement letter to document our understanding with the client. However, if a

more formal agreement is needed (for example, to set firm deadlines for audit readiness), an engagement letter may be used - see Audit

Policy 2140 for details.

DURI NG the Entrance Conference:

Present and discuss information on the entrance conference handout to ensure there is a clear understanding of the following areas: Scope and

timing of the audit, including the month we expect to issue our report; reporting levels for audit recommendations; audit costs; audit staffing;

expected communications; and other information considered important to the audit.

AFTER the Entrance Conference:

Attach the entrance conference handout and any other documents that were presented.

Document the conference attendees (SAO and client) as well as the date of the conference.

Document any significant conversations that might result in a change in our risk assessment or audit plan.

Send copies of the entrance document to any elected officials who were not able to attend the conference, unless the governing body

uses a finance/audit committee for contact with the auditor.

Policy/Standards:

Seattle School District No. 1

SAO Audit Policy 2130 - Inviting Officials to Entrance and Exit Conferences

SAO Audit Policy 2210 - Conducting Entrance Conferences

Record of Work Done:

Invitations:

Invitations to the entrance conference were sent to board members and executive management via email.

Entrance Conference:

The entrance conference handout is documented at Entrance Conference Document - 2013 SSD Audits. The following people attended the official

entrance conference, held in accordance with Audit Policy 2210:

Charles Wright, Deputy Superintendent

Sherry Carr, Board member and Audit & Finance Committee Chair

Susan Peters, Board member and Audit & Finance Committee member

Harium Martin, Board member and Audit & Finance Committe member

Kathie Technow, Accounting Manager

Andrew Medina, I nternal Auditor

Ken Gotsch, Business & Finance Assistant Superintendent

Linda Siebring, Budget Manager

Kimberly Fry, Internal Audit employee

J im Griggs, SAO Audit Manager

Anastassia Kavanaugh, SAO Assistant Audit Manager

Heidi Wiley, SAO Auditor in Charge

In addition to the topics shown on the entrance conference handout, the following items were also discussed:

The reason why Head Start was selected as a program for the single audit when the feds came in and did a thorough audit. We explained

the feds did a program audit and because of the program is a major program that we needed to select it to meet certain requirements.

Does SAO and the District have a contract since the audit cost is more than $250,000 since District policy is that any cost above that

amount is required to be approved by the Board with a contract. Sherry Carr explained to Ken Gotsch that SAO is a different case as the

District is required to have the audits done. But Charles Wright will follow up with legal to make sure the District is following their policy.

Seattle School District No. 1

Board and Superintendent's office offered their assistance in making sure the District cooperates and information is provided. I f we run

into any problems we can contact them directly.

We also sent copies of the entrance conference handout via email to the following people:

'schoolboard@seattleschools.org'; 'superintendent@seattleschools.org'; 'kcgotsch@seattleschools.org'; 'paapostle@seattleschools.org'; kcorrigan@

seattleschools.org; 'lmsebring@seattleschools.org'; 'pmcevoy@seattleschools.org'; 'mftolley@seattleschools.org'; 'lherndon@seattleschools.org'; 'c

wright@seattleschools.org'

D.1.PRG - Concluding Accountability Audit Procedures

Procedure Step: Changes to Audit Plan

Prepared By: AVE, 6/18/2014

Reviewed By: JWG, 6/18/2014

Purpose/Conclusion:

Purpose:

To document changes in the audit plan and determine whether changes caused audit objectives not to be met.

Conclusion:

After documenting and analyzing changes in the audit plan, we determined that these changes supported audit objectives.

Testing Strategy:

Document any changes to the original audit plan.

Changes made during the course of the audit should be differentiated from the original audit plan. These changes may be documented in

the Record of Work Done below or as part of the original audit plan (ex: using a different font color or listing the changes in a separate

section of the original plan).

Seattle School District No. 1

Determine whether changes to the original audit plan support audit objectives.

Auditors should consider whether permanent file information needs to be updated to capture any significant new information discovered during

the course of the audit.

Policy/Standards:

SAO Audit Policy 4210 - Planning Accountability Audits

Record of Work Done:

During the course of the audit we identified two additional risks:

1. Procurement of technology purchases. We became aware of the risk is that SSD does not comply with the law when awarding contract to

Apple, Inc. after phone conference with Team School Programs on 2/5/2014.

See D.10.PRG

We determined that the District appropriately procured technology purchases.

2. Self-Insurance - during our audit we noted that this area was not reviewed in the past five audits. We performed initial risk assessment to

determine if SSD self-insures for any risks and if SSD uses ESDs.

See D.11.PRG

We determined that the District does not use ESDs. The district self-insures for worker's comp, liability and potentially for health - vision only.