Professional Documents

Culture Documents

Michael D Nieves - TransUnion Personal Credit Report - 20140730

Uploaded by

chfthegodOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Michael D Nieves - TransUnion Personal Credit Report - 20140730

Uploaded by

chfthegodCopyright:

Available Formats

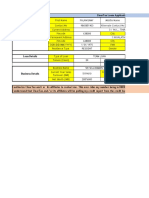

07/30/2014 File Number: 330379853

-Begin Credit Report-

You have been on our files since 06/28/2009

SSN: XXX-XX-3167

Your SSN has been masked for your protection.

Names Reported: MICHAEL D. NIEVES

Addresses Reported:

Address Date Reported

33 STANLEY AVE, STATEN ISLAND, NY 10301-2833 07/17/2013

30 MERLE PL APT 3F, STATEN ISLAND, NY 10305-3751 06/28/2009

Telephone Numbers Reported:

(917) 794-1331

Employment Data Reported:

Employer Name Date Verified

SELFEMPLOYED 03/12/2013

Regular Inquiries are posted when someone accesses your credit information from TransUnion. The presence of an inquiry means that the company listed received your credit

information on the dates specified. These inquiries will remain on your credit file for up to 2 years.

T-MOBILE

12920 SE 38TH STRE

BELLEVUE, WA 98006

(800) 318-9270

Requested On: 06/11/2014, 03/12/2014, 01/09/2014,

06/28/2013

Inquiry Type: Individual

VERIZON WIRELESS

80 INTERNATIONAL

DRIVE SUITE 500

GREENVILLE, SC 29615

(800) 468-2267

Requested On: 06/22/2013

Inquiry Type: Individual

DISCOVER FINANCIAL SVCS

2500 LAKE COOK RD,

RIVERWOODS, IL 60015

(800) 347-2683

Requested On: 03/12/2013

Inquiry Type: Individual

AT&T SERVICES

12911 E 183RD STRE

CERRITOS, CA 90703

(800) 331-0500

Requested On: 01/30/2013

Inquiry Type: Individual

The listing of a company's inquiry in this section means that they obtained information from your credit file in connection with an account review or other business transaction with you.

These inquiries are not seen by anyone but you and will not be used in scoring your credit file (except insurance companies may have access to other insurance company inquiries,

certain collection companies may have access to other collection company inquiries, and users of a report for employment purposes may have access to other employment inquiries,

where permitted by law).

ALLY BANK

PO BOX 380901

BLOOMINGTON, MN 55438

(877) 247-2559

Requested On: 04/14/2014, 12/29/2013, 12/27/2013, 10/01/2013

Permissible Purpose: CONSUMER INITIATED TRANSACTION

CONSUMERINFO.COM

PO BOX 2390

ALLEN, TX 75013

(877) 481-6826

Requested On: 10/19/2013

Permissible Purpose: WRITTEN AUTHORIZATION

CONSUMERINFO via CONSUMER INFO.COM

PO BOX 2390

ALLEN, TX 75013

(877) 481-6826

Requested On: 10/14/2013

Permissible Purpose: CONSUMER REQUEST

TU INTERACTIVE

100 CROSS ST

#202

SAN LUIS OBISP, CA 93401

(888) 567-8688

Requested On: 01/19/2013, 01/18/2013

FACTACT FREE DISCLOSURE

P O BOX 1000

CHESTER, PA 19022

(800) 888-4213

Requested On: 01/18/2013

MICHAEL NIEVES via KARMA/TRANSUNION INTERAC

100 CROSS STREET

SAN LUIS OBISP, CA 93401

(805) 782-8282

Requested On: 01/18/2013

Permissible Purpose: CONSUMER REQUEST

Your credit report contains the following messages.

PROMOTIONAL OPT-OUT: This file has been opted out of promotional lists supplied by TransUnion.

(Note: This opt-out is set to expire in 02/2015.)

The opt out on your file will remain in effect until the expiration date specified above, unless you request it to be made permanent. To permanently opt out of promotional lists provided by

TransUnion, you must send us a signed "Notice of Election" form, which can be obtained by writing us or calling us at 800-916-8800 and speaking with a representative.

-End of Credit Report-

Should you wish to contact TransUnion, you may do so,

Online:

To report an inaccuracy, please visit: dispute.transunion.com

For answers to general questions, please visit: www.transunion.com

By Mail:

TransUnion Consumer Relations

P.O. Box 2000

Chester, PA 19022-2000

By Phone:

(800) 916-8800

You may contact us between the hours of 8:00 a.m. and 11:00 p.m. Eastern Time, Monday

through Friday, except major holidays.

For all correspondence, please have your TransUnion file number available

(located at the top of this report).

-Begin Additional Information-

The following disclosure of information is provided as a courtesy to you. This information is not part of your TransUnion credit report, but may be provided when TransUnion receives an

inquiry about you from an authorized party. This additional information can include Special Messages, Possible Office of Foreign Assets Control ("OFAC") Name Matches and Inquiry

Analysis information. Any of the previously listed information that pertains to you will be listed below.

The companies that request your credit report must first provide certain information about you. Within the past 90 days, companies that requested your report provided the following

information.

T-MOBILE

Requested On: 06/11/2014

Identifying information they provided:

MICHAEL D. NIEVES

30 MERLE PL 30

STATEN ISLAND, NY 10305

-End of Additional Information-

Para informacion en espanol, visite www.consumerfinance.gov/learnmore o escribe a la Consumer Financial Protection Bureau, 1700 G Street N.W.,

Washington, DC 20552.

A Summary of Your Rights Under the Fair Credit Reporting Act

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of information in the files of consumer

reporting agencies. There are many types of consumer reporting agencies, including credit bureaus and specialty agencies (such as

agencies that sell information about check writing histories, medical records, and rental history records). Here is a summary of your

major rights under the FCRA. For more information, including information about additional rights, go to

www.consumerfinance.gov/learnmore or write to: Consumer Financial Protection Bureau, 1700 G Street N.W., Washington, DC

20552.

You must be told if information in your file has been used against you.

Anyone who uses a credit report or another type of consumer report to deny your application for credit, insurance, or employment -- or to take

another adverse action against you -- must tell you, and must give you the name, address, and phone number of the agency that provided the

information.

You have the right to know what is in your file.

You may request and obtain all the information about you in the files of a consumer reporting agency (your "file disclosure"). You will be

required to provide proper identification, which may include your Social Security Number. In many cases, the disclosure will be free. You are

entitled to a free file disclosure if:

a person has taken adverse action against you because of information in your credit report;

you are the victim of identity theft and place a fraud alert in your file;

your file contains inaccurate information as a result of fraud;

you are on public assistance;

you are unemployed but expect to apply for employment within 60 days.

In addition, all consumers are entitled to one free disclosure every 12 months upon request from each nationwide credit bureau and from

nationwide specialty consumer reporting agencies. See www.consumerfinance.gov/learnmore for additional information.

You have the right to ask for a credit score.

Credit scores are numerical summaries of your credit-worthiness based on information from credit bureaus. You may request a credit score

from consumer reporting agencies that create scores or distribute scores used in residential real property loans, but you will have to pay for it.

In some mortgage transactions, you will receive credit score information for free from the mortgage lender.

You have the right to dispute incomplete or inaccurate information.

If you identify information in your file that is incomplete or inaccurate, and report it to the consumer reporting agency, the agency must

investigate unless your dispute is frivolous. See www.consumerfinance.gov/learnmore for an explanation of dispute procedures.

Consumer reporting agencies must correct or delete inaccurate, incomplete, or unverifiable information.

Inaccurate, incomplete, or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting

agency may continue to report information it has verified as accurate.

Consumer reporting agencies may not report outdated negative information.

In most cases, a consumer reporting agency may not report negative information that is more than seven years old, or bankruptcies that are

more than 10 years old.

Access to your file is limited.

A consumer reporting agency may provide information about you only to people with a valid need - usually to consider an application with a

creditor, insurer, employer, landlord, or other business. The FCRA specifies those with a valid need for access.

You must give your consent for reports to be provided to employers.

A consumer reporting agency may not give out information about you to your employer, or a potential employer, without your written consent

given to the employer. Written consent generally is not required in the trucking industry. For more information, go to

www.consumerfinance.gov/learnmore

You may limit "prescreened" offers of credit and insurance you get based on information in your credit report.

Unsolicited "prescreened" offers for credit and insurance must include a toll-free phone number you can call if you choose to remove your

name and address from the lists these offers are based on. You may opt-out with the nationwide credit bureaus at 1-888-567-8688

(888-5OPTOUT).

You may seek damages from violators.

If a consumer reporting agency, or, in some cases, a user of consumer reports or a furnisher of information to a consumer reporting agency

violates the FCRA, you may be able to sue in state or federal court.

Identity theft victims and active duty military personnel have additional rights.

For more information, visit www.consumerfinance.gov/learnmore

States may enforce the FCRA, and many states have their own consumer reporting laws. In some cases, you may have more rights

under state law. For more information, contact your state or local consumer protection agency or your state Attorney General. For

information about your federal rights, contact:

TYPE OF BUSINESS: CONTACT:

1.a. Banks, savings associations, and credit unions with total assets of

over $10 billion and their affiliates.

Bureau of Consumer Financial Protection

1700 G Street, N.W.

Washington, DC 20552

b. Such affiliates that are not banks, savings associations, or credit

unions also should list, in addition to the CFPB:

Federal Trade Commission

Consumer Response Center - FCRA

Washington, DC 20580

1-877-382-4357

2. To the extent not included in item 1 above:

a. National banks, federal savings associations, and federal branches

and federal agencies of foreign banks

Office of the Comptroller of the Currency

Customer Assistance Group

1301 McKinney Street, Suite 3450

Houston, TX 77010-9050

b. State member banks, branches and agencies of foreign banks

(other than federal branches, federal agencies, and insured state

branches of foreign banks), commercial lending companies owned or

controlled by foreign banks, and organizations operating under section

25 or 25A of the Federal Reserve Act

Federal Reserve Consumer Help (FRCH)

PO Box 1200

Minneapolis, MN 55480

c. Nonmember Insured Banks, Insured State Branches of Foreign

Banks, and Insured state savings associations

FDIC Consumer Response Center

1100 Walnut Street, Box #11

Kansas City, MO 64106

d. Federal credit unions National Credit Union Administration

Office of Consumer Protection (OCP)

Division of Consumer Compliance and Outreach (DCCO)

1775 Duke Street

Alexandria, VA 22314

3. Air carriers Asst. General Counsel for Aviation Enforcement & Proceedings

Aviation Consumer Protection Division

Department of Transportation

1200 New Jersey Avenue, S.E.

Washington, DC 20590

1-202-366-1306

4. Creditors Subject to Surface Transportation Board Office of Proceedings, Surface Transportation Board

Department of Transportation

395 E Street, S.W.

Washington, DC 20423

5. Creditors subject to Packers and Stockyards Act, 1921 Nearest Packers and Stockyards Administration area supervisor

6. Small Business Investment Companies Associate Deputy Administrator for Capital Access

United States Small Business Administration

409 Third Street, SW, 8th Floor

Washington, DC 20416

7. Brokers and Dealers Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

8. Federal Land Banks, Federal Land Bank Associations, Federal

Intermediate Credit Banks, and Production Credit Associations

Farm Credit Administration

1501 Farm Credit Drive

McLean, VA 22102-5090

9. Retailers, Finance Companies, and All Other Creditors Not Listed

Above

FTC Regional Office for region in which the creditor operates or

Federal Trade Commission: Consumer Response Center-FCRA

Washington, DC 20580

1-877-382-4357

Information Regarding State Laws

New York Residents

New York Consumers Have the Right to Obtain a Security Freeze

As of November 1, 2006 you have a right to place a "Security Freeze" on your credit report, which will prohibit a Consumer Credit Reporting

Agency from releasing information in your credit report without your express authorization. A Security Freeze must be requested in writing [by

certified or overnight mail] delivery confirmation requested or via telephone, secure electronic means, or other methods developed by the

Consumer Credit Reporting Agency. The Security Freeze is designed to prevent credit, loans, and services from being approved in your name

without your consent. However, you should be aware that using a Security Freeze to take control over who gets access to the personal and

financial information in your credit report may delay, interfere with, or prohibit the timely approval of any subsequent request or application you

make regarding a new loan, credit, mortgage, government services or payments, insurance, rental housing, employment, investment, license,

cellular phone, utilities, digital signature, internet credit card transaction, or other services, including an extension of credit at point of sale.

When you place a Security Freeze on your credit report, you will be provided a personal identification number or password to use if you choose

to remove the freeze on your credit report to a specific party or for a period of time after the freeze is in place. To provide that authorization you

must contact the Consumer Credit Reporting Agency and provide all of the following:

1) The personal identification number or password;

2) Proper Identification to verify your identity;

3) The proper information regarding the party or parties who are to receive the credit report or the period of time for which the report shall be

available to users of the credit report; and

4) Payment of any applicable fee.

A Consumer Credit Reporting Agency must authorize the release of your credit report no later than three business days after receiving the

above information. Effective September 1, 2009, a Consumer Credit Reporting Agency that receives a request via telephone or secure

electronic method shall release a consumer's credit report within fifteen minutes when the request is received.

A Security Freeze does not apply to circumstances in which you have an existing account relationship and a copy of your report is requested

by your existing creditor or its agents or affiliates for certain types of account review, collection, fraud control or similar activities.

If you are actively seeking credit, you should understand that the procedures involved in lifting a security freeze may slow your application for

credit. You should plan ahead and lift a freeze, either completely if you are shopping around, or specifically for a certain creditor, before

applying for new credit. When seeking credit or pursuing another transaction requiring access to your credit report, it is not necessary to

relinquish your PIN or password to the creditor or business; you can contact the Consumer Credit Reporting Agency directly. If you choose to

give out your PIN or password to the creditor or business, it is recommended that you obtain a new PIN or password from the Consumer Credit

Reporting Agency.

You might also like

- Michael C. Dematos Equifax Credit Report SummaryDocument10 pagesMichael C. Dematos Equifax Credit Report SummaryCarlos M. De Matos0% (1)

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDocument10 pagesFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramBrittany LyNo ratings yet

- Loan Rein Ex InfoDocument5 pagesLoan Rein Ex InfoGomezLiliNo ratings yet

- COSO Training - DeloitteDocument180 pagesCOSO Training - DeloitteHossein Davani100% (4)

- Edgar JDocument2 pagesEdgar Japi-585014034No ratings yet

- Creditreport 1597869732925 PDFDocument134 pagesCreditreport 1597869732925 PDFDed Maroz0% (1)

- Creditreport 1552490650914Document24 pagesCreditreport 1552490650914Angel G Colon MoralesNo ratings yet

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDocument10 pagesFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramRhaxma ConspiracyNo ratings yet

- Equifax FACT RPT 01152013Document21 pagesEquifax FACT RPT 01152013NextSecOfficial100% (2)

- Equifax Personal Solutions - Credit Reports PDFDocument11 pagesEquifax Personal Solutions - Credit Reports PDFTara Stewart80% (5)

- Selection-26 - 55 PDFDocument1 pageSelection-26 - 55 PDFAnonymous fu1jUQNo ratings yet

- Equifax Credit Report Format PDFDocument22 pagesEquifax Credit Report Format PDFMuradxan NovruzovNo ratings yet

- Samart Bank Form - V 310118 PDFDocument2 pagesSamart Bank Form - V 310118 PDFJoe Pianist Samart RukpanyaNo ratings yet

- Credit ApplicationDocument1 pageCredit Applicationdhine77No ratings yet

- Drivers License UV Markings Per StateDocument2 pagesDrivers License UV Markings Per StateSome OneNo ratings yet

- Michelle Morrison - TransUnion Personal Credit ReportDocument23 pagesMichelle Morrison - TransUnion Personal Credit ReportchfthegodNo ratings yet

- Apply for financing over $2,500Document1 pageApply for financing over $2,500Jose Daniel MirandaNo ratings yet

- Peter Hart - TransUnion Personal Credit Report - 20200721 PDFDocument12 pagesPeter Hart - TransUnion Personal Credit Report - 20200721 PDFSusu0% (1)

- 1040 Tax Form SummaryDocument2 pages1040 Tax Form SummaryKevin RowanNo ratings yet

- Corene Boyd - TransUnion Personal Credit Report - 20160125 2Document25 pagesCorene Boyd - TransUnion Personal Credit Report - 20160125 2jessica nulphNo ratings yet

- Christopher Mulligan - TransUnion Personal Credit Report - 20140123Document8 pagesChristopher Mulligan - TransUnion Personal Credit Report - 20140123Richard MulliganNo ratings yet

- Profit or Loss From Business: Linda Gercken 156-56-8670Document2 pagesProfit or Loss From Business: Linda Gercken 156-56-8670ROB100% (1)

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statuskenneth kittleson100% (1)

- Chapter 8-SHEDocument77 pagesChapter 8-SHEVip Bigbang100% (1)

- Banking Law Assgmnt 1 FinalizedDocument7 pagesBanking Law Assgmnt 1 FinalizedneemNo ratings yet

- Private Commercial BanksDocument7 pagesPrivate Commercial Banksjakia sultanaNo ratings yet

- Transunion NewDocument8 pagesTransunion NewCaleb HolleyNo ratings yet

- Role of The Government in BusinessDocument8 pagesRole of The Government in BusinessMaulikJoshiNo ratings yet

- Chasity D EnglishDocument7 pagesChasity D EnglishbpspillkillNo ratings yet

- Sara Barz - TransUnion Personal Credit Report - 20141116 PDFDocument14 pagesSara Barz - TransUnion Personal Credit Report - 20141116 PDFSaraBarz50% (2)

- April 14 2021 TUIDocument4 pagesApril 14 2021 TUIJimario SullivanNo ratings yet

- Credit Report Summary for Regina L. DeFazioDocument9 pagesCredit Report Summary for Regina L. DeFaziolriege88No ratings yet

- ChecksDocument2 pagesChecksbranch_dawnNo ratings yet

- Financing of Power Projects & International FinanceDocument116 pagesFinancing of Power Projects & International FinanceSamNo ratings yet

- Bank of America Online Statement 1Document1 pageBank of America Online Statement 1Wells Wally100% (1)

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Creditreport 1561319714905 PDFDocument38 pagesCreditreport 1561319714905 PDFMustaffa ShabazzNo ratings yet

- Health Insurance Forms 1Document1 pageHealth Insurance Forms 1api-453439542No ratings yet

- Report Details Personal and Financial Information for Christopher StegerDocument28 pagesReport Details Personal and Financial Information for Christopher StegerChristopher StegerNo ratings yet

- 6911 Credit View Road Mississauga, Ontario. L5N 8G1: February 21 2019Document2 pages6911 Credit View Road Mississauga, Ontario. L5N 8G1: February 21 2019Virender AryaNo ratings yet

- Austin Dmello CibilDocument26 pagesAustin Dmello CibilJNSDFVJNo ratings yet

- Emergency Loan (Active Member) Application FormDocument2 pagesEmergency Loan (Active Member) Application FormFermarc Lestajo100% (1)

- HbsDocument45 pagesHbsClaudia Ladolcevita JohnsonNo ratings yet

- Experian Credit Report: 0 Late AccountsDocument18 pagesExperian Credit Report: 0 Late Accountsmary hunterNo ratings yet

- Credit Report PDFDocument8 pagesCredit Report PDFAshley Davis50% (2)

- BAR QnA BankingDocument4 pagesBAR QnA BankingCzarina BantayNo ratings yet

- Auroara P ClientDocument33 pagesAuroara P Clientapi-301661379No ratings yet

- Personal Loan Application Form Borang Permohonan Pinjaman PeribadiDocument6 pagesPersonal Loan Application Form Borang Permohonan Pinjaman PeribadiMohd AzhariNo ratings yet

- 15 1 03 003887Document1 page15 1 03 003887Aryan ChaudharyNo ratings yet

- TransUnion Credit ReportDocument11 pagesTransUnion Credit ReportEdmond SevilleNo ratings yet

- SunTrust Equity Line of Credit Statement SummaryDocument1 pageSunTrust Equity Line of Credit Statement SummaryIrakli IrakliNo ratings yet

- Printable ReportDocument15 pagesPrintable Reportkristine33No ratings yet

- Business Loan - Application Form & Document ListDocument5 pagesBusiness Loan - Application Form & Document ListsamaadhuNo ratings yet

- AZ Argan Ventures LTDDocument20 pagesAZ Argan Ventures LTDBarangaySanLuisNo ratings yet

- O o o o O: ReceivedDocument10 pagesO o o o O: ReceivedCalWonkNo ratings yet

- TAF DocumentsDocument80 pagesTAF DocumentsreutersdotcomNo ratings yet

- GviewDocument13 pagesGviewEfren Baruela JrNo ratings yet

- Hotel Voucher: Booking InformationDocument2 pagesHotel Voucher: Booking Informationsenthil dharunNo ratings yet

- 083000108: 301612084422: 3016120844121 PNC Bank StatementDocument5 pages083000108: 301612084422: 3016120844121 PNC Bank StatementKevinNo ratings yet

- US Internal Revenue Service: f1040nr - 2004Document5 pagesUS Internal Revenue Service: f1040nr - 2004IRSNo ratings yet

- ProblemC ch05Document5 pagesProblemC ch05Adan FakihNo ratings yet

- Please Sign PPP Origination Application - PDF BDocument12 pagesPlease Sign PPP Origination Application - PDF BpayneNo ratings yet

- 2014 Laminated ID RequirementsDocument2 pages2014 Laminated ID Requirementsj millerNo ratings yet

- Better Covid ThingDocument4 pagesBetter Covid ThingAuguste RiedlNo ratings yet

- File by Mail Instructions For Your 2009 Federal Tax ReturnDocument11 pagesFile by Mail Instructions For Your 2009 Federal Tax ReturnjakeNo ratings yet

- 9e301cd2-2c64-4148-95c2-900d1d72033eDocument1 page9e301cd2-2c64-4148-95c2-900d1d72033eHunter TateNo ratings yet

- Jacqueline Scanlin HR Business Partner-GDS: October 5, 2022 Personal & Confidential Via Electronic MailDocument6 pagesJacqueline Scanlin HR Business Partner-GDS: October 5, 2022 Personal & Confidential Via Electronic MailTravaras PerryNo ratings yet

- UT Dallas Syllabus For Fin7310.001 05f Taught by Nina Baranchuk (nxb043000)Document5 pagesUT Dallas Syllabus For Fin7310.001 05f Taught by Nina Baranchuk (nxb043000)UT Dallas Provost's Technology GroupNo ratings yet

- D13 1Document12 pagesD13 1Charmine de la CruzNo ratings yet

- Sample Questions:: Section I: Subjective QuestionsDocument8 pagesSample Questions:: Section I: Subjective Questionsnaved katuaNo ratings yet

- Application For Registration: (To Be Filled Up by BIR) DLNDocument2 pagesApplication For Registration: (To Be Filled Up by BIR) DLNRhu BurauenNo ratings yet

- Performance of Mutual Fund Schemes in IndiaDocument8 pagesPerformance of Mutual Fund Schemes in IndiaPankaj GuravNo ratings yet

- Investor Summit Focus on Frontier MarketsDocument14 pagesInvestor Summit Focus on Frontier Markets1124varNo ratings yet

- Quant Dynamic Fund DetailsDocument2 pagesQuant Dynamic Fund DetailsAbhishek KumarNo ratings yet

- Investment Appraisal: Client: C. J. Chapman Password: Robin664 Investment Grade: Private Institutional Pages: 2Document2 pagesInvestment Appraisal: Client: C. J. Chapman Password: Robin664 Investment Grade: Private Institutional Pages: 2Leslie SargentNo ratings yet

- Capital Market Questions BankDocument11 pagesCapital Market Questions Bankdev12_lokesh100% (1)

- Tesco and LMU Plc.Document11 pagesTesco and LMU Plc.susanNo ratings yet

- WhiteMonk HEG Equity Research ReportDocument15 pagesWhiteMonk HEG Equity Research ReportgirishamrNo ratings yet

- Final Exam: Derivatives and Risk ManagementDocument29 pagesFinal Exam: Derivatives and Risk ManagementTrang Nguyễn Hoàng LêNo ratings yet

- IFR Magazine - May 01, Issue 2381, 2021Document116 pagesIFR Magazine - May 01, Issue 2381, 2021gustale scasoNo ratings yet

- Ch2 The Conceptual Framework Project TesDocument15 pagesCh2 The Conceptual Framework Project TesAbdalelah FrarjehNo ratings yet

- On Balance Sheet NettingDocument4 pagesOn Balance Sheet NettingGaurav JainNo ratings yet

- Financial Statements-Schedule-III - Companies Act, 2013 PDFDocument13 pagesFinancial Statements-Schedule-III - Companies Act, 2013 PDFCA Ujjwal KumarNo ratings yet

- Technical Anomalies: A Theoretical Review: Keywords: Technical Anomalies, Short-Term Momentum, Long-Run Return ReversalsDocument8 pagesTechnical Anomalies: A Theoretical Review: Keywords: Technical Anomalies, Short-Term Momentum, Long-Run Return ReversalsAlan TurkNo ratings yet

- Rosamond Underwood Smith Wilson, Thomas W. Smith and Frank Stapleton, As Executors of The Estate of Cothran P. Smith v. United States, 257 F.2d 534, 2d Cir. (1958)Document6 pagesRosamond Underwood Smith Wilson, Thomas W. Smith and Frank Stapleton, As Executors of The Estate of Cothran P. Smith v. United States, 257 F.2d 534, 2d Cir. (1958)Scribd Government DocsNo ratings yet

- Sebi & Investors ProtectionDocument20 pagesSebi & Investors ProtectionDeep ShahNo ratings yet

- The Fine Art of Friendly AcquisitionDocument14 pagesThe Fine Art of Friendly AcquisitionArpita TripathyNo ratings yet

- Banking Awareness Hand Book by Er. G C Nayak PDFDocument86 pagesBanking Awareness Hand Book by Er. G C Nayak PDFTapas Kumar NandiNo ratings yet

- An Appraisal of Grameen Mutual Fund 12Document9 pagesAn Appraisal of Grameen Mutual Fund 12Saikat PaulNo ratings yet