Professional Documents

Culture Documents

Types of Export Finance Explained

Uploaded by

samy75410 ratings0% found this document useful (0 votes)

187 views14 pagesregarding preshipment and post shipment

Original Title

export finance

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentregarding preshipment and post shipment

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

187 views14 pagesTypes of Export Finance Explained

Uploaded by

samy7541regarding preshipment and post shipment

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 14

TYPES OF EXPORT FINANCE.

The export finance is being classified into two types viz.

Pre-shipment finance.

Post-shipment finance.

Pre shipment finance

Pre-shipment is also referred as packing credit. It is working capital

finance provided by commercial banks to the exporter prior to shipment

of goods. The finance required to meet various expenses before

shipment of goods is called pre-shipment finance or packing credit.

I MPORTANCE OF FINANCE AT PRE-SHIPMENT STAGE:

To purchase raw material, and other inputs to manufacture goods.

To assemble the goods in the case of merchant exporters.

To store the goods in suitable warehouses till the goods are

shipped.

To pay for packing, marking and labeling of goods.

To pay for pre-shipment inspection charges.

To import or purchase from the domestic market heavy machinery

and other capital goods to produce export goods.

To pay for consultancy services.

To pay for export documentation expenses.

Procedure for obtaining pre-shipment finance

Submitting application to the bank:

The exporter who intends to obtain packing credit should apply in

prescribed forms to his bankers, giving all details of the credit

requirement. The form must accompany the following documents:

a) Letter of credit/contract

b) An undertaking

c) Copies of income tax and wealth tax.

d) Board of resolution.

e) Letter of authority.

f) Appropriate ECGC policy.

g) Undertaking of shipment.

h) Copy of Registration-cum-Membership.

i) Other documents needed by bank.

Processing of application :

On submission of application with necessary documents, the banks

scrutinises the same and if satisfied as regards documentary

evidence and credit-worthiness of the exporter, establishes the

packing credit limit.

Sanctioning of loan:

As a practice, the bank sanctions loan equal to F.O.B value of

export order or letter of credit or equal to market value of goods

whichever is less. It also depends on the value of export incentives

receivable exporter.

Loan agreement:

The bank executes a formal loan agreement with the exporte before

that actual disbursement of the loan.

Manner of payment:

Packing credit advances are not disbursed to the exporter in a lum

sum but depending on the need of exporter.

Maintenance of accounts:

As per RBI directives, lending bank must maintain a separate

account of each pre-shipment advance sanctioned by it.

Monitoring of use of loan:

The lending bank is required to periodically monitor the use of

packing credit advance by exporter to ensure that the same is used

for export purpose only. Penalty may imposed by the bank if

misused any.

Repayment of loan:

The exporter is expected to liquidate or repay the amount of

advance together with interest charged as soon as the export

proceeds or incentives are realized.

Forms of pre-shipment finance

Extended packing credit loan :

This facility, though for a short period, is granted to those

exporters who are rated first class by the bank.

Packing credit loan(hypothecation):

In this case packing credit is extended for obtaining raw materials,

work-in-process and/or finished goods. The goods acquired are

treated as security for the loan granted. Goods remain in the

possession of the exporter and he is required to execute

hypothecation deed in favors of the bank.

Packing credit loan(pledge):

This facility is available for seasonal goods or those acquired by

the exporter under odd lots. The documents relating to acquisition

of raw materials are placed to the bank while possession.

Advances against back to back letter of credit:

An exporter, who has received original letter of credit from

importer, requests his banker to open a domestic letter of credit in

favors of his supplier. This is known as bank-to-back L/C.

Advances against red clause L/C:

When the exporter receives red clause L/C from the importer, it

authorizes the exporters bank to provide advances to complete

production.

Advances against export incentives:

Advances against export incentives such as DBK are provided by the

bank both had pre-shipment and post-shipment stage.

Packing credit for imports against advance license entitlement:

This credit facility is available to manufacturer exporters who are

not in receipt of letter of credit or confirmed export order. Finance

is made available from imports against license for manufacture of

exports goods.

Special packing credit schemes.

a) EXIM Banks Pre-shipment finance.

b) IDBIs Pre-shipment credit in foreign currency.

c) Packing credit for Deemed exports.

SOME SCHEMES IN PRE-SHIPMENT STAGE OF

FINANCE

1. PACKING CREDIT SANCTION OF PACKING CREDIT

ADVANCES:

There are certain factors, which should be considered while

sanctioning the packing credit advances viz.

I. Banks may relax norms for debt-equity ratio, margins etc but

no compromise in respect of viability of the proposal and

integrity of the borrower.

II. Satisfaction about the capacity of the execution of the orders

within the stipulated time and the management of the export

business.

III. Quantum of finance.

IV. Standing of credit opening bank if the exports are covered

under letters of credit.

V. Regulations, political and financial conditions of the buyers

country.

2. DISBURSEMENT OF PACKING CREDIT:

After proper sanctioning of credit limits, the disbursing branch

should ensure:

To inform ECGC the details of limit sanctioned in the prescribed

format within 30 days from the date of sanction.

a. To complete proper documentation and compliance of the

terms of sanction i.e. creation of mortgage etc.

b. There should be an export order or a letter of credit

produced by the exporter on the basis of which

disbursements are normally allowed.

In both the cases following particulars are to be verified:

i. Name of the Buyer.

ii. Commodity to be exported.

iii. Quantity.

iv. Value.

v. Date of Shipment / Negotiation.

vi. Any other terms to be complied with.

2. FOREIGN CURRENCY PRE-SHIPMENT CREDIT (FCPC)

The FCPC is available to exporting companies as well as

commercial banks for lending to the former.

It is an additional window to rupee packing credit scheme &

available to cover both the domestic i.e. indigenous &

imported inputs. The exporter has two options to avail him of

export finance.

To avail him of pre-shipment credit in rupees & then the post

shipment credit either in rupees or in foreign currency

denominated credit or discounting /rediscounting of export

bills.

To avail of pre-shipment credit in foreign currency &

discounting/rediscounting of the export bills in foreign

currency.

FCPC will also be available both to the supplier EOU/EPZ

unit and the receiver EOU/EPZ unit.

Pre-shipment credit in foreign currency shall also be

available on exports to ACU (Asian Clearing Union)

countries with effect from 1.1.1996.

POST-SHIPMENT FINANCE

MEANING:

Post shipment finance is provided to meet working capital

requirements after the actual shipment of goods. It bridges the

financial gap between the date of shipment and actual receipt of

payment from overseas buyer thereof. Whereas the finance

provided after shipment of goods is called post-shipment finance.

IMPORTANCE OF FINANCE AT POST-SHIPMENT STAGE:

To pay to agents/distributors and others for their services.

To pay for publicity and advertising in the overseas markets.

To pay for port authorities, customs and shipping agents

charges.

To pay towards export duty or tax, if any.

To pay towards ECGC premium.

To pay for freight and other shipping expenses.

To pay towards marine insurance premium, under CIF

contracts.

To meet expenses in respect of after sale service.

To pay towards such expenses regarding participation in

exhibitions and trade fairs in India and abroad.

To pay for representatives abroad in connection with their stay

board.

Procedure for obtaining a post-shipment

finance

o Application to the bank:

An exporter willing to obtain this credit facility has to submit

an application together with relevant shipping documents

and necessary undertakings to the bank. Bank insist on

opening a separate account in the name of exporter.

o Scrutiny of application:

The banks scrutinize the application and documents to

ensure that the applicant has complied all the conditions.

o Rate of interest:

The normal short term loans are sanctioned for 90 days at

the concessional rate of Interest.

o Sanctioning of advance:

If the application is found to be proper, the bank may

sanction the amount of loan.

o Loan agreement:

The bank requires the exporter to execute a formal loan

agreement before disbursing the loan.

o Manner of payment:

Normally the amount of loan sanctioned is not released in a

lump sum but in phased manner as and when needed by the

exporter.

o Maintenance of accounts:

As per directives if RBI, banks are required to maintain a

separate account for each post-shipment finance advance.

o Monitoring the use of loans:

The bank extending post-shipment finance credit facility

should monitor the use of the credit by the exporter to

ensure that the amount is used for export purpose only.

o Repayment of loan:

The exporter is expected to repay the amount of loan to the

lending bank as soon as the export proceeds incentives are

received.

Forms of a post-shipMent finance

Export bills negotiated under L/C:

An exporter can avail of post-shipment credit by drawing bills or

drafts under the L/C. the bank insists on production of the

necessary documents as stated in the L/C.

DISCOUNTING OF EXPORT BILLS UNDER CONFIRMED

ORDERS:

If L/C is not available as security, bank financing depends upon

the credit-worthiness of the exporter. At the request of the

exporter, the bank will purchase or discount the export bill and

pay the equivalent rupees to the exporter.

Advance against bills sent for collection:

If the exporter fails to get his document negotiated by the bank or

if he does not want to discount the bills on the ground that the

rates are unfavorable, than he may request the bank to send the

bills on collection basis.

Advance against goods sent on consignment basis:

In case of consignment sale, the goods are exported without

entering into a firm contract with the buyer.

Advance against duty drawback entitlement:

Advances against duty drawback entitlement are given at the pre-

shipment and post-shipment stage. Drawbacks means refund of

custom duty paid on import of raw materials used to manufacture

exportable goods.

Advances against undrawn balances of bills:

In some cases bills are not drawn for the full invoiced value of

goods. Certain amount remains undrawn, which is due for

payment after adjustments on account of differences in rates,

weight, quality etc to be ascertained after inspection and approval

of the goods.

Advance against retention money:

Banks provide advance against such retention money. The

advance repayable within one year from the date of shipment.

Advance against deemed exports:

Certain specific sales made in India are consider as deemed

export although they are not export in real sense. Credit is given

for 30 days in the case of deemed exports.

Advances against deferred payments:

Commercial bank together with EXIM bank offer advances

against deferred payment at concessional rate of interest for 180

days.

Conclusion:

FINANCE IS THE LIFE AND BLOOD OF ANY BUSINESS.

Success or failure of any export order mainly depends upon the finance

available to execute the order. Nowadays export finance is gaining great

significance in the field of international Finance. Many Nationalized as

well as Private Banks are taking measures to help the exporter by

providing them pre-shipment and post- shipment finance at subsidized

rate of interest. Some of the major financial institutions are EXIM Bank,

RBI, and other financial institutions and banks. EXIM India is the major

bank in the field of export and import of India. It has introduced various

schemes like forfeiting, FREPEC Scheme, etc.

Even Government is taking measures to help the exporters to execute

their export orders without any hassles. Government has introduced

schemes like Duty Entitlement Pass Book Scheme, Duty free Materials,

setting up of Export Promotion Zones and Export Oriented Units, and

other scheme promoting export and import in India. Initially the Indian

exporter had to face many hurdles for executing an export order, but

over the period these hurdles have been removed by the government to

smoothen the procedure of export and import in India.

You might also like

- Export Financing: Pre-Shipment & Post-Shipment FinanceDocument24 pagesExport Financing: Pre-Shipment & Post-Shipment FinancevidhyaaravinthanNo ratings yet

- Procedures For Credits - ALL PDFDocument165 pagesProcedures For Credits - ALL PDFIslam MongedNo ratings yet

- CHAP - 03 - Managing and Pricing Deposit ServicesDocument60 pagesCHAP - 03 - Managing and Pricing Deposit ServicesTran Thanh NganNo ratings yet

- The Term Alternate Delivery ChannelDocument4 pagesThe Term Alternate Delivery ChannelIftekhar Abid Fahim100% (1)

- Informed Consent in Mobile Credit ScoringDocument20 pagesInformed Consent in Mobile Credit ScoringCGAP PublicationsNo ratings yet

- Updated Loan Policy To Board 31.03.2012 Sent To Ro & ZoDocument187 pagesUpdated Loan Policy To Board 31.03.2012 Sent To Ro & ZoAbhishek BoseNo ratings yet

- Webapp User Manual EN Rev1.0Document44 pagesWebapp User Manual EN Rev1.0LOUBNA TAG100% (1)

- Loan-Agreement Citi MortgagesDocument80 pagesLoan-Agreement Citi Mortgagesmrinal lalNo ratings yet

- Banking Solutions A Transition From Manual System To CBSDocument13 pagesBanking Solutions A Transition From Manual System To CBSPravah ShuklaNo ratings yet

- Customer Service in Banks - RBI RulesDocument15 pagesCustomer Service in Banks - RBI RulesRAMESHBABUNo ratings yet

- Internship Report On RBBDocument32 pagesInternship Report On RBBAmrit sanjyalNo ratings yet

- Export Finance in IndiaDocument6 pagesExport Finance in Indiaadil.abrar3504No ratings yet

- MCQ On Home Loans (A K Marandi, SBLC-Siliguri)Document4 pagesMCQ On Home Loans (A K Marandi, SBLC-Siliguri)Raghu NayakNo ratings yet

- Presentation On Export CreditDocument21 pagesPresentation On Export CreditArpit KhandelwalNo ratings yet

- Final-General Banking .Document27 pagesFinal-General Banking .Salman AhmedNo ratings yet

- Questions Regarding This Proposal Should Be Directed To:: Ffice of The Rizona Ttorney EneralDocument5 pagesQuestions Regarding This Proposal Should Be Directed To:: Ffice of The Rizona Ttorney EneralBrian KnightNo ratings yet

- Credit Risk Management On HDFC BankDocument17 pagesCredit Risk Management On HDFC BankAhemad 12No ratings yet

- Presentation MSME Products 24092018 - Ver 1Document52 pagesPresentation MSME Products 24092018 - Ver 1Murali KrishnanNo ratings yet

- Policy On Bank Deposits: PreambleDocument6 pagesPolicy On Bank Deposits: PreambleLukumoni GogoiNo ratings yet

- Standard Operating Procedure (SOP) For eNPSDocument22 pagesStandard Operating Procedure (SOP) For eNPSahan verma100% (1)

- Standard Operating Procedure (SOP) For NPS Account Maintenance - Karvy NPSDocument10 pagesStandard Operating Procedure (SOP) For NPS Account Maintenance - Karvy NPSahan verma100% (1)

- Credit Policy Version 1.2Document157 pagesCredit Policy Version 1.2Amit SinghNo ratings yet

- Prodigy Finance Brochure (Oct 2017) - 18Document26 pagesProdigy Finance Brochure (Oct 2017) - 18dubstepoNo ratings yet

- RFP Pre-Paid Card ProjectDocument40 pagesRFP Pre-Paid Card ProjectDhruv KumarNo ratings yet

- Online Banking Benefits for CustomersDocument65 pagesOnline Banking Benefits for CustomersMazharul IslamNo ratings yet

- Credit Policy GuidelinesDocument46 pagesCredit Policy GuidelinesRabi Shrestha100% (1)

- CAIIB Retail Products Module B Retail Banking PDFDocument29 pagesCAIIB Retail Products Module B Retail Banking PDFmansiNo ratings yet

- PNB Roi New Supplementry Agreement-WordDocument2 pagesPNB Roi New Supplementry Agreement-WordAnonymous XsYDXMVNo ratings yet

- SOP WithdrawalsDocument111 pagesSOP Withdrawalsashoku24007No ratings yet

- External Commercial BorrowingDocument14 pagesExternal Commercial BorrowingKK SinghNo ratings yet

- Export and Import Finance GuideDocument61 pagesExport and Import Finance GuidekanikaNo ratings yet

- Agent Banking:: 1. Necessities of Agent Banking To The Retail OutletsDocument6 pagesAgent Banking:: 1. Necessities of Agent Banking To The Retail OutletsFarhan Ashraf SaadNo ratings yet

- A Research Paper On RBI Branch Licensing Policy: "Branching" The Gap Between FinancialDocument13 pagesA Research Paper On RBI Branch Licensing Policy: "Branching" The Gap Between Financialgayatrimohanty05No ratings yet

- Credit Appraisal and AssessmentDocument8 pagesCredit Appraisal and Assessmentkinz7879No ratings yet

- FEMA Overview and FDI Policy Harshal BhutaDocument68 pagesFEMA Overview and FDI Policy Harshal BhutaJitendra MadhanNo ratings yet

- Bangladesh Automated Clearing House (BACHDocument24 pagesBangladesh Automated Clearing House (BACHMorium ZafarNo ratings yet

- Department of Management Studies: Serial No. Name ID No. Assignment Marks Presentation MarksDocument14 pagesDepartment of Management Studies: Serial No. Name ID No. Assignment Marks Presentation MarksKawsar Ahmed BadhonNo ratings yet

- Merchant Banking An OverviewDocument23 pagesMerchant Banking An OverviewSushant Kumar MishraNo ratings yet

- SOP - Loan Against Securities - Version 4Document5 pagesSOP - Loan Against Securities - Version 4RuchitaNo ratings yet

- Consumer Financing in PakistanDocument63 pagesConsumer Financing in Pakistansheharyar696No ratings yet

- Problem Loan ManagementDocument13 pagesProblem Loan ManagementAsadul HoqueNo ratings yet

- Comparing Deposit Products to Expand EBL's Customer BaseDocument14 pagesComparing Deposit Products to Expand EBL's Customer BaseGanesh TiwariNo ratings yet

- Credit Appraisal and Risk Rating at PNBDocument48 pagesCredit Appraisal and Risk Rating at PNBAbhay Thakur100% (2)

- Pradhanmantri Jan Dhan Yojana: Finatix Club IIM RaipurDocument10 pagesPradhanmantri Jan Dhan Yojana: Finatix Club IIM RaipurYadvendra YadavNo ratings yet

- Loan Policy: Uttar Bihar Gramin BankDocument27 pagesLoan Policy: Uttar Bihar Gramin BankNaim Siddiqui100% (1)

- Term LoanDocument8 pagesTerm LoanDarshan PatilNo ratings yet

- Credit Appraisal - Term LoansDocument92 pagesCredit Appraisal - Term Loanspoppyeolive0% (1)

- Agency BankingDocument4 pagesAgency BankingASHEHU SANI100% (1)

- 08L0767 Fy18-19 Kyc Aml CFT Fatca CRSDocument13 pages08L0767 Fy18-19 Kyc Aml CFT Fatca CRSabhi646son5124No ratings yet

- External Commercial BorrowingsDocument6 pagesExternal Commercial BorrowingsrameshkumartNo ratings yet

- Electronic Letter of Guarantee For Banking SystemDocument18 pagesElectronic Letter of Guarantee For Banking SystemAnonymous Gl4IRRjzNNo ratings yet

- Credit Appraisal ProcessDocument19 pagesCredit Appraisal ProcessVaishnavi khot100% (1)

- KYC New ProjectDocument42 pagesKYC New ProjectNisha RathoreNo ratings yet

- Syllabus Banking Diploma, IBB 5Document2 pagesSyllabus Banking Diploma, IBB 5sohanantashaNo ratings yet

- Payyyyyying Banker and Collllllecting Banker by Chu PersonDocument59 pagesPayyyyyying Banker and Collllllecting Banker by Chu PersonSahirAaryaNo ratings yet

- Branch Banking Complete PDFDocument263 pagesBranch Banking Complete PDF03322080738No ratings yet

- Q1Document1 pageQ1samy7541No ratings yet

- Consumer Price Index (CPI)Document8 pagesConsumer Price Index (CPI)samy7541No ratings yet

- Bata Stage 3Document4 pagesBata Stage 3samy7541No ratings yet

- Problems of SMEDocument16 pagesProblems of SMEsamy7541No ratings yet

- Return On Equity Net Income/Shareholder's EquityDocument3 pagesReturn On Equity Net Income/Shareholder's Equitysamy7541No ratings yet

- AnalysisDocument4 pagesAnalysissamy7541No ratings yet

- Quality Services Theory ExplainedDocument3 pagesQuality Services Theory Explainedsamy7541No ratings yet

- Literature Review EconomicsDocument4 pagesLiterature Review Economicssamy7541No ratings yet

- Lateral Thinking NotesDocument4 pagesLateral Thinking Notessamy7541No ratings yet

- MaliDocument3 pagesMalisamy7541No ratings yet

- Banking StocksDocument61 pagesBanking Stockssamy7541No ratings yet

- Definition 2. How Planning Starts 3. Levels of Planning 4. Types of PlansDocument21 pagesDefinition 2. How Planning Starts 3. Levels of Planning 4. Types of Planssamy7541No ratings yet

- Quality ProductsDocument2 pagesQuality Productssamy7541No ratings yet

- Effect On Revenue Due To Change in PriceDocument3 pagesEffect On Revenue Due To Change in Pricesamy7541No ratings yet

- Project Financing - Financial Scheme For Long-Term ProjectsDocument11 pagesProject Financing - Financial Scheme For Long-Term Projectssamy7541No ratings yet

- Stock IndexDocument32 pagesStock Indexsamy7541No ratings yet

- Electronic Performance Management SystemDocument3 pagesElectronic Performance Management SystemRaghu AppuNo ratings yet

- List of DocumentDocument1 pageList of Documentsamy7541No ratings yet

- Eicher Motors Limited WordDocument4 pagesEicher Motors Limited Wordsamy7541No ratings yet

- Share Price of Eicher Motors Over The YearsDocument6 pagesShare Price of Eicher Motors Over The Yearssamy7541No ratings yet

- HRM ConceptsDocument10 pagesHRM Conceptssamy7541No ratings yet

- Wealth MGT 2013 QbankDocument2 pagesWealth MGT 2013 Qbanksamy7541No ratings yet

- Swot SpartekDocument3 pagesSwot Sparteksamy7541No ratings yet

- Transactional AnalysisDocument23 pagesTransactional Analysissamy7541No ratings yet

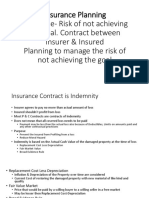

- Insurance PlanningDocument15 pagesInsurance Planningsamy7541No ratings yet

- Havells Acquisition of Lloyds SWOT AnalysisDocument2 pagesHavells Acquisition of Lloyds SWOT Analysissamy7541No ratings yet

- Indemnity BondDocument2 pagesIndemnity Bondsamy754192% (12)

- 12 Economics Notes Micro Ch01 IntroductionDocument9 pages12 Economics Notes Micro Ch01 IntroductionRama NagpalNo ratings yet

- Spartek CeramicsDocument9 pagesSpartek Ceramicssamy7541No ratings yet

- HansDocument19 pagesHanssamy7541No ratings yet

- Statement 20140508Document2 pagesStatement 20140508franraizerNo ratings yet

- Industry ProfileDocument15 pagesIndustry ProfileP.Anandha Geethan80% (5)

- The Equity Implications of Taxation: Tax IncidenceDocument21 pagesThe Equity Implications of Taxation: Tax IncidenceA. Rizki HimawanNo ratings yet

- BA8IC ADJUSTMENTS FOR PARTNERSHIPDocument22 pagesBA8IC ADJUSTMENTS FOR PARTNERSHIPOm JogiNo ratings yet

- 9 TAXREV - Michigan Holdings v. City Treasurer of MakatiDocument1 page9 TAXREV - Michigan Holdings v. City Treasurer of MakatiRS SuyosaNo ratings yet

- Barangay ClearanceDocument2 pagesBarangay Clearancegingen100% (1)

- CFO VP Finance Project Controls Engineer in Morristown NJ Resume Matthew GentileDocument2 pagesCFO VP Finance Project Controls Engineer in Morristown NJ Resume Matthew GentileMatthewGentileNo ratings yet

- Icwim PDFDocument2 pagesIcwim PDFWolfgangNo ratings yet

- PrabhakarDocument91 pagesPrabhakaransari naseem ahmadNo ratings yet

- Capital Allowance Guide for EducationDocument41 pagesCapital Allowance Guide for EducationAgnesNo ratings yet

- Strategic Management Procter & Gamble 2011Document10 pagesStrategic Management Procter & Gamble 2011Zadeexx50% (2)

- Ass 2wrkDocument6 pagesAss 2wrkDavor ProfesorNo ratings yet

- Business Finance - ModuleDocument33 pagesBusiness Finance - ModuleMark Laurence FernandoNo ratings yet

- PAF - Karachi Institute of Economics and Technology Course: Financial Management Faculty: Ali Sajid Class ID: 110217 Total Marks: Examination: Assignment #1 DateDocument3 pagesPAF - Karachi Institute of Economics and Technology Course: Financial Management Faculty: Ali Sajid Class ID: 110217 Total Marks: Examination: Assignment #1 DateZaka HassanNo ratings yet

- Sales Report: Sweet Bliss CompanyDocument6 pagesSales Report: Sweet Bliss CompanyDonna Julian ReyesNo ratings yet

- DocumentDocument16 pagesDocumentKiko FinanceNo ratings yet

- Strategic Management 1Document112 pagesStrategic Management 1Aashish Mehra0% (1)

- Keith Weiner The Swiss Franc Will CollapseDocument16 pagesKeith Weiner The Swiss Franc Will CollapseTREND_7425No ratings yet

- Credit Rating Report G.P. 2 PDFDocument16 pagesCredit Rating Report G.P. 2 PDFMohammad AdnanNo ratings yet

- Cameroon Cabinet Meeting 30 August 2013Document4 pagesCameroon Cabinet Meeting 30 August 2013cameroonwebnewsNo ratings yet

- Working Capital Management at Tata SteelDocument134 pagesWorking Capital Management at Tata Steelagr_bela75% (8)

- (2013 Pattern) PDFDocument77 pages(2013 Pattern) PDFamNo ratings yet

- EM416 Cost of QualityDocument24 pagesEM416 Cost of QualityYao SsengssNo ratings yet

- Nikon Annual ReportDocument15 pagesNikon Annual Reportksushka89No ratings yet

- What Is A Journal Entry in AccountingDocument20 pagesWhat Is A Journal Entry in AccountingIc Abacan100% (1)

- 5 RCBC Savings V Odrada DigestDocument1 page5 RCBC Savings V Odrada DigestDamienNo ratings yet

- Rotomac Global Public Banks Conned AgainDocument3 pagesRotomac Global Public Banks Conned AgainAkansha SharmaNo ratings yet

- Foundations of Engineering Economy: Graw HillDocument141 pagesFoundations of Engineering Economy: Graw HillRizky RamadhanNo ratings yet

- Credit Management - Config and UserguideDocument34 pagesCredit Management - Config and UserguideAmit NandaNo ratings yet

- Prescribed Barangay FormsDocument53 pagesPrescribed Barangay FormsSeth Cabrera100% (1)