Professional Documents

Culture Documents

8th August, 2014 Daily Global Rice E-Newsletter by Riceplus Magazine-IE

Uploaded by

Mujahid AliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

8th August, 2014 Daily Global Rice E-Newsletter by Riceplus Magazine-IE

Uploaded by

Mujahid AliCopyright:

Available Formats

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.

com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

8th August, 2014

TOP Contents - Tailored for YOU

Latest News Headlines

China orders 100,000 tonnes of broken rice from Thailand

Pusa 1509 paddy begins to arrive in Haryana, fetches

lower price

China prohibits cross-border rice imports from Vietnam

RPT--S.Korea buys 34,724 T of rice for Nov-Dec

Rice bids below ministry's 'floor prices'

Nagpur Foodgrain Prices - APMC & Open Market- August

08

Farm Service Agency Administrator Juan Garcia Retires

Thumbs up for U.S. rice and wild rice

SWLA rice industry weighs in on Russian ban on U.S.

imports - KPLC 7 News, Lake Charles, Louisiana

Grain of Truth to Growing Rice Here

USA Rice Federation, Marriner Marketing Collaborate

Again To Relaunch MenuRice.com

For first time in 30 years, PHL exports 400MT of rice

BioLife Solutions' (BLFS) CEO Mike Rice on Q2 2014

Results - Earnings Call Transcript

Rice millers demand soft loans to modernise

Meet a local scientist: Dr. Shannon Pinson

News Detail

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

China orders 100,000 tonnes of broken rice from Thailand

August 8, 2014 5:53 pm

Junta chief Gen Prayuth Geb Prayuth Chan-ocha said Friday that China this month ordered 100,000 tonnes of broken rice

from Thailand.Speaking during his weekly TV programme, Prayuth said China also asked Thailand to send samples of

rice in the stock for it to check so that it could press more orders.He added that China regards that rice is a symbol of

cultural tie between the two countries.

The Nation

Pusa 1509 paddy begins to arrive in Haryana, fetches lower price

OUR BUREAU

Rice prices seen stabilising by September-end

CHENNAI, AUGUST 8:

With many farmers opting to sow Pusa 1509 basmati rice this year the short-duration variety has already begun

arriving in Haryana markets, but in a small quantity.Pusa 1509 arrived in Karnal market on Friday, though it

was only some 500 tonnes, said Amit Chandna, a rice mill owner.The new paddy was sold at 2,700-2,800 a

quintal against over 3,000 last year. Prices are low because a bumper output of Pusa 1509 is likely, said

Chandana.

Though kharif paddy sowing is lower this year at 221.56 lakh hectares against 237.89 lh during the

corresponding period a year ago, sowing is higher in Haryana.

Thanks to irrigation facilities, Haryana farmers have not faced any problem in planting paddy. Irrigation has

made up for the marginal shortage of rain under the influence of the South-West monsoon. We expect prices to

settle around last week of September or early October since arrivals begin peaking then, Chandna said.

Currently, stockists are selling paddy to keep space for new arrivals. This has led to rice prices dropping. Rice

prices have declined in the last couple of weeks by some 2 per cent in view of the sales.

Currently, Sharbati paddy is ruling at 4,600-4,900 a quintal, while the PR-14 variety is at 2,800. The coarser

Permal variety is ruling at 2,200-2,450.

PTI reports: In the New Delhi market, basmati common and Pusa-1121 varieties were down at 9,200-10,000

and 7,300-10,300 against the previous close of 9,400-10,500 and 7,800-10,800.

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

(This article was published on August 8, 2014)

China prohibits cross-border rice imports from Vietnam

VietNamNet Bridge Vietnamese enterprises that export rice to China across the border have said that China,

as expected, has prohibited rice imports from Vietnam through unofficial channels. However, they say this will

not affect the domestic market.

Nguyen Cong Khanh, a merchant in Hai Phong City, who collects rice from

farmers to sell to Chinese businessmen, said that Vietnams rice can be exported

only through official channels, while imports that go through the border gates

have been banned by the Chinese administration.According to Khanh, China has

prevented the rice imports across the border in order to tighten control over tax

payments made by Chinese rice importers.Many Chinese importers of rice have

been found evading tax. So, the Chinese administration imposed the ban, and

plans to have fixed tax rates for easier control, he said.Nguyen Thi Tu, another

merchant in Hai Phong City, who specializes in providing rice to Chinese

businessmen, has also confirmed that the rice import ban was issued to prevent tax evasion.However, they (Chinese) still

have high demand for Vietnams rice, she said.

Observers said though China stopped buying Vietnams rice through the border gates, this will in no way affect the

domestic market and rice production.According to Lam Anh Tuan, director of Thinh Phat Company in Ben Tre Province,

Chinese businessmen mostly order fragrant rice, but there is no longer an abundant domestic supply of this rice.I heard

from some businessmen who directly export rice to China that the Chinese demand for rice is now weaker than several

months ago, he said.Meanwhile, Huynh The Nang, general director of the Southern Food Corporation (Vinafood 2), told

the press on August 5 that he has not been told about the Chinese decision to prohibit rice imports from

Vietnam.However, Nang said, even if this is true, the domestic market will not be badly affected. At this moment, China

is not one of the major clients to whom Vietnam wants to sell rice at any cost.The demand from countries other than

China for Vietnams rice is very high now, while the domestic supply is declining, he noted.

The Philippines wants to buy more rice from Vietnam. Meanwhile, Indonesia and Malaysia are considering importing

more rice. I think the current conditions are very favorable for Vietnams rice, he maintained.

The rice price has been staying firmly high in the domestic market. In the Mekong River Delta, the rice granary of

Vietnam, IR 50404 rice is sold at VND7,700 per kilo, while long-grain rice at VND7,800 per kilo.The export rice price

offered by Vietnamese exporters have regained the previous high levels after they decreased slightly some days ago. Five

percent broken rice is offered at $465-475 per kilo, while the 25 percent broken rice at $415-425 per ton.Dat Viet

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

newspaper has quoted Oryza as saying that Vietnams rice price has hit a record high since October 2012, which is now

even higher than Thai, Indian, Pakistani and Cambodian rice.

TBKTSG

Tags:cross-border rice imports, China, border, rice export,

RPT--S.Korea buys 34,724 T of rice for Nov-Dec

Fri Aug 8, 2014 5:31am GMT

(Repeats to fix formatting)

SEOUL, Aug 8 (Reuters) - South Korea bought 34,724 tonnes of

non-glutinous China origin rice for arrival between November and

December via tenders closed on Aug. 7, the state-run Korea

Agro-Fisheries & Food Trade said on its website (www.at.or.kr).

Details of the purchases are as follows:

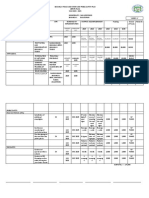

TONNES GRAIN TYPE SUPPLIER/PRICE($/T) ARRIVAL/PORT

10,000 Brown Short Daewoo Int'l/$928.00 Nov.30/Mokpo

13,985 Milled Short Daewoo Int'l/$1,007.00 Dec.31/Pyeongtaek

10,739 Milled Short Singsong/$997.00 Dec.31/Pyeongtaek

* Note: The agency sought Japonica type and U.S. No. 1 for

the 13,985 T of Milled Short and U.S. No. 3 or better rice for

the other two tenders.

(Reporting by Chris Lee; Editing by Anupama Dwivedi)

Thomson Reuters 2014 All rights reserved

Rice bids below ministry's 'floor prices'

Petchanet Pratruangkrai

The Nation August 8, 2014 1:00 am

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

Scores of traders queued at the Commerce Ministry yesterday to join the first rice auction of the year, but bid

below the ministry's "floor prices" despite high demand during the off season and amid transparency in the

bidding process.The working committee will need to ask the bidders who offered the highest prices to raise their

prices and will propose the results of the auction to the Rice Policy Committee to decide whether to sell this lot

of rice or cancel the sale," said Duangporn Rodphaya, director-general of the Foreign Trade Department.

Of the 49 traders applying, 46 passed the ministry's qualifications for participating in the auction. Exporters,

packers, millers and others bid for 167,000 tonnes of various kinds of rice from the past three harvest

seasons.The working committee did not expect the bids to be lower than floor prices, so it may need to ask for a

mandate from the chairman of the Rice Policy Committee to adjust some floor prices in order to release rice

from the government's stocks.If the prices are not satisfactory, the government will not be in a hurry to sell rice

from its inventory, as pressure to do so has lessened because of a low supply in the market.The ministry says it

is still confident it can reduce rice stockpiles and will continue holding auctions.

It will give the result of this auction to the vice chairman of the Rice Policy Committee today. Charoen

Laothammatas, president of the Thai Rice Exporters Association, said many traders joined the government's

auction because demand was high in the market. He said the bids were quite high and the government should

agree to sell rice to increase supply.The market price for rice is rising gradually because of low supply in the

world market.Chookiat Ophaswongse, honorary president of the association, said it was a good time to release

rice from the stockpiles, but the government might have to accept low prices as some stocks had deteriorated in

quality.For this round, many traders were willing to join because it was transparent and open to small outfits. It

is hard for traders to conspire on bid rigging because of the high demand in the market, Chookiat said.A rice-

miller source said the bids were quite high. Small traders may be unable to compete with large players, but they had

to join the auction because of the shortage of rice in the market.

Nagpur Foodgrain Prices - APMC & Open Market- August 08

Fri Aug 8, 2014 2:26pm IST

Nagpur, Aug 8 (Reuters) - Gram prices in Nagpur Agriculture Produce and

Marketing Committee (APMC) recovered in open market on good demand from local traders amid weak

supply from producing belts. Reports about weak monsoon in this season, notable rise on NCDEX

and repeated enquiries from South-based millers also jacked up prices, according to sources.

* * * *

FOODGRAINS & PULSES

GRAM

* Gram varieties ruled steady in open market on subdued demand from local traders amid

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

ample stock in ready position.

TUAR

* Tuar black reported down in open market in absence of buyers amid good arrival from

producing regions.

* Wheat varieties firmed up in open market on increased festival season demand from

local traders amid restricted supply from producing belts like Punjab and Haryana.

* In Akola, Tuar - 4,600-4,800, Tuar dal - 6,200-6,600, Udid at 7,000-7,200,

Udid Mogar (clean) - 8,000-8,500, Moong - 7,000-7,400, Moong Mogar

(clean) 8,400-9,100, Gram - 2,400-2,500, Gram Super best bold - 3,600-3,800

for 100 kg.

* Rice and other commodities remained steady in open market in thin trading activity,

according to sources.

Nagpur foodgrains APMC auction/open-market prices in rupees for 100 kg

FOODGRAINS Available prices Previous close

Gram Auction 2,255-2,930 2,225-2,840

Gram Pink Auction n.a. 2,100-2,600

Tuar Auction n.a. 4,200-4,895

Moong Auction n.a. 4,300-4,600

Udid Auction n.a. 4,300-4,500

Masoor Auction n.a. 2,600-2,800

Gram Super Best Bold 3,800-4,200 3,800-4,200

Gram Super Best n.a.

Gram Medium Best 3,400-3,600 3,400-3,600

Gram Dal Medium n.a. n.a.

Gram Mill Quality 3,400-3,500 3,500-3,500

Desi gram Raw 2,650-2,750 2,650-2,750

Gram Filter new 3,200-3,600 3,200-3,600

Gram Kabuli 8,000-9,500 8,000-9,500

Gram Pink 7,200-7,400 7,200-7,400

Tuar Fataka Best 6,900-7,100 6,900-7,100

Tuar Fataka Medium 6,500-6,700 6,500-6,600

Tuar Dal Best Phod 6,100-6,250 6,100-6,250

Tuar Dal Medium phod 5,700-5,950 5,700-5,950

Tuar Gavarani 4,800-4,900 4,800-4,900

Tuar Karnataka 4,900-5,100 4,900-5,100

Tuar Black 8,200-8,500 8,300-8,600

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

Masoor dal best 6,500-6,600 6,500-6,660

Masoor dal medium 6,150-6,350 6,150-6,350

Masoor n.a. n.a.

Moong Mogar bold 9,500-9,800 9,500-9,800

Moong Mogar Medium best 8,500-8,800 8,500-8,800

Moong dal super best 7,600-7,800 7,600-7,800

Moong dal Chilka 7,500-7,700 7,500-7,700

Moong Mill quality n.a. n.a.

Moong Chamki best 8,000-9,100 8,000-9,100

Udid Mogar Super best (100 INR/KG) 8,000-8,500 8,000-8,500

Udid Mogar Medium (100 INR/KG) 7,200-7,800 7,200-7,800

Udid Dal Black (100 INR/KG) 5,500-6,400 5,500-6,400

Batri dal (100 INR/KG) 4,000-5,000 4,000-5,000

Lakhodi dal (100 INR/kg) 2,850-2,950 2,850-2,950

Watana Dal (100 INR/KG) 3,350-3,600 3,350-3,600

Watana White (100 INR/KG) 3,500-3,600 3,500-3,600

Watana Green Best (100 INR/KG) 4,900-5,300 4,900-5,300

Wheat 308 (100 INR/KG) 1,200-1,500 1,200-1,500

Wheat Mill quality(100 INR/KG) 1,650-1,750 1,500-1,750

Wheat Filter (100 INR/KG) 1,300-1,500 1,200-1,400

Wheat Lokwan best (100 INR/KG) 2,100-2,400 1,900-2,200

Wheat Lokwan medium (100 INR/KG) 1,800-2,000 1,600-1,800

Lokwan Hath Binar (100 INR/KG) n.a. n.a.

MP Sharbati Best (100 INR/KG) 2,800-3,200 2,600-3,200

MP Sharbati Medium (100 INR/KG) 2,150-2,500 2,100-2,500

Wheat 147 (100 INR/KG) 1,200-1,400 1,100-1,300

Wheat Best (100 INR/KG) 1,600-1,900 1,500-1,800

Rice BPT (100 INR/KG) 2,900-3,200 2,900-3,200

Rice Parmal (100 INR/KG) 1,600-1,800 1,600-1,800

Rice Swarna old (100 INR/KG) 2,700-2,900 2,600-2,800

Rice HMT (100 INR/KG) 4,000-4,200 4,000-4,200

Rice HMT Shriram (100 INR/KG) 4,600-5,100 4,600-5,100

Rice Basmati best (100 INR/KG) 10,400-13,000 10,400-13,000

Rice Basmati Medium (100 INR/KG) 7,300-10,000 7,300-10,000

Rice Chinnor (100 INR/KG) 5,200-5,600 5,200-5,600

Jowar Gavarani (100 INR/KG) 1,300-1,500 1,300-1,500

Jowar CH-5 (100 INR/KG) 1,600-1,700 1,600-1,700

WEATHER (NAGPUR)

Maximum temp. 33.2 degree Celsius (91.7 degree Fahrenheit), minimum temp.

23.3 degree Celsius (73.9 degree Fahrenheit)

Humidity: Highest - n.a., lowest - n.a..

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

Rainfall : nil

FORECAST: Partly cloudy sky. Rains or thunder-showers likely. Maximum and Minimum temperature

likely to be around 33 and 23 degree Celsius respectively.

Note: n.a.--not available

(For oils, transport costs are excluded from plant delivery prices, but included in market prices.)

Farm Service Agency Administrator Juan Garcia Retires

Juan Garcia

WASHINGTON, DC -- Yesterday, U.S. Secretary of Agriculture Tom Vilsack announced the retirement of Farm Service

Agency (FSA) Administrator Juan M. Garcia. Garcia has served as Administrator since July 2012 and has been

instrumental in implementing the new Farm Bill. "Juan's hard work and sound leadership have helped to create new

opportunities and achieve record results for America's farmers and ranchers, including the 2014 Farm Bill disaster

assistance programs...that have provided relief to thousands of producers as they rebuild in the face of natural disasters,"

said Vilsack. Garcia has worked for FSA in various capacities for over 36 years, with most of his time spent with FSA in

his home state of Texas, including as State Executive Director.

"As an industry, we want to thank Juan for his years of service and dedication to agriculture and for always being

accessible and understanding our issues," said Linda Raun, an El Campo, Texas rice producer. "I had the opportunity to

work directly with Juan for many years in Texas and consider him a personal friend and wish him all the best in the

future."USDA has not yet announced a replacement for Garcia.

Contact: Reece Langley (703) 236-1471

SDA/FAS Confirms Rice and Wild Rice are Not Part of Russia's Agricultural Ban

Thumbs up for U.S. rice and wild rice

MOSCOW, RUSSIA -- In a Global Agricultural Information Network report posted yesterday evening, the U.S.

Foreign Agricultural Service confirmed that rice and wild rice are not on the list of banned imports of

agricultural products from the U.S., the European Union, Canada, Australia, and Norway, as reported here

yesterday. The products ban does include beef, pork, poultry, fruits, vegetables, fish, seafood, cheese, and milk.

The restrictions on these imports went into effect yesterday and will last for one year.

Contact: Kristin Dayton (703) 236-1454

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

SWLA rice industry weighs in on Russian ban on U.S. imports -

KPLC 7 News, Lake Charles, Louisiana

LAKE CHARLES, LA (KPLC) -

Russia has imposed a ban on agricultural imports from the United States, but will this have a negative impact on

the Southwest Louisiana rice industry? Local rice milling companies and rice farmers say they don't think

they'll have anything to worry about.

"From a pure agricultural stand point, this has no impact on our local producers," said CEO of Farmers Rice

Milling Company in Lake Charles Jamie Warshaw. "Russia is one of those countries that depend greatly on the

world to feed its people.

About 40 percent of what Russia consumes has to be imported; it's somewhat political suicide."

Commissioner of the Louisiana Department of Agriculture and Forestry Dr. Mike Strain says some industries

like the meat and soy bean industry, which are some of the goods that have been shipped to Russia, may see

most of the negative impact. Though it may affect Louisiana agriculture as a whole, he says the state will work

together to overcome this potential crisis."If he doesn't choose to buy any of our products then we will just

make a concerted effort to sell more to our other trading partners," said Strain. "At the end of the day, you

know, we will persevere."The White House said the ban will only deepen Russia's isolation from the

international community.The imports are to be banned or limited for up to one year.

Grain of Truth to Growing Rice Here

Noli Taylor

Thursday, August 7, 2014 - 6:56pm

Akaogi Farm sits on a quiet piece of hilly green land in Westminster West, Vt., in the southern part of the state.

Takeshi and Linda Akaogi grow a great variety of fruits and vegetables on their beautiful farm, but the thing

that brought me there this past week was perhaps their most unusual New England crop: rice.The Akaogis were

hosting the fifth annual Northeast USA Rice Conference, and I was there to learn more about how to grow this

important staple crop successfully in our Island schools.

This past school year was the first we at Island Grown Schools tried growing rice as part of our new grain

program, integrating staple grain crops into what has traditionally been fruit and vegetable-growing school

gardens. This season we are growing rice in five-gallon buckets and in raised beds at most of the 14 school

gardens we maintain at all the public schools and at seven preschools on the Vineyard. We love the experiment

of growing dry-land rice with our students, but have much to learn about how to make this crop work in our

Island environment.

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

The Akaogis grow a stunning array of different kinds of rice in three rice paddies Takeshi dug by hand, fed by a

reservoir they built themselves just a few feet higher than the paddies. Each paddy is filled with straight, tidy

rows of rice plants some tall, some short, some with long fingers of young rice kernels growing on the ends,

some not yet flowering. On the day we visited, in the middle of one paddy stood two huge dark-purple rice

plants, tops bending down toward the water, laden with beautiful purple and white-streaked grains.Each row is

carefully labeled with a tongue depressor marked in Sharpie with a different varietal name. The Akaogis are

farmer partners with Susan McCoutch and her team in plant breeding and genetics at Cornell University, testing

different rice varieties in trial growing experiments to see which will grow best in our part of the country.

Rice growing in New England is a new pursuit, but Dr. McCoutch and her team explained that there is great

potential for the development of this crop in our region. Rice is the most important human food crop, with

nearly half the worlds population relying on rice in their diets every day. The vast majority of the worlds rice

is grown in Asia, but there are more than three million acres of rice grown in the U.S. Domestically produced

rice has traditionally been grown in the southern states and in California, usually on vast acreage using

techniques that require a great amount of chemical pesticide and herbicide applications.

Rice gives growers in New England the opportunity to demonstrate lower-input, more sustainable domestic rice

production methods while putting to use farmland that has been considered marginal or unusable, and

increasing opportunities for regional farmers and eaters.Years ago, the Akaogis struggled with how wet the soil

was on one part of their farm, a common challenge for Northeast farmers. When they dug into the dirt, water

would pool up, and nothing wanted to grow there. That was when Takeshi thought he would experiment with

growing rice, a crop he was familiar with from his years in Japan. Rice has now proven to be an important part

of what he and Linda produce and an important part of their farm income.As much of the country struggles with

drought, and as climate change brings higher temperatures to the parts of the U.S. that have traditionally been

the big rice-growing regions, New England, which is generally water-rich, could become an increasingly

favorable climate for growing this crop. For those that grow wetland rice, paddies can also increase biodiversity

on farms by attracting insects and creating new habitat for frogs and birds.

The Akaogis rice paddies were teeming with life tiny gray frogs, dragonflies and many kinds of birds kept

us company while we enjoyed the beauty and peace of their hand-made wetland environment. Rice is also a

highly unique and marketable product for farmers in this part of the country. Very few New England farmers

have begun growing rice, making it a rare specialty crop for which consumers have been willing to pay a

premium. With yields of up to two tons per acre in wetland systems, Northeast farmers could gain a new

opportunity to fill a niche market that could support farm income and help keep their farms viable into the

future.We are honored to be able to work with Island children to serve as early pioneers of Northeast rice

production, and will share our lessons learned in the school gardens about dry land rice production in our region

with the researchers at the forefront of this work. As the students participate in this important agricultural

research, we in turn are able to teach them a host of their required subject materials in the context of rice.

From hands-on science work measuring soils, plant growth, and more to social studies-based lessons on

rice production and rice culture from Italy to Japan, rice provides rich subject matter that our students can

interact with in a hands-on way on their school grounds every day.At the end of the conference, Dr. McCoutch

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

from Cornell and Takeshi Akaogi thanked those of us who had gathered for participating in this great

experiment of bringing rice cultivation to New England. We, in turn, cheered for them for giving us the

opportunity to bring this fascinating and important crop to our own communities.

Noli Taylor is program leader for Island Grown Schools, a program of the Island Grown Initiative. She lives in

Aquinnah and contributes regularly to the Gazette.

USA Rice Federation, Marriner Marketing Collaborate Again To

Relaunch MenuRice.com

by Marriner Marketing Communications

Posted: Thursday, August 7, 2014 at 3:21PM EDT

By teaming again with Marriner Marketing Communications, the USA

Rice Federation has completely redesigned and relaunched its

foodservice website: www.MenuRice.com. Based on site analytics and

foodservice digital insights, the look and feel of MenuRice.com was

modernized, relevant U.S.-grown rice information is highlighted in an

easier-to-see format, and functionality has been improved in response to

new digital trends.Built using the latest technologies and best practices,

the new site incorporates responsive design so the content adapts for

easy viewing on a variety of mobile platforms including tablets and

smart phones. Since 2011, there has been a surge in mobile device use

by foodservice professionals with nearly 74% using smart phones and

57% using tablets to access information.1 Based on Google Analytics history, the site was re-organized to better

feature the most popular content areas, including the Culinary Center, Resources and Training Tools, All About

U.S. Rice, Meet U.S. Rice Farmers, and K-12.Chefs and operators rely on us for all of the essential

information about U.S. rice when they need it, and that need is increasingly mobile, says Katie Maher,

Manager of Domestic Promotion at USA Rice. The relaunched site highlights our role as a trusted resource for

foodservice professionals, and the bold color palette and new dashboard layout are in keeping pace with current

web designs and trends. As our long-time partner in foodservice communications, Marriner was the clear choice

for continuing to enrich our web presence moving forward.

Susan Gunther, Partner and Director of Client Services at Marriner, adds, We were proud to be tapped as USA

Rices partner in 2006 when they first initiated a comprehensive foodservice communications program, with

MenuRice.com serving as the main hub of information. As we watched the foodservice industrys digital needs

evolve, we were thrilled to help re-imagine the site to create new and important engagement opportunities for

U.S.-grown rice with culinary professionals.

ABOUT USA RICE FEDERATION

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

The USA Rice Federation is the global advocate for the U.S. rice industry, conducting programs to inform

consumers about domestically grown rice.U.S. farmers produce an abundance of short, medium and long grain

rice, as well as organic and specialty rices including jasmine, basmati, Arborio, red aromatic and black japonica,

among others. Farmers in Arkansas, California, Louisiana, Mississippi, Missouri and Texas grow some 20

billion pounds of rice each year, according to the highest quality standards. Eighty-five percent of the rice

Americans consume is grown in the USA. Look for the U.S. rice industrys Grown in the U.S. logo on

packages of 100% domestically grown rice. For more information, visit www.usarice.com.

ABOUT MARRINER

For almost 25 years, Marriner Marketing Communications has been a leader in providing integrated marketing

solutions for the food, beverage and hospitality industries. Clients count on Marriner for effective, clarity-driven

communications to address a wide variety of business challenges. Marriner's Clients include such notable

brands as Butterball, CP Foods, Hospitality Mints, Knouse Foods, Marriott International, Massimo Zanetti

Beverages, McCormick & Company, Perdue, Phillips, The Original Cakerie, USA Rice Federation, Vulcan,

Wolf & Berkel, and Zatarain's. For more information, visit www.marriner.com.

For media inquiries, contact Susan Gunther at 410-715-1500 or susang@marriner.com.

1 Source: CSP Foodservice Media Consumption Study, June 2013

Source: Marriner Marketing Communications

For first time in 30 years, PHL exports 400MT of rice

Friday, August 8, 2014

THE Philippines has exported 400 metric tons of high quality rice for the first time in 30 years, the Department

of Agriculture (DA) said Friday.Agriculture Secretary Proceso Alcala said that the country has already

exceeded earlier projections on the volume of premium rice the country can export."Ang amin pong naunang

projection ay ang maka-export ng 100 metric tons of premium rice, but we have already exported 400 metric

tons of premium ricered rice, black rice and organic riceand the year is not yet over," Alcala said.He said

that in the event the Philippines hit rice self-sufficiency and there is already adequate buffer stock, rice farmers

will be encouraged to cultivate more premium rice for export.

According to Alcala, Hong Kong and Singapore have large requirements for premium rice but they do not have

any production.He added that it is a good sign that the country was finally able to export rice "because it has

become somewhat embarrassing that for more than 30 years, we have been importing rice and among the

world's top importers of rice."Earlier the DA said the Philippines saved not less than P147 billion on rice

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

importation from 2010 to 2013 because instead of buying rice from the Vietnamese and Thai neighbors,

Filipino farmers had a good harvest and were able to meet part of the demand.

The country used to rely in imports to stabilize rice supply and price with an import dependency ratio of 13.57

percent from 2001-2010.The DA noted that the past administration spent more in National Food Authority

imports than in production support from 2001-2010P105.6 billion for production compared to P292.5 billion

for NFA imports, making production grow at a rate of only 2.27 percent or a little over 313,000 MT

annually.From 2008 to 2010, the amount paid for rice imports worth P176.18 billion was eight times the amount

of P22.06 billion paid for the period 2011-2013. Payments for rice imports were 2.8 times the level of support

for rice programs from 2001-2010.This was reversed from 2011 to 2013 with support for local producers at 3.9

times that of payments for rice imports, which drove the farmers to deliver the performance in the last three

years with a higher annual average growth rate of 5.37 percent, equivalent to 889, 029 MT, the DA

said. (SDR/Sunnex)

BioLife Solutions' (BLFS) CEO Mike Rice on Q2 2014 Results - Earnings Call

Transcript

Aug. 8, 2014 1:20 AM ET | About: BioLife Solutions, Inc. (BLFS) by: SA Transcripts

BioLife Solutions, Inc. (NASDAQ:BLFS)

Q2 2014 Earnings Conference Call

August 7, 2014 4:30 PM ET

Executives

Paul Arndt - MD, Communications

Mike Rice - President and CEO

Daphne Taylor - VP, Finance and Administration and CFO

Analysts

Jeffrey Cohen - Ladenburg Thalmann

Brian Marckx - Zacks Investment Research

Vesselin Mihaylov - Newport Coast Securities

David Musket - ProMed

Operator

Good day, ladies and gentlemen, and welcome to the BioLife Solutions Second Quarter 2014 Financial Results

Conference Call. At this time, all participants are in a listen-only mode. Later, we will conduct a question-and-

answer session and instructions will be given at that time. (Operator Instructions) As a reminder this conference

call is being recorded. Ill now introduce your host for todays conference, Paul Arndt, Managing Director of

LifeSci Advisors. You may begin.

Paul Arndt

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

Thank you Ashley and good afternoon everyone. Thank you for joining us this afternoon for the BioLife

Solutions conference call and webcast to review the financial results for its 2014 second quarter ended on June

30, 2014. The Company issued a press release and filed a Form 10-Q quarterly report today containing detailed

results for the second quarter of 2014. This release is available on the Investor Relations page of Companys

Web site at www.biolifesolutions.com as well as various financial Web sites.

As a reminder this call is also being recorded and broadcast live on the Companys Web site. A replay of the

webcast will be available through the same link for 90 days.

Before we get started wed like to remind you that during the course of this conference call the Company may

make projections and other forward-looking statements regarding future events or the future financial

performance of the Company. These include without limitation statements regarding future operating results,

growth opportunities and other statements that reflect BioLifes plans, prospects, expectations, strategies,

intensions and beliefs.

These statements are subject to many risks and uncertainties that could cause actual results to differ materially

from expectations. For a detailed discussion of these risks and uncertainties that effect the Companys business

and that qualify to be forward-looking statements made on this call. We refer you to the Companys periodic

and other public filings filed with the SEC including the Forms 10-K for the fiscal year ended December 31,

2013, the quarterly Form 10-Q filings and the Forms 8-K filed today.

Companys projections and forward looking statements are based on factors that are subject to change and

therefore these statements speak only as of todays day Thursday August 7, 2014. The Company assumes no

obligation to update any projections or forward looking statements except as required by law. With that said Id

now like to hand the call over to Mike Rice, President and CEO of BioLife Solutions.

Mike Rice

Thank you, Paul and thank you everyone for joining the call. With me today is Daphne Taylor our CFO.

Following our business update and review of BioLifes second quarter 2014 performance well be glad to take

your questions.

Id like to start with an overview. For Q2 were pleased with our results for the second quarter. This quarter we

reported increased revenue from our core products of 14% over the same quarter last year. This was our fourth

consecutive quarter with at last $1 million in core product revenue. Total revenue was down 5% from last

quarter and as you know we previously explained in our quarterly revenue is highly affected by fluctuations in

orders from our regen med customers who order our products to support their clinical trials. Their demand for

our products is impacted by funding and patient enrollment rates in their trials.

Our focus on increasing penetration in our three strategic markets of regenerative medicine, drug discovery and

biobanking continues to result in more academic clinical centers and commercial companies adopting our best-

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

in-class biopreservation media products. Id like to update you on our success in the regen med segment by

sharing some metrics on customer acquisition rates.

In October 2012 we estimated that our products were being used in more than 50 customer clinical trials, this

increased to more than 85 in September 2013 to more than 100 by January of 2014 and we now believe in more

130 customer clinical trials. We also believe that the average annual revenue for clinical indication should our

customers receive marketing and regulatory approvals and commence large scale commercial manufacturing

and be in the $500,000 to $2 million range. This is a really remarkable customer base, represents significant

revenue and profit upside for BioLife over the next several years.

In the quarter we had large orders from several marquee customers in the regen med space and as their trials

continue to progress. We also had a good quarter selling our products internationally with over 20% of our

revenue coming from customers outside the U.S. To this point one of our newer regen med customers has just

opened a facility in Beijing and completed our first shipment to the new location in the quarter. Our products

continued to be evaluated by companies and institutions developing cell based cancer immunotherapies. Many

of the major players in this space have incorporated our biopreservation media products into their protocols and

were well configured to participate in the growth of this market.

This is a really exciting space and you maybe following the recent funding activity with Juno just this week

announcing another $134 million raise, bringing the total to over 300 million since December, Kite Pharma has

done $128 million IPO in June and Pfizers recently announced deal with Selectus. We believe we have 15

customers in this space. Weve also been successful on getting our products adopted in the veterinary

regenerative medicine market, which is somewhat less regulated and carry a huge upside considering the current

spend for veterinary care throughout the world. We have several customers developing autologous and

allogeneic cell therapies for a number of clinical applications that have really large potential treatment

populations. Demand for biopreservation media is expected to grow from 345 million this year to 820 million

by 2019 and the regen med space represents our long-term growth opportunity.

Turning to our second strategic market of drug discovery, significant contributors to our core revenue in the

quarter are the suppliers of cells used as high-throughput stream for drug discovery, toxicology testing and other

diagnostic purposes with the end-users primarily being big pharma. We continue to see growth in current

customers and are marketing to new prospects in this segment.

Key customers include Cellular Dynamics, B Lonza, Stem Cell Technologies, Triangle Research Labs and

Quidel Diagnostic Hybrids are products are used to preserve frozen and fresh cells during shipment from

suppliers to their customers. The last market, that you first speak to is biobanking, we consider this strategic to

BioLife. This space is comprised of cord blood banks, tissue banks, stem cell banks and biorepositories and also

including hair transplant physicians.

We have a number of high profile customers in this space and see this is an area of potential growth as interest

in personalized cell banking, could take off over the next several years. Today, there are a number of companies

and labs offering long-term storage of cord blood or tissue, autopolis tissue, peripheral stem cells, and dental

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

stem cells. In this space our products are used by these customers to more effectively transport biologics to their

storage facilities and to improve survival following long-term storage.

Recently our products were included in the multicenter biobanking study our various shipment conditions for

cells used to support efficiency testing programs. A study compared our CryoStor freeze media a typical home-

brew freeze media cocktail and also a room temperature storage media in shipping conditions using dried-ice,

liquid nitrogen and room temperature. The cell types tested were peripheral blood mononuclear cells or PBMCs

and also Jurkat cells a type of T-cell.

The offers included a combination of CryoStor and Dry Ice it is higher liability by every assessment method

used for each liability level and is the most cost efficient shipment method. The study further concluded that

room temperature transport medium dramatically and adversely affected integrity environment for your cells.

The data from this study augments the already significant body of evidence on our Web site, where we have

about 150 journal articles, oral abstracts and poster presentations sighting the use of our products.

Finally in the biobanking segment, we continue to market to the hair transplant community of our goal to make

progress in expanding adoption of HypoThermosol in this space. We had another quarter and I believe we have

60 physicians or group routinely using HypoThermosol as an improved ex-vivo storage medium for hair grass.

The formulation of HypoThermosol has been shown to extend ex-vivo viability of grass and according to

several customers for more fastened grass -- mono transplanted grass. This is a niche $15 million addressable

market for us but with patient education and physician Web site advertising augmenting our own sales efforts

we continue to make great progress.

Next Id like to give you an update on biologistex, recall this is a new collagen management service that plan to

launch in the fourth quarter of this year. Biologistex is a cloud-based data management solution in conjunction

with the new EVO-controlled temperature container from SAVSU Technologies. EVO shippers monitor

payload environmental conditions and translate this data and location data to the cloud where our customers can

much better manage the logistics of shipping them very precious clinical and biologic materials. We believe

biologistex can improve quality and positively impact patient care. We also believe the addressable market for

biologistex is quite large, if were successful this service offering could contribute very meaningful revenue and

profits to BioLife. Wed be glad to keep you updated on the product launch as we get closer.

Also like to give a brief update on Somahlution, you might recall that in June we announced that we signed a

long-term contract manufacturing agreement with Somahlution based in Florida under which were going to

manufacture their DuraGraft preservation solution, DuraGraft is a tissue preservation solution for storage of

harvested veins that are used in coronary artery bypass and other vascular access surgeries.

Before Somahlution, DuraGraft was marketed for several years under different brand and used in more than

10,000 patients. Somahlution has compiled a significant body of clinical literature on its use. According to

Somahlution the worldwide market potential for DuraGraft is based on CABG and peripheral vascular bypass

rates that are currently more than 0.1% of the population. Annually about 600,000 CABG and more than

500,000 peripheral vascular surgeries are performed just in the U.S. and Europe.

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

We expect to complete process engineering and manufacturing validation to support five deliveries to

Somahlution starting in the fourth quarter of 2014. The signing of this contract manufacturing agreement

represents significant upside to us and once Somahlution achieves regulatory approvals it further demonstrates

our value as a value added provider of aseptic formulation, full and finished services of liquid medium products.

And we sure to keep you updated on the product approvals on our own initial steps to them. Just a reminder as

we said before going to keep looking for additional contract manufacturing opportunities that are aligned with

our capabilities and expertise to leverage our manufacturing capacity.

Now I will turn the call over to Daphne to go over our financial results for the quarter.

Daphne Taylor

Thanks, Mike, and good afternoon everyone. Revenue was 1.2 million in the second quarter. This was an

overall decline of 48% than the first quarter of 2013 and a decline of 41% than the first quarter of this year. A

majority of this decline is due to cancellation of our contract manufacturing agreement which occurred at the

beginning of this quarter.

As Mike said, our proprietary solutions revenue this quarter was again over $1 million, year-over-year weve

seen a 29% increase in proprietary solutions revenue but the total for the first six months of the year of $2.2

million compared to 1.7 million for the first six months of last year. Q2 proprietary solutions revenue increased

by 14% over the second quarter of 2013 and was down slightly from Q1 of this year by 5%. This highlights that

while overall revenue was growing steadily from year-to-year, we still expect lumpiness based on the progress

of our customers clinical trials.

Gross margin in Q2 was 45% compared with 36% in the second quarter of 2013, reflecting the value of growing

our higher margin core product revenue with most of the revenue in Q2 coming from our core customers. We

reported a net loss in the second quarter of this year of $883,000 compared to approximately $283,000 in the

second quarter of 2013. This includes the impact of a lost contract manufacturing revenue and some increased

spending on R&D sales and marketing and G&A to support expansion of our core business in contract

manufacturing services.

We ended Q2 with cash and cash equivalents of 11.9 million compared to 156,000 at the end of last year. This

quarter we burned cash of about $1 million, we increased the investments in our inventory, we took care of

some vendors who supported us prior to our equity raise last year. We believe were now well positioned to take

advantage of the strategic growth opportunities.

And I will now turn the call back over to Mike.

Mike Rice

Thanks Daphne. In closing I want to say that I am very optimistic about our future and our ability to execute our

growth plan. Just after our last call I bought 20,000 shares in the open market. Team is very solid we just hired a

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

new Director of Marketing and also a very talented researcher from the University of Washington we would be

joining us in a fuel application scientist role. Later this well build out the biologistex team ahead of the

products and service launch. So for us its full speed ahead at BioLife.

I want to thank you for your interest in BioLife. And with that well open the call for questions, operator?

Question-and-Answer Session

Operator

Thank you. (Operator Instructions) Our first question comes from Jeffrey Cohen of Ladenburg Thalmann. Your

line is open.

Jeffrey Cohen - Ladenburg Thalmann

So just a few if I may. Could you talk about the SAVSU agreement? Have you started shipping some of the

packages and utilizing them on their own or have you started to utilize them with your cold storage solutions as

well?

Mike Rice

So Jeff the new EVO shipper is not ready, thats what well be launching in the fourth quarter. You might recall

that last year we signed the initial exclusive distribution agreement with SAVSU or not SAVSU but their earlier

generation products. And while well still be able to do that our efforts are really toward completing the product

development on the backend database development to support the new EVO smart shipper. And then to clarify

when we ship our own products to customers it dont need to be shipped cold, so we ship Amgen.

Jeffrey Cohen - Ladenburg Thalmann

The 130 customers you referenced, did you talk about change over the past one or two quarters with those

numbers?

Mike Rice

I think youll have to go back to the last, the most recent metric that we gave. And so I said in January of this

year we were at about 100 and now about 130. And Jeff lets clarify, its not customer just number of clinical

trials. So the number of customers is slightly less than that, somewhere more than one clinical trial thats using

our product, okay.

Jeffrey Cohen - Ladenburg Thalmann

And the composition of Phase 1s, 2s and 3s will that be provided or is that in the Q?

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

Mike Rice

Its not in the Q but it has been roughly, I am happy to tell that now. We think that perhaps 12 to 15 Phase 3,

there is a nice bonus of about 60 or so in Phase 2, a little less than that maybe 40 or so in Phase 1 and handful,

what we would call our preclinical phase, where were doing animal testing and other supplier qualification of

BioLife.

Jeffrey Cohen - Ladenburg Thalmann

And one more if I can, could you talk about any anticipated timing on DuraGraft?

Mike Rice

I cant, I wished I could but were going to differ to Somahlution in their own press release, any regulatory

approvals that they hope to receive in which parts of the world. But what we know is based in our conversation

today and what you may have seen in the press release when we announced the agreement we expect our initial

shipments to them to commence in the fourth quarter of this year.

Jeffrey Cohen - Ladenburg Thalmann

One more, material customer for the quarter were there any in excess of 10%?

Mike Rice

No.

Operator

Thank you. Our next question comes from Brian Marckx of Zacks. Your line is open.

Brian Marckx - Zacks Investment Research

I guess I would have expected operating expenses sales and marketing and G&A to come down given the fact

that you knew revenue was going to come down. Can you talk about why SG&A would have went up so

considerably in the quarter?

Mike Rice

So the basic situation is this, we talked a little bit about this in the last call. If you recall when we raised the

funding and we closed the funding, we decided that were going to hold on to most of the cash but were going

to very deliberately and smartly spend perhaps a couple of million dollars in the first 12 months from the close

of the raise to expand sales and marketing, hire some additional sellers, go to some additional trade shows. We

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

believe that were going to spend a decent amount of money launch biologistex on the other parts of the OpEx,

Daphne has done a great job which was up until the raise, a pretty stressful cash situation and so she cleaned up

some vendors and got AP squared up, so all things considered thats really the bulk of the majority of the

increase in the spending.

Brian Marckx - Zacks Investment Research

So, G&A went from about 864,000 to about 970,000, so about a 130,000 in Q1 to Q2. I am still trying to figure

out why it would jump to that level particularly with the expectation that that revenue would fall close to 50%?

Mike Rice

Brian, its a fair question but then again our intention is growing the core business. It has been and it will be

continue to be. We are very fortunate to have signed this agreement with Somahlution. We think thats going to

be a very meaningful relationship for us for revenue and also reasonable margins but our core focus here and

our focus is to grow the core business and see the proprietary solutions adapted and we need to do that by

increasing the spend and sales and marketing and other related G&A expenses. Daphne, if you have got

anything in the queue that provides any granularity on that then we can share that but if we dont then we

shouldnt.

Daphne Taylor

We just thought it was due to increase in some corporate costs and we havent really provided any additional

granularity.

Brian Marckx - Zacks Investment Research

I think the overall question is, it comes down to operating leverage and when are we going to see operating

leverage, if revenue was coming down and expenses are going up. And everybody understands that you have to

make investments to grow revenue but when you see this level of operating expense increase with the

expectation that at least in the near-term revenue is going to come down without any clear idea of when

revenues are going to come back up, I guess that is the question of what is in G&A thats making it go up

130,000 without disclosure in the queue?

Mike Rice

Fair question, Brian, yes, so to go back and sort of answer your first question, so today on this call we are not

going to guide when we think we are going to breakeven.

We think that the new sellers at least the new seller and the new biologistex sellers, that will be initial

investment, they are going to be recent productive but not right away. So, this is really -- this is a transitional

quarter too for BioLife. We are going to be very mindful of overall expenses but without getting into too much

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

granularity about AP and vendor relationships and things like that in this rate related cost. What we can say is

that we think we are very judiciously using the funds that we raised and we are going to hold on to most of that

cash but this is really -- its a sales and marketing showing up operations sort of transition period for the

company.

I am going to say it again though I think with the launch of biologistex

and Somahlution should they get fair

approvals which we are hopeful and confident they will, I think in the next three to four quarters and our

financial houses going to look at vast improvement from what it is today, and I mean that in the realm of again

having significant amount of cash in the balance sheet and more meaningful contract manufacturing revenue,

having a biologistex

service starting to contribute something that we'll be pretty pleased to talk about.

Brian Marckx - Zacks Investment Research

You guys have certainly demonstrated that you can run the business and grow revenue and control cost and I

think thats fair. So, thanks Mike for the insight. Thats all I had.

Operator

Thank you. (Operator Instructions). Our next question comes from Vesselin Mihaylov of Newport Coast

Securities. Your line is open.

Vesselin Mihaylov - Newport Coast Securities

I have a couple of questions, so first of all could you please educate the listeners and readers of the transcript of

the conference call, what is the publicly released information about the Somahlution approval process. Is it

expected next year, I mean that company must have given some guidance and I am sure you know best from

pretty much everybody thats on this call.

Mike Rice

Great question, Vess and we do know Vess because they have told us their geographic areas are seeking

approval in their expected timelines but it would be inappropriate for us to convey that without approval from

the company. So, all I can do really just relate back to what we disclosed in the press release and what I

reiterated in this call which is that we believe that for shipments that are going to happen in the fourth quarter of

this year and we are working really hard to complete the process engineering and our material supply chain

well-understood and they expect us to ship some products to them in the fourth quarter of this year and that is

clearly our goal.

Vesselin Mihaylov - Newport Coast Securities

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

Okay and I understand if its inappropriate for you to share non-public information but have they given

guidance publicly themselves, can we find this on the internet or are you saying its not really publicly

announced?

Mike Rice

They really havent and it would be really helpful if they could because that will be conceited and we could all

have a little bit clear picture at least from your guys perspective about what this means to BioLife and how soon

that might be material to us. We have a really good sense of what that could turn into based on some

communication but nevertheless we have some permission from them to share that information until they

actually start to disclose the wrong forecast and unit shipments it wouldnt be our place to share that now.

Vesselin Mihaylov - Newport Coast Securities

Okay. So the kind of revenues that this account can bring, you mentioned that the other people that are using the

solution trials you expect the average its pretty wide range here between $500,000 to 2.5 million a year I

assume, is that correct.

Mike Rice

In the regenerate mass and cell base that is out there in this space thats right.

Vesselin Mihaylov - Newport Coast Securities

Thats per year. So the midpoint is I would say $1.5 million, is this customer of potentially that side or its order

of magnitude is larger?

Mike Rice

We have to look at the intended patient population and I dont want to disclose any of the forecasting

information that weve given, but the cabin space in the vascular access surgery space those are pretty good size

numbers, some of it certainly has some competition in the space nevertheless they continue to make a real

business out of this. So if they are successful and we will be very pleased to report very meaningful revenue in

[indiscernible] BioLife.

Vesselin Mihaylov - Newport Coast Securities

Now what would the normalize cash flow from operations burn? Obviously I am only looking -- I didnt see --

look at queue but I saw that cash decreased by about $2 million sequentially, the cash balance now you said that

you paid some vendors some accounts that were really due to be paid. So what would you say is the normalized

cash burn per quarter going forward, is it 1 million, is it less than that?

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

Daphne Taylor

There was definitely a couple hundred thousand in there that is I would consider one-time occurrence due to

paying back vendors and getting on back to better terms with vendors.

Vesselin Mihaylov - Newport Coast Securities

So its really not $2 million, its cash flow from operations but its closer to probably 1 million.

Mike Rice

Thats a fair estimate.

Vesselin Mihaylov - Newport Coast Securities

And lets go over a little bit on the shipping service business, the anticipated business model. So I am looking

for one of your competitors trial report that is basically doing, I mean they are not a direct competitor weve

discussed this in the past, but lets say that it was in liquid nitrogen to shift tissues. So the revenues surrounding

is about slightly less than 1 million a quarter and the gross margins are now approaching 40% roughly. So I am

just wondering you said you are going to launch the product in the fourth quarter. My first sub-question is do

you expect any revenues in the fourth quarter or just the launch?

And number two, the first full quarter of commercial availability. Do you anticipate having gross margin in that

quarter or are the first few quarters really going to be negative gross margins on this service?

Mike Rice

Really great questions. I will be somewhat careful on how I answer. So initially your first question is any

revenue in the fourth quarter.

Its possible but we are in a stage now where we are conducting customer focused groups and we are really

refining the final feature set. The testing pricing elasticity and obviously the other metrics of our pricing in tiers

and really the entire offering.

So its possible we could see some revenue in the fourth quarter. And we are not guiding to that, we dont want

to have any quantification in a range but there is a possibility.

And then your second question, so the first few quarters out, whats that going to look like? The business will

be a lower gross margin but a positive gross margin more or less from the beginning and then getting much

better over time.

Vesselin Mihaylov - Newport Coast Securities

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

And that is fantastic because as you can see the market is being basically about the 30 million -- in excess of 30

million enterprise value for that company and it is losing much money but its doing about 1 million a quarter

and has about 40%, lets call it 35% gross margin. So here is the value that can be unlocked. If you properly

execute and properly communicate all these achievements to the investment community. That could be a huge

future unlocked value.

And I had one last question. You announced a few months ago the granting of patent in the blood storage area.

And I was meant to ask this question but I think this is the time because you mentioned blood storage and

biobanking. What are these patents really about, are they -- is this -- do you have like a better [indiscernible]

solution for blood storage or something that is going to come out of (less fuel) [ph] that is unexpected to you. Is

it some really foundational pattern that we got here and you are going to work on or is this just incremental

business that's going to come from this?

Mike Rice

Really great question and thanks for bringing that up for the Group Fest. So the blood storage, the patent that we

were granted to improve the isolation preservation of cells isolated from whole blood. It does have some utility,

it doesnt come without some pretty significant regulatory investment and hurdles should we intent to market

HypoThermosol or some other variant of HypoThermosol as an approved storage or additive for blood.

And so were in the process of sorting out what might be the best way to unlock the value from the patent. We

have many customers today using HypoThermosol to store and to ship cells isolated from whole blood which is

really great and they are doing that just because they can buy the solution from us, they test it, they see better

results and they use it. So in one sense, we could further market that and just expand the number of users using

that application. From other sense, its just a nice addition to the patent state, but the big home run would be

with some additional testing, could we actually see a way to commercialize and then get approval for a next

generation blood storage solution. And thats a fair amount of work considering the meaning of the methods

that are out there today and the cost structures and the various deals that folks get today and looking various

other additives that are like.

Vesselin Mihaylov - Newport Coast Securities

So this is best as necessary, hypothetically you could basically create a solution to address the entire blood

banking market, why spread use of potential of HypoThermosol, is that what is the opportunity down the road?

Mike Rice

Its a potential opportunity but consider the cost and the pricing sensitivity, the number of alternatives out there

today and also the percentage of deals improvement or expense of storages or shelf life you have to be able to

show to actually make a meaningful difference where you could capture a significant spend of that market.

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

And we understand the players and we understand the dynamics and the various performances that are out there

and that would be a lot of work to get into the point to describe sort of the home run application that you just

described. But certainly something were thinking about and it's a research, but I dont want to underestimate

the work involved.

Vesselin Mihaylov - Newport Coast Securities

Understood thank you very much. Thanks for putting this conference call and just please keep guiding us as

much as possible in future press releases about once the firmer footing is established in terms of anticipated

revenue growth and so on. Thanks.

Mike Rice

We'll do that and great questions. I am hitting the road next week again another series of meetings with

potential investors and analyst and fund managers so on and so forth, so again were going to just continue to be

very active with the investment community and well try to tell as much as we can and make sure that people

know what were up to.

Operator

Thank you. Our next question comes from David Musket of ProMed. Your line is open.

David Musket - ProMed

Just a follow-up on questions earlier about SG&A for you and Daphne, are expecting specially going to be at

about this level now for the remainder of the year or do we have some additional investments spending that we

have to do in front of BioLogistic point?

Mike Rice

Great question, Dave, Ill let the Daphne that.

Daphne Taylor

Well, thats a two part question. So included in the number for this quarter we have the couple of onetime item

are not going to recur, but we think that were going to do some investing of resources to give BioLogistic

launch this before the end of this year maybe not be in Q3 maybe in Q4. We dont have an exact number for

that but as you can imagine there is some ground work that has to begin before the launch and were going do

that.

David Musket - ProMed

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

Okay great, so the point being that or the conclusion being that you have some usual expenses in this quarter,

you will have some additional unusual expense for the remainder of the year, so its probably going to be about

this level the next two quarters?

Daphne Taylor

Thats a reasonable assumption.

David Musket - ProMed

Okay with respect to those expenses, are any of this tied to some comparison studies that we might see on

BioLogistic that would be similar to the publication that you just put out with respect to class?

Mike Rice

Yes, super question, Dave, so we definitely have planned an entire series of data studies to first just convey the

performance of the shipper against other shippers in a drive payload situation then against the classic ISTA

winter and summer profiles, but we also intent to actually storage, ship the number of cell types and some of the

testing here and some with some collaborators where we can completely correlate temperature stability to cell

viability and actually move cells ship them around and really just better articulate and sort of clean up whats

going on in the space of small form factor shippers.

If you follow the space, youll get in to the marketing materials from what would be our various competitors. I

say that there is less than complete marketing approach by several companies. Some stake a claim on our value

installation use in the shipper, others have some data graphs which show great performance of the payload, but

they omit, they dont you in the graphs what the outside temperature is, so were just going to clean that up and

take the high road and so were going to be doing all that. To answer your question, but how much thats all

thats going cost, there is a little bit of cost in there, but I dont want to say its material amount okay.

David Musket - ProMed

When we some of that prior to the launch Mike or is that something that's going to happen next year and when

should we just see something?

Mike Rice

I think just prior to the launch, were going to have white papers and were going to have some dedicated

website and then just a complete integrated marketing solution around that, so were not going wait until the

actual launch [indiscernible], but first things first, the final form factor of the shipper is just about done, once

thats done, then well put that shipper in these temperature stability chamber and well start to run the

basement analysis then well get the competing devices and do the same thing and again move to the -- but I

think its the really important phase of data collection and that is not what the drive payload with actual sales of

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

interest that will be used, and clinical relevant cells, so you bet, the idea is to just get the product development

completed, get the backend data base, square it up, use again the portal and then start to unveil the data

performance.

There could be cases where a competing shipper might work almost as well which is to say it might hold the

temperature almost as long but nonetheless we think that the premium that we can command were having a

smart shipper have customers have access to this various payload environmental and location data.

Its going to be pretty well received. But first and foremost it all starts with the shipper and installation material.

So I am glad you asked that and its clearly a big part of our marketing and our customer and education

program.

David Musket - ProMed

It seems like there could be a sweeper I dont think I for one don't have a full appreciation of that opportunity.

But do you have to hire any additional people to now launch this product?

Mike Rice

We do.

Unidentified Company Representative

Were going to hire sellers were going to have some order fulfillment people, some customer service/tech

support people and we have a reasonable sense of how many and how fast.

A key facing item for us will be the conclusion of the data group sessions and the customer folks group sessions

so we can really complete definition. In the meantime everything on the manufacturing side continues to track

along with our partner [Sasa] and then well be doing a lot of work on the database side and the floor side so we

have a just a really robust customer experience when they log into the portal.

Were planning some not at large but were planning some post launch smartphone applications where

customers will have some fit for a smartphone interface some functionality to interact with the portal, the

database, do some command and control of the electronics and the cellphone and interrogate the device, see

where it is understand the payload parameters and so on and so forth.

But yes there is a whole headcount kind of scheme that were thinking in its ranges and it really depends Dave

on how fast this ramps. So we think weve got a sense of -- if the number of transactions, the number of

shipments is X then we need Y people to support it, if it takes off faster than we think then were ready to scale

appropriately.

David Musket - ProMed

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

I assume youve already had the conversations with your existing customer base on this. Do you have any sense

of what kind of conversion you might get?

Mike Rice

Its a great question we talked to many, many customers and in that space theyre all preapprovals so theyre

buying shippers from various companies theyre shipping these things around in clinical trials and all I can tell

you is this the interest level is just really phenomenal. And I say that with complete confidence that if this was

available today and we had really good problems to solve here.

Operator

Thank you. Thats all the time we have for questions today. Ill hand the call back over to Mike Rice for any

closing comments.

Mike Rice

Great. Thanks Ashley. So, in closing just let me say again thank you very much for joining us. Really looking

forward to speaking to you in the future and keeping updated on the progress of the company and remain

completely optimistic and confident that the BioLife is in the right place, the right time with biologistics. The

core business continues to grow and all things considered really happy with the way things are going and the

team that weve built. So thanks again. Appreciate your interest.

Operator

Ladies and gentlemen, thank you for participating in todays conference. This concludes todays program. You

may all disconnect. Everyone have a great day.

Copyright policy: All transcripts on this site are the copyright of Seeking Alpha. However, we view them as an

important resource for bloggers and journalists, and are excited to contribute to the democratization of financial

information on the Internet. (Until now investors have had to pay thousands of dollars in subscription fees for

transcripts.) So our reproduction policy is as follows: You may quote up to 400 words of any transcript on the

condition that you attribute the transcript to Seeking Alpha and either link to the original transcript or to

www.SeekingAlpha.com. All other use is prohibited.

the information contained here is a textual representation of the applicable company's conference call,

conference presentation or other audio presentation, and while efforts are made to provide an accurate

transcription, there may be material errors, omissions, or inaccuracies in the reporting of the substance of the

audio presentations. in no way does seeking alpha assume any responsibility for any investment or other

decisions made based upon the information provided on this web site or in any transcript. users are advised to

review the applicable company's audio presentation itself and the applicable company's sec filings before

making any investment or other decisions.

Daily Rice E-Newsletter by Rice Plus Magazine www.ricepluss.com

News and R&D Section mujajhid.riceplus@gmail.com Cell # 92 321 369 2874

If you have any additional questions about our online transcripts, please contact us

at: transcripts@seekingalpha.com. Thank you!

Rice millers demand soft loans to modernise

Ahmed Humayun Kabir Topu, Pabna

Taposh Kumar, additional secretary of power and energy, attends a discussion on government support for dissemination of modern rice parboiling

technology organised by German aid agency GIZ and local rice millers association at Ishwardi Sugarcane Research Institute in Ishwardi yesterday.

Photo: GIZ

Millers can increase rice parboiling by 8 lakh tonnes and

rice bran oil production by 15 lakh tonnes a year with

implementation of the modern parboiling technology

developed by Bangladesh Rice Research Institute in