Professional Documents

Culture Documents

Wyckoff Methods

Uploaded by

analyst_anil14Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wyckoff Methods

Uploaded by

analyst_anil14Copyright:

Available Formats

TECHNI CALL

06 April 09

SPECIAL REPORT

NIFTY - Ready for Mark Up

Richard Wyckoff, one of the most successful Wall Street traders in the early 1900s, developed a method

or sequence known as Wyckoff method of technical analysis. It analyses the price and volume

movement of the market or a tradable item according to the principles of mass psychology. This method

is based on the theory that the market tops and bottoms are generally the result of series of events

occurring in a particular sequence. These events include; the preliminary supply vs. demand imbalance

which instigates the price movement; the selling or buying climax; an automatic reaction to that climax;

a secondary test of the climax; and the result of that secondary test(a show of strength or weakness

generating movement in the opposite direction). Wyckoffs underlying concept was that all economic

movements, by their very nature, are motivated by crown psychology.

The different market phases as mentioned in Wyckoff technique are -

Accumulation : The establishment of an investment or speculative position by professional

interests in anticipation of an advance in price.

Mark-up : A sustained upward price movement.

Re-accumulation: Momentary stopping or pausing points in the up-trend.

Distribution : The elimination of a long investment or speculative position.

Re-distribution : Momentary stopping or pausing points in the downtrend.

Markdown : A sustained downward price movement.

Following are the excerpts of behavioral points/phases as explained in Wyckoff studies about the

Accumulation phase.

Trading Range Support: Defines support in the range.

Trading Range Resistance: Defines resistance in the range.

1. (PS) Preliminary Support is where substantial buying begins to provide support after a

prolonged down move. Volume and spread widens and provides a signal that the down move

may be approaching its end.

2. (SC) Selling climax is the point at which widening spread and selling pressure usually climaxes

and the larger professional interests at prices near the bottom are absorbing heavy or panicky

selling by the public.

3. (AR) Automatic Reaction: Selling pressure has now been exhausted. A wave of buying can

now easily push up prices. This is further fueled by short covering. The high of this rally will

help define the top of the Trading Range.

4. (ST) Secondary test(s): Revisit the area of the SC (selling climax) to test the supply-demand

balance at these price levels. If a bottom is to be confirmed then significant supply should not

resurface, and volume and price spread should be significantly diminished as the market

approaches support in the area of the SC.

5. The Creek is an analogy to wavy line of resistance and floating supply drawn loosely across

rally peaks within the Trading Range. There are, of course, minor lines of resistance that will

have to be crossed before the market journey can continue onward and upward.

6. Springs, Shakeouts and Tests usually occur late within the Trading range and allow the

market and its dominant players to make a definitive test of available supply before a mark up

campaign will unfold. If the amount of supply that surfaces on a break of support is very light

(low volume), it will be an indication that the way is clear for a sustained advance. Heavy supply

here will usually mean a renewed decline. Moderate volumes here may mean, More testing of

support and to proceed with caution. The Spring or Shakeout also serves the purpose of

providing dominant players with additional supply from weak holder at low prices. Springs and

shakeouts are, many times, accompanied by a Test.

7. (Jump) Jump across the Creek is a continuation of the Creek analogy. The market jumps

resistance very deliberately. In a Jump, it is a good sign if it is done on good spread and volume,

thus, depicting sign of strength (SOS).

8. (SOS) Sign of strength: An advance on good (increasing) spread and volume. The market

moves very easily upward.

9. (LPS) Last Point of Support and (BU) Back Up to the Edge of the Creek. A pull back to

support (that was resistance earlier) on diminished spread and volume after a SOS. This is a

good place to initiate long position or pyramid profitable ones the positions bought at Spring,

Test or on the SOS.

A series of SOS and LPS is good evidence that a bottom is in place and Price Markup has begun.

In Accumulation Phase there are sub-phases e.g. A to E. These are sub-phases, through which Trading

Range passes, as conceptualized by Wyckoff methods.

Phase A: - Shows us the preliminary support (PS) and a Selling Climax (SC) with the exhaustion of

supply, as the steep downtrend is broken. The Automatic Reaction (AR) and Secondary Test (ST) set

the boundaries of the Trading Range that follows.

Phase B: - In the early stage, we see a wide swing and higher volume and the first sign of demand

asserting its dominance, as professionals absorb supply. Late in phase B, low volume shows supply has

reduced at the Trading Range lows.

Phase C: - Gives us a final and unconvincing test and break of the Trading Range lows on extremely

light volume. This followed by SOS on dramatically increased volume.

Phase D: - We see a consistent and pronounced dominance of demand over supply on widening spread

and increased volume to the upside. Reactions are comparatively weak and on light volume.

Phase E: - The stock is marking up on rising volume. Demand remains in control.

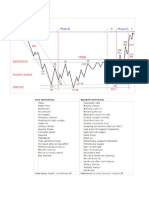

We give below a model sample of Accumulation Phase which is been explained by Wyckoff years

back in his studies.

Now look at the daily chart of Nifty from J uly 2008 to 2

nd

April 2009.

Look at the amazing similarity between the two charts. Most of the behavioral points shown in the Nifty

chart are matching with the model chart.

In Nifty chart, Phase A was completed in the 3rd week of November 2008 with PS (preliminary

support) taking place on 10

th

October and SC (selling climax) on 27

th

October. AR (automatic reaction)

took place on 5 November. ST (secondary test) was seen on 20 November. A Trading Range is now

formed between 2500-3150, which was maintained until fourth of April 2009.

After that, Phase B started where the volume increased in the rising market but reduced drastically when

levels were near the low of the Trading Range. This phase was over by beginning of March.

Phase C was seen during 16 February to 9 March. During this phase, we have seen very low volume

and a final assault was made on sixth and eighth of March to break the low of the Trading Range but

volume was very low and was absorbed perhaps by dominant players (FII, MF and Insurance funds).

The assault was unsuccessful.

Now, the Phase D seems to have started with all characteristics mentioned in Wyckoff studies. From 12

March, onwards the bulls are in complete control of the market and bears seem to be retreating.

Volumes are rising and corrections are sub-normal.

If the current working of our market is further to be matched with the model sample, then we can

presumably say that we have moved out the Trading Range with first SOS (Sign of strength). We may

have seen the LPS (Last point of support) on. We may or may not see series of SOS and LPS in

coming days. However, we are seeing the rise in price levels with increasing volume. This development

can lead to Mark-up. Nifty can go up to 3500 3800 or even up to 4000.

The stark resemblance of the two charts has encouraged us to write this report, which is purely to

explain and understand the Wyckoff methods in the current context.

You might also like

- San Francisco Technical Securities Analysts Association: Wyckoff's WorldDocument2 pagesSan Francisco Technical Securities Analysts Association: Wyckoff's Worldlasithah100% (3)

- VSA - Cheat SheetDocument18 pagesVSA - Cheat SheetAriel Devulsky90% (20)

- Wyckoff Terms ExplainedDocument3 pagesWyckoff Terms Explainedbestnifty100% (7)

- Reading Price & Volume Across Multiple Timeframes - Dr. Gary DaytonDocument7 pagesReading Price & Volume Across Multiple Timeframes - Dr. Gary Daytonmr1232375% (8)

- Wychoff WorkbookDocument31 pagesWychoff Workbookhemsvg100% (5)

- Wyckoff Bar-by-Bar Analysis of S&P E-miniDocument4 pagesWyckoff Bar-by-Bar Analysis of S&P E-miniIgor Shishkin91% (11)

- Summary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthFrom EverandSummary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthNo ratings yet

- Summary of John Bollinger's Bollinger on Bollinger BandsFrom EverandSummary of John Bollinger's Bollinger on Bollinger BandsRating: 3 out of 5 stars3/5 (1)

- The Wyckoff Methodology in Depth: How to trade financial markets logicallyFrom EverandThe Wyckoff Methodology in Depth: How to trade financial markets logicallyRating: 4.5 out of 5 stars4.5/5 (65)

- Summary of Anna Coulling's A Complete Guide To Volume Price AnalysisFrom EverandSummary of Anna Coulling's A Complete Guide To Volume Price AnalysisRating: 5 out of 5 stars5/5 (1)

- High-Probability Trade Setups: A Chartist�s Guide to Real-Time TradingFrom EverandHigh-Probability Trade Setups: A Chartist�s Guide to Real-Time TradingRating: 4 out of 5 stars4/5 (1)

- Summary of Steve Nison's Japanese Candlestick Charting TechniquesFrom EverandSummary of Steve Nison's Japanese Candlestick Charting TechniquesRating: 4 out of 5 stars4/5 (1)

- Mind Over Markets: Power Trading with Market Generated Information, Updated EditionFrom EverandMind Over Markets: Power Trading with Market Generated Information, Updated EditionRating: 4 out of 5 stars4/5 (6)

- WyckoffDocument3 pagesWyckoff'Izzad Afif100% (5)

- Wyckoff Schematics - Visual Templates For Market Timing DecisionsDocument6 pagesWyckoff Schematics - Visual Templates For Market Timing DecisionssgsgNo ratings yet

- Wyckoff - 9 Classic Tests For Accumulation PDFDocument16 pagesWyckoff - 9 Classic Tests For Accumulation PDFpt100% (5)

- Wyckoff Price and Market StructuresDocument2 pagesWyckoff Price and Market StructuresSeo Soon Yi100% (10)

- Richard Wyckoff False BreakoutsDocument4 pagesRichard Wyckoff False Breakoutsdaviduk95% (20)

- Wyckoff Volume Analysis Using Cumulative DeltaDocument6 pagesWyckoff Volume Analysis Using Cumulative DeltaMarcianopro183% (6)

- Wyckoff MethodDocument19 pagesWyckoff MethodAlan Foong50% (2)

- VSA Bar Definitions V 2Document1 pageVSA Bar Definitions V 2No Name89% (9)

- Price VolumeDocument3 pagesPrice VolumeCryptoFX96% (24)

- Volume Spread Analysis Karthik MararDocument34 pagesVolume Spread Analysis Karthik Mararku43to95% (19)

- Wyckoff Method - Law+TestDocument6 pagesWyckoff Method - Law+Testallegre100% (3)

- Volume Spread Analysis Improved With Wyckoff 2Document3 pagesVolume Spread Analysis Improved With Wyckoff 2ngocleasing86% (7)

- Priceaction WaycoffDocument48 pagesPriceaction Waycofferic5woon5kim5thak100% (6)

- Follow The Smart Money VSADocument10 pagesFollow The Smart Money VSADavid Gordon100% (2)

- Wyckoff MethodDocument14 pagesWyckoff MethodAnonymous rPnAUz47Fe100% (6)

- Nine Classic and Nine New Wyckoff Tests for Accumulation and Re-Accumulation PhasesDocument6 pagesNine Classic and Nine New Wyckoff Tests for Accumulation and Re-Accumulation Phasespatus1986100% (8)

- Understanding how volume impacts prices in financial marketsDocument32 pagesUnderstanding how volume impacts prices in financial marketsHafeezah Ausar100% (3)

- The Wyckoff MethodDocument7 pagesThe Wyckoff MethodWuU234575% (4)

- Richard Wyckoff MethodDocument10 pagesRichard Wyckoff MethodPratik Chheda100% (1)

- MBoxWave Wyckoff Trading SystemDocument15 pagesMBoxWave Wyckoff Trading Systemsololeos100% (5)

- Wyckoff WorkbookDocument33 pagesWyckoff WorkbookSergey Khaidukov73% (11)

- Volume Spread Analysis ExamplesDocument55 pagesVolume Spread Analysis Examplesthinkscripter82% (11)

- Best of WyckoffDocument35 pagesBest of Wyckoffdfmarq100% (1)

- The Wyckoff Method Session 5Document24 pagesThe Wyckoff Method Session 5Upasara Wulung100% (1)

- Volume Spread Analysis RulesDocument3 pagesVolume Spread Analysis RulesPRASADNo ratings yet

- Wyckoff Playbook Slides (Crop) PDFDocument156 pagesWyckoff Playbook Slides (Crop) PDFDuy Dang100% (5)

- The ABC’s of VSA: Supply & DemandDocument20 pagesThe ABC’s of VSA: Supply & Demandsliderboy100% (6)

- Volume Profile Trading Strategy BriefingDocument6 pagesVolume Profile Trading Strategy BriefingSyed Asad TirmazieNo ratings yet

- Trades About to Happen: A Modern Adaptation of the Wyckoff MethodFrom EverandTrades About to Happen: A Modern Adaptation of the Wyckoff MethodRating: 4 out of 5 stars4/5 (3)

- The Trader's Book of Volume: The Definitive Guide to Volume Trading: The Definitive Guide to Volume TradingFrom EverandThe Trader's Book of Volume: The Definitive Guide to Volume Trading: The Definitive Guide to Volume TradingRating: 4.5 out of 5 stars4.5/5 (20)

- The Secret Science of Price and Volume: Techniques for Spotting Market Trends, Hot Sectors, and the Best StocksFrom EverandThe Secret Science of Price and Volume: Techniques for Spotting Market Trends, Hot Sectors, and the Best StocksRating: 5 out of 5 stars5/5 (1)

- Wyckoff 2.0: Structures, Volume Profile and Order FlowFrom EverandWyckoff 2.0: Structures, Volume Profile and Order FlowRating: 4 out of 5 stars4/5 (28)

- The Janus Factor: Trend Follower's Guide to Market DialecticsFrom EverandThe Janus Factor: Trend Follower's Guide to Market DialecticsNo ratings yet

- How I Trade and Invest in Stocks and Bonds: Being Some Methods Evolved and Adopted During My Thirty-Three Years Experience in Wall StreetFrom EverandHow I Trade and Invest in Stocks and Bonds: Being Some Methods Evolved and Adopted During My Thirty-Three Years Experience in Wall StreetRating: 5 out of 5 stars5/5 (3)

- The Three Skills of Top Trading: Behavioral Systems Building, Pattern Recognition, and Mental State ManagementFrom EverandThe Three Skills of Top Trading: Behavioral Systems Building, Pattern Recognition, and Mental State ManagementRating: 3.5 out of 5 stars3.5/5 (4)

- Pring on Price Patterns: The Definitive Guide to Price Pattern Analysis and IntrepretationFrom EverandPring on Price Patterns: The Definitive Guide to Price Pattern Analysis and IntrepretationNo ratings yet

- Trading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketFrom EverandTrading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketNo ratings yet

- Market Profile Basics: What is the Market Worth?From EverandMarket Profile Basics: What is the Market Worth?Rating: 4.5 out of 5 stars4.5/5 (12)

- The Nature of Trends: Strategies and Concepts for Successful Investing and TradingFrom EverandThe Nature of Trends: Strategies and Concepts for Successful Investing and TradingNo ratings yet

- Granville’s New Key to Stock Market ProfitsFrom EverandGranville’s New Key to Stock Market ProfitsRating: 5 out of 5 stars5/5 (1)

- Elliott Wave Timing Beyond Ordinary Fibonacci MethodsFrom EverandElliott Wave Timing Beyond Ordinary Fibonacci MethodsRating: 4 out of 5 stars4/5 (21)

- The Power of Japanese Candlestick Charts: Advanced Filtering Techniques for Trading Stocks, Futures, and ForexFrom EverandThe Power of Japanese Candlestick Charts: Advanced Filtering Techniques for Trading Stocks, Futures, and ForexRating: 4.5 out of 5 stars4.5/5 (2)

- Bhandup 1520314072027Document7 pagesBhandup 1520314072027analyst_anil14No ratings yet

- 821 PDFDocument4 pages821 PDFanalyst_anil14No ratings yet

- Higher High Lower LowDocument33 pagesHigher High Lower LowKav100% (4)

- Tracking Trends and Momentum with Moving AveragesDocument22 pagesTracking Trends and Momentum with Moving Averagesanalyst_anil14No ratings yet

- Chart Patterns Trading and Dan Zanger - Technical Analysis of Stocks & Commodities - (2003)Document5 pagesChart Patterns Trading and Dan Zanger - Technical Analysis of Stocks & Commodities - (2003)Sebastian100% (1)

- Top Technical Patterns For Swing Trading and High-Probability Credit Spreads PDF 181116-1Document43 pagesTop Technical Patterns For Swing Trading and High-Probability Credit Spreads PDF 181116-1analyst_anil14100% (2)

- Zazen Cheats BasesDocument8 pagesZazen Cheats Basesanalyst_anil14No ratings yet

- The Monthly Chart.: Sunday, January 19, 2014Document6 pagesThe Monthly Chart.: Sunday, January 19, 2014analyst_anil14No ratings yet

- 12.finding Trades at Specific Areas Inside The TrendDocument11 pages12.finding Trades at Specific Areas Inside The Trendanalyst_anil140% (1)

- Pivot MarkingDocument10 pagesPivot Markinganalyst_anil14No ratings yet

- Position Sizing - Jon BoormanDocument4 pagesPosition Sizing - Jon Boormananalyst_anil1450% (2)

- Magic Indicators - 5 Must-Use Indicators for Analyzing StocksDocument17 pagesMagic Indicators - 5 Must-Use Indicators for Analyzing Stocksanalyst_anil14No ratings yet

- PA ArticleDocument41 pagesPA ArticlevidhyapathyNo ratings yet

- Conversion ManualDocument5 pagesConversion Manualkunalji_jainNo ratings yet

- Stick With Strength To Beat August Heat - TheStreetDocument6 pagesStick With Strength To Beat August Heat - TheStreetanalyst_anil14No ratings yet

- PinocchioBars 03 2010 V2 PDFDocument4 pagesPinocchioBars 03 2010 V2 PDFanalyst_anil14No ratings yet

- Technical Perspectives: Louise Yamada Technical Research Advisors, LLCDocument8 pagesTechnical Perspectives: Louise Yamada Technical Research Advisors, LLCanalyst_anil14No ratings yet

- Managing Growth SharesDocument13 pagesManaging Growth Sharesanalyst_anil14100% (1)

- Ta Tutorial - Module 03Document7 pagesTa Tutorial - Module 03analyst_anil14No ratings yet

- 20-Rules 102808 PDFDocument22 pages20-Rules 102808 PDFelisa100% (1)

- Cycles in Time and MoneyDocument7 pagesCycles in Time and MoneyNDameanNo ratings yet

- Hull Moving AverageDocument19 pagesHull Moving Averagecsp_675491100% (3)

- Stein Stan - Secrets For Profiting in Bull and Bear MarketsDocument5 pagesStein Stan - Secrets For Profiting in Bull and Bear MarketsAnmol Bajaj100% (3)

- US Market CrashesDocument14 pagesUS Market Crashesjohn2ma2No ratings yet

- CWT The One Thing 2nd EditionDocument54 pagesCWT The One Thing 2nd Editionanalyst_anil14No ratings yet

- The Blue Chip Report: Important - Variation in ResultsDocument7 pagesThe Blue Chip Report: Important - Variation in Resultsanalyst_anil14No ratings yet

- Ta Tutorial - Module 04Document4 pagesTa Tutorial - Module 04analyst_anil14No ratings yet

- US Market Crashes PDFDocument14 pagesUS Market Crashes PDFanalyst_anil14No ratings yet

- Double-Bottom 102808 PDFDocument16 pagesDouble-Bottom 102808 PDFanalyst_anil14No ratings yet

- 1110 RaschkeDocument29 pages1110 Raschkeanalyst_anil14100% (1)

- Chapter 17. Bothriocephalus Acheilognathi Yamaguti, 1934: December 2012Document16 pagesChapter 17. Bothriocephalus Acheilognathi Yamaguti, 1934: December 2012Igor YuskivNo ratings yet

- Thief King's Vault PDFDocument24 pagesThief King's Vault PDFCarlos Eduardo Schnorr100% (2)

- Learn Microscope Parts & Functions Under 40x MagnificationDocument3 pagesLearn Microscope Parts & Functions Under 40x Magnificationjaze025100% (1)

- Task 2 AmberjordanDocument15 pagesTask 2 Amberjordanapi-200086677100% (2)

- Gujarat State Eligibility Test: Gset SyllabusDocument6 pagesGujarat State Eligibility Test: Gset SyllabussomiyaNo ratings yet

- Application of Leadership TheoriesDocument24 pagesApplication of Leadership TheoriesTine WojiNo ratings yet

- Control System Question BankDocument3 pagesControl System Question Bankmanish_iitrNo ratings yet

- Solar CompendiumDocument19 pagesSolar CompendiumCasey Prohn100% (4)

- CSR & Corporate FraudDocument18 pagesCSR & Corporate FraudManojNo ratings yet

- Business Statistics: Methods For Describing Sets of DataDocument103 pagesBusiness Statistics: Methods For Describing Sets of DataDrake AdamNo ratings yet

- Sociology of Behavioral ScienceDocument164 pagesSociology of Behavioral ScienceNAZMUSH SAKIBNo ratings yet

- Ipw - Proposal To OrganizationDocument3 pagesIpw - Proposal To Organizationapi-346139339No ratings yet

- Positive Efefcts of Extra Curricular ActivitiesDocument6 pagesPositive Efefcts of Extra Curricular Activitiesamira ashariNo ratings yet

- Doctors not guilty of negligence in patient's deathDocument1 pageDoctors not guilty of negligence in patient's deathAlleine TupazNo ratings yet

- Photobiomodulation With Near Infrared Light Helmet in A Pilot Placebo Controlled Clinical Trial in Dementia Patients Testing MemorDocument8 pagesPhotobiomodulation With Near Infrared Light Helmet in A Pilot Placebo Controlled Clinical Trial in Dementia Patients Testing MemorarexixNo ratings yet

- Forbidden TextsDocument179 pagesForbidden TextsThalles FerreiraNo ratings yet

- Quarter 3 - Module 8: The Power (Positivity, Optimism and Resiliency) To CopeDocument3 pagesQuarter 3 - Module 8: The Power (Positivity, Optimism and Resiliency) To Copejonalyn felipe100% (1)

- Integra® Licox® PtO2 Monitor User's ManualDocument134 pagesIntegra® Licox® PtO2 Monitor User's ManualSrajner PéterNo ratings yet

- 10, Services Marketing: 6, Segmentation and Targeting of ServicesDocument9 pages10, Services Marketing: 6, Segmentation and Targeting of ServicesPreeti KachhawaNo ratings yet

- Problem Set 1Document5 pagesProblem Set 1sxmmmNo ratings yet

- Jim Kwik - 10 Morning Habits Geniuses Use To Jump Start The Brain - YouTube Video Transcript (Life-Changing-Insights Book 15) - Stefan Kreienbuehl PDFDocument5 pagesJim Kwik - 10 Morning Habits Geniuses Use To Jump Start The Brain - YouTube Video Transcript (Life-Changing-Insights Book 15) - Stefan Kreienbuehl PDFCarlos Silva100% (11)

- Beginners Guide To Sketching Chapter 06Document30 pagesBeginners Guide To Sketching Chapter 06renzo alfaroNo ratings yet

- Destined To ReignDocument7 pagesDestined To ReignMichael B. BolotaoloNo ratings yet

- Altered Mental Status: by Diana King, MD, and Jeffrey R. Avner, MDDocument9 pagesAltered Mental Status: by Diana King, MD, and Jeffrey R. Avner, MDchintya claraNo ratings yet

- Juvy Ciocon-Reer v. Juddge Lubao (DIGEST)Document1 pageJuvy Ciocon-Reer v. Juddge Lubao (DIGEST)Glory Grace Obenza-Nodado100% (1)

- Advertising and Promotion An Integrated Marketing Communications Perspective 11Th Edition Belch Solutions Manual Full Chapter PDFDocument36 pagesAdvertising and Promotion An Integrated Marketing Communications Perspective 11Th Edition Belch Solutions Manual Full Chapter PDFjames.graven613100% (13)

- PV LITERATURE ROUGHDocument11 pagesPV LITERATURE ROUGHraghudeepaNo ratings yet

- The Curse of MillhavenDocument2 pagesThe Curse of MillhavenstipemogwaiNo ratings yet

- Pastors Sunday MessageDocument4 pagesPastors Sunday MessageDiana Janica Magalong100% (1)

- Linkbelt Telescopic Truck Crane HTC 840 HTC 850 Service ManualDocument22 pagesLinkbelt Telescopic Truck Crane HTC 840 HTC 850 Service Manualcindyhorton080191pay100% (124)