Professional Documents

Culture Documents

Paper

Uploaded by

Adnan SethiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paper

Uploaded by

Adnan SethiCopyright:

Available Formats

Impact of financial leverage on dividend policy at Tehran Stock Exchange: A case study of food

industry

Problem statement:

Dividend policy became one of the main component of financial leverage. Number of researches are

conducted on dividend repayment and capital structure. Most of these researches are based upon the

current theories of dividend payment, but these theories are fail to define about how much dividend is

paid and what extent of dividend is retained by the organizations. Dividend payment scenarios are solely

dependent upon manager decisions. For stance, if the organization pays a large amount of dividend to

shareholders, the lesser will be the retained earnings of the company for repayment of debt and vice

versa.

Among different researches, much of the work is done on relationship between dividend policy and

leverage is in developed countries. There is not considerable study that can study the relationship

between dividend policy and financial leverage in Iranian stock.

Research Gap:

This study defines the relationship between the dividend structure and the financial leverage in Iranian

food sector, because of consideration of dividend as an important determinant of calculation of financial

risk and capital structure of the organization. This study derives the behavior of organizations as

dividend policy and link it with the financial leverage to study the dynamic of relationship between

them.

Theoretical background to justify the relationship:

This research uses the linter model (1956) to derive the relationship, in which dividend per share is

taken as a proxy of dividend policy of a firm and dividend yield, debt ratios and changes in earnings as a

proxy of financial leverage for independent variables. The change in earning are taken on the basis of

fama and babaik study (1968), which shows that the linter model is improved by introducing an

additional term like retained earnings of previous year of the organization. The dividend payment

practice from the current year profits constitutes the most related and important variable which causes

the change in the dividend while dividend payment practices and policies of the companies are also

influenced by the previous dividend paying period

Financial leverage is considered as independent variable, because it has a main role in reduction of

agency problems between management and ownership. However, the determinants for financial

leverage are condensed from the study of attiya (2009) adopting extended linter model in Pakistan non-

financial listed organizations.

This study replicates the model of asif et al (2011) study conducted on stock exchange in Pakistan, which

is on the determinants of dividend policy in Pakistan, and uses the same model and same variables for

deriving the relationship in context of Pakistan.

Model:

The study uses the research model devised by linter in (1956), but in its extended form as defined by

fama and babaik (1968). However the conceptual framework of this study is as following:

Variables of the study includes dividend yield, debt ratio, while changes in earnings is included as a

dummy variable in this study.

Operationalization of variables:

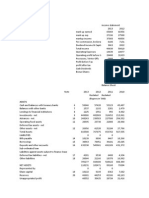

Dividends per share (DPS) = Total amount of dividends No. of shares of the firm i at time t.

Debt ratio (DR) /Leverage = Total debt Total assets of the firm i at time t.

Dividend yield (DY) = Dividend per share Price of the share (The chosen price, applied as

denominator, corresponds to the share price at the end of financial year, when all the dividend

announcements for corporate dividend have been made).

Changes in earnings (E) = Earnings it Earnings i, t-1 Earnings i, t-1

and it is the error term.

Along with descriptive statistics Regression and correlation techniques are used in this research to

define the relationship.

Some of the results of this study are matched with the similar study on broader context is studied by asif

at el (2011) in Pakistan like debt ratio and dividend are significantly related in case of Pakistan, but in

this study, they are insignificant.

This study results also correlates with the jelling (2007) study here is no significant relationship

between companies profits that meet to financial leverage rather than profits that have high

financial leverage in same times. Other results in research explain if comparison is performed by

other factors such as free cash flow and companys growth and development, difference in profit will be

significant, that is accordance with our results. That means, there are other factors that have high

effect on dividend policy

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Following Tables Contain Financial Statements For Dynastatics Corporation AlthoughDocument2 pagesThe Following Tables Contain Financial Statements For Dynastatics Corporation Althoughtrilocksp SinghNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Harvard Financial Accounting Final Exam 3Document11 pagesHarvard Financial Accounting Final Exam 3Bharathi Raju0% (1)

- Chapter 1 - Accounting As A Form of Communication (Notes)Document7 pagesChapter 1 - Accounting As A Form of Communication (Notes)Hareem Zoya WarsiNo ratings yet

- MBA Finance 1st Semester Final Previous QuestionDocument8 pagesMBA Finance 1st Semester Final Previous Questionmuhammad shahid ullahNo ratings yet

- Fac2601 PDFDocument7 pagesFac2601 PDFoscar.matenguNo ratings yet

- Capital Budgeting AssignmentDocument6 pagesCapital Budgeting AssignmentAdnan SethiNo ratings yet

- Section 1: Demographic InformationDocument2 pagesSection 1: Demographic InformationAdnan SethiNo ratings yet

- Logic Bs-IIIDocument139 pagesLogic Bs-IIIAdnan Sethi0% (1)

- Section 1: Demographic InformationDocument2 pagesSection 1: Demographic InformationAdnan SethiNo ratings yet

- My Internship Report 13Document73 pagesMy Internship Report 13Adnan SethiNo ratings yet

- ARDLDocument10 pagesARDLAdnan SethiNo ratings yet

- Guru AssignmentDocument3 pagesGuru AssignmentAdnan SethiNo ratings yet

- Rough Justification For PaperDocument2 pagesRough Justification For PaperAdnan SethiNo ratings yet

- Calculation of KSE 100 IndexDocument10 pagesCalculation of KSE 100 IndexAdnan SethiNo ratings yet

- B.F PaperDocument3 pagesB.F PaperAdnan SethiNo ratings yet

- MCB AnalysisDocument7 pagesMCB AnalysisAdnan SethiNo ratings yet

- Book 1Document8 pagesBook 1Adnan SethiNo ratings yet

- Case Study Dot Com CrashDocument2 pagesCase Study Dot Com CrashElaineKongNo ratings yet

- Guru AssignmentDocument3 pagesGuru AssignmentAdnan SethiNo ratings yet

- Not All Contract Breach Are The Same The Interconnection of Social Exchange and Psychological Contract Processes in OrganizationsDocument1 pageNot All Contract Breach Are The Same The Interconnection of Social Exchange and Psychological Contract Processes in OrganizationsAdnan SethiNo ratings yet

- L21 TheDot ComBubbleDocument17 pagesL21 TheDot ComBubbleAdnan SethiNo ratings yet

- Cash Flow StatementDocument10 pagesCash Flow StatementAdnan SethiNo ratings yet

- Cost Management and Strategy - An Overview: QuestionsDocument29 pagesCost Management and Strategy - An Overview: QuestionsAdnan SethiNo ratings yet

- 7.1 KSE 100 & General Index of All Shares: Sector NameDocument5 pages7.1 KSE 100 & General Index of All Shares: Sector NameZahid RehmanNo ratings yet

- GDP GrowthDocument1 pageGDP GrowthAdnan SethiNo ratings yet

- EconomicsDocument7 pagesEconomicsAdnan SethiNo ratings yet

- EconomicsDocument7 pagesEconomicsAdnan SethiNo ratings yet

- 1 Page EssayDocument1 page1 Page EssayAdnan SethiNo ratings yet

- The Impact of Personality On Psychological ContractsDocument1 pageThe Impact of Personality On Psychological ContractsAdnan SethiNo ratings yet

- Managment ArticlesDocument1 pageManagment ArticlesAdnan SethiNo ratings yet

- Pioneer Cement FinalDocument48 pagesPioneer Cement FinalAdnan SethiNo ratings yet

- Internship Report On Nishat MillsDocument45 pagesInternship Report On Nishat MillsSana KhanNo ratings yet

- 348 - Master of Commerce Part 1 M.Com GernarelDocument36 pages348 - Master of Commerce Part 1 M.Com GernarelAmisha Singh VishenNo ratings yet

- Investor Presentation (Company Update)Document48 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- Winnipeg Enterprises Inc Reported The Following Summarized Balance Sheet atDocument2 pagesWinnipeg Enterprises Inc Reported The Following Summarized Balance Sheet atMuhammad ShahidNo ratings yet

- Tax Guide 2015Document58 pagesTax Guide 2015Anatolii PasichnykNo ratings yet

- Equity Analysis and Valuation: AnalyzeDocument13 pagesEquity Analysis and Valuation: AnalyzeElfrida YulianaNo ratings yet

- Dentsu Annual Report For The Year Ended March 31 2009Document94 pagesDentsu Annual Report For The Year Ended March 31 2009leonnoxNo ratings yet

- Cma TemplateDocument25 pagesCma TemplateSavoir PenNo ratings yet

- Accounting Final ProjectDocument21 pagesAccounting Final ProjectKeenNo ratings yet

- Executive SummaryDocument49 pagesExecutive SummaryMuhsin ShahNo ratings yet

- (1963) RA 3591-PDIC CharterDocument10 pages(1963) RA 3591-PDIC CharterDuko Alcala EnjambreNo ratings yet

- United States v. Davis, 397 U.S. 301 (1970)Document10 pagesUnited States v. Davis, 397 U.S. 301 (1970)Scribd Government DocsNo ratings yet

- FINA2010 Financial Management: Lecture 6: Bond and Stock ValuationDocument61 pagesFINA2010 Financial Management: Lecture 6: Bond and Stock ValuationmoonNo ratings yet

- The Relevance of Leverage, Profitability, Market Performance, and Macroeconomic To Stock PriceDocument11 pagesThe Relevance of Leverage, Profitability, Market Performance, and Macroeconomic To Stock PriceHalimahNo ratings yet

- Investment HomeworkDocument14 pagesInvestment HomeworkĐức HoàngNo ratings yet

- Instruction: Write The Letter of Your Choice On The Space Provided Before The NumberDocument4 pagesInstruction: Write The Letter of Your Choice On The Space Provided Before The NumberASDDD100% (2)

- ABB India 2003 Annual ReportDocument76 pagesABB India 2003 Annual ReportKunal DesaiNo ratings yet

- 208-Test-Bank-2nd-Edth s1 2019Document96 pages208-Test-Bank-2nd-Edth s1 2019MilanNo ratings yet

- It Governance Technology-Chapter 01Document4 pagesIt Governance Technology-Chapter 01IQBAL MAHMUDNo ratings yet

- Chola FY21Document137 pagesChola FY21city OfficeNo ratings yet

- Fast Food Restaurant Business PlanDocument6 pagesFast Food Restaurant Business PlanChris MineNo ratings yet

- Lecture 1 Introduction Financial Management PDFDocument29 pagesLecture 1 Introduction Financial Management PDFKamauWafulaWanyamaNo ratings yet

- Nature and Scope of Financial ManagementDocument78 pagesNature and Scope of Financial ManagementNguyen Dac ThichNo ratings yet

- Dividend PolicyDocument47 pagesDividend PolicyniovaleyNo ratings yet

- Desco Final Account AnalysisDocument26 pagesDesco Final Account AnalysiskmsakibNo ratings yet

- Marks & Spencer PLCDocument7 pagesMarks & Spencer PLCMoona AwanNo ratings yet