Professional Documents

Culture Documents

To Take An Integrated View of The Overall Development of India

Uploaded by

jophythomasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

To Take An Integrated View of The Overall Development of India

Uploaded by

jophythomasCopyright:

Available Formats

To take an integrated view of the overall development of India's foreign trade, a

comprehensive Foreign Trade Policy (FTP) for 2004-09 was announced on 31st August,

2004 and its Annual Supplement was released for the year 2006-07 on 7th April, 2006. The

basic objective of this policy is to double our percentage share of global merchandise trade in

next five years and to make exports an effective instrument of economic growth by giving

thrust to employment generation particularly in semi urban and rural areas through a number

of policy initiatives. These include simplification of procedures, reduction in transaction

costneutralization of incidence of levies and duties on inputs used for exports and

development of global hubs for manufacturing, trading and services. Keeping in view the

interest of domestic entrepreneur, farmers, traders as well as India's international

commitments and bilateral treaties, amendments/changes in policy are made from time to

time as and when these become necessary in public interest.

Some of the major initiatives taken recently including measures announced in the Annual

Supplement to the FTP in April, 2006 are given below:

Hon'ble Commerce & Industry Minister addressing a Press Conference to Announcethe Annual Supplement to the FTP 2004-09 in New

Delhi on 7th April 2006)

Focus Market Scheme

The Scheme has been introduced w.e.f 1-4-2006. The Scheme aims at offsetting the high

freight cost and other disabilities faced in accessing select international markets. The

initiative will enhance India's export competitiveness in these regions. The Scheme allows

duty credit facility @ 2.5 per cent of the FOB value of exports of all products to the notified

countries.

Focus Product Scheme

The Scheme has been introduced w.e.f 1-4-2006. It provides incentives to export of products

which have high employment potential in rural and semi urban areas in order to offset the

inherent infrastructure bottlenecks and other associated costs involved in marketing of such

products.

The Scheme allows duty credit facility @ 2.5 per cent of the FOB value of exports to 50 per

cent of the export turnover of notified products such as value added fish and leather products,

stationery items, fireworks, sports goods, handloom products bearing handloom mark and

handicraft items.

The scrip and the items imported against both the above mentioned schemes would be freely

transferable. The Duty Credit, thus obtained may be used for import of inputs or goods

including capital goods, provided the same is freely importable under ITC (HS).

Exporters will have the option to avail of the benefits in respect of the same exported

product/s under only one of the three schemes i.e. the Focus Market Scheme, the Focus

Product Scheme or the Vishesh Krishi and Gram Udyog Yojana.

Vishesh Krishi and Gram Udyog Yojana (Special Agriculture and Village Industry

Scheme)

Keeping in view the objective of Foreign Trade Policy to promote employment generation in

rural and semi urban areas, it has been decided to incentivise the export of Gram Udyog

products i.e. village and cottage industry products by awarding a duty free scrip @ 5 per cent

of FOB value of exports under the expanded Vishesh Krishi Upaj Yojana, which has been

renamed as Vishesh Krishi and Gram Udyog Yojana.

However, the duty credit scrip shall be granted only at a reduced rate of 3.5 per cent of the

FOB value of exports in such cases where the exporter has availed the benefits under Chapter

4 of this Policy for import of Agriculture Inputs (other than catalysts, consumable and

packing materials) relating to export item under this scheme. The certificate can be used for

import of all freely importable items except capital goods or other such items as have been

notified by DGFT. The scrip and the items imported against it shall be freely transferable.

In terms of number of applications received during April to December, 2006, a growth rate of

394 per cent has been recorded over the number of applications during April-December 2005.

Similarly, in terms of value of Duty Credit issued, a growth rate of 296 per cent was

recorded.

Service Exports

A number of trade friendly features have been included in the Served from India Scheme to

meet the requirements of Service Exporters:

Service exports in Indian Rupees, which are otherwise considered as having been paid

for in free foreign exchange by RBI, will now qualify for benefits under the Served

from India Scheme. In addition, the foreign exchange earned through International

Credit Cards and other instruments as permitted by RBI for rendering of service by

the service providers shall be taken into account for the purposes of computation of

entitlement under the Scheme.

Benefits of the Scheme earned by one service provider of a Group company can now

be utilized by other service provider of the same Group Company including managed

hotels. The measure aims to supporting the Group service companies not earning

foreign exchange in getting access to the international quality products at competitive

prices and providing services of international standards. This new initiative allows

transfer of both the scrip and the imported input to the Group Service Company,

whereas the earlier provision allowed transfer of imported material only.

Stand-alone restaurants will now be eligible for benefits under Served from India

Scheme @ 10 per cent of FOB value of exports (instead of the earlier 20 per cent).

Package for Marine Sector

List of specialized inputs used in the marine sector has been expanded to include

additional items of chemicals and additives within the present duty free entitlement of

1 per cent.

Self removal procedure for clearance of seafood waste to be applicable subject to

prescribed wastage norms.

Gems & Jewellery Sector

Re-import of rejected Jewellery on payment of Customs Duty on the inputs and not

the Jewellery exported earlier under Export Promotion Scheme.

Import of Precious Metal Scrap/Used Jewellery for melting and re-export of

Jewellery/Bullion etc., thereby increasing the capacity utilisation of the refineries in

India.

Export of Jewellery on Consignment Basis allowed.

Extension of the facility of legal undertaking in lieu of Bank Guarantee to reduce

transaction cost.

Export of cut and Polished Precious and Semi-precious Stones for treatment and re-

import for further value addition within the country.

Export of Gems & Jewellery for Export Promotion Tours, thereby reducing the

transaction cost and time.

Procedural simplification introduced relating to:

1. Inclusion of New Research Center of DTC in U.K. for the facility of Testing and

Certification of Cut and Polished Diamonds.

2. Inclusion of Customs Ports of Cochin and Coimbatore for personal carriage of Gems

and Jewellery.

Duty Free Import Authorization (DFIA)

A new Scheme called DFIA was launched w.e.f.1.5.2006. It offers the facility of duty free

imports for exports and allows the facility of transferability of scrip or the imported inputs

once the export obligation is completed.

Advance Authorization Scheme (AA)

In addition to the existing facility under the scheme, supply of stores to out-going

vessels/aircrafts is now entitlement for duty free import of inputs under the scheme. This will

enable India to offer competitive fuel prices and will attract mid-route stops of the

international flights. Hence, it will promote India as a re-fuelling center.

A total of 1,23,863 applications were received during the period April-December 2006

compared to 71,706 applications received during the corresponding period in the year 2005,

thus recording a growth rate of 72.7 per cent.

Duty Free Replenishment Certificate (DFRC)

DFRC Scheme has been withdrawn w.e.f. 1.5.2006.

Duty Entitlement Pass Book (DEPB)

DEPB Scheme shall continue till the same is replaced by a new Scheme, which is under

consideration by an Expert Group constituted for the purpose.

EPCG Scheme

With a view to accelerate exports under this scheme, the EPCG authorization holders, who

fulfill 75 per cent or more of Export Obligation (E.O.) within half or less than half of the

specified E.O. period, are exempted from fulfilling the balance E.O. and the authorization can

be redeemed by the licensing authority concerned. Further, the norms for maintenance of

average export obligation under the Scheme are being re-visited for streamlining it as per

current requirement.

Export Oriented Units (EOUs)/Electronic Hardware Technology Park

(EHTP)/Software Technology Part (STP)/Biotechnology Part (BTP)

EOUs have been allowed to effect supplies in the Domestic Tariff Area (DTA) against

Foreign exchange remittance received from overseas and such supplies will be counted for

the purpose of fulfillment of Export Obligation. Similarly, in addition to supplies to holders

of advance authorization, EOUs are allowed to make supplies under duty free import

authorization scheme. The IT enabled services / business process outsourcing units have been

made eligible for reimbursement of Central sales tax, even without a 'C' form.

Deemed Exports

In addition to Advance authorization, supply of goods against duty free replenishment

certificate and duty free import authorization have been treated as deemed export for grant of

benefits under chapter-8 of Foreign Trade Policy.

A comparative status on Export and Import Licences issued during the year 2005 and 2006 is

in shown the graph below:

Graph 3.1 & 3.2 depict the growth in number and value of export under top four categories of

licences issued during April-Dec 2006 Vs April-Dec 2005. Graph 3.3 and 3.4 depict

percentage share of number and value of exports of major licences issued under export

promotion schemes.

Trade Facilitation

To enable the users to make commercial decisions in a more professional manner,

DGCI&S trade data is being made available with minimum time lag in a query based

structured format on commercial criteria.

All DGFT offices continued to provide facilitation to exporters in regard to

developments in international trade i.e. WTO agreements, Rules of Origin and SPS

requirements, Anti-Dumping issues, etc. to help the exporters to strategise their

import and export decisions in an internationally dynamic environment.

To promote export of 'Minor Forest Products', Shellac Export Promotion Council has

been designated as a nodal EPC for minor forest produce.

All EPCs have opened a separate Cell to involve and encourage youth and women

entrepreneurs in the export effort.

It has also been decided to develop a Trademark for Handloom on lines similar to

'Woolmark' and 'Silkmark'.

In order to maintain quality and retain the brand equity of Indian Teas, a new Tea

(Distribution and Export) Control Order, 2005 was issued which prescribes strict

norms for tea. Tea has been classified for the purpose of issue of non-preferential

Certificate of Origin into three categories. A minimum value addition norm of 50 per

cent on export of all imported tea and a time period of 6 months from the date of

import for the export of imported tea have been prescribed.

Keeping in view the need to serve the exporting community and providing them

requisite services at the door step, a new office was opened at Dehradun to cater to the

exporters and importers of State of Uttranchal.

EDI Initiatives

DGFT is also committed to simplify procedures relating to International Trade and to put in

place an exporter friendly regime for obtaining import authorizations under various Export

Promotion Schemes administered by it. The following EDI initiatives are being taken: -

Bring all the community partners dealing with international trade on an EDI enabled

platform to reduce transaction costs;

Extend the online web enabled application procedure for issue of licence /

authorization to other categories of licences / authorization;

Consolidate the message exchange system with Customs and extend its scope to cover

all categories of Shipping Bills relating to different export promotion schemes;

Doing away with the manual double verification of the authorisation system by way

of online validation with the Customs Authority initially atleast for the ports having

EDI facility.

Important Notifications during the Year 2006-07

Import policy of Cellular Telephone, Narcotic Drugs and Psychotropic Substances

under the NDPS Act and NDPS Rules, Human Blood, Boric Acid, Fish Lipid Oil,

PVC Scrap, and 6-APA (Exim Code 2941 1050) has been amended.

Import of Kuth Roots, Cactus, Agar Wood, Serpentina Roots, and Agar Oil,

Trichloroethance a Sandal Wood (Santalum Alvurm) has been restricted.

Due to the reporting of the outbreak of Highly Pathogenic Avial Influenza (Fowl

Plague), imports of certain livestock and livestock products have been prohibited.

Chloroform has been made freely importable.

Units in the Special Economic Zone will be allowed to sell Worn Clothing in the

Domestic Tariff Area to the extent of 15 per cent of the CIF value of imports made in

the previous year.

Condition No.18 of Chapter 1A (General Notes Regarding Import Policy) will not

apply to import of Soyabean Oil till 31.3.2007.

Export of sugar was banned during July 2006 to 31st March 2007. However, the

Government has allowed export of sugar with quantitative saving from January 2007

onwards.

Export of pulses has been prohibited from end of June 2006 till 31.3.2007.

Export of wheat, which has been prohibited up to 31.12.2007 shall remain in

abeyance till 28 February 2007. During this period import of wheat is allowed freely.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Dated: 31 Aug & 2 Sept, 2013 TopicDocument20 pagesDated: 31 Aug & 2 Sept, 2013 TopicjophythomasNo ratings yet

- Operations Management: Topic: Quality Control, Total QualityDocument18 pagesOperations Management: Topic: Quality Control, Total QualityjophythomasNo ratings yet

- Notes On Monetary & Credit Policy of RBIDocument5 pagesNotes On Monetary & Credit Policy of RBIjophythomasNo ratings yet

- How Digital Marketing Helped AvatarDocument3 pagesHow Digital Marketing Helped AvatarjophythomasNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 09 Chapter 1Document45 pages09 Chapter 1AJITNo ratings yet

- Question 4 - MbaDocument3 pagesQuestion 4 - MbaRatul GoswamiNo ratings yet

- Chapter 12Document7 pagesChapter 12Xynith Nicole RamosNo ratings yet

- The Legal Nature of WTO Obligations and The Consequences of Their ViolationDocument20 pagesThe Legal Nature of WTO Obligations and The Consequences of Their Violationrohan hebbalNo ratings yet

- Fields MappingDocument15 pagesFields MappingChristian RamosNo ratings yet

- Osm ProjectDocument14 pagesOsm ProjectADi SEPTIAWANNo ratings yet

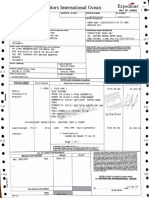

- !: SRR - RN N T MN: Expeditors International OceanDocument1 page!: SRR - RN N T MN: Expeditors International OceanLuis Felipe Laurada LiloyNo ratings yet

- Accounting ch9 Solutions QuestionDocument49 pagesAccounting ch9 Solutions Questionaboodyuae2000No ratings yet

- Bustax Chapter 1Document9 pagesBustax Chapter 1Pineda, Paula MarieNo ratings yet

- Maitry Research TybafDocument40 pagesMaitry Research TybafMaitry VasaNo ratings yet

- Anti Dumping Case VietnamDocument3 pagesAnti Dumping Case VietnamVY HOÀNG THÁI NHƯNo ratings yet

- German ExhibitionsDocument39 pagesGerman ExhibitionsMallikarjun Raju100% (1)

- Verify Copy: Bill of Lading For Ocean Transport or Multimodal TransportDocument2 pagesVerify Copy: Bill of Lading For Ocean Transport or Multimodal Transportdaniyal mehmoodNo ratings yet

- BL Draft Tyo0457749Document2 pagesBL Draft Tyo0457749Constant Ngalamou TiadeuNo ratings yet

- A2 MicroEconomics Summary NotesDocument106 pagesA2 MicroEconomics Summary Notesangeleschang99No ratings yet

- Porters Five Forces Model - Textile IndustryDocument3 pagesPorters Five Forces Model - Textile Industrykritiangra60% (10)

- Compound InterestDocument4 pagesCompound InterestNeha JainNo ratings yet

- Accounting Special Transaction - PartnershipDocument12 pagesAccounting Special Transaction - PartnershipMikee LajatoNo ratings yet

- 1.5 Borrowing CostsDocument37 pages1.5 Borrowing CostsMinal BihaniNo ratings yet

- Taxation AssignmentDocument3 pagesTaxation AssignmentAadheesh SoodNo ratings yet

- AC InvoiceDocument1 pageAC InvoiceVickySaravananNo ratings yet

- Semester Wise Syllabus of B.A. Semester-III Paper-II Public FinanceDocument10 pagesSemester Wise Syllabus of B.A. Semester-III Paper-II Public FinanceVishal A KumarNo ratings yet

- Empty Marine Container Logistics: Facts, Issues and Management StrategiesDocument15 pagesEmpty Marine Container Logistics: Facts, Issues and Management StrategiesAdhi GunarwanNo ratings yet

- FIN 30220: Macroeconomic Analysis: Capital MarketsDocument66 pagesFIN 30220: Macroeconomic Analysis: Capital MarketsPushpa KamatNo ratings yet

- Test Bank For International Economics 9th Edition by HustedDocument6 pagesTest Bank For International Economics 9th Edition by HustedJennifer Vega100% (42)

- BMGT 21Document4 pagesBMGT 21ashley nicoleNo ratings yet

- s.6 Economics Past PaperDocument7 pagess.6 Economics Past PaperMukasa NajibNo ratings yet

- Abfm CH 10 FullDocument30 pagesAbfm CH 10 Fullarjunjec123No ratings yet

- IABF FEU Midyear Tuition Rates SY2020 2021Document10 pagesIABF FEU Midyear Tuition Rates SY2020 2021Janjo SevillaNo ratings yet