Professional Documents

Culture Documents

P8 Financial Analysis

Uploaded by

Dhanushka RajapakshaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P8 Financial Analysis

Uploaded by

Dhanushka RajapakshaCopyright:

Available Formats

The Chartered Institute of Management Accountants 2008

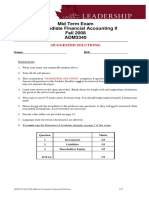

November 2008 Examinations

Managerial Level

Paper P8 Financial Analysis

Question Paper 2

Examiners Brief Guide to the Paper 18

Examiners Answers 20

The answers published here have been written by the Examiner and should provide a helpful

guide for both tutors and students.

Published separately on the CIMA website (www.cimaglobal.com/students) from February is

a Post Examination Guide for the paper which provides much valuable and complementary

material including indicative mark information.

The Chartered Institute of Management Accountants. All rights reserved. No part of this publication may be

reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical,

photocopying, recorded or otherwise, without the written permission of the publisher.

P8 2 November 2008

Financial Management Pillar

Managerial Level Paper

P8 Financial Analysis

18 November 2008 Tuesday Afternoon Session

Instructions to candidates

You are allowed three hours to answer this question paper.

You are allowed 20 minutes reading time before the examination begins

during which you should read the question paper and, if you wish, highlight

and/or make notes on the question paper. However, you will not be allowed,

under any circumstances, to open the answer book and start writing or use

your calculator during this reading time.

You are strongly advised to carefully read ALL the question requirements

before attempting the question concerned (that is all parts and/or sub-

questions). The question requirements for questions in Sections B and C are

highlighted in a dotted box.

ALL answers must be written in the answer book. Answers written on the

question paper will not be submitted for marking.

Answer the ONE compulsory question in Section A. This has seven objective

test questions on pages 2 to 4.

Answer ALL THREE questions in Section B on pages 5 to 7.

Answer TWO of the three questions in Section C on pages 8 to 13.

Maths Tables are provided on pages 15 to 17.

The list of verbs as published in the syllabus is given for reference on the

inside back cover of this question paper.

Write your candidate number, the paper number and examination subject title

in the spaces provided on the front of the answer book. Also write your

contact ID and name in the space provided in the right hand margin and seal

to close.

Tick the appropriate boxes on the front of the answer book to indicate which

questions you have answered.

P

8

F

i

n

a

n

c

i

a

l

A

n

a

l

y

s

i

s

November 2008 3 P8

SECTION A 20 MARKS

[indicative time for answering this Section is 36 minutes]

ANSWER ALL SEVEN SUB-QUESTIONS

Instructions for answering Section A:

The answers to the seven sub-questions in Section A should ALL be

written in your answer book.

Your answers should be clearly numbered with the sub-question number and

then ruled off, so that the markers know which sub-question you are answering.

For multiple choice questions, you need only write the sub-question

number and the letter of the answer option you have chosen. You do not

need to start a new page for each sub-question.

For sub-questions 1.3 and 1.7, you should show your workings as marks are

available for method for these sub-questions.

Question One

1.1 On 31 August 2007, the consolidated balance sheet of MIP included minority interests

of $77,600. One year later, on 31 August 2008, the minority interests balance was

$64,700. During the year ended 31 August 2008, MIP had disposed of its holding of

75% of the ordinary share capital of its subsidiary NJ Z. At the date of disposal the net

assets of NJ Z totalled $64,000. The minority interests in the MIP groups profits for the

year ended 31 August 2008 was $6,500.

What amount was included in the consolidated cash flow statement as a dividend paid to the

minority interests during the year ended 31 August 2008?

A $3,100

B $3,400

C $19,400

D $22,400

(2 marks)

1.2 BJ J is planning to acquire a subsidiary, XZZ, for $13 million. The fair value of the net

assets recognised by XZZ in its own financial statements amounts to only $400,000.

BJ J s directors are confident that the difference between the amounts is accounted for

principally by unrecognised intangible assets. BJ J s directors wish, if possible, to

recognise these assets on acquisition.

Describe the conditions that must be met, in accordance with IFRS 3 Business Combinations,

in order to be able to recognise intangible assets upon acquisition of a subsidiary.

(2 marks)

P8 4 November 2008

1.3 J SX, a listed entity, has a defined benefits pension scheme. The following information

relates to the pension scheme for the year ended 31 October 2008:

$

Current service cost 362,600

Contributions to scheme 550,700

Benefits paid 662,400

Fair value of scheme assets at 1 November 2007 10,660,000

Fair value of scheme assets at 31 October 2008 11,204,000

Interest cost in respect of defined benefit obligation 730,600

The expected return on scheme assets for the year ended 31 October 2008 was 62%.

Calculate the actuarial gain or loss on J SXs pension scheme assets for the year ended

31 October 2008.

(4 marks)

1.4 Describe the principal characteristics common to joint venture arrangements, as

identified by IAS 31 Interests in Joint Ventures.

(2 marks)

1.5 During its 2008 financial year GZP makes the following investments:

1. A loan of $1,000,000 to one of its suppliers. The loan agreement stipulates that

GZP will not transfer or assign the loan to a third party. The supplier is obliged to

repay the loan in five years time and to pay interest at 2% over bank base rate

annually during the term of the loan.

2. Purchase of a small holding of shares in a listed company, ANG. GZPs

intention is to realise this investment towards the end of its financial year when

seasonal fluctuations in its business make a cash shortfall probable.

Neither asset is classified by GZP as being at fair value through profit or loss.

Explain how each of these financial assets should be

(i) initially classified; and

(ii) measured, subsequent to initial classification, in accordance with IAS 39 Financial

Instruments: Recognition and Measurement.

(4 marks)

1.6 Which ONE of the following statements is correct?

A derivative financial instrument

A can be recognised only if it is highly effective.

B requires little or no initial net investment.

C invariably forms part of a hedging relationship.

D should be valued at cost.

(2 marks)

November 2008 5 P8

1.7 On 1 April 2005, APL bought 30% of the 1 million $1 ordinary shares of CST for

$12 million, thus achieving significant influence over CSTs operations and policies.

The retained earnings of CST at the date of acquisition were $16 million.

Between the date of acquisition and 30 September 2008, APL groups financial year

end, CST had earned profits of $320,000.

APL sells goods to CST at a mark up of 25%. At 30 September 2008, CSTs

inventories included $100,000 of goods at cost that had been purchased from APL.

In the financial year ended 30 September 2007, CST paid a dividend of 10 per share

to its investors. Before that, no dividend had been paid by CST since 1 April 2005, and

there have been no changes in its issued share capital.

Identify the method of accounting that APL should use for CST in its consolidated financial

statements and, using this method, calculate the amount of the investment in CST for

inclusion in the consolidated balance sheet at 30 September 2008.

(4 marks)

(Total for Question One = 20 marks)

Reminder

All answers to Section A must be written in your answer book.

Answers to Section A written on the question paper will not be

submitted for marking.

End of Section A

P8 6 November 2008

SECTION B 30 MARKS

[indicative time for answering this Section is 54 minutes]

ANSWER ALL THREE QUESTIONS

Question Two

CIMAs Official Terminology defines intellectual capital as knowledge which can be used to

create value.

Currently, IFRS permit the recognition of only a limited range of internally generated

intellectual assets including, for example, copyrights.

Required:

(a) Explain the advantages that could be gained by entities and their stakeholders if

the scope of IFRS were expanded to permit the recognition in the balance sheet

of a wider range of intellectual assets, such as know-how, the value of the

workforce, and employee skills.

(5 marks)

(b) Explain the principal reasons why IFRS do not currently permit the recognition in

the balance sheet of intellectual assets such as know-how, the value of the

workforce, and employee skills.

(5 marks)

Total for Question Two = 10 marks

Section B continues on the next page

November 2008 7 P8

Question Three

AGZ is a listed entity. You are a member of the team drafting its financial statements for the

year ended 31 August 2008.

Extracts from the draft income statement, including comparative figures, are shown below:

2008 2007

$million $million

Profit before tax 2764 2627

Income tax expense 850 800

Profit for the period 1914 1827

At the beginning of the financial year, on 1 September 2007, AGZ had 750 million ordinary

shares of 50 in issue. At that date the market price of one ordinary share was 876.

On 1 December 2007, AGZ made a bonus issue of one new ordinary 50 share for every

three held.

In 2006, AGZ issued $75 million convertible bonds. Each unit of $100 of bonds in issue will

be convertible at the holders option into 200 ordinary 50 shares on 31 August 2012. The

interest expense relating to the liability element of the bonds for the year ended 31 August

2008 was $63 million (2007 $62 million). The tax effect related to the interest expense

was $20 million (2007 $18 million).

There were no other changes affecting or potentially affecting the number of ordinary shares

in issue in either the 2008 or 2007 financial years.

Required:

(a) Calculate earnings per share and diluted earnings per share for the year ended

31 August 2008, including the comparative figures.

(8 marks)

(b) Explain the reason for the treatment of the bonus shares as required by IAS 33

Earnings per Share.

(2 marks)

Total for Question Three = 10 marks

P8 8 November 2008

Question Four

At its year end on 31 August 2008, DNT held investments in two subsidiaries, CM and BL.

Details of the investments were as follows:

1. Several years ago DNT purchased 850,000 of CMs 1 million ordinary $1 shares when

CMs retained earnings were $1,775,000 (there were no other reserves). At 31 August

2008, CMs retained earnings were $2,475,000.

2. On 31 May 2008, DNT purchased 175,000 of BLs 250,000 $1 ordinary shares. At

1 September 2007, BLs retained earnings were $650,000 (there were no other

reserves). During the year ended 31 August 2008, BL made a loss after tax of

$40,000. It can be assumed that BLs revenue and expenses accrue evenly throughout

the year.

No adjustments to fair value of the subsidiaries net assets were required at either of the

acquisitions.

On 1 March 2007 CM sold an item of machinery to DNT for $75,000. The carrying amount of

the item at the date of sale was $60,000, and CM recorded a profit on disposal of $15,000.

The remaining useful life of the item at the date of sale was 25 years. The group

depreciation policy in respect of machinery is the straight line basis with a proportionate

charge in the years of acquisition and of disposal.

DNTs retained earnings balance at 31 August 2008 was $2,669,400.

Required:

Calculate the amounts of consolidated retained earnings and minority interest for

inclusion in the DNT groups balance sheet at 31 August 2008.

Total for Question Four = 10 marks

End of Section B

Section C starts on the next page

November 2008 9 P8

SECTION C 50 MARKS

[indicative time for answering this Section is 90 minutes]

ANSWER TWO QUESTIONS OUT OF THREE

Question Five

On 1 November 2003, DX invested in 100% of the share capital of EY, a new entity

incorporated on that date. EYs operations are located in a foreign country where the

currency is the Franc. DX has no other subsidiaries.

The summary financial statements of the two entities at their 31 October 2008 year-end were

as follows:

Summary income statements for the year ended 31 October 2008

DX EY

$000 Franc 000

Revenue 3,600 1,200

Cost of sales, other expenses and income tax (2,800) (1,000)

Profit for the period 800 200

Summary statements of changes in equity for the year ended 31 October 2008

DX EY

$000 Franc 000

Brought forward at 1 November 2007 5,225 1,500

Profit for the period 800 200

Dividends (200) -

Carried forward at 31 October 2008 5,825 1,700

Summary balance sheets at 31 October 2008

DX EY

$000 Franc 000

Property, plant and equipment 5,000 1,500

Investment in EY 25 -

Current assets 4,400 2,000

9,425 3,500

Share capital 1,000 50

Retained earnings 4,825 1,650

Current liabilities 3,600 1,800

9,425 3,500

Relevant exchange rates were as follows:

1 November 2003 1$ =20 francs

31 October 2007 1$ =23 francs

31 October 2008 1$ =27 francs

Average rate for year ended 31 October 2008 1$ =26 francs

P8 10 November 2008

Required:

(a) Explain the meaning of the term functional currency as used by IAS 21 The

Effects of Changes in Foreign Exchange Rates, and identify THREE factors that

an entity should consider in determining its functional currency.

(4 marks)

(b) Prepare:

(i) the summary consolidated income statement for the year ended

31 October 2008;

(2 marks)

(ii) the summary consolidated balance sheet at 31 October 2008.

(6 marks)

(c) Prepare the summary consolidated statement of changes in equity for the year to

31 October 2008 and a calculation that shows how the exchange gain or loss for

the year has arisen.

(13 marks)

Total for Question Five = 25 marks

Work to the nearest $

Section C continues on the next page

November 2008 11 P8

Question Six

You are assistant to the Chief Financial Officer (CFO) of SWW, a large fashion retailer.

SWWs merchandise is sourced from many different suppliers around the world. SWWs

senior management has a business policy of building lasting relationships with suppliers

either by investing in their shares, or by making loans to them at favourable rates of interest.

A request has recently been received from a supplier, TEX, for a loan of $25 million to allow it

to invest in up to date machinery. The directors of TEX claim that the investment will result in

efficiency improvements which, in the short to medium term, will allow it to reduce prices to its

customers. SWW is a major customer of TEX, buying approximately 10% of TEXs annual

output of cotton clothing.

In support of the application, TEXs CFO has supplied a one page report on the state of the

business, and a balance sheet and income statement for the year ended 30 September 2008.

The 2008 figures are unaudited. TEX has not paid a dividend in the last five years. TEXs

shares are listed on a local stock exchange, although the entitys founding family has retained

a minor holding. TEXs functional and presentation currency is the $, and its financial

statements are prepared in accordance with IFRS.

The financial statements supplied by TEX are as follows:

TEX: Consolidated income statement for the year ended 30 September 2008

2008 2007

$million $million

Revenue 2563 2817

Cost of sales (2266) (2431)

Gross profit 297 386

Selling and distribution costs (92) (89)

Administrative expenses (187) (156)

Finance costs (54) (62)

Share of losses of associate (13) (68)

(Loss)/profit before tax (49) 11

Income tax expense 15 (04)

(Loss)/profit for the period (34) 07

Attributable to:

Equity holders of parent (32) 06

Minority interest (02) 01

(34) 07

P8 12 November 2008

TEX: Consolidated balance sheet at 30 September 2008

2008 2007

$million $million $million $million

ASSETS

Non-current assets:

Property, plant and equipment 2214 2273

Investment in associate 138 151

Available for sale investments 26 48

2378 2472

Current assets:

Inventories 1324 1256

Trade and other receivables 517 582

Cash - 48

1841 1886

4219 4358

EQUITY AND LIABILITIES

Equity

Share capital ($1 shares) 250 250

Retained earnings and other reserves 1032 1062

Minority interest 137 139

1419 1451

Non-current liabilities:

Long-term borrowings 572 671

Deferred tax 180 258

Defined benefit obligation 260 242

1012 1171

Current liabilities:

Trade and other payables 1501 1612

Borrowings 287 124

1788 1736

4219 4358

Required:

Produce a report to the CFO of SWW that:

(a) analyses and interprets the information given above from the point of view of

SWW as a potential lender;

(20 marks)

(b) describes the areas of uncertainty in the analysis and the nature of any

additional information that will be required before a lending decision can be

made.

(5 marks)

Note: Up to 8 marks are available in part (a) for the calculation of relevant accounting

ratios.

Total for Question Six = 25 marks

November 2008 13 P8

Question Seven

Ned is a recently appointed non-executive director of ABC Corp, a listed entity. ABCs

corporate governance arrangements permit non-executives to seek independent advice on

accounting and legal matters affecting the entity, where they have any grounds for concern.

Ned has asked you, an independent accountant, for advice because he is worried about

certain aspects of the draft financial statements for ABCs year ended 30 September 2008.

The ownership of most of ABCs ordinary share capital is widely dispersed, but the three

largest institutional shareholders each own around 10% of the entitys ordinary shares. In

meetings with management, these shareholders have made it clear that they expect

improvements in the entitys performance and position. ABC appointed a new Chief Financial

Officer (CFO) at the start of the 2007/08 financial year, and the board has set ambitious

financial targets for the next five years.

The 2007/08 targets were expressed in the form of three key accounting ratios, as follows:

Return on capital employed (profit before interest as a percentage of debt +equity): 7%

Net profit margin (profit before tax as a percentage of revenue): 5%

Gearing (long-term and short-term debt as a percentage of the total of debt +equity):

below 48%

The draft financial statements include the following figures:

$

Revenue 31,850,000

Profit before interest 2,972,000

Interest 1,241,000

Equity 22,450,800

Debt 18,253,500

The key ratios, based on the draft financial statements, are as follows:

Return on capital employed 73%

Net profit margin 54%

Gearing 448%

Neds copies of the minutes of board meetings provide the following relevant information:

1. On 1 October 2007 ABC sold an item of plant for $1,000,000 to XB, an entity that

provides financial services to businesses. The carrying value of the plant at the date of

sale was $1,000,000. XB has the option to require ABC to repurchase the plant on

1 October 2008 for $1,100,000. If the option is not exercised at that date, ABC will be

required under the terms of the agreement between the entities to repurchase the plant

on 1 October 2009 for $1,210,000. ABC has continued to insure the plant and to store

it on its business premises. The sale to XB was recognised as revenue in the draft

financial statements and the asset was derecognised.

2. A few days before the 30 September 2008 year end, ABC entered into a debt factoring

agreement with LM, a factoring business. The terms of the agreement are that ABC is

permitted to draw down cash up to a maximum of 75% of the receivables that are

covered under the factoring arrangement. However, LM is able to require repayment of

any part of the receivables that are uncollectible. In addition, ABC is obliged to pay

interest at an annual rate of 10% on any amounts it draws down in advance of cash

being received from customers by LM. As soon as the agreement was finalised, ABC

drew down the maximum cash available in respect of the $2,000,000 receivables it had

transferred to LM as part of the agreement. This amount was accounted for by debiting

cash and crediting receivables.

P8 14 November 2008

3. In October 2007, ABC issued 2,000,000 $1 preference shares at par. The full years

dividend of 8% was paid before the 30 September 2008 year end, and was recognised

in the statement of changes in equity. The preference shares are redeemable in 2015,

and the entity is obliged to pay the dividend on a fixed date each year. The full

$2,000,000 proceeds of the issue were credited to equity capital.

Required:

(a) Discuss the accounting treatment of the three transactions, identifying any errors

that you think have been made in applying accounting principles with references,

where appropriate, to IFRS. Prepare the adjustments that are required to correct

those errors and identify any areas where you would require further information.

(15 marks)

(b) Calculate the effect of your adjustments on ABCs key accounting ratios for the

year ended 30 September 2008.

(7 marks)

(c) Explain, briefly, the results and the implications of your analysis to the non-

executive director.

(3 marks)

Total for Question Seven = 25 marks

End of Section C. End of Question Paper

November 2008 15 P8

MATHS TABLES AND FORMULAE

Present value table

Present value of $1, that is (1 +r)

-n

where r =interest rate; n =number of periods until payment or

receipt.

Interest rates (r) Periods

(n) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10%

1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909

2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826

3 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751

4 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683

5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621

6 0.942 0.888 0.837 0.790 0.746 0705 0.666 0.630 0.596 0.564

7 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513

8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467

9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424

10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386

11 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350

12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319

13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290

14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263

15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239

16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218

17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198

18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180

19 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164

20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149

Interest rates (r) Periods

(n) 11% 12% 13% 14% 15% 16% 17% 18% 19% 20%

1 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833

2 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694

3 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579

4 0.659 0.636 0.613 0.592 0.572 0.552 0.534 0.516 0.499 0.482

5 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402

6 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335

7 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279

8 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233

9 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194

10 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162

11 0.317 0.287 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135

12 0.286 0.257 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112

13 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093

14 0.232 0.205 0.181 0.160 0.141 0.125 0.111 0.099 0.088 0.078

15 0.209 0.183 0.160 0.140 0.123 0.108 0.095 0.084 0.079 0.065

16 0.188 0.163 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054

17 0.170 0.146 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045

18 0.153 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038

19 0.138 0.116 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031

20 0.124 0.104 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026

P8 16 November 2008

Cumulative present value of $1 per annum,

Receivable or Payable at the end of each year for n years

r

r

n

+ ) (1 1

Interest rates (r) Periods

(n) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10%

1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909

2 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736

3 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487

4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170

5 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791

6 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355

7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868

8 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335

9 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759

10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145

11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495

12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814

13 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103

14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367

15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606

16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824

17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022

18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201

19 17.226 15.679 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365

20 18.046 16.351 14.878 13.590 12.462 11.470 10.594 9.818 9.129 8.514

Interest rates (r) Periods

(n) 11% 12% 13% 14% 15% 16% 17% 18% 19% 20%

1 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833

2 1.713 1.690 1.668 1.647 1.626 1.605 1.585 1.566 1.547 1.528

3 2.444 2.402 2.361 2.322 2.283 2.246 2.210 2.174 2.140 2.106

4 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.589

5 3.696 3.605 3.517 3.433 3.352 3.274 3.199 3.127 3.058 2.991

6 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 3.410 3.326

7 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605

8 5.146 4.968 4.799 4.639 4.487 4.344 4.207 4.078 3.954 3.837

9 5.537 5.328 5.132 4.946 4.772 4.607 4.451 4.303 4.163 4.031

10 5.889 5.650 5.426 5.216 5.019 4.833 4.659 4.494 4.339 4.192

11 6.207 5.938 5.687 5.453 5.234 5.029 4.836 4.656 4.486 4.327

12 6.492 6.194 5.918 5.660 5.421 5.197 4.988 7.793 4.611 4.439

13 6.750 6.424 6.122 5.842 5.583 5.342 5.118 4.910 4.715 4.533

14 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4.611

15 7.191 6.811 6.462 6.142 5.847 5.575 5.324 5.092 4.876 4.675

16 7.379 6.974 6.604 6.265 5.954 5.668 5.405 5.162 4.938 4.730

17 7.549 7.120 6.729 6.373 6.047 5.749 5.475 5.222 4.990 4.775

18 7.702 7.250 6.840 6.467 6.128 5.818 5.534 5.273 5.033 4.812

19 7.839 7.366 6.938 6.550 6.198 5.877 5.584 5.316 5.070 4.843

20 7.963 7.469 7.025 6.623 6.259 5.929 5.628 5.353 5.101 4.870

November 2008 17 P8

FORMULAE

Annuity

Present value of an annuity of $1 per annum receivable or payable for n years, commencing

in one year, discounted at r% per annum:

PV =

n

r

r

] [1

1

1

1

Perpetuity

Present value of $1 per annum receivable or payable in perpetuity, commencing in one year,

discounted at r% per annum:

PV =

r

1

Growing Perpetuity

Present value of $1 per annum, receivable or payable, commencing in one year, growing in

perpetuity at a constant rate of g% per annum, discounted at r% per annum:

PV =

g r

1

P8 18 November 2008

LIST OF VERBS USED IN THE QUESTION REQUIREMENTS

A list of the learning objectives and verbs that appear in the syllabus and in the question requirements for

each question in this paper.

It is important that you answer the question according to the definition of the verb.

LEARNING OBJECTIVE VERBS USED DEFINITION

1 KNOWLEDGE

What you are expected to know. List Make a list of

State Express, fully or clearly, the details of/facts of

Define Give the exact meaning of

2 COMPREHENSION

What you are expected to understand. Describe Communicate the key features

Distinguish Highlight the differences between

Explain Make clear or intelligible/State the meaning of

Identify Recognise, establish or select after

consideration

Illustrate Use an example to describe or explain

something

3 APPLICATION

How you are expected to apply your knowledge. Apply

Calculate/compute

To put to practical use

To ascertain or reckon mathematically

Demonstrate To prove with certainty or to exhibit by

practical means

Prepare To make or get ready for use

Reconcile To make or prove consistent/compatible

Solve Find an answer to

Tabulate Arrange in a table

4 ANALYSIS

How are you expected to analyse the detail of

what you have learned.

Analyse

Categorise

Examine in detail the structure of

Place into a defined class or division

Compare and contrast Show the similarities and/or differences

between

Construct To build up or compile

Discuss To examine in detail by argument

Interpret To translate into intelligible or familiar terms

Produce To create or bring into existence

5 EVALUATION

How are you expected to use your learning to

evaluate, make decisions or recommendations.

Advise

Evaluate

Recommend

To counsel, inform or notify

To appraise or assess the value of

To advise on a course of action

November 2008 19 P8

The Examiner for Financial Analysis offers to future candidates and to tutors

using this booklet for study purposes, the following background and guidance

on the questions included in this examination paper.

Section A Question One Compulsory

1.1 OTQ that required calculation of the amount, of a dividend for minority interests, for

inclusion in the consolidated cash flow statement of the entity concerned. Tested

learning outcome A (iii).

1.2 Short question that required a description of the conditions to be met to recognise

intangible assets upon acquisition of a subsidiary. Tested learning outcome A (iii).

1.3 Short question that required calculation of the actuarial gain/loss on the pension

scheme assets of the entity concerned. Tested learning outcome B (vi).

1.4 Short question that tested knowledge of the principal characteristics common to joint

venture arrangements. Tested learning outcome A (vi).

1.5 Short question that required initial classification and subsequent measurement, in

accordance with the current International Standard, of two financial assets. Tested

learning outcome B (v).

1.6 OTQ that tested knowledge of the nature of derivative financial instruments. Tested

learning outcome B (v).

1.7 Short question that required both identification of the method of accounting an entity

should use and calculation of the amount of investment by this entity in another for

inclusion in its consolidated balance sheet. Tested learning outcome A (vi).

Section B Compulsory

Question Two required an explanation, with regard to intellectual capital, as to the

advantages that might be gained by entities, were they permitted to allow its wider recognition

in financial statements, together with the reasons as to why International Standards do not

currently permit such recognition. Tested learning outcome D (iv).

Question Three part (a) required calculations of EPS and diluted EPS for a listed entity. Part

(b) required an explanation for the reason for the treatment of bonus shares as required by

the applicable International Standard. Tested learning outcome C (i).

Question Four required calculation of the amounts of consolidated retained earnings and

minority interest for inclusion in the group balance sheet of the entity concerned. Tested

learning outcome A (iii).

Section C Answer two from three questions

Question Five required in part (a) an explanation of the meaning of the term functional

currency and identification of three factors to be considered in determining a functional

currency. Part (b) required preparation of the summary consolidated income statement and

balance sheet of the entity concerned and, in part (c), the summary consolidated statement of

changes in equity, together with a calculation as to how an exchange gain/loss has arisen.

Tested learning outcome A (x).

Question Six required preparation of a report that analysed and interpreted scenario

information from the view of the entity concerned as a lender and described any areas of

uncertainty in the analysis and interpretation, together with an indication of any additional

information required prior to a lending decision being made. Tested learning outcome B (i)

and C (ii), (iii) and (iv).

P8 20 November 2008

Question Seven part (a) required a discussion of the three transactions described in the

scenario identifying any errors made and their adjustment. Part (b) required calculation of the

effect of such adjustments on the key accounting ratios of the entity concerned. Finally part

(c) required a brief explanation of the results and implications. Tested learning outcomes B (i),

(iii) and (iv) and C ((iii).

November 2008 21 P8

Managerial Level Paper

P8 Financial Analysis

Examiners Answers

SECTION A

Answer to Question One

1.1

$

Balance brought forward 77,600

Disposal: 25% x 64,000 (16,000)

Share of profit for the period 6,500

Dividend paid (balancing figure) (3,400)

Balance carried forward 64,700

The correct answer is B

1.2 IFRS 3 permits recognition of an intangible asset upon acquisition of a subsidiary only

if:

(a) it meets the definition provided by IAS 38 Intangible Assets.

(b) its fair value can be measured reliably.

1.3 JSX: Calculation of actuarial gain or loss on pension scheme assets for the year

ended 31 October 2008

$

Fair value of scheme assets at 1 November 2007 10,660,000

Expected return on scheme assets (10,660,000 x 62%) 660,920

Contributions to scheme 550,700

Benefits paid (662,400)

Actuarial loss on scheme assets (balancing figure) (5,220)

Fair value of scheme assets at 31 October 2008 11,204,000

P8 22 November 2008

1.4 The principal characteristics common to joint venture arrangements are that joint

control is established by two or more venturers who are bound by a contractual

arrangement.

1.5 GZP

1.

(i) The facts that the loan to the supplier is intended to be held until its fixed maturity, and

that determinable payments of interest are to be made, make it clear that this should be

classified as a held-to-maturity investment.

(ii) Subsequent measurement is at amortised cost using the effective interest rate method.

2.

(i) The investment in shares of a listed company should be classified as an available-for-

sale financial asset.

(ii) Subsequent measurement is at fair value with any gains or losses before derecognition

to be recognised in equity.

1.6 The correct answer is B

1.7 Investment in CST to be recognised in the consolidated financial statements of

APL for the year ended 30 September 2008

The investment should be measured using the equity accounting method, as follows:

$

Cost of investment 1,200,000

Add: share of post-acquisition profits of the associate: $320,000 x 30% 96,000

Less: dividend paid in 2007 financial year: 10 x 300,000 shares (30,000)

Less: provision for unrealised profit in inventory:

25/125 x $100,000 x 30% =

(6,000)

Investment in associate 1,260,000

November 2008 23 P8

SECTION B

Answer to Question Two

(a)

The recognition of intangible assets, and of intellectual capital assets in particular, has been

much discussed in recent years. The traditional business model involving exploitation of

physical assets in the form of tangible non-current assets and inventory is no longer so

prevalent. For many service businesses, the most significant category of asset relates to

the skills and talents of the people who work for them. If accounting regulation and practice

permitted the recognition of such assets as part of the business balance sheet, there could be

some positive effects.

Under current accounting practice, the balance sheets of many types of business recognise

few intangible assets. Recognition of a wider range of assets would provide a more realistic

view of the productive capacity of the business, which could be helpful to many categories of

stakeholder. For example, existing and potential investors would find it easier to relate the

flow of revenue to the assets that had produced it, thus improving understanding of the

nature of the business and its ability to generate positive income streams.

A related point is that realistic analysis of the financial statements would be much easier

where a greater range of assets was recognised. Under current IFRS many of the standard

accounting ratios make little sense because the recognised asset base is so low. Accounting

ratios such as asset turnover, return on assets and return on capital employed are essentially

meaningless in businesses that rely principally on intellectual capital assets. With full

recognition of intellectual assets, comparisons between the productivity of different types of

business would become more realistic.

From the point of view of the employee stakeholder group, recognition of intellectual assets

would increase the prominence of the value they add to the organisation. Instead of being

viewed as a cost to be borne by the business, the amounts incurred in remunerating and

training employees could be seen as an investment by the business. If a formal valuation

process were adopted in respect of individuals their status and prospects could be improved.

(b) The principal problems relating to the recognition of intellectual assets are as follows:

Intellectual assets such as know-how and skills do not usually fall into the Framework

definition of an asset (a resource controlled by the entity as a result of past events and from

which future economic benefits are expected to flow to the entity). The problem is one of

control: skills are in the possession of the individual employee who has the option to cease

working for the entity and to take his or her skills elsewhere. Where resources cannot be

controlled their value to the entity is questionable.

Realistic measurement of intellectual assets presents a challenge that may well be

insuperable in practice. Although some guidance is provided by market salary rates from

which a capital value could in theory be extrapolated, any such values would necessarily be

vague and imprecise. The difficulties involved in reaching realistic values would rule out valid

inter-firm comparability.

Finally, because of the problems of arriving at consistent and robust measurement

techniques, there would be scope for creative accounting by the unscrupulous.

P8 24 November 2008

Answer to Question Three

(a)

2008 2007

Earnings per share: 1914/1,000 191 1827/1,000 183

(W1) (W1)

Diluted earnings per share

(W3) 1,150

(W2) 7 195 170

(W3) 1,150

(W2) 1 187 163

Workings

1. Bonus issue of shares: 1 new share for every 3 already in issue =750 million/3 x 4 =

1,000 million.

2. Diluted earnings adjustments

2008 2007

Profit for the period 1914 1827

Add back interest 63 62

Less: tax effects (20) (18)

43 44

1957 1871

3. Fully diluted shares

If all conversion options are taken up:

150m 200 x

100

$75m

=

Added to the existing shares this gives a fully diluted number of shares of 1,150m (1,000m +

150m).

(b)

Bonus shares are issued for no consideration, and so there is no increase in resources

associated with them. All other things being equal, no increase in earnings can be expected

following a bonus issue; the effect is that the same amount of earnings is divided by a greater

number of shares. In order to ensure continuing comparability, the bonus issue is adjusted

for as if it had taken place at the beginning of the earliest period presented.

November 2008 25 P8

Answer to Question Four

Consolidated retained earnings

$

DNTs retained earnings 2,669,400

Group share of CMs post-acquisition earnings (W2) 582,250

Consolidation adjustment: additional depreciation (W3) 9,000

Group share of BLs post-acquisition loss (W4) (7,000)

3,253,650

Minority interest

$

CM: share capital (1,000,000 - 850,000) 150,000

CM: retained earnings (2,475,000 - 15,000) x 15% 369,000

BL: share capital (250,000 - 175,000) 75,000

BL: retained earnings (650,000 - 40,000) x 30% 183,000

777,000

Workings

1. DNTs holding in CM: 850,000/1,000,000 =85%

DNTs holding in BL: 175,000/250,000 =70%

2. Group share of CMs post-acquisition earnings

$

Post-acquisition earnings (2,475,000 - 1,775,000) 700,000

Less: profit on intra-group disposal (15,000)

685,000

85% of post acquisition earnings 582,250

3. Additional depreciation adjustment

Required in respect of the additional depreciation on the item of machinery. 15 years

(out of a remaining life of 25 years) have elapsed since the intra-group purchase.

($75,000 60,000) x 15/25 9,000

4. Group share of BLs post-acquisition loss

3/12 x 40,000 x 70% 7,000

P8 26 November 2008

SECTION C

Answer to Question Five

(a)

An entitys functional currency is the currency of the primary economic environment in which it

operates. Entities need to consider the following factors in determining their functional

currency:

Which currency primarily influences selling prices for goods and services?

Which countrys competitive forces and regulations principally determine the selling

prices of the entitys goods and services?

In which currency are funds for financial activities (debt and equity instruments)

generated?

In which currency are receipts from operations generally kept?

Which currency influences labour, material and other costs of providing goods or

services?

(b)

(i) Income statement for the year ended 31 October 2008

EY Rate EY DX Consolidation

adjustment

Consolidated

Franc $ $ $

Revenue 1,200,000 260 461,538 3,600,000 4,061,538

Expenses 1,000,000 260 384,615 2,800,000 3,184,615

Profit 200,000 76,923 800,000 876,923

(ii) Balance sheet at 31 October 2008

EY Rate EY DX Consolidation

adjustment

Consolidated

Franc $ $ $

PPE 1,500,000 270 555,556 5,000,000 5,555,556

Investment 25,000 (25,000) -

Current assets 2,000,000 270 740,741 4,400,000 5,140,741

3,500,000 1,296,297 9,425,000 (25,000) 10,696,297

Share capital 50,000 200 25,000 1,000,000 (25,000) 1,000,000

Retained

earnings

1,650,000 Bal

f

i

g

604,630 4,825,000 5,429,630

Current

liabilities

1,800,000 270 666,667 3,600,000 4,266,667

3,500,000 1,296,297 9,425,000 (25,000) 10,696,297

November 2008 27 P8

(c)

Statement of changes in equity for the year ended 31 October 2008

$

Brought forward at 1 November 2007 (W1) 5,852,174

Profit for the period (from income statement) 876,923

Dividend (200,000)

Exchange loss (balancing figure) (99,467)

Closing equity (1,000,000 +5,429,630) 6,429,630

Working

1. Equity brought forward at 1 November 2007

Post-acquisition retained earnings in EY $

Opening equity in EY (1,650,000 +50,000 200,000) 1,500,000 francs @ 230 652,174

Less: share capital in EY (50,000 @ 2.00) (25,000)

627,174

DX equity 5,225,000

5,852,174

Exchange loss for the year

Opening equity in EY (1,500,000 francs as above):

$ $

Translated at opening rate (1,500,000/230) 652,174

Translated at closing rate (1,500,000/270) 555,556

Exchange loss 96,618

Profit for the year in EY (200,000):

Translated at average rate (200,000/260) 76,923

Translated at closing rate (200,000/270) 74,074

Exchange loss 2,849

99,467

P8 28 November 2008

Answer to Question Six

From: Accountant

To: CFO

Report on TEX loan application

(a) TEXs performance has deteriorated significantly between 2007 and 2008. Revenue in

2008 has decreased by 9% on the previous years figure, and the fall in gross

profitability has been even more significant. Gross margin in 2007 was 137%, falling

to only 116% in 2008, and the business is now loss-making. Non-current asset

turnover has decreased, which may suggest inefficiencies in operation, or possibly

deteriorating performance from old machinery. Performance is not helped by the

results of the associate whose loss, although not as large as in 2007, has contributed

significantly to the overall loss. The balance sheet valuation of the investment in

associate has not, apparently, been reduced by the recognition of any impairment

losses. If the investment is impaired, the impairment loss would further increase the

loss for the year.

Turning to the balance sheet, the position is worse in most respects than in 2007. The

business is holding a very large amount of inventory, even more than in 2007, thus

tying up cash and incurring holding costs. A significant proportion of inventory could be

raw material and there may be good reasons why large amounts should be held at the

end of September. However, it is also possible that some of the inventory is obsolete,

and should be written off, which again would increase the loss for the year.

Receivables turnover is slow, but that could be expected in this business. It has

actually improved slightly between 2007 and 2008, which may mean that management

has made a definite effort to speed up cash collection.

By the end of September 2008 the business has no cash in hand, and its balance of

available for sale investments which could, presumably, be realised in an emergency,

is almost halved from the previous year end. Borrowings net of cash at the 2007 year

end were $747 million ($671 +124 48), but by the end of 2008 they had increased

to $859 ($572 +287), and gearing had increased substantially. The large increase in

borrowings is a worrying sign, but so also is the fact that a much higher proportion of

the total is classified in current liabilities. On the face of it, the business will have

difficulty meeting its current liabilities as they fall due, an impression which is reinforced

by the very low quick ratio. Trade and other payables have fallen, but the total of

$1501 million outstanding at the end of 2008 is extremely high in the context of the

other balance sheet figures. It is likely that many of TEXs suppliers are not in a

position to complain about non-payment of amounts owing, but there is the danger that

it could force some of its suppliers out of business.

The level of interest cover is not attractive to a potential lender. It is surprising to note

that interest has actually fallen in 2008 compared to 2007. This may mean that at other

times of year the position is not as bad as it appears at the year end. Nevertheless, the

position is so poor as to provide a significant deterrent to SWW as a potential lender.

There are additional sources of concern in the other long-term liabilities. The net

liability on the pension scheme is significant in size at both year ends, and it may

indicate on-going difficulties in funding the obligations under the scheme. The deferred

tax balance is also significant and is a prospective, if not immediate, cause for concern.

If the position and performance of TEX continues to deteriorate in line with current

trends, it is quite possible that the business will become insolvent in the foreseeable

future. On the evidence provided so far, a loan to TEX would be very risky, and there

would be a significant probability of non-recovery.

November 2008 29 P8

(b)

The analysis above is subject to a great deal of uncertainty. Some of the significant

uncertainties, and the information required to resolve them, are as follows:

1. The information for 2008 is both incomplete and unaudited. We would need to see a

full, audited, annual report at least, and it is quite likely that we would need additional

information about, for example, the age and condition of property, plant and equipment

and inventory.

2. The only amount recognised separately in the financial statements in respect of the

defined benefits pension scheme is the net liability. Many detailed disclosures are

required by IAS 19, and we would need to scrutinise these carefully. The costs of the

scheme are presumably recognised somewhere within the income statement, and their

location could affect our analysis of the statements.

3. The associate has been turning in significant losses. We would need information about

it in order to understand the groups involvement and continuing commitment.

4. If present trends continue the group could face insolvency before too long. There has

been no dividend in the recent past, and return on equity, poor in 2007, is now

negative. It would be necessary to know more about the principal shareholders and the

extent to which they are likely to continue to support the business. It is possible that a

takeover bid could be made for the business, and if we had lent significant amounts to

the business, our relationship could be jeopardised.

5. The existing level of gearing is high, and as previously remarked, some of the

borrowings fall due to be repaid within the short term. We would need to know a great

deal more about the existing lenders, terms of loans and the nature and extent of

security provided.

P8 30 November 2008

APPENDIX

Relevant ratios

2008 2007

Gross profit margin:

0 10 x

Revenue

profit Gross

6% 1 1 100 x

3 256

7 9 2

=

% 7 3 1 100 x

7 281

6 8 3

=

Net (loss)/profit margin:

100 x

Revenue

profit Net(loss)/

%) 3 1 ( 100 x

3 256

) 4 (3

=

% 2 0 100 x

7 281

7 0

=

Return on shareholders equity

100 x

Equity

tax before fit (Loss)/pro

%) 5 3 ( 100 x

9 41 1

) 9 (4

=

% 8 0 100 x

1 145

1 1

=

Inventories turnover:

100 x

sales of Cost

s Inventorie

days 3 3 1 2 365 x

6 226

4 132

=

days 6 88 1 365 x

1 243

6 125

=

Receivables turnover:

365 x

Revenue

s Receivable

days 6 73 365 x

3 256

7 51

=

days 4 75 365 x

7 281

2 58

=

Non-current asset turnover:

equipment and plant Property,

Revenue

16 1

4 221

3 256

=

24 1

3 227

7 281

=

Gearing:

100 x

Equity

Debt

6% 60 100 x

9 141

7 28 2 57

=

+

8% 4 5 100 x

1 145

4 2 1 1 67

=

+

Interest cover:

costs Finance

costs finance before Profit

33 0

4 5

) 7 18 2 9 7 29 (

=

27 2

2 6

) 6 15 9 8 6 38 (

=

Current ratio:

Current assets : current

liabilities

1 : 03 1

8 178

1 184

=

1 : 09 1

6 173

6 188

=

Quick ratio:

Current assets less inventories:

current liabilities

1 : 29 0

8 178

7 51

=

1 : 36 0

6 173

) 8 4 2 58 (

=

+

November 2008 31 P8

Answer to Question Seven

(a) Transaction 1

The relevant accounting principle that should be applied in this case is that of substance over

form, which, according to the Framework for the Preparation and Presentation of Financial

Statements, is an important aspect of the qualitative characteristic of financial statement

reliability. While this transaction apparently has some of the characteristics of a sale, in

substance it is a financing arrangement. The substance of the transaction is that ABC has

borrowed $1,000,000 at an interest rate of 10%. IAS 18 Revenue permits the recognition of

revenue only where the selling entity has transferred the risks and rewards of ownership to

the buyer. This is clearly not the case in respect of this transaction as ABC continues to

insure and to store the plant.

Correcting accounting entries should be made to remove $1,000,000 from sales and cost of

sales and the asset should be reinstated as part of plant and machinery. A charge to

depreciation should be made for the year ended 30 September 2008, but there is insufficient

information available in the facts presented to estimate the amount and impact of this charge.

The amount of $1,000,000 should be recognised as borrowings, either long-term if the liability

is to be settled on 1 October 2009, or short-term if it is settled on 1 October 2008. Interest of

$100,000 should be charged to profit or loss for the year, with a corresponding credit entry to

borrowings.

The correcting journal entries to correspond with the above description would be:

DR Revenue 1,000,000

CR Cost of sales 1,000,000

DR Plant 1,000,000

DR Interest payable 100,000

CR Borrowings 1,100,000

Transaction 2

Like the first transaction, this one should be reflected in the financial statements according to

the principle of substance over form. ABC continues to bear the risks relating to all the

receivables covered by the factoring arrangement; this is indicated by the fact that LM can

require repayment in respect of any uncollectible element. The substance of the transaction

is that ABC has borrowed $1,500,000 (75% of the total of $2,000,000 transferred to LM),

against the security of its receivables. Interest is chargeable on these amounts at a rate of

10%.

Insufficient information is available to calculate the charge for interest, but because the

agreement was made only a few days before the year end the interest would not be a very

significant amount. The amount of $1,500,000 should, however, be reinstated as part of

receivables and a short-term payable of the same amount should be recognised.

The correcting journal entry would be:

DR Receivables 1,500,000

CR Borrowings 1,500,000

Transaction 3

The relevant accounting standard in this case is IAS 32 Financial Instruments: Presentation.

One of the objectives of this standard is to establish principles for presenting financial

instruments as liabilities or equity. The classification as equity or liability must be made in

accordance with the substance of the contract, so this transaction provides another instance

where substance over form must be considered. The preference shares in this case are

redeemable on a specific date, and this fact, together with the unavoidable obligation to pay

annual interest, points towards the instrument being a liability rather than equity. The

P8 32 November 2008

preference shares should therefore be reclassified as a long-term liability. The dividend (8%

x $2,000,000 =$160,000) in respect of the shares appears in the statement of changes in

equity in the draft financial statements, but this should be reclassified as interest in the

income statement.

(b)

Effects of the adjustments on ABCs key ratios

Before adjustment saction 1 saction 2 saction 3 After adjustment

$ $ $ $ $

Revenue 31,850,000 -1,000,000 30,850,000

Profit before interest 2,972,000 2,972,000

Interest 1,241,000 +100,000 +160,000 1,501,000

Equity 22,450,800 -100,000 -2,000,000 20,350,800

Debt 18,253,500 +1,100,000 +1,500,000 +2,000,000 22,853,500

Key ratios recalculated:

Return on capital employed

% 9 6

500 , 753 , 22 800 , 350 , 20

000 , 972 , 2

=

+

Cant get into box change 22,753,500 to 22,853,500

Net profit margin

% 8 4

800 , 850 , 30

000 , 471 , 1

=

Change 30850800 to 30,850,000

Gearing

% 8 52

500 , 753 , 22 800 , 350 , 20

000 , 753 , 22

=

+

Change top line from 22,753,000 to 22,853,500

Change bottom line from 22,753,500 to 22,853,500

Change ratio from 52.8% to 52.9%

(c)

To: Ned

From: Independent accountant

After making the adjustments in respect of the three transactions that you have identified as

questionable, all three of the key ratios fail to meet the targets set by the directors, although

the shortfall is not great in respect of any of the three. A greater cause for concern is the fact

that the transactions have not been accounted for in accordance with IFRS. This suggests a

willingness on the part of the CFO to engage in creative accounting. You have identified

three instances, but there may be others that are less obvious. In future years, performance

and position may continue to be misstated in order to meet budgets and targets, and the ways

in which the misstatements are achieved may be more subtle.

You might also like

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- Financial Analyst P8nov09exampaperDocument20 pagesFinancial Analyst P8nov09exampaperNhlanhla2011No ratings yet

- P9 Nov 09 ExampaperDocument24 pagesP9 Nov 09 ExampaperShahbazYaqubNo ratings yet

- Acct1511 2013s2c2 Handout 2 PDFDocument19 pagesAcct1511 2013s2c2 Handout 2 PDFcelopurpleNo ratings yet

- Preparing Financial Statements: (International Stream)Document13 pagesPreparing Financial Statements: (International Stream)Jerahmeel JalalNo ratings yet

- Financial Reporting (S-501) : Stage-5 / Professional IIIDocument4 pagesFinancial Reporting (S-501) : Stage-5 / Professional IIIIrfanNo ratings yet

- QP March2012 p1Document20 pagesQP March2012 p1Dhanushka Rajapaksha100% (1)

- CR Questions Nov 18 Questions FinalDocument18 pagesCR Questions Nov 18 Questions Finalswarna dasNo ratings yet

- F1 May 2010 For Print. 23.3Document20 pagesF1 May 2010 For Print. 23.3mavkaziNo ratings yet

- Mid Term Exam Intermediate Financial Accounting II Fall 2008 ADM3340Document12 pagesMid Term Exam Intermediate Financial Accounting II Fall 2008 ADM3340yoonNo ratings yet

- P7 - Financial Accounting and Tax Principles: Financial Management Pillar Managerial Level PaperDocument20 pagesP7 - Financial Accounting and Tax Principles: Financial Management Pillar Managerial Level PaperlunoguNo ratings yet

- Model Paper Financial AccountingDocument6 pagesModel Paper Financial AccountingzurwahmirzaNo ratings yet

- 7110 s08 QP 2Document16 pages7110 s08 QP 2Tayyab AbdullahNo ratings yet

- F1 - Financial OperationsDocument20 pagesF1 - Financial OperationsMarcin MichalakNo ratings yet

- M1 - CIMA Masters Gateway Assessment 22 May 2012 - Tuesday Afternoon SessionDocument20 pagesM1 - CIMA Masters Gateway Assessment 22 May 2012 - Tuesday Afternoon Sessionkarunkumar89No ratings yet

- Extracts From The Consolidated Financial Statements of The Eag GroupDocument1 pageExtracts From The Consolidated Financial Statements of The Eag GroupTaimur TechnologistNo ratings yet

- FR Question Paper 81655199552Document3 pagesFR Question Paper 81655199552Nakul GoyalNo ratings yet

- AC3103 Seminar 2 Discussion Questions - Value Relevance, Measurement Approach, Fair ValueDocument3 pagesAC3103 Seminar 2 Discussion Questions - Value Relevance, Measurement Approach, Fair ValuehieveNo ratings yet

- Test Bank For Financial Statement Analysis and Valuation 2nd Edition EastonDocument29 pagesTest Bank For Financial Statement Analysis and Valuation 2nd Edition Eastonagnesgrainneo30No ratings yet

- Mid-Term Exam: Professor: Kevin Petit-Frère Duration: 180 MinutesDocument7 pagesMid-Term Exam: Professor: Kevin Petit-Frère Duration: 180 MinutesAbby Hacther0% (2)

- AssignmentsDocument5 pagesAssignmentsshikha mittalNo ratings yet

- F2 Sept 2013 QPDocument20 pagesF2 Sept 2013 QPFahadNo ratings yet

- Exam 1 F08 A430-530 With SolutionDocument13 pagesExam 1 F08 A430-530 With Solutionkrstn_hghtwrNo ratings yet

- P1 Sept 2013Document20 pagesP1 Sept 2013Anu MauryaNo ratings yet

- QP F2 May 2013Document20 pagesQP F2 May 2013kazimkorogluNo ratings yet

- QP March2012 f2Document16 pagesQP March2012 f2g296469No ratings yet

- Test Bank For Financial Statement Analysis and Valuation 2nd Edition by EastonDocument29 pagesTest Bank For Financial Statement Analysis and Valuation 2nd Edition by EastonRandyNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement Analysiselsana philipNo ratings yet

- Question 1 (40marks - 48 Minutes)Document8 pagesQuestion 1 (40marks - 48 Minutes)dianimNo ratings yet

- Acct1511 Final VersionDocument33 pagesAcct1511 Final VersioncarolinetsangNo ratings yet

- F2 - Financial ManagementDocument20 pagesF2 - Financial Managementkarlr9No ratings yet

- Accounting Feb 2021Document11 pagesAccounting Feb 2021TAQQI JAFFARINo ratings yet

- CA (Final) Financial Reporting: FR Chapter: Ind As 24, 33, 108 MARKS-30 Duration - 50 MinsDocument4 pagesCA (Final) Financial Reporting: FR Chapter: Ind As 24, 33, 108 MARKS-30 Duration - 50 MinsNakul GoyalNo ratings yet

- Corporate Reporting (Hong Kong) : Tuesday 11 December 2007Document9 pagesCorporate Reporting (Hong Kong) : Tuesday 11 December 2007Mhamudul HasanNo ratings yet

- AICPA Newly Released MCQsDocument54 pagesAICPA Newly Released MCQsDaljeet SinghNo ratings yet

- G1 - CIMA Management Accountant Gateway Assessment 20 November 2012 - Tuesday Afternoon SessionDocument20 pagesG1 - CIMA Management Accountant Gateway Assessment 20 November 2012 - Tuesday Afternoon Sessionsalmanahmedkhi1No ratings yet

- Far Aicpa Questions 2020Document54 pagesFar Aicpa Questions 2020Jon100% (1)

- 2008 LCCI Level 2 (2507) Series 3 Model AnswersDocument17 pages2008 LCCI Level 2 (2507) Series 3 Model AnswersTracy Chan0% (1)

- CPGA QP May 2010 For PrintDocument20 pagesCPGA QP May 2010 For PrintfaizthemeNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsIrfanNo ratings yet

- F2 QP March 2014 Final For PrintDocument20 pagesF2 QP March 2014 Final For PrintwardahtNo ratings yet

- P1 - Corporate Reporting April 08Document25 pagesP1 - Corporate Reporting April 08IrfanNo ratings yet

- HKICPA QP Exam (Module A) Feb2008 Question PaperDocument8 pagesHKICPA QP Exam (Module A) Feb2008 Question Papercynthia tsuiNo ratings yet

- Acct1511 Final VersionDocument27 pagesAcct1511 Final VersioncarolinetsangNo ratings yet

- P1 March 2011 For PublicationDocument24 pagesP1 March 2011 For PublicationmavkaziNo ratings yet

- Exam2 Acct414 F07Document16 pagesExam2 Acct414 F07ElvinNo ratings yet

- Advanced Financial Accounting: Professional 2 Examination - April 2007Document12 pagesAdvanced Financial Accounting: Professional 2 Examination - April 2007Muhammad QamarNo ratings yet

- Financial Accounting Scanner Section IIDocument17 pagesFinancial Accounting Scanner Section IImknatoo1963No ratings yet

- Iandfct2exam201504 0Document8 pagesIandfct2exam201504 0Patrick MugoNo ratings yet

- SFM CA Final Mutual FundDocument7 pagesSFM CA Final Mutual FundShrey KunjNo ratings yet

- p1 Managerial Finance August 2017Document24 pagesp1 Managerial Finance August 2017ghulam murtazaNo ratings yet

- A - Level Accounting: June 2008: Unit 6 - Mark SchemeDocument14 pagesA - Level Accounting: June 2008: Unit 6 - Mark SchemeDannyshrewNo ratings yet

- Cima F1 May 2013Document20 pagesCima F1 May 2013MHasankuNo ratings yet

- Final Auditing Question Paper - May - 2008Document5 pagesFinal Auditing Question Paper - May - 2008Khristine CaserialNo ratings yet

- FI504 Case Study 1 The Complete Accounting CycleDocument16 pagesFI504 Case Study 1 The Complete Accounting CycleElizabeth Hurtado-Rivera0% (1)

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)From EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Rating: 3 out of 5 stars3/5 (1)

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Chapter 4 Randomized Blocks Missing Values STAT 5333Document3 pagesChapter 4 Randomized Blocks Missing Values STAT 5333Dhanushka RajapakshaNo ratings yet

- 101Document16 pages101Madhur LenkaNo ratings yet

- Worksheet1: STAT5333 FALL 2016Document1 pageWorksheet1: STAT5333 FALL 2016Dhanushka RajapakshaNo ratings yet

- The Latin Square DesignDocument16 pagesThe Latin Square DesignDhanushka RajapakshaNo ratings yet

- Selection Criteria StatementsDocument2 pagesSelection Criteria StatementsApeksha KadamNo ratings yet

- Entering Sample Data. 3. Test1 90 80 70 80 80 60 75 95 70 85Document6 pagesEntering Sample Data. 3. Test1 90 80 70 80 80 60 75 95 70 85Dhanushka RajapakshaNo ratings yet

- Problem 1Document10 pagesProblem 1Dhanushka RajapakshaNo ratings yet

- Regression DdaDocument7 pagesRegression DdaDhanushka RajapakshaNo ratings yet

- ch04 PDFDocument43 pagesch04 PDFDhanushka RajapakshaNo ratings yet

- Question I Per SNLDocument11 pagesQuestion I Per SNLDhanushka RajapakshaNo ratings yet

- Chapter 3Document3 pagesChapter 3Dhanushka RajapakshaNo ratings yet

- Mult DecompDocument5 pagesMult DecompDhanushka RajapakshaNo ratings yet

- Chapter 2Document1 pageChapter 2Dhanushka RajapakshaNo ratings yet

- Chapter 4Document8 pagesChapter 4Dhanushka RajapakshaNo ratings yet

- MemoDocument5 pagesMemoDhanushka RajapakshaNo ratings yet

- Analyze Baseball Player Data and Matrix Functions in RDocument2 pagesAnalyze Baseball Player Data and Matrix Functions in RDhanushka RajapakshaNo ratings yet

- GRE AntonymsDocument96 pagesGRE AntonymsmahamnadirminhasNo ratings yet

- Coding Standards For R Coding Standards For RDocument6 pagesCoding Standards For R Coding Standards For Ridoku2010No ratings yet

- Chapter TwoDocument11 pagesChapter TwoDhanushka RajapakshaNo ratings yet

- CIMA Old P1 May 2005 QP and ANSDocument35 pagesCIMA Old P1 May 2005 QP and ANSHarktheDark0% (1)

- CS104 Mid Semester Exam Programming QuestionsDocument1 pageCS104 Mid Semester Exam Programming QuestionsDhanushka RajapakshaNo ratings yet

- Chapter TwoDocument11 pagesChapter TwoDhanushka RajapakshaNo ratings yet

- MAY06P1BOOKDocument35 pagesMAY06P1BOOKDhanushka RajapakshaNo ratings yet

- Marketing: Four Alternative PhilosophiesDocument10 pagesMarketing: Four Alternative PhilosophiesDhanushka RajapakshaNo ratings yet

- HRMDocument20 pagesHRMDhanushka RajapakshaNo ratings yet

- 666666666666666666666666Document3 pages666666666666666666666666Dhanushka RajapakshaNo ratings yet

- Time Series in RDocument30 pagesTime Series in Rmudgal108No ratings yet

- Lecture Outline - 10-B - Macroeconomic Variables in Sri Lankan EconomyDocument3 pagesLecture Outline - 10-B - Macroeconomic Variables in Sri Lankan EconomyDhanushka RajapakshaNo ratings yet

- Lecture Outline - 10 - Introduction To MacroeconomicsDocument4 pagesLecture Outline - 10 - Introduction To MacroeconomicsDhanushka RajapakshaNo ratings yet

- Shalini Sharma Final ThesisDocument124 pagesShalini Sharma Final ThesisAnita SaxenaNo ratings yet

- Barron 39 S January 24 2022Document72 pagesBarron 39 S January 24 2022yazzNo ratings yet

- Transitional Living Program For Young AdultsDocument5 pagesTransitional Living Program For Young AdultsBrian HaraNo ratings yet

- Investment Memorandum (v7)Document36 pagesInvestment Memorandum (v7)adventurer0512No ratings yet

- Sector 3: Banking and Financial Services: Chapter ContentsDocument20 pagesSector 3: Banking and Financial Services: Chapter ContentsAmartya Bodh TripathiNo ratings yet

- Chap18 DecisionDocument36 pagesChap18 Decisionawaisjinnah75% (4)

- Objectives and Methodology of RSRM Cost StudyDocument46 pagesObjectives and Methodology of RSRM Cost StudySaikat DuttaNo ratings yet

- Capital BudgetingDocument53 pagesCapital Budgetingapi-3747098100% (1)

- Anubhav Plantation ScamDocument11 pagesAnubhav Plantation Scamsmok3^No ratings yet

- Financial Assets at Fair ValueDocument27 pagesFinancial Assets at Fair ValueYna Peejay Estrel100% (1)

- Gems and Jewellery IndustryDocument18 pagesGems and Jewellery IndustryMadhavi Pawar RangariNo ratings yet

- Economics HelpsDocument3 pagesEconomics HelpssahilsureshNo ratings yet

- SOCIO-ECONOMIC CHALLENGES IN PAKISTANDocument4 pagesSOCIO-ECONOMIC CHALLENGES IN PAKISTANnaveedNo ratings yet

- April 2006Document8 pagesApril 2006Mohd HafizNo ratings yet

- Financing Infrastructure Projects in The Phils.: Jose Patrick Rosales, Author For UnescapDocument81 pagesFinancing Infrastructure Projects in The Phils.: Jose Patrick Rosales, Author For UnescapJoshua B. JimenezNo ratings yet

- Kenya's Construction Industry Drives Economic GrowthDocument19 pagesKenya's Construction Industry Drives Economic GrowthPrinceCollinzeLockoNo ratings yet

- Liberty - March 7 2022Document1 pageLiberty - March 7 2022Lisle Daverin BlythNo ratings yet

- EPGPX02 Group 3 - Strategic Decisions and ToolsDocument14 pagesEPGPX02 Group 3 - Strategic Decisions and ToolsrishiNo ratings yet

- Quiz 1 SolDocument74 pagesQuiz 1 SolMAYANK JAINNo ratings yet

- Chapter 10 PPE Accounting ProblemsDocument4 pagesChapter 10 PPE Accounting ProblemsJudithRavelloNo ratings yet

- Strategic Management: Jpmorgan Chase & CoDocument16 pagesStrategic Management: Jpmorgan Chase & CoBea Garcia100% (1)

- #4 Assignment Description (Ch. 7-8)Document5 pages#4 Assignment Description (Ch. 7-8)Karan BhavsarNo ratings yet

- CNG StationDocument53 pagesCNG Stationshani27100% (5)

- RERADocument16 pagesRERAanugyamishra327No ratings yet

- Govt. InterventionDocument20 pagesGovt. InterventionRadhika IyerNo ratings yet

- IaaifDocument96 pagesIaaifsmitpatel652No ratings yet

- International Business MGMTDocument4 pagesInternational Business MGMTdevi ghimireNo ratings yet

- E2 Biofuel Market Report 2013.finalDocument37 pagesE2 Biofuel Market Report 2013.finalAnonymous UT0gI7No ratings yet

- Lista contribuabililor care nu mai au calitatea de mari contribuabiliDocument31 pagesLista contribuabililor care nu mai au calitatea de mari contribuabiliChirila AdrianNo ratings yet

- 3 MDocument12 pages3 MRicha KothariNo ratings yet