Professional Documents

Culture Documents

Deutsche Bank India and Its 4P's of Marketing

Uploaded by

vishwasacharyab0 ratings0% found this document useful (0 votes)

121 views7 pagesDescribes the 4P's of Marketing of the Deutsche Bank in the context of the Indian regulation of the Entry and the Branch operations in the country.

It compares its marketing strategy with that of other foreign Banks in India and some of the factors that led to the success of the bank in the Indian context.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDescribes the 4P's of Marketing of the Deutsche Bank in the context of the Indian regulation of the Entry and the Branch operations in the country.

It compares its marketing strategy with that of other foreign Banks in India and some of the factors that led to the success of the bank in the Indian context.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

121 views7 pagesDeutsche Bank India and Its 4P's of Marketing

Uploaded by

vishwasacharyabDescribes the 4P's of Marketing of the Deutsche Bank in the context of the Indian regulation of the Entry and the Branch operations in the country.

It compares its marketing strategy with that of other foreign Banks in India and some of the factors that led to the success of the bank in the Indian context.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 7

DEUTSCHE BANK and its

success factors in the context

of Regulation & 4Ps of

Marketing.

SSSIHL,

BRINDAVAN

CAMPUS

| Vishwas B , Roll No:13214

Introduction

The story of foreign banks in India goes back to the 19th century when the colonial economy

brought with it the need for modern banking services, uniform currency and remittances by

British army personnel and civil servants. The banking institutions were established mainly

because of the growing need for banking services by the merchants who came from the west.

The three presidency banks established by the East India Company would later merge to form

the State Bank of India, Indias largest lender. British owned and controlled, these early banks

are considered Indias first foreign banks.

The first phase of banking reforms, triggered by recommendations of the Narasimhan

Committee in 1991 and the licensing of the new private sector banks through the next two

decades inaugurated an era of change. Meanwhile, the opening-up of the economy to

increased participation by foreign players created greater opportunities for foreign banks to

work with their multinational clients in India.

Foreign banks in India in 2013: A snapshot

As of March 2013, there are 43 foreign banks from 26 countries operating as branches and 46

banks from 22 countries operating as representative offices. A number of foreign banks have

also entered India via the NBFC route, while a considerable number have set up captive centres

in the country.

Foreign banks present in India as representative offices often have correspondent banking

relationships with domestic banks and provide a useful platform for foreign banks to access

opportunities for foreign currency lending to Indian corporate and financial institutions.

The efficiency levels of the foreign banks are generally better than that of the other banks

operating in the country and have lower NPAs , but, because they cater to the same kind of

corporate clients, their risks are correlated and in turn higher .Their Strict Lending norms and

policies allow only a few corporate clients to pass their criteria, so naturally they are

considered niche segment in India.

Foreign banks: Evolution and approaches to banking in India

Due to the local branch regime and the operating model of choice, foreign banks have, for the

large part, remained niche players, focusing on trade finance, external commercial borrowing,

wholesale lending, investment banking and treasury activities. Some large foreign banks have

focused on capturing the retail market but have remained confined to the high end of private

banking and wealth management, while a few others have created valuable niche offerings in

the areas of transaction banking, cash management and remittance products.

REGULATORY FRAMEWORK

Foreign banks that look to do business in India has to face challenges that are unique and

specific to each of the foreign banks in India. For any bank looking to start operations in India

foreign or domestic compliance with stringent RBI regulations is a major challenge.

No differential licensing

Foreign Banks that look to offer unique products and services looking for differential licensing

are forced to apply for universal banking only that mandates all the banks to offer full fledged

banking services in the country.

Financial inclusion

Complying with the RBIs guidelines on financial inclusion requires offering banking products

and services to unbanked and under banked areas and customers. This involves costs that

foreign banks with few branches and fewer sources of raising low-cost funds may find difficult

to implement. It means operating in areas that these foreign banks does not have expertise in,

which leads to more NPAs.

Priority sector lending

Foreign Banks are required to lend to Priority sector which is 32% of the Adjusted Net bank credit for

banks having lesser than 20 branches , this figure stands at 40% for banks that have more than

20 branches in India. As already mentioned these foreign banks dont have the expertise in

lending to the priority sector in India. As some in the banking industry said, referring to this

predicament of the foreign banks They know nothing about the price of ploughs. A rule of

thumb is that priority lending cuts bank profits by a fifth. Foreign banks have just 21 ATMs in

rural India compared to 41 foreign banks operating in India with 323 branches and 1414 ATMs.

Setting up a wholly owned banking subsidiary (WOS)

Foreign banks in India operated as branches of the parent bank located overseas. However RBI

had released guidelines for setting up wholly owned subsidiaries (WOS) by foreign banks in

India. A WOS would have to be in the form of a locally incorporated entity. These new guide-

lines will result in banks losing the advantages of a branch structure.

ABOUT DEUTSCHE BANK

Deutsche Bank started operations in India in 1980.It is know for strong client relationships,

highly specialized product technology and global connectivity, all built around strong corporate

governance standards.

Deutsche has established strong relationships with its clients in India in the last 30 years. It has

17 branches across the country in Mumbai, New Delhi, Bangalore, Chennai, Kolkata, Noida,

Aurangabad, Gurgaon, Kolhapur, Pune, Salem, Vellore, Moradabad, Ludhiana and Ahmedabad,

as well as Global Service Delivery Centres in three locations.

Its strength lies in areas such as Debt and Derivatives ;Global Transaction Banking cash

management, trade finance and custody; Investment Banking ,Institutional Equity broking,

asset and private wealth management, retail banking and BPO.

THE 4Ps

PRODUCTS

Corporate Banking and Securities

This includes sales and trading of securities, foreign exchange and derivatives dealing,

corporate advisory, M&A.

Under the Foreign Exchange and derivatives segment it deals in onshore swaps, interbank

interest rate and overnight index swaps, Government Bond Trading it is one of the very few

banks in the country offering such a distinguished suite of services.

In the Corporate banking side it has overlooked various IPOs and M&A transactions.

It offers various cash management services leveraging on its well developed technology,

offering Trade finance products such as account payables, receivables and liquidity

management. It has a group offering dedicated services in trade financing and risk advising.

Private & Business Clients

It offers Current account, loans, deposits and investment

advisory services to Individuals as well as small and

medium corporate clients. It has around 150000 retail

customers in India and it offers its services across its 16

branches in the country.

Asset and Wealth Management

It is one of the countrys leading wealth management

companies. Its main focus in this segment is to offer

innovative financial planning and investment products and

services to the High Net Worth individuals in the Country.

PLACE

Deutsche Bank has 17 branches in India located at Mumbai, New Delhi, Bangalore, Chennai,

Kolkata, Gurgaon, Noida, Aurangabad, Kolhapur, Pune, Salem, Vellore, Moradabad, Ludhiana

and Ahmedabad. it also has its Global Service Delivery Centres in three locations. One of its

core competencies comes from its global expertise, technology driven operations and its local

tie-ups. It has several service centres in India, GBS service centres which was set up in 2006 by

DBOI Global services which is subsidiary of the Deutsche Group Company to leverage on Indias

operating infrastructure and Qualified and talented Workforce to support its global operations

across various areas of Services and products the bank offers. These service centres are

strategically located in India at Jaipur, Bangalore and Mumbai.

PROMOTION

It has placed itself as an innovative, performance oriented, leading global financial services

provider in the world. Its mission statement says We compete to be the leading global

provider of financial solutions, creating lasting value for our clients, our shareholders, our

people and the communities in which we operate.

One of their main links to the customers is Relationship managers; Productivity of these

relationship managers is their biggest focal point. Customers especially the HNIs which the

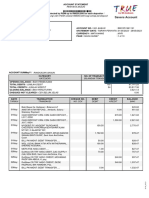

Figure 1: Deutsche Bank's segment wise revenue

Share.

bank focuses on are least worried about the number of branches the bank has in the country

they look for Brand Image and Investment Expertise and services and Deutsche Bank stands for

that.

To ensure that customers remain loyal to the bank, they encourage customers to look for value

additions to the products and services that they provide. Their managers make a point to visit

any clients where they are unhappy with their service or where they have lost money; this in

turn gets a lot of referrals to the bank and in a market where its clients are mostly HNIs even 1

referral by a client makes a big difference.

PRICING

Deutsche bank offers products at a premium, it has positioned itself as a premium brand

offering highly sophisticated, technology driven, performance driven products. One of its

unique selling points is its Value added services. It encourages its customers to go for banks

which is highly efficient and has high level of expertise in the field rather than looking for the

strength of no of branches in the country alone.

DEUTSCHE BANKs STRATEGY AND WHERE THE OTHER BANKS ARE LAGGING BEHIND

Deutsche Banks profit at its Indian operations increased 25% to Rs. 1,033 crores in fiscal 2012-

13 led by a 78% rise in advances to Rs. 22,374 crores from Rs. 12,549 crores in 2011-12.

The bank focused on high-yielding assets and shed those offering lower yields.

Deutsche Bank also announced that its retail banking division had turned profitable seven years

after it started giving loans to individuals in India in 2005-06. The key to success has been focus

on core businesses, stress on quality and customer satisfaction while maintaining strict cost

discipline. In 2011 it sold its credit card business worth 224 crores to IndusInd Bank Ltd,

together with the platform, technology and the talent. Thereby it reduced its retailbook in India

except in areas such as Individual bank accounts, personal and Home loans, with more focus on

its core businesses.

One of the heads of the Bank said that the sale helped the German lender concentrate its retail

banking business around deposits, wealth management, and secured lending.

It was in 2008 after the financial crisis hit many of the customers of foreign banks started

defaulting on their loans or credit card payments Citibank, HSBC and Standard Chartered -

which together account for over 60 per cent of total foreign banking assets in India - suffered

significant losses in their consumer finance portfolio. This was mainly because of foreign banks

aggressive lending to the retail sector it was in this context that Deutsche bank sold its credit

card business. Foreign banks especially the big four Citi bank, HSBC, Stanchart and Deutsche.

Whereas the former three reduced their total assets, Deutsche banks Increased Its total assets

by lending to its core areas like wholesale banking and other operations, it improved its

operating profits from 1506cr to 1821cr whereas Citibank and HSBC declined with Stanchart

making a marginal improvement over its previous year . It also brought in additional

Investments to India to the tune of 455 crores in 2012.

Conclusion:

Deutsche banks CEO Ravneet Gill says that Deutsche Banks robust growth in profits in a

challenging business environment reflects its judicious allocation of resources, deep client

relationships and well diversified businesses. The success of deutsche bank is mainly due to its

focus on the core products and leveraging on its core competencies and reducing exposure to

businesses where its competency does not lie. It should continue to make profits as long as it

sticks to its current strategy.

REFERENCES:

Foreign banks in India At an inflection (Manoj K Kashyap and Shinjini Kumar ,Price Water Coopers)

Deutsche Bank India Country Fact Sheet (db.com/India)

Interview-CEO Deutsche Bank, India - Asian Wealth Management and Asian Private Banking

Hubbis.

Different Branches, New Regime Livemint.com

Deutsche Bank: Winning in a changed environment: Investor day Presentation ,db.com

Foreign banks in India Into another country ,The Economist

Deutsche Bank infuses Rs 455 cr to grow Indian business , Live mint

IndusInd Bank snaps up Deutsche Bank credit card biz ,Business Line

IndusInd to buy Deutsche Bank's credit card biz , Business Standard News

Foreign banks curb retail lending, shift focus to institutional business, Business Today

India continues to offer vast opportunities to foreign banks , Business Today

Mid-sized foreign banks struggle to turn retail operations in India profitable , Business Standard

News

What ails foreign banks in India, Livemint.

You might also like

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- Sai NathDocument6 pagesSai NathLinda MartinNo ratings yet

- Destination India: An Attractive Opportunity For Foreign BanksDocument4 pagesDestination India: An Attractive Opportunity For Foreign BanksAbhi MaheshwariNo ratings yet

- A Project Report On Comparison Between HDFC Bank & ICICI BankDocument75 pagesA Project Report On Comparison Between HDFC Bank & ICICI Bankvarun_bawa25191592% (12)

- A Project Report On Employees Satisfaction Regarding HDFC BankDocument77 pagesA Project Report On Employees Satisfaction Regarding HDFC Bankvarun_bawa25191578% (23)

- Sangeetha PlagarisumDocument63 pagesSangeetha PlagarisumSangeetha BNo ratings yet

- Finlatics Research Insight 1Document7 pagesFinlatics Research Insight 1Aishwarya GangawaneNo ratings yet

- Abn Ambro Bank Final 19-09-2007Document85 pagesAbn Ambro Bank Final 19-09-2007Gaurav NathaniNo ratings yet

- Project Report GIMDocument66 pagesProject Report GIMVarsha ValsanNo ratings yet

- Standard Chartered BankDocument28 pagesStandard Chartered BankRajni YadavNo ratings yet

- Profitability Operational Efficiency of HDFC Bank LTDDocument43 pagesProfitability Operational Efficiency of HDFC Bank LTDSonu K SinghNo ratings yet

- Id 1Document19 pagesId 1UmeshNo ratings yet

- Profitability & Operational Efficiency of HDFC Bank LTDDocument82 pagesProfitability & Operational Efficiency of HDFC Bank LTDBharat Rijvani75% (4)

- Background: PromoterDocument6 pagesBackground: Promotererajkumar_91No ratings yet

- Abn-Ambro Bank Final 2007Document60 pagesAbn-Ambro Bank Final 2007Ajay PawarNo ratings yet

- Project On HDFC BANKDocument70 pagesProject On HDFC BANKAshutosh MishraNo ratings yet

- Financial & Swot Analysis of HDFC BankDocument45 pagesFinancial & Swot Analysis of HDFC Bankarushiwadhwa0% (1)

- A Project Report On Comparison Between HDFC Bank Amp Icici BankDocument75 pagesA Project Report On Comparison Between HDFC Bank Amp Icici BankSAHIL AGNIHOTRINo ratings yet

- Banking Term PaperDocument18 pagesBanking Term PaperSangeeta ChakiNo ratings yet

- History of HDFC Bank: TH THDocument10 pagesHistory of HDFC Bank: TH THBhumi PrajapatiNo ratings yet

- Study of Retail Banking Services of HDFC Bank With Reference To Customer SatisfactionDocument89 pagesStudy of Retail Banking Services of HDFC Bank With Reference To Customer SatisfactionPriya GuptaNo ratings yet

- Exchange Banks-1Document15 pagesExchange Banks-1Sweta SumanNo ratings yet

- Introduction of BankingDocument7 pagesIntroduction of BankingNice NameNo ratings yet

- HDFC Bank Was Incorporated in August 1994Document6 pagesHDFC Bank Was Incorporated in August 1994Deepu ShankerNo ratings yet

- Company Profile: Banking Structure in IndiaDocument46 pagesCompany Profile: Banking Structure in IndiaManpreet SahniNo ratings yet

- A Project Report On Comparison Between HDFC Bank Amp ICICI BankDocument45 pagesA Project Report On Comparison Between HDFC Bank Amp ICICI Bankillusionofsoul_51347No ratings yet

- HDFC BankDocument20 pagesHDFC Bankmohd.irfanNo ratings yet

- Project Vijaya Bank FinalDocument62 pagesProject Vijaya Bank FinalNalina Gs G100% (1)

- The Housing Development Finance Corporation LimitedDocument13 pagesThe Housing Development Finance Corporation LimitedshibanibhNo ratings yet

- Organisational Centered Study On HDFCDocument20 pagesOrganisational Centered Study On HDFCAkshay Krishnan VNo ratings yet

- HDFC BankDocument11 pagesHDFC Banklove gumberNo ratings yet

- HDFCDocument34 pagesHDFClovleshrubyNo ratings yet

- HDFC Bank Company ProfileDocument18 pagesHDFC Bank Company Profilemohammed khayyumNo ratings yet

- Punjab National BankDocument50 pagesPunjab National BankHitesh KumarNo ratings yet

- HDFC ProfileDocument10 pagesHDFC ProfilePunitha AradhyaNo ratings yet

- Overview of BanksDocument9 pagesOverview of BanksParesh MaradiyaNo ratings yet

- MBA HR ProjectDocument62 pagesMBA HR ProjectRajeshKumarJainNo ratings yet

- 34 Ashok HDFCBankLtdDocument8 pages34 Ashok HDFCBankLtdAshok ChoudharyNo ratings yet

- Prathima RajanDocument20 pagesPrathima RajanSubrahmanyasarma ManthaNo ratings yet

- Project Report Bank of Baroda: Holy Family Junior CollegeDocument14 pagesProject Report Bank of Baroda: Holy Family Junior CollegeFloydCorreaNo ratings yet

- Dena BankDocument25 pagesDena BankJaved ShaikhNo ratings yet

- Yama DeepikaDocument13 pagesYama Deepikamrcopy xeroxNo ratings yet

- FM Project HDFCDocument14 pagesFM Project HDFCsameer_kiniNo ratings yet

- HDFC Bank Summer ReportDocument55 pagesHDFC Bank Summer Reportilover_140085% (20)

- Marketing of Consumer Financial Products: Insights From Service MarketingFrom EverandMarketing of Consumer Financial Products: Insights From Service MarketingNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Financial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeFrom EverandFinancial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Entrepreneur's Handbook: Establishing a Successful Money Broker BusinessFrom EverandEntrepreneur's Handbook: Establishing a Successful Money Broker BusinessNo ratings yet

- Guidance Note on State-Owned Enterprise Reform for Nonsovereign and One ADB ProjectsFrom EverandGuidance Note on State-Owned Enterprise Reform for Nonsovereign and One ADB ProjectsNo ratings yet

- The Bankable SOE: Commercial Financing for State-Owned EnterprisesFrom EverandThe Bankable SOE: Commercial Financing for State-Owned EnterprisesNo ratings yet

- Bank Fundamentals: An Introduction to the World of Finance and BankingFrom EverandBank Fundamentals: An Introduction to the World of Finance and BankingRating: 4.5 out of 5 stars4.5/5 (4)

- Vishwas Seminar SapmDocument9 pagesVishwas Seminar SapmvishwasacharyabNo ratings yet

- BancassuranceDocument10 pagesBancassurancevishwasacharyabNo ratings yet

- BancassuranceDocument10 pagesBancassurancevishwasacharyabNo ratings yet

- Deutsche Bank India and Its 4P's of MarketingDocument7 pagesDeutsche Bank India and Its 4P's of MarketingvishwasacharyabNo ratings yet

- Deutsche Bank India and Its 4P's of MarketingDocument7 pagesDeutsche Bank India and Its 4P's of MarketingvishwasacharyabNo ratings yet

- Bancassurance and Marketing Mix in IndiaDocument9 pagesBancassurance and Marketing Mix in IndiavishwasacharyabNo ratings yet

- Deutsche Bank India and Its 4P's of MarketingDocument7 pagesDeutsche Bank India and Its 4P's of MarketingvishwasacharyabNo ratings yet

- Deutsche Bank India and Its 4P's of MarketingDocument7 pagesDeutsche Bank India and Its 4P's of MarketingvishwasacharyabNo ratings yet

- Russia 15 November 2006 Arbitration Proceeding 98:2005 (Feedstock Equipment Case) (Translation AvailDocument12 pagesRussia 15 November 2006 Arbitration Proceeding 98:2005 (Feedstock Equipment Case) (Translation AvailSergey KsenzovetsNo ratings yet

- Important Points For Parents 23-24-1Document4 pagesImportant Points For Parents 23-24-1Prince RajNo ratings yet

- Cash and Cash Equivalents Mock TestDocument3 pagesCash and Cash Equivalents Mock Testwednesday addamsNo ratings yet

- GTM Guidebook Analytical CRMDocument7 pagesGTM Guidebook Analytical CRMKirsonNo ratings yet

- Sample Construction Joint Venture AgreementDocument18 pagesSample Construction Joint Venture AgreementAriaz BrinjiNo ratings yet

- Sky Debit Order AuthorisationDocument1 pageSky Debit Order AuthorisationMark SilbermanNo ratings yet

- Pestle and Banking IndustryDocument16 pagesPestle and Banking IndustryRegina Leona DeLos SantosNo ratings yet

- 2 (F) and 12 (B) Colleges - Proforma For Soliciting Xii Plan Requirements of The CollegeDocument15 pages2 (F) and 12 (B) Colleges - Proforma For Soliciting Xii Plan Requirements of The CollegeSenthil KumarNo ratings yet

- CombinepdfDocument19 pagesCombinepdfAbdul HannanNo ratings yet

- Blue Book PDFDocument151 pagesBlue Book PDFdhruv KhandelwalNo ratings yet

- Comparison of Sbi Internet Banking Facilities With Icici BankDocument7 pagesComparison of Sbi Internet Banking Facilities With Icici BankEkta KhoslaNo ratings yet

- Financial Statement AnalysisDocument2 pagesFinancial Statement AnalysisSrilekha RoyNo ratings yet

- Table of Content: Schedule of Bank Charges (Exclusive of FED)Document30 pagesTable of Content: Schedule of Bank Charges (Exclusive of FED)ahsanNo ratings yet

- Micro Project: (Your Guide Name)Document17 pagesMicro Project: (Your Guide Name)Dictator Aditya AcharyaNo ratings yet

- E-Commerce AssignmentDocument39 pagesE-Commerce AssignmentMuttant SparrowNo ratings yet

- 2 Accounting PDFDocument3 pages2 Accounting PDFibrahimbdNo ratings yet

- Business Plan Liquid SoapDocument14 pagesBusiness Plan Liquid SoapPeter Rock100% (1)

- University of KarachiDocument53 pagesUniversity of KarachiWaqasBakaliNo ratings yet

- Understanding Bank Financial StatementsDocument49 pagesUnderstanding Bank Financial StatementsRajat MehtaNo ratings yet

- Philippine Deposit Insurance Corporation (PDIC)Document4 pagesPhilippine Deposit Insurance Corporation (PDIC)Angelo Raphael B. DelmundoNo ratings yet

- Savings Bank Accounts Rules & RegulationsDocument3 pagesSavings Bank Accounts Rules & Regulationsmanish sharmaNo ratings yet

- Imp 2 PDFDocument86 pagesImp 2 PDFDebabrato SasmalNo ratings yet

- Overpaid Bank TellersDocument7 pagesOverpaid Bank TellersMaryam KhushbakhatNo ratings yet

- Q-1 Engineering EconomicsDocument2 pagesQ-1 Engineering EconomicsMac KYNo ratings yet

- The Genesis of Bank Deposits (W. F. Crick)Document13 pagesThe Genesis of Bank Deposits (W. F. Crick)João Henrique F. VieiraNo ratings yet

- EngEcon TVM Formular 2Document17 pagesEngEcon TVM Formular 2Chidi HenryNo ratings yet

- Ratio Analysis 2022Document34 pagesRatio Analysis 2022Asanka8522No ratings yet

- Qualified Theft and Estafa As Furtive CrimesDocument37 pagesQualified Theft and Estafa As Furtive CrimesNikki Delgado100% (1)

- Tybaf Black Book Topic (23-24)Document3 pagesTybaf Black Book Topic (23-24)mahekpurohit1800No ratings yet

- Cash ManagementDocument38 pagesCash ManagementArunKumarNo ratings yet