Professional Documents

Culture Documents

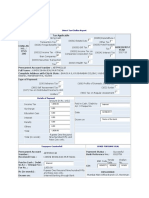

Assignment 1

Uploaded by

JoannaGaboCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 1

Uploaded by

JoannaGaboCopyright:

Available Formats

WHATISCORPORATEFINANCE?

Everydecisionthatabusinessmakeshasnancialimplications,andanydecisionwhichaects

thenancesofabusinessisacorporatenancedecision.

Denedbroadly,everythingthatabusinessdoestsundertherubricofcorporatenance.

Intraditionalcorporatefinance,theobjectiveindecisionmakingistomaximizethevalueofthefirm.

Anarrowerobjectiveistomaximizestockholderwealth.Whenthestockistradedandmarketsare

viewedtobeefficient,theobjectiveistomaximizethestockprice.

Thedefinitionofcorporatefinancevariesconsiderablyacrosstheworld.IntheUS,forexample,it

isusedinamuchbroaderwaythanintheUKtodescribeactivities,decisionsandtechniques

thatdealwithmanyaspectsofacompanysfinancesandcapital.

IntheUK,thetermscorporatefinanceandcorporatefinanciertendtobeassociatedwith

transactionsinwhichcapitalisraisedinordertocreate,develop,groworacquirebusinesses

TheFirm:StructuralSetUp

Incorporatefinance,wewillusefirmgenericallytorefertoanybusiness,largeorsmall,manufacturingor

service,privateorpublic.Thus,acornergrocerystoreandMicrosoftarebothfirms.Thefirmsinvestments

aregenericallytermedassets.Althoughassetsareoftencategorizedbyaccountantsintofixedassets,

whicharelonglived,andcurrentassets,whichareshortterm,wepreferadifferentcategorization.The

assetsthatthefirmhasalreadyinvestedinarecalledassetsinplace,whereasthoseassetsthatthefirm

isexpectedtoinvestinthefuturearecalledgrowthassets.Thoughitmayseemstrangethatafirmcanget

valuefrominvestmentsithasnotmadeyet,highgrowthfirmsgetthebulkoftheirvaluefromthese

yettobemadeinvestments.Tofinancetheseassets,thefirmcanraisemoneyfromtwosources.Itcan

raisefundsfrominvestorsorfinancialinstitutionsbypromisinginvestorsafixedclaim(interestpayments)on

thecashflowsgeneratedbytheassets,withalimitedornoroleinthedaytodayrunningofthebusiness.

Wecategorizethistypeoffinancingtobedebt.Alternatively,itcanofferaresidualclaimonthecashflows

(i.e.,investorscangetwhatisleftoveraftertheinterestpaymentshavebeenmade)andamuchgreaterrole

intheoperationofthebusiness.Wecallthisequity.Notethatthesedefinitionsaregeneralenoughtocover

bothprivatefirms,wheredebtmaytaketheformofbankloansandequityistheownersownmoney,as

wellaspubliclytradedcompanies,wherethefirmmayissuebonds(toraisedebt)andcommonstock(to

raiseequity).

SomeFundamentalPropositionsaboutCorporateFinance

1.Corporatefinancehasaninternalconsistencythatflowsfromitschoiceofmaximizingfirmvalueas

theonlyobjectivefunctionanditsdependenceonafewbedrockprinciples:Riskhastoberewarded,cash

flowsmattermorethanaccountingincome,marketsarenoteasilyfooled,andeverydecisionafirmmakes

hasaneffectonitsvalue.

2.Corporatefinancemustbeviewedasanintegratedwhole,ratherthanacollectionofdecisions.

Investmentdecisionsgenerallyaffectfinancingdecisionsandviceversafinancingdecisionsofteninfluence

dividenddecisionsandviceversa.Althoughtherearecircumstancesunderwhichthesedecisionsmaybe

independentofeachother,thisisseldomthecaseinpractice.Accordingly,itisunlikelythatfirmsthatdeal

withtheirproblemsonapiecemealbasiswilleverresolvetheseproblems.Forinstance,afirmthattakes

poorinvestmentsmaysoonfinditselfwithadividendproblem(withinsufficientfundstopaydividends)anda

financingproblem(becausethedropinearningsmaymakeitdifficultforthemtomeetinterestexpenses).

3.Corporatefinancematterstoeverybody.Thereisacorporatefinancialaspecttoalmosteverydecision

madebyabusinessthoughnoteveryonewillfindauseforallthecomponentsofcorporatefinance,

everyonewillfindauseforatleastsomepartofit.Marketingmanagers,corporatestrategists,human

resourcemanagers,andinformationtechnologymanagersallmakecorporatefinancedecisionseveryday

andoftendontrealizeit.Anunderstandingofcorporatefinancewillhelpthemmakebetterdecisions.

4.Corporatefinanceisfun.Thismayseemtobethetallestclaimofall.Afterall,mostpeopleassociate

corporatefinancewithnumbers,accountingstatements,andhardheadedanalyses.Althoughcorporate

financeisquantitativeinitsfocus,thereisasignificantcomponentofcreativethinkinginvolvedincomingup

withsolutionstothefinancialproblemsbusinessesdoencounter.Itisnocoincidencethatfinancialmarkets

remainbreedinggroundsforinnovationandchange.

5.Thebestwaytolearncorporatefinanceisbyapplyingitsmodelsandtheoriestorealworld

problems.Althoughthetheorythathasbeendevelopedoverthepastfewdecadesisimpressive,the

ultimatetestofanytheoryisapplication.Aswewillargue,much(ifnotall)ofthetheorycanbeappliedto

realcompaniesandnotjusttoabstractexamples,thoughwehavetocompromiseandmakeassumptions

intheprocess.

WHOARETHEVARIOUSPLAYERSINCORPORATEFINANCE?

WHATISTHEROLEOFACORPORATEFINANCELAWYER?

Solicitorswhoareprimarilyinvolvedinadvisingonthetypesoftransactionincludinglegaldue

diligence.

InPhilippines,thereexistcountlesslawsthatgovernthefunctioningofanykindofbusiness

establishment.Thecorporatefinancelawyermusthaveagoodunderstandingoftheselaws.Quite

often,economicexpertsclassifytheselawsintotwotheonesthatprotecttheinterestsofthe

corporationandtheonesthattakecareoftheclients(servedbythecompany).Alongwith

comprehendingthelaws,theattorneymustbehavingamplelevelsofexpertiseandexperienceto

tackleanyformoffinancialadversity.Attheendoftheday,thecorporatefinancelawyerhastosee

toitthatthemanagementishappywiththeperformanceandtheoperationalmannersofthe

establishment.

The role of a corporate finance law attorney cannot be sidelined in the corporate world today. This

man of law is equipped to hand le the intricacies of corporate finance law that could take a toll on

your business health if not taken care of in time and in the right manner. As a corporate entity or a

shareholder you need to comply with the corporate law from time to time. The need also arises as

youbuyandsellagreementsandaddressthenuancesofcapitalization.

The corporate finance law attorney is now accessible online and offline to offer suggestions and

guidance in return for a small and very negligible fee. Their answers to queries and timely help

enable you to rest assured that the business is in safe hands. With the productive legal results you

actually gain the guarantee that the company's future growth is secured. It is not easy to battle

commercial law on your own. The legal assistance given by the corporate finance law attorney is

effectiveandcoversallcorporatetransactions.

A corporate finance lawyer's job is mainly about guiding a company into making profits with the

primary task of keeping the company's actions within the boundary of the law. A corporate lawyer

may also seek State legislation for a desired act by the company which is seeking to make profit or

a move by executing the act. Although not so much inside the courtroom, a corporate lawyer's job

can be tedious, lengthy and demanding. Corporate lawyers are hired by firms maximize their profits

withintheconstraintsoflaw.

WHENMAYACOMPANYNEEDTOSEEKFINANCING?

Mostbusinessesseekfinancetoimprovecashfloworreplacemachineryorequipmentofsome

kind.Whiletherearemanyotherreasonswhyahealthybusinesswillseekfinance,forsomeitmay

flagunderlyingfinancialproblems.Beforeyouseekfinance,carefullyconsiderthefollowing

questionswithaqualifiedaccountantorbusinessadvisor:

Whatdoesyourbusinessneed?

Whyareyouseekingfinance?

Shouldyoubeseekingfinance?

Whatfinanceoptionsareavailable?

Whichfinanceoptionsarebestsuitedtoyoursituation?

Doyouhavetheabilitytorepaythefinance?

Businessownerswhoseekfinancingfaceafundamentalchoice:shouldtheyborrowfundsortakein

newequitycapital?Sincedebtandequityhaveverydifferentcharacteristics,eachhasadifferent

impactonearnings,cashflow,balancesheetpresentation,andtaxes.Eachalsohasdifferent

effectonaCompanysleverage,dilution,andahostofothermetricsbywhichbusinessesare

measured.Finally,eachfinancingoptionbringsadifferenttypeofrelationshipwiththerespective

financingsource.TheCompanysplanneduseoffunds,desiredrelationshipwiththecapitalsource,

andtype/stageofthecompanywilllargelydeterminetheoptimalformoffinancingforagiven

situation.

WHATDOYOUMEANBYMARKETCONDITIONS?

Characteristicofamarketintowhichafirmisenteringorintowhichanewproductwillbe

introduced,suchasnumberofthecompetitors,levelorintensityofcompetitiveness,andthe

market'sgrowthrate.

Thesearecharacteristicsofanindustrysector,e.g,retail,whichcanaffectbuyersandsellersin

thatsector.Factorstoconsiderinclude,forexample,thenumberofcompetitorsinthesector,if

thereisasurplusthennewcompaniesmayfinditdifficulttoenterthemarketandremainin

business.

WHATISSOUNDFINANCIALMANAGEMENT?

Itmeanstheaggregatesetofpracticesandprocedureswhichallowfortheaccurate,transparent,

andeffectivehandlingofallgovernmentmoniesandgovernmentcontracts.

Asoundpublicfinancialmanagementsystemhelpsgovernmentdecisionmakersbothoversight

agenciesandspendingagenciesinperformingtheirfunctionsdotheirjobseffectively,efficiently

andeconomically.Ithelpsthemtochannelfundstowheretheyareintendedandwilldothe

greatestgoodandsendsoffsignalswhendeviationsoccur.Mostimportantly,ithelpstoinform

citizenswherepublicfundsareactuallybeingspent

WHATARETHEDIFFERENTREGULATORYMEASURES

INVOLVINGCORPORATEFINANCEINTHEPHILIPPINES?

FinancingCompanyActof1998

FinanceRelatedRegulations

You might also like

- Understanding Options StrategiesDocument32 pagesUnderstanding Options Strategiesjohnsm2010No ratings yet

- Forms of Business Ownership and RegistrationDocument26 pagesForms of Business Ownership and Registrationchrissa padolinaNo ratings yet

- Starting A Business Checklist 2023 GovDocument10 pagesStarting A Business Checklist 2023 Govjcgoku9No ratings yet

- Investment Advisory Business Plan TemplateDocument22 pagesInvestment Advisory Business Plan TemplatesolomonNo ratings yet

- Report PublicDocument5 pagesReport PublicIpe DimatulacNo ratings yet

- HOW TO START & OPERATE A SUCCESSFUL BUSINESS: “The Trusted Professional Step-By-Step Guide”From EverandHOW TO START & OPERATE A SUCCESSFUL BUSINESS: “The Trusted Professional Step-By-Step Guide”No ratings yet

- Financial Coaching Business Plan TemplateDocument21 pagesFinancial Coaching Business Plan TemplatesolomonNo ratings yet

- Business Finance ConceptDocument55 pagesBusiness Finance ConceptBir MallaNo ratings yet

- Jollibee Foods CorporationDocument27 pagesJollibee Foods CorporationRexter Balista0% (1)

- Ferrari Report Group1Document8 pagesFerrari Report Group1DavidNo ratings yet

- 17 Key Lessons For Entrepreneurs Starting A BusinessDocument3 pages17 Key Lessons For Entrepreneurs Starting A BusinessP SssNo ratings yet

- Joint ArrangementDocument5 pagesJoint ArrangementEzrah Lukes100% (2)

- 14 - Audit Other Related ServicesDocument38 pages14 - Audit Other Related ServicesSyafiq AhmadNo ratings yet

- Business and Strategy: OxfordDocument22 pagesBusiness and Strategy: OxfordSudeep BatraNo ratings yet

- Preparation For Consolidations in SAP ECC To Meet Your EPM Integration NeedsDocument25 pagesPreparation For Consolidations in SAP ECC To Meet Your EPM Integration NeedsarunvisNo ratings yet

- Start Up LawDocument41 pagesStart Up LawMALKANI DISHA DEEPAKNo ratings yet

- Role of Financial ManagerDocument6 pagesRole of Financial ManagerSaAl-ismailNo ratings yet

- Carlyn Cpa EncodeDocument221 pagesCarlyn Cpa EncodePaul Espinosa100% (6)

- General PartnershipDocument3 pagesGeneral PartnershipJoannaGabo100% (1)

- 1 Introduction To Pricing StrategyDocument9 pages1 Introduction To Pricing Strategymayank_chowdharyNo ratings yet

- Corporate FinanceDocument8 pagesCorporate FinanceNeha KesarwaniNo ratings yet

- Module 5 Applied EconomicsDocument19 pagesModule 5 Applied Economicsjxnnx sakura33% (3)

- Role of A Financial ManagerDocument13 pagesRole of A Financial ManagerpratibhaNo ratings yet

- Statement of Management Responsibility For BIRDocument1 pageStatement of Management Responsibility For BIRGia Paola CastilloNo ratings yet

- 13 (D) Ericsson Telecommunications, Inc. vs. City of PasigDocument2 pages13 (D) Ericsson Telecommunications, Inc. vs. City of PasigGoodyNo ratings yet

- Managing GrowthDocument13 pagesManaging GrowthDave Castillo BangisanNo ratings yet

- Setting Up Business in UK Made Feasible For Greece Residents! NewDocument4 pagesSetting Up Business in UK Made Feasible For Greece Residents! Newmike petersonNo ratings yet

- Business Environment 1 PDF PDFDocument35 pagesBusiness Environment 1 PDF PDFDave NNo ratings yet

- Here Are Five Reasons Why Should I Study FinanceDocument5 pagesHere Are Five Reasons Why Should I Study Financekazi A.R RafiNo ratings yet

- Business Finance - Lesson 1Document49 pagesBusiness Finance - Lesson 1joesNo ratings yet

- Busifin1 Chapter2Document96 pagesBusifin1 Chapter2Ronald MojadoNo ratings yet

- MBA203Document4 pagesMBA203Janice AbarcaNo ratings yet

- Lecture 2Document28 pagesLecture 2Modest DarteyNo ratings yet

- FMDocument22 pagesFMFiona MiralpesNo ratings yet

- Financing Your Growth StrategyDocument6 pagesFinancing Your Growth StrategyPinky ThackerNo ratings yet

- FUNDAMENTAL of ManagementDocument100 pagesFUNDAMENTAL of ManagementEralisa Paden100% (1)

- INTOYDocument5 pagesINTOYJoshua HonraNo ratings yet

- Meaning of Business Finance: Economic ActivitiesDocument4 pagesMeaning of Business Finance: Economic ActivitiesRica RaviaNo ratings yet

- Lesson 1Document6 pagesLesson 1Chelsea Joy AtienzaNo ratings yet

- Corporate Social ResponsibilityDocument6 pagesCorporate Social ResponsibilityMaria AliNo ratings yet

- Enterpreneurship - ManagementDocument6 pagesEnterpreneurship - ManagementFaiq AlekberovNo ratings yet

- Lesson 2 Organization PDFDocument20 pagesLesson 2 Organization PDFAngelita Dela cruzNo ratings yet

- Unit - 5 NotesDocument11 pagesUnit - 5 Notesdilipkumar.1267No ratings yet

- UNIT-1 NotesDocument15 pagesUNIT-1 NotesRaman TiwariNo ratings yet

- Financial Management: OverviewDocument54 pagesFinancial Management: OverviewmarieieiemNo ratings yet

- Chapter 2 - Types of BusinessesDocument24 pagesChapter 2 - Types of BusinessessanuNo ratings yet

- Differences in-WPS OfficeDocument11 pagesDifferences in-WPS OfficeHitesh KumarNo ratings yet

- Business Creation and Growth (GNS 302 - 2021) Important SummariesDocument148 pagesBusiness Creation and Growth (GNS 302 - 2021) Important SummariesAminu AbdullahiNo ratings yet

- How To Grow A Business - Funding StrategiesDocument8 pagesHow To Grow A Business - Funding StrategiesSangram PandaNo ratings yet

- Finance Note Module 1Document12 pagesFinance Note Module 1Ruth MuñozNo ratings yet

- Leverage Capital Markets Money Management: FinanceDocument13 pagesLeverage Capital Markets Money Management: FinanceIYSWARYA GNo ratings yet

- Mba Business Environment Unit 1Document21 pagesMba Business Environment Unit 1kamaltechnolkoNo ratings yet

- Sahar Micro ComputerDocument6 pagesSahar Micro ComputernoorNo ratings yet

- Getting Started: Principles of FinanceDocument9 pagesGetting Started: Principles of FinancexacrilegeNo ratings yet

- Business Finance Lecture 1Document19 pagesBusiness Finance Lecture 1arabella joy gabitoNo ratings yet

- Entrepreneurship AssignmentDocument7 pagesEntrepreneurship AssignmentMazhar ArfinNo ratings yet

- LKZ ASSIGNMENT 5 ResearchDocument11 pagesLKZ ASSIGNMENT 5 ResearchLinda ZyongweNo ratings yet

- Corporate Sales: Frequently Asked QuestionsDocument7 pagesCorporate Sales: Frequently Asked QuestionsLeonardo SepúlvedaNo ratings yet

- Emst UsDocument34 pagesEmst UsDibyendu DAsNo ratings yet

- Chapter One 13th Batch Lecture OneDocument13 pagesChapter One 13th Batch Lecture Oneriajul islam jamiNo ratings yet

- TEAM 7 - Activities in Business OrganizationsDocument26 pagesTEAM 7 - Activities in Business OrganizationsEduardo BautistaNo ratings yet

- Fundamentals of Corporate Finance Are Given in The Diagram Below.Document24 pagesFundamentals of Corporate Finance Are Given in The Diagram Below.Nidhi Kulkarni100% (2)

- Law On Corporate Finance NotesDocument25 pagesLaw On Corporate Finance NotesTHAKUR SAHABNo ratings yet

- Banks and Other Commercial Lenders: 3 Effective Ways To Utilize Your Working Capital WiselyDocument2 pagesBanks and Other Commercial Lenders: 3 Effective Ways To Utilize Your Working Capital Wiselymariel buyagonNo ratings yet

- Questions,,,EnterprieDocument5 pagesQuestions,,,EnterprieMuhammad yaseenNo ratings yet

- Unit - 2 BookDocument68 pagesUnit - 2 BookManav JainNo ratings yet

- Unit 1Document15 pagesUnit 1navaditya.gupta2027No ratings yet

- Group 11 Final Research PT in EnglishDocument18 pagesGroup 11 Final Research PT in EnglishRyanNo ratings yet

- Unit 8 CompleteDocument6 pagesUnit 8 CompleteDanyell MorrisNo ratings yet

- Patent CasesDocument4 pagesPatent CasesJoannaGaboNo ratings yet

- Thought Catalog - 10 "Firsts" in A Law Student's LifeDocument2 pagesThought Catalog - 10 "Firsts" in A Law Student's LifeJoannaGaboNo ratings yet

- Implementation of Ihr LDocument10 pagesImplementation of Ihr LJoannaGaboNo ratings yet

- Labor Answers-Prohibited PracticesDocument1 pageLabor Answers-Prohibited PracticesJoannaGaboNo ratings yet

- Special Power of AttorneyDocument2 pagesSpecial Power of AttorneyJoannaGaboNo ratings yet

- 04.BPI Vs CADocument5 pages04.BPI Vs CAJoannaGaboNo ratings yet

- Mun of Makati Vs CADocument4 pagesMun of Makati Vs CAJoannaGaboNo ratings yet

- Cebu Portland Cement Vs CTADocument4 pagesCebu Portland Cement Vs CTAJoannaGaboNo ratings yet

- 03.CIR Vs AlgueDocument3 pages03.CIR Vs AlgueJoannaGaboNo ratings yet

- Transcom Worldwide Philippines, Inc.: Taxable Income DetailsDocument1 pageTranscom Worldwide Philippines, Inc.: Taxable Income Detailsbktsuna0201No ratings yet

- DAI 2009 Annual ReportDocument264 pagesDAI 2009 Annual Reportdarshit88No ratings yet

- Application Form: Iba Ihsan Trust-National Talent Hunt Program - 2019Document4 pagesApplication Form: Iba Ihsan Trust-National Talent Hunt Program - 2019Hamza AhmedNo ratings yet

- Pfa0064 - Topic 9Document18 pagesPfa0064 - Topic 9Jeyaletchumy Nava RatinamNo ratings yet

- XBRL I.E Extensible Business Reporting LanguageDocument15 pagesXBRL I.E Extensible Business Reporting Languagemeenakshi56No ratings yet

- Macro1 PDFDocument23 pagesMacro1 PDFPMNo ratings yet

- Advance Payment of TaxDocument35 pagesAdvance Payment of TaxTrapti Garg Goyal0% (1)

- Caiib PDFDocument14 pagesCaiib PDFAbhishek KaushikNo ratings yet

- Direct Tax Challan ReportDocument2 pagesDirect Tax Challan ReportVivek MurtadakNo ratings yet

- Accruals and Prepayments - Principles of AccountingDocument6 pagesAccruals and Prepayments - Principles of AccountingAbdulla MaseehNo ratings yet

- Test 4 - Q2Document5 pagesTest 4 - Q2Tu Anh PhanNo ratings yet

- Pay Commission ReportDocument762 pagesPay Commission ReportddetvmNo ratings yet

- 2003 Annual Financial StatementDocument11 pages2003 Annual Financial Statementvenga1932No ratings yet

- Motives and Consequences of Fraudulent Financial ReportingDocument8 pagesMotives and Consequences of Fraudulent Financial ReportingAndreea VioletaNo ratings yet

- 11 Chapter 3 (Working Capital Aspects)Document30 pages11 Chapter 3 (Working Capital Aspects)Abin VargheseNo ratings yet

- Partnership FormationDocument12 pagesPartnership FormationMa Teresa B. CerezoNo ratings yet

- ITIL Intermediate Capability SOA Sample1 SCENARIO BOOKLET v6.1Document9 pagesITIL Intermediate Capability SOA Sample1 SCENARIO BOOKLET v6.1Anonymous zWUrYoc2VNo ratings yet

- Production Theory ELE D4 2 PDFDocument102 pagesProduction Theory ELE D4 2 PDFnadieNo ratings yet

- Report On Industrial Training at "Amco Pipe Industries"Document53 pagesReport On Industrial Training at "Amco Pipe Industries"Ashwini KumaranNo ratings yet

- BHEL One PagerDocument1 pageBHEL One PagerdidwaniasNo ratings yet