Professional Documents

Culture Documents

Rizwan & Khan (2007)

Uploaded by

fika'Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rizwan & Khan (2007)

Uploaded by

fika'Copyright:

Available Formats

International Review of Business Research Papers

Vol.3 No.2 June 2007, Pp. 362 - 375

362

Stock Return Volatility in Emerging Equity Market (Kse): The

Relative Effects of Country and Global Factors

Mohammad Faisal Rizwan* and Safi Ullah Khan**

This paper focuses on the role of macroeconomic variables and global

factors on the volatility of the stock returns in an emerging market like

Pakistan. The paper uses two multivariate models, multivariate EGARCH

and Vector Auto Regressive (VAR) models to investigate the effect of

exchange rate, interest rate, industrial production, money supply, Morgan

Stanley Capital International (MSCI) World Index and 6-months LIBOR

on stock prices in Pakistans equity market. The estimate shows that

domestic macroeconomic variables have varying degrees of importance

in explaining the relationship between stock returns and volatility in

Karachi Stock Exchange. The empirical results also show that the two

global factors, MSCI World Index and 6-months LIBOR, variables used in

this paper explain the stock returns in KSE. An important conclusion

drawn from the results is that macroeconomic variables exhibit

asymmetric effects on returns volatility. Overall, the results show that

Pakistans stock market is partially integrated as shown by the significant

role of both country and global factors.

Field of Research: Finance

1. Introduction

Studies on the link between macroeconomic variables and stock returns are broadly

divided into two groups based on the level of market integration. The first strand

promotes the view that markets are generally integrated and, as a result, global risk

factors are more important in explaining returns volatility than country factors. Most of

the studies that emphasize the role of global risk factors have modeled returns as linear

function of global risk factors (Ferson and Harvey, 1994; Dumas and Solnim, 1995;

Harvey, 1995). A list of most popular factors examined in the integrated market

approach includes industrial production, unexpected inflation, changes in expected

inflation, real interest rates, term structure risk and price of crude oil.

________________________________________

*Faisal Rizwan , Government College University, Faisalabad, Pakistan.

Email: rizwan_faisal2000@yahoo.com

**Safi Ullah Khan , Kohat University of Science and Technology, Kohat, Pakistan. Email:

safiullah75@yahoo.com

Rizwan & Khan

363

Ferson and Harvey (1993a, 1993b) examined all these variables, measured as global

aggregates, as potential risk factors for global asset pricing models. The few studies

that looked at the role of global risk factors on the stock returns of emerging markets

have also implicitly or explicitly emphasized the relevance of market integration in their

analyses. Harvey (1995), for example, tested the relationship between returns in the

emerging markets and a set of global variables including world inflation, world GDP,

world oil prices and trade weighted world exchange rate. Results of his study suggests

that standard global asset pricing models, which assume complete integration of capital

markets, fails to explain the cross section of average returns in emerging markets.

Bekaert and Harvey (1997) use liberalization dates to examine the behavior of volatility

in emerging markets. The time series and cross-sectional models analyze the reasons

that volatility is different across emerging markets, particularly with respect to the timing

of capital market reforms. This study finds that capital market liberalization often

increase the correlation between local market returns and the world market but do not

drive up local market volatility.

The proponents of complete market segmentation highlight the overriding role of

domestic macroeconomic variables in their investigation of return volatility. Again most

of these studies are predominantly focused on developed markets (Chen et al., 1986;

Fama; 1990; Jorion, 1991; Ely and Robinson, 1997). It has been argued that in less

integrated markets, correlation with the world portfolio is weaker and according to

Harvey (1998, 2000) only local market variance explains the cross-section in emerging

markets.

Chen, Roll and Ross (1986) studying whether innovations in macroeconomic variables

affect stock returns, find that the spread between long and short run interest rates,

expected and unexpected inflation, industrial production and the spread between high

and low grade bonds were found to systematically affect the stock market returns.

FAMA (1990) finds that U.S. stock returns and its aggregate real activity are correlated.

Ely and Robinson (1997) concludes that stocks do maintain their value relative to

movements in overall price indexes and this conclusion generally does not depend on

whether the source of the inflation shock is from the real or monetary sector.

Empirical studies that have investigated the level of integration have generally found

that emerging stock markets are only partially integrated. Since the markets are neither

perfectly segmented nor perfectly integrated, investigating the role of macroeconomic

variables at the two extremes may lead to inconclusive results. Hence, the third

research strand calls for consideration of both domestic and global variables in the

study of emerging markets.

The current study examines the relevance of macroeconomic variables in the

framework of partial integration. In other words, the study investigates the effects of

both country and global variables on the volatility of emerging market stock returns.

This study investigates the following questions regarding the relationship between

macroeconomic factors and stock returns in Pakistans emerging equity market. First,

are the mean effects and volatility shocks of macroeconomic variables transmitted to

Karachi Stock Market (KSE).And if so, are the shocks persistent. The presence of

Rizwan & Khan

364

persistence in volatility clustering may signify inefficiency of the market, and provide the

possibility of arbitrage. Second, whether macroeconomic shocks and global factors

have any significant asymmetric effects on the returns volatility of the equity market.

Ross (1989) points out that volatility is directly linked to the rate of information flow.

Hence, positive and negative macroeconomic shocks may be transmitted differently.

This study is important for domestic and foreign investors in terms of risk management

and portfolio diversification strategies for many reasons. First, the accurate

measurement of the volatility of financial data is important because economic agents

make decisions based on the perceptions that high levels of volatility of financial tend to

cause the general erosion of investors confidence and a flow of capital away from the

stock markets (Schwert, 1989, Ballie and DeGennaro, 1990). Second, answers to these

questions may be important for decision-making by national policy makers as well as

our understanding of how such decisions affect the stock market of the country.

Analyzing specific macroeconomic fundamentals can also help us understand the

extent to which differences in performance of stock market is justified by economic

fundamentals. In addition, the predictability of volatility is important in designing optimal

asset allocation decisions as well as dynamic hedging strategies for options and futures

(Baillie and Myers, 1991). Therefore understanding the fundamentals underlying

volatility is also important for the valuation of stocks and their corresponding derivative

products in stock market.

2. Data and Descriptive Statistics

Karachi Stock Exchange, established in 1950, is the largest and the most active of the

three stock exchanges of Pakistan. Other regional exchanges are in Islamabad and

Lahore which are relatively inactive. KSE currently lists 662 companies with a market

capitalization of over Rs. 52 billion. The KSE-100, a capital weighted index, represents

major blue chips companies and is fairly representative of the market.

This study uses monthly returns on stock index. The month-end closing values of the

KSE-100 index were obtained from online database of Yahoo finance for the period

from July 2000 to Jun 2005. The market returns are calculated by taking first difference

of logs of two consecutive month-end closing values.

2.1 Country and Global Variables

The domestic macroeconomic variables used for the study are Money supply, Monthly

CPI, Industrial production, Exchange rate and Interest rate, while 6-month LIBOR and

Morgan Stanley Capital International (MSCI) All Countries World Index are used as

global variables. The data on these macroeconomic variables were obtained from

monthly publication of International Monetary Fund (IMF). Data on all macro economic

variables cover the period July 2000 to Jun 2005.

Rizwan & Khan

365

2.2 Descriptive Statistics

To assess the distributional properties of the monthly stock returns various descriptive

statistics are reported in Table 1 that includes mean, variance, standard deviation,

kurtosis, skewness. This study covers a period from July 2000 to June 2005. The mean

monthly return is 2.55 percent and the standard deviation is 8.7 percent which indicates

high volatility of returns that characterize the market as one of the emerging markets.

The deviations from the normality in the returns can be seen from the excess positive

kurtosis which implies that the underlying distribution has long right tails. Kurtosis of

normal distributions is said to be equal to 3. If the kurtosis exceeds 3, the distribution is

peaked relative to normal (i.e., leptokurtic). Therefore, stock returns examined in the

study exhibit non-normality.

3. Econometric Models

As shown by descriptive statistics in Table 1, the distribution of the return series does

not follow a normal distribution; the nature of the distribution suggests volatility

clustering, where large returns are followed by large returns and small returns tends to

be follow by small returns, leading to contiguous periods of volatility and stability. Such

data require appropriate econometric modeling techniques in order to ensure proper

interpretation and conclusion.

Engle (1982) developed a model to capture time-varying variance- the Autoregressive

Conditional Heteroscedastic (ARCH) approach. The basic ARCH model has led to other

related formulations describing the evolution of the variance of time series, such as the

Generalized ARCH (GARCH) model. Among the various formulations of the GARCH

models, the EGARCH approach has been identified as the most appropriate model for

stock indexes. Moreover, parameter restrictions are not necessary because EGARCH

models the log of conditional variance, thereby guaranteeing that the variance will be

positive. Furthermore, Engle and Ng (1993), report that asymmetric models such as

EGARCH provide the best forecast of volatility. Based on the conceptual underpinnings

of the study, the hypothesized questions and the past performance of the exponential

GARCH model, this study uses a multivariate EGARCH model.

4. Unit Root tests

It is important to check whether the data series is stationary before using the Vector

Auto Regressive (VAR) and the EGARCH Models. Engel and Granger (1987) suggest

different unit root tests. Augmented Dickey Fuller (ADF) test is believed to be the most

powerful test among them. The ADF test examines the unit root of the observed data by

taking the unit root (non stationarity) as the null hypothesis. The rejection of H

o

implies

that the series X

t

is stationary. Table 2 reports the results of the ADF test. Since the

ADF test statistic for monthly stock returns (7.83) is less than the critical value, the null

hypothesis of a unit root is rejected. Therefore, monthly stock returns series are

stationary. The result of the ADF tests for the countrys macroeconomic and the global

factors are also less than the critical values, and are therefore, stationary.

Rizwan & Khan

366

5. Multivariate EGARCH Model

The multivariate Exponential Generalized Auto Regressive Conditional

Heteroscedasticity (EGARCH) model used in this study is based on one estimated by

Christofi and Pericli (1999). Let R

t

be the logarithmic market return at time t for j

macroeconomic variables, given that j=1, 2, 3, 4, 5, 6, 7 (1= Exchange rate, 2=

Domestic interest rate, 3= Industrial production, 4= Money supply, 5= Monthly CPI, 6=

MSCI world index, 7= 6-months LIBOR),

t

and

2

t

the conditional mean and conditional

variance respectively, and k is the lag length.

t

is the innovation at time t (i.e.

t

= R

t

-

t

)

and Z

t

the standardized innovation (i.e. Z

t

=

t

/

2

t

) at time t. The model is specified as

follows:

) 1 (

2

1

) (

7

1

0

+ + =

= =

t k t

k

k j

j

t

R c | |

) 2 ( ) ln( exp

2

1

2

1

) (

7

1

0

2

(

+ + =

=

=

t

k

k t k j

j

T

X o o o o

( ) | | ) 3 (

1 . 1 . 1 . 1 .

+ =

t j j t j t j t j

Z Z E Z X o

Equation (1) models the conditional mean return of country and is specified as a

function of the lagged values of its exchange rates, interest rates, industrial production,

money supply, the MSCI world index, CPI and the 6-months LIBOR rates. The residuals

from first-order autoregressions fitted to these variables are used as proxies for shocks

to returns. This specification is meant to investigate the first question of the study

whether the mean shocks of macroeconomic variables are transmitted to the stock

market returns. The coefficient

j

measures the degree of effects across

macroeconomic variables. A significant

j

coefficient would imply that variable j leads

market or equivalently, that current returns in variable j can be used to predict future

returns in market.

The hypothesis tested is that each macroeconomic variable is important in explaining

the returns of a country. So the null hypothesis here is that:

H

o

:

i

= 0, for all i

Eq. (2) describes the conditional variance process as an extended EGARCH process,

which allows the testing and measuring of the asymmetric impact of its own, and, the

domestic and global macroeconomic variables past standardizes innovations on the

conditional variance of a market. The specification here examines the research question

regarding the transmission of macroeconomic volatility shocks and whether they are

persistent over time. The coefficient

j

in Eq. (2) captures the effect of innovations from

macroeconomic variable j to market. This coefficient specifically measures the

significance of past volatilities (standardized residuals) in each macroeconomic variable

on the conditional variance of the equity returns.

Significant

j

implies that the past volatilities of a macroeconomic variable impact the

conditional volatility of the equity returns. The null hypotheses tested here are that past

volatilities in the js do not impact the conditional variance of the equity returns.

H

o

:

i

= 0 for all i

The coefficient in Eq. (2) measures the persistence in volatility. A high value suggests

that an information shock tends to persist for some time into the future. The presence of

persistence in volatility clustering may imply the inefficiency of the market. The variable

Rizwan & Khan

367

X

j,t-1

is specified in Eq. (3) and is intended

to capture the asymmetric effect of past

standardized innovations, Z

j,t-1

(Z

j,t-1

=

j,1-t

/

j,t-1

), on current volatility. This specification

is intended to investigate, whether there are asymmetric effects in the transmission of

the volatilities of macroeconomic variables. The term |Z

j.t-1

| - E(|Z

j.t-1

|) measures the size

effect, while the term

j

Z

j.t-1

measures the sign effect. If the lagged values of the market

and/or macroeconomic variable advance and decline impacts volatility symmetrically,

the coefficient

j

would not be expected to be significant. If declines in macroeconomic

variable j (Z

j,t-1

>0) are followed by higher (lower) volatility than the variables advances

(Z

j,t-1

>0), then

j

would be expected to be negative (positive) and significant. Assuming

that

j

is positive, the larger the deviation of past standardized innovation from its

expected value, the larger the impact (positive or negative) on the current variance. The

null hypothesis tested is that:

H

o

:

j

= 0 and

j

= 0 for

j

> 0 and

j

> 0

6. Empirical Results of the EGARCH Model

The exponential GARCH results for the relative effects of country and global factors on

stock returns are reported in Table 3. It reports the empirical results for Karachi Stock

Exchange past returns, modeled as lagged returns in the GARCH model are positive

and significant in explaining current returns. This result is consistent with the volatility

clustering phenomena of most emerging markets. That is, higher periods of returns are

followed by higher returns and vice versa. Table 3 also reports that the industrial

production coefficient is positive but insignificant. In fact most previous studies have

found low or no effect of industrial activity on security prices. Hardouvetis (1987), for

instance, concludes that financial markets respond primarily to monetary and not real

activity news. So the failure to detect any significant effect may be due to the fact that

the impact horizon is short under this model. The money supply variable is negative and

significant (-1.56308). The reason may be that Pakistan has experienced higher levels

of inflationary trends that tend to depress stock prices. The coefficient for CPI is

negative and significant (-4.63263). The reason may be that higher inflation uncertainty

increases risk, the discount factor and so leads to decline in stock prices. The table also

reports that the stock market is positively impacted by the global factor; MSCI World

Index. The coefficient for MSCI world Index is (0.638144) positive and significant. This

finding suggests that Pakistans stock market have increased interaction with the global

economy ever since it opened up for foreign investors. While coefficients for exchange

rate and interest rate are negative but insignificant. This is because currency exchange

rate and interest rate in emerging markets like Pakistan is controlled by government

policies. This situation means that the exchange rate and interest rate are less

predicting factors compared to the situation in developed markets. The fundamental

economic factors such as exchange rate, deposit interest rate, have been found to be

more predicting factor in case of developed stock markets, this is due to the fact that

fundamental factors are tied and controlled in the emerging economies and may be less

relevant to predict stock volatility.

Rizwan & Khan

368

7. Analysis of the Conditional Variance Equation

Table 4 reports the estimated coefficients of the conditional equations and shows MSCI

World Index, Money Supply, CPI and LIBOR have significant impact on the stock price

volatility. The implication of this result is that increases in the volatilities of these country

and global variables leads to increases in the volatility of the Pakistans stock market.

While the coefficients of the exchange rate, interest rate and industrial production are

not significant in explaining the volatility in the stock market. The reason may be that in

emerging markets, investors in financial markets respond mainly to monetary news

instead of real activity news. Similar studies of interest rate volatility on Brazil and

Argentinas market also found insignificant results for interest rates volatility. The money

supply (-1.733) and the CPI (-0.0057) variables are negative and significant. A possible

explanation may be that high levels of inflation tend to depress stock prices. The table

also reports that the coefficients of MSCI World Index, Exchange rate and interest rate

not significant in explaining stock market volatility.

8. Analysis of Asymmetric Component

The EGARCH proposed by Nelson (1991) estimates the conditional variance as a

function of standardized innovations and allows the conditional variance to respond

asymmetrically to positive and negative innovations. The estimates from the multivariate

EGARCH model shows that the country and global variables do not impact stock prices

symmetrically as has been assumed by some previous studies. Table 4 (5.3 reports that

the symmetry effect hypothesis is rejected in case of Pakistans stock market

suggesting that macroeconomic variables do exhibit asymmetric effect. This asymmetric

coefficient is (-.7223747) negative and is significant at 5% level and the negative sign

indicates that negative news about macroeconomic variables affect stock prices more

than positive news. The results also suggest that stock market sensitivity to

macroeconomic news depends on the size and sign of the surprise in the news. The

negative sign of the asymmetry coefficient suggests that bad economic news is followed

by higher stock market volatility than good economic news.

9. Multivariate Vector Auto Regressive Model

Developed by Sims in 1990, the VAR model is based on multivariate time series

analysis, in which a variable, R

t

, is stated as a function of the past history of R

t

and the

past history of other variables (R

2

.R

n

) that influence R

t

. The following multivariate

VAR model is used following Granger (1969).

i i t

n

i

j

m

i

i t i t

K R R c | o + + + =

= =

1 1

1

Where R

t

is monthly return at time t for stock index., and

i,

j,

are parameters, m and n

are the lag lengths for monthly stock index returns and the macroeconomic and global

factors respectively to be used in the equation. The above-mentioned Granger (1969)

Causality test is designed to examine whether time series move one after the other or

Rizwan & Khan

369

contemporaneously. When they move contemporaneously, one provides no information

for characterizing the other. If some of the

j

values are statistically not zero, then K is

said to Granger-cause stock returns. If

j

parameters are statistically equal to zero,

then economic variables are not impacting the stock returns. A standard F-test can be

applied to test the null hypothesis that economic variables and the global variables fail

to Granger cause the stock returns.

H

o: 0 =

j

, for all j macroeconomic variables

Using the Akaikes (1969) Final Prediction Error criterion for determining the auto-

regressive lag length, the equation is estimated for m = 1 and n = 1.

Table 5 reports the VAR coefficients for the response of the stock market to the shocks

from the country and global factors. The results show that MSCI World Index, Money

Supply, CPI, LIBOR are important variables in explaining stock price performance, as

the coefficients of these variables are significant. These variables significantly impact

the performance of the stock prices.

10. Conclusion and Implications

A number of previous studies have reported that a relationship between macroeconomic

variables and equity market returns. However, most of these studies have typically

focused on developed market. This paper extends the literature by investigating

whether there are relationships between macroeconomic variables and the stock

returns in an emerging market like Pakistans stock market. This paper uses two

multivariate models, multivariate EGARCH and Vector Auto Regressive (VAR) models

to investigate the effect of exchange rate, interest rate, industrial production, money

supply, Morgan Stanely Capital International (MSCI) World Index and 6-month LIBOR

on stock prices in Karachi Stock Exchange. The estimate shows that domestic

macroeconomic variables have varying degrees of importance in explaining the

relationship between stock returns and volatility in KSE. The empirical results show that

the two global, MSCI World Index and 6-months LIBOR, variables used in this paper

explains the stock returns in KSE. An important conclusion drawn from the results is

that macroeconomic variables exhibit asymmetric effects on returns volatility. In

particular the results show that for KSE the past returns, modeled as lagged returns in

the GARCH model are positive and significant in explaining current returns. This result

is consistent with the volatility clustering phenomenon of most emerging markets.

The estimated coefficients of EGARCH models show that stock returns respond

significantly to money supply, CPI and LIBOR and MSCI World Index. Similar results

are found for the VAR model.

The estimated coefficient of EGARCH conditional equation shows that only money

supply, CPI and LIBOR volatility in Pakistan has significant impact on stock price

volatility. The implication of this result is that an increase in money supply and CPI

volatility in Pakistan leads to an increase in volatility of the stock market. The industrial

production coefficient as reported by VAR is positive but not significant. Previous

studies have found low or no effect of industrial activity on security prices. Hardouvelis

Rizwan & Khan

370

(1987), for instance concludes that financial markets respond primarily to monetary and

not real activity news.

The measure of persistence of volatility shocks in the EGARCH model suggests that

news information in this market does not die quickly but is persistent over time. The

symmetry effect hypothesis is rejected suggesting that macroeconomic variables do

exhibit asymmetric effect in Pakistans stock market. The negative signs indicate that

negative news about macroeconomic variables in Pakistans stock market affect stock

prices more than positive news do. The result suggests that bad economic news is

followed by higher stock market volatility than good economic news. The finding is

consistent with the findings in some other studies. Overall, the results show that

Pakistans stock market is partially integrated as shown by the significant role of both

country and global factors. The above conclusions have important implications for both

investors and policy makers.

11. Implications

The results reported in this study suggest that macroeconomic variables are important

with regard to stock market volatility in Pakistan. International investors can therefore,

improve their portfolio performance by considering the stability in economic

fundamentals as determinants of stock market volatility. Policy makers, on the other

hand, can concentrate their efforts to attain stability in economic fundamentals in order

to reduce volatility and minimize investor uncertainty. Policy makers should be sensitive

to asymmetric effects of volatility in the market. Effective macroeconomic management,

market transparency and availability of information can provide a market environment

with low asymmetric information and its related problem.

References

Baille, R. T., Myers, R. 1991. Modelling commodity price distributions and estimating

the optimal futures hedge, Journal of Applied Econometrics 6,109-124.

Harvey, C.R., 1997, Emerging equity market volatility, Journal of Finance 55, 565-613.

Bekaert, G., 1995, Market integration and investment barriers in emerging equity

markets. World Bank Economic Review 9, 75-107.

Ballie, R. T., DeGennaro, R. P. 1990, Stock returns and volatility, Journal of Financial

and Quantitative Analysis 25, 203-215.

Chen, N., Roll, R., Ross, S. 1986, Economic forces and the stock market, Journal of

Business 39, 383-403.

Christofi, A., Pericli, A., 1999, Correlation in price changes and volatility of major Latin

American stock markets. Journal of Multinational Financial Management 9, 79-93.

Rizwan & Khan

371

Dumas and Solnik, 1995 Solnik, B., 1995, The world price of foreign exchange risk,

Applied Economics Letters 3, 121-123.

Ely, D.P., Robinson, K. J, 1997, Are stock a hedge against inflation? International

evidence using a long-run approach, Journal of International Money and Finance 16,

141-167.

Engle, R. F. Ng, V. K. 1993, Measuring and testing the impact of news on volatility,

Journal of Finance 48, 1749-1778.

Fama, E. F. 1990, Stock returns, expected returns, and real activity, Journal of Finance

1089-1109.

Ferson, W. E. and Harvey C.R., 1994a, Sources of risk and expected returns in

international equity markets, Journal of Banking and Finance 18, 775-803.

Ferson W. E., Harvey, C.R. 1993, The risk and predictability of international equity

returns, Review of Financial Studies 6: 527-566.

Ferson W. E., and Harvey, C.R. 1994b, An exploratory investigation of fundamental

determinants of international equity returns. In Frankel, J.A. Internationalization of

Equity Markets, Univrsity of Chisago Press (ISNB 0-226-26001-1), pp. 59-148.

Granger, C. W. J. 1981, Some Properties of Time Series Data and Their Use in

Econometric Model Specification, Journal of Econometrics, 16: 121-30

Hardouvelis, G. 1987, Macroeconomic information and stock prices, Journal of

Economic and Business, 131-139.

Harvey, C. R. 1995, The risk exposure of emerging markets, World Bank Economic

Review 9, 19-50.

Harvey, C. R. 1998, The future of investment in emerging countries. NBER Reports

(Summer), 5-8.

Harvey, C. R. 2000, The derivers of expected in international markets, Emerging

Markets Quarterly 3: 32-49.

Johnson, P. 1991, The pricing of exchange rate risk in the stock market, Journal of

Financial and Quantitative Analysis 26: 363-376.

Nelson, D.B. 1991, Conditional heteroscedasticity in asset returns: a new approach,

Econometrica 59: 347-370.

Ross, S.A. 1989, Information and volatility: The no-arbitrage Martingle approach to

timing and resolution irrelevancy, Journal of Finance 44: 1-17.

Rizwan & Khan

372

Schwert, G.W. 1989, Why does stock market volatility change over time? Journal of

Finance 44 (5): 1115-1154.

Rizwan & Khan

373

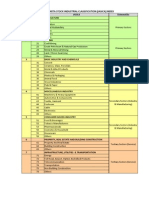

Appendices

Tables

Table 1

Summary Statistics of Monthly KSE Returns

Mean 0.025528

Median 0.021724

Maximum 0.241114

Minimum -0.15455

Std. Dev. 0.087079

Skewness 0.29688

Kurtosis 2.771848

Table 2: Augmented Dickey Fuller Test Results for stock returns and

macroeconomic variables

KSE Returns -7.838

*

1% Critical Value -3.569

MSCI World Index -6.717

*

5% Critical Value -2.924

Money Supply -8.429

*

10% Critical Value -2.597

Exchange Rate -3.904

*

CPI -6.219

*

LIBOR -3.941

*

Interest Rate -7.792

*

* shows significance at 1%

Rizwan & Khan

374

Table 3: Mean Effects of Macroeconomic Variables on Stock Returns

) 1 (

2

1

) (

7

1

0

+ + =

= =

t k t

k

k j

j

t

R c | |

Coefficient Std. Error t-Statistic

Past Returns 0.022553

**

0.012718 1.77323

Industrial

Production

0.00076 0.000826 0.920069

CPI -4.63263

*

1.362635 -3.39976

Exchange Rate -1.36637 0.969568 -1.40925

Interest Rate 0.003296 0.158029 0.020855

LIBOR 0.51002

*

0.115744 4.406457

Money Supply -1.56308

*

0.516928 -3.02378

MSCI World Index 0.638144

*

0.213747 2.985511

C 0.129876

*

0.032461 4.000937

R

2

0.213745

Note:

**

shows significance at 10% and

*

at 5% level.

Rizwan & Khan

375

Table 4: EGARCH RESULTS

) 2 ( ) ln( exp

2

1

2

1

7

1

0

2

(

+ + =

=

=

t

k

k t k

j

T

X o o o o

Co-eff. Std. Err. t-statistic

MSCI World Index 0.31387 0.26243 1.2

Money Supply -2.32176

*

0.79826 -2.91

Exchange Rate 0.19775 0.98254 0.2

CPI -3.64433

*

1.67786 -2.17

LIBOR 0.40508

*

0.14652 2.76

Interest Rate -0.06653 0.14909 -0.45

Asymmetric effect -0.72237

*

0.34156 -2.11

-0.84674

*

0.22810 -3.71

0

-9.94651

*

1.27097 -7.83

ARCH + GARCH terms 0.70

Note:

*

shows significance at 5% level.

Table 5: Results of Vector Auto Regressive Model

i i t

n

i

j

m

i

i t i t

K R R c | o + + + =

= =

1 1

1

F-Statistic 2.81

*

R

2

0.31

Coef. Std. Err t

1

o 0.116614 0.3588285 0.32

KSE Returns -0.11335 .1136981 -1.00

MSCI World Index 0.678133

*

.2638073 2.57

Money Supply -1.73345

*

.7685238 -2.26

Exchange Rate 0.006148 .0067167 0.92

CPI -0.0057

*

.002718 -2.10

LIBOR 0.320005

**

.1677306 1.91

Interest rate 0.00212 .0070671 0.30

Industrial Production 9.92E-05 .0002094 0.47

Note:

*

shows significance at 5% and

**

at 10% level.

You might also like

- Macroeconomic Forces and Stock Prices in BangladeshDocument55 pagesMacroeconomic Forces and Stock Prices in BangladeshSayed Farrukh AhmedNo ratings yet

- Synopsis 1Document20 pagesSynopsis 1Kalsoom AkhtarNo ratings yet

- Stock Return and Macroeconomic Fundamentals in Model-Specification Framework: Evidence From Indian Stock MarketDocument29 pagesStock Return and Macroeconomic Fundamentals in Model-Specification Framework: Evidence From Indian Stock MarketEdwin PurnamanNo ratings yet

- Relationship between stock volatility and macro variables in PakistanDocument21 pagesRelationship between stock volatility and macro variables in PakistanMuhammadIjazAslamNo ratings yet

- Lje 2009Document23 pagesLje 2009Arshad HasanNo ratings yet

- Causal Loop ModelingDocument8 pagesCausal Loop Modelingomid yNo ratings yet

- M NishatDocument22 pagesM NishatHameeda AkhtarNo ratings yet

- Impact of Macro Economic Variables On Stock Market Volatility: A Study of GCC Stock MarketsDocument9 pagesImpact of Macro Economic Variables On Stock Market Volatility: A Study of GCC Stock MarketsajmrdNo ratings yet

- Shaikh, A. S., Et Al (2017)Document25 pagesShaikh, A. S., Et Al (2017)Irza RayhanNo ratings yet

- Aggregate Economic Variables and Stock Markets in IndiaDocument24 pagesAggregate Economic Variables and Stock Markets in IndiaUttam RungtaNo ratings yet

- 3967 12689 1 SMDocument12 pages3967 12689 1 SMkaylakshmi8314No ratings yet

- Empirical Determinants of Equity Market Development Analysis of High Income and Middle Income Economies.Document13 pagesEmpirical Determinants of Equity Market Development Analysis of High Income and Middle Income Economies.JEAN PIERRE RIVERA HUANUCONo ratings yet

- Luqman Reserch PaperDocument12 pagesLuqman Reserch PaperTran DuongNo ratings yet

- 1510 4415 1 PB PDFDocument4 pages1510 4415 1 PB PDFyogesh KannaiahNo ratings yet

- Macroeconomic Factors and The Indian Stock Market: Exploring Long and Short Run RelationshipsDocument14 pagesMacroeconomic Factors and The Indian Stock Market: Exploring Long and Short Run Relationshipsaurorashiva1No ratings yet

- Stock and Foreign Exchange Markets Relationship StudyDocument24 pagesStock and Foreign Exchange Markets Relationship StudyDr. Sajid Mohy Ul DinNo ratings yet

- فقه النصر والتمكين نهائيDocument19 pagesفقه النصر والتمكين نهائيRSI Cahaya GiriNo ratings yet

- Cia - Iii: Final Model and Report BY Raghav Agarwal 2028004Document12 pagesCia - Iii: Final Model and Report BY Raghav Agarwal 2028004Raghav AgrawalNo ratings yet

- The Determinants of Stock Prices in PakistanDocument17 pagesThe Determinants of Stock Prices in PakistaneditoraessNo ratings yet

- The Relationship Between Stock Prices and Stock Market Activity Under Influence of Non-Informational Factors in PakistanDocument4 pagesThe Relationship Between Stock Prices and Stock Market Activity Under Influence of Non-Informational Factors in Pakistanfarooqafridi93No ratings yet

- Impact of Macroeconomic Variables on Stock Markets: A Literature ReviewDocument31 pagesImpact of Macroeconomic Variables on Stock Markets: A Literature ReviewBA20-042 DambaruNo ratings yet

- Literature ReviewDocument2 pagesLiterature ReviewKhushboo AroraNo ratings yet

- Investment ArticleDocument15 pagesInvestment ArticleShabbir HussainNo ratings yet

- Stock Market Volatility and Macro Economic Variables Volatility in Nigeria An Exponential GARCH ApproachDocument15 pagesStock Market Volatility and Macro Economic Variables Volatility in Nigeria An Exponential GARCH ApproachiisteNo ratings yet

- Macroeconomic Factors and Bangladesh Stock Market: Impact Analysis Through Co Integration ApproachDocument15 pagesMacroeconomic Factors and Bangladesh Stock Market: Impact Analysis Through Co Integration ApproachAnkul BariaNo ratings yet

- Kwon1999 PDFDocument11 pagesKwon1999 PDFEvertonNo ratings yet

- Integration and Comovement of Developed and Emerging Islamic Stock Markets: A Case Study of MalaysiaDocument37 pagesIntegration and Comovement of Developed and Emerging Islamic Stock Markets: A Case Study of MalaysiaPriscillia DanielNo ratings yet

- Trading Volume and Stock Return: The Impact of Events in Pakistan On KSE 100 IndexesDocument11 pagesTrading Volume and Stock Return: The Impact of Events in Pakistan On KSE 100 IndexesTyaNo ratings yet

- Foreign Portfolio Flows and Their Impact On Financial Markets in IndiaDocument22 pagesForeign Portfolio Flows and Their Impact On Financial Markets in IndiaAdarsh KumarNo ratings yet

- IJMRES 1 Paper Vol 7 No1 2017Document29 pagesIJMRES 1 Paper Vol 7 No1 2017International Journal of Management Research and Emerging SciencesNo ratings yet

- Macroeconomic Factors and Equity Prices: An Empirical Investigation by Using ARDL ApproachDocument18 pagesMacroeconomic Factors and Equity Prices: An Empirical Investigation by Using ARDL ApproachNasir JamalNo ratings yet

- A Study of Return, Liquidity of Sectoral Indices, Market Index Return of Indian Financial Market (BSE)Document20 pagesA Study of Return, Liquidity of Sectoral Indices, Market Index Return of Indian Financial Market (BSE)Jayanta DuttaNo ratings yet

- Impact of Exchange Rate On Stock Market: International Review of Economics & Finance January 2015Document5 pagesImpact of Exchange Rate On Stock Market: International Review of Economics & Finance January 2015Thanh NgânNo ratings yet

- Exploring The Volatility of Stock Markets: Indian ExperienceDocument15 pagesExploring The Volatility of Stock Markets: Indian ExperienceShubham GuptaNo ratings yet

- Derivatives Market and Econmoicn Growth Is There A RelationshipDocument45 pagesDerivatives Market and Econmoicn Growth Is There A RelationshipPratik ChourasiaNo ratings yet

- Trading Volume and Stock Returns: Evidence From Pakistan's Stock MarketDocument12 pagesTrading Volume and Stock Returns: Evidence From Pakistan's Stock MarketJannat KhanNo ratings yet

- Abdullah If ProjectDocument11 pagesAbdullah If Projectabdullah akhtarNo ratings yet

- The Effects of Rupee Dollar Exchange Rate Parity On The Indian Stock MarketDocument11 pagesThe Effects of Rupee Dollar Exchange Rate Parity On The Indian Stock MarketAssociation for Pure and Applied ResearchesNo ratings yet

- Macroeconomic Factors and Sectoral Indices: A Study of Karachi Stock Exchange (Pakistan)Document21 pagesMacroeconomic Factors and Sectoral Indices: A Study of Karachi Stock Exchange (Pakistan)Sagheer MuhammadNo ratings yet

- Neural Network Models For Forecasting Mutual Fund Net Asset ValueDocument18 pagesNeural Network Models For Forecasting Mutual Fund Net Asset ValueClara Agustin StephaniNo ratings yet

- Factors Affecting the BSE Sensex Index in IndiaDocument17 pagesFactors Affecting the BSE Sensex Index in IndiaDhrupal ShahNo ratings yet

- The Relationship Between Stock Market Volatility and Macro Economic VolatilityDocument12 pagesThe Relationship Between Stock Market Volatility and Macro Economic VolatilitygodotwhocomesNo ratings yet

- Comparative Study of Distribution of Indian Stock Market With Other Asian MarketsDocument20 pagesComparative Study of Distribution of Indian Stock Market With Other Asian Marketsadmin2146No ratings yet

- Journal of Economics and Management: Katarzyna NiewińskaDocument17 pagesJournal of Economics and Management: Katarzyna NiewińskaUmer ArifNo ratings yet

- Adaptive Market Hypothesis Evidence From Indian Bond MarketDocument14 pagesAdaptive Market Hypothesis Evidence From Indian Bond MarketsaravanakrisNo ratings yet

- 4480-Article Text-10676-1-10-20210607Document6 pages4480-Article Text-10676-1-10-20210607Haris MirzaNo ratings yet

- Indian stock price movements and macroeconomic factorsDocument10 pagesIndian stock price movements and macroeconomic factorsAysha LipiNo ratings yet

- Determinants of Stock Market Liquidity A Macroeconomic PerspectiveDocument22 pagesDeterminants of Stock Market Liquidity A Macroeconomic PerspectiveMuhammad MansoorNo ratings yet

- Assignment Research ProposalDocument14 pagesAssignment Research ProposalSeb BazerqueNo ratings yet

- OTD Research About MARKET RETURNSDocument9 pagesOTD Research About MARKET RETURNSObaid R.No ratings yet

- Does Stock Market Development Cause Economic Growth? A Time Series Analysis For Bangladesh EconomyDocument9 pagesDoes Stock Market Development Cause Economic Growth? A Time Series Analysis For Bangladesh EconomyPushpa BaruaNo ratings yet

- RechrpprDocument10 pagesRechrpprNiam MahmudNo ratings yet

- Investigating Day-of-the-Week Effect in Stock Returns: Evidence From Karachi Stock Exchange - PakistanDocument13 pagesInvestigating Day-of-the-Week Effect in Stock Returns: Evidence From Karachi Stock Exchange - PakistanAnand ChineyNo ratings yet

- Macroeconomic Volatility Impacts Malaysian Stock PricesDocument13 pagesMacroeconomic Volatility Impacts Malaysian Stock PriceshanuNo ratings yet

- 9676-Article Text-36134-2-10-20160502.pdf Brazil PDFDocument8 pages9676-Article Text-36134-2-10-20160502.pdf Brazil PDFwahyu erlanggaNo ratings yet

- Literature Review: Stock Exchange & SEBI An Evolution in Indian Financial Market & Economy As A WholeDocument6 pagesLiterature Review: Stock Exchange & SEBI An Evolution in Indian Financial Market & Economy As A WholeRaghunath AgarwallaNo ratings yet

- (1-12) Stock Prices and Micro Economic VariablesDocument12 pages(1-12) Stock Prices and Micro Economic VariablesiisteNo ratings yet

- Malaysian Stock Market Impacted by Macroeconomic FactorsDocument2 pagesMalaysian Stock Market Impacted by Macroeconomic FactorsHitesh BalNo ratings yet

- Stock Market and Foreign Exchange Market: An Empirical GuidanceFrom EverandStock Market and Foreign Exchange Market: An Empirical GuidanceNo ratings yet

- Kajian Kritis Feminist Posmodernis Dalam Formulasi Aset Mental Organisasi Feminis ReligiusDocument8 pagesKajian Kritis Feminist Posmodernis Dalam Formulasi Aset Mental Organisasi Feminis Religiusfika'No ratings yet

- Tax Position, Investment Opportunity Set (IOS), and Signaling Effect As A Determinant of LeverageDocument14 pagesTax Position, Investment Opportunity Set (IOS), and Signaling Effect As A Determinant of LeverageRasi BantingNo ratings yet

- Good Corporate Governance, Information AsymmetryDocument13 pagesGood Corporate Governance, Information Asymmetryfika'No ratings yet

- Journal of Corporate Accounting & Finance Volume 11 Issue 1 1999 Shirley Dennis-Escoffier - Good News, Bad NewsDocument6 pagesJournal of Corporate Accounting & Finance Volume 11 Issue 1 1999 Shirley Dennis-Escoffier - Good News, Bad Newsfika'No ratings yet

- Daftar Emiten BEIDocument23 pagesDaftar Emiten BEIisnaini latifah0% (1)

- Multicollinearity in Regression ModelsDocument13 pagesMulticollinearity in Regression ModelsAndi Alimuddin RaufNo ratings yet

- Eppaper09-1 IncentivecompDocument11 pagesEppaper09-1 Incentivecompfika'No ratings yet

- MCX Client Account Opening Procedure Circulars 2013Document28 pagesMCX Client Account Opening Procedure Circulars 2013Disability Rights AllianceNo ratings yet

- Cocofed V RepublicDocument2 pagesCocofed V RepublicGlewin DavidNo ratings yet

- Commodity Market With Special Refernce To Gold and SilverDocument28 pagesCommodity Market With Special Refernce To Gold and Silveranon_86173686293% (14)

- BF2201 Investments CheatsheetDocument4 pagesBF2201 Investments CheatsheetRahman Md SaifurNo ratings yet

- Vodafone International Holdings ... Vs Union of India & Anr On 20 January, 2012Document82 pagesVodafone International Holdings ... Vs Union of India & Anr On 20 January, 2012silvernitrate1953No ratings yet

- Investor Perception About Systematic Investment Plan (SIP) Plan: An Alternative Investment StrategyDocument7 pagesInvestor Perception About Systematic Investment Plan (SIP) Plan: An Alternative Investment StrategyUma Maheswar KNo ratings yet

- Impact of East West Metro, KolkataDocument3 pagesImpact of East West Metro, KolkatashreekanyaNo ratings yet

- Borders Group Inc. Bankruptcy AnalysisDocument10 pagesBorders Group Inc. Bankruptcy AnalysisJill PiccioneNo ratings yet

- ECON430 SolutionDocument3 pagesECON430 Solutionالاشقر اليامي67% (3)

- Blades Inc. Future StrategiesDocument31 pagesBlades Inc. Future StrategiesRoyal LinNo ratings yet

- Definition of Business PolicyDocument5 pagesDefinition of Business PolicyJessica LaguatanNo ratings yet

- Almaha Ceramics ProspectusDocument148 pagesAlmaha Ceramics ProspectusAbdoKhaledNo ratings yet

- AltairDocument1 pageAltairjozefRudyNo ratings yet

- F2-17 Capital Budgeting and Discounted Cash Flows PDFDocument28 pagesF2-17 Capital Budgeting and Discounted Cash Flows PDFJaved ImranNo ratings yet

- Java High Speed Train ProjectDocument26 pagesJava High Speed Train Projectkekipi100% (3)

- MacroEconomics - EstradaDocument4 pagesMacroEconomics - EstradaDahzle Kaye100% (1)

- Hunter Grain, Swap and RD1 On A ShipDocument1 pageHunter Grain, Swap and RD1 On A ShipRichardNo ratings yet

- Forex NotesDocument9 pagesForex NotesPrasad NaikNo ratings yet

- The Rise of Tncs From Emerging Markets: The Issues: Karl P. SauvantDocument12 pagesThe Rise of Tncs From Emerging Markets: The Issues: Karl P. Sauvantjorgel_alvaNo ratings yet

- FM Top Companies 2014Document80 pagesFM Top Companies 2014Sara Mitchell MitchellNo ratings yet

- Assessing investment propertyDocument11 pagesAssessing investment propertyNicoleVenturaTadejaNo ratings yet

- Peraturan Presiden TKDN Nomor 29 Tahun 2018 (Eng Ver.)Document34 pagesPeraturan Presiden TKDN Nomor 29 Tahun 2018 (Eng Ver.)tiaraNo ratings yet

- Determination of Ultimate Pit LimitsDocument16 pagesDetermination of Ultimate Pit LimitsOrlando Chura Torres100% (1)

- Clerk 2019 Main PaperDocument29 pagesClerk 2019 Main PaperSaifi KhanNo ratings yet

- 07MB105 Financial & Management Accounting - OKDocument21 pages07MB105 Financial & Management Accounting - OKKumaran Thayumanavan0% (1)

- Bussiness Interruption InsuranceDocument30 pagesBussiness Interruption InsuranceFarazNaseerNo ratings yet

- BlackstoneDocument2 pagesBlackstoneaidem100% (2)

- Career Research MemoDocument3 pagesCareer Research Memoapi-246640622No ratings yet

- Ocean ManufacturingDocument3 pagesOcean Manufacturingreem0% (1)

- Financial Analysis of Everest BankDocument25 pagesFinancial Analysis of Everest BankBarishtLalKaparNo ratings yet