Professional Documents

Culture Documents

Petroleum Economics

Uploaded by

arazaasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Petroleum Economics

Uploaded by

arazaasCopyright:

Available Formats

1

Petroleum Economics Petroleum Economics

by by

Dr.Thitisak Dr.Thitisak Boonpramote Boonpramote

Department of Mining and Petroleum Engineering Department of Mining and Petroleum Engineering

Chulalongkorn Chulalongkorn University University

Crude Oil Pricing Crude Oil Pricing

2

What What is the is the current crude oil prices? current crude oil prices?

A. The price people will pay

B. WTI & Brent

C. What the pricing services say

D. Cost of production plus margin

Answer: A, B & C Definitely NOT D!

So E&P profitability depend on high oil prices at

low production costs

Full cost of producing one barrel of oil equivalent Full cost of producing one barrel of oil equivalent

(source: (source: www.amec.com www.amec.com in 2005) in 2005)

Reserves,

bln.bbl

* - finding, development and production

excl. transportation and taxes (CERA)

100

16

12

8

4

200 300 400 500 600 700

$/bbl

Iraq Iran Saudi Arabia UAE

USA,

stripper wells

Western

Siberia

Venezuela(x-heavy)

Other Latin America

Nigeria

Algeria

Brasil

North Sea

Western Canada

Mexico

China (onshore)

Indonesia

USA, Mexican Gulf (deep)

USA, Alaska

USA onshore

Angola

Kazakhstan

Russia

Other

800

Best

Companies**

** - 2001 finding, development and production cost 3.7 $/bbl,

Including Government expenses

Venezuela(conv)

Kuwait

3

History of Crude History of Crude Oil Oil Pric Pricing ing Systems Systems

Posted prices Posted prices : 1945-1970

Set by oil companies (cost plus margin)

OSPs OSPs (Official Selling Prices) (Official Selling Prices) : 1970-Present

Set by governments and NOCs

Netbacks Netbacks : 1985-1986

Based on product values

Benchmark Pricing Benchmark Pricing ( (Spot market Spot market- -linked): linked): 1986-Present

Set by clearing markets and pricing services

Marker Crude for 3 Regional Markets Marker Crude for 3 Regional Markets

4

Benchmarks act as a barometer of outright values

Used as a reference price reference price

Often used to price other grades:

For example, Oman/Dubai used to price oil from

Saudi Arabia, Iran, Kuwait, UAE etc.

Differentials Differentials are negotiated off benchmark price

Benchmark does not change physical value

Responsive to supply/demand fundamentals

Use of Benchmarks in Pricing Use of Benchmarks in Pricing

Criteria for benchmarks Criteria for benchmarks

Production volume

Open trade free of bottlenecks

Fungible quality

Wide equity and customer base

Market liquidity

Price Transparency

Market forces Market forces

determine price

Price cannot be

dictated by any

single party

5

Brent

WTI

Dubai

Benchmark

Active, many

contracts

IPE Brent

Successful

Europe

Active, linked to

futures

NYMEX sweet

very successful

US

Active, many

contracts

Limited role to date

but DME startup

due May 1, 2007

Asia

Swaps Futures Region

The Traditional Benchmarks The Traditional Benchmarks

WTI

WTI

BRENT

BRENT

DUBAI

OMAN

TAPIS

WTI (West Texas Intermediate): North & South America

Dubai / Oman: Middle East

Brent: Europe & Africa

Tapis: Far East

Marker Crude / Marker Crude / Benchmark Benchmark Crude Crude

6

The Americas The Americas West Texas Intermediate (WTI) West Texas Intermediate (WTI)

Europe/Asia Europe/Asia

International Petroleum Exchange (IPE) linked International Petroleum Exchange (IPE) linked

7

Arabian Gulf (AG) Arabian Gulf (AG) Exports to Asia Exports to Asia

Other Asian Marker Crudes Other Asian Marker Crudes

8

Benchmark Pricing Mechanism Benchmark Pricing Mechanism Benchmark Pricing Mechanism

FUNDAMETALS FUNDAMETALS

A A. . PRODUCTION PRODUCTION/ /DRILLING DRILLING - - OPEC OPEC

- - NON NON- -OPEC OPEC

B B. . CRUDE RUN CRUDE RUN

C C. . CRUDE STOCK CRUDE STOCK

D D. . REFINING OPERATION REFINING OPERATION

E E. . END END- -USER DEMAND USER DEMAND- -GDP GDP

F F. . PRODUCT STOCK PRODUCT STOCK

PROCEDURE YIELD PROCEDURE YIELD

ACCESSMENTS ACCESSMENTS

REFINERY ECONOMIC REFINERY ECONOMIC

ACCESSMENT ACCESSMENT

PRICING ACCESSMENT PRICING ACCESSMENT

AGENTCY AGENTCY

PLATT PLATT S S, , ARGUS ARGUS, , APPI APPI

OTC OTC

PRICE SWAP PRICE SWAP, , FORWARD FORWARD

TRANSECTION TRANSECTION

( (OTHER FINANCIAL OTHER FINANCIAL

DERIVATIVE DERIVATIVE

TRANSECTION TRANSECTION) )

FUTURE MARKET FUTURE MARKET

NEW YORK NEW YORK

NYMEX NYMEX

LONDON LONDON

IPE IPE

DERIVATIVE DERIVATIVE

TRADERS TRADERS

SPECULATORS SPECULATORS

BENCHMARK CRUDE BENCHMARK CRUDE QUALITY ADJ QUALITY ADJ. . PREMIUM PREMIUM / /

DISCOUNT DISCOUNT

PRODUCT PRICE ACCESSMENT PRODUCT PRICE ACCESSMENT

AGAINT YIELD OF CRUDE AGAINT YIELD OF CRUDE

PHYSICAL PHYSICAL

TRADERS TRADERS

TECHNICAL PRICE MOVEMENT TECHNICAL PRICE MOVEMENT

ANALYSIS ANALYSIS

MARKET PARTICIPANTS PHYCOLOGY MARKET PARTICIPANTS PHYCOLOGY

( (MARKET INTEREST MARKET INTEREST) ) - - SPECULATORS SPECULATORS

OTHER OTHER - - COMMODITIES TRADE COMMODITIES TRADE

MARKET MARKET

WTI, BRENT

DUBAI

Buy

Buy

Sale

Sale Price =

Issues Concern : We still do not know the exact price in advance (@ deal done).

Publication Spot

Accessment

- Platts

- Argus

- APPI

Publication Spot Publication Spot

Accessment Accessment

- - Platt Platt s s

- - Argus Argus

- - APPI APPI

Benchmark Price + Quality Adjustment

Key Characteristics of Benchmark Crude

Deep, liquid markets

Aggregate spot demand/supply of a region

Freely Traded No government intervene

High degree of transparency

Assessment methodology is clearly defined

Market Relate Price Structure Market Relate Price Structure

9

Crude Oil Price Formula Crude Oil Price Formula

Price Adjustment Factors Price Adjustment Factors

10

PHYSICAL CRUDE HILIGHTS PHYSICAL CRUDE HILIGHTS

SORCES OF SUPPLY SORCES OF SUPPLY

QUANTITIES QUANTITIES

QUALITIES QUALITIES

TYPE OF CRUDE TYPE OF CRUDE

LOGISTICS LOGISTICS

EXPORT TERMINAL EXPORT TERMINAL

TANKERS TANKERS

PIPELINES PIPELINES

REFINERIES REFINERIES

TYPE TYPE/ /COMPLEXITY COMPLEXITY

CAPACITY CAPACITY

LOCATION LOCATION

Physical Crude Physical Crude O Oil il

Some basic Terminology Some basic Terminology

Light

Heavy

Sweet

Sour

Light ends

Middle

distillates

Residues

Density

API gravity

SG

Sulfur

% weight

ppm

Clean or white

products

Moved in clean

tankers

Dark or black

products

Moved in dirty

tankers

CRUDE

11

Crude Oil - Physical Crude Oil Crude Oil - - Physical Physical

DETAILED ASSAYS DETAILED ASSAYS

YIELDS YIELDS, , QUALITIES QUALITIES

THEIR PRODUCTION THEIR PRODUCTION

QUANTITY QUANTITY

LOGISTIC POSITIONS LOGISTIC POSITIONS

HOW TO TRANSPORT HOW TO TRANSPORT

HOW TO MARKETING HOW TO MARKETING

PRICING MECHANISM PRICING MECHANISM

Fuel Fuel

Oil Oil

Diesel Diesel

Diesel Diesel

LPG LPG

LPG LPG

LPG LPG

Kerosene Kerosene

Heavy Heavy

Naphtha Naphtha

Heavy Heavy

Naphtha Naphtha

Light Light

Naphtha Naphtha

Kerosene Kerosene

MAIN ISSUES MAIN ISSUES

Not all crude oil was made alike Not all crude oil was made alike

The Crude Oil Constellation

Cabinda

Iranian Heavy

Urals

Vasconia

Marlim

Oman

Dubai

Iranian Light

Bonny Light

BRENT

WTI

Daqing

Basrah

ANS

0

0.5

1

1.5

2

2.5

20 25 30 35 40 45

Light Heavy

S

o

u

r

S

w

e

e

t

12

0.03 46.0 Malaysia Tapis

1.20 34.0 Oman Oman

1.90 30.7 United Arab

Emirates

Dubai

0.40 38.5 North Sea

3

Brent

0.30 38-40 USA WTI

Sulfur

2

(wt.%)

API Gravity

1

Source Crude Oil Name

1

API Gravity > 38 = light crude

API Gravity 22-28 = medium crude

API Gravity < 22 = heavy crude

2

Sulfur < 0.5% = sweet crude

> 0.5% = sour crude

3

North Sea = Norway, UK, Denmark, The Netherlands, Germany

Light/Heavy: API Gravity Light/Heavy: API Gravity

Light vs. Heavy Crude Light vs. Heavy Crude

Light Texas Crude

Palo Pinto Field

North Texas

Light Texas Crude

Palo Pinto Field

North Texas

Heavy Texas Crude

Humble Oil Field

Southwest Texas

Heavy Texas Crude

Humble Oil Field

Southwest Texas

13

Selected Crude Oil Property Selected Crude Oil Property

( ( . . ) )

Petrocorp Petrocorp

( ( , ,

. . ) )

BP BP ( ( . . ) )

PHET PHET

( (

. . ) )

North Central North Central

( ( . . ) )

, ,

( (Chevron Chevron) )

( (Unocal Unocal) )

Thai Crude Oil Fields Thai Crude Oil Fields

(before M&A of oil companies) (before M&A of oil companies)

14

Some Thai Petroleum API Gravity Some Thai Petroleum API Gravity

+6 +12 91 68 62 50 DUBAI

+7 +11 96 73 66 55 BRENT

+6 +9 97 72 66 57 WTI

Annual

Change

2006/07

Annual

Change

2005/06

Average

Jan 2008

Average

2007

Average

2006

Average

2005

Crude

Benchmark Prices Highlight ( Benchmark Prices Highlight ($/BBL) $/BBL)

15

Marker Crude Price Differential Marker Crude Price Differential

Profile of Crude Price Formula Profile of Crude Price Formula Profile of Crude Price Formula

EXAMPLE EXAMPLE

1. 1. SAUDI ARABIA SAUDI ARABIA

2. 2. KUWAIT KUWAIT

3. 3. IRAQ IRAQ

4. 4. NIGERIA NIGERIA

5. 5. MEXICO MEXICO

6. 6. EQUADOR EQUADOR

7. 7. YEMEN YEMEN

FROM FROM TO UNITED STATES TO UNITED STATES TO EUROPE TO EUROPE TO ASIA TO ASIA

WTI WTI+ +ADJ ADJ. . FACTORS FACTORS

WTI WTI+ +ADJ ADJ. . FACTORS FACTORS

ANS ANS+ +ADJ ADJ. . FACTORS FACTORS

BRENT BRENT+ +ADJ ADJ. . FACTORS FACTORS

0.30 0.30 ( (WTS WTS+ +LLS LLS)+ )+

0.20 0.20 ( (ANS ANS+ +DB DB) )

ANS ANS + + ADJ ADJ. . FACTORS FACTORS

N N. .A A

BRENT BRENT+ +ADJ ADJ. . FACTORS FACTORS

BRENT BRENT+ +ADJ ADJ. . FACTORS FACTORS

BRENT BRENT+ +ADJ ADJ. . FACTORS FACTORS

BRENT BRENT+ +ADJ ADJ. . FACTORS FACTORS

0.80 0.80 DB DB+0.13 +0.13 HSFO HSFO

180, 180, 3.5% 3.5%S S

N N. .A A

N N. .A A

( (OM OM+ +DB DB)/2+ )/2+ADJ ADJ. . FACTORS FACTORS

( (OM OM+ +DB DB)/2+ )/2+ADJ ADJ. . FACTORS FACTORS

( (OM OM+ +DB DB)/2+ )/2+ADJ ADJ. . FACTORS FACTORS

BRENT BRENT + +ADJ ADJ. . FACTORS FACTORS

( (OM OM+ +DB DB)/2+ )/2+ADJ ADJ. . FACTORS FACTORS

N N. .A A

BRENT BRENT + + ADJ ADJ. . FACTORS FACTORS

16

Oil Dependency Factors

2002

Oil Oil Dependency Dependency Factors Factors

2002 2002

USA

Total Import : 11,357 KBD

Europe

Total Import: 11,895 KBD

China

Total Import: 2,042 KBD

J apan

Total Import : 5,070 KBD

Other Asia Pacific

Total Import : 8,622 KBD

USA

Europe

Asia

China

ME

S.+centralAmerica

Europe

FSU

North America

Asia

Africa

others

20%

36% 10%

2%

17%

12%

2%

1% 27%

4%

36%

2%

1%

9%

21%

38%

1%

8 % 32%

16%

1% 4%

78%

2%

15% 1% 4%

75%

2%

1%

1%

12%

9%

10%

2%

Where Asia gets its crude Where Asia gets its crude

17

Persian Gulf Imports Persian Gulf Imports

(as a Percent of Total Oil Demand) (as a Percent of Total Oil Demand)

North America North America

12% 12%

Europe 19% Europe 19%

Asia 46% Asia 46%

U.S. Dept. of Energy, Energy Information

Administration: International Energy Outlook 2004

18

Middle East crude qualities Middle East crude qualities

Crude Oil Price: Asian Premium Crude Oil Price: Asian Premium

19

FOB

price at

source

+ Transport

+ Insurance

+ Import duty

+ Loss

CIF

(delivered)

cost

FOB

price at

source

Benchmark

crude price

= +

Premium

Quality Adj

Mkt premium

Benchmark Crude

Dubai

Tapis

Related Crude

Oman, Arab Light

Tapis, Seria Light

1/

2/

Remark

1/ average Spot on delivery month by PLATT

2/ average Spot on delivery month by APPI

Thai Imported Crude Price Thai Imported Crude Price Thai Imported Crude Price

VOL VOL., ., KBD KBD

%ON IMPORTED %ON IMPORTED

TOTAL TOTAL

PRICING FORMULA PRICING FORMULA

IMPORTED CRUDE OIL IMPORTED CRUDE OIL : : 3,978.8 3,978.8 ML ML, , 834.2 834.2 KBD KBD ( (April April 04) 04)

@FAR EAST @FAR EAST(391.7 (391.7 ML ML,82.1 ,82.1KBD KBD) )

21.0 21.0

20.4 20.4

11.7 11.7

10.6 10.6

2.5 2.5

2.4 2.4

1.4 1.4

1.3 1.3

TAPIS TAPIS + + ADJ ADJ. . FACTORS FACTORS

TAPIS TAPIS + + ADJ ADJ. . FACTORS FACTORS

TAPIS TAPIS + + ADJ ADJ. . FACTORS FACTORS

TAPIS TAPIS + + ADJ ADJ. . FACTORS FACTORS

- - LABUAN LABUAN, , MALAYSIA MALAYSIA

- - DULANG DULANG, , MALAYSIA MALAYSIA

- - CHAMPION CHAMPION, , BRUNAI BRUNAI

- - SERIA LIGHT SERIA LIGHT, , BRUNAI BRUNAI

@ MIDDLE EAST @ MIDDLE EAST (3,423.1 (3,423.1 ML ML,717.7 ,717.7 KBD KBD) )

142.1 142.1

132.7 132.7

100.3 100.3

99.7 99.7

17.0 17.0

15.9 15.9

12.0 12.0

12.0 12.0

DUBAI DUBAI + + ADJ ADJ. . FACTORS FACTORS

BRENT BRENT + + ADJ ADJ. . FACTORS FACTORS

DUBAI DUBAI + + ADJ ADJ. . FACTORS FACTORS

( (OMAN OMAN + + DUBAI DUBAI)/ 2 )/ 2 + +

ADJ ADJ. . FACTORS FACTORS

- - OMAN OMAN, , OMAN OMAN

- - MASILA MASILA, , YEMEN YEMEN

- - MURBAN MURBAN, , UAE UAE

- - ARAB EXTRA LIGHT ARAB EXTRA LIGHT, ,

SAUDI ARABIA SAUDI ARABIA

21.2 21.2

17.4 17.4

40.8 40.8

33.5 33.5

TAPIS TAPIS + + ADJ ADJ. . FACTORS FACTORS

( (OMAN OMAN+ +MINAS MINAS+ +ADJUNA ADJUNA)/ 3 )/ 3

+ ADJ. FACTORS + ADJ. FACTORS

- - PATTANI PATTANI

- - PHET PHET

DOMESTIC CRUDE OIL DOMESTIC CRUDE OIL : : 247.4 247.4 ML ML, , 51.9 51.9 KBD KBD ( (April April 04) 04)

Thai Crude Price Thai Crude Price Thai Crude Price

SOURCE SOURCE : : MINISTRY OF ENERGY MINISTRY OF ENERGY ( (APRIL REPORT APRIL REPORT) )

20

Middle Eastern Crude Oil Pricing Middle Eastern Crude Oil Pricing

Netback Value Netback Value

21

Derived Demand of Crude Oil Derived Demand of Crude Oil

Petroleum Products Petroleum Products

Gasoline Gasoline - - 19.5 gallons 19.5 gallons

A Barrel of Crude Oil Provides:

Fuel Oil Fuel Oil - - 9.2 gallons 9.2 gallons

Jet Fuel Jet Fuel - - 4.1 gallons 4.1 gallons

Asphalt Asphalt - - 2.3 gallons 2.3 gallons

Kerosene Kerosene - - 0.2 gallons 0.2 gallons

Lubricants Lubricants - - 0.5 gallons 0.5 gallons

Petrochemicals, Petrochemicals,

other products other products - - 6.2 gallons 6.2 gallons

One Barrel = One Barrel =

42 gallons 42 gallons

American Petroleum Institute, 1999 American Petroleum Institute, 1999

22

Crude Crude- -Product Flow Diagram Product Flow Diagram

Oil Business Loop Oil Business Loop

23

Selected Crude Oils Distillation Yield Selected Crude Oils Distillation Yield

Net Back Value Net Back Value

24

Product Revenue @BKK

Crude Cost

Gross Refining Margin

US$/ BBL

X

Y

X - Y

X = (Ex- refinery price@BKK of product i) x (Yield of product i)

Y = (CIF crude cost@ SRC of crude i) x (Slate of crude i)

Gross Refining Margin (GRM) Gross Gross Refining Refining Margin Margin (GRM) (GRM)

Reserve Cost

Transhipment Cost to

BKK

Agreed Oil Loss

(SPore-Thailand)

Insurance Premium

Transportation Cost

(SPore-Sriracha @

Agreed Cargo Size)

Quality Adjustment to

Thai Specs

SPore Spot Price

= Deem Import Parity Concept (Lowest Cost) = Crude Cost Related

@ Singapore

= Agreed amount : Refiners vs Marketers

= Deem Import Parity Concept (Lowest Cost) = Crude Cost Related

@ Singapore

= Agreed amount : Refiners vs Marketers

Ex- refinery price@ BKK

(Mean of platt daily assessment)

Product Price Benchmark @ SPore

(3 Day around B/L)

Agreed Oil Loss (0.5%)

Insurance(0.084% C&F)

F

C

CIF

Import Duty

Ex Ex- -Refinery Pricing Pattern Refinery Pricing Pattern

25

-

Contract Petromin

C3/C4 (cp)

LPG

Typical Size

: Minimum 50,000 BBL/Cargo

Loading Location

: 5 Day period FOB SPore

Price Assessment

: Reflect the pricing of product for 15-30

Days ahead

Unleaded 95 Ron

(Mean of Platt =

MOP)

ULG 95

ULR 91

Gasohol 95

Gasohol 91

Basis (Daily Assessment)

Benchmark

Assessment

Products

Benchmark Market Product Pricing Benchmark Market Product Pricing

Typical Size

: 20,000 MT/Cargo

Loading Location

: 5 Day period FOB SPore

Price Assessment

: Reflect the pricing of product for 15-30

Days ahead

High Sulfur Fuel Oil

3.5%s (HSFO 3.5%s)

(Mean of Platt = MOP)

Fuel Oil

Typical Size

: 150,000 BBL/Cargo

Loading Location

: 5 Day period FOB SPore

Price Assessment

: Reflect the pricing of product for 15-30

Days ahead

Gasoil 0.5%s

(Mean of Platt = MOP)

Diesel

Diesel B5

Basis (Daily Assessment)

Benchmark

Assessment

Products

Benchmark Market Product Pricing Benchmark Market Product Pricing

26

GRM & MKM GRM & MKM

GRM = Spread between crude & products

MKM = Spread between retail price &

ex. Refinery price

GRM Example GRM Example

27

Crude

cost

(CIF)

Variable

cost

Utilities

Catalyst

Chemicals

etc.

Revenues

=

(Distillate yield) x

(distillate price)

(Fuel oil yield) x

(fuel oil price)

(Gasoline yield) x

(gasoline price)

(Other) x

(price)

GRM

Total

cost

Fixed

cost

Fixed cost

Salary & Wage

Outside Contractor

Turnaround & Inspection

Overhead

Depre./ Amortiz.

Financial expense

Net Profit

Refining Economics Refining Economics Refining Economics

Production Pattern of Thai Refineries Production Pattern of Thai Refineries

(PTIT, 2004) (PTIT, 2004)

28

Thailand Weighted Average GRM Thailand Weighted Average GRM

Thailand Supply/Demand Forecast Thailand Supply/Demand Forecast

KBD KBD

29

Thailand Demand & Supply Balance Thailand Demand & Supply Balance

Regional oil refining margins Regional oil refining margins

30

More Refining Capacity More Refining Capacity

World Oil Refining Additions

Planned and Announced New Capacity 2006-2012 (bpd)

2

0

0

,

0

0

0

1

,

6

3

9

,

0

0

0

1

,

6

4

9

,

5

0

0

1

,

7

9

0

,

0

0

0

3

,

6

0

0

,

0

0

0

5

,

1

5

5

,

0

0

0

1

,

5

4

6

,

0

0

0

0

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

2006 2007 2008 2009 2010 2011 2012

31

MBD MBD

Asia Pacific Oil Refining Capacity & Demand Growth Asia Pacific Oil Refining Capacity & Demand Growth

0

5

10

15

20

25

30

35

2006 2007 2008 2009 2010 2011

Asic Pacific Capacity Additional Capacity Demand 1% Demand 2% Demand 3%

Source : Reuters, Platts, MS ,GS as of 07 Sep. 2007

Depends on Growth, the surplus might be in 2010 onwards.

Location of planned new refining capacity Location of planned new refining capacity

C h i n a

3 6 %

T a i w a n

6 %

M i d d l e E a s t

1 8 %

U S A

2 %

O t h e r

2 1 %

I n d i a

1 7 %

Most of planned new refining capacity is in strong demand growth locations.

Question-marks remain, however, over what percentage of projects will

actually be implemented

32

GRM Forecast GRM Forecast

$/BBL

Decreasing trend due to new regional refinery capacity

Petroleum Product Supply Affected By Numerous Factors Petroleum Product Supply Affected By Numerous Factors

Changing Product

Specifications

Changing Feed

Quality

Capacity Changes Petroleum Refined

Product Supply

Technology

Imports

33

Clean Fuel Parameters Clean Fuel Parameters

Gasoline

Sulfur

Aromatics

Olefins

Europe

Auto Oil Program

National regulations

Gasoline

Oxygenates

Additives

RVP

Sulfur

United States

Clean Air Act

Federal regulations

Gasoline

Sulfur

Aromatics

RVP

Oxygenates

Asia

National regulations

Diesel

Sulfur

Aromatics

Biofuel content

Diesel

Sulfur

Alternative fuels

Vehicle fleet changes

Diesel

Sulfur

Polyaromatics

Cetane, SG, distillation

Biofuel content

Alternative fuels

Vehicle fleet changes

Alternative fuels

Vehicle fleet changes

European specification changes European specification changes

Gasoline set to 50 ppm max sulfur from January 1, 2005

Aromatics limit in gasoline lowered to 35 max same date

Jet fuel sulfur tightened under Defstan 91/91 issue 5

Diesel moved to 50 ppm max sulfur from January 1, 2005

Diesel10 ppm max sulfur targeted across EU by 2009

Sulfur in gasoil to be reduced to 0.1% (1000 ppm) from 0.2% (2000 ppm)

from January 1, 2008

34

Fuel Specifications Tighten Fuel Specifications Tighten

2000

2000

50/10

50/10

2007

1000

2000

50/10

50/10

2008

1000 2000 2000 2000 Gasoil

2000 2000 3000 3000 Jet kero

10 50/10 50/10 350 Diesel

10 50/10 50/10 150 Gasoline

2009 2006 2005 2000 Product

The table shows maximum level of sulfur in parts per million (ppm)

allowed in fuels within the European Union in the period 2000-

2009. Fuel qualities are set to tighten substantially during this

period.

US specification changes US specification changes

Gasoline moved to 30 ppm maximum sulfur from January 1, 2005

This was phased in by allowing sulfur credits against progressively tighter

limits on average sulfur over year; sulfur credits accrued in one year allowed

as offset against next year, allowing a phased approach rather than big

bang

Corporate pool average reduced from 120 ppm in 2004 to 90 ppm in 2005

to 30 ppm in 2006; Maximum 300 ppm level for individual batches reduced

to 80 ppm from January 1, 2006

Oxygenates in gasoline in US have been replaced by ethanol after liability

waivers were removed

Sulfur limits in diesel also being tightened

Diesel scheduled for move to 15 ppm maximum sulfur from middle of 2006;

with various extensions allowed (temporary limit of 22 ppm through fall

2006)

No changes in bunker fuel qualities

35

Sulfur quality in diesel assessments Sulfur quality in diesel assessments

Increasing activity on physical for 0.25%S, 0.05%S and 0.005%S grades

0.5% Sulfur remains benchmark grade in Asia

Australian, NZ move to 50ppm supportive of 0.005%S swaps

market

Liquidity on 0.005% should increase as region migrates to lower

sulfur specifications

Sulfur Sulfur spreads spreads

36

Quality differentials Quality differentials

You might also like

- M SC Petroleum EconomicsDocument142 pagesM SC Petroleum EconomicsHector Garcia100% (3)

- ACC 8211 Oil and Gas AccountingDocument93 pagesACC 8211 Oil and Gas Accountingmanojjg72No ratings yet

- Petroleum Refining and PetrochemicalsDocument1 pagePetroleum Refining and PetrochemicalsadityamduttaNo ratings yet

- Enhanced Oil Recovery Using PolymerDocument12 pagesEnhanced Oil Recovery Using Polymerkalpak jadhavNo ratings yet

- Petroleum Economics-Basic ConceptDocument51 pagesPetroleum Economics-Basic ConceptDajev100% (1)

- Oil RefiningDocument11 pagesOil RefiningBo BoNo ratings yet

- Petroleum Economic EvaluationDocument24 pagesPetroleum Economic EvaluationSanjeev Singh NegiNo ratings yet

- Petroleum QuizDocument62 pagesPetroleum Quizchoksi himanshu100% (1)

- Upstream - Petroleum Economic AspectsDocument5 pagesUpstream - Petroleum Economic AspectsediwskiNo ratings yet

- Economics of Oil & GasDocument44 pagesEconomics of Oil & GasSiva Sankara Narayanan Subramanian100% (1)

- Chemical Flooding in EOR: A Case Study of Enhanced Oil Recovery Using Surfactant and Polymer InjectionDocument18 pagesChemical Flooding in EOR: A Case Study of Enhanced Oil Recovery Using Surfactant and Polymer InjectionAli AbukhzamNo ratings yet

- JPTDocument144 pagesJPTbilalNo ratings yet

- Intro To Field Development Planning (FDP)Document31 pagesIntro To Field Development Planning (FDP)HECTOR FLORESNo ratings yet

- Oil Price Trends in India and Its DeterminentsDocument16 pagesOil Price Trends in India and Its DeterminentsDeepthi Priya BejjamNo ratings yet

- Upstream Oil & Gas: A Passion For ExcellenceDocument16 pagesUpstream Oil & Gas: A Passion For ExcellencerajeshbharambeNo ratings yet

- Petroleum Economics Cash FlowDocument167 pagesPetroleum Economics Cash Flowstanlnleybuduka100% (1)

- 6 Economics 1 PDFDocument44 pages6 Economics 1 PDFjhon berez223344No ratings yet

- Petroleum Economics NotesDocument16 pagesPetroleum Economics Noteshouda debdiNo ratings yet

- Web Shell Energy Transition ReportDocument41 pagesWeb Shell Energy Transition ReportTsukomaruNo ratings yet

- Drilling Input Field Development PlanDocument40 pagesDrilling Input Field Development PlanAnonymous Nb2o12WyQj100% (2)

- Tertiary Enhanced Oil RecoveryDocument25 pagesTertiary Enhanced Oil RecoveryAmlk MartinezNo ratings yet

- Technical and economic viability of water injection for marginal oil fieldsDocument20 pagesTechnical and economic viability of water injection for marginal oil fieldssegunoyesNo ratings yet

- Opex 2019 The Drive Towards Operational Excellence in Oil and Gas Oil and Gas iqRNIFb0AhUSeZzZ1Z9WwJIZAWN3fSM6XmxOQCtOiG PDFDocument10 pagesOpex 2019 The Drive Towards Operational Excellence in Oil and Gas Oil and Gas iqRNIFb0AhUSeZzZ1Z9WwJIZAWN3fSM6XmxOQCtOiG PDFnaveenNo ratings yet

- John M. Campbell PF4 Oil Production & Processing FacilitiesDocument2 pagesJohn M. Campbell PF4 Oil Production & Processing FacilitiesMouradDjebriNo ratings yet

- 00introduction To The Upstream Oil and Gas IndustryDocument15 pages00introduction To The Upstream Oil and Gas IndustryWSG SARIRNo ratings yet

- PTRL3025 Lecture NotesDocument7 pagesPTRL3025 Lecture NotesericpenhNo ratings yet

- CO2 Injection Enhanced Oil RecoveryDocument2 pagesCO2 Injection Enhanced Oil RecoveryRiko Susetia YudaNo ratings yet

- CO2 FloodingDocument15 pagesCO2 FloodingUzumaki28No ratings yet

- Enhanced Oil RecoveryDocument6 pagesEnhanced Oil RecoveryRatih Retno PalupiNo ratings yet

- Storage and Transportation LNGDocument5 pagesStorage and Transportation LNGSanil Kuriakose100% (1)

- Oil Markets and Trading BP GoodDocument12 pagesOil Markets and Trading BP GoodgeorgiadisgNo ratings yet

- Petroleum Reservoir ManagementDocument147 pagesPetroleum Reservoir ManagementEvelyn QuinteroNo ratings yet

- Whitepaper Marginal FieldsDocument8 pagesWhitepaper Marginal FieldsarispriyatmonoNo ratings yet

- Petroleum EconomicsDocument51 pagesPetroleum EconomicsJoeMacho86% (7)

- Advanced Petroleum Economics HandoutDocument51 pagesAdvanced Petroleum Economics HandoutConstantin RotaruNo ratings yet

- Enhanced Oil RecoveryDocument2 pagesEnhanced Oil RecoveryEl Sayed Zakaria100% (1)

- Debottlenecking Options and OptimizationDocument0 pagesDebottlenecking Options and OptimizationnasirmuzaffarNo ratings yet

- Shale ReviewDocument17 pagesShale ReviewAnonymous QZd4nBoTNo ratings yet

- Mega-Field Developments Require Special Tatics, Risk Management PDFDocument3 pagesMega-Field Developments Require Special Tatics, Risk Management PDFGILBERTO YOSHIDANo ratings yet

- Ledata Temp Turnitintool 1240997209. 1082 1364429002 230121Document13 pagesLedata Temp Turnitintool 1240997209. 1082 1364429002 230121Kenaouia BahaaNo ratings yet

- Produced Water Treatment Methods and Regulations: Lessons From The Gulf of Mexico and North Sea For NigeriaDocument12 pagesProduced Water Treatment Methods and Regulations: Lessons From The Gulf of Mexico and North Sea For NigeriaAJER JOURNALNo ratings yet

- Decision Making Challenges in Oil & GasDocument41 pagesDecision Making Challenges in Oil & Gasgreg100% (1)

- Oil RefiningDocument11 pagesOil Refiningdemirci100% (1)

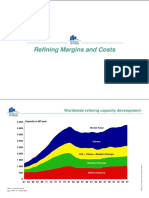

- 20 - Refining Margins and CostsDocument9 pages20 - Refining Margins and CostsBogdanAlinNo ratings yet

- Research Internship: Petroleum Engineers AssociationDocument8 pagesResearch Internship: Petroleum Engineers AssociationadityamduttaNo ratings yet

- Investment and Decision Analysis For Petroleum ExplorationDocument24 pagesInvestment and Decision Analysis For Petroleum Explorationsandro0112No ratings yet

- The Modern Field Development ApproachDocument9 pagesThe Modern Field Development ApproachEyoma Etim100% (2)

- Downstream GCC Market - May2018 PDFDocument84 pagesDownstream GCC Market - May2018 PDFvaruninderNo ratings yet

- Petroleum PrinciplesDocument35 pagesPetroleum PrinciplesDevananda NarahNo ratings yet

- Crude Oil Chemistry PDFDocument410 pagesCrude Oil Chemistry PDFJesse Haney IIINo ratings yet

- Introduction To Petroleum Engineering - Field Appraisal and DevelopmentDocument26 pagesIntroduction To Petroleum Engineering - Field Appraisal and DevelopmentshanecarlNo ratings yet

- Development Plans For Oil and Gas ReservoirsDocument11 pagesDevelopment Plans For Oil and Gas ReservoirsFranklyn FrankNo ratings yet

- English Communication Skills: For The Oil & Gas IndustriesDocument4 pagesEnglish Communication Skills: For The Oil & Gas Industriessandapeharda9717No ratings yet

- Petroleum Refining & PetrochemicalsDocument436 pagesPetroleum Refining & PetrochemicalsDaniele Cirina100% (2)

- Introduction To Petroleum Engineering - Final - Oil and Gas TransportationDocument12 pagesIntroduction To Petroleum Engineering - Final - Oil and Gas TransportationshanecarlNo ratings yet

- Exploiting the Digital Oilfield: 15 Requirements for Business ValueFrom EverandExploiting the Digital Oilfield: 15 Requirements for Business ValueRating: 5 out of 5 stars5/5 (1)

- Steam Turbines For Pump DrivesDocument94 pagesSteam Turbines For Pump DrivesFabbrox100% (9)

- Thermal Efficiency Fired HeaterDocument5 pagesThermal Efficiency Fired Heatermuhammad_asim_10No ratings yet

- Reciprocating Pump - MaintenanceDocument57 pagesReciprocating Pump - Maintenancesum1else4No ratings yet

- God FatherDocument207 pagesGod FatherarazaasNo ratings yet

- Heavy Crude Processing 808157080Document7 pagesHeavy Crude Processing 808157080kapurrrn100% (1)

- OGRA-IfEM Notification For JULY-14Document1 pageOGRA-IfEM Notification For JULY-14arazaasNo ratings yet

- Heavy Crude Processing 808157080Document7 pagesHeavy Crude Processing 808157080kapurrrn100% (1)

- Preferred Vendors For CoilDocument4 pagesPreferred Vendors For CoildeepakNo ratings yet

- Brief History of Gifted and Talented EducationDocument4 pagesBrief History of Gifted and Talented Educationapi-336040000No ratings yet

- Eight Directions Feng ShuiDocument6 pagesEight Directions Feng Shuifree_scribdNo ratings yet

- 100 Seniman Yang Membentuk Sejarah DuniaDocument134 pages100 Seniman Yang Membentuk Sejarah DuniaIBRAHIM S.Sos,INo ratings yet

- Design Inducer PumpDocument2 pagesDesign Inducer PumpnicoNo ratings yet

- Axial and Appendicular Muscles GuideDocument10 pagesAxial and Appendicular Muscles GuideYasmeen AlnajjarNo ratings yet

- Tectonics, Vol. 8, NO. 5, PAGES 1015-1036, October 1989Document22 pagesTectonics, Vol. 8, NO. 5, PAGES 1015-1036, October 1989atoinsepeNo ratings yet

- Emg 1204 Introduction To Materials Science Tutorial I Attempt All These Questions Question OneDocument2 pagesEmg 1204 Introduction To Materials Science Tutorial I Attempt All These Questions Question Onesteve gateriNo ratings yet

- FMS 1Document27 pagesFMS 1bishal dattaNo ratings yet

- Using The 12c Real-Time SQL Monitoring Report History For Performance AnalysisDocument39 pagesUsing The 12c Real-Time SQL Monitoring Report History For Performance AnalysisJack WangNo ratings yet

- Phlebotomy Blood, Micro-OrganismDocument4 pagesPhlebotomy Blood, Micro-Organismapi-372107867% (3)

- Alchemical Psychology Uniform Edition o - HillmanDocument207 pagesAlchemical Psychology Uniform Edition o - HillmanElsy Arana95% (22)

- Educational PlanningDocument20 pagesEducational PlanningedelynNo ratings yet

- Tauros TBM Guidance SystemDocument3 pagesTauros TBM Guidance SystemMiloš StanimirovićNo ratings yet

- Indian Standard: Hexagon Head Bolts, Screws and Nuts of Product Grades A and BDocument11 pagesIndian Standard: Hexagon Head Bolts, Screws and Nuts of Product Grades A and BJignesh TrivediNo ratings yet

- MTH101 Practice Qs Solutions Lectures 1 To 22 PDFDocument50 pagesMTH101 Practice Qs Solutions Lectures 1 To 22 PDFRubab Babar75% (4)

- Sense Organs Lesson PlanDocument16 pagesSense Organs Lesson PlanBernard DayotNo ratings yet

- C27 and C32 Generator With EMCP4.2 Electrical SystemDocument2 pagesC27 and C32 Generator With EMCP4.2 Electrical SystemAngel BernacheaNo ratings yet

- OE & HS Subjects 2018-19Document94 pagesOE & HS Subjects 2018-19bharath hsNo ratings yet

- Komatsu HD785-7 Shop Manual PDFDocument1,491 pagesKomatsu HD785-7 Shop Manual PDFIB EldinNo ratings yet

- ABV Testing Performa For ICF CoachesDocument2 pagesABV Testing Performa For ICF Coachesmicell dieselNo ratings yet

- Lala Hardayal - BiographyDocument6 pagesLala Hardayal - Biographyamarsingh1001No ratings yet

- HB Im70 QRDocument1 pageHB Im70 QROsamaNo ratings yet

- Create SOAP Notes Using Medical TerminologyDocument4 pagesCreate SOAP Notes Using Medical TerminologyLatora Gardner Boswell100% (3)

- Atestat EnglezaDocument29 pagesAtestat EnglezaAdrianaNo ratings yet

- She Walks in BeautyDocument6 pagesShe Walks in Beautyksdnc100% (1)

- 3: Batteries: I Ne NR+RDocument3 pages3: Batteries: I Ne NR+RIsrael EdeagheNo ratings yet

- Business Research Chapter 1Document27 pagesBusiness Research Chapter 1Toto H. Ali100% (2)

- History of Technical Writing HardDocument4 pagesHistory of Technical Writing HardAllyMae LopezNo ratings yet

- Investors' Perceptions of StocksDocument95 pagesInvestors' Perceptions of StocksPriya Ramanathan67% (3)