Professional Documents

Culture Documents

CH 3 Sol A

Uploaded by

anandrej1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 3 Sol A

Uploaded by

anandrej1Copyright:

Available Formats

Chapter 03 - Solutions to Exercises - Series A

SOLUTIONS TO EXERCISES - SERIES A - CHAPTER 3

EXERCISE 3-1A

Account

Category

Accounts Receivable

Accounts Payable

Common Stock

Land

Unearned Revenue

Service Revenue

Retained Earnings

Insurance Expense

Rent Expense

Prepaid Rent

Interest Revenue

Used to

Increase This

Account

Debit

Credit

Credit

Debit

Credit

Credit

Credit

Debit

Debit

Debit

Credit

3-1

Used to

Decrease This

Account

Credit

Debit

Debit

Credit

Debit

Debit

Debit

Credit

Credit

Credit

Debit

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-2A

Devon was right when he said both students were correct.

Chris was correct that debits increase account balances

and credits decrease account balances, if he is referring to

assets, expenses, or dividends. However, Patty is correct

that credits increase account balances and debits decrease

account balances if she is referring to liability, common

stock or retained earnings accounts.

Examples of transactions:

1. Debits increase account balances:

Performed services for cash. Cash is debited and

this increases the asset account Cash.

2.

Credits decrease account balances:

Paid cash for operating expenses. Cash is

credited and this decreases the asset account

Cash.

3.

Credits increase account balances:

Performed services for cash. Service revenue is

credited and this increases the revenue account

Service Revenue.

4.

Debits decrease account balances:

Paid accounts payable. Accounts payable is

debited and this decreases the liability account

Accounts Payable.

3-2

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-3A

a.

b.

c.

d.

e.

f.

g.

h.

i.

j.

k.

l.

Account

Common Stock

Prepaid Rent

Supplies

Accounts Payable

Interest Revenue

Rent Expense

Unearned Revenue

Service Revenue

Dividends

Land

Accounts Receivable

Cash

Normal Balance

Credit

Debit

Debit

Credit

Credit

Debit

Credit

Credit

Debit

Debit

Debit

Debit

3-3

Chapter 03 - Solutions to Exercises - Series A

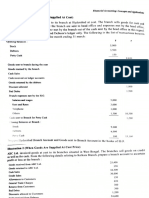

EXERCISE 3-4A

a.

Event

1. Purchased land for

cash.

2. Paid a cash

dividend to the

stockholders.

3. Provided services

for cash.

4. Recognized

accrued salaries at

the end of the

period.

5. Recognized

accrued interest

revenue

6. Provided services

on account

7. Paid cash for

operating

expenses.

8. Acquired cash from

the issue of

common stock.

9. Purchased supplies

on account.

Account Debited

Land

Account Credited

Cash

Dividends

Cash

Cash

Service Revenue

Salaries Expense

Salaries Payable

Interest

Receivable

Interest Revenue

Accounts

Receivable

Operating

Expense

Service Revenue

Cash

Common Stock

Supplies

Accounts Payable

Cash

b.

No

.

1.

2.

3.

4.

5.

Asset = Liab. + Equit

s

y

NA

NA

+/

NA

+

NA

+

NA

+

+

NA

+

Rev. Exp. =

NA

NA

+

NA

+

3-4

NA

NA

NA

+

NA

Net

Inc.

NA

NA

+

Cash

Flow

IA

FA

+ OA

NA

NA

Chapter 03 - Solutions to Exercises - Series A

6.

7.

8.

9.

+

+

NA

NA

NA

+

+

NA

+

NA

NA

NA

3-5

NA

+

NA

NA

NA

NA

NA

OA

FA

NA

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-5A

Event Number

a.

b.

Account Debited

Cash

Accounts

Account Credited

Common Stock

Service Revenue

c.

d.

e.

f.

g.

h.

Receivable

Accounts Payable

Cash

Supplies

Prepaid Rent

Unearned Revenue

Operating

Cash

Unearned Revenue

Accounts Payable

Cash

Service Revenue

Cash

i.

j.

k.

Expenses

Salaries Payable

Dividends

Interest

Cash

Cash

Interest Revenue

l.

m.

n.

Receivable

Rent Expense

Salaries Expense

Cash

3-6

Prepaid Rent

Cash

Accounts Receivable

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-6A

Event

No.

a.

Type

of

Event

AS

Assets

+

Stockholders Equity

Common

Retained

= Liabilitie +

Stock

+ Earnings

s

+ Credit

NA

NA

AU

Debit

NA

NA

AE

Credit

+

NA

NA

AS

Credit

+

NA

NA

Credit

e.

AS

Debit

+

NA

NA

Credit

f.

AE

Debit

+

NA

NA

Debit

NA

NA

NA

NA

+ Credit

NA

NA

b.

c.

Debit

NA

Debit

d.

NA

Debit

g.

h.

CE

AE

Credit

NA

+

Credit

NA

Debit

i.

j.

AS

AS

Credit

+ Debit

+

3-7

Credit

NA

Chapter 03 - Solutions to Exercises - Series A

k.

l.

m.

n.

AU

Debit

Debit

NA

AU

Credit

NA

NA

Debit

CE

AU

Credit

NA

+ Credit

NA

NA

NA

Debit

Debit

Credit

3-8

NA

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-7A

Assets

Debit

Increas

e

Credit

Decreas

e

Liabilities

Debit

Credit

Decreas Increas

e

e

Stockholders

Equity

Debit

Credit

Decreas Increase

e

Revenue

Debit

Credit

Decreas Increase

e

Expense

Debit

Credit

Increas Decreas

e

e

3-9

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-8A

a.

Cash

Debit

Credit

$40,000

Common Stock

Debit

Credit

$40,000

This is an asset source transaction. Assets are

increased; stockholders equity is increased.

b.

Supplies

Debit

Credit

$1,800

Cash

Debit

Credit

$1,800

This is an asset exchange transaction. The asset

supplies is increased and the asset cash is decreased.

c.

Accounts Receivable

Debit

Credit

$14,000

Service Revenue

Debit

Credit

$14,000

This is an asset source transaction. Assets are

increased by $14,000 and revenue increases

stockholders equity by $14,000.

d.

Cash

Debit

Salaries Expense

Debit

Credit

$8,000

Credit

$8,000

This is an asset use transaction. The asset cash is

decreased and the expense account salaries expense is

3-10

Chapter 03 - Solutions to Exercises - Series A

increased. This has the effect of decreasing

stockholders equity.

3-11

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-9A

a. e. & f.

Assets

Cash

= Stockholders Equity

Retained Earnings

Accounts Rec.

2013

2013

2.

24,000

Bal. 24,000

1. 30,000 2.

Bal. 6,000

2014

2014

6,000

Bal. 30,000

2013

3.

3.

24,000

cl 30,000

Bal. 30,000

6,000

Service Revenue

-0-

Bal.

2013

cl 30,000

1. 30,000

Bal.

-02014

-0-

b. & g. NC = Net Change in Cash

Rice Company

Effect of Transactions on the Financial Statements for 2013 and 2014

Assets

No.

Cash

Acct.

Rec.

Liab.

Stockholders

Equity

Com.

Ret.

Stock + Earn.

Rev.

Exp.

= Net Inc.

Cash Flows

2013

1.

2.

NA

30,000

24,00

(24,000

0

)

24,00 +

6,000 =

0

NA

NA

3.

6,000

NA

Bal.

30,00 +

0

Bal.

-0- +

NA

NA

-0- +

30,000

NA

30,000

NA

30,000

30,000

NA

NA

30,000

NA

NA

24,000 OA

-0- = 30,000

24,000 NC

2014

(6,000)

-0- =

-0- +

NA

-0- +

NA

30,000

3-12

NA

-0-

NA

-0- =

NA

-0-

6,000 OA

6,000 NC

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-9A (cont.)

c.

2013 Revenue = $30,000

d.

2013 Cash Flows From Operating Activities = $24,000

e.

See T-accounts above.

f.

See T-accounts above.

g.

See the Statements Model above.

h.

2014 Net Income = $-02014 Cash Flows From Operating Activities = $6,000

3-13

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-10A

a. b. & e.

Assets

Accounts Rec.

Debit

a1 36,000

Credit

Bal.

36,000

Liabilities

Accounts Pay.

Debit

Credit

a2 10,000

Stockholders

Equity

Retained Earnings

Debit

Credit

cl 8,200 cl 36,000

Bal.

Bal.

10,000

Supplies

Debit

Credit

a2 10,000 b. 8,200

27,800

Service Revenue

Debit

Credit

a1

36,000

Bal.

Bal. 1,800

36,000

cl 36,000

Bal.

-0-

Supplies Expense

Debit

Credit

b. 8,200

Bal.

8,200

cl 8,200

Bal.

3-14

-0-

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-10A (cont.)

c.

Hern Consulting Services

Effect of Transactions on the Financial Statements for 2013

Assets

No.

a1.

a2.

b.

Bal.

d.

Liab.

Accts.

Accts.

Rec. + Suppli = Pay.

es

36,000

NA

NA

NA

10,000

10,000

NA

(8,200

NA

)

36,000 + 1,800 = 10,000

Stockholders

Equity

Commo

Ret.

+ n Stock + Earn.

NA

NA

NA

+

36,000

NA

(8,200)

-0- + 27,800

Revenu

e

Exp.

36,000

NA

NA

NA

NA

8,200

Net

Inc.

36,000

NA

(8,200)

36,000 8,200 = 27,800

Cash

Flows

NA

NA

NA

NC

Net income is $27,800; Net Cash Flow from Operating Activities is $-0-. $36,000

of revenue earned was on account, but none was collected; $8,200 of supplies

were used, but none were paid for.

3-15

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-10A (cont.)

e.

General Journal

Date

Account Titles

Debit

Credit

Closing Entries

Dec. 31

Dec. 31

Service Revenue

Retained Earnings

36,000

36,000

Retained Earnings

Supplies Expense

8,200

8,200

Closing entries are posted to the T-accounts in part a.

Hern Counsulting Services

Post-Closing Trial Balance

December 31, 2013

Account Titles

Debit

Accounts Receivable

Supplies

Accounts Payable

Retained Earnings

$36,000

1,800

Totals

$37,800

Credit

$10,000

27,800

3-16

$37,800

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-11A

a. & b.

Assets

Liabilities

Cash

a.

Unearned

Revenue

90,000

Stockholders

Equity

Service Revenue

75,000 a. 90,000

b.

b.

75,000*

Bal.

15,000

*$90,000 x 10/12 = $75,000

c. NC = Net Change in Cash

Effect of Transactions on Financial Statements

Balance Sheet

Date

Asset =

s

3/1

Liab.

90,000

12/3

1

90,00

0

NA

S.

Equity

NA

Rev.

NA

75,000

75,00

0

(75,00

0)

= 15,000 + 75,000

Bal.

90,00

0

Income Statement

Exp.

Statement

of

Cash Flows

NA

Net

Inc.

NA

90,000 OA

NA

75,000

NA

NA = 75,000

90,000 NC

75,00

0

d. Revenue

Expenses

Net Income

$75,000

-0$75,000

Cash Flows From Operating Activities:

Cash Received from Clients

$90,000

Net Cash Flow from Operating Activities$90,000

e. Unearned Revenue = $15,000 (See T-accounts above.)

3-17

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-12A

Accounts Receivable

Debit

Credit

Beg. Bal.105,000 Coll. 467,000

Rev.

448,000

End. Bal. 86,000

$467,000 of cash was collected [($105,000 + $448,000)

$86,000].

Cash inflow from operating activities = $467,000

EXERCISE 3-13A

Accounts Payable

Debit

Credit

Beg. Bal. 36,000

Paid

96,000

Exp.

108,000

End Bal. 48,000

$96,000 of cash was paid for expenses [($36,000 + $108,000)

$48,000].

3-18

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-14A

a.

Account Title

Debit

4,000

Cash

Unearned Revenue

Assets = Liab.

4,000

+ Equit

y

4,000

NA

Credit

4,000

Re Exp.

v.

N

NA

A

Net

Inc.

NA

Cash

Flow

4,000

OA

b.

Account Title

Debit

2,400

Supplies

Cash

Assets = Liab. + Equit

y

2,400

NA

NA

Credit

2,400

Re Exp. =

v.

N

NA

A

Net

Inc.

NA

Cash

Flow

(2,400)

OA

(2,400)

c.

Account Title

Accounts Receivable

Service Revenue

Assets = Liab + Equity

.

50,000

NA

50,00

0

Debit

50,000

Credit

50,000

Rev. Exp = Net

.

Inc.

50,0

NA

50,00

00

0

Cash Flow

NA

d.

Account Title

Operating Expenses

Accounts Payable

Debit

2,000

Credit

2,000

3-19

Chapter 03 - Solutions to Exercises - Series A

Assets = Liab. + Equity

NA

2,000

(2,000

)

Re Exp. = Net Inc.

v.

NA

2,00

(2,000)

0

3-20

Cash

Flow

NA

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-14A (cont.)

e.

Account Title

Debit

27,000

Cash

Accounts Receivable

Assets = Lia + Equit

b.

y

27,000

NA

NA

Credit

27,000

Re Exp. =

v.

NA

NA

Net

Inc.

NA

Cash Flow

27,000

OA

(27,000

)

f.

Account Title

Accounts Payable

Cash

Assets = Liab. + Equit

y

(700)

(700)

NA

Debit

700

Credit

700

Re Exp. =

v.

NA

NA

Net

Inc.

NA

Cash

Flow

(700)

OA

g.

Account Title

Prepaid Insurance

Cash

Assets = Liab. + Equit

y

6,800

NA

NA

Debit

6,800

Credit

6,800

Re Exp. =

v.

NA

NA

Net

Inc.

NA

Cash Flow

(6,800)

OA

(6,800)

h.

Account Title

Insurance Expense

Prepaid Insurance

Debit

4,500

Credit

4,500

3-21

Chapter 03 - Solutions to Exercises - Series A

Assets = Liab + Equity

.

(4,500)

NA

(4,500

)

Re Exp. = Net

v.

Inc.

NA

4,50

(4,500)

0

3-22

Cash

Flow

NA

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-14A (cont.)

i.

Account Title

Interest Receivable

Interest Revenue

Assets = Liab + Equity

.

800

NA

800

Debit

800

Credit

800

Re Exp. =

v.

80

NA

0

3-23

Net

Inc.

800

Cash

Flow

NA

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-15A

a.

Debit

12,000

Salaries Expense

Salaries Payable

b.

Asset =

s

NA

c.

Liab.

Sal.

Pay.

12,000

12,000

Equity

Re Exp. =

v.

Ret.

Earn.

(12,000)

Revenue

Salaries Expense

Net Income

Credit

NA

12,0

00

Net

Inc.

Cash

Flow

(12,00

0)

NA

$29,000

(12,000)

$17,000

Cash Flows From Operating Activities:

Cash Received from Revenue

$29,000

Cash Payment for Expense

-0Net Cash Flow from Operating Activities$29,000

d.

Salaries Payable = $12,000

EXERCISE 3-16A

a. & b.

Washington Mining

Journal Entries for 2013

Date

a. 3/1

b.

12/31

Account Titles

Debit

Prepaid Rent (Lease)

Cash

135,000

Rent Expense

112,500

Credit

135,000

Prepaid Rent

112,500

3-24

Chapter 03 - Solutions to Exercises - Series A

*$135,000 12 = $11,250 per month; $11,250 x 10 mo. =

$112,500

3-25

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-16A (cont.)

c. NC = Net Change in Cash

Washington Mining

Horizontal Statements Model for 2013

Assets

Even

t

1.

2.

3.

Cash

+

150,000

(135,00

0)

172,500

= Lia +

b.

Stk. Equity

Prepaid

Comm.

Ret. Earn

Rent

=

+ Stock +

NA

NA

150,00

NA

0

135,000

NA

NA

NA

NA

172,500

(112,50

NA

NA

0)

Bal. 187,500 + 22,500 = NA + 150,00

0

(112,50

0)

+ 60,000

Adj.

d.

NA

NA

NA

Revenue

Expense

Net Income

Income Statement

Revenue Expense =

NA

NA

of

Cash Flows

150,000 FA

NA

NA

(135,000) OA

172,50

0

NA

NA

172,500

172,500 OA

(112,50

0)

172,50 112,500 = 60,000

0

$172,500

(112,500)

$ 60,000

Prepaid Rent: $22,500 ($135,000 $112,500)

3-26

Net Inc.

NA

NA

Cash Flows From Operating Activities:

Cash Received from Revenue

$172,500

Cash Payment for Expense

(135,000)

Net Cash Flow from Operating Activities$ 37,500

e.

Statement

112,500

NA

187,500 NC

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-17A

a.

1.

2.

3.

Closing Entries

Service Revenue

Retained Earnings

Debit

153,000

153,000

Retained Earnings

Advertising Expense

Rent Expense

Salaries Expense

Supplies Expense

91,600

Retained Earnings

Dividends

10,000

7,000

15,600

64,000

5,000

10,000

b.

Retained Earnings, 2013

Beginning Retained Earnings

Add: Revenue

Less: Expenses

Less: Dividends

Ending Retained Earnings

Credit

$38,800

153,000

(91,600)

(10,000)

$90,200

3-27

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-18A

a.

Sanford Service Co.

General Journal, 2013

Even

Account Titles

t

1.

Cash

Common Stock

2.

3.

4.

5.

6.

7.

8.

Debit

Credit

60,000

60,000

Accounts Receivable

Service Revenue

100,000

100,000

Salaries Expense

Cash

74,000

Supplies

Accounts Payable

13,000

Cash

Accounts Receivable

79,000

74,000

13,000

79,000

Accounts Payable

Cash

9,500

Dividends

Cash

6,000

9,500

6,000

Supplies Expense*

Supplies

10,500

10,500

*$13,000 $2,500 = $10,500

3-28

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-18A (cont.)

b.

ASSETS

Cash

1. 60,000 3. 74,000

5. 79,000 6. 9,500

7.

LIABILITIES

STOCKHOLDERS

EQUITY

Accounts Payable

6. 9,500 4. 13,000

Bal. 3,500

Common Stock

1. 60,000

Bal.

60,000

6,000

Bal.49,500

7.

Bal.

Accounts

Receivable

2.100,000 5. 79,000

Bal.21,000

Dividends

6,000

6,000

Service Revenue

2.

100,000

Bal.

100,000

Supplies

4. 13,000 8. 10,500

Bal. 2,500

Salaries Expense

3. 74,000

Bal.

74,000

Supplies Expense

8. 10,500

Bal.

10,500

c.

Total Assets = $73,000 ($49,500 + $21,000 + $2,500)

3-29

Chapter 03 - Solutions to Exercises - Series A

d.

Net Income = $15,500 ($100,000 $74,000 $10,500)

3-30

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-19A

Magee Company

Trial Balance

December 31, 2013

Account Titles

Debit

Cash

Accounts Receivable

Office Supplies

Prepaid Insurance

Land

Accounts Payable

Unearned Revenue

Common Stock

Retained Earnings

Dividends

Service Revenue

Advertising Expense

Rent Expense

Salaries Expense

$ 120,000

13,000

3,600

12,800

44,000

Totals

$270,400

Credit

$ 4,000

36,000

50,000

28,400

10,000

152,000

5,000

30,000

32,000

3-31

$270,400

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-20A

a.

Not out of balance because a credit was posted and

debits equaled credits, even though the credit is posted

to the wrong account; the liability account, Accounts

Payable, will be understated by $2,500 and the asset

account, Cash, will be understated by $2,500.

b.

Out of balance; credits are overstated by $400; Accounts

Receivable is understated by $400. The credit side of the

trial balance will be higher.

c.

Out of balance; credits are understated by $2,000;

Salaries Payable is understated by $2,000. The debit side

of the trial balance will be higher.

d.

Out of balance; debits are understated, the asset

account, Cash, is understated by $900. The debit side of

the trial balance will be lower.

e.

Not out of balance because a debit was posted and debits

equaled credits, even though the debit is posted to the

wrong account; the asset account, Prepaid Rent, is

understated by $3,000, and expense account, Rent

Expense, is overstated by $3,000.

3-32

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-21A a.

Davis Dry Cleaners

General Journal, 2013

Event

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

Account Titles

Cash

Common Stock

Debit

45,000

Credit

45,000

Accounts Receivable

Service Revenue

37,500

Operating Expenses

Accounts Payable

15,000

Cash

Service Revenue

30,000

Land

Cash

12,000

Cash

Accounts Receivable

33,000

37,500

15,000

30,000

12,000

33,000

Cash

Unearned Revenue

9,000

Supplies

Accounts Payable

1,350

9,000

1,350

Accounts Payable

Cash

11,250

11,250

Dividends

Cash

7,500

7,500

Supplies Expense

Supplies

750

750

Unearned Revenue

Service Revenue

7,500

Interest Receivable

Interest Revenue

1,350

7,500

1,350

3-33

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-21A

b.

Davis Dry Cleaners

T-Accounts, 2013

ASSETS

=

LIABILITIES

+

STOCKHOLDERS EQUITY

Cash

Accounts Payable

Common Stock

Retained Earnings

Debit

Credit

Debit

Credit

Debit

Credit

Debit

Credit

5.

12,000

1. 45,000

9.11,250 3. 15,000

1. 45,000

-0Bal.

4. 30,000 9.

8. 1,350

45,000

11,250

6. 33,000 10.

Bal. 5,100

7,500

00000

7. 9,000

Bal.

Unearned

Dividends

86,250

Revenue

Debit

Credit

Debit

Credit

12.

7. 9,000

10. 7,500

7,500

Bal. 1,500

Bal. 7,500

Service Revenue

Debit

Credit

2. 37,500

4. 30,000

Accounts Rec.

Debit

Credit

2. 37,500 6.

33,000

Bal. 4,500

12. 7,500

Bal.

75,000

Interest Rec.

Operating

Expense

Debit

Credit

3. 15,000

13. 1,350

Bal.1,350

Bal.

15,000

Supplies

Debit

Credit

8. 1,350 11. 750

Bal.

600

Supplies Expenses

Debit

Credit

11. 750

Bal. 750

Land

Debit

Credit

5. 12,000

Interest Revenue

Credit

Debit

13. 1,350

3-34

Chapter 03 - Solutions to Exercises - Series A

Bal.1,350

Bal.

12,000

3-35

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-21A (cont.)

c.

Davis Dry Cleaners

Trial Balance

As of December 31, 2013

Account Titles

Debit

Cash

Accounts Receivable

Interest Receivable

Supplies

Land

Accounts Payable

Unearned Revenue

Common Stock

Dividends

Service Revenue

Interest Revenue

Operating Expenses

Supplies Expense

$ 86,250

4,500

1,350

600

12,000

Totals

$127,950

Credit

5,100

1,500

45,000

7,500

75,000

1,350

15,000

750

3-36

$127,950

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-22A

a.

Eva Event Services

General Journal, 2013

Date

1.

2.

3.

4.

5.

6.

Account Titles

Debit

Accounts Receivable

Service Revenue

130,000

Operating Expenses

Accounts Payable

6,200

Credit

130,000

6,200

Cash

Accounts Receivable

112,000

112,000

Salaries Expense

Cash

72,000

Accounts Payable

Cash

30,000

Dividends

Cash

16,000

72,000

30,000

16,000

3-37

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-22A (cont.)

b. and d.

Eva Event Services

T-Accounts, 2013

Assets

Cash

Debit

Credit

Bal. 60,000

3. 112,000 4.

5.

6.

Bal. 54,000

72,000

30,000

16,000

Liabilities

+

Accounts Payable

Debit

Credit

Bal.

24,800

5. 30,000 2.

6,200

Bal. 1,000

Stockholders Equity

Common Stock

Debit

Credit

Bal. 48,000

cl

cl

Accounts Receivable

Debit

Credit

Bal. 38,000

1. 130,000 3. 112,000

Bal. 56,000

Retained Earnings

Debit

Credit

Bal. 25,200

78,200 cl 130,000

16,000

Bal. 61,000

Dividends

Debit

Credit

6.

16,000

Bal. 16,000

cl 16,000

Bal.

-0Service Revenue

Debit

Credit

1. 130,000

Bal.

130,000

cl 130,000

Bal.

-0Operating Expenses

Debit

Credit

2.

6,200

Bal. 6,200

cl

6,200

Bal.

-0Salaries Expense

Debit

Credit

4.

72,000

Bal. 72,000

cl 72,000

Bal.

-0-

3-38

Chapter 03 - Solutions to Exercises - Series A

EXERCISE 3-22A (cont.)

c. NC = Net Change in Cash

Eva Event Services

Effect of Transactions on the Financial Statements for 2013

No.

Bal.

1.

2.

3.

4.

5.

6.

Bal.

Balance Sheet

= Liab. +

Assets

Stockholders

Equity

Accts.

Acc.

Comm

Ret.

=

+

+

Cash +

Rec.

Pay.

.

Earn.

Stock

60,000

38,000

24,800 48,00

25,200

0

NA

130,000

NA

NA

130,000

NA

NA

6,200

NA

(6,200)

112,00

(112,000

NA

NA

NA

0

)

(72,000

NA

NA

NA

(72,000)

)

(30,000

NA

(30,000

NA

NA

)

)

(16,000

NA

NA

NA

(16,000)

)

54,000 + 56,000 = 1,000 + 48,00 + 61,000

0

3-39

Income Statement

Rev. Exp. = Net Inc.

NA

NA

NA

Statement of

Cash Flows

NA

130,00

0

NA

NA

NA

130,000

NA

6,200

NA

(6,200)

NA

NA

72,000

NA

NA

NA

(30,000) OA

NA

NA

NA

(16,000) FA

130,00 78,200 = 51,800

0

(6,000) NC

NA

112,000 OA

(72,000) (72,000) OA

Chapter 03 - Solutions - Series A

EXERCISE 3-22A (cont.)

d.

Event

Account Titles

Debit

Credit

Closing Entries

7.

Service Revenue

Retained Earnings

8.

9.

130,000

130,000

Retained Earnings

Operating Expenses

Salaries Expense

78,200

Retained Earnings

Dividends

16,000

6,200

72,000

16,000

Net Income = $51,800

e.

Change in retained earnings = $35,800 (NI $51,800 Div.

$16,000)

The change in retained earnings is different from the

amount of net income by $16,000 because retained

earnings is also affected by dividends to the

shareholders. The distribution reduces retained earnings

but does not decrease net income.

f.

Eva Event Services

Post-Closing Trial Balance

As of December 31, 2013

Account Titles

Debit

Cash

Accounts Receivable

Accounts Payable

Common Stock

Retained Earnings

$ 54,000

56,000

Totals

$110,000

Credit

3-40

1,000

48,000

61,000

$110,000

Chapter 03 - Solutions - Series A

EXERCISE 3-23A

a.

Company

b.

Total

Debt

Total

Assets

Common Unit

= of Measure %

North

$178,500

$416,000 =

42.9%

South

$57,500

$164,000 =

35.1%

Based only on the debt to assets ratio, North Company has more

financial risk than South Company because it is financing more of its

assets with borrowed money.

EXERCISE 3-24A

The IASB is the International Accounting Standards Board. It

is an independent standard-setting board, appointed and

overseen by a geographically and professionally diverse group

of Trustees who are accountable to the public interest. The

IASB cooperates with national standard-setters around the

world to achieve convergence in accounting standards.

3-41

Chapter 03 - Solutions - Series A

SOLUTIONS TO PROBLEMS - SERIES A - CHAPTER 3

PROBLEM 3-25A

No

.

a.

Account

Balanc

e

No

.

Account

Balanc

e

Credit

Debit

k.

b.

Interest

Receivable

Interest Revenue

Credit

l.

c.

Dividends

Debit

m.

d.

Debit

n.

Credit

o.

f.

Operating

Expense

Unearned

Revenue

Accounts Payable

Retained

Earnings

Prepaid

Insurance

Insurance

Expense

Accounts

Receivable

Salaries Payable

Credit

p.

Cash

Debit

g.

Supplies

Debit

q.

Common Stock

Credit

h.

Service Revenue

Credit

r.

Rent Expense

Debit

i.

Prepaid Rent

Debit

s.

Salaries Expense

Debit

j.

Supplies Expense

Debit

t.

Land

Debit

e.

3-42

Debit

Debit

Debit

Credit

Chapter 03 - Solutions - Series A

PROBLEM 3-26A

Event

Type of Event

Account Debited

Account Credited

1.

AS

Cash

Common Stock

2.

AS

Accounts Receivable

Service Revenue

3.

AE

Prepaid Rent

Cash

4.

AU

Operating Expenses

Cash

5.

AS

Cash

Unearned Revenue

6.

AU

Salaries Expense

Cash

7.

AU

Utilities Expense

Cash

8.

AU

Accounts Payable

Cash

9.

AU

Dividends

Cash

10.

AS

Supplies

Accounts Payable

11.

AS

Cash

Service Revenue

12.

AS

Interest Receivable

Interest Revenue

13.

AU

Rent Expense

Prepaid Rent

14.

CE

Unearned Revenue

Service Revenue

15.

CE

Salaries Expense

Salaries Payable

3-43

Chapter 03 - Solutions - Series A

PROBLEM 3-27A

a.

Cash

1. 40,000 6.

2. 2,000 8.

8,000

1,000

3. 9,000 9. 7,200

7. 17,000 10. 6,000

11. 4,000

12.

840

Bal.

40,960

Barnes-Accounts, 2013

Accounts Payable

12.

840 5.

840

13.

300

14.

Bal.

250

550

Bal.

40,000

Dividends

11. 4,000

Bal. 4,000

Unearned Revenue

15. 6,000 3.

Accounts Receivable

4. 24,000 7. 17,000

Bal. 7,000

Common Stock

1. 40,000

9,000

Bal. 3,000

Salaries Payable

16. 1,800

Bal. 1,800

Interest Receivable

19.

900

Bal. 900

Service Revenue

2. 2,000

4. 24,000

15. 6,000

Bal.

32,000

Salaries Expense

10. 6,000

16. 1,800

Bal. 7,800

Advertising Expense

13.

300

Bal.

300

Supplies

5.

840 17. 1,600

8. 1,000

Bal.

240

Utilities Expense

14.

250

Bal.

250

Prepaid Rent

9. 7,200 18. 1,800

Bal. 5,400

Supplies Expense

17. 1,600

Bal. 1,600

Land

6. 8,000

Bal. 8,000

Rent Expense

18. 1,800

Bal. 1,800

Interest Revenue

19.

900

Bal. 900

3-44

Chapter 03 - Solutions - Series A

3-45

Chapter 03 - Solutions - Series A

PROBLEM 3-27A (cont.)

b.

Barnes Company

Before-Closing Trial Balance for 2013

Account Titles

Debit

Cash

Accounts Receivable

Interest Receivable

Supplies

Prepaid Rent

Land

Accounts Payable

Unearned Revenue

Salaries Payable

Common Stock

Dividends

Service Revenue

Salaries Expense

Advertising Expense

Utilities Expense

Supplies Expense

Rent Expense

Interest Revenue

$40,960

7,000

900

240

5,400

8,000

Totals

$78,250

Credit

550

3,000

1,800

40,000

4,000

32,000

7,800

300

250

1,600

1,800

900

3-46

$78,250

Chapter 03 - Solutions - Series A

PROBLEM 3-27A (cont.)

c.

Barnes Co.

Effect of Transactions on Financial Statements for 2013

Even

t

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

Balance Sheet

Asset = Liab. + S.

s

Equity

+

NA

+

+

NA

+

+

+

NA

+

NA

+

+

+

NA

NA

NA

+

NA

NA

+

NA

NA

+

NA

NA

+

NA

NA

NA

NA

+

NA

+

NA

+

NA

+

NA

NA

+

NA

+

Income Statement

Rev Exp = Net

.

.

Inc.

NA

NA

NA

+

NA

+

NA

NA

NA

+

NA

+

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

+

NA

NA

NA

NA

NA

NA

NA

+

NA

+

+

NA

+

NA

+

NA

+

NA

+

+

NA

+

3-47

Stmt. of

Cash

Flows

+ FA

+ OA

+ OA

NA

NA

IA

+ OA

OA

OA

OA

FA

OA

NA

NA

NA

NA

NA

NA

NA

Chapter 03 - Solutions - Series A

PROBLEM 3-28A

Effect of Transactions on Financial Statements

Even

t

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

Balance Sheet

Asset = Liab + S.

s

.

Equity

+

NA

+

+

NA

+

+/

NA

NA

+

+

NA

+

+

NA

+

NA

+

NA

NA

NA

+/

NA

NA

+

NA

NA

NA

Income Statement

Rev Exp =Net

.

.

Inc.

NA

NA

NA

+

NA

+

NA

NA

NA

NA

NA

NA

NA

NA

NA

+

NA

+

NA

+

NA

NA

NA

NA

+

+

NA

+

NA

+

NA

+

NA

NA

NA

3-48

Stmt. of

Cash

Flows

+ FA

NA

+ OA

NA

+ OA

+ OA

OA

OA

OA

NA

NA

NA

FA

Chapter 03 - Solutions - Series A

PROBLEM 3-29A

Entry Date

January 1

Description of Transaction

February 1

Acquired cash from the issuance of common

stock.

Paid cash in advance to rent space.

March 1

Purchased supplies on account.

April 1

May 20

Collected cash for services to be performed in

the future.

Performed services on account.

June 30

Paid cash for salaries.

June 30

Paid cash for property taxes.

August 1

Performed services for cash.

October 2

Received cash from customers on account.

December 1

Paid a cash dividend to stockholders.

December 31

Recognized expense for supplies that had

been used during the period.

December 31

Recognized rent expense. Cash had been paid

in a prior transaction.

December 31

Recognized revenue that had been earned

during the period. Cash had been received in

a prior transaction.

3-49

Chapter 03 - Solutions - Series A

PROBLEM 3-30A

General Journal

No.

a.

Date

Oct. 1

Dec. 31

b.

June 15

Dec. 31

c.

Sept. 1

Dec. 31

d.

May 1

Dec. 31

Account Titles

Debit

Prepaid Rent

Cash

Rent Expense ($8,400 x 3/12)

Prepaid Rent

8,400

Supplies

Accounts Payable

Supplies Expense ($1,600

$200)

Supplies

1,600

Cash

Unearned Revenue

Unearned Revenue ($4,800 x

4/12)

Service Revenue

4,800

Prepaid Insurance

Cash

Insurance Expense ($4,800 x

4,800

8/12)

Prepaid Insurance

3-50

Credit

8,400

2,100

2,100

1,600

1,400

1,400

4,800

1,600

1,600

4,800

3,200

3,200

Chapter 03 - Solutions - Series A

PROBLEM 3-31A

a.

1.

Debits would be greater by $2,000. Assets are overstated

by $2,000.

2.

Debits and credits would be equal, but assets are

understated and liabilities are understated.

3.

Debits and credits would be equal; both assets and equity

(revenue) would be understated by $900.

4.

Debits and credits would be equal; total debits and total

credits would also be correct but cash would be understated

and accounts receivable would be overstated.

5.

Debits and credits would be equal; assets and liabilities

would both be overstated.

6.

Debits and credits would be equal; liabilities would be

understated, equity would be overstated, expense would be

understated.

b.

Event

No.

1.

2.

3.

4.

5.

6.

Assets

Overstate

Understat

e

Understat

e

No Effect

Overstate

No Effect

Liabilities

No Effect

Understat

e

No Effect

No Effect

Overstate

Understat

e

3-51

Stk.

Equity

No Effect

No Effect

Understat

e

No Effect

No Effect

Overstate

Chapter 03 - Solutions - Series A

PROBLEM 3-31A (cont.)

c.

Smith Inc.

Trial Balance

As of May 31, 2013

Account Titles

Debit

Cash ($7,200 + $1,600 + $1,200 $800)

Accounts Receivable ($1,770 +$900

$1,200)

Supplies

Prepaid Insurance

Land ($5,000 $2,000)

Accounts Payable ($1,500 + $1,600

$800 + $1,050)

Common Stock

Retained Earnings

Dividends

Service Revenue ($19,600 + $900)

Rent Expense

Salaries Expense

Operating Expenses

Utilities Expense ($-0- + $1,050)

$ 9,200

1,470

Totals

$33,040

3-52

Credit

420

2,400

3,000

$ 3,350

1,800

7,390

400

20,500

3,600

9,000

2,500

1,050

$33,040

Chapter 03 - Solutions - Series A

PROBLEM 3-32A

Boykin Corporation

General Journal, 2013

Date

Jan. 1

Mar. 1

Apr. 14

June 30

July 5

Aug. 1

Aug. 8

Sept. 1

Sept. 9

Oct. 5

Nov. 2

Account Titles

Cash

Common Stock

Debit

Credit

25,000

25,000

Prepaid Rent

Cash

8,400

8,400

Supplies

Accounts Payable

400

400

Cash

Unearned Revenue

12,000

12,000

Accounts Payable

Cash

300

300

Accounts Receivable

Service Revenue

4,800

Cash

Service Revenue

1,600

4,800

1,600

Salaries Expense

Cash

18,000

18,000

Cash

Accounts Receivable

Accounts Receivable

Service Revenue

4,250

4,250

17,000

17,000

Dividends

Cash

500

500

3-53

Chapter 03 - Solutions - Series A

PROBLEM 3-32A a. (cont.)

Boykin Corporation

General Journal (cont)

Date

Account Titles

Debit

Credit

Adjusting Entries

Dec. 31

Dec. 31

Dec. 31

Dec. 31

Unearned Revenue ($12,000 x

6/12)

Service Revenue

6,000

Salaries Expense

Salaries Payable

1,100

Rent Expense ($8,400 x 10/24)

Prepaid Rent

3,500

Supplies Expense ($400 $50)

Supplies

350

6,000

1,100

3-54

3,500

350

Chapter 03 - Solutions - Series A

PROBLEM 3-32A (cont.) b.

Boykin Corporation T-Accounts

Assets

Cash

1/1 25,000 3/1

6/30

7/5

=

8,400

300

12,000

8/8 1,600 9/1 18,000

9/9 4,250 11/2

500

Bal. 15,650

Accounts Receivable

8/1 4,800 9/9 4,250

Liabilities

+ Stockholders Equity

Accounts Payable

Common Stock

7/5

300 4/14

400

1/1 25,000

Bal.

100

Bal. 25,000

Unearned Revenue

12/31 6,000 6/30 12,000

Bal. 6,000

Bal.

17,000

Salaries Payable

Bal.

17,550

1,100

Bal. 1,100

12/31

Bal.

Dividends

500

500

11/2

10/5

4/14

Retained Earnings

Bal.

-0-

Supplies

400 12/31

50

350

Service Revenue

8/1

4,800

8/8 1,600

10/5

17,000

12/31

6,000

Prepaid Rent

3/1

8,400

Bal.

29,400

12/31

3,500

Bal. 4,900

Rent Expense

12/31

3,500

Bal. 3,500

Salaries Expense

9/1 18,000

12/311,100

Bal.

19,100

Supplies Expense

12/31 350

Bal.

350

3-55

Chapter 03 - Solutions - Series A

PROBLEM 3-32A (cont.)

c.

Boykin Corporation

Trial Balance

December 31, 2013

Account Titles

Debit

Cash

Accounts Receivable

Supplies

Prepaid Rent

Accounts Payable

Unearned Revenue

Salaries Payable

Common Stock

Credit

$15,650

17,550

50

4,900

$

100

6,000

1,100

25,000

Dividends

Service Revenue

Rent Expense

Salaries Expense

Supplies Expense

500

29,400

3,500

19,100

350

Totals

$61,600

3-56

$61,600

Chapter 03 - Solutions - Series A

PROBLEM 3-32A (cont.)

d.

Boykin Corporation

Financial Statements

For the Year Ended December 31, 2013

Income Statement

Service Revenue

$29,400

Expenses

Salaries Expense

Rent Expense

Supplies Expense

Total Expenses

$19,100

3,500

350

(22,950)

Net Income

$ 6,450

Statement of Changes in Stockholders Equity

Beginning Common Stock

Plus: Stock Issued

Ending Common Stock

$

-025,000

Beginning

Retained

Earnings

Plus: Net Income

Less: Dividends

Ending Retained Earnings

$25,000

Total Stockholders Equity

-06,450

(500)

5,950

$30,950

3-57

Chapter 03 - Solutions - Series A

PROBLEM 3-32A d. (cont.)

Boykin Corporation

Balance Sheet

As of December 31, 2013

Assets

Cash

$15,65

0

17,550

50

4,900

Accounts Receivable

Supplies

Prepaid Rent

Total Assets

$38,150

Liabilities

Accounts Payable

$

100

6,000

1,100

Unearned Revenue

Salaries Payable

Total Liabilities

$ 7,200

Stockholders Equity

Common Stock

Retained Earnings

Total Stockholders Equity

Total Liabilities and Stockholders

Equity

3-58

$25,00

0

5,950

30,950

$38,150

Chapter 03 - Solutions - Series A

PROBLEM 3-32A d. (cont.)

Boykin Corporation

Statement of Cash Flows

For the Year Ended December 31, 2013

Cash

Flows

From

Operating

Activities:

Inflow from Customers*

$17,850

Outflow for Expenses**

(26,700)

Net Cash Flow from Operating

$

Activities

( 8,850)

Cash Flows From Investing Activities

Cash

Flows

From

Activities:

Inflow from Stock Issue

Outflow for Dividends

Net Cash Flow from

Activities

-0-

Financing

$25,000

(500)

Financing

Net Change in Cash

Plus: Beginning Cash Balance

Ending Cash Balance

*(6/30) $12,000 + (8/8) $1,600 + (9/9) $4,250 = $17,850

**(3/1) $8,400 + (7/5) $300 + (9/1) $18,000 = $26,700

3-59

24,500

15,650

-0$15,650

Chapter 03 - Solutions - Series A

PROBLEM 3-32A (cont.)

e.

Date

Account Titles

Debit

Credit

Closing Entries

Dec.

31

Service Revenue

29,400

Retained Earnings

Dec.

31

29,400

Retained Earnings

22,950

Salaries Expense

Rent Expense

Supplies Expense

Dec.

31

19,100

3,500

350

Retained Earnings

500

Dividends

500

3-60

Chapter 03 - Solutions - Series A

PROBLEM 3-32A e. (cont.)

Boykin Corporation

T-Accounts for Closing Entries, 2013

Assets

Cash

Bal.

15,650

Accounts Receivable

Liabilities

Accounts Payable

Bal.

100

Common Stock

Unearned Revenue

Bal. 6,000

Retained Earnings

cl 22,950 cl 29,400

cl

500

Bal.

17,550

Bal.

Supplies

50

+ Stockholders Equity

Bal.

25,000

Salaries Payable

Bal. 1,100

Bal.

Bal.

Bal.

Prepaid Rent

Bal. 4,900

Dividends

500 cl

-0-

5,950

500

Service Revenue

cl 29,400 Bal. 29,400

Bal.

-0Rent Expense

Bal. 3,500 cl

3,500

Bal.

-0Salaries Expense

Bal.

cl 19,100

19,100

Bal.

-0Supplies Expense

Bal.

350 cl

350

Bal.

-0-

3-61

Chapter 03 - Solutions - Series A

PROBLEM 3-32A (cont.)

f.

Boykin Corporation

Post-Closing Trial Balance

December 31, 2013

Account Titles

Debit

Cash

Accounts Receivable

Supplies

Prepaid Rent

Accounts Payable

Unearned Revenue

Salaries Payable

Common Stock

Retained Earnings

Credit

$ 15,650

17,550

50

4,900

$

100

6,000

1,100

25,000

5,950

Totals

$38,150

3-62

$38,150

Chapter 03 - Solutions - Series A

PROBLEM 3-33A

a.

Atlanis Machining

General Journal, 2013

Event

1.

2.

3.

4.

5.

6.

7.

8.

Account Titles

Cash

Common Stock

Debit

Credit

100,000

100,000

Prepaid Rent

Cash

12,000

12,000

Cash

Unearned Revenue

Accounts Receivable

Service Revenue

9,600

9,600

130,400

130,400

Operating Expenses

Accounts Payable

Cash

Accounts Receivable

63,000

63,000

113,800

113,800

Salaries Expense

Cash

44,000

Accounts Payable

Cash

56,000

44,000

56,000

Adjusting Entries

9.

10.

11.

Rent Expense ($12,000 x

11/12)

Prepaid Rent

11,000

11,000

Unearned Revenue ($9,600 x

4/12)

Service Revenue

3,200

Salaries Expense

Salaries Payable

4,200

3,200

4,200

3-63

Chapter 03 - Solutions - Series A

PROBLEM 3-33A (cont.)

b.

Atlantis Machining

T-Accounts, 2013

Assets

Cash

1.

2. 12,000

100,000

3. 9,600 7. 44,000

6.

113,800

Bal.

111,400

8. 56,000

Accounts

Receivable

4.

6.

130,400 113,800

Bal.

16,600

Prepaid Rent

Liabilities

Accounts Payable

Stockholders

Equity

Common Stock

8. 56,000 5.

63,000

Bal.

7,000

1. 100,000

Bal.

100,000

Service Revenue

Salaries Payable

11. 4,200

Bal.

4,200

4. 130,400

10. 3,200

Bal.

133,600

Unearned Revenue

Operating Expenses

10. 3,200 3. 9,600

Bal.

6,400

5. 63,000

Bal.

63,000

2. 12,000 9. 11,000

Bal.

1,000

Rent Expense

9. 11,000

Bal.

11,000

Salaries Expense

7. 44,000

11. 4,200

Bal.

48,200

3-64

Chapter 03 - Solutions - Series A

PROBLEM 3-33A (cont.)

c.

Atlantis Machining

Trial Balance

December 31, 2013

Account Titles

Debit

Cash

Accounts Receivable

Prepaid Rent

Accounts Payable

Salaries Payable

Unearned Revenue

Common Stock

Service Revenue

Operating Expenses

Salaries Expense

Rent Expense

$111,400

16,600

1,000

Totals

$251,200

Credit

7,000

4,200

6,400

100,000

133,600

63,000

48,200

11,000

3-65

$251,200

Chapter 03 - Solutions - Series A

PROBLEM 3-33A (cont.)

d.

Atlantis Machining

Financial Statements

For the Year Ended December 31, 2013

Income Statement

Service Revenue

$133,600

Expenses

Operating Expenses

Salaries Expense

Rent Expense

Total Expenses

$63,000

48,200

11,000

(122,200)

Net Income

$ 11,400

Statement of Changes in Stockholders Equity

Beginning Common Stock

Plus: Stock Issued

Ending Common Stock

$

-0100,000

Beginning

Retained

Earnings

Plus: Net Income

Ending Retained Earnings

Total

Equity

$100,000

Stockholders

3-66

-0-

11,400

11,400

$111,400

Chapter 03 - Solutions - Series A

PROBLEM 3-33A d. (cont.)

Atlantis Machining

Balance Sheet

As of December 31, 2013

Assets

Cash

Accounts Receivable

Prepaid Rent

Total Assets

$111,400

16,600

1,000

$129,000

Liabilities

Accounts Payable

Salaries Payable

Unearned Revenue

Total Liabilities

$ 7,000

4,200

6,400

$ 17,600

Stockholders Equity

Common Stock

Retained Earnings

Total Stockholders Equity

Total Liabilities

Equity

and

$100,000

11,400

111,400

Stockholders

$129,000

Statement of Cash Flows

For the Year Ended December 31, 2013

Cash Flows From Operating Activities:

Inflow from Customers

$123,400

Outflow for Expenses

(112,000)

Net

Cash

Flow

from

Operating

$ 11,400

Activities

Cash Flows From Investing Activities

Cash Flows From Financing Activities:

Inflow from Stock Issue

$100,000

Net

Cash

Flow

from

Financing

Activities

Net Change in Cash

Plus: Beginning Cash Balance

Ending Cash Balance

3-67

-0-

100,000

111,400

-0$111,400

Chapter 03 - Solutions - Series A

3-68

Chapter 03 - Solutions - Series A

PROBLEM 3-33A (cont.)

e.

Date

Account Titles

Debit

Credit

Closing Entries

Dec.

31

Service Revenue

133,600

Retained Earnings

Dec.

31

133,600

Retained Earnings

122,200

Operating Expenses

Salaries Expense

Rent Expense

63,000

48,200

11,000

Atlantis Machining

T-Accounts for Closing Entries, 2013

Assets

Cash

Bal.

111,400

Accounts Rec.

Liabilities

Prepaid Rent

Stockholders

Equity

Accounts Payable

Bal.

7,000

Common Stock

Bal.

100,000

Salaries Payable

Bal.

4,200

Retained Earnings

cl

cl 133,600

122,200

Bal.11,400

Bal.

16,600

Unearned Revenue

Bal.

6,400

Bal.1,000

Service Revenue

Bal.

133,600 133,600

Bal.

-0-

cl

Operating Expenses

Bal.

cl 63,000

63,000

Bal.

-0Salaries Expense

3-69

Chapter 03 - Solutions - Series A

Bal.

48,200

Bal.

-0-

cl

48,200

Rent Expense

Bal.

cl 11,000

11,000

Bal.

-0-

3-70

Chapter 03 - Solutions - Series A

PROBLEM 3-33A (cont.)

f.

Atlantis Machining

Post-Closing Trial Balance

December 31, 2013

Account Titles

Debit

Cash

Accounts Receivable

Prepaid Rent

Accounts Payable

Salaries Payable

Unearned Revenue

Common Stock

Retained Earnings

$111,400

16,600

1,000

Totals

$129,000

Credit

$ 7,000

4,200

6,400

100,000

11,400

3-71

$129,000

Chapter 03 - Solutions - Series A

PROBLEM 3-33A (cont.) g.

Atlantis Machining

General Journal, 2014

Event

1.

2.

Account Titles

Debit

Salaries Payable

Cash

4,200

4,200

Cash

81,000

Service Revenue

3.

81,000

Land

50,000

Cash

4.

5.

6.

7.

50,000

Prepaid Rent

Cash

10,800

10,800

Accounts Receivable

Service Revenue

164,000

164,000

Operating Expenses

Accounts Payable

98,200

98,200

Cash

152,600

Accounts Receivable

8.

9.

10.

11.

12.

13.

1

2

Credit

152,600

Accounts Payable

Cash

96,000

Salaries Expense

Cash

82,000

Dividends

Cash

10,000

96,000

82,000

10,000

Unearned Revenue

Service Revenue1

6,400

6,400

Rent Expense2

Prepaid Rent

10,900

10,900

Salaries Expense

Salaries Payable

7,000

7,000

$9,600 x 8/12 = $6,400

($12,000 x 1/12) + ($10,800 x 11/12) = $10,900

3-72

Chapter 03 - Solutions - Series A

PROBLEM 3-33A g. (cont.)

Atlantis Machining

T-Accounts, 2014

Assets

Cash

Bal.

111,400

2. 81,000 1. 4,200

7.

3. 50,000

152,600

4. 10,800

8. 96,000

9. 82,000

10.

10,000

Liabilities

Accounts Payable

Bal.

7,000

8. 96,000 6. 98,200

Salaries Payable

Bal.

4,200

1. 4,200 13. 7,000

Bal.

Bal.

28,000

Retained Earnings

Bal.

11,400

Dividends

7,000

Unearned Revenue

10.

10,000

Bal.

10,000

Bal. 6,400

Bal.

5.

7.

164,000 152,600

Common Stock

Bal.

100,000

9,200

92,000

16,600

Stockholders

Equity

Bal.

Bal.

Accounts Rec.

11.6,400

Service Revenue

Bal.

-0-

2. 81,000

5.

164,000

11. 6,400

Bal.

251,400

Prepaid Rent

Bal. 1,000

4. 10,800 12.

10,900

Bal. 900

Operating Expenses

6. 98,200

Bal.

98,200

Land

3. 50,000

3-73

Chapter 03 - Solutions - Series A

Bal.

Rent Expense

50,000

12.

10,900

Bal.

10,900

Salaries Expense

9. 82,000

13. 7,000

Bal.

89,000

3-74

Chapter 03 - Solutions - Series A

PROBLEM 3-33A g. (cont.)

Atlantis Machining

Trial Balance

December 31, 2014

Account Titles

Debit

Cash

Accounts Receivable

Prepaid Rent

Land

Accounts Payable

Salaries Payable

Common Stock

Retained Earnings

Dividends

Service Revenue

Operating Expenses

Salaries Expense

Rent Expense

$ 92,000

28,000

900

50,000

Totals

$379,000

Credit

9,200

7,000

100,000

11,400

10,000

251,400

98,200

89,000

10,900

3-75

$379,000

Chapter 03 - Solutions - Series A

PROBLEM 3-33A g. (cont.)

Atlantis Machining

Financial Statements

For the Year Ended December 31, 2014

Income Statement

Service Revenue

$251,400

Expenses

Operating Expenses

Rent Expense

Salaries Expense

Total Expenses

$98,200

10,900

89,000

(198,100)

Net Income

$ 53,300

Statement of Changes in Stockholders Equity

Beginning Common Stock

$100,000

-0-

Plus: Stock Issued

Ending Common Stock

$100,000

Beginning

Retained

Earnings

Plus: Net Income

Less: Dividends

Ending Retained Earnings

Total

Equity

Stockholders

3-76

$11,400

53,300

(10,000)

54,700

$154,700

Chapter 03 - Solutions - Series A

PROBLEM 3-33A g. (cont.)

Atlantis Machining

Balance Sheet

As of December 31, 2014

Assets

Cash

Accounts Receivable

Prepaid Rent

Land

Total Assets

$92,000

28,000

900

50,000

Liabilities

Accounts Payable

Salaries Payable

Total Liabilities

$ 9,200

7,000

$170,90

0

$

16,200

Stockholders Equity

Common Stock

Retained Earnings

Total Stockholders Equity

Total Liabilities and Stockholders

Equity

3-77

$100,00

0

54,700

154,700

$170,90

0

Chapter 03 - Solutions - Series A

PROBLEM 3-33A g. (cont.)

Atlantis Machining

Statement of Cash Flows

For the Year Ended December 31, 2014

Cash

Flows

From

Operating

Activities:

Inflow from Customers*

$233,600

Outflow for Expenses**

(193,000

)

Net Cash Flow from Operating

$ 40,600

Activities

Cash

Flows

From

Investing

Activities:

Outflow to Purchase Land

$(50,000

)

Net Cash Flow from Investing

(50,000)

Activities

Cash

Flows

From

Activities:

Outflow for Dividends

Financing

Net Cash

Activities

Financing

Flow

from

$(10,000

)

Net Change in Cash

Plus: Beginning Cash Balance

Ending Cash Balance

*(2) $81,000 + (7) $152,600 = $233,600

(10,000)

(19,400)

111,400

$

92,000

**(1) $4,200 + (4) $10,800 + (8) $96,000 + (9) $82,000 = $193,000

3-78

Chapter 03 - Solutions - Series A

PROBLEM 3-33A g. (cont.)

Date

Account Titles

Debit

Credit

Closing Entries

Dec.

31

Service Revenue

251,400

Retained Earnings

Dec.

31

251,400

Retained Earnings

198,100

Operating Expenses

Salaries Expense

Rent Expense

Dec.

31

98,200

89,000

10,900

Retained Earnings

10,000

Dividends

10,000

3-79

Chapter 03 - Solutions - Series A

PROBLEM 3-33A g. (cont.)

Atlantis Machining

T-Accounts for Closing Entries, 2014

Assets

Cash

Bal.

92,000

Accounts Rec.

Liabilities

+ Stockholders Equity

Accounts Payable

Bal.

9,200

Common Stock

Bal.

100,000

Salaries Payable

Bal.

7,000

Retained Earnings

cl

Bal.11,400

198,100

cl 10,000 cl 251,400

Bal.

28,000

Bal.54,700

Prepaid Rent

Bal. 900

Dividends

Bal.

cl 10,000

10,000

Bal. -0-

Land

Service Revenue

cl

Bal.

251,400 251,400

Bal.

-0-

Bal.

50,000

Operating Expenses

Bal.

cl 98,200

98,200

Bal. -0Salaries Expense

Bal.

cl 89,000

89,000

Bal. -0Rent Expense

Bal.

cl 10,900

10,900

Bal. -03-80

Chapter 03 - Solutions - Series A

3-81

Chapter 03 - Solutions - Series A

PROBLEM 3-33A g. (cont.)

Atlantis Machining

Post-Closing Trial Balance

December 31, 2014

Account Titles

Debit

Cash

Accounts Receivable

Prepaid Rent

Land

Accounts Payable

Salaries Payable

Common Stock

Retained Earnings

$ 92,000

28,000

900

50,000

Totals

$170,900

Credit

9,200

7,000

100,000

54,700

3-82

$170,900

Chapter 03 - Solutions - Series A

PROBLEM 3-34A

a.

Debt-to-Assets Ratio: Total debt Total assets

Boise

Tuscon

$ 93,000 $127,000 = 73.2%

$452,000 $753,000 = 60.0%

Return-on-Equity Ratio:

b.

Net income Equity

Boise

Tuscon

$ 8,000

$45,000

$ 34,000 = 23.5%

$301,000 = 15.0%

Boise

Tuscon

100% 73.2% = 26.8%

100% 60.0% = 40.0%

c.

Based only on the information available, Boise appears to have the

greatest financial risk.

d.

Boise has the highest profitability.

e.

Yes, companies with higher percentages of assets financed by debt

have lower percentages of assets financed by owners. If a company can

achieve about the same level of earnings with less investment by the owners,

the ROE ratio will be higher.

3-83

Chapter 03 - Solutions - Series A

PROBLEM 3-35A

Bombay, Inc.

General Journal

Event

2013

a. 11/1

b.

12/31

Account Titles

Cash

Notes Payable

Debit

10,000

10,000

Interest Expense ($10,000 x 9% x

2/12)

150

Interest Payable

150

2014

c. 10/31 Interest Expense ($10,000 x 9% x

10/12)

750

Interest Payable

d.

10/31

750

Interest Payable

900

Cash

e.

10/31

Credit

900

Notes Payable

10,000

Cash

10,000

3-84

Chapter 03 - Solutions - Series A

PROBLEM 3-36A

Lee Company

General Journal, 2013

Event

1.

2. 2/1

3.

4.

5.

6. 5/1

7.

8.

Account Titles

Debit

Computer

Cash

7,500

Prepaid Rent

Cash

6,600

Supplies

Cash

1,100

7,500

6,600

1,100

Cash

Service Revenue

56,000

Salaries Expense

Cash

18,000

56,000

18,000

Cash

Unearned Revenue

9,000

Depreciation Expense*

Accumulated

Depreciation

1,700

Rent Expense ($6,600 x

6,050

11/12)

9,000

1,700

Prepaid Rent

9.

10.

Credit

6,050

Supplies Expense

Supplies ($1,100 - $120)

Unearned Revenue ($9,000 x

8/12)

Service Revenue

980

980

6,000

6,000

*($7,500 - $2,400) 3 = $1,700

3-85

Chapter 03 - Solutions - Series A

PROBLEM 3-36A a. (cont.)

Lee Company

T-Accounts 2013

Assets

Cash

Bal.

22,000

4. 56,000 1. 7,500

6. 9,000 2. 6,600

3. 1,100

5. 18,000

Liabilities

Unearned

Revenue

6. 9,000

Stockholders

Equity

Common Stock

Bal.

12,000

10. 6,000

Bal. 3,000

Retained Earnings

Bal.

Bal.

53,800

10,000

Service Revenue

4. 56,000

10. 6,000

Prepaid Insurance

2. 6,600 8. 6,050

Bal. 550

Bal.

62,000

Salaries Expense

5.18,000

Supplies

1,100 9. 980

3.

Bal.

Bal.

18,000

120

Depreciation

Expense

7. 1,700

Bal. 1,700

Computer

1. 7,500

Bal.7,500

Rent Expense

81. 6,050

Bal. 6,050

Accumulated

Depr.

7. 1,700

Bal.

Supplies Expense

3-86

Chapter 03 - Solutions - Series A

1,700

9.

Bal.

3-87

980

980

Chapter 03 - Solutions - Series A

PROBLEM 3-36A b. (cont.)

Lee Company

Financial Statements

For the Year Ended December 31, 2013

Income Statement

Service Revenue

Expenses

Salaries Expense

Depreciation Expense

Rent Expense

Supplies Expense

Total Expenses

$62,000

$18,000

1,700

6,050

980

(26,730)

Net Income

$35,270

3-88

Chapter 03 - Solutions - Series A

PROBLEM 3-36A b. (cont.)

Lee Company

Balance Sheet

As of December 31, 2013

Assets

Cash

Prepaid Insurance

Supplies

Office Equipment

Accumulated Depreciation

Total Assets

Liabilities

Unearned Revenue

$53,80

0

550

120

7,500

(1,700)

$60,27

0

$

3,000

Total Liabilities

$

3,000

Stockholders Equity

Common Stock

Retained Earnings

Total Stockholders Equity

Total Liabilities and Stockholders

Equity

3-89

$12,00

0

45,270

57,270

$60,27

0

Chapter 03 - Solutions - Series A

PROBLEM 3-36A b. (cont.)

Lee Company

Statement of Cash Flows

For the Year Ended December 31, 2013

Cash

Flows

From

Operating

Activities:

Inflow from Customers1

$65,000

2

Outflow for Expenses

(25,700)

Net Cash Flow from Operating

$39,300

Activities

Cash Flows From Investing Activities

Purchased Computer

Net Cash Flow from Financing

Activities

Cash

Flows

Activities:

From

Financing

Net Change in Cash

Plus: Beginning Cash Balance

Ending Cash Balance

1

2

(4) $56,000 + (6) $9,000 = $65,000

(2) $6,600 + (3) $1,100 + (5) $18,000 = $25,700

3-90

(7,500)

(7,500)

-031,800

22,000

$53,80

0

You might also like

- Multiple Choice Review Questions 2021Document8 pagesMultiple Choice Review Questions 2021Bryson WeaverNo ratings yet

- Chapter 8Document66 pagesChapter 8Jamaica Rose Salazar0% (1)

- Ch03 TB Hoggetta8eDocument15 pagesCh03 TB Hoggetta8eAlex Schuldiner75% (8)

- Google Form Model A.A University 1Document96 pagesGoogle Form Model A.A University 1Tesfu HettoNo ratings yet

- CH 01Document4 pagesCH 01Hoàng HuyNo ratings yet

- HM PrelimsDocument9 pagesHM PrelimsYu BabylanNo ratings yet

- Chapter 3 Question ReviewDocument9 pagesChapter 3 Question ReviewSunny KhanNo ratings yet

- MCQDocument19 pagesMCQk_Dashy846580% (5)

- Quiz AnsDocument14 pagesQuiz AnsRosalind WangNo ratings yet

- C3 Accounting & Information SystemDocument22 pagesC3 Accounting & Information SystemSteeeeeeeephNo ratings yet

- Answer To Homework QuestionsDocument102 pagesAnswer To Homework QuestionsDhanesh SharmaNo ratings yet

- HorngrenIMA14eSM ch15Document37 pagesHorngrenIMA14eSM ch15Piyal Hossain50% (2)

- 221 Chapter 3Document20 pages221 Chapter 3Shane Hundley100% (1)

- Acct 3351Document10 pagesAcct 3351RedWolf PopeNo ratings yet

- MGT45 Fall 2013 HW#2 11AM SectionDocument25 pagesMGT45 Fall 2013 HW#2 11AM SectionTrevor Allen HolleronNo ratings yet

- FINALEXAMACC101Document62 pagesFINALEXAMACC101Le Khang (K17CT)No ratings yet

- Accounting Quiz Bee QuestionsDocument8 pagesAccounting Quiz Bee QuestionsJanella Patrizia67% (3)

- Adjusting Accounts For Financial Statements: Learning Objectives - Coverage by QuestionDocument82 pagesAdjusting Accounts For Financial Statements: Learning Objectives - Coverage by QuestionpoollookNo ratings yet

- Foa MidtermDocument5 pagesFoa MidtermRiza CariloNo ratings yet

- CH 3 - End of Chapter Exercises SolutionsDocument69 pagesCH 3 - End of Chapter Exercises SolutionsPatrick AlphonseNo ratings yet

- SOAL AkuntansiDocument13 pagesSOAL AkuntansiArum MashitoNo ratings yet

- Accounting Concepts and PrinciplesDocument30 pagesAccounting Concepts and PrinciplesKristine Lei Del MundoNo ratings yet

- Chapter-2 Theory - 1-21 - Financial AccountingDocument8 pagesChapter-2 Theory - 1-21 - Financial AccountingOmor FarukNo ratings yet

- Chapter 07 - Accounting Information SystemsDocument21 pagesChapter 07 - Accounting Information SystemsflowerkmNo ratings yet

- Financial Accounting - All QsDocument21 pagesFinancial Accounting - All QsJulioNo ratings yet

- Survey of Accounting 7th Edition Warren Test BankDocument27 pagesSurvey of Accounting 7th Edition Warren Test Bankdevinsmithddsfzmioybeqr100% (13)

- C. Side Represented by Increases in The Account BalanceDocument19 pagesC. Side Represented by Increases in The Account Balancealyanna alanoNo ratings yet

- Adjusting Accounts and Preparing Financial Statements: QuestionsDocument74 pagesAdjusting Accounts and Preparing Financial Statements: QuestionsChaituNo ratings yet

- 157 28395 EY111 2013 4 2 1 Chap003Document74 pages157 28395 EY111 2013 4 2 1 Chap003JasonNo ratings yet